PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1698600

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1698600

Tomato Processing Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034

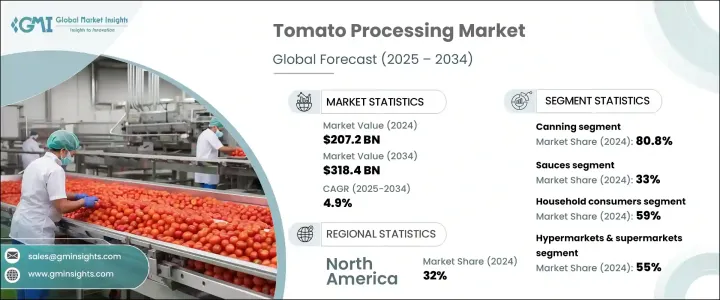

The Global Tomato Processing Market was valued at USD 207.2 billion in 2024 and is estimated to grow at a CAGR of 4.9% from 2025 to 2034. The increasing demand for convenience foods and the globalization of food supply chains are key factors driving this growth. Processed tomato products have become essential in modern households and the food service industry, fueling production and market expansion. Consumer preference for quick and easy meal solutions has led to a surge in demand for products like pastes, sauces, and canned tomatoes, as these are primary ingredients in ready-to-eat and ready-to-cook meals. Additionally, modern retail expansion, including supermarkets, hypermarkets, and e-commerce platforms, has made processed tomato products more accessible, further driving market growth. Urbanization and evolving dietary habits continue to reinforce the market's momentum, with consumer behavior shifting toward packaged and pre-prepared food options.

The tomato processing industry includes a wide range of products such as pasta, canned tomatoes, diced tomatoes, sauces, ketchup, juice, puree, concentrate, and powder. Among these, sauces held 33% of the market share in 2024 due to their extensive use in various cuisines. As convenience foods gain popularity, ready-to-eat sauces are experiencing heightened demand. Manufacturers are capitalizing on shifting consumer preferences by introducing organic and low-sodium options to appeal to health-conscious buyers. The foodservice industry, including quick-service and casual dining restaurants, remains a significant contributor to market expansion, as these establishments rely on pre-prepared tomato-based products for efficient meal preparation. Innovations in food processing and ingredient formulation further enhance the appeal of this segment.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $207.2 Billion |

| Forecast Value | $318.4 Billion |

| CAGR | 4.9% |

Processing methods in the market include concentration, canning, juice extraction, drying, sauce production, freezing, and fermentation. Canning dominated the market in 2024, accounting for 80.8% of the share, and is expected to grow at a 4.9% CAGR. The convenience and long shelf life of canned tomato products drive their demand among consumers and food service providers. Other methods, such as drying and freezing, attract customers looking for extended product durability, while juice extraction appeals to health-conscious consumers. Concentration processes produce tomato paste, which serves as a versatile cooking ingredient. Fermented tomato products are also gaining traction as niche markets develop for specialized food applications.

The market is segmented by end users, including household consumers, industrial food processors, and restaurants. Household consumers accounted for 59% of the market share in 2024, driven by accessibility and affordability. The industrial sector and food service industry continue to expand, as bulk orders for consistent, high-quality processed tomato products remain essential. The beverage and pharmaceutical sectors are also incorporating tomato extracts into new product innovations. Differentiation through organic and premium offerings plays a crucial role in market competition.

Distribution channels include hypermarkets, supermarkets, specialty stores, and convenience stores, with hypermarkets and supermarkets leading the segment at 55% of the market share in 2024. Competitive pricing and a wide product range contribute to their dominance. Specialty stores cater to niche markets with organic and premium selections, while convenience stores focus on ready-to-eat tomato products. Online sales and direct-to-consumer options continue to rise, offering a broader selection and home delivery convenience.

North America led the market in 2024, accounting for 32% of global revenue, driven by a strong demand for processed tomato products. However, the Asia-Pacific region is expected to witness the highest growth, supported by rising urbanization and increasing disposable incomes. Europe's market expansion is fueled by sustainability initiatives, organic product demand, and stricter food safety regulations. With ongoing advancements in food technology and distribution, the global tomato processing industry is poised for sustained growth.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Increasing demand for convenience foods

- 3.6.1.2 Globalization of food supply chains

- 3.6.1.3 Increasing food retail channels

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Seasonal variability in tomato supply

- 3.6.2.2 Price volatility of raw materials

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates and Forecast, By Product, 2021 – 2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Sauces

- 5.3 Pasta

- 5.4 Canned tomatoes

- 5.5 Ketchup

- 5.6 Juice

- 5.7 Puree

- 5.8 Diced & chopped

- 5.9 Concentrate

- 5.10 Sauce

- 5.11 Powder

- 5.12 Others

Chapter 6 Market Estimates and Forecast, By Processing Method, 2021 – 2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Canning

- 6.3 Sauce production

- 6.4 Juice extraction

- 6.5 Concentration

- 6.6 Drying

- 6.7 Freezing

- 6.8 Fermentation

- 6.9 Others

Chapter 7 Market Estimates and Forecast, By End Use, 2021 – 2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Household consumers

- 7.3 Industrial food processors

- 7.3.1 Beverage industry

- 7.3.2 Pharmaceutical industry

- 7.3.3 Others

- 7.4 Restaurants & foodservice

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021 – 2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 Hypermarkets & supermarkets

- 8.3 Food specialty stores

- 8.4 Convenience stores

- 8.5 Others

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Billion) (Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 J.G. Boswell Tomato Company

- 10.2 Campbell Soup Company

- 10.3 CFT Group

- 10.4 ConAgra Brands, Inc

- 10.5 CONESA Group

- 10.6 Del Monte Foods, Inc

- 10.7 Food & Biotech Engineers (India) Pvt. Ltd.

- 10.8 JBT Corporation

- 10.9 Kagome Co., Ltd.

- 10.10 Los Gatos Tomato Products

- 10.11 Morning Star Company