PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1698255

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1698255

Liquid Packaging Cartons Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

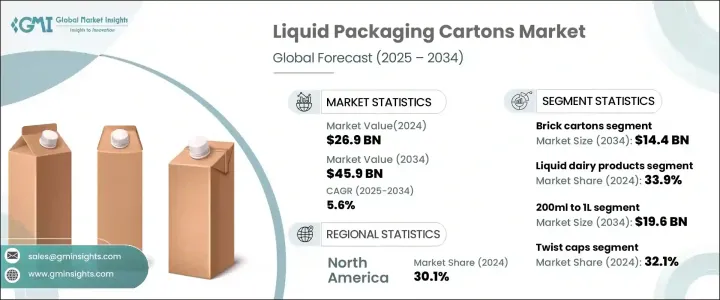

The Global Liquid Packaging Cartons Market was valued at USD 26.9 billion in 2024 and is projected to grow at a CAGR of 5.6% between 2025 and 2034. The rising demand for packaged beverages and the booming e-commerce sector are fueling market expansion. As consumers seek convenient, long-lasting, and safe packaging solutions for liquids, the market continues to grow at a steady pace. Increasing awareness of sustainable packaging is also contributing to the market's positive outlook, with brands investing in eco-friendly alternatives to reduce plastic waste.

Aseptic packaging is a key factor driving this growth, allowing liquid products to retain their quality and safety while extending shelf life. The preference for dairy, juices, plant-based beverages, and liquid foods continues to accelerate the adoption of liquid packaging cartons. In addition, the rise of on-the-go consumption trends is pushing beverage manufacturers to adopt compact, easy-to-use carton solutions. The expansion of food delivery services and the increasing preference for fortified and organic beverages further contribute to market momentum. With regulatory bodies tightening restrictions on plastic packaging, manufacturers are rapidly innovating to provide recyclable and biodegradable carton solutions, ensuring compliance with environmental standards. As these trends gain traction, the liquid packaging cartons market is positioned for sustained growth in the years ahead.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $26.9 Billion |

| Forecast Value | $45.9 Billion |

| CAGR | 5.6% |

The market is segmented by type, with brick cartons, gable top cartons, shaped cartons, and others leading the industry. Brick cartons dominate due to their durability, efficient space utilization, and long shelf life. These cartons are widely used in dairy and juice packaging, offering aseptic protection that ensures product sterility and safety. Their ability to extend shelf life without refrigeration makes them a preferred choice for brands catering to global markets. As health-conscious consumers demand preservative-free options, aseptic brick cartons are becoming an industry standard, ensuring longer freshness while maintaining product integrity.

The market is also categorized by application, with key segments including liquid foods, liquid dairy products, non-carbonated soft drinks, and alcoholic beverages. In 2024, the liquid dairy products segment held a significant market share, driven by increasing global dairy consumption. Fortified and flavored dairy products are particularly fueling demand for advanced packaging solutions. Aseptic cartons, which feature high-barrier coatings, are gaining traction in the dairy sector, preserving quality and extending shelf life without the need for refrigeration.

The U.S. liquid packaging cartons market is set to grow significantly, reaching USD 14.3 billion by 2034. Rising health awareness and the growing popularity of plant-based beverages, such as almond and oat milk, are key growth drivers. Manufacturers are rapidly adopting aseptic packaging solutions to improve shelf life and maintain product freshness. This transition toward longer-lasting and sustainable packaging solutions is expected to propel the growth of the liquid packaging cartons market across the U.S. and beyond.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing consumption of packaged beverages

- 3.2.1.2 Rising demand for sustainable and eco-friendly packaging solutions

- 3.2.1.3 Growth in dairy product consumption

- 3.2.1.4 Expansion of e-commerce and home delivery services

- 3.2.1.5 Growth in the ready-to-drink (RTD) beverage market

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High initial production and recycling costs

- 3.2.2.2 Limited suitability for carbonated beverages

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Type, 2021 – 2034 (USD Bn & Kilo Tons)

- 5.1 Key trends

- 5.2 Brick cartons

- 5.3 Gable top liquid cartons

- 5.4 Shaped cartons

- 5.5 Others

Chapter 6 Market Estimates and Forecast, By Capacity, 2021 – 2034 (USD Bn & Kilo Tons)

- 6.1 Key trends

- 6.2 Up to 200ml

- 6.3 200ml to 1l

- 6.4 Above 1l

Chapter 7 Market Estimates and Forecast, By Closure Type, 2021 – 2034 (USD Bn & Kilo Tons)

- 7.1 Key trends

- 7.2 Cut or tear-open

- 7.3 Twist caps

- 7.4 Pull tabs

- 7.5 Straw hole

Chapter 8 Market Estimates and Forecast, By Application, 2021 – 2034 (USD Bn & Kilo Tons)

- 8.1 Key trends

- 8.2 Liquid dairy products

- 8.3 Non-carbonated soft drinks

- 8.4 Liquid foods

- 8.5 Alcoholic drinks

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Bn & Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Adam Pack

- 10.2 Atlas Packaging

- 10.3 Elopak

- 10.4 Graphic Packaging International

- 10.5 Lami Packaging

- 10.6 Mondi

- 10.7 Nippon Paper Industries

- 10.8 Oji Holdings

- 10.9 Pactiv Evergreen

- 10.10 Refresco Group

- 10.11 Rotopacking Materials

- 10.12 SIG Combibloc Group

- 10.13 Smurfit Kappa Group

- 10.14 Stora Enso

- 10.15 Tetra Pak International

- 10.16 UFlex (Asepto)