PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1549858

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1549858

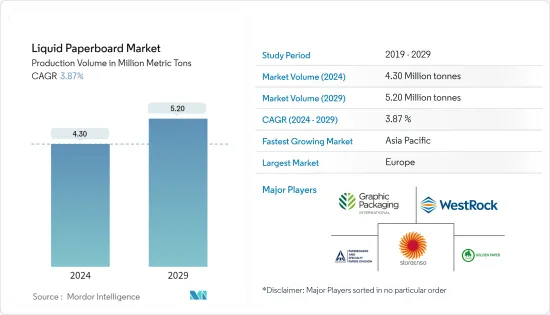

Liquid Paperboard - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The Liquid Paperboard Market size in terms of production volume is expected to grow from 4.30 Million metric tons in 2024 to 5.20 Million metric tons by 2029, at a CAGR of 3.87% during the forecast period (2024-2029).

Key Highlights

- Liquid paperboard (LPB) is a versatile and sustainable packaging material predominantly used in the food and beverage industry. Liquid paperboard consists of layers coated with various barrier materials, typically polyethylene or other biopolymers, to enhance its protective qualities. This multi-layered structure provides robust physical protection and effective barriers against moisture, oxygen, and light, making it ideal for packaging liquid products like milk, juices, soups, and sauces.

- Liquid paperboard is widely used in packaging for liquid cartons due to its sustainability and barrier properties. Manufacturers employ a minimalist, designable approach to create smaller packs that cater to single servings, reducing material usage and waste. These compact designs enhance convenience for consumers and promote environmental responsibility by minimizing the carbon footprint associated with packaging.

- Technological advancements in barrier coating have been a key driver in developing and enhancing liquid paperboard. Innovative coating technologies, such as those involving bio-based and biodegradable materials, are being developed to improve the performance of LPB while minimizing its environmental impact. These coatings not only enhance the shelf life and quality of the packaged products by preventing contamination and spoilage but also align with the growing consumer and regulatory push for sustainable packaging. For instance, advancements in nanotechnology have enabled the creation of ultra-thin yet highly effective barrier layers that can be applied to LPB, improving its functionality without significantly increasing its weight or cost.

- However, recycling liquid paperboard presents challenges because it is a composite material made from paperboard and polyethylene. Existing recycling infrastructure often needs help to separate these layers, hindering the recycling process efficiently. This complexity necessitates advancements in recycling technologies and systems to effectively handle liquid paperboard and improve its sustainability credentials.

Liquid Paperboard Market Trends

Rising Demand from the Beverage Segment Boosts The Market

- The rising demand from the beverage segment is significantly boosting the liquid paper board market. Packaging manufacturers and consumer brands increasingly opt for liquid paperboard because it can use fewer raw materials and create less waste, offering cost savings compared to other materials such as plastic or glass. By utilizing liquid paperboard, companies can produce lighter, more sustainable packaging that reduces transportation costs and minimizes environmental impact. This efficiency is particularly beneficial in the beverage industry, where the volume and weight of packaging can substantially influence overall logistics and carbon footprint.

- Premium liquid packaging boards are cost-effective and deliver exceptional product protection, ensuring the freshness and safety of beverages. These boards offer superior printing, converting, and filling performance, enabling brands to maintain high-quality standards and visually appealing designs. This combination of functionality and aesthetics makes liquid paperboard an attractive choice for packaging applications in the beverage industry, including juice, soups, water, and yogurt. The ability to provide a strong barrier against moisture, oxygen, and light further enhances these products' shelf life and quality, making liquid paperboard a preferred material for manufacturers.

- To further enhance the sustainability and efficiency of liquid paperboard, companies like Stora Enso are making significant investments in boosting the circularity of used beverage cartons. They are focusing on improving material efficiency and developing innovative solutions to enhance the performance of liquid paperboard. One such advancement is incorporating microfibrillated cellulose (MFC), which strengthens the paperboard while reducing its weight. This improvement decreases the amount of raw material needed and enhances the durability and functionality of the packaging, making it more competitive against other formats.

- Beverage cartons for long-life liquid products, like dairy products, soy milk, juices, fruit-based lemonades, and non-carbonated waters, additionally have a foil laminate. This thin aluminum layer protects beverages from light and oxygen. The aluminum layer is just 6.5 micrometers thick, less than a quarter of a hair. Aluminum is an excellent barrier for oxygen and light, and these drinks can last up to 18 months without preservatives or refrigeration.

- According to a report published in the annual report of the Metsa Board in 2023, a liquid packaging board with an annual demand of 5 million tons represents only 8.5% of the total carton board demand, which stands at 59 million tons. This segment is popular for packaging liquids due to specialized properties, such as durability, moisture resistance, and sustainability, making it crucial for sectors like beverages and dairy.

Europe is Set To Witness Significant Growth

- The European liquid paperboard market is experiencing a transformative shift, primarily driven by a heightened focus on sustainability. Consumer preferences increasingly lean toward eco-friendly packaging options due to growing environmental awareness. This trend significantly boosts the demand for liquid paperboard, a more sustainable alternative to traditional plastic packaging.

- The shift is also reinforced by European regulations, such as the EU's single-use plastics directive, which mandates the reduction of single-use plastics and encourages using renewable, recyclable materials like liquid paperboard.

- Additionally, the market is being influenced by the rapid growth of e-commerce. The rise in online shopping has increased the need for robust and reliable packaging solutions that protect goods during transit while being environmentally friendly. Liquid paperboard fits this requirement well, offering both durability and sustainability. This dual benefit makes liquid paperboard attractive for retailers and e-commerce companies looking to align their operations with sustainability goals and meet consumer expectations from green packaging.

- The market consolidation in the European liquid paperboard sector is also noteworthy. A few large players dominate the market, leading to high levels of consolidation. This consolidation enables significant investments in research and development, fostering innovation and efficiency improvements. These large manufacturers are continually exploring ways to enhance the performance and sustainability of liquid paperboard through technological advancements.

- Developments such as digital printing technologies allow for high-quality, customizable packaging solutions that cater to brand differentiation and consumer engagement. Additionally, biodegradable and compostable coating advancements make liquid paperboard even more sustainable. These technological innovations improve the environmental footprint of liquid paperboard and expand its applications across various sectors, further driving market growth.

- According to Food and Agriculture Organization data, Germany has a production capacity of 24.53 million tons in 2024. In contrast, the country has a production capacity of 1.74 million tons for carton boards, which is only 7% of total paper and paperboard production capacity. The carton boards include folding milk cartons and foodservice boxboards.

Liquid Paperboard Industry Overview

The market for liquid paperboard is dominated by key players such as Stora Enso, ITC, Graphic Packaging, WestRock, and Golden Paper Group. Major players are driving this consolidation through strategic mergers and acquisitions, enhancing their market share and expanding their global reach to meet the rising demand for sustainable packaging.

June 2023: Stora Enso and Tetra Pak started a new recycling line for post-consumer beverage cartons at Stora Enso's Ostroleka corrugated packaging plant in Poland. According to the companies, the newly added capacity intends to make the site one of Europe's main recycling hubs for liquid paperboard packaging. Stora Enso reported that the new line has a capacity of 50,000 tonnes a year. It handles only beverage cartons, separating the fibers from polymers and aluminum. The fibers are then recycled and reused for board production. Czech companies Plastigram Industries and Tetra Pak are industrializing a solution to recycle the non-fiber "PolyAl" fraction into new products.

March 2023: Asia Symbol Jiangsu Co. Ltd selected Tietoevry's Manufacturing Execution System (MES) to execute business transformation and increase operational efficiency in their Rugao mill's carton board line. The latest information technologies, digitalization, and automation of key business processes enable production and operations management improvements.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Current Market Scenario For Liquid Paperboard and Liquid Cartons

- 4.4.1 Technological Advancements Leading to Better Barrier Properties and Extended Shelf Life

- 4.4.2 Trend Analysis for Minimalist Designs Resulting in Smaller Beverage Carton Packs

- 4.4.3 International Trade Policies on Import and Export of Paperboard Materials

- 4.4.4 Industry Regulations

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for Convenient and Easy-to-Use Packaging Formats

- 5.1.2 Growing Focus on Sustainable and Eco-Friendly Packaging Solutions

- 5.2 Market Challenge

- 5.2.1 Alternative Forms of Packaging is Challenging the Market Growth

6 MARKET SEGMENTATION

- 6.1 By Material Type

- 6.1.1 Liquid Packaging Board

- 6.1.2 Food and Cupstock

- 6.2 By End-Use Application

- 6.2.1 Beverage

- 6.2.2 Food

- 6.2.3 Nutraceuticals

- 6.2.4 Homecare and Personal Care

- 6.2.5 Other End-use Applications

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

7 VENDOR MARKET SHARE

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Stora Enso Oyj

- 8.1.2 Graphic Packaging International

- 8.1.3 WestRock Company

- 8.1.4 ITC Limited

- 8.1.5 Golden Paper Company

- 8.1.6 Greatview Aseptic Packaging Co. Ltd

- 8.1.7 Ningbo Sure Paper Co. Ltd

- 8.1.8 Suneja Sons

- 8.1.9 Billerud AB

- 8.1.10 Asia Symbol Paper Co. Ltd

9 INVESTMENT ANALYSIS

10 FUTURE OUTLOOK OF THE MARKET