PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1685219

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1685219

Maltodextrin Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

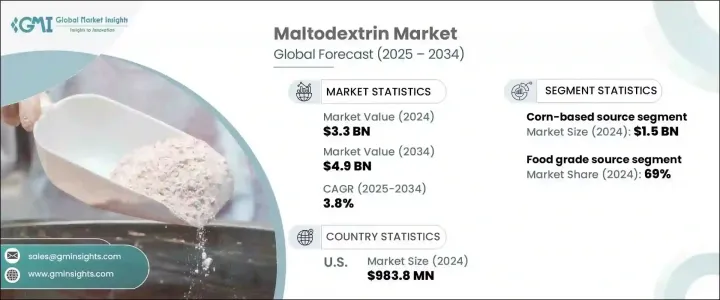

The Global Maltodextrin Market, valued at USD 3.3 billion in 2024, is set to experience robust growth at a CAGR of 3.8% from 2025 to 2034. The demand for maltodextrin is surging due to its broad and versatile applications across various industries, such as food and beverage, pharmaceuticals, and cosmetics. In particular, the food and beverage industry remains the primary driver of market expansion, as maltodextrin is widely used as a filler, thickener, and stabilizer in processed foods. With the increasing consumer preference for convenience foods and functional ingredients, the demand for maltodextrin is expected to rise steadily. This growth is further fueled by the innovation in product development to meet evolving consumer needs, including healthier, on-the-go options. As the global maltodextrin market continues to diversify its product offerings, industries are capitalizing on its cost-effectiveness and functional benefits, ensuring sustained growth well into the next decade.

The maltodextrin market is divided into various sources, including corn, potato, cassava, wheat, and others. Corn-based maltodextrin, the leading segment, generated USD 1.5 billion in 2024 and is projected to reach USD 2.1 billion by 2034. The widespread availability, affordability, and multifunctionality of corn-based maltodextrin make it the go-to choice for food and beverage manufacturers. Meanwhile, wheat-based maltodextrin also maintains a significant share in the market, prized for its functional qualities and adaptability across numerous industries.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.3 Billion |

| Forecast Value | $4.9 Billion |

| CAGR | 3.8% |

In terms of product grade, the maltodextrin market is segmented into pharmaceutical grade, food grade, and industrial grade. Food-grade maltodextrin dominates the market with a 69% share in 2024, largely due to its role in thickening, stabilizing, and bulking various food products. Its ability to improve texture and enhance shelf life makes it indispensable in processed foods. Pharmaceutical-grade maltodextrin, while a smaller segment, is crucial as a filler and binder in the production of medical tablets and capsules, contributing to the market's steady growth.

The U.S. maltodextrin market, valued at USD 983.8 million in 2024, remains a major player in the global landscape. The country's thriving food processing industry, coupled with the widespread use of maltodextrin as a multifunctional additive, ensures the U.S. remains a dominant market. Additionally, the pharmaceutical industry in the U.S. continues to drive consistent demand, further fueling growth. Technological advancements and innovations in maltodextrin formulations are expected to meet the growing consumer demand for functional, convenient, and health-conscious food products, boosting the regional market even further.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Increasing demand in food and beverage industry

- 3.6.1.2 Rising health consciousness

- 3.6.1.3 Expanding applications in pharmaceuticals and cosmetics

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Health concerns and perception

- 3.6.2.2 Fluctuating raw material prices

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Size and Forecast, By Source, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Corn-based

- 5.3 Wheat-based

- 5.4 Potato-based

- 5.5 Cassava-based

- 5.6 Others

Chapter 6 Market Size and Forecast, By Grade, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Food grade

- 6.3 Pharmaceutical grade

- 6.4 Industrial grade

Chapter 7 Market Size and Forecast, By Application, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Food and beverages

- 7.2.1 Baked goods

- 7.2.2 Confectionery

- 7.2.3 Dairy products

- 7.2.4 Beverages

- 7.2.5 Convenience foods

- 7.2.6 Others

- 7.3 Pharmaceuticals

- 7.3.1 Excipient in drug formulations

- 7.3.2 Nutritional supplements

- 7.4 Cosmetics and personal care

- 7.4.1 Skincare products

- 7.4.2 Haircare products

- 7.5 Industrial applications

- 7.5.1 Adhesives

- 7.5.2 Binders

- 7.5.3 Coating and encapsulation

- 7.6 Others

- 7.6.1 Animal feed

- 7.6.2 Fermentation processes

Chapter 8 Market Size and Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 AGRANA Group

- 9.2 Archer Daniels Midland

- 9.3 Avebe

- 9.4 Cargill

- 9.5 Golden Grain Group

- 9.6 Grain Processing Corporation

- 9.7 Gulshan Polyols

- 9.8 Ingredion

- 9.9 Matsutani America

- 9.10 Mengzhou Tailijie

- 9.11 Roquette Frères

- 9.12 Tate & Lyle

- 9.13 Zhucheng Dongxiao Biotechnology