PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1684822

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1684822

Edible Oils and Fats Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

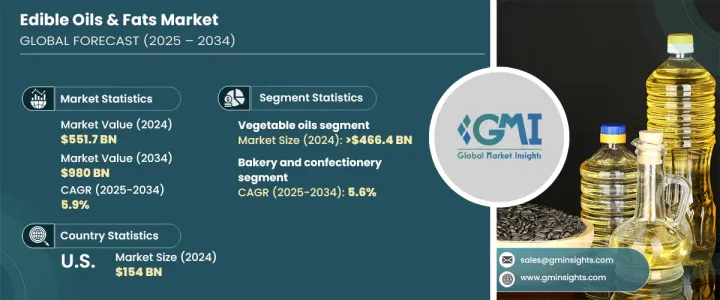

The Global Edible Oils And Fats Market was valued at USD 551.7 billion in 2024 and is projected to grow at a CAGR of 5.9% between 2025 and 2034. As a staple in cooking, baking, and food production, edible oils and fats play a critical role in enhancing flavor, texture, and nutritional value. Sourced from plant-based ingredients such as palm, soybean, and olive oils, as well as animal-derived fats like butter and lard, these products are indispensable across households and the food industry.

The market is experiencing a significant transformation driven by shifting consumer preferences toward healthier alternatives, the rising adoption of plant-based diets, and increasing awareness of nutritional benefits. Health-conscious consumers are actively seeking oils and fats with lower saturated fat content and higher levels of unsaturated fats and omega-3 fatty acids. The growing demand for organic, non-GMO, and minimally processed oils is also fueling market expansion as manufacturers focus on transparency and clean-label products. Additionally, innovations in production techniques, sustainable sourcing, and regulatory measures promoting trans fat reduction are reshaping the market dynamics.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $551.7 Billion |

| Forecast Value | $980 Billion |

| CAGR | 5.9% |

The vegetable oils segment accounted for USD 466.4 billion in 2024 and is expected to grow at a CAGR of 5.7% during the forecast period. Vegetable oils dominate the market due to their affordability, versatility, and perceived health benefits. These oils are widely used in food preparation, processing, and industrial applications, making them a staple in the production of snacks, sauces, and baked goods. The rising demand for healthier plant-based alternatives has led to increased consumption of vegetable oils rich in monounsaturated and polyunsaturated fats, such as olive, canola, and sunflower oils. Consumers are becoming more aware of the benefits of heart-healthy oils, further driving market growth.

The bakery and confectionery segment in the edible oils and fats market contributed USD 244.1 billion in 2024 and is forecasted to grow at a 5.6% CAGR through 2034. Oils and fats are essential in baking, ensuring the right texture, moisture retention, and extended shelf life of products. Margarine, shortening, and specialty oils are integral to the preparation of bread, pastries, and sweets, playing a key role in achieving the desired consistency and flavor profile. The increasing demand for premium bakery products, artisanal goods, and healthier alternatives such as trans-fat-free and plant-based baked items is further propelling market growth.

The U.S. edible oils and fats market held USD 154 billion in 2024 and is anticipated to grow at a CAGR of 5.2% between 2025 and 2034. The growing health consciousness among American consumers has led to a shift toward oils perceived as healthier, including olive, avocado, and coconut oils. The increasing popularity of plant-based diets and the food industry's commitment to eliminating trans fats have fueled demand for vegetable oils over traditional animal fats. Consumers are prioritizing oils with added functional benefits, such as enhanced nutritional content and sustainability certifications. The food service sector and retail industry are also witnessing a surge in demand for premium and specialty oils as brands continue to innovate and offer differentiated products that cater to evolving preferences.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Changing consumer dietary preferences

- 3.6.1.2 Growing population and urbanization

- 3.6.1.3 Expanding biofuel industry

- 3.6.1.4 Innovation in products

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Raw material price volatility

- 3.6.2.2 Competition from other food products

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Type, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Vegetable oils

- 5.2.1 Palm oil

- 5.2.2 Soybean oil

- 5.2.3 Rapeseed oil

- 5.2.4 Mustard oil

- 5.2.5 Coconut oil

- 5.3 Animal fats

- 5.3.1 Tallow

- 5.3.2 Lard

- 5.3.3 Ghee

- 5.3.4 Others

Chapter 6 Market Estimates & Forecast, By Application, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Bakery and confectionery

- 6.3 Snacks

- 6.4 Meat products

- 6.5 Others

Chapter 7 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 UK

- 7.3.2 Germany

- 7.3.3 France

- 7.3.4 Italy

- 7.3.5 Spain

- 7.3.6 Russia

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 South Korea

- 7.4.5 Australia

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.6 MEA

- 7.6.1 South Africa

- 7.6.2 Saudi Arabia

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 ACH Food Companies, Inc.

- 8.2 Archer Daniels Midland Company (ADM)

- 8.3 Bunge Limited

- 8.4 Cargill Inc.

- 8.5 Conagra Brands, Inc.

- 8.6 Fuji Oil Co., Ltd

- 8.7 GrainCorp

- 8.8 IOI Corporation Berhad

- 8.9 Louis Dreyfus Company B.V

- 8.10 The Nisshin Oillio Group Ltd

- 8.11 Wilmar International Limited