PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1667051

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1667051

North America Paper Machine Oil Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

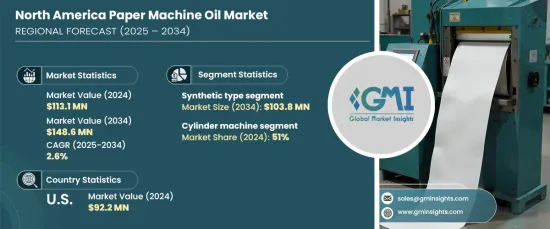

North America Paper Machine Oil Market was valued at USD 113.1 million in 2024 and is expected to grow at a CAGR of 2.6% from 2025 to 2034. Paper machine oils are essential lubricants that safeguard metal surfaces and ensure the smooth operation of moving components in paper machines. They play a crucial role in both wet-end and dry-end circulating oil systems, promoting efficiency and preventing wear and tear. As demand for paper continues to rise, especially in the packaging sector, the market for paper machine oils is expanding. The increasing consumption of paper-based products such as paper bags, tissues, coated papers, and hygiene products is driving investments in new production lines and facilities. Moreover, the rapid growth of e-commerce has significantly boosted the demand for cardboard packaging, further supporting the paper and paperboard industry.

The shift towards sustainable and eco-friendly solutions is also impacting the market, with companies seeking biodegradable and high-performance oils that align with environmental regulations and promote energy-efficient operations. Innovations in lubrication technologies are enhancing the operational efficiency of paper mills, reducing downtime, and lowering maintenance costs. This transition to advanced lubrication solutions is expected to drive the demand for synthetic oils, which have superior properties, such as excellent viscosity performance under extreme temperatures, greater shear and chemical stability, and improved system cleanliness. These advantages make synthetic oils the preferred choice in high-efficiency paper mill operations, further propelling the market.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $113.1 Million |

| Forecast Value | $148.6 Million |

| CAGR | 2.6% |

The market is divided into two segments: mineral oils and synthetic oils. In 2024, the synthetic oil segment generated USD 73.9 million and is projected to reach USD 103.8 million by 2034. The superior qualities of synthetic oils, particularly their ability to perform well across a broad range of temperatures, are expected to fuel their growing adoption in the paper machine oil market. As the demand for high-quality and specialized papers for packaging applications increases, the adoption of synthetic oils in the paper industry will likely rise.

By machine type, the market is further segmented into cylinder machines and fourdrinier machines. Cylinder machines, accounting for a dominant 51% market share in 2024, are preferred for producing high-quality paperboard and specialty papers, which are crucial for packaging materials. These machines are built to handle heavier paper grades, making them ideal for producing corrugated packaging and industrial paper products, which are in high demand due to the growing e-commerce sector.

In the U.S., the paper machine oil market was valued at USD 92.2 million in 2024. The U.S. market is being driven by the increasing demand for packaging materials, which is largely influenced by the boom in e-commerce and the expanding consumer goods sector. Additionally, investments in paper mills focused on producing specialty and recycled paper are accelerating the adoption of cutting-edge lubrication solutions. The rising trend of using eco-friendly, energy-efficient machinery, driven by stringent environmental regulations, is also fostering greater use of high-performance biodegradable oils.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Flourishing demand for paper-based products in packaging industry and hygiene products

- 3.6.1.2 Replacing plastic packaging for food application

- 3.6.1.3 Growing awareness toward sustainable packing material and recyclability of papers

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High cost of synthetic paper machine oil

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Size and Forecast, By Product, 2021-2034 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Mineral

- 5.2.1 Zinc-based mineral

- 5.2.2 Zinc-free mineral

- 5.3 Synthetic

Chapter 6 Market Size and Forecast, By Machine Type, 2021-2034 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Cylinder machine

- 6.2.1 Automatic

- 6.2.2 Semi-automatic

- 6.3 Fourdrinier machine

- 6.3.1 Automatic

- 6.3.2 Semi-automatic

Chapter 7 Market Size and Forecast, By End Use, 2021-2034 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 OEM

- 7.3 Aftermarket

Chapter 8 Market Size and Forecast, By Region, 2021-2034 (USD Million) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

Chapter 9 Company Profiles

- 9.1 Bechem GmbH

- 9.2 Brewer Hendley Oil Corporation

- 9.3 Castrol

- 9.4 Chevron Corporation

- 9.5 Exxon Mobil Corporation

- 9.6 Fuchs Schmierstoffe

- 9.7 Interlube Corporation

- 9.8 Kluber Lubrication

- 9.9 Petro Canada Lubricants

- 9.10 Phillips 66 Company

- 9.11 Royal Dutch Shell

- 9.12 TotalEnergies