PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910454

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910454

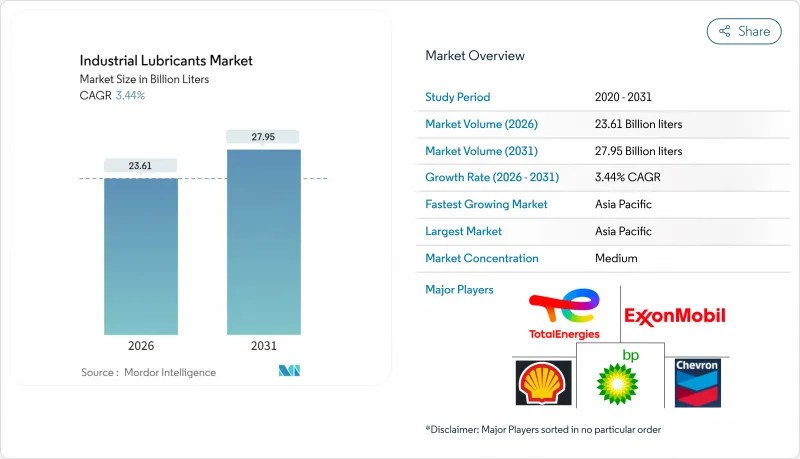

Industrial Lubricants - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Industrial Lubricants Market market is expected to grow from 22.82 billion liters in 2025 to 23.61 billion liters in 2026 and is forecast to reach 27.95 billion liters by 2031 at 3.44% CAGR over 2026-2031.

This steady trajectory shows the sector's shift from bulk commodity sales to tailor-made fluids that maximize equipment uptime and energy efficiency. Rapid wind-turbine installations and Industry 4.0 upgrades are expanding lubricant performance requirements beyond legacy specifications, spurring demand for synthetic and bio-based chemistries. Asia-Pacific dominates current consumption thanks to large-scale manufacturing investments and integrated refinery-petrochemical complexes that capture higher-value lubricant margins. Producers worldwide are also channeling R&D toward PFAS-free additives and condition-monitoring-ready fluids in response to tightening environmental rules and predictive-maintenance adoption.

Global Industrial Lubricants Market Trends and Insights

Surging Wind-Turbine Gearbox Lubricant Demand

Global wind-power build-outs are multiplying specialized gearbox-oil requirements that standard fluids cannot satisfy. China's installed wind capacity reached 440 GW by December 2023, with many turbine failures traced to lubrication shortcomings. Synthetic oils fortified with anti-wear and corrosion inhibitors extend service intervals from 6 months to 3 years, trimming offshore maintenance costs. Robust water-separation properties are essential because remote turbines must minimize helicopter-based servicing. Developers increasingly specify ISO VG 320-460 PAO blends that preserve viscosity across wide temperature swings, protecting multi-megawatt gearsets during harsh gust events. Each 15-MW offshore turbine can consume over 800 liters per service cycle, so the industrial lubricants market sees a direct volume lift from larger unit ratings.

Industrial Automation and Industry 4.0 Lubrication Intensity

Smart factories deploy precision equipment that runs hotter and faster, demanding fluids with narrow viscosity tolerances and negligible sensor interference. Automated lubrication systems meter doses based on real-time analytics, cutting consumption 30%-40% while boosting uptime. Fluids must keep tribological stability when exposed to magnetic-plug or infrared debris monitoring, so additive solubility and metal-ion content are tightly specified. Artificial-intelligence platforms now adjust formulation recommendations by reading vibration and temperature feeds, pushing suppliers to create modular additive packages for on-site customization. These developments anchor a long-term upward mix shift within the industrial lubricants market toward premium synthetic and hybrid products.

Stricter Waste-Oil and Spill Regulations

PFAS-phaseout mandates in the EU and several U.S. states force formulators to redesign long-standing products. Certification of alternative chemistries slows time-to-market and inflates R&D budgets. At the user level, collection systems must now document cradle-to-grave traceability, lifting disposal costs and capital outlays for containment. Spill-prevention directives require double-walled tanks and real-time leak alarms, raising infrastructure costs for small workshops. While these hurdles dampen short-term demand, they also open niches for compliant, higher-margin formulations within the industrial lubricants market.

Other drivers and restraints analyzed in the detailed report include:

- Shift Toward Synthetic and Semi-Synthetic Long-Drain Oils

- Expansion of Mining and Construction Equipment Fleets

- Crude-Derived Base-Oil Price Volatility

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Engine oil contributed 23.29% of 2025 sales, safeguarding critical generators and stationary compressors across heavy industries. This share underscores deep-rooted maintenance routines that favor monograde SAE 40 and 15W-40 multigrades compatible with legacy engines. Yet demand plateaus as OEMs pivot to gas engines with longer drain specifications. Hydraulic and transmission fluids, in contrast, are set to grow at a 3.92% CAGR as robotics, injection-molding machines, and wind-turbine pitch systems expand. Metalworking fluids benefit from Asia-Pacific machine-tool investments, and ionic-liquid cutting oils deliver longer tool life than mineral benchmarks.

Synthetic grease blends incorporating molybdenum disulfide and graphite are grabbing share in extreme-pressure bearings exposed to 200 °C kiln outlets. Meanwhile, demand for process oils ties directly to petrochemical debottlenecking in China, India, and the U.S. Up-and-coming electric-motor cooling oils illustrate how evolving machinery profiles continuously reshape the industrial lubricants market.

The Industrial Lubricants Market Report is Segmented by Product Type (Engine Oil, Hydraulic and Transmission Fluid, Metalworking Fluid, and More), End-User Industry (Power Generation, Heavy Equipment, Food and Beverage Processing, Metallurgy and Metalworking, Chemical and Process Industries, and Other Industries), and Geography (Asia-Pacific, North America, and More). The Market Forecasts are Provided in Terms of Volume (Liters).

Geography Analysis

Asia-Pacific accounted for 46.88% of 2025 volumes and is tracking a 3.61% CAGR through 2031, where Chinese refiners integrate chemicals to lift lubricant margins. India draws heavy foreign investment, with Lubrizol earmarking USD 200 million for a new Aurangabad plant that will be its second-largest worldwide. Southeast Asian countries welcome factory relocations and renewable-energy projects, driving hydraulic and gear oil uptake. Japan and South Korea sustain above-average synthetic penetration due to precision manufacturing and stringent energy-saving targets.

North America and Europe concentrate on PFAS-free formulations and carbon-linked efficiency gains. The U.S. leverages shale-derived feedstocks, yet EV adoption gradually curbs traditional engine oil demand. Europe leads the policy push that elevates bio-lubricants, compelling rapid formulation shifts. Canada's oil-sands mining keeps high-temperature lubricant requirements active, whereas Mexico's automotive investments broaden local demand.

The Middle-East and Africa rely on hydrocarbon extraction projects that underpin base oil supply and diversify into chemicals. A new additive plant from the Richful-Farabi venture in Saudi Arabia will shorten supply lines for regional blenders. South Africa's deep-level mining and Nigeria's refining upgrades contribute niche opportunities. South America shows pockets of high growth around Brazilian petrochemical debottlenecking and Chilean copper expansions, cementing its role as an important albeit smaller outlet for industrial lubricants market suppliers.

- AMSOIL Inc.

- Bharat Petroleum Corp. Ltd

- Blaser Swisslube AG

- BP p.l.c. (Castrol)

- Carl Bechem GmbH

- Chevron Corporation

- China National Petroleum Corporation (PetroChina)

- China Petroleum & Chemical Corp. (Sinopec)

- ENEOS Corporation

- Eni SpA

- Exxon Mobil Corporation

- FUCHS SE

- Gazprom Neft PJSC

- GS Caltex Corporation

- Gulf Oil International

- Hindustan Petroleum Corp. Ltd

- Idemitsu Kosan Co. Ltd

- Indian Oil Corporation Ltd.

- Kluber Lubrication

- LUKOIL

- Motul

- Petrobras

- Petronas Lubricants International

- Phillips 66 Company

- PT Pertamina (Persero)

- Repsol

- ROCOL

- ROSNEFT

- Shell plc

- TotalEnergies SE

- Valvoline Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surging wind-turbine gearbox lubricant demand

- 4.2.2 Industrial automation and Industry 4.0 lubrication intensity

- 4.2.3 Shift toward synthetic and semi-synthetic long-drain oils

- 4.2.4 Expansion of mining and construction equipment fleets

- 4.2.5 Carbon-pricing pull for ultra-low-friction bio-lubricants

- 4.3 Market Restraints

- 4.3.1 Stricter waste-oil and spill regulations

- 4.3.2 Crude-derived base-oil price volatility

- 4.3.3 Dry-drive electric motors reducing oil demand

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Product Type

- 5.1.1 Engine Oil

- 5.1.2 Hydraulic and Transmission Fluid

- 5.1.3 Metalworking Fluid

- 5.1.4 General Industrial Oil

- 5.1.5 Gear Oil

- 5.1.6 Grease

- 5.1.7 Process Oil

- 5.1.8 Others

- 5.2 By End-user Industry

- 5.2.1 Power Generation

- 5.2.2 Heavy Equipment

- 5.2.3 Food and Beverage Processing

- 5.2.4 Metallurgy and Metalworking

- 5.2.5 Chemical and Process Industries

- 5.2.6 Other Industries (Pulp and Paper, Marine, etc.)

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Indonesia

- 5.3.1.6 Thailand

- 5.3.1.7 Vietnam

- 5.3.1.8 Malaysia

- 5.3.1.9 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Spain

- 5.3.3.6 Russia

- 5.3.3.7 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 South Africa

- 5.3.5.4 Egypt

- 5.3.5.5 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 AMSOIL Inc.

- 6.4.2 Bharat Petroleum Corp. Ltd

- 6.4.3 Blaser Swisslube AG

- 6.4.4 BP p.l.c. (Castrol)

- 6.4.5 Carl Bechem GmbH

- 6.4.6 Chevron Corporation

- 6.4.7 China National Petroleum Corporation (PetroChina)

- 6.4.8 China Petroleum & Chemical Corp. (Sinopec)

- 6.4.9 ENEOS Corporation

- 6.4.10 Eni SpA

- 6.4.11 Exxon Mobil Corporation

- 6.4.12 FUCHS SE

- 6.4.13 Gazprom Neft PJSC

- 6.4.14 GS Caltex Corporation

- 6.4.15 Gulf Oil International

- 6.4.16 Hindustan Petroleum Corp. Ltd

- 6.4.17 Idemitsu Kosan Co. Ltd

- 6.4.18 Indian Oil Corporation Ltd.

- 6.4.19 Kluber Lubrication

- 6.4.20 LUKOIL

- 6.4.21 Motul

- 6.4.22 Petrobras

- 6.4.23 Petronas Lubricants International

- 6.4.24 Phillips 66 Company

- 6.4.25 PT Pertamina (Persero)

- 6.4.26 Repsol

- 6.4.27 ROCOL

- 6.4.28 ROSNEFT

- 6.4.29 Shell plc

- 6.4.30 TotalEnergies SE

- 6.4.31 Valvoline Inc.

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment