PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1666928

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1666928

Europe Medium Voltage Switchgear Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

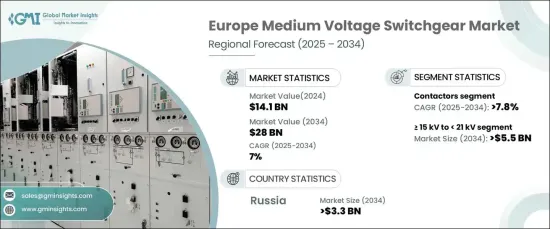

Europe Medium Voltage Switchgear Market was valued at USD 14.1 billion in 2024, with expectations to grow at a CAGR of 7% from 2025 to 2034. This growth is being driven by the increasing need for robust infrastructure and renewable energy sources, which are placing greater demand on reliable medium voltage switchgear to ensure efficient power distribution. As governments in Europe focus on improving energy efficiency, adopting smart grid technologies, and promoting sustainable energy solutions, the market is set to expand. The need for grid modernization, along with the rising trend of electrification in both urban and rural settings, is also fueling the demand for medium voltage switchgear. Additionally, sectors like manufacturing, utilities, and commercial enterprises are increasingly turning to these solutions to maintain safety and streamline power distribution.

Technological advances, including the integration of digital solutions and automation, are significantly enhancing the efficiency and dependability of medium voltage switchgear systems. The ongoing push toward decarbonization and the growth of electric vehicle charging infrastructure also presents substantial opportunities for market development. As industries modernize and adopt more advanced systems, the reliance on high-performance switchgear continues to grow.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $14.1 Billion |

| Forecast Value | $28 Billion |

| CAGR | 7% |

Among voltage categories, the >= 15 kV to 21 kV range is predicted to surpass USD 5.5 billion by 2034. These voltage levels are particularly efficient for connecting key grid components like substations, power lines, and renewable energy installations. The surge in renewable energy generation from sources such as wind, solar, and hydropower is driving this shift, as these sources often demand higher voltage levels for seamless grid integration and system stability.

In terms of components, the contactors segment is poised for a robust CAGR of over 7.8% through 2034. With industries and utilities increasingly implementing automation, the need for reliable switching devices, particularly contractors, continues to rise. These devices play a critical role in automating electrical circuits, allowing for remote operations and better control of power distribution systems. This demand is especially relevant in the development of modern smart grids and industrial operations, where automation is essential for improved operational efficiency.

In Russia, the medium voltage switchgear market is anticipated to exceed USD 3.3 billion by 2034. This is largely due to the country's significant efforts to upgrade its aging power grid infrastructure, especially in urban and industrial areas. The modernization of Russia's power distribution systems to cope with rising demand and improve reliability is a major catalyst for the market growth. The ongoing development of new cities and industrial zones, combined with a need for advanced power distribution networks, is driving demand for medium voltage switchgear. As urbanization accelerates, these systems are becoming essential for supporting both new construction projects and the upgrade of existing infrastructure.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Strategic dashboard

- 4.2 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Voltage, 2021 – 2034 (USD Million, ‘000 Units)

- 5.1 Key trends

- 5.2 ≥ 3 kV to < 9 kV

- 5.3 ≥ 9 kV to < 15 kV

- 5.4 ≥ 15 kV to < 21 kV

- 5.5 ≥ 21 kV to < 27 kV

- 5.6 ≥ 27 kV to < 33 kV

- 5.7 ≥ 33 kV

Chapter 6 Market Size and Forecast, By Component, 2021 – 2034 (USD Million, ‘000 Units)

- 6.1 Key trends

- 6.2 Circuit breakers

- 6.3 Contactors

- 6.4 Switches & disconnector

- 6.5 Fuses

- 6.6 Others

Chapter 7 Market Size and Forecast, By Insulation, 2021 – 2034 (USD Million, ‘000 Units)

- 7.1 Key trends

- 7.2 Air

- 7.3 Gas

- 7.4 Oil

- 7.5 Vacuum

- 7.6 Others

Chapter 8 Market Size and Forecast, By End Use, 2021 – 2034 (USD Million, ‘000 Units)

- 8.1 Key trends

- 8.2 Power stations

- 8.3 Transformer substations

- 8.4 Local electricity supply

- 8.5 Others

Chapter 9 Market Size and Forecast, By Application, 2021 – 2034 (USD Million, ‘000 Units)

- 9.1 Key trends

- 9.2 Residential

- 9.3 Commercial

- 9.4 Industrial

- 9.5 Utility

Chapter 10 Market Size and Forecast, By Country, 2021 – 2034 (USD Million, ‘000 Units)

- 10.1 Key trends

- 10.2 UK

- 10.3 France

- 10.4 Germany

- 10.5 Italy

- 10.6 Russia

- 10.7 Spain

Chapter 11 Company Profiles

- 11.1 ABB

- 11.2 Bharat Heavy Electricals

- 11.3 CG Power and Industrial Solutions

- 11.4 E + I Engineering

- 11.5 Eaton

- 11.6 Fuji Electric

- 11.7 General Electric

- 11.8 HD Hyundai Electric

- 11.9 Hitachi

- 11.10 Lucy Group

- 11.11 Mitsubishi Electric

- 11.12 Ormazabal

- 11.13 Schneider Electric

- 11.14 Siemens

- 11.15 Skema

- 11.16 Toshiba