Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636118

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636118

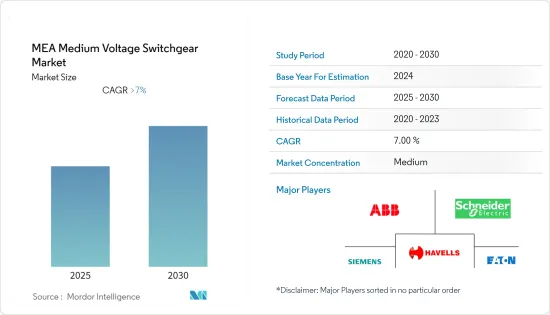

MEA Medium Voltage Switchgear - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 95 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

The MEA Medium Voltage Switchgear Market is expected to register a CAGR of greater than 7% during the forecast period.

The COVID-19 pandemic drastically affected the electrical equipment market due to the crashed power demand and fewer power projects planned in the region.

Key Highlights

- Over the short term, the Middle East and Africa switchgear market is anticipated to include elevated growth due to the growing penetration of renewables in the power sector. It is also due to the new transmission and distribution network projects in countries needing appreciable access to electricity.

- On the other hand, the dominance of the conventional energy supply, that is, the incumbent oil and gas industry in the region, is expected to challenge the growth of the power sector to fulfil the energy needs.

- Nevertheless, the growing urbanization in the Middle East and Africa magnifies energy consumption. Hence, the demand for power generation and transmission places ample opportunities for the switchgear market.

- Saudi Arabia will likely ace the market due to escalating energy needs and renewables-propelled smart grid development.

MEA Medium Voltage Switchgear Market Trends

The Upcoming Smart Grid Projects Expected to Drive the Market

- The Middle East and African region witnessed a steady growth in renewables integration in the transmission and distribution network. However, it is far less than in other regions across the globe. Still, it progressed in many countries like Iran, Saudi Arabia, United Arab Emirates, Mozambique, Ghana, South Africa, and Egypt.

- The renewables-based power generation output in South Africa was around 16TWh (6.7%) in the electricity generation mix as of 2021. It is a considerable share as compared to other parts of the region.

- The advancing steps of renewable energy growth deepened the urge to include smart grids for efficient and effective integration into the traditional electricity supply network. Many countries in the region started upgrading their power transmission and distribution infrastructure with smart grids, accelerating the demand for power supply-controlling devices like switchgear.

- For example, in December 2022, Siemens AG clinched a contract to establish a distribution management system and advanced metering infrastructure for North Delta Electricity Distribution Company, Egypt. The upgrading project includes constructing a medium voltage ADMS control centre and a smart metering system for the Damietta region.

- Furthermore, in June 2022, the Tunisian government in North Africa signed the contracts for the first phase of the Smart Grid project with Siemens, E-Fluid, Sagemcom Energie, and telecom companies. The program aims to ensure better renewables integration in the power generation and distribution system.

- Such developments are expected to boost the demand for power regulating and controlling devices like medium voltage switchgear in the region.

Saudi Arabia Expected to Witness Significant Growth

- For two reasons, Saudi Arabia is anticipated to pick up steam in the future. One is the growing infrastructure projects leading to high power demand, and the other is the augmented growth of renewables integration in the electricity supply network of the country.

- The renewables share in the power generation mix is relatively low compared to other energy sources. Thus the government is keen on expanding the ratio. As of 2021, the contribution from renewable sources was around 0.8TWh in the electricity generation mix.

- To fill these loopholes, the Saudi Arabian government contains new blueprints on the table. In December 2022, they planned 10 new renewable energy projects with a total capacity of 7 GW. The country already approved a major part of the 2023 budget for the execution of the projects. The projects are a part of the country's target to achieve 50% of renewables' share in the energy mix by 2030.

- Furthermore, the Saudi Electricity Co. signed two contracts with a Chinese and a Saudi company to implement a smart grid project worth USD 720 million for the Kingdom's electricity distribution network. The project involves connecting the country's distribution network with advanced control centres.

- Due to such developments, the country will likely grow faster in the medium voltage switchgear market in the coming years.

MEA Medium Voltage Switchgear Industry Overview

The Middle East and Africa medium voltage switchgear market is moderately fragmented. Some key players (in no particular order) include ABB Ltd., Schneider Electric SE, Eaton Corporation Plc., Havells Group, and Siemens AG.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 5000102

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Compact Switchgear

- 5.1.2 Metal-Clad Switchgear

- 5.1.3 Metal-Enclosed Switchgear

- 5.1.4 Vault or Subsurface Switchgear

- 5.1.5 Pad-mounted Switchgear

- 5.2 Installation

- 5.2.1 Indoor

- 5.2.2 Outdoor

- 5.3 Applications

- 5.3.1 Transmission and Distribution Networks

- 5.3.2 Electricity Generating Stations

- 5.3.3 Commercial Buildings

- 5.3.4 Industrial Sector

- 5.3.5 Railways

- 5.3.6 Others

- 5.4 Geography

- 5.4.1 Iran

- 5.4.2 Saudi Arabia

- 5.4.3 United Arab Emirates

- 5.4.4 Angola

- 5.4.5 South Africa

- 5.4.6 Rest of Middle-East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 ABB Ltd.

- 6.3.2 Schneider Electric SE

- 6.3.3 Eaton Corporation Plc.

- 6.3.4 Havells Group

- 6.3.5 Siemens AG

- 6.3.6 Middle-East Switchgear Ind. Ltd.

- 6.3.7 Al Sumaa Elect Switchgear Industry LLC

- 6.3.8 Alfanar Group

- 6.3.9 Mitsubishi Electric Corporation

- 6.3.10 Nuventura GmBH

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.