PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1666924

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1666924

Flue Gas Desulfurization System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

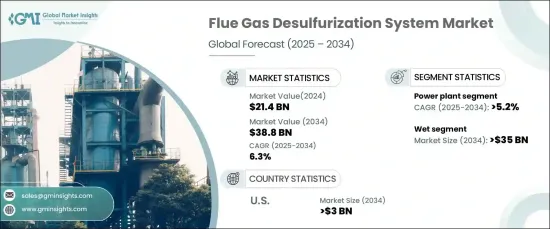

The Global Flue Gas Desulfurization System Market, valued at USD 21.4 billion in 2024, is anticipated to grow at a steady CAGR of 6.3% from 2025 to 2034. The increasing energy demand has led to a rise in industrial emissions, contributing to significant environmental challenges. With growing concerns over air pollution caused by power plants and industrial facilities, governments and policymakers worldwide are emphasizing stricter emission control measures.

The rapid expansion of industrial activities, driven by the establishment of new manufacturing facilities and industrial hubs, has further underscored the urgency of implementing robust environmental regulations. As industrial operations intensify, emissions of harmful pollutants such as sulfur dioxide (SO2) have escalated, highlighting the critical need for advanced emission control technologies like FGD systems.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $21.4 Billion |

| Forecast Value | $38.8 Billion |

| CAGR | 6.3% |

The market for wet FGD systems is projected to surpass USD 35 billion by 2034. These systems are highly efficient in reducing sulfur dioxide and particulate matter from industrial emissions, making them a popular choice for industries aiming to comply with evolving environmental standards. The effectiveness of wet FGD systems in managing both air and wastewater pollutants has positioned them as a key solution in energy-intensive sectors.

FGD systems are also gaining traction in power generation applications, with this segment expected to grow at a CAGR of over 5.2% by 2034. As the electricity demand continues to rise, driven by economic development and industrialization, the adoption of advanced technologies to curb emission levels has become essential. FGD systems are vital in reducing sulfur dioxide emissions and ensuring adherence to stringent environmental guidelines in power plants.

In the United States, the FGD system market is expected to exceed USD 3 billion by 2034. Investments in emission control technologies, supported by government initiatives and funding, are driving market growth. These advancements are helping to lower the costs of deploying sophisticated systems, paving the way for widespread adoption.

In the Asia Pacific, efforts to integrate energy infrastructure with emission control technologies are accelerating the deployment of FGD systems. Collaborative regional approaches and a focus on industrial hubs are fostering progress toward reducing air pollution, supporting the market's growth in the region. This strategy is expected to drive further advancements in the adoption of FGD systems globally.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's Analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL Analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Strategic outlook

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Technology, 2021 – 2034 (USD Billion)

- 5.1 Key trends

- 5.2 Wet

- 5.3 Dry

Chapter 6 Market Size and Forecast, By Application, 2021 – 2034 (USD Billion)

- 6.1 Key trends

- 6.2 Power Plants

- 6.3 Chemical & petrochemical

- 6.4 Cement

- 6.5 Metal Processing & mining

- 6.6 Manufacturing

- 6.7 Others

Chapter 7 Market Size and Forecast, By Region, 2021 – 2034 (USD Billion)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.2.3 Mexico

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 South Korea

- 7.4.5 Indonesia

- 7.4.6 Australia

- 7.4.7 Vietnam

- 7.5 Middle East & Africa

- 7.5.1 Saudi Arabia

- 7.5.2 UAE

- 7.5.3 South Africa

- 7.5.4 Nigeria

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Argentina

- 7.6.3 Chile

Chapter 8 Company Profiles

- 8.1 Alstom

- 8.2 Andritz

- 8.3 Babcock & Wilcox

- 8.4 Beijing SPC Environment Protection Tech

- 8.5 Chiyoda

- 8.6 Doosan Enerbility

- 8.7 Ducon Infratechnologies

- 8.8 FLSmidth

- 8.9 General Electric

- 8.10 Hamon

- 8.11 Ljungstrom

- 8.12 Longking Environmental Protection

- 8.13 Marsulex Environmental Technologies

- 8.14 Mitsubishi Heavy Industries

- 8.15 Thermax

- 8.16 Valmet