PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773221

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773221

Dry Flue Gas Desulfurization System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

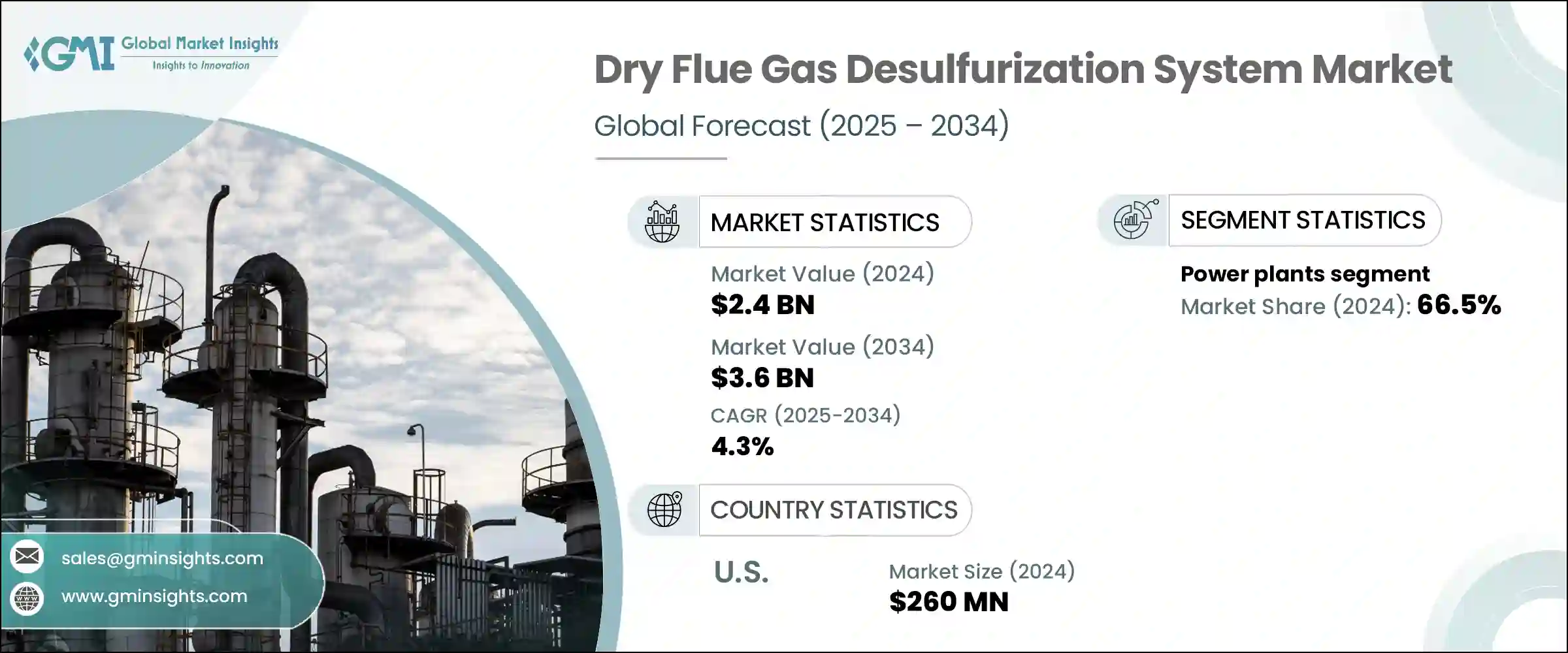

The Global Dry Flue Gas Desulfurization System Market was valued at USD 2.4 billion in 2024 and is estimated to grow at a CAGR of 4.3% to reach USD 3.6 billion by 2034. The market growth is fueled by increasing industrial demand for efficient sulfur dioxide (SO2 ) emission control, driven by tightening environmental regulations and the global push toward cleaner production. These dry FGD technologies provide several advantages, including low water consumption, reduced system complexity, and simplified integration into existing infrastructure. Industries such as power generation, chemical manufacturing, cement production, and metal processing are increasingly installing these systems as part of compliance and sustainability strategies.

Technological upgrades continue to improve the performance and reliability of dry FGD systems, making them a preferred choice for businesses aiming to lower emissions without compromising productivity. As public and regulatory pressure mounts to cut air pollution, industries in fast-developing economies are seeing growing demand for these systems. Retrofitting existing facilities has become easier due to the compact design and modular capabilities of dry FGD technologies. In regions like Europe and North America, strong policy enforcement and green initiatives are leading to widespread adoption, especially where regulatory compliance and environmental performance are prioritized.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.4 Billion |

| Forecast Value | $3.6 Billion |

| CAGR | 4.3% |

In terms of application, the power generation segment held the largest market share at 66.5% in 2024 and is projected to grow at a CAGR of 3.6% through 2034. This growth is primarily driven by aggressive emission mandates that require older coal-based plants to be retrofitted quickly and cost-effectively. Dry FGD systems remain an ideal fit, offering minimal water usage, streamlined design, and quicker installation timelines. Their scalable, modular nature provides utilities with the flexibility to meet emission standards without heavy investment in civil engineering or plant overhaul, especially amid a broader global energy transition.

United States Dry Flue Gas Desulfurization System Market generated USD 260 million in 2024. The market's strength is supported by rigorous EPA regulations and a strong emphasis on reducing sulfur emissions in industrial processes. Dry FGD technologies stand out in this market for their water-saving features, ease of installation in pre-existing flue gas channels, and reduced operational interruptions during upgrades. As environmental accountability intensifies, these systems are playing a vital role in helping U.S. industries meet compliance requirements with efficiency.

Prominent players shaping the Dry Flue Gas Desulfurization System Market include Mitsubishi Heavy Industries, GE Vernova, CECO Environmental, and Babcock & Wilcox Enterprises. Companies in the dry flue gas desulfurization system market are focusing on strategic initiatives such as forming partnerships with energy producers, offering turnkey retrofit solutions, and expanding service portfolios to include digital monitoring and predictive maintenance tools.

By prioritizing modular system designs and water-efficient technologies, firms are addressing the practical needs of industries operating in water-scarce regions. Investments in R&D aim to enhance system efficiency, reduce energy consumption, and improve SO2 capture rates. Manufacturers are also expanding their global footprints by targeting emerging markets with industrial expansion and strict air quality regulations. Leveraging automation and smart control integration has allowed these companies to deliver more tailored, compliance-ready solutions that align with industry-specific emission control standards and operational constraints.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, 2024

- 4.3 Strategy dashboard

- 4.4 Strategic initiative

- 4.5 Competitive benchmarking

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Application, 2021 - 2034, (USD Billion)

- 5.1 Key trends

- 5.2 Power plants

- 5.3 Chemical & petrochemical

- 5.4 Cement

- 5.5 Metal processing & mining

- 5.6 Manufacturing

- 5.7 Others

Chapter 6 Market Size and Forecast, By Region, 2021 - 2034, (USD Billion)

- 6.1 Key trends

- 6.2 North America

- 6.2.1 U.S.

- 6.2.2 Canada

- 6.2.3 Mexico

- 6.3 Europe

- 6.3.1 Germany

- 6.3.2 UK

- 6.3.3 France

- 6.3.4 Spain

- 6.3.5 Italy

- 6.3.6 Netherlands

- 6.4 Asia Pacific

- 6.4.1 China

- 6.4.2 India

- 6.4.3 Japan

- 6.4.4 South Korea

- 6.4.5 Australia

- 6.5 Middle East & Africa

- 6.5.1 Saudi Arabia

- 6.5.2 UAE

- 6.5.3 South Africa

- 6.6 Latin America

- 6.6.1 Brazil

- 6.6.2 Chile

- 6.6.3 Argentina

Chapter 7 Company Profiles

- 7.1 Babcock & Wilcox Enterprises

- 7.2 CECO Environmental

- 7.3 Duconenv

- 7.4 GE Vernova

- 7.5 GEA Group Aktiengesellschaft

- 7.6 Hitachi Zosen Inova AG

- 7.7 John Cockerill

- 7.8 KC Cottrell India

- 7.9 MET

- 7.10 Mitsubishi Heavy Industries

- 7.11 Nederman Holding AB

- 7.12 Thermax Limited.

- 7.13 Tri-Mer Corporation

- 7.14 Valmet

- 7.15 Verantis Environmental Solutions Group