PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1666693

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1666693

Large Bore Vacuum Insulated Pipe Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

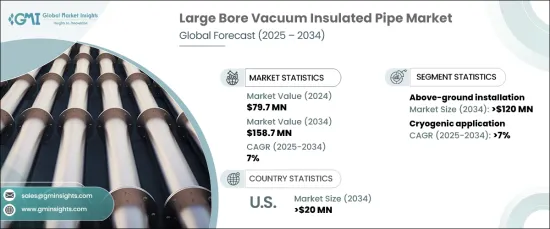

The Global Large Bore Vacuum Insulated Pipe Market was valued at USD 79.7 million in 2024 and is projected to grow at a robust CAGR of 7% between 2025 and 2034. This growth is fueled by the increasing integration of advanced materials designed to enhance thermal efficiency and minimize heat ingress, crucial in a world shifting toward sustainability. As industries seek more energy-efficient solutions for the transportation and storage of cryogenic liquids, large bore vacuum insulated pipes have become essential in supporting the evolving infrastructure.

This is particularly evident in the LNG (liquefied natural gas) sector, where these pipes play a key role in ensuring safety and efficiency in critical energy systems. Moreover, the rising global focus on clean energy and resource optimization, alongside investments in space exploration and biotechnology, has further heightened the demand for vacuum insulation technologies. These sectors require precise and reliable thermal regulation, a need that large bore vacuum insulated pipes fulfill with increasing precision.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $79.7 Million |

| Forecast Value | $158.7 Million |

| CAGR | 7% |

The integration of vacuum-insulated pipes into these industries reflects broader trends in technological advancements. Companies are increasingly turning to these systems for their ability to maintain extremely low temperatures while preventing energy losses. The ability of these pipes to maintain cryogenic liquids at optimal conditions for longer periods of time has made them indispensable in industries beyond just energy, including medical and aerospace sectors, where the safe transport and storage of sensitive materials are paramount. These pipes are not only enhancing operational efficiency but are also helping businesses adhere to growing environmental regulations, further accelerating their adoption across diverse industries.

The above-ground installation segment of this market is set to reach USD 120 million by 2034. This growth is primarily driven by the increasing number of integrated gasification combined cycle (IGCC) projects. These projects, which combine power generation with purified gas production, place a strong emphasis on environmental benefits and efficiency, thereby boosting demand for vacuum-insulated piping solutions. Innovations in containment technologies have further improved the performance and design of vacuum-insulated pipes, allowing for more effective cryogenic liquid transport.

In terms of applications, the cryogenic segment is projected to grow at a steady 7% CAGR through 2034. The global demand for cryogenic liquids such as LNG, helium, hydrogen, and nitrogen is escalating due to expanding international trade and a global push for energy efficiency. Furthermore, the growing adoption of natural gas-based power plants highlights a global shift toward cleaner energy, creating a strong need for vacuum-insulated pipes in both energy and industrial applications.

The U.S. large bore vacuum insulated pipe market is forecast to reach USD 20 million by 2034. This surge is driven by the increasing need for energy-efficient cryogenic systems across various industries. With advances in materials that improve thermal efficiency and continued innovations in LNG infrastructure, the demand for vacuum-insulated pipes in the U.S. is expected to grow substantially. This market is being shaped by efforts to optimize industrial processes while supporting the transport of cryogenic fluids with greater efficiency and safety.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Strategic outlook

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Installation, 2021 – 2034 (km & USD Million)

- 5.1 Key trends

- 5.2 Above ground

- 5.3 Under ground

- 5.4 Under sea

Chapter 6 Market Size and Forecast, By Application, 2021 – 2034 (km & USD Million)

- 6.1 Key trends

- 6.2 Cryogenic

- 6.3 Aerospace

- 6.4 Chemical

- 6.5 Others

Chapter 7 Market Size and Forecast, By Region, 2021 – 2034 (km & USD Million)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.2.3 Mexico

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 Italy

- 7.3.4 France

- 7.3.5 Spain

- 7.3.6 Russia

- 7.3.7 Norway

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 South Korea

- 7.4.5 Indonesia

- 7.4.6 Thailand

- 7.4.7 Malaysia

- 7.4.8 Australia

- 7.5 Middle East & Africa

- 7.5.1 Kuwait

- 7.5.2 Oman

- 7.5.3 Saudi Arabia

- 7.5.4 UAE

- 7.5.5 Qatar

- 7.5.6 South Africa

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Argentina

Chapter 8 Company Profiles

- 8.1 Ability Engineering Technology, Inc.

- 8.2 Cryogas Equipment Pvt. Ltd.

- 8.3 CRYOSPAIN

- 8.4 Cryoworld

- 8.5 Demaco

- 8.6 INTECH GmbH

- 8.7 Maxcon Industries Pty. Ltd

- 8.8 PERMA-PIPE International Holdings, Inc.

- 8.9 Schwanner GmbH

- 8.10 TMK