PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1666646

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1666646

Pressure Sensor Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

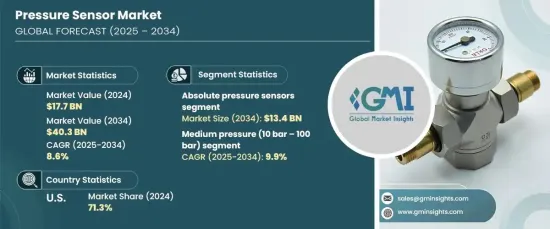

The Global Pressure Sensor Market reached USD 17.7 billion in 2024 and is projected to expand at a CAGR of 8.6% between 2025 and 2034. This surge is primarily fueled by continuous advancements in sensor technology, including miniaturization, improved spectral resolution, and the development of cost-effective systems that are accessible to a wide range of industries.

As the demand for smarter and more reliable sensing solutions increases across sectors such as automotive, healthcare, industrial automation, and aerospace, pressure sensors have become essential components for many critical applications. Their versatility and accuracy make them integral to the smooth operation of numerous systems, from engine management to environmental monitoring. The growing reliance on automation, coupled with the rising need for precision in high-performance machinery, is driving market growth. With significant investments in smart technologies and infrastructure development, the demand for advanced pressure sensors is set to escalate in the coming years.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $17.7 billion |

| Forecast Value | $40.3 billion |

| CAGR | 8.6% |

Pressure sensors are categorized by product type, with differential, absolute, vacuum, sealed, multi-range, and gauge pressure sensors being the most commonly used. Among these, the absolute pressure sensor segment holds the largest share of the market and is projected to reach USD 13.4 billion by 2034. These sensors are designed to measure pressure in relation to a perfect vacuum, making them crucial for applications requiring high levels of precision, such as in aerospace, automotive, and environmental monitoring. With their ability to function consistently despite fluctuations in atmospheric pressure, they are indispensable in environments where accuracy is non-negotiable.

The market is also segmented by pressure range, including low (up to 10 bar), medium (10 bar to 100 bar), and high-pressure (above 100 bar) sensors. The medium-pressure segment, operating within the 10 bar to 100 bar range, is the fastest-growing category, with a projected CAGR of 9.9% from 2025 to 2034. These sensors play a vital role in industries such as manufacturing, automotive, and industrial automation. They are essential for the monitoring and control of hydraulic and pneumatic systems, which ensure the stability and efficiency of various machinery and processes.

In 2024, the U.S. dominated the global pressure sensor market, holding a commanding 71.3% share. The country's leading position is attributed to its advanced technological infrastructure, strong automotive sector, and significant investments in industrial automation and healthcare. As these industries continue to innovate, the demand for pressure sensors is expected to keep rising. With ongoing advancements in technology and infrastructure, particularly in areas requiring high precision and reliability, the U.S. remains a key player in the global market.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Advancements in automotive technologies

- 3.6.1.2 Growth in industrial automation

- 3.6.1.3 Expansion of consumer electronics

- 3.6.1.4 Increased focus on healthcare monitoring

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High manufacturing costs

- 3.6.2.2 Integration and calibration complexities

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product Type, 2021-2034 (USD Million & Volume Units)

- 5.1 Key trends

- 5.2 Absolute pressure sensors

- 5.3 Gauge pressure sensors

- 5.4 Differential pressure sensors

- 5.5 Vacuum pressure sensors

- 5.6 Sealed pressure sensors

- 5.7 Multi-range pressure sensors

- 5.8 Others

Chapter 6 Market Estimates & Forecast, By Technology, 2021-2034 (USD Million & Units)

- 6.1 Key trends

- 6.2 Piezoresistive

- 6.3 Capacitive

- 6.4 Electromagnetic

- 6.5 Resonant solid-state

- 6.6 Optical

- 6.7 Others

Chapter 7 Market Estimates & Forecast, By Output Type, 2021-2034 (USD Million & Units)

- 7.1 Key trends

- 7.2 Analog output

- 7.3 Digital output

Chapter 8 Market Estimates & Forecast, By Pressure Range, 2021-2034 (USD Million & Units)

- 8.1 Key trends

- 8.2 Low pressure (Up to 10 bar)

- 8.3 Medium pressure (10 bar – 100 bar)

- 8.4 High pressure (Above 100 bar)

Chapter 9 Market Estimates & Forecast, By Industry Vertical, 2021-2034 (USD Million & Units)

- 9.1 Key trends

- 9.2 Automotive

- 9.3 Healthcare

- 9.4 Industrial manufacturing

- 9.5 Energy and power

- 9.6 Consumer electronics

- 9.7 Aerospace & defense

- 9.8 Oil & gas

- 9.9 Others

Chapter 10 Market Estimates & Forecast, By Region, 2021-2034 (USD Million & Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Analog Devices Inc. (ADI)

- 11.2 APG (American Pressure Gauge)

- 11.3 Bosch Sensortec

- 11.4 Delphi Technologies

- 11.5 Emerson Electric Co.

- 11.6 First Sensor AG

- 11.7 FUTEK Advanced Sensor Technology

- 11.8 Hitec Products

- 11.9 Honeywell International Inc.

- 11.10 Infineon Technologies AG

- 11.11 Kistler Instrumente AG

- 11.12 Murata Manufacturing Co., Ltd.

- 11.13 NXP Semiconductors

- 11.14 Panasonic Corporation

- 11.15 Sensata Technologies

- 11.16 STMicroelectronics

- 11.17 TE Connectivity

- 11.18 Texas Instruments (TI)