PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850010

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850010

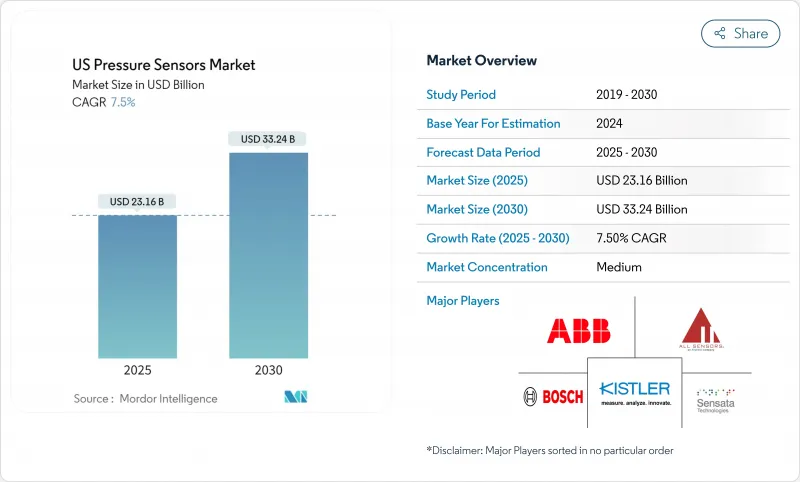

US Pressure Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The US pressure sensors market is valued at USD 23.16 billion in 2025 and is projected to climb to USD 33.24 billion by 2030, advancing at a 7.50% CAGR.

Semiconductor manufacturers are driving a large share of this expansion as fabs tighten vacuum and gas control tolerances below +-0.05% full scale. Heightened safety rules in automotive, medical, and LNG infrastructure keep demand resilient even when supply chains face stress. The convergence of MEMS and NEMS platforms is reshaping cost curves, with nanoscale devices setting new accuracy benchmarks while easing integration into AI-ready modules. Battery-powered IoT systems are pushing adoption of capacitive designs that combine low power with temperature stability. Regionally, the South benefits from energy-cost advantages that attract new plants, while helium scarcity is forcing packaging innovation that improves long-term hermeticity.

US Pressure Sensors Market Trends and Insights

TPMS Replacement Cycle Accelerates Aftermarket Demand

First-generation mandatory Tire Pressure Monitoring Systems are now reaching end-of-life, creating repeat business for sensor suppliers. Vehicles built after the 2007 TREAD Act are entering second and third replacement cycles, and winter road-salt exposure in the Northeast and Midwest quickens battery depletion. Bartec Auto ID's 2025 Rite-SensorBlue(R), tailored for Tesla models, illustrates the shift toward EV-optimized TPMS that adds Bluetooth diagnostics and extends service intervals. Predictive alerts embedded in these units move the aftermarket from reactive swaps to scheduled maintenance, supporting premium price points.

Medicare Reimbursement for Home BP Monitors

Expanded Medicare and Medicaid coverage now reaches 84% of state plans for self-measured blood pressure devices, opening access for about 1.4 million beneficiaries with hypertension. Michigan's program pays up to USD 75 per device, setting a national pricing anchor. This reimbursement landscape fuels rapid demand for reliable low-pressure sensors that fit in compact arm-cuffs while streaming data into telehealth platforms.

Smart-Phone Barometer Saturation

Nearly every mid-to-high-tier handset now ships with a barometric sensor, capping volume growth in consumer electronics. Manufacturers pivot toward differentiated performance such as ultra-low-power variants for wearables or high-precision altimeters for drones, carving niche gains in an otherwise mature space concentrated in West Coast supply chains.

Other drivers and restraints analyzed in the detailed report include:

- OSHA LNG Continuous-Logging Mandate

- Semiconductor-Fab Ultra-High-Accuracy Demand

- Helium Shortage Inflates MEMS Packaging Cost

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

MEMS held 31.05% of the US pressure sensors market share in 2024 and underpin mainstream automotive and industrial designs. Yield-optimized silicon lines keep unit costs low, while graphene membranes now lift sensitivity to 66 µV/V/kPa, enhancing resolution for altimeters and medical wearables. Strain-gauge devices remain favored in harsh settings such as upstream oil where silicon carbide variants work reliably at 600 °C. Optical sensors gain ground in environments with strong electromagnetic fields.

As foundries deploy shared tooling, production scale will narrow cost gaps with MEMS, opening broader adoption in high-volume medical disposables. The US pressure sensors market will therefore see a gradual blend of micro and nano formats in mixed-technology modules that embed AI and data encryption.

Piezoresistive architectures led with 46.00% revenue share in 2024 because manufacturers can reuse mature CMOS back-end steps. Recent silicon-carbide revisions cut the temperature coefficient of zero output to 0.08% per °C, fitting harsh oilfield or aerospace needs. Polynomial-regression algorithms embedded in ASICs trim residual errors to 0.008% FS, aligning accuracy with mission-critical expectations.

Capacitive sensing, projected to rise at a 10.20% CAGR, provides superior energy efficiency vital for battery-powered IoT nodes. ES Systems' 2024 release achieves +-0.25% FS total error while offering I2C, SPI, and analog outputs. Resonant techniques stay in specialty vacuum gauges where 0.1 Pa resolution guides semiconductor chamber pressure. The US pressure sensors market will see competitive overlap as vendors integrate multiple technologies into single packages that let OEMs dial performance to application-specific thresholds.

The United States Pressure Sensors Market Report is Segmented by Sensor Type (MEMS, Strain-Gauge and More), Technology (Piezoresistive, Capacitive and More), Output Interface, Pressure Range, Application (Automotive, Medical, Industrial, Consumer Electronics and More), US Region (Northeast, Midwest and More)

List of Companies Covered in this Report:

- Honeywell International Inc.

- Sensata Technologies Inc.

- Bosch Sensortec GmbH

- Emerson Electric Co. (Rosemount)

- ABB Ltd.

- Infineon Technologies AG

- STMicroelectronics NV

- Tektronix-Kistler Group

- NXP Semiconductors NV

- Panasonic Industry Co.

- TE Connectivity Ltd.

- Omron Corporation

- Pressure Systems Inc.

- All Sensors Corp.

- Endress+Hauser AG

- Rockwell Automation Inc.

- Yokogawa Electric Corp.

- Siemens AG

- Kulite Semiconductor Products Inc.

- TDK-Invensense Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 TPMS replacement cycle accelerates aftermarket demand

- 4.2.2 Medicare reimbursement for home BP monitors

- 4.2.3 OSHA LNG continuous?logging mandate

- 4.2.4 Semiconductor-fab ultra-high-accuracy demand

- 4.3 Market Restraints

- 4.3.1 Smart-phone barometer saturation

- 4.3.2 Helium shortage inflates MEMS packaging cost

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Sensor Type

- 5.1.1 MEMS

- 5.1.2 Strain-Gauge

- 5.1.3 NEMS

- 5.1.4 Optical

- 5.2 By Technology

- 5.2.1 Piezoresistive

- 5.2.2 Capacitive

- 5.2.3 Resonant

- 5.2.4 Others

- 5.3 By Output Interface

- 5.3.1 Analog

- 5.3.2 Digital (IC/SPI)

- 5.4 By Pressure Range

- 5.4.1 <10 kPa (Low)

- 5.4.2 10 kPa 1 MPa (Medium)

- 5.4.3 >1 MPa (High)

- 5.5 By Application

- 5.5.1 Automotive

- 5.5.2 Medical

- 5.5.3 Consumer Electronics

- 5.5.4 Industrial

- 5.5.5 Aerospace & Defence

- 5.5.6 Food & Beverage

- 5.5.7 HVAC

- 5.5.8 Others

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Honeywell International Inc.

- 6.4.2 Sensata Technologies Inc.

- 6.4.3 Bosch Sensortec GmbH

- 6.4.4 Emerson Electric Co. (Rosemount)

- 6.4.5 ABB Ltd.

- 6.4.6 Infineon Technologies AG

- 6.4.7 STMicroelectronics NV

- 6.4.8 Tektronix-Kistler Group

- 6.4.9 NXP Semiconductors NV

- 6.4.10 Panasonic Industry Co.

- 6.4.11 TE Connectivity Ltd.

- 6.4.12 Omron Corporation

- 6.4.13 Pressure Systems Inc.

- 6.4.14 All Sensors Corp.

- 6.4.15 Endress+Hauser AG

- 6.4.16 Rockwell Automation Inc.

- 6.4.17 Yokogawa Electric Corp.

- 6.4.18 Siemens AG

- 6.4.19 Kulite Semiconductor Products Inc.

- 6.4.20 TDK-Invensense Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space & Unmet-need Assessment