PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892858

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892858

Animal Feed Probiotics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

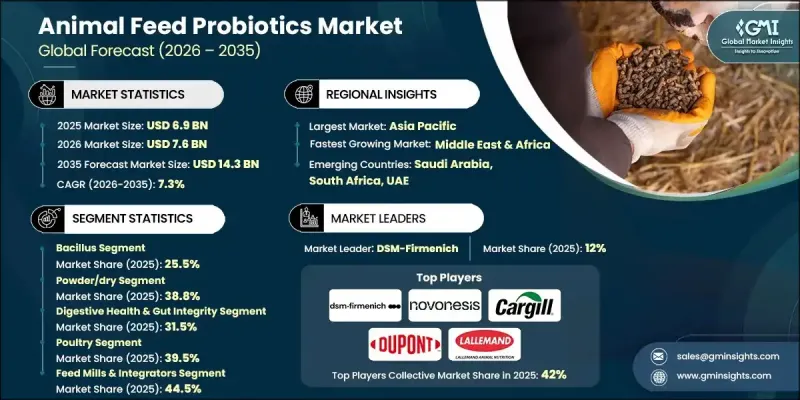

The Global Animal Feed Probiotics Market was valued at USD 6.9 billion in 2025 and is estimated to grow at a CAGR of 7.3% to reach USD 14.3 billion by 2035.

Growth is supported by regulatory shifts that limit the use of antibiotics in animal nutrition, encouraging producers to adopt alternative health management approaches. Feed manufacturers increasingly rely on nutrition-based solutions that support gut balance and overall animal performance. Probiotics have become an integral part of this transition as microbiome-focused ingredients that enhance health outcomes without relying on medically important compounds. Even modest adoption levels have a significant impact due to the sheer scale of global feed production. Market acceptance is reinforced by consistent performance improvements observed across production systems, including better growth efficiency, reduced disease pressure, and improved output quality. These benefits align probiotics with preventive animal health strategies rather than reactive treatment models. Sustainability considerations further strengthen demand, as probiotics support improved nutrient utilization and contribute to lower environmental impact, helping producers meet climate commitments and evolving sourcing standards.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $6.9 Billion |

| Forecast Value | $14.3 Billion |

| CAGR | 7.3% |

The bacillus-based probiotics segment held a 25.5% share in 2025 and is expected to grow at a CAGR of 6.6% through 2035. Their stability under high processing temperatures and challenging storage conditions supports widespread use in commercial feed manufacturing. These characteristics make them a reliable solution for maintaining digestive balance and enzyme activity under production stress.

The powder and dry formulations segment held 38.8% share in 2025 and is forecast to grow at a CAGR of 6.2% from 2026 to 2035. Their ease of handling, uniform blending, long shelf life, and cost efficiency continue to drive adoption across large-scale feed operations.

North America Animal Feed Probiotics Market captured 29% share in 2025. Advanced production systems, strong regulatory oversight, and widespread adoption of antibiotic-free feeding programs continue to support market expansion. Regional leadership in precision nutrition and sustainability initiatives encourages ongoing innovation in probiotic development and delivery.

Key companies operating in the Global Animal Feed Probiotics Market include Chr. Hansen (Novonesis), DSM-Firmenich, Alltech, Cargill Animal Nutrition, Lallemand Animal Nutrition, Evonik Industries, Kemin Industries, DuPont Nutrition & Biosciences (IFF), Nutreco, Novus International, Lesaffre Group, Angel Yeast, Biomin, and MicroSynbiotiX. Companies in the Animal Feed Probiotics Market pursue focused strategies to strengthen their competitive position. Investment in research and strain development remains a priority to enhance efficacy and stability. Manufacturers expand product portfolios to address evolving regulatory and sustainability requirements. Strategic partnerships with feed producers support wider market penetration and application expertise. Firms emphasize quality assurance and traceability to build customer trust. Geographic expansion into high-growth regions improves scale and distribution reach.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product Type

- 2.2.3 Form

- 2.2.4 Function

- 2.2.5 Livestock

- 2.2.6 Distribution Channel

- 2.2.7 End Use

- 2.3 TAM Analysis, 2025-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Science-backed performance gains

- 3.2.1.2 Stewardship and trade requirements

- 3.2.1.3 Precision farming & stability tech

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Strain variability & dosing

- 3.2.2.2 Regulatory complexity

- 3.2.3 Market opportunities

- 3.2.3.1 Methane and nutrient management

- 3.2.3.2 Aquaculture and pet nutrition.

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product type

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) ( Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2022-2035 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Bacillus

- 5.3 Lactobacilli

- 5.4 Saccharomyces (Yeast-Based)

- 5.5 Bifidobacterium

- 5.6 Enterococcus

- 5.7 Postbiotics

- 5.8 Streptococcus

- 5.9 Others

Chapter 6 Market Estimates and Forecast, By Form, 2022-2035 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Powder/Dry

- 6.3 Microencapsulated

- 6.4 Liquid/Soluble

- 6.5 Granules

- 6.6 Others

Chapter 7 Market Estimates and Forecast, By Function, 2022-2035 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Digestive health & gut integrity

- 7.3 Immune support & modulation

- 7.4 Growth promotion & feed efficiency

- 7.5 Pathogen control & competitive exclusion

- 7.6 Stress management

- 7.7 Others

Chapter 8 Market Estimates and Forecast, By Livestock, 2022-2035 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 Poultry

- 8.2.1 Broilers

- 8.2.2 Layers

- 8.2.3 Breeders

- 8.2.4 Others

- 8.3 Swine

- 8.3.1 Piglets (pre-weaning & post-weaning)

- 8.3.2 Growers

- 8.3.3 Finishers

- 8.3.4 Others

- 8.4 Cattle (ruminants)

- 8.4.1 Dairy cattle

- 8.4.2 Beef cattle

- 8.5 Aquaculture

- 8.5.1 Salmon

- 8.5.2 Trout

- 8.5.3 Shrimp

- 8.5.4 Carp

- 8.5.5 Others

- 8.6 Pet food

- 8.6.1 Dogs

- 8.6.2 Cats

- 8.7 Equine

- 8.8 Others

Chapter 9 Market Estimates and Forecast, By Distribution Channel, 2022-2035 (USD Billion) (Kilo Tons)

- 9.1 Key trends

- 9.2 Feed mills & integrators

- 9.3 Veterinary distributors

- 9.4 Direct sales (manufacturer to farm)

- 9.5 Online/e-commerce

- 9.6 Others

Chapter 10 Market Estimates and Forecast, By End Use, 2022-2035 (USD Billion) (Kilo Tons)

- 10.1 Key trends

- 10.2 Commercial/industrial farms

- 10.3 Small-scale/backyard operations

- 10.4 Others

Chapter 11 Market Estimates and Forecast, By Region, 2022-2035 (USD Billion) (Kilo Tons)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Spain

- 11.3.5 Italy

- 11.3.6 Rest of Europe

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.4.6 Rest of Asia Pacific

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.5.4 Rest of Latin America

- 11.6 Middle East and Africa

- 11.6.1 Saudi Arabia

- 11.6.2 South Africa

- 11.6.3 UAE

- 11.6.4 Rest of Middle East and Africa

Chapter 12 Company Profiles

- 12.1 DSM-Firmenich

- 12.2 Chr. Hansen (Novonesis)

- 12.3 Cargill Animal Nutrition

- 12.4 DuPont Nutrition & Biosciences (IFF)

- 12.5 Lallemand Animal Nutrition

- 12.6 Alltech

- 12.7 Kemin Industries

- 12.8 Evonik Industries

- 12.9 Novus International

- 12.10 Lesaffre Group

- 12.11 Angel Yeast

- 12.12 Biomin

- 12.13 Nutreco

- 12.14 MicroSynbiotiX