PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1928995

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1928995

Stretch and Shrink Films Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

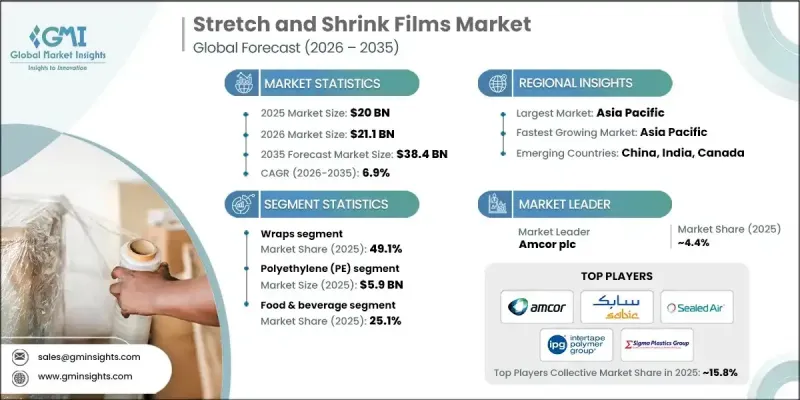

The Global Stretch and Shrink Films Market was valued at USD 20 billion in 2025 and is estimated to grow at a CAGR of 6.9% to reach USD 38.4 billion by 2035.

Market growth is driven by the accelerating adoption of circular economy practices, rising recycling initiatives, and increasing regulatory focus on sustainable packaging solutions. Rapid expansion of e-commerce and logistics activities is significantly boosting demand for durable, lightweight, and cost-efficient packaging materials that protect goods during transportation and storage. Growing applications in food preservation, combined with advancements in smart packaging and film manufacturing technologies, are further supporting market expansion. Heightened environmental awareness and stricter plastic waste regulations are encouraging manufacturers to introduce recyclable, biodegradable, and environmentally responsible film solutions. In addition, a growing preference for local sourcing and compliance with regional sustainability policies is reshaping supply chains. These trends have gained momentum over the past few years, particularly across Europe and North America, where eco-conscious packaging adoption has accelerated due to regulatory pressure and shifting consumer preferences.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $20 Billion |

| Forecast Value | $38.4 Billion |

| CAGR | 6.9% |

The wraps segment accounted for 49.1% share in 2025. Demand within this segment is being supported by the need for affordable and protective packaging solutions that maintain product integrity across food, retail, and online distribution channels. Manufacturers are increasingly prioritizing the development of high-performance and sustainable wrap solutions that balance protection, efficiency, and reduced environmental impact.

The polyethylene segment generated USD 5.9 billion in 2025. Polyethylene films continue to be widely adopted due to their versatility, durability, and cost advantages across multiple end-use industries. Producers are focusing on enhancing film quality while advancing recyclable, compostable, and lower-impact material options.

North America Stretch and Shrink Films Market held a 30.2% share in 2025. Regional growth is being driven by strong e-commerce activity, increasing automation in packaging operations, and regulatory frameworks that promote sustainable packaging adoption. Consumer demand for environmentally responsible packaging is further reinforcing market momentum.

Key companies operating in the Global Stretch and Shrink Films Market include Berry Global Inc., Amcor plc, Dow, LyondellBasell Industries N.V., Sealed Air, SABIC, Sigma Plastics Group, Paragon Films, RKW Group, Klockner Pentaplast, Intertape Polymer Group Inc., Coveris Holdings S.A., Bollore Inc, Balcan Innovations Inc, Scientex Berhad, HIPAC Spa, Italdibipack SpA, Film Source Packaging, A-Z Packaging, LUBAN PACK, and Shaktiman Packaging Pvt. Ltd. Companies in the Global Stretch and Shrink Films Market are strengthening their competitive position through sustainability-focused innovation, capacity expansion, and material optimization. Many players are investing in research to develop recyclable and bio-based films that comply with evolving environmental regulations. Enhancing production efficiency through automation and advanced manufacturing techniques is helping reduce costs and improve consistency. Strategic partnerships with e-commerce, food, and logistics companies are enabling long-term supply agreements.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry snapshot, 2022-2035

- 2.2 Key market trends

- 2.2.1 Material trends

- 2.2.2 Product trends

- 2.2.3 Thickness type trends

- 2.2.4 Application trends

- 2.2.5 Regional trends

- 2.3 TAM analysis, 2026-2035 (USD Million)

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Focus on circular economy and recycling initiatives

- 3.2.1.2 Expansion of E-commerce and logistics sector

- 3.2.1.3 Increasing applications in food preservation

- 3.2.1.4 Emergence of smart packaging solutions

- 3.2.1.5 Advancements in film manufacturing technologies

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Competition of alternative packaging materials

- 3.2.2.2 Regulatory pressures for plastic use reduction

- 3.2.3 Market Opportunities

- 3.2.3.1 Sustainable packaging solutions

- 3.2.3.2 Adoption of biodegradable films

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter';s analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Emerging business models

- 3.9 Compliance requirements

- 3.10 Sustainability measures

- 3.11 Consumer sentiment analysis

- 3.12 Geopolitical and trade dynamics

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 MEA

- 4.2.2 Market Concentration Analysis

- 4.2.1 By region

- 4.3 Competitive Benchmarking of key Players

- 4.3.1 Financial Performance Comparison

- 4.3.1.1 Revenue

- 4.3.1.2 Profit Margin

- 4.3.1.3 R&D

- 4.3.2 Product Portfolio Comparison

- 4.3.2.1 Product Range Breadth

- 4.3.2.2 Technology

- 4.3.2.3 Innovation

- 4.3.3 Geographic Presence Comparison

- 4.3.3.1 Global Footprint Analysis

- 4.3.3.2 Service Network Coverage

- 4.3.3.3 Market Penetration by Region

- 4.3.4 Competitive Positioning Matrix

- 4.3.4.1 Leaders

- 4.3.4.2 Challengers

- 4.3.4.3 Followers

- 4.3.4.4 Niche Players

- 4.3.5 Strategic outlook matrix

- 4.3.1 Financial Performance Comparison

- 4.4 Key developments, 2022-2025

- 4.4.1 Mergers and Acquisitions

- 4.4.2 Partnerships and Collaborations

- 4.4.3 Technological Advancements

- 4.4.4 Expansion and Investment Strategies

- 4.4.5 Sustainability Initiatives

- 4.4.6 Digital Transformation Initiatives

Emerging/ Startup Competitors Landscape

Chapter 5 Market Estimates and Forecast, By Material, 2022 - 2035 (USD Million)

- 5.1 Key trends

- 5.2 Polyethylene (PE)

- 5.3 Polyvinyl chloride (PVC)

- 5.4 Polypropylene (PP)

- 5.5 Biodegradable and compostable

- 5.6 Others

Chapter 6 Market Estimates and Forecast, By Product, 2022 - 2035 (USD Million)

- 6.1 Key trends

- 6.2 Hoods

- 6.3 Sleeves and labels

- 6.4 Wraps

Chapter 7 Market Estimates and Forecast, By Thickness Type, 2022 - 2035 (USD Million)

- 7.1 Key trends

- 7.2 Very thin / downgauged films (5-15 μm)

- 7.3 Standard commercial films (15- 25 μm)

- 7.4 Heavy-duty films (25-50 μm)

- 7.5 Ultra-heavy / specialty gauges (50 μm and above)

Chapter 8 Market Estimates and Forecast, By Application, 2022 - 2035 (USD Million)

- 8.1 Key trends

- 8.2 Consumer goods

- 8.3 Food & beverage

- 8.4 Industrial packaging

- 8.5 Logistics & transportation

- 8.6 Pharmaceuticals

- 8.7 Others

Chapter 9 Market Estimates and Forecast, By Region, 2022 - 2035 (USD Million)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Global Key Players

- 10.1.1 Amcor plc

- 10.1.2 Dow

- 10.1.3 Sealed Air

- 10.1.4 SABIC

- 10.2 Regional key players

- 10.2.1 North America

- 10.2.1.1 Intertape Polymer Group Inc.

- 10.2.1.2 Film Source Packaging

- 10.2.1.3 Sigma Plastics Group

- 10.2.2 Asia Pacific

- 10.2.2.1 Scientex Berhad

- 10.2.2.2 Shaktiman Packaging Pvt. Ltd.

- 10.2.3 Europe

- 10.2.3.1 Klockner Pentaplast

- 10.2.3.2 Bollore Inc.

- 10.2.1 North America

- 10.3 Niche Players/Disruptors

- 10.3.1 Balcan Innovations Inc.

- 10.3.2 HIPAC Spa

- 10.3.3 Italdibipack SpA

- 10.3.4 RKW Group

- 10.3.5 LyondellBasell Industries N.V.

- 10.3.6 A-Z Packaging

- 10.3.7 Paragon Films

- 10.3.8 Coveris Holdings S.A.

- 10.3.9 LUBAN PACK