PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1698517

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1698517

Protein Powder Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034

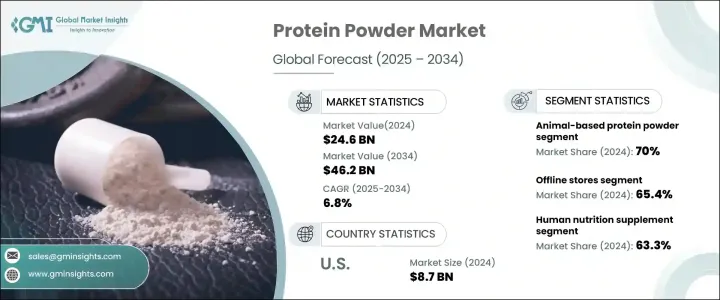

The Global Protein Powder Market, valued at USD 24.6 billion in 2024, is projected to expand at a CAGR of 6.8% from 2025 to 2034, driven by increasing consumer awareness of nutrition and wellness. This surge is fueled by a rising preference for high-protein diets, the availability of diverse flavors, and the crucial role protein plays in muscle development, metabolic function, and immune support. Health-conscious individuals and fitness enthusiasts are actively incorporating protein powders into their diets, reinforcing demand across various demographics.

With an increasing focus on preventive healthcare, consumers are seeking products that support overall well-being and fitness goals. The demand for protein powders is also being driven by a shift toward active lifestyles, where individuals prioritize dietary supplementation to enhance performance and recovery. Additionally, rapid urbanization and the fast-paced nature of modern living have led to a preference for convenient, on-the-go nutrition solutions, further propelling market expansion. Consumers are looking for formulations that align with their dietary preferences, whether plant-based, organic, or fortified with additional nutrients. As brands continue to innovate, new product launches catering to evolving consumer preferences are significantly influencing purchasing behavior.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $24.6 Billion |

| Forecast Value | $46.2 Billion |

| CAGR | 6.8% |

The market is segmented by protein source into plant-based and animal-based protein powders. Animal-based protein powders dominated the market with a 70% share in 2024, attributed to their superior amino acid profile and effectiveness in muscle recovery, weight management, and overall nutrition. These formulations are widely adopted by athletes, bodybuilders, and fitness professionals who require high-quality protein for optimized performance. Whey and casein proteins, derived from dairy sources, continue to lead the segment due to their rapid absorption and proven benefits in muscle synthesis. Meanwhile, plant-based protein powders, including pea, soy, and hemp protein, are gaining traction as consumers seek vegan and allergen-free alternatives. Brands are responding to this shift by enhancing product formulations to offer comparable protein content and improved digestibility.

The distribution landscape of the protein powder market is evolving, with offline and online channels shaping consumer purchasing behavior. In 2024, offline retail stores held a 65.4% market share, driven by consumer preference for in-store product trials and immediate purchases. Supermarkets, specialty nutrition stores, and health food retailers continue to be primary sales channels, offering a diverse range of products catering to different consumer needs. However, the growing influence of e-commerce platforms is reshaping the market dynamics. The convenience of doorstep delivery, coupled with exclusive online discounts and subscription models, has prompted a shift in consumer buying patterns. Digital shopping trends have accelerated, pushing brands to optimize their online presence through targeted advertising, influencer partnerships, and social media marketing strategies. Companies are leveraging data analytics to personalize offerings, enhance customer engagement, and drive sales in a competitive digital landscape.

The U.S. protein powder market, generating USD 8.7 billion in 2024, remains a key player in global industry expansion. With the number of licensed edible stores expected to surpass 165,000 in 2025, offline distribution channels are poised for further growth. Retailers are actively adapting to changing consumer preferences by improving product placement, expanding category selections, and offering in-store consultations to enhance customer experiences. At the same time, digital sales channels are witnessing exponential growth, fueled by increasing online engagement and brand-led marketing initiatives. Companies are continuously innovating to meet the dynamic expectations of modern consumers, ensuring product offerings remain relevant and accessible across multiple touchpoints. As the industry advances, competitive differentiation through product innovation, strategic partnerships, and omnichannel distribution will remain critical in sustaining market momentum.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Rising health awareness

- 3.6.1.2 Availability of various flavors

- 3.6.1.3 Expansion of offline distribution channels

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Fluctuations in price of raw materials

- 3.6.2.2 Mislabelling or inconsistent product potency

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates and Forecast, By Source, 2021 – 2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Plant-based

- 5.2.1 Soy

- 5.2.2 Spirulina

- 5.2.3 Hemp

- 5.2.4 Rice

- 5.2.5 Pea

- 5.2.6 Others

- 5.3 Animal-based

- 5.3.1 Whey

- 5.3.2 Casein

- 5.3.3 Egg

- 5.3.4 Fish

- 5.3.5 Insect

Chapter 6 Market Estimates and Forecast, By Application, 2021 – 2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Human nutrition supplement

- 6.2.1 Sports nutrition

- 6.2.2 Functional foods

- 6.3 Animal nutrition supplement

- 6.3.1 Poultry

- 6.3.2 Swine

- 6.3.3 Cattle

- 6.3.4 Aquaculture

- 6.3.5 Equine

- 6.3.6 Others

Chapter 7 Market Estimates and Forecast, By Distribution Channel, 2021 – 2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Supermarket/Hypermarket

- 7.3 Online

- 7.4 Drugstore

- 7.5 Nutrition & health food store

- 7.6 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 ABH Pharma Inc

- 9.2 Melaleuca Inc

- 9.3 Amway

- 9.4 Abbott Laboratories

- 9.5 Glanbia Group.

- 9.6 GlaxoSmithKline

- 9.7 Herbalife International of America, Inc.

- 9.8 GNC Holdings

- 9.9 Living Inc

- 9.10 Omega Protein

- 9.11 Vitaco Health

- 9.12 Atlantic Multipower UK Limited

- 9.13 Dalblads

- 9.14 Atlantic Multipower