PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1797838

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1797838

Ambulatory Surgical Centers Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

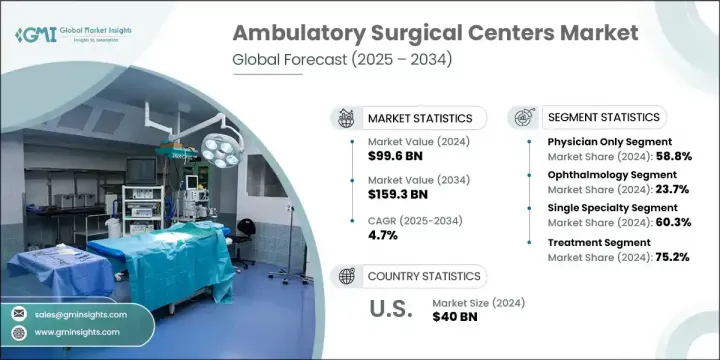

The Global Ambulatory Surgical Centers Market was valued at USD 99.6 billion in 2024 and is estimated to grow at a CAGR of 4.7% to reach USD 159.3 billion by 2034. This robust growth can be attributed to several key factors, including the increasing number of surgical procedures conducted in ASCs, the rising prevalence of chronic diseases such as cancer, diabetes, and obesity, and supportive reimbursement policies. ASCs are outpatient healthcare facilities that offer patients the convenience of same-day surgeries, making them a popular choice. As the demand for cost-effective, accessible, and convenient healthcare solutions increases, these centers are becoming an attractive option for physicians, as they not only provide a source of additional income but also enable better control over care delivery.

The increasing prevalence of chronic diseases, such as cancer, diabetes, and obesity, is significantly contributing to the growth of the ambulatory surgical center (ASC) market. These conditions require regular surgical interventions, creating a steady demand for outpatient procedures. Alongside this, favorable government policies, including improved reimbursement structures and incentives for outpatient care, are bolstering the sector's growth. Policies that encourage cost-effective and efficient healthcare services are further accelerating the shift from traditional hospital settings to more affordable ASC alternatives.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $99.6 Billion |

| Forecast Value | $159.3 Billion |

| CAGR | 4.7% |

The physician-led segment, which captured 58.8% of the market in 2024, remains a dominant force due to the autonomy it offers healthcare professionals. Physicians benefit from the ability to control essential aspects of their practice, such as surgical scheduling, equipment selection, and facility management. This level of flexibility not only enhances the quality of care but also provides physicians with an additional income stream, making it a highly attractive option for many in the medical field.

Furthermore, the ophthalmology segment holds the largest share of 23.7%, driven by the growing demand for eye surgeries, particularly cataract removal. The shift towards more affordable and efficient outpatient treatments is further fueling this growth, with many patients opting for ASCs to undergo common eye procedures like LASIK and retinal surgeries.

United States Ambulatory Surgical Centers Market was valued at USD 40 billion in 2024 and is expected to grow at a CAGR of 3.5% through 2034. The key driver behind this growth is the increasing trend of surgeries moving to outpatient settings, which provides patients with more cost-effective and convenient alternatives compared to traditional hospital-based surgeries. This transition not only supports healthcare efficiency but also aligns with the growing demand for personalized, timely care.

Key players in the Global Ambulatory Surgical Centers Market include AMSURG, ASD MANAGEMENT, Community Health Systems, Cura Day Surgery, Endeavor Health, HCA Healthcare, Mednation, Nova Medical Centers, Pediatrix, Physicians Endoscopy, Pinnacle III, Proliance SURGEONS, Ramsay Sante, Regent Surgical, SCA HEALTH, SURGCENTER DEVELOPMENT, SURGERY PARTNERS, Surgical Management Professionals, Tenet Health, and Trias MD. To strengthen their position in the market, companies in the ambulatory surgical centers sector focus on expanding their networks and improving operational efficiency. Strategies include forging partnerships with healthcare providers, investing in advanced technologies to improve patient care, and enhancing their service offerings by integrating specialized surgical procedures. Additionally, firms aim to leverage value-based care models, which emphasize cost-effective treatment while improving patient outcomes.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Ownership trends

- 2.2.3 Surgery type trends

- 2.2.4 Specialty type trends

- 2.2.5 Service trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of chronic diseases

- 3.2.1.2 Rise in number of surgical procedures

- 3.2.1.3 Favorable reimbursements and government policies

- 3.2.1.4 Lower risk of infections in ASCs than hospitals

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High costs of medical devices

- 3.2.2.2 Low physician-to-patient ratio

- 3.2.3 Market opportunities

- 3.2.3.1 Shift from inpatient to outpatient settings

- 3.2.3.2 Integration of AI and robotics in ASC surgeries

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Historical timeline of ASCs

- 3.7 Future market trends

- 3.8 Consumer behaviour analysis

- 3.9 Reimbursement scenario

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

- 3.12 Gap analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Global

- 4.2.2 North America

- 4.2.2.1 U.S.

- 4.2.3 Europe

- 4.2.4 Rest of the world (RoW)

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Ownership, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Physician only

- 5.3 Hospital only

- 5.4 Corporate only

- 5.5 Physician and hospital

- 5.6 Physician and corporate

- 5.7 Other ownership types

Chapter 6 Market Estimates and Forecast, By Surgery Type, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Ophthalmology

- 6.3 Endoscopy

- 6.4 Orthopedic

- 6.5 Neurology

- 6.6 Pain management

- 6.7 Plastic Surgery

- 6.8 Podiatry

- 6.9 Otolaryngology

- 6.10 Obstetrics / Gynecology

- 6.11 Dental

- 6.12 Others surgery types

Chapter 7 Market Estimates and Forecast, By Specialty Type, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Single specialty

- 7.3 Multi specialty

Chapter 8 Market Estimates and Forecast, By Service, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Treatment

- 8.3 Diagnosis

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 AMSURG

- 10.2 ASD MANAGEMENT

- 10.3 Community Health Systems

- 10.4 Cura Day Surgery

- 10.5 Endeavor Health

- 10.6 HCA Healthcare

- 10.7 Mednation

- 10.8 Nova Medical Centers

- 10.9 Pediatrix

- 10.10 Physicians endoscopy

- 10.11 Pinnacle III

- 10.12 Proliance SURGEONS

- 10.13 Ramsay Sante

- 10.14 Regent Surgical

- 10.15 SCA HEALTH

- 10.16 SURGCENTER DEVELOPMENT

- 10.17 SURGERY PARTNERS

- 10.18 Surgical Management Professionals

- 10.19 Tenet Health

- 10.20 Trias MD