PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1797864

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1797864

U.S. Ambulatory Surgical Centers Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

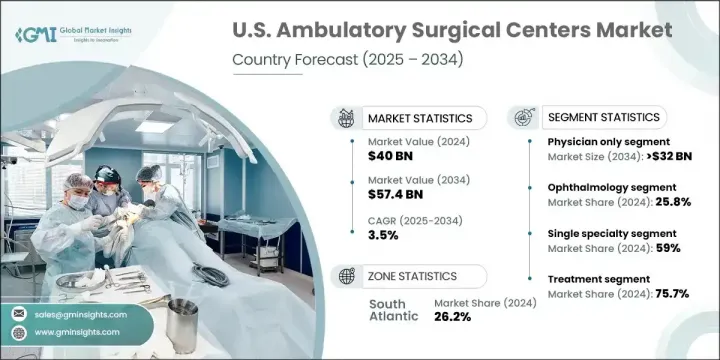

U.S. Ambulatory Surgical Centers Market was valued at USD 40 billion in 2024 and is estimated to grow at a CAGR of 3.5% to reach USD 57.4 billion by 2034. This robust growth is driven by factors such as the increasing prevalence of chronic diseases like cancer, favorable government reimbursement policies, and the rising number of surgical procedures being performed. ASCs offer treatments at a lower cost compared to traditional hospital settings, which makes them an attractive option for both healthcare providers and patients. These outpatient facilities are becoming more popular due to their efficiency and the fact that they can handle diagnostic, preventive, and surgical care, including routine and complex procedures. Major players in the industry include several large healthcare providers, as well as private physicians who prefer ownership models that allow them to share in both the management and financial success of the facilities.

The rising number of surgical procedures, the growing network of ASCs, and the affordability they offer continue to drive the market's expansion. With more patients opting for outpatient procedures due to their convenience and lower costs, ASCs have become the go-to choice for a wide variety of surgeries, from minor diagnostic procedures to more complex surgeries. The increasing pressure on traditional hospitals to reduce costs while maintaining quality care is prompting a shift toward outpatient facilities like ASCs, which are more cost-efficient and less resource-intensive. As the healthcare landscape evolves, more ASCs are opening across the U.S., expanding their reach into suburban and rural areas. These facilities are often more accessible to patients compared to hospitals, offering shorter wait times and less crowded environments.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $40 Billion |

| Forecast Value | $57.4 Billion |

| CAGR | 3.5% |

The physician segment held 59.3% share in 2024. This model offers doctors complete control over decision-making and management, resulting in better alignment between clinical and financial performance. With total ownership of their ASC, physicians can efficiently manage their practice, ultimately benefiting patients through more personalized care and faster decision-making processes.

The ophthalmology segment held 25.8% share in 2024. Procedures like cataract surgeries and LASIK are frequently performed in ASCs due to their cost-effectiveness and ability to meet the growing demand, especially with an aging population. Ophthalmology has become a key driver in the ASC sector, as these procedures can often be performed more efficiently and affordably in outpatient settings. With the increased preference for ambulatory surgery, ASCs are playing a crucial role in the delivery of quality eye care.

South Atlantic Ambulatory Surgical Centers Market held 26.2% in 2024. States like Florida, Georgia, and Maryland are expected to see a steady increase in both new and established ASCs. As population growth continues in this region, the demand for healthcare services will increase, which in turn will drive the expansion of surgical centers and boost industry growth across the U.S.

Prominent players operating in the U.S. Ambulatory Surgical Centers Market include HCA Healthcare, Surgery Partners, Tenet Health, Pinnacle III, Regent Surgical, Physicians Endoscopy, Surgical Management Professionals, ASCOA, Proliance Surgeons, ASD Management, Trias MD, and others. To strengthen their position in the U.S. ambulatory surgical centers market, companies are adopting several strategies aimed at improving both patient care and operational efficiency. Many providers are focusing on expanding their geographic reach by opening new centers in high-growth areas and underserved regions. Companies are also investing heavily in technological advancements, including the adoption of state-of-the-art medical equipment and digital health tools that enhance patient experience and streamline administrative tasks. Another key strategy is forming strategic partnerships with physicians, enabling them to jointly own and manage ASCs.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Zonal/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Zonal trends

- 2.2.2 Ownership trends

- 2.2.3 Surgery type trends

- 2.2.4 Specialty type trends

- 2.2.5 Service trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of chronic diseases

- 3.2.1.2 Rise in number of surgical procedures

- 3.2.1.3 Favorable reimbursements and government policies

- 3.2.1.4 Lower risk of infections in ASCs than hospitals

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High costs of medical devices

- 3.2.2.2 Low physician-to-patient ratio

- 3.2.3 Market opportunities

- 3.2.3.1 Shift from inpatient to outpatient settings

- 3.2.3.2 Integration of AI and robotics in ASC surgeries

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Ambulatory surgical centers - Shifting industry landscape

- 3.7 Historical timeline of ASCs

- 3.8 ASCs categorization, 2024

- 3.8.1 Operating room (OR)

- 3.8.2 Multi-specialty ASCs

- 3.8.3 ASC payer mix

- 3.9 ASCs procedure outlook - Most common and recent inclusions

- 3.10 Future market trends

- 3.11 Consumer behaviour analysis

- 3.12 Reimbursement scenario

- 3.13 Porter's analysis

- 3.14 PESTEL analysis

- 3.15 Gap analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Ownership, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Physician only

- 5.3 Hospital only

- 5.4 Corporate only

- 5.5 Physician and hospital

- 5.6 Physician and corporate

- 5.7 Other ownership types

Chapter 6 Market Estimates and Forecast, By Surgery Type, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Ophthalmology

- 6.3 Endoscopy

- 6.4 Orthopedic

- 6.5 Neurology

- 6.6 Pain management

- 6.7 Plastic Surgery

- 6.8 Podiatry

- 6.9 Otolaryngology

- 6.10 Obstetrics / Gynecology

- 6.11 Dental

- 6.12 Others surgery types

Chapter 7 Market Estimates and Forecast, By Specialty Type, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Single specialty

- 7.3 Multi specialty

Chapter 8 Market Estimates and Forecast, By Service, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Treatment

- 8.3 Diagnosis

Chapter 9 Market Estimates and Forecast, By Zones, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 South Atlantic

- 9.2.1 Delaware

- 9.2.2 Florida

- 9.2.3 Georgia

- 9.2.4 Maryland

- 9.2.5 North Carolina

- 9.2.6 South Carolina

- 9.2.7 Virginia

- 9.2.8 West Virginia

- 9.2.9 Washington, D.C.

- 9.3 Pacific Central

- 9.3.1 Alaska

- 9.3.2 California

- 9.3.3 Hawaii

- 9.3.4 Oregon

- 9.3.5 Washington

- 9.4 Northeast

- 9.4.1 Connecticut

- 9.4.2 Maine

- 9.4.3 Massachusetts

- 9.4.4 New Hampshire

- 9.4.5 Rhode Island

- 9.4.6 Vermont

- 9.4.7 New Jersey

- 9.4.8 New York

- 9.4.9 Pennsylvania

- 9.5 East North Central

- 9.5.1 Illinois

- 9.5.2 Indiana

- 9.5.3 Michigan

- 9.5.4 Ohio

- 9.5.5 Wisconsin

- 9.6 West South Central

- 9.6.1 Arkansas

- 9.6.2 Louisiana

- 9.6.3 Oklahoma

- 9.6.4 Texas

- 9.7 West North Central

- 9.7.1 Iowa

- 9.7.2 Kansas

- 9.7.3 Minnesota

- 9.7.4 Missouri

- 9.7.5 Nebraska

- 9.7.6 North Dakota

- 9.7.7 South Dakota

- 9.8 East South Central

- 9.8.1 Alabama

- 9.8.2 Kentucky

- 9.8.3 Mississippi

- 9.8.4 Tennessee

- 9.9 Mountain States

- 9.9.1 Arizona

- 9.9.2 Colorado

- 9.9.3 Utah

- 9.9.4 Nevada

- 9.9.5 New Mexico

- 9.9.6 Idaho

- 9.9.7 Montana

- 9.9.8 Wyoming

Chapter 10 Company Profiles

- 10.1 AMBULATORY SURGICAL CENTER of AMERICA (ASCOA)

- 10.2 AMSURG

- 10.3 ASD MANAGEMENT

- 10.4 HCA Healthcare

- 10.5 Physicians endoscopy

- 10.6 Pinnacle III

- 10.7 Proliance SURGEONS

- 10.8 Regent Surgical

- 10.9 SCA HEALTH

- 10.10 SURGCENTER DEVELOPMENT

- 10.11 SURGERY PARTNERS

- 10.12 Surgical Management Professionals

- 10.13 Tenet Health

- 10.14 Trias MD