PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1698520

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1698520

Silicon Carbide Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034

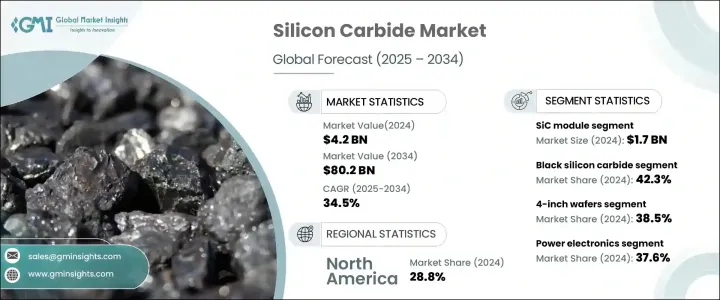

The Global Silicon Carbide Market was valued at USD 4.2 billion in 2024 and is projected to expand at a CAGR of 34.5% from 2025 to 2034, driven by the rising adoption of electric vehicles (EVs), expanding renewable energy applications, and increasing demand for high-efficiency power electronics. As industries shift toward advanced energy solutions, silicon carbide has emerged as a crucial material in various applications due to its superior efficiency, durability, and thermal performance.

One of the primary drivers of this growth is the surging demand for EVs worldwide. Automakers are increasingly integrating silicon carbide components into power electronics to enhance vehicle performance, improve charging efficiency, and extend battery range. SiC-based power semiconductors enable higher energy conversion efficiency, reducing power losses and heat generation in electric drivetrains. As governments introduce stringent emissions regulations and incentivize EV adoption, the demand for silicon carbide continues to accelerate. In addition to EVs, silicon carbide plays a critical role in renewable energy applications, particularly in solar and wind power systems. Its high thermal conductivity and resistance to extreme conditions enhance energy efficiency and system longevity, making it an essential component in next-generation power solutions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.2 Billion |

| Forecast Value | $80.2 Billion |

| CAGR | 34.5% |

The market is segmented by device type, with SiC modules generating USD 1.7 billion in revenue in 2024. These modules, which consist of components such as diodes and MOSFETs, are extensively used in electric vehicles, industrial power supplies, and renewable energy infrastructure. Their ability to handle high voltages and temperatures makes them ideal for power conversion applications, particularly in EV inverters and charging stations. As the automotive industry continues transitioning toward electric mobility, the demand for SiC modules is expected to rise significantly, fueling overall market growth.

Silicon carbide is also categorized by product type, with black silicon carbide holding a dominant market share of 42.3% in 2024. Recognized for its exceptional hardness and strength, black SiC is widely utilized in abrasive applications across industries such as automotive, aerospace, and metal fabrication. Its use in grinding, cutting, polishing, and wear-resistant coatings makes it indispensable in high-performance manufacturing. The increasing demand for durable and efficient abrasive materials has been a key factor in the segment's expansion.

North America accounted for 28.8% of the global silicon carbide market share in 2024, driven by advancements in electric vehicle technology, industrial automation, and renewable energy projects. The region's focus on energy efficiency and the widespread adoption of high-performance electronics have propelled market expansion. As industries continue investing in next-generation technologies, silicon carbide is set to play a vital role in shaping the future of power electronics and sustainable energy solutions.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing demand for energy efficient power electronics

- 3.2.1.2 Growing adoption of electric vehicles (EVs)

- 3.2.1.3 Growth in renewable energy systems

- 3.2.1.4 Expansion of 5G and telecommunications infrastructure

- 3.2.1.5 Expanding applications in aerospace and defense

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High manufacturing costs

- 3.2.2.2 Technical complexity and integration issues

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 – 2034 (USD Bn)

- 5.1 Key trends

- 5.2 Black silicon carbide

- 5.3 Green silicon carbide

- 5.4 Other silicon carbide types

Chapter 6 Market Estimates and Forecast, By Device Type, 2021 – 2034 (USD Bn)

- 6.1 Key trends

- 6.2 SiC discrete devices

- 6.2.1 Diodes

- 6.2.2 MOSFETs

- 6.2.3 BJTs (Bipolar Junction Transistors)

- 6.2.4 JFETs (Junction Field Effect Transistors)

- 6.3 SiC modules

- 6.4 Other SiC devices

Chapter 7 Market Estimates and Forecast, By Wafer Size, 2021 – 2034 (USD Bn)

- 7.1 Key trends

- 7.2 2-inch

- 7.3 4-inch

- 7.4 6-inch and above

Chapter 8 Market Estimates and Forecast, By Application, 2021 – 2034 (USD Bn)

- 8.1 Key trends

- 8.2 Power electronics

- 8.2.1 Power supply and inverter

- 8.2.2 Wireless charging

- 8.2.3 Power grid devices

- 8.2.4 Industrial motor drives

- 8.2.5 Electric vehicle charging infrastructure

- 8.2.6 Renewable energy systems

- 8.3 Optical Devices

- 8.3.1 LED lighting

- 8.3.2 Photonics

- 8.3.3 Laser applications

- 8.3.4 UV detectors

- 8.4 Sensing

- 8.4.1 Pressure sensors

- 8.4.2 Temperature sensors

- 8.4.3 Gas sensors

- 8.4.4 Radiation detectors

- 8.4.5 Other applications

Chapter 9 Market Estimates and Forecast, By Production Method, 2021 – 2034 (USD Bn)

- 9.1 Key trends

- 9.2 Acheson process

- 9.3 Physical Vapor Transport (PVT)

- 9.4 Chemical Vapor Deposition (CVD)

- 9.5 Other production methods

Chapter 10 Market Estimates and Forecast, By End Use industry, 2021 – 2034 (USD Bn)

- 10.1 Key trends

- 10.2 Automotive

- 10.3 Aerospace & defense

- 10.4 Telecommunications

- 10.5 Energy & power

- 10.6 Healthcare

- 10.7 Electronics & semiconductors

- 10.8 Industrial manufacturing

- 10.9 Oil & gas

- 10.10 Mining

- 10.11 Chemical processing

- 10.12 Consumer electronics

- 10.13 Research & development

Chapter 11 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Bn & Kilo Tons)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Spain

- 11.3.5 Italy

- 11.3.6 Netherlands

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 Middle East and Africa

- 11.6.1 Saudi Arabia

- 11.6.2 South Africa

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 ROHM Co., Ltd.

- 12.2 Central Semiconductor Corp.

- 12.3 Cree, Inc.

- 12.4 Danfoss A/S

- 12.5 Fuji Electric Co., Ltd.

- 12.6 General Electric Company (GE Aviation)

- 12.7 GeneSiC Semiconductor Inc.

- 12.8 Global Power Technologies Group

- 12.9 Hitachi Power Semiconductor Device, Ltd.

- 12.10 II-VI Incorporated

- 12.11 Infineon Technologies AG

- 12.12 Littelfuse, Inc.

- 12.13 Microsemi Corporation

- 12.14 Mitsubishi Electric Corporation

- 12.15 NXP Semiconductors N.V.

- 12.16 ON Semiconductor Corporation

- 12.17 Power Integrations, Inc.

- 12.18 Renesas Electronics Corporation

- 12.19 STMicroelectronics N.V.

- 12.20 Taiyo Yuden Co., Ltd.

- 12.21 Toshiba Corporation

- 12.22 United Silicon Carbide, Inc. (USCi)