PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1859002

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1859002

Asia Pacific Distribution Substation Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

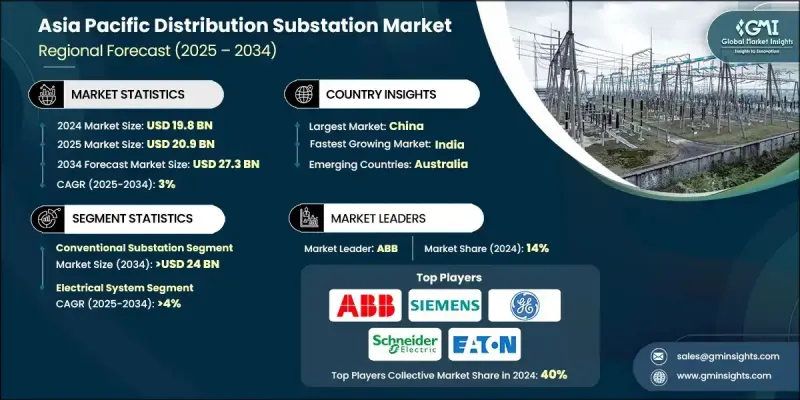

Asia Pacific Distribution Substation Market was valued at USD 19.8 billion in 2024 and is estimated to grow at a CAGR of 3% to reach USD 27.3 billion by 2034.

The growth reflects the region's fast-paced urbanization and rising electricity needs across major economies. Nations such as China, India, and Japan are facing surging energy demand due to mass urban migration and increased pressure on aging electrical infrastructure. To keep pace, both public and private sector investments are flowing into advanced grid systems and modern substations. As renewable energy continues to gain traction, fluctuating power output from solar and wind sources demands substations equipped to stabilize loads and support reliable distribution. Several countries in the region are aiming to integrate 40-50% renewable energy into their power mix by 2040, further pushing the need for updated substation infrastructure.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $19.8 Billion |

| Forecast Value | $27.3 Billion |

| CAGR | 3% |

Smart grid integration is also becoming central to this market's evolution. Nations across Asia Pacific are deploying substations with real-time diagnostics, IoT-based monitoring, and fault detection capabilities to improve grid efficiency. China leads the transition to digital substations by using high-speed communication protocols to reduce downtime and improve automated operations. The manufacturing, energy, mining, and transport sectors also require resilient and scalable power systems, which further elevates the importance of robust substations.

The conventional substation segment is expected to reach USD 24 billion by 2034, retaining a crucial role across established urban power grids. These systems utilize widely adopted technologies like air-insulated switchgear and conventional transformers. While the industry pivots toward clean energy, many urban locations find it more feasible to continue relying on existing substation infrastructure. At the same time, emerging projects in green hydrogen and ammonia are expanding infrastructure demand across the region, adding complexity and opportunity to substation development.

The substation automation segment will grow at a decent CAGR through 2034, driven by the core requirement that enables power providers to manage outages, perform maintenance, and streamline operations with minimal human intervention. These systems support smarter energy distribution and align with large-scale initiatives, such as India's USD 41 billion Revamped Distribution Sector Scheme, which focuses on grid modernization and reducing energy losses. Automation is especially valuable as more utilities look to enhance system performance and reduce overall downtime.

China Distribution Substation Market was valued at USD 8.3 billion in 2024. The country holds the largest share in the region, driven by its industrial intensity and large-scale urban energy needs. With a growing population and major economic activities, the demand for stable and efficient electricity delivery continues to rise, solidifying China's leadership in substation infrastructure development.

Leading companies active in the Asia Pacific Distribution Substation Market include SPML Infra Ltd., Schneider Electric, Fuji Electric, Netcontrol Group, General Electric, Belden, Tesco Automation, KEC International, Hitachi Energy, Cisco Systems, Rockwell Automation, Eaton, ABB, L&T Electrical and Automation, Siemens, Efacec, Burns & McDonnell, and CG Power and Industrial Solutions. Companies across the Asia Pacific Distribution Substation Market are enhancing their market position by focusing on digital integration, local partnerships, and robust after-sales support. Major players are investing in automation technologies that support real-time monitoring, remote diagnostics, and predictive maintenance to align with smart grid initiatives. Many are forming collaborations with regional governments and utilities to assist in infrastructure upgrades and renewable integration.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

- 3.6.1 Political factors

- 3.6.2 Economic factors

- 3.6.3 Social factors

- 3.6.4 Technological factors

- 3.6.5 Legal factors

- 3.6.6 Environmental factors

- 3.7 Emerging opportunities & trends

- 3.7.1 Digitalization & IoT integration

- 3.7.2 Emerging market penetration

- 3.8 Investment analysis & future outlook

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, by country, 2024

- 4.2.1 China

- 4.2.2 Australia

- 4.2.3 India

- 4.2.4 Japan

- 4.2.5 South Korea

- 4.3 Strategic initiatives

- 4.4 Competitive benchmarking depictions

- 4.5 Strategy dashboard

- 4.6 Innovation & technology landscape

Chapter 5 Asia Pacific Distribution Substation Market Size and Forecast, By Technology, 2021 - 2034 (USD Million, Units)

- 5.1 Key trends

- 5.2 Conventional

- 5.3 Digital

Chapter 6 Asia Pacific Distribution Substation Market Size and Forecast, By Component, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 Substation automation system

- 6.3 Communication network

- 6.4 Electrical system

- 6.5 Monitoring & control system

- 6.6 Others

Chapter 7 Asia Pacific Distribution Substation Market Size and Forecast, By Category, 2021 - 2034 (USD Million & Units)

- 7.1 Key trends

- 7.2 New

- 7.3 Refurbished

Chapter 8 Asia Pacific Distribution Substation Market Size and Forecast, By Voltage Level, 2021 - 2034 (USD Million & Units)

- 8.1 Key trends

- 8.2 Low

- 8.3 Medium

- 8.4 High

Chapter 9 Asia Pacific Distribution Substation Market Size and Forecast, By End Use, 2021 - 2034 (USD Million & Units)

- 9.1 Key trends

- 9.2 Utility

- 9.3 Industrial

Chapter 10 Asia Pacific Distribution Substation Market Size and Forecast, By Country, 2021 - 2034 (USD Million & Units)

- 10.1 China

- 10.2 Australia

- 10.3 India

- 10.4 Japan

- 10.5 South Korea

Chapter 11 Company Profiles

- 11.1 ABB

- 11.2 Belden

- 11.3 Burns & McDonnell

- 11.4 CG Power and Industrial Solutions

- 11.5 Cisco Systems

- 11.6 Eaton

- 11.7 Efacec

- 11.8 Fuji Electric

- 11.9 General Electric

- 11.10 Hitachi Energy

- 11.11 KEC International

- 11.12 L&T Electrical and Automation

- 11.13 Netcontrol Group

- 11.14 Rockwell Automation

- 11.15 Siemens

- 11.16 SPML Infra Ltd.

- 11.17 Tesco Automation