PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1928962

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1928962

Reciprocating Engine Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

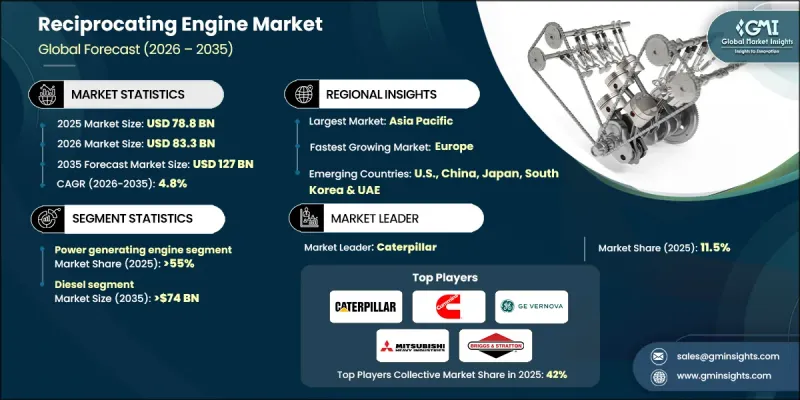

The Global Reciprocating Engine Market was valued at USD 78.8 billion in 2025 and is estimated to grow at a CAGR of 4.8% to reach USD 127 billion by 2035.

The market growth is fueled by continuous innovation in modular and simplified engine designs, which provide greater operational flexibility and ease of maintenance. Increasing adoption of fuel-efficient technologies, coupled with strict emission regulations, is shaping the next generation of reciprocating engines. Integration of advanced digital monitoring systems and predictive maintenance tools is enhancing reliability and minimizing downtime. Modern reciprocating engines combine robust engineering with operational strategies to deliver consistent, efficient power across diverse applications. They improve combustion efficiency, maintain thermal stability, and offer compatibility with multiple fuel types. With applications spanning industrial, commercial, and distributed generation systems, these engines support energy resilience while integrating seamlessly with renewable energy sources. Advancements in hybrid technologies, fuel optimization, and control systems further enhance performance, making them ideal for both standby and continuous power generation.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $78.8 Billion |

| Forecast Value | $127 Billion |

| CAGR | 4.8% |

The power segment accounted for 55% share in 2025 and is expected to grow at a CAGR of 4% through 2035. Its expansion is supported by rising demand for reliable power solutions, flexible modular designs, and the increasing deployment of distributed generation systems. Reciprocating engines in this segment are favored for their fast start-up, high efficiency, and compatibility with renewable energy integration.

The gas-fired engine segment is expected to grow at a CAGR of 5.5% by 2035, driven by lower emissions of nitrogen oxides, sulfur dioxide, and particulates. These cleaner operations make gas engines an attractive choice for companies prioritizing compliance with environmental regulations and global sustainability objectives.

North America Reciprocating Engine Market is projected to reach USD 20 billion by 2035, driven by modernization efforts in energy infrastructure, adoption of high-performance, low-emission engines, and ongoing industrial expansion. Continuous technological advancements in engine performance and efficiency are expected to strengthen the market outlook across the region.

Major players in the Global Reciprocating Engine Market include AB Volvo Penta, Cummins, GE Vernova, MAN Energy Solutions, Mitsubishi Heavy Industries, Yamaha Motor, Perkins Engines, Honda Motor, Lister Petter, Briggs & Stratton, Rehlko, J C Bamford Excavators, Wartsila, Kawasaki Heavy Industries, KUBOTA Corporation, Caterpillar, Yanmar Holdings, Guascor Energy, and Rolls-Royce.

Companies in the Global Reciprocating Engine Market focus on several strategies to maintain and expand their market position. Product innovation remains central, with firms developing modular, fuel-efficient, and hybrid-compatible engines. Strategic partnerships and collaborations help expand global distribution networks and access new customer segments. Investment in digital technologies, predictive maintenance, and IoT-enabled monitoring improves reliability and customer value. Companies also adopt sustainability-driven strategies, focusing on low-emission engines and compliance with environmental regulations. After-sales services, extended warranties, and technical support enhance customer loyalty. Mergers and acquisitions are leveraged to consolidate market share, expand product portfolios, and strengthen regional presence, while targeted marketing and R&D investments ensure competitiveness in evolving energy and industrial sectors.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Quality commitment

- 1.2.1 GMI AI policy & data integrity commitment

- 1.2.1.1 Source consistency protocol

- 1.2.1 GMI AI policy & data integrity commitment

- 1.3 Research Trail & Confidence Scoring

- 1.3.1 Research Trail Components

- 1.3.2 Scoring Components

- 1.4 Data Collection

- 1.4.1 Partial list of primary sources

- 1.5 Data mining sources

- 1.5.1 Paid sources

- 1.5.1.1 Sources, by region

- 1.5.1 Paid sources

- 1.6 Base estimates and calculations

- 1.6.1 Base year calculation for any one approach

- 1.7 Market estimates & forecasts parameters

- 1.8 Forecast model

- 1.9 Research transparency addendum

- 1.9.1 Source attribution framework

- 1.9.2 Quality assurance metrics

- 1.9.3 Our commitment to trust

- 1.10 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2022 - 2035

- 2.2 Business trends

- 2.3 Fuel trends

- 2.4 Rated power trends

- 2.5 Application trends

- 2.6 Cylinder configuration trends

- 2.7 Regional trends

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Raw material availability & sourcing analysis

- 3.1.2 Manufacturing capacity assessment

- 3.1.3 Supply chain resilience & risk factors

- 3.1.4 Distribution network analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter';s analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

- 3.6.1 Political factors

- 3.6.2 Economic factors

- 3.6.3 Social factors

- 3.6.4 Technological factors

- 3.6.5 Legal factors

- 3.6.6 Environmental factors

- 3.7 Cost structure analysis of reciprocating engines

- 3.8 Price trend analysis (USD/MW)

- 3.8.1 By region

- 3.8.2 By rated power

- 3.9 Emerging opportunities & trends

- 3.9.1 Digitalization & IoT integration

- 3.9.2 Emerging market penetration

- 3.10 Investment analysis & future outlook

Chapter 4 Competitive Landscape, 2026

- 4.1 Introduction

- 4.2 Company market share analysis, by region, 2025

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Middle East & Africa

- 4.2.5 Latin America

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.4.1 Key partnerships & collaborations

- 4.4.2 Major M&A activities

- 4.4.3 Product innovations & launches

- 4.4.4 Market expansion strategies

- 4.5 Competitive benchmarking

- 4.6 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Fuel, 2022 - 2035 (USD Million & MW)

- 5.1 Key trends

- 5.2 Diesel

- 5.3 Gas

- 5.4 Others

Chapter 6 Market Size and Forecast, By Rated Power, 2022 - 2035 (USD Million & MW)

- 6.1 Key trends

- 6.2 0.5 MW - 1 MW

- 6.3 > 1 MW - 2 MW

- 6.4 > 2 MW - 3.5 MW

- 6.5 > 3.5 MW - 5 MW

- 6.6 > 5 MW - 7.5 MW

- 6.7 > 7.5 MW

Chapter 7 Market Size and Forecast, By Application, 2022 - 2035 (USD Million & MW)

- 7.1 Key trends

- 7.2 Power

- 7.3 Marine

- 7.4 Mechanical

Chapter 8 Market Size and Forecast, By Cylinder Configuration, 2022 - 2035 (USD Million & MW)

- 8.1 Key trends

- 8.2 Inline

- 8.3 V-Type

- 8.4 Radial

- 8.5 Opposed piston

Chapter 9 Market Size and Forecast, By Region, 2022 - 2035 (USD Million & MW)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.2.3 Mexico

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 France

- 9.3.3 Germany

- 9.3.4 Russia

- 9.3.5 Italy

- 9.3.6 Spain

- 9.3.7 Netherlands

- 9.3.8 Denmark

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.4.6 Thailand

- 9.4.7 Singapore

- 9.5 Middle East & Africa

- 9.5.1 UAE

- 9.5.2 Saudi Arabia

- 9.5.3 Qatar

- 9.5.4 Oman

- 9.5.5 Kuwait

- 9.5.6 Egypt

- 9.5.7 Turkey

- 9.5.8 South Africa

- 9.6 Latin America

- 9.6.1 Brazil

- 9.6.2 Argentina

- 9.6.3 Chile

Chapter 10 Company Profiles

- 10.1 AB Volvo Penta

- 10.2 Briggs & Stratton

- 10.3 Caterpillar

- 10.4 Cummins

- 10.5 GE Vernova

- 10.6 Guascor Energy

- 10.7 Honda Motor

- 10.8 IHI Corporation

- 10.9 J C Bamford Excavators

- 10.10 Kawasaki Heavy Industries

- 10.11 KUBOTA Corporation

- 10.12 Lister Petter

- 10.13 MAN Energy Solutions

- 10.14 Mitsubishi Heavy Industries

- 10.15 Perkins Engines

- 10.16 Rehlko

- 10.17 Rolls-Royce

- 10.18 Wartsila

- 10.19 Yamaha Motor

- 10.20 Yanmar Holdings