PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876790

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876790

Crane Rental Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

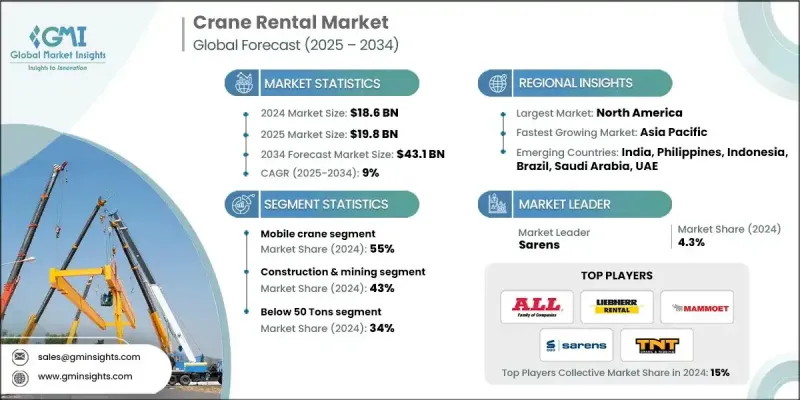

The Global Crane Rental Market was valued at USD 18.6 billion in 2024 and is estimated to grow at a CAGR of 9% to reach USD 43.1 billion by 2034.

The market's expansion is driven by the increasing adoption of rental-based heavy lifting solutions across construction, infrastructure, and industrial sectors. Renting cranes allows contractors and project developers to access advanced lifting equipment without large capital investments, enabling more efficient capital allocation and operational flexibility. Rapidly growing urban megaprojects, renewable energy installations, and large-scale logistics operations are fueling demand for reliable, on-demand lifting solutions that include professional operators and maintenance services. The ongoing energy transition and modernization of infrastructure are further accelerating crane rentals, as renewable projects such as wind farms, solar arrays, and grid expansions require heavy-lifting support for turbines, modules, and structural components. Crane rental companies are investing in high-capacity crawler and rough-terrain cranes suitable for remote sites, optimizing logistics costs while promoting operational sustainability. Post-COVID-19 digitalization and equipment-sharing models have encouraged flexible rental contracts with service guarantees, online booking platforms, and telematics-based maintenance support.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $18.6 Billion |

| Forecast Value | $43.1 Billion |

| CAGR | 9% |

The mobile crane segment held a 55% share in 2024 and is expected to grow at a CAGR of 8.6% through 2034. Mobile cranes dominate due to their versatility, ease of transport, and ability to perform a wide range of lifting tasks across construction, industrial, and infrastructure projects. Their rapid setup and mobility reduce downtime, and options like all-terrain, rough-terrain, and truck-mounted variants make them suitable for both urban and remote environments.

The construction & mining sector held a 43% share in 2024 and is forecast to grow at a CAGR of 9.7% from 2025 to 2034. Rising infrastructure projects, commercial developments, and mining expansions drive demand in this segment. Cranes are critical for lifting heavy materials and equipment in high-rise construction, roadworks, and bridge projects, making rental solutions cost-effective and flexible. Advanced lifting technologies and efficiency requirements in large-scale projects further strengthen this segment's market position.

North America Crane Rental Market held 85% share and generated USD 9.1 billion in 2024. Growth is fueled by infrastructure development, industrial construction, and renewable energy projects. Federal investments, including highway, bridge, and utility projects, are increasing demand for heavy-lifting solutions, while offshore wind and solar initiatives amplify the need for mobile and high-capacity cranes.

Key players in the Global Crane Rental Market include Sarens, Maxim Crane Works, Ainscough Crane, Bigge Crane, Liebherr Rental, United Rentals, TNT Crane & Rigging, All Family/All Crane, Sanghvi Movers, and Mammoet. Companies in the Global Crane Rental Market focus on several strategic initiatives to enhance their presence and market share. They invest in expanding their fleet with high-capacity, specialized cranes for remote, urban, and renewable project sites. Partnerships with construction firms, logistics providers, and industrial clients help broaden market reach. Firms are also adopting digital solutions, including online booking platforms, telematics-enabled maintenance, and real-time monitoring, to improve service efficiency and client satisfaction. Geographic expansion, targeted marketing campaigns, and participation in industry exhibitions enhance brand recognition.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Application

- 2.2.4 Lifting capacity

- 2.2.5 Rental duration

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising Infrastructure Development Projects

- 3.2.1.2 Surge in Construction of Industrial Facilities

- 3.2.1.3 Increase in fleet modernization and adoption of hybrid/electric cranes

- 3.2.1.4 Rise in collaborations between OEMs and rental companies

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Lack of skilled and qualified operators

- 3.2.2.2 High maintenance and repair costs

- 3.2.3 Market opportunities

- 3.2.3.1 Adoption of digital platforms for equipment leasing

- 3.2.3.2 Expansion in port and logistics infrastructure

- 3.2.3.3 Growth of public-private partnership (PPP) projects

- 3.2.3.4 Technological integration and automation

- 3.2.3.5 Aftermarket services and value-added offerings

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 LAMEA

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Patent analysis

- 3.9 Price trends

- 3.9.1 By region

- 3.9.2 By type

- 3.10 Cost breakdown analysis

- 3.11 Business Case & ROI Analysis

- 3.11.1 Total cost of ownership framework

- 3.11.2 ROI calculation methodologies

- 3.11.3 Implementation timeline & milestones

- 3.11.4 Risk assessment & mitigation strategies

- 3.12 Sustainability and environmental impact analysis

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.12.5 Carbon footprint considerations

- 3.13 Future outlook & opportunities

- 3.13.1 Emerging use cases and application expansion

- 3.13.2 Next-generation crane technologies

- 3.13.3 Automation and digital optimization trends

- 3.13.4 Regulatory shifts and compliance impact

- 3.13.5 Supply chain and rental model transformation

- 3.13.6 Investment hotspots and growth risks

- 3.13.7 Energy efficiency and hybrid technology assessment

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LAMEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Type, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Mobile Cranes

- 5.2.1 All-Terrain Cranes

- 5.2.2 Rough Terrain Cranes

- 5.2.3 Truck-Mounted Cranes

- 5.2.4 Pick and Carry Cranes

- 5.3 Fixed Cranes

- 5.3.1 Tower Cranes

- 5.3.2 Overhead/Bridge Cranes

- 5.3.3 Gantry Cranes

- 5.3.4 Jib Cranes

- 5.4 Crawler Cranes

- 5.5 Marine and Offshore Cranes

Chapter 6 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.1.1 Construction & mining

- 6.1.2 Utility

- 6.1.3 Manufacturing

- 6.1.4 Transportation

- 6.1.5 Oil & gas

- 6.1.6 Others

Chapter 7 Market Estimates & Forecast, By Lifting Capacity, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Below 50 Tons

- 7.3 50-150 Tons

- 7.4 150-300 Tons

- 7.5 Above 300 Tons

Chapter 8 Market Estimates & Forecast, By Rental Duration, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Short-Term Rental

- 8.3 Long-Term Rental

- 8.4 Project-Based Rental

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 US

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Philippines

- 9.4.7 Indonesia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Global Players

- 10.1.1 Ashtead

- 10.1.2 Kobelco Construction Machinery

- 10.1.3 Liebherr

- 10.1.4 Link-Belt Cranes

- 10.1.5 Mammoet

- 10.1.6 Manitowoc Company

- 10.1.7 National Crane

- 10.1.8 Palfinger North America

- 10.1.9 Sarens

- 10.1.10 Tadano

- 10.1.11 Terex

- 10.1.12 United Rentals

- 10.2 Regional Players

- 10.2.1 Action Crane & Equipment

- 10.2.2 ALL Erection & Crane Rental

- 10.2.3 Barnhart Crane & Rigging

- 10.2.4 Bigge Crane and Rigging

- 10.2.5 Crane Rental

- 10.2.6 Crane Service

- 10.2.7 Lampson International

- 10.2.8 Liebherr Rental

- 10.2.9 Maxim Crane Works

- 10.2.10 NessCampbell Crane + Rigging

- 10.2.11 TNT Crane & Rigging

- 10.3 Emerging Players

- 10.3.1 BigRentz

- 10.3.2 Crane Network

- 10.3.3 Cranes for Rent

- 10.3.4 EquipmentShare

- 10.3.5 Sanghvi Movers

- 10.3.6 Sany America