PUBLISHER: Coherent Market Insights | PRODUCT CODE: 1674403

PUBLISHER: Coherent Market Insights | PRODUCT CODE: 1674403

U.S. Nutraceuticals Market, By Product Type (Dietary supplements, Functional foods, and Functional beverages), By Product Form (Tablet & Capsules, Powder, Liquid, and Solids/Semi-solids)

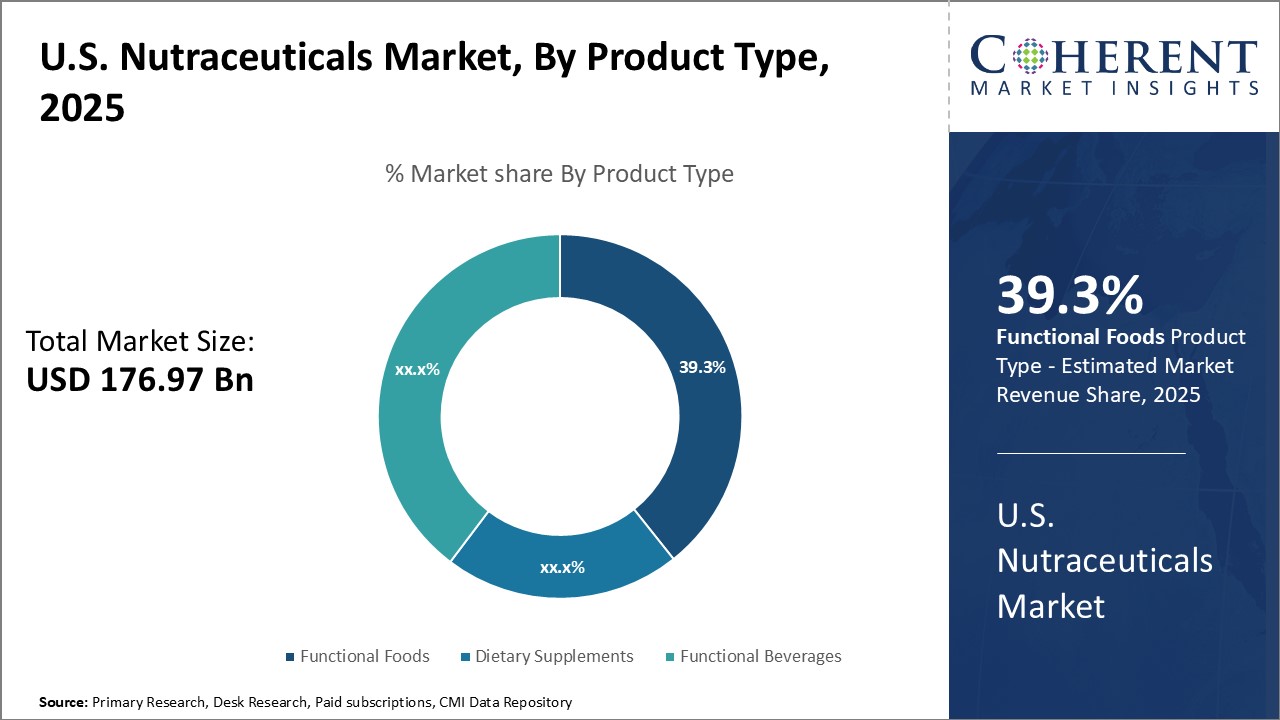

Global U.S. Nutraceuticals Market is estimated to be valued at USD 176.97 Bn in 2025 and is expected to reach USD 254.21 Bn by 2032, growing at a compound annual growth rate (CAGR) of 5.3% from 2025 to 2032.

| Report Coverage | Report Details | ||

|---|---|---|---|

| Base Year: | 2024 | Market Size in 2025: | USD 176.97 Bn |

| Historical Data for: | 2020 To 2024 | Forecast Period: | 2025 To 2032 |

| Forecast Period 2025 to 2032 CAGR: | 5.30% | 2032 Value Projection: | USD 254.21 Bn |

The US nutraceuticals market has been witnessing substantial growth over the past few years. Nutraceuticals can be defined as food or parts of food that provide medical or health benefits, including the prevention and treatment of disease. Rising health consciousness among consumers and growing preference for preventive healthcare have boosted the demand for nutraceutical products in the US. Several factors such as the increasing prevalence of lifestyle diseases, growing aging population, and favorable regulatory framework are expected to drive the growth of the nutraceuticals industry in the country. Moreover, innovations in product offerings and aggressive marketing strategies by key players are further propelling the market expansion. However, factors such as high prices of products and stringent regulatory approval process remain key challenges for the industry.

Market Dynamics:

The key drivers fueling the growth of the U.S. nutraceuticals market include rising health awareness, growing prevalence of chronic diseases, and favorable regulations. Additionally, aggressive promotion by market players and increasing accessibility through e-commerce channels are further augmenting the market growth. However, high product and R&D costs remain a major restraint. Moreover, the presence of counterfeit products also hinders the market development to some extent. On the positive side, untapped opportunities in the herbal and sports nutrition segments are projected to offer new avenues for market expansion in the coming years. Continuous innovations with the development of novel formulations are also expected to generate attractive prospects.

Key Features of the Study:

- This report provides in-depth analysis of the U.S. nutraceuticals market and provides market size (US$ Bn) and compound annual growth rate (CAGR%) for the forecast period (2025-2032), considering 2024 as the base year

- It elucidates potential revenue opportunities across different segments and explains attractive investment proposition matrices for this market

- This study also provides key insights about market drivers, restraints, opportunities, new product launches or approval, market trends, regional outlook, and competitive strategies adopted by key players

- It profiles key players in the U.S. nutraceuticals market based on the following parameters - company highlights, products portfolio, key highlights, financial performance, and strategies

- Key companies covered as a part of this study include BASF S.E., BioNeutra Global Corporation, Botaneco Inc., Cargill Inc., Ceapro Inc., DowDuPont Inc., GrainFrac Inc., Ingredion Incorporated, InovoBiologic Inc., Jamieson Laboratories Ltd., Koninklijke DSM N.V., Lallemand Inc., Radient Technologies Inc., SunOpta Inc., The Nature's Bounty Co., Groupe Danone, Abbott Laboratories, Chobani LLC, and Pfizer Inc.

- Insights from this report would allow marketers and the management authorities of the companies to make informed decisions regarding their future product launches, type up-gradation, market expansion, and marketing tactics

- The U.S. nutraceuticals market report caters to various stakeholders in this industry including investors, suppliers, product manufacturers, distributors, new entrants, and financial analysts

- Stakeholders would have ease in decision-making through various strategy matrices used in analyzing the U.S. nutraceuticals market.

Detailed Segmentation-

- By Product Type:

- Dietary supplements

- Functional foods

- Functional beverages

- By Product Form:

- Tablet & Capsules

- Powder

- Liquid

- Solids/Semi-solids

- Company Profiles:

- BASF S.E.

- BioNeutra Global Corporation

- Botaneco Inc.

- Cargill Inc.

- Ceapro Inc.

- DowDuPont Inc.

- GrainFrac Inc.

- Ingredion Incorporated

- InovoBiologic Inc.

- Jamieson Laboratories Ltd.

- Koninklijke DSM N.V.

- Lallemand Inc.

- Radient Technologies Inc.

- SunOpta Inc.

- The Nature's Bounty Co.

- Groupe Danone

- Abbott Laboratories

- Chobani LLC

- Pfizer Inc.

Table of Contents

1. Research Objectives and Assumptions

- Research Objectives

- Assumptions

- Abbreviations

2. Market Purview

- Report Description

- Market Definition and Scope

- Executive Summary

- Market Snippet, By Product Type

- Market Snippet, By Product Form

3. Market Dynamics, Regulations, and Trends Analysis

- Market Dynamics

- Drivers

- Restraints

- PEST Analysis

- PORTER's Five Forces Analysis

- Market Opportunities

- Regulatory Scenario

- Industry Trend

- Mergers and Acquisitions

4. U.S. Nutraceuticals Market - Impact of Coronavirus (COVID-19) Pandemic

- Overview

- Factors Affecting the U.S. Nutraceuticals Market

- Impact Analysis

5. U.S. Nutraceuticals Market, By Product Type, 2020-2032, (US$ Bn)

- Introduction

- Market Share Analysis, 2025, 2028 and 2032 (%)

- Y-o-Y Growth Analysis, 2021 - 2032

- Segment Trends

- Dietary supplements

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020 - 2032, (US$ Bn)

- Segment Trends

- Functional foods

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020 - 2032, (US$ Bn)

- Segment Trends

- Functional beverages

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020 - 2032, (US$ Bn)

- Segment Trends

6. U.S. Nutraceuticals Market, By Product Form, 2020-2032, (US$ Bn)

- Introduction

- Market Share Analysis, 2025, 2028 and 2032 (%)

- Y-o-Y Growth Analysis, 2021 - 2032

- Segment Trends

- Tablet & Capsules

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020 - 2032, (US$ Bn)

- Segment Trends

- Powder

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020 - 2032, (US$ Bn)

- Segment Trends

- Liquid

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020 - 2032, (US$ Bn)

- Segment Trends

- Solids/Semi-solids

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2020 - 2032, (US$ Bn)

- Segment Trends

7. Competitive Landscape

- Market Share Analysis

- Company Profiles

- BASF S.E.

- Company Overview

- Product Type Portfolio

- Recent Developments/Updates

- BioNeutra Global Corporation

- Company Overview

- Product Type Portfolio

- Recent Developments/Updates

- Botaneco Inc.

- Company Overview

- Product Type Portfolio

- Recent Developments/Updates

- Cargill Inc.

- Company Overview

- Product Type Portfolio

- Recent Developments/Updates

- Ceapro Inc.

- Company Overview

- Product Type Portfolio

- Recent Developments/Updates

- DowDuPont Inc.

- Company Overview

- Product Type Portfolio

- Recent Developments/Updates

- GrainFrac Inc.

- Company Overview

- Product Type Portfolio

- Recent Developments/Updates

- Ingredion Incorporated

- Company Overview

- Product Type Portfolio

- Recent Developments/Updates

- InovoBiologic Inc.

- Company Overview

- Product Type Portfolio

- Recent Developments/Updates

- Jamieson Laboratories Ltd.

- Company Overview

- Product Type Portfolio

- Recent Developments/Updates

- Koninklijke DSM N.V.

- Company Overview

- Product Type Portfolio

- Recent Developments/Updates

- Lallemand Inc.

- Company Overview

- Product Type Portfolio

- Recent Developments/Updates

- Radient Technologies Inc.

- Company Overview

- Product Type Portfolio

- Recent Developments/Updates

- SunOpta Inc.

- Company Overview

- Product Type Portfolio

- Recent Developments/Updates

- The Nature's Bounty Co.

- Company Overview

- Product Type Portfolio

- Recent Developments/Updates

- Groupe Danone

- Company Overview

- Product Type Portfolio

- Recent Developments/Updates

- Abbott Laboratories

- Company Overview

- Product Type Portfolio

- Recent Developments/Updates

- Chobani LLC

- Company Overview

- Product Type Portfolio

- Recent Developments/Updates

- Pfizer Inc.

- Company Overview

- Product Type Portfolio

- Recent Developments/Updates

- BASF S.E.

8. Analyst Recommendations

- Wheel of Fortune

- Analyst View

- Coherent Opportunity Map

9. Section

- References

- Research Methodology

- About Us and Sales Contact