PUBLISHER: Coherent Market Insights | PRODUCT CODE: 1672677

PUBLISHER: Coherent Market Insights | PRODUCT CODE: 1672677

Smoking Cessation and Nicotine De-addiction Products Market, By Route of Administration, By Product, By Distribution Channel, By Geography

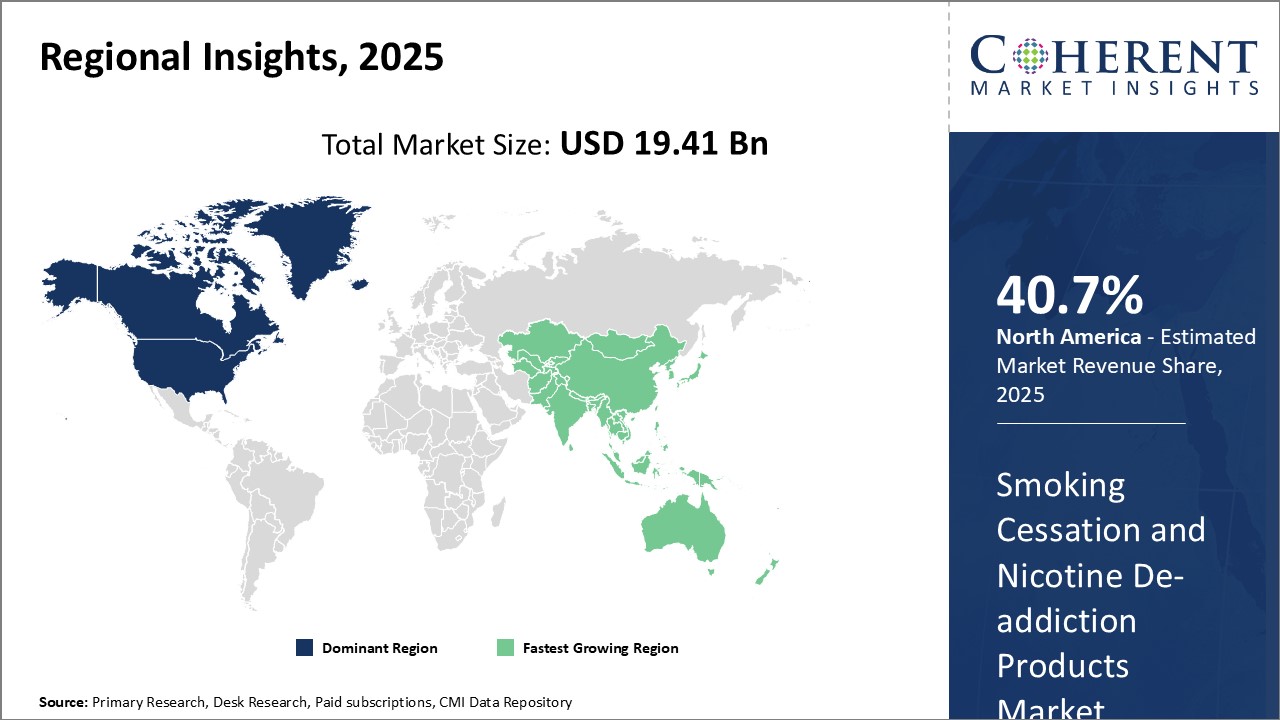

Global Smoking Cessation and Nicotine De-addiction Products Market is estimated to be valued at USD 19.41 Bn in 2025 and is expected to reach USD 59.36 Bn by 2032, growing at a compound annual growth rate (CAGR) of 17.3% from 2025 to 2032.

| Report Coverage | Report Details | ||

|---|---|---|---|

| Base Year: | 2024 | Market Size in 2025: | USD 19.41 Bn |

| Historical Data for: | 2020 To 2024 | Forecast Period: | 2025 To 2032 |

| Forecast Period 2025 to 2032 CAGR: | 17.30% | 2032 Value Projection: | USD 59.36 Bn |

The global market for smoking cessation and nicotine de-addiction products is growing significantly owing to the rising global population of smokers and increasing awareness about health hazards of smoking. Smoking has become a worldwide public health issue and the World Health Organization (WHO) recommends various measures to help people quit tobacco consumption. Nicotine replacement therapies and other smoking cessation aids are proving effective in assisting smokers to break the habit. Several awareness campaigns by governments and NGOs have boosted the demand for nicotine gums, patches, lozenges and prescription medications for quitting smoking. Advancements in product formulations and newer technologies are expanding the choices available to smokers who want to quit. However, high prices of certain de-addiction products and persistence of tobacco addiction pose challenges to the industry.

Market Dynamics:

The global smoking cessation and nicotine de-addiction products market growth is driven by the increasing prevalence of smoking-related diseases, growing health consciousness among consumers, and various initiatives by public organizations to curb tobacco use. However, high costs of certain smoking cessation therapies, along with strong tobacco industry lobbying against product regulations, are restraining the market growth. The widespread adoption of digital solutions for smoking cessation therapies is opening new opportunities. Various mobile apps and online programs are being developed to improve the effectiveness of nicotine replacement therapies and behavioral support for consumers. Innovation in alternate delivery forms of nicotine is another key trend gaining traction.

Key Features of the Study:

- This report provides in-depth analysis of the global smoking cessation and nicotine de-addiction products market, and provides market size (USD Billion) and compound annual growth rate (CAGR%) for the forecast period (2025-2032), considering 2024 as the base year

- It elucidates potential revenue opportunities across different segments and explains attractive investment proposition matrices for this market

- This study also provides key insights about market drivers, restraints, opportunities, new product launches or approval, market trends, regional outlook, and competitive strategies adopted by key players

- It profiles key players in the global smoking cessation and nicotine de-addiction products market based on the following parameters - company highlights, products portfolio, key highlights, financial performance, and strategies

- Key companies covered as a part of this study include GlaxoSmithKline, Pfizer, Johnson & Johnson, and Dr. Reddy's Laboratories

- Insights from this report would allow marketers and the management authorities of the companies to make informed decisions regarding their future product launches, type up-gradation, market expansion, and marketing tactics

- The global smoking cessation and nicotine de-addiction products market report caters to various stakeholders in this industry including investors, suppliers, product manufacturers, distributors, new entrants, and financial analysts

- Stakeholders would have ease in decision-making through various strategy matrices used in analyzing the global smoking cessation and nicotine de-addiction products market.

Detailed Segmentation-

- By Route of Administration

- Oral

- Transdermal

- Nasal

- Sublingual

- Oral

- By Product

- Nicotine Replacement Therapy

- Nicotine Spray

- Nicotine Inhalers

- Nicotine Gum

- Nicotine Transdermal Patches

- Nicotine Sublingual Tablets

- Nicotine Lozenges

- Drug Therapy

- Varenicline

- Zyban

- Nicorette Buccal

- E-cigarettes/E-liquid

- By Distribution Channel

- Hospital Pharmacy

- Online Pharmacy

- Retail Pharmacy

- By Region:

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East

- Africa

- Company Profiles:

- GlaxoSmithKline plc (GSK)

- Pfizer Inc.

- Johnson & Johnson

- Novartis International AG

- Imperial Brands plc

- British American Tobacco plc (BAT)

- Cipla Inc.

- McNeil AB

- NJOY, Inc.

- Reddy's Laboratories Ltd.

- Perrigo Company plc

- Fertin Pharma

- Philip Morris International Inc.

- Alkalon A/S

- Japan Tobacco Inc.

- Nicotek, LLC

- 22nd Century Group Inc.

Table of Contents

1. Research Objectives and Assumptions

- Research Objectives

- Assumptions

- Abbreviations

2. Market Purview

- Report Description

- Market Definition and Scope

- Executive Summary

- Market Snapshot, By Route of Administration

- Market Snapshot, By Product

- Market Snapshot, By Distribution Channel

- Market Snapshot, By Region

- Coherent Opportunity Map (COM)

3. Market Dynamics, Regulations, and Trends Analysis

- Market Dynamics

- Drivers

- Restraints

- Opportunities

- Impact Analysis

- Market Trends

- Key Developments

- Regulatory Scenario

- Acquisitions and Partnerships Scenario

- Funding and Investments

- PEST Analysis

- Porter's Analysis

4. Global Smoking Cessation and Nicotine De-addiction Products Market - Impact of Coronavirus (COVID-19) Pandemic

- Overall Impact

- Government Initiatives

- COVID-19 Impact on the Market

5. Global Smoking Cessation and Nicotine De-addiction Products Market, By Route of Administration, 2020 - 2032, (USD Bn)

- Overview

- Market Share Analysis, 2025 and 2032 (%)

- Y-o-Y Growth Analysis, 2020 - 2032

- Segment Trends

- Oral

- Overview

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Bn)

- Transdermal

- Overview

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Bn)

- Nasal

- Overview

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Bn)

- Sublingual

- Overview

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Bn)

6. Global Smoking Cessation and Nicotine De-addiction Products Market, By Product, 2020 - 2032, (USD Bn)

- Overview

- Market Share Analysis, 2025 and 2032 (%)

- Y-o-Y Growth Analysis, 2020 - 2032

- Segment Trends

- Nicotine Replacement Therapy

- Overview

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Bn)

- Nicotine Spray

- Overview

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Bn)

- Nicotine Inhalers

- Overview

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Bn)

- Nicotine Gum

- Overview

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Bn)

- Nicotine Transdermal Patches

- Overview

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Bn)

- Nicotine Sublingual Tablets

- Overview

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Bn)

- Nicotine Lozenges

- Overview

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Bn)

- Drug Therapy

- Overview

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Bn)

- Varenicline

- Overview

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Bn)

- Zyban

- Overview

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Bn)

- Nicorette Buccal

- Overview

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Bn)

- E-cigarettes/E-liquid

- Overview

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Bn)

7. Global Smoking Cessation and Nicotine De-addiction Products Market, By Distribution Channel, 2020 - 2032, (USD Bn)

- Overview

- Market Share Analysis, 2025 and 2032 (%)

- Y-o-Y Growth Analysis, 2020 - 2032

- Segment Trends

- Hospital Pharmacy

- Overview

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Bn)

- Online Pharmacy

- Overview

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Bn)

- Retail Pharmacy

- Overview

- Market Size and Forecast, and Y-o-Y Growth, 2020-2032, (USD Bn)

8. Global Smoking Cessation and Nicotine De-addiction Products Market, By Region, 2020 - 2032, (USD Bn)

- Introduction

- Market Share Analysis, By Region, 2025 and 2032 (%)

- Y-o-Y Growth Analysis, For Region, 2020-2032

- Regional Trends

- North America

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, By Route of Administration, 2020 - 2032, (USD Bn)

- Market Size and Forecast, and Y-o-Y Growth, By Product, 2020 - 2032, (USD Bn)

- Market Size and Forecast, and Y-o-Y Growth, By Distribution Channel, 2020 - 2032, (USD Bn)

- Market Size and Forecast, and Y-o-Y Growth, By Country, 2020 - 2032, (USD Bn)

- U.S.

- Canada

- Latin America

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, By Route of Administration, 2020 - 2032, (USD Bn)

- Market Size and Forecast, and Y-o-Y Growth, By Product, 2020 - 2032, (USD Bn)

- Market Size and Forecast, and Y-o-Y Growth, By Distribution Channel, 2020 - 2032, (USD Bn)

- Market Size and Forecast, and Y-o-Y Growth, By Country, 2020 - 2032, (USD Bn)

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Europe

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, By Route of Administration, 2020 - 2032, (USD Bn)

- Market Size and Forecast, and Y-o-Y Growth, By Product, 2020 - 2032, (USD Bn)

- Market Size and Forecast, and Y-o-Y Growth, By Distribution Channel, 2020 - 2032, (USD Bn)

- Market Size and Forecast, and Y-o-Y Growth, By Country, 2020 - 2032, (USD Bn)

- U.K.

- Germany

- Italy

- France

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, By Route of Administration, 2020 - 2032, (USD Bn)

- Market Size and Forecast, and Y-o-Y Growth, By Product, 2020 - 2032, (USD Bn)

- Market Size and Forecast, and Y-o-Y Growth, By Distribution Channel, 2020 - 2032, (USD Bn)

- Market Size and Forecast, and Y-o-Y Growth, By Country, 2020 - 2032, (USD Bn)

- China

- India

- Japan

- ASEAN

- Australia

- South Korea

- Rest of Asia Pacific

- Middle East

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, By Route of Administration, 2020 - 2032, (USD Bn)

- Market Size and Forecast, and Y-o-Y Growth, By Product, 2020 - 2032, (USD Bn)

- Market Size and Forecast, and Y-o-Y Growth, By Distribution Channel, 2020 - 2032, (USD Bn)

- Market Size and Forecast, and Y-o-Y Growth, By Country, 2020 - 2032, (USD Bn)

- GCC

- Israel

- Rest of Middle East

- Africa

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, By Route of Administration, 2020 - 2032, (USD Bn)

- Market Size and Forecast, and Y-o-Y Growth, By Product, 2020 - 2032, (USD Bn)

- Market Size and Forecast, and Y-o-Y Growth, By Distribution Channel, 2020 - 2032, (USD Bn)

- Market Size and Forecast, and Y-o-Y Growth, By Country/Region, 2020 - 2032, (USD Bn)

- North Africa

- Central Africa

- South Africa

9. Competitive Landscape

- Company Profiles

- GlaxoSmithKline plc (GSK)

- Company Highlights

- Method Portfolio

- Key Highlights

- Financial Performance

- Market Strategies

- Pfizer Inc.

- Johnson & Johnson

- Novartis International AG

- Imperial Brands plc

- British American Tobacco plc (BAT)

- Cipla Inc.

- McNeil AB

- NJOY, Inc.

- Dr. Reddy's Laboratories Ltd.

- Perrigo Company plc

- Fertin Pharma

- Philip Morris International Inc.

- Alkalon A/S

- Japan Tobacco Inc.

- Nicotek, LLC

- 22nd Century Group Inc.

- GlaxoSmithKline plc (GSK)

10. Analyst Recommendations

- Wheel of Fortune

- Analyst View

- Coherent Opportunity Map

11. References and Research Methodology

- References

- Research Methodology

- About us and Sales Contact