PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1709980

PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1709980

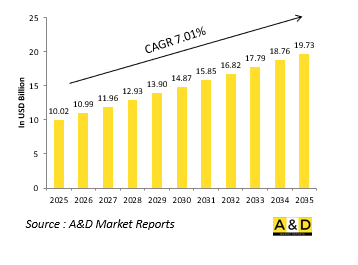

Global Naval Optronics Market 2025-2035

The Global Naval Optronics market is estimated at USD 10.02 billion in 2025, projected to grow to USD 19.73 billion by 2035 at a Compound Annual Growth Rate (CAGR) of 7.01% over the forecast period 2025-2035.

Introduction to Naval Optronics Market:

The defense naval optronics market plays a central role in modern maritime operations, enabling advanced situational awareness, surveillance, target acquisition, and threat detection for naval platforms. Naval optronics systems-combining optical and electronic technologies-are critical components aboard surface vessels, submarines, and coastal defense installations. These systems include a range of technologies such as electro-optical sensors, thermal imagers, infrared cameras, laser rangefinders, and night vision devices. Together, they provide real-time data and visual clarity in low-visibility environments, enhancing navigation safety, search-and-rescue operations, and combat effectiveness. As naval warfare evolves toward more sophisticated and stealth-based engagements, the demand for high-resolution, long-range, and multispectral sensing solutions continues to rise. Naval forces are increasingly relying on optronics for persistent surveillance and precision targeting, especially in complex littoral zones and contested waters. These systems are also essential for counter-piracy, mine detection, and boarding operations, allowing operators to assess threats visually before engagement. The global nature of maritime security threats-from illicit trafficking to territorial incursions-has further accelerated investments in robust naval optronic capabilities. As defense strategies pivot toward networked and sensor-rich platforms, naval optronics stand as a vital bridge between raw environmental data and actionable naval intelligence.

Technology Impact in Naval Optronics Market:

Technological advancements are reshaping the capabilities and strategic role of naval optronics, turning them into integral nodes within larger maritime command-and-control ecosystems. Modern sensors are now equipped with multi-spectral imaging, allowing them to operate seamlessly across visible, infrared, and low-light spectrums. This versatility gives naval forces greater flexibility when operating in adverse weather, nighttime, or heavily cluttered environments. Improvements in sensor resolution and image processing have significantly boosted detection accuracy, enabling identification of smaller or partially concealed threats from longer distances. Additionally, the integration of artificial intelligence and machine learning enhances target recognition and anomaly detection, reducing the cognitive load on human operators while increasing operational speed. Many of today's optronic systems are also being designed for modularity, allowing for easy integration with radar, sonar, and electronic warfare systems. Enhanced stabilization technologies ensure steady imaging even in high-sea conditions, while secure, high-bandwidth data links allow for real-time transmission and analysis across distributed naval assets. Miniaturization is another major breakthrough, enabling compact, high-performance sensors to be deployed on unmanned surface and underwater vehicles. These technological shifts are not only improving individual system performance but also fostering greater interoperability and data fusion, thereby transforming how naval missions are planned, executed, and refined.

Key Drivers in Naval Optronics Market:

The growing complexity of naval missions and the dynamic nature of maritime threats are driving demand for advanced optronic systems across global defense forces. A key motivation is the increasing need for enhanced surveillance and early threat detection, particularly in congested or contested waters where asymmetric threats and stealth tactics are common. The shift toward multi-domain operations has made it essential for navies to possess real-time situational awareness, both above and below the surface. Optronics offer a non-emissive alternative to radar and sonar, allowing silent observation without giving away a ship's position. This is particularly valuable for submarines and stealth ships aiming to avoid detection. Moreover, the rise of unmanned platforms has further spurred the need for compact, ruggedized, and autonomous sensing systems capable of operating independently in remote environments. Border security, anti-piracy operations, and anti-smuggling missions also benefit from persistent, high-clarity imaging and long-range identification capabilities. Environmental monitoring and humanitarian efforts at sea often rely on optronics for navigation and visual confirmation. With geopolitical tensions rising and maritime domains becoming more contested, naval forces are prioritizing systems that can operate effectively across a range of mission profiles, giving optronics a central role in both peace-time operations and high-intensity conflict scenarios.

Regional Trends in Naval Optronics Market:

Regional dynamics in the naval optronics market reflect diverse maritime security needs, industrial capabilities, and investment priorities. In North America, robust procurement programs and ongoing fleet modernization efforts continue to drive demand for state-of-the-art optronic solutions. The U.S. Navy, in particular, is integrating advanced sensor suites across its carrier groups, destroyers, and unmanned maritime systems to maintain technological superiority in both blue-water and littoral zones. Europe has seen a surge in development and deployment of integrated optronic systems as part of multi-nation naval programs and coastal security operations. Countries bordering the Mediterranean and the Baltic Sea have emphasized high-resolution surveillance to address increased maritime activity and regional tensions. The Asia-Pacific region is witnessing significant growth, fueled by the expansion of naval capabilities in countries like China, India, Japan, and Australia. With growing territorial disputes and increased focus on maritime domain awareness, regional navies are investing heavily in both surface and subsurface optronic enhancements. In the Middle East, coastal defense and naval modernization programs are supporting the adoption of optronics for surveillance, interdiction, and ship protection roles. Across these regions, the shared objective is to bolster maritime situational awareness through sensor-driven intelligence, reinforcing the strategic value of optronics in the evolving defense landscape.

Key Naval Optronics Program:

Safran has been chosen to provide its advanced optronic and navigation systems for integration aboard the Egyptian Navy's fleet of ten offshore patrol vessels (OPVs), in a move aimed at strengthening Egypt's maritime defense capabilities. NVL Egypt-a joint venture between German shipbuilder Lurssen and the Egyptian government-selected Safran's VIGY 4 optronic sights and Argonyx inertial navigation systems for the vessels. The VIGY 4 is a compact, stabilized, long-range panoramic observation and targeting system, designed to deliver superior situational awareness and precision in demanding naval environments.

Table of Contents

Global Naval optronics market- Table of Contents

Global Naval optronics market Report Definition

Global Naval optronics market Segmentation

By Type

By Platform

By Technology

By Region

Global Naval optronics market Analysis for next 10 Years

The 10-year Global Naval optronics market analysis would give a detailed overview of Global Naval optronics market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Global Naval optronics market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Naval optronics market Forecast

The 10-year Global Naval optronics market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Global Naval optronics market Trends & Forecast

The regional counter drone market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Global Naval optronics market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Global Naval optronics market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Global Naval optronics market

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2022-2032

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2022-2032

- Table 18: Scenario Analysis, Scenario 1, By Platform, 2022-2032

- Table 19: Scenario Analysis, Scenario 1, By Technology, 2022-2032

- Table 20: Scenario Analysis, Scenario 1, By Type, 2022-2032

- Table 21: Scenario Analysis, Scenario 2, By Region, 2022-2032

- Table 22: Scenario Analysis, Scenario 2, By Platform, 2022-2032

- Table 23: Scenario Analysis, Scenario 2, By Technology, 2022-2032

- Table 24: Scenario Analysis, Scenario 2, By Type, 2022-2032

List of Figures

- Figure 1: Global Naval Optronics Market Forecast, 2022-2032

- Figure 2: Global Naval Optronics Market Forecast, By Region, 2022-2032

- Figure 3: Global Naval Optronics Market Forecast, By Platform, 2022-2032

- Figure 4: Global Naval Optronics Market Forecast, By Technology, 2022-2032

- Figure 5: Global Naval Optronics Market Forecast, By Type, 2022-2032

- Figure 6: North America, Naval Optronics Market, Market Forecast, 2022-2032

- Figure 7: Europe, Naval Optronics Market, Market Forecast, 2022-2032

- Figure 8: Middle East, Naval Optronics Market, Market Forecast, 2022-2032

- Figure 9: APAC, Naval Optronics Market, Market Forecast, 2022-2032

- Figure 10: South America, Naval Optronics Market, Market Forecast, 2022-2032

- Figure 11: United States, Naval Optronics Market, Technology Maturation, 2022-2032

- Figure 12: United States, Naval Optronics Market, Market Forecast, 2022-2032

- Figure 13: Canada, Naval Optronics Market, Technology Maturation, 2022-2032

- Figure 14: Canada, Naval Optronics Market, Market Forecast, 2022-2032

- Figure 15: Italy, Naval Optronics Market, Technology Maturation, 2022-2032

- Figure 16: Italy, Naval Optronics Market, Market Forecast, 2022-2032

- Figure 17: France, Naval Optronics Market, Technology Maturation, 2022-2032

- Figure 18: France, Naval Optronics Market, Market Forecast, 2022-2032

- Figure 19: Germany, Naval Optronics Market, Technology Maturation, 2022-2032

- Figure 20: Germany, Naval Optronics Market, Market Forecast, 2022-2032

- Figure 21: Netherlands, Naval Optronics Market, Technology Maturation, 2022-2032

- Figure 22: Netherlands, Naval Optronics Market, Market Forecast, 2022-2032

- Figure 23: Belgium, Naval Optronics Market, Technology Maturation, 2022-2032

- Figure 24: Belgium, Naval Optronics Market, Market Forecast, 2022-2032

- Figure 25: Spain, Naval Optronics Market, Technology Maturation, 2022-2032

- Figure 26: Spain, Naval Optronics Market, Market Forecast, 2022-2032

- Figure 27: Sweden, Naval Optronics Market, Technology Maturation, 2022-2032

- Figure 28: Sweden, Naval Optronics Market, Market Forecast, 2022-2032

- Figure 29: Brazil, Naval Optronics Market, Technology Maturation, 2022-2032

- Figure 30: Brazil, Naval Optronics Market, Market Forecast, 2022-2032

- Figure 31: Australia, Naval Optronics Market, Technology Maturation, 2022-2032

- Figure 32: Australia, Naval Optronics Market, Market Forecast, 2022-2032

- Figure 33: India, Naval Optronics Market, Technology Maturation, 2022-2032

- Figure 34: India, Naval Optronics Market, Market Forecast, 2022-2032

- Figure 35: China, Naval Optronics Market, Technology Maturation, 2022-2032

- Figure 36: China, Naval Optronics Market, Market Forecast, 2022-2032

- Figure 37: Saudi Arabia, Naval Optronics Market, Technology Maturation, 2022-2032

- Figure 38: Saudi Arabia, Naval Optronics Market, Market Forecast, 2022-2032

- Figure 39: South Korea, Naval Optronics Market, Technology Maturation, 2022-2032

- Figure 40: South Korea, Naval Optronics Market, Market Forecast, 2022-2032

- Figure 41: Japan, Naval Optronics Market, Technology Maturation, 2022-2032

- Figure 42: Japan, Naval Optronics Market, Market Forecast, 2022-2032

- Figure 43: Malaysia, Naval Optronics Market, Technology Maturation, 2022-2032

- Figure 44: Malaysia, Naval Optronics Market, Market Forecast, 2022-2032

- Figure 45: Singapore, Naval Optronics Market, Technology Maturation, 2022-2032

- Figure 46: Singapore, Naval Optronics Market, Market Forecast, 2022-2032

- Figure 47: United Kingdom, Naval Optronics Market, Technology Maturation, 2022-2032

- Figure 48: United Kingdom, Naval Optronics Market, Market Forecast, 2022-2032

- Figure 49: Opportunity Analysis, Naval Optronics Market, By Region (Cumulative Market), 2022-2032

- Figure 50: Opportunity Analysis, Naval Optronics Market, By Region (CAGR), 2022-2032

- Figure 51: Opportunity Analysis, Naval Optronics Market, By Technology (Cumulative Market), 2022-2032

- Figure 52: Opportunity Analysis, Naval Optronics Market, By Technology (CAGR), 2022-2032

- Figure 53: Opportunity Analysis, Naval Optronics Market, By Platform (Cumulative Market), 2022-2032

- Figure 54: Opportunity Analysis, Naval Optronics Market, By Platform (CAGR), 2022-2032

- Figure 55: Opportunity Analysis, Naval Optronics Market, By Type (Cumulative Market), 2022-2032

- Figure 56: Opportunity Analysis, Naval Optronics Market, By Type (CAGR), 2022-2032

- Figure 57: Scenario Analysis, Naval Optronics Market, Cumulative Market, 2022-2032

- Figure 58: Scenario Analysis, Naval Optronics Market, Global Market, 2022-2032

- Figure 59: Scenario 1, Naval Optronics Market, Total Market, 2022-2032

- Figure 60: Scenario 1, Naval Optronics Market, By Region, 2022-2032

- Figure 61: Scenario 1, Naval Optronics Market, By Platform, 2022-2032

- Figure 62: Scenario 1, Naval Optronics Market, By Technology, 2022-2032

- Figure 63: Scenario 1, Naval Optronics Market, By Type, 2022-2032

- Figure 64: Scenario 2, Naval Optronics Market, Total Market, 2022-2032

- Figure 65: Scenario 2, Naval Optronics Market, By Region, 2022-2032

- Figure 66: Scenario 2, Naval Optronics Market, By Platform, 2022-2032

- Figure 67: Scenario 2, Naval Optronics Market, By Technology, 2022-2032

- Figure 68: Scenario 2, Naval Optronics Market, By Type, 2022-2032

- Figure 69: Company Benchmark, Naval Optronics Market, 2022-2032