PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1904992

PUBLISHER: Aviation & Defense Market Reports (A&D) | PRODUCT CODE: 1904992

Global Defense Optronics Market 2026-2036

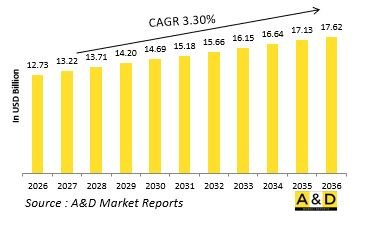

The Global Defense Optronics market is estimated at USD 12.73 billion in 2026, projected to grow to USD 17.62 billion by 2036 at a Compound Annual Growth Rate (CAGR) of 3.30% over the forecast period 2026-2036.

Introduction to Defense Optronics Market:

The Global Defense Optronics Market encompasses electro-optical and infrared systems that extend human vision capabilities across the electromagnetic spectrum for surveillance, targeting, navigation, and threat detection. These systems convert photons into electronic signals that can be processed, displayed, and analyzed, providing critical capabilities in darkness, through obscurants, and at extended ranges. Optronics components include thermal imagers, image intensifiers, laser rangefinders, target designators, and hyperspectral sensors deployed across all military domains-from individual soldier sights to satellite surveillance systems. The technology enables seeing without being seen, targeting with precision, and navigating in degraded visual environments. As warfare extends into around-the-clock operations and environments where visual observation is limited, optronics have become force multipliers that fundamentally alter situational awareness and engagement dynamics across tactical, operational, and strategic levels.

Technology Impact in Defense Optronics Market:

Technological advancement in optronics focuses on sensor fusion, resolution enhancement, and cognitive processing. High-definition thermal sensors with smaller pixel pitches deliver sharper imagery at longer ranges while reducing system size and power requirements. Multispectral and hyperspectral imaging combines information across numerous spectral bands to detect camouflaged objects and identify material composition. Advanced image processing algorithms employ artificial intelligence to automatically detect, classify, and track targets while reducing operator workload. Fusion of thermal, low-light, and laser data into single integrated displays provides comprehensive situational pictures. Quantum-based sensing technologies promise revolutionary improvements in sensitivity and discrimination capabilities. Miniaturization continues to drive deployment on smaller platforms including unmanned systems and individual weapons. These innovations transform optronics from simple vision enhancement tools into intelligent sensing systems that automatically extract and prioritize critical battlefield information.

Key Drivers in Defense Optronics Market:

The imperative for 24/7 operational capability across all environments drives continuous optronics enhancement, as night and adverse weather no longer provide tactical respite. Asymmetric warfare against adversaries employing concealment and deception tactics increases demand for advanced detection and identification capabilities. Platform survivability requirements push for earlier threat detection at greater distances to enable proactive countermeasures. Precision engagement mandates necessitate highly accurate targeting data regardless of visibility conditions. Soldier modernization programs worldwide prioritize individual optronics to enhance squad-level situational awareness and marksmanship. Additionally, counter-drone and perimeter protection missions create new requirements for wide-area persistent surveillance using networked optronics arrays. The convergence of these drivers ensures sustained investment across all optronics categories and platform types throughout defense modernization cycles.

Regional Trends in Defense Optronics Market:

Regional optronics development reflects differing threat perceptions, industrial capabilities, and operational doctrines. North American programs emphasize multi-spectral systems with advanced processing and networking for integration into digitized battlespaces. European development focuses on high-performance thermal imagers and targeting systems for next-generation armored vehicles and aircraft. The Asia-Pacific region shows strong growth in indigenous production, particularly in uncooled thermal technology for widespread infantry deployment. Middle Eastern procurement prioritizes systems optimized for desert environments with extreme temperature ranges and long observation distances. Israeli industry maintains particular strength in innovative optronics solutions refined through continuous operational experience. Developing nations increasingly access capable optronics through technology transfer arrangements as part of larger platform acquisitions, though often facing challenges with maintenance and sustainment of sophisticated systems.

Key Defense Optronics Program:

MKU Limited has been awarded a major contract by the Indian Army for the supply of 29,762 units of its advanced Netro NW 3000 Night Vision Weapon Sights, with the order valued at approximately ₹660 crore. Finalized under the special procurement powers of the Raksha Mantri, the agreement represents one of the largest electro-optics acquisitions undertaken by the Indian Army to date. The contract underscores the growing emphasis on equipping frontline forces with domestically developed, high-performance technologies tailored for modern combat environments. The Netro NW 3000 systems are designed to enhance night-time operational capability by enabling accurate target acquisition and engagement under low-visibility conditions, thereby improving soldier effectiveness and battlefield survivability. This procurement further reflects India's broader strategic focus on strengthening indigenous defense manufacturing under the Make in India and Atmanirbhar Bharat initiatives. By sourcing a significant volume of critical electro-optical equipment from a domestic supplier, the Indian Army is reducing reliance on imports while fostering the growth of local design, engineering, and production capabilities. Beyond its immediate operational impact, the contract reinforces MKU's position as a key contributor to India's defense technology ecosystem. It also signals continued momentum in the Army's modernization efforts, particularly in enhancing infantry lethality and situational awareness through locally developed, mission-ready solutions.

Table of Contents

Defense Optronics Market Report Definition

Defense Optronics Market Segmentation

By Region

By Technology

By Platform

Defense Optronics Market Analysis for next 10 Years

The 10-year Defense Optronics Market analysis would give a detailed overview of Defense Optronics Market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Defense Optronics Market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Defense Optronics Market Forecast

The 10-year Defense Optronics Market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Defense Optronics Market Trends & Forecast

The regional Defense Optronics Market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Defense Optronics Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Defense Optronics Market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Defense Optronics Market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2025-2035

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2025-2035

- Table 18: Scenario Analysis, Scenario 1, By Application, 2025-2035

- Table 19: Scenario Analysis, Scenario 1, By Platform, 2025-2035

- Table 20: Scenario Analysis, Scenario 2, By Region, 2025-2035

- Table 21: Scenario Analysis, Scenario 2, By Application, 2025-2035

- Table 22: Scenario Analysis, Scenario 2, By Platform, 2025-2035

List of Figures

- Figure 1: Global Defense Optronics Market Forecast, 2025-2035

- Figure 2: Global Defense Optronics Market Forecast, By Region, 2025-2035

- Figure 3: Global Defense Optronics Market Forecast, By Application, 2025-2035

- Figure 4: Global Defense Optronics Market Forecast, By Platform, 2025-2035

- Figure 5: North America, Defense Optronics Market, Market Forecast, 2025-2035

- Figure 6: Europe, Defense Optronics Market, Market Forecast, 2025-2035

- Figure 7: Middle East, Defense Optronics Market, Market Forecast, 2025-2035

- Figure 8: APAC, Defense Optronics Market, Market Forecast, 2025-2035

- Figure 9: South America, Defense Optronics Market, Market Forecast, 2025-2035

- Figure 10: United States, Defense Optronics Market, Technology Maturation, 2025-2035

- Figure 11: United States, Defense Optronics Market, Market Forecast, 2025-2035

- Figure 12: Canada, Defense Optronics Market, Technology Maturation, 2025-2035

- Figure 13: Canada, Defense Optronics Market, Market Forecast, 2025-2035

- Figure 14: Italy, Defense Optronics Market, Technology Maturation, 2025-2035

- Figure 15: Italy, Defense Optronics Market, Market Forecast, 2025-2035

- Figure 16: France, Defense Optronics Market, Technology Maturation, 2025-2035

- Figure 17: France, Defense Optronics Market, Market Forecast, 2025-2035

- Figure 18: Germany, Defense Optronics Market, Technology Maturation, 2025-2035

- Figure 19: Germany, Defense Optronics Market, Market Forecast, 2025-2035

- Figure 20: Netherland, Defense Optronics Market, Technology Maturation, 2025-2035

- Figure 21: Netherland, Defense Optronics Market, Market Forecast, 2025-2035

- Figure 22: Belgium, Defense Optronics Market, Technology Maturation, 2025-2035

- Figure 23: Belgium, Defense Optronics Market, Market Forecast, 2025-2035

- Figure 24: Spain, Defense Optronics Market, Technology Maturation, 2025-2035

- Figure 25: Spain, Defense Optronics Market, Market Forecast, 2025-2035

- Figure 26: Sweden, Defense Optronics Market, Technology Maturation, 2025-2035

- Figure 27: Sweden, Defense Optronics Market, Market Forecast, 2025-2035

- Figure 28: Brazil, Defense Optronics Market, Technology Maturation, 2025-2035

- Figure 29: Brazil, Defense Optronics Market, Market Forecast, 2025-2035

- Figure 30: Australia, Defense Optronics Market, Technology Maturation, 2025-2035

- Figure 31: Australia, Defense Optronics Market, Market Forecast, 2025-2035

- Figure 32: India, Defense Optronics Market, Technology Maturation, 2025-2035

- Figure 33: India, Defense Optronics Market, Market Forecast, 2025-2035

- Figure 34: China, Defense Optronics Market, Technology Maturation, 2025-2035

- Figure 35: China, Defense Optronics Market, Market Forecast, 2025-2035

- Figure 36: Saudi Arabia, Defense Optronics Market, Technology Maturation, 2025-2035

- Figure 37: Saudi Arabia, Defense Optronics Market, Market Forecast, 2025-2035

- Figure 38: South Korea, Defense Optronics Market, Technology Maturation, 2025-2035

- Figure 39: South Korea, Defense Optronics Market, Market Forecast, 2025-2035

- Figure 40: Japan, Defense Optronics Market, Technology Maturation, 2025-2035

- Figure 41: Japan, Defense Optronics Market, Market Forecast, 2025-2035

- Figure 42: Malaysia, Defense Optronics Market, Technology Maturation, 2025-2035

- Figure 43: Malaysia, Defense Optronics Market, Market Forecast, 2025-2035

- Figure 44: Singapore, Defense Optronics Market, Technology Maturation, 2025-2035

- Figure 45: Singapore, Defense Optronics Market, Market Forecast, 2025-2035

- Figure 46: United Kingdom, Defense Optronics Market, Technology Maturation, 2025-2035

- Figure 47: United Kingdom, Defense Optronics Market, Market Forecast, 2025-2035

- Figure 48: Opportunity Analysis, Defense Optronics Market, By Region (Cumulative Market), 2025-2035

- Figure 49: Opportunity Analysis, Defense Optronics Market, By Region (CAGR), 2025-2035

- Figure 50: Opportunity Analysis, Defense Optronics Market, By Application (Cumulative Market), 2025-2035

- Figure 51: Opportunity Analysis, Defense Optronics Market, By Application (CAGR), 2025-2035

- Figure 52: Opportunity Analysis, Defense Optronics Market, By Platform (Cumulative Market), 2025-2035

- Figure 53: Opportunity Analysis, Defense Optronics Market, By Platform (CAGR), 2025-2035

- Figure 54: Scenario Analysis, Defense Optronics Market, Cumulative Market, 2025-2035

- Figure 55: Scenario Analysis, Defense Optronics Market, Global Market, 2025-2035

- Figure 56: Scenario 1, Defense Optronics Market, Total Market, 2025-2035

- Figure 57: Scenario 1, Defense Optronics Market, By Region, 2025-2035

- Figure 58: Scenario 1, Defense Optronics Market, By Application, 2025-2035

- Figure 59: Scenario 1, Defense Optronics Market, By Platform, 2025-2035

- Figure 60: Scenario 2, Defense Optronics Market, Total Market, 2025-2035

- Figure 61: Scenario 2, Defense Optronics Market, By Region, 2025-2035

- Figure 62: Scenario 2, Defense Optronics Market, By Application, 2025-2035

- Figure 63: Scenario 2, Defense Optronics Market, By Platform, 2025-2035

- Figure 64: Company Benchmark, Defense Optronics Market, 2025-2035