PUBLISHER: Allied Market Research | PRODUCT CODE: 1641748

PUBLISHER: Allied Market Research | PRODUCT CODE: 1641748

U.S. Foot Care Products Market By Product , By Application By Distribution Channel : Opportunity Analysis and Industry Forecast, 2024-2034

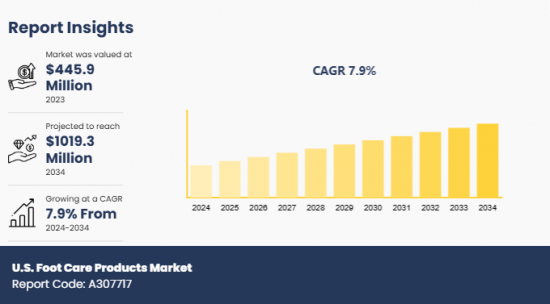

The U.S. foot care products market was valued at $445.9 million in 2023, and is projected to reach $1019.3 million by 2034, growing at a CAGR of 7.9% from 2024 to 2034.

Foot care products refer to a wide range of items designed to maintain the health, hygiene, and comfort of feet. These include creams, lotions, sprays, powders, foot soaks, insoles, and specialized tools such as pumice stones, foot files, and nail clippers. The primary purposes of these products are to prevent or treat foot-related issues such as dryness, cracks, odor, fungal infections, and discomfort caused by prolonged walking or standing.

The growth of the U.S. foot care products market is majorly driven by factors such as increase in awareness about foot hygiene and health among the U.S. population and rise in awareness about foot health coupled with surge in demand for solutions to treat conditions like dryness, odor, and fungal infections. In addition, the growing elderly population in the U.S. is a key driver, as older adults are more susceptible to foot-related issues such as cracked heels, fungal infections, and circulation problems, necessitating regular foot care. As per 2024 Foot Pain Trends Report, approximately 81% of Americans report foot pain in 2024, which has been shown to significantly impact their quality of life. This trend contributes to an increased need for foot care solutions among the elderly. Moreover, alarming increase in the prevalence of diabetes acts as the key driving force of the market. This is attributed to the fact that diabetes is a significant health concern in the U.S., and foot care is a critical aspect of diabetes management. Thus, the demand for specialized foot care products designed to prevent complications like ulcers and infections is steadily rising. A study by Centers for Disease Control and Prevention stated that approximately 38.4 million people of all ages-or 11.6% of the U.S. population-had diabetes. Furthermore, surge in sports and fitness activities has boosted the need for foot care products, especially among athletes and fitness enthusiasts who face challenges such as blisters, calluses, and athlete's foot. However, premium foot care products, particularly those with specialized ingredients or medical-grade formulations, can be costly. This price point may limit access for budget-conscious consumers, restricting market growth. While awareness of foot health is growing in urban areas, rural regions still lag in terms of consumer education and availability of specialized foot care products, limiting market expansion in these areas. On the contrary, the introduction of innovative and multifunctional foot care products, such as medicated creams, organic formulations, and devices like electric foot files, is expected to offer lucrative opportunities for the market growth during the forecast period.

The U.S. foot care products market is segmented into product, application, and distribution channel. By product, the market is divided into foot repair ointment, foot creams, foot cleansing lotions, slough scrub products, and others. On the basis of application, it is classified into sports & athletics, medical, and personal comfort. Depending on distribution channel, it is segregated into drug stores & pharmacies, hospitals & specialty clinics, drug stores & pharmacies stores, and others.

Competition Analysis

The major players operating in the global U.S. foot care products market include Blistex Inc., Revlon, Inc., Miracle of Aloe, Aetna Foot Products, Alva-Amco Pharmacal Companies, LLC, Combe, Incorporated, HoMedics USA LLC, Scholls Wellness Co., GlaxoSmithKline Plc., and PediFix Inc. These major players have adopted various key development strategies such as business expansion, new product launches, and partnerships to sustain the intense competition and gain a strong foothold in the market.

Additional benefits you will get with this purchase are:

- Quarterly Update and* (only available with a corporate license, on listed price)

- 5 additional Company Profile of client Choice pre- or Post-purchase, as a free update.

- Free Upcoming Version on the Purchase of Five and Enterprise User License.

- 16 analyst hours of support* (post-purchase, if you find additional data requirements upon review of the report, you may receive support amounting to 16 analyst hours to solve questions, and post-sale queries)

- 15% Free Customization* (in case the scope or segment of the report does not match your requirements, 15% is equivalent to 3 working days of free work, applicable once)

- Free data Pack on the Five and Enterprise User License. (Excel version of the report)

- Free Updated report if the report is 6-12 months old or older.

- 24-hour priority response*

- Free Industry updates and white papers.

Possible Customization with this report (with additional cost and timeline, please talk to the sales executive to know more)

- Consumer Buying Behavior Analysis

- Additional company profiles with specific to client's interest

- Additional country or region analysis- market size and forecast

- Brands Share Analysis

- Historic market data

Key Market Segments

By Product

- Foot Repair Ointment

- Foot Creams

- Foot Cleansing Lotions

- Slough Scrub Products

- Others

By Application

- Sports and Athletics

- Medical

- Personal Comfort

By Distribution Channel

- Drug stores and Pharmacies

- Hospitals and Specialty Clinics

- Online Stores

- Others

Key Market Players:

- Blistex Inc.

- Revlon, Inc.

- Miracle of Aloe

- Aetna Foot Products

- Alva-Amco Pharmacal Companies, LLC

- Combe, Incorporated

- HoMedics USA LLC

- Scholls Wellness Co.

- GlaxoSmithKline Plc.

- PediFix Inc.

TABLE OF CONTENTS

CHAPTER 1: INTRODUCTION

- 1.1. Report Description

- 1.2. Key Market Segments

- 1.3. Key Benefits

- 1.4. Research Methodology

- 1.4.1. Primary Research

- 1.4.2. Secondary Research

- 1.4.3. Analyst Tools and Models

CHAPTER 2: EXECUTIVE SUMMARY

- 2.1. CXO Perspective

CHAPTER 3: MARKET LANDSCAPE

- 3.1. Market Definition and Scope

- 3.2. Key Findings

- 3.2.1. Top Investment Pockets

- 3.2.2. Top Winning Strategies

- 3.3. Porter's Five Forces Analysis

- 3.3.1. Bargaining Power of Suppliers

- 3.3.2. Threat of New Entrants

- 3.3.3. Threat of Substitutes

- 3.3.4. Competitive Rivalry

- 3.3.5. Bargaining Power among Buyers

- 3.4. Market Dynamics

- 3.4.1. Drivers

- 3.4.2. Restraints

- 3.4.3. Opportunities

CHAPTER 4: U.S. FOOT CARE PRODUCTS MARKET, BY PRODUCT

- 4.1. Market Overview

- 4.1.1 Market Size and Forecast, By Product

- 4.2. Foot Repair Ointment

- 4.2.1. Key Market Trends, Growth Factors and Opportunities

- 4.3. Foot Creams

- 4.3.1. Key Market Trends, Growth Factors and Opportunities

- 4.4. Foot Cleansing Lotions

- 4.4.1. Key Market Trends, Growth Factors and Opportunities

- 4.5. Slough Scrub Products

- 4.5.1. Key Market Trends, Growth Factors and Opportunities

- 4.6. Others

- 4.6.1. Key Market Trends, Growth Factors and Opportunities

CHAPTER 5: U.S. FOOT CARE PRODUCTS MARKET, BY APPLICATION

- 5.1. Market Overview

- 5.1.1 Market Size and Forecast, By Application

- 5.2. Sports And Athletics

- 5.2.1. Key Market Trends, Growth Factors and Opportunities

- 5.3. Medical

- 5.3.1. Key Market Trends, Growth Factors and Opportunities

- 5.4. Personal Comfort

- 5.4.1. Key Market Trends, Growth Factors and Opportunities

CHAPTER 6: U.S. FOOT CARE PRODUCTS MARKET, BY DISTRIBUTION CHANNEL

- 6.1. Market Overview

- 6.1.1 Market Size and Forecast, By Distribution Channel

- 6.2. Drug Stores And Pharmacies

- 6.2.1. Key Market Trends, Growth Factors and Opportunities

- 6.3. Hospitals And Specialty Clinics

- 6.3.1. Key Market Trends, Growth Factors and Opportunities

- 6.4. Online Stores

- 6.4.1. Key Market Trends, Growth Factors and Opportunities

- 6.5. Others

- 6.5.1. Key Market Trends, Growth Factors and Opportunities

CHAPTER 7: COMPETITIVE LANDSCAPE

- 7.1. Introduction

- 7.2. Top Winning Strategies

- 7.3. Product Mapping Of Top 10 Player

- 7.4. Competitive Dashboard

- 7.5. Competitive Heatmap

- 7.6. Top Player Positioning,2023

CHAPTER 8: COMPANY PROFILES

- 8.1. Blistex Inc.

- 8.1.1. Company Overview

- 8.1.2. Key Executives

- 8.1.3. Company Snapshot

- 8.1.4. Operating Business Segments

- 8.1.5. Product Portfolio

- 8.1.6. Business Performance

- 8.1.7. Key Strategic Moves and Developments

- 8.2. Revlon, Inc.

- 8.2.1. Company Overview

- 8.2.2. Key Executives

- 8.2.3. Company Snapshot

- 8.2.4. Operating Business Segments

- 8.2.5. Product Portfolio

- 8.2.6. Business Performance

- 8.2.7. Key Strategic Moves and Developments

- 8.3. Miracle Of Aloe

- 8.3.1. Company Overview

- 8.3.2. Key Executives

- 8.3.3. Company Snapshot

- 8.3.4. Operating Business Segments

- 8.3.5. Product Portfolio

- 8.3.6. Business Performance

- 8.3.7. Key Strategic Moves and Developments

- 8.4. Aetna Foot Products

- 8.4.1. Company Overview

- 8.4.2. Key Executives

- 8.4.3. Company Snapshot

- 8.4.4. Operating Business Segments

- 8.4.5. Product Portfolio

- 8.4.6. Business Performance

- 8.4.7. Key Strategic Moves and Developments

- 8.5. Alva-Amco Pharmacal Companies, LLC

- 8.5.1. Company Overview

- 8.5.2. Key Executives

- 8.5.3. Company Snapshot

- 8.5.4. Operating Business Segments

- 8.5.5. Product Portfolio

- 8.5.6. Business Performance

- 8.5.7. Key Strategic Moves and Developments

- 8.6. Combe, Incorporated

- 8.6.1. Company Overview

- 8.6.2. Key Executives

- 8.6.3. Company Snapshot

- 8.6.4. Operating Business Segments

- 8.6.5. Product Portfolio

- 8.6.6. Business Performance

- 8.6.7. Key Strategic Moves and Developments

- 8.7. HoMedics USA LLC

- 8.7.1. Company Overview

- 8.7.2. Key Executives

- 8.7.3. Company Snapshot

- 8.7.4. Operating Business Segments

- 8.7.5. Product Portfolio

- 8.7.6. Business Performance

- 8.7.7. Key Strategic Moves and Developments

- 8.8. Scholls Wellness Co.

- 8.8.1. Company Overview

- 8.8.2. Key Executives

- 8.8.3. Company Snapshot

- 8.8.4. Operating Business Segments

- 8.8.5. Product Portfolio

- 8.8.6. Business Performance

- 8.8.7. Key Strategic Moves and Developments

- 8.9. GlaxoSmithKline Plc.

- 8.9.1. Company Overview

- 8.9.2. Key Executives

- 8.9.3. Company Snapshot

- 8.9.4. Operating Business Segments

- 8.9.5. Product Portfolio

- 8.9.6. Business Performance

- 8.9.7. Key Strategic Moves and Developments

- 8.10. PediFix Inc.

- 8.10.1. Company Overview

- 8.10.2. Key Executives

- 8.10.3. Company Snapshot

- 8.10.4. Operating Business Segments

- 8.10.5. Product Portfolio

- 8.10.6. Business Performance

- 8.10.7. Key Strategic Moves and Developments

- TABLE 1. U.S. FOOT CARE PRODUCTS MARKET, BY PRODUCT, 2024 - 2034 ($MILLION)

- TABLE 2. U.S. FOOT CARE PRODUCTS MARKET, BY APPLICATION, 2024 - 2034 ($MILLION)

- TABLE 3. U.S. FOOT CARE PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2024 - 2034 ($MILLION)

- TABLE 4. BLISTEX INC.: KEY EXECUTIVES

- TABLE 5. BLISTEX INC.: COMPANY SNAPSHOT

- TABLE 6. BLISTEX INC.: OPERATING SEGMENTS

- TABLE 7. BLISTEX INC.: PRODUCT PORTFOLIO

- TABLE 8. BLISTEX INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

- TABLE 9. REVLON, INC.: KEY EXECUTIVES

- TABLE 10. REVLON, INC.: COMPANY SNAPSHOT

- TABLE 11. REVLON, INC.: OPERATING SEGMENTS

- TABLE 12. REVLON, INC.: PRODUCT PORTFOLIO

- TABLE 13. REVLON, INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

- TABLE 14. MIRACLE OF ALOE: KEY EXECUTIVES

- TABLE 15. MIRACLE OF ALOE: COMPANY SNAPSHOT

- TABLE 16. MIRACLE OF ALOE: OPERATING SEGMENTS

- TABLE 17. MIRACLE OF ALOE: PRODUCT PORTFOLIO

- TABLE 18. MIRACLE OF ALOE: KEY STRATEGIC MOVES AND DEVELOPMENTS

- TABLE 19. AETNA FOOT PRODUCTS: KEY EXECUTIVES

- TABLE 20. AETNA FOOT PRODUCTS: COMPANY SNAPSHOT

- TABLE 21. AETNA FOOT PRODUCTS: OPERATING SEGMENTS

- TABLE 22. AETNA FOOT PRODUCTS: PRODUCT PORTFOLIO

- TABLE 23. AETNA FOOT PRODUCTS: KEY STRATEGIC MOVES AND DEVELOPMENTS

- TABLE 24. ALVA-AMCO PHARMACAL COMPANIES, LLC: KEY EXECUTIVES

- TABLE 25. ALVA-AMCO PHARMACAL COMPANIES, LLC: COMPANY SNAPSHOT

- TABLE 26. ALVA-AMCO PHARMACAL COMPANIES, LLC: OPERATING SEGMENTS

- TABLE 27. ALVA-AMCO PHARMACAL COMPANIES, LLC: PRODUCT PORTFOLIO

- TABLE 28. ALVA-AMCO PHARMACAL COMPANIES, LLC: KEY STRATEGIC MOVES AND DEVELOPMENTS

- TABLE 29. COMBE, INCORPORATED: KEY EXECUTIVES

- TABLE 30. COMBE, INCORPORATED: COMPANY SNAPSHOT

- TABLE 31. COMBE, INCORPORATED: OPERATING SEGMENTS

- TABLE 32. COMBE, INCORPORATED: PRODUCT PORTFOLIO

- TABLE 33. COMBE, INCORPORATED: KEY STRATEGIC MOVES AND DEVELOPMENTS

- TABLE 34. HOMEDICS USA LLC: KEY EXECUTIVES

- TABLE 35. HOMEDICS USA LLC: COMPANY SNAPSHOT

- TABLE 36. HOMEDICS USA LLC: OPERATING SEGMENTS

- TABLE 37. HOMEDICS USA LLC: PRODUCT PORTFOLIO

- TABLE 38. HOMEDICS USA LLC: KEY STRATEGIC MOVES AND DEVELOPMENTS

- TABLE 39. SCHOLLS WELLNESS CO.: KEY EXECUTIVES

- TABLE 40. SCHOLLS WELLNESS CO.: COMPANY SNAPSHOT

- TABLE 41. SCHOLLS WELLNESS CO.: OPERATING SEGMENTS

- TABLE 42. SCHOLLS WELLNESS CO.: PRODUCT PORTFOLIO

- TABLE 43. SCHOLLS WELLNESS CO.: KEY STRATEGIC MOVES AND DEVELOPMENTS

- TABLE 44. GLAXOSMITHKLINE PLC.: KEY EXECUTIVES

- TABLE 45. GLAXOSMITHKLINE PLC.: COMPANY SNAPSHOT

- TABLE 46. GLAXOSMITHKLINE PLC.: OPERATING SEGMENTS

- TABLE 47. GLAXOSMITHKLINE PLC.: PRODUCT PORTFOLIO

- TABLE 48. GLAXOSMITHKLINE PLC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

- TABLE 49. PEDIFIX INC.: KEY EXECUTIVES

- TABLE 50. PEDIFIX INC.: COMPANY SNAPSHOT

- TABLE 51. PEDIFIX INC.: OPERATING SEGMENTS

- TABLE 52. PEDIFIX INC.: PRODUCT PORTFOLIO

- TABLE 53. PEDIFIX INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

- FIGURE 1. U.S. FOOT CARE PRODUCTS MARKET,2024 - 2034

- FIGURE 2. SEGMENTATION OF U.S. FOOT CARE PRODUCTS MARKET,2024 - 2034

- FIGURE 3. TOP INVESTMENT POCKET IN U.S. FOOT CARE PRODUCTS MARKET,2024 - 2034

- FIGURE 4. MODERATE BARGAINING POWER OF BUYERS

- FIGURE 5. MODERATE BARGAINING POWER OF SUPPLIERS

- FIGURE 6. MODERATE THREAT OF NEW ENTRANTS

- FIGURE 7. LOW THREAT OF SUBSTITUTION

- FIGURE 8. HIGH COMPETITIVE RIVALRY

- FIGURE 9. OPPORTUNITIES, RESTRAINTS AND DRIVERS: U.S. FOOT CARE PRODUCTS MARKET

- FIGURE 10. U.S. FOOT CARE PRODUCTS MARKET , BY PRODUCT,2024 - 2034 ($MILLION)

- FIGURE 11. U.S. FOOT CARE PRODUCTS MARKET , BY APPLICATION,2024 - 2034 ($MILLION)

- FIGURE 12. U.S. FOOT CARE PRODUCTS MARKET , BY DISTRIBUTION CHANNEL,2024 - 2034 ($MILLION)

- FIGURE 13. TOP WINNING STRATEGIES, BY YEAR, 2021-2023*

- FIGURE 14. TOP WINNING STRATEGIES, BY DEVELOPMENT, 2021-2023*

- FIGURE 15. TOP WINNING STRATEGIES, BY COMPANY, 2021-2023*

- FIGURE 16. PRODUCT MAPPING OF TOP 10 PLAYERS

- FIGURE 17. COMPETITIVE DASHBOARD

- FIGURE 18. COMPETITIVE HEATMAP: U.S. FOOT CARE PRODUCTS MARKET

- FIGURE 19. TOP PLAYER POSITIONING,2023

- FIGURE 20. BLISTEX INC.: NET SALES, 2021-2023 ($MILLION)

- FIGURE 21. BLISTEX INC.: REVENUE SHARE, BY SEGMENT, 2023 (%)

- FIGURE 22. BLISTEX INC.: REVENUE SHARE, BY REGION, 2023 (%)

- FIGURE 23. REVLON, INC.: NET SALES, 2021-2023 ($MILLION)

- FIGURE 24. REVLON, INC.: REVENUE SHARE, BY SEGMENT, 2023 (%)

- FIGURE 25. REVLON, INC.: REVENUE SHARE, BY REGION, 2023 (%)

- FIGURE 26. MIRACLE OF ALOE: NET SALES, 2021-2023 ($MILLION)

- FIGURE 27. MIRACLE OF ALOE: REVENUE SHARE, BY SEGMENT, 2023 (%)

- FIGURE 28. MIRACLE OF ALOE: REVENUE SHARE, BY REGION, 2023 (%)

- FIGURE 29. AETNA FOOT PRODUCTS: NET SALES, 2021-2023 ($MILLION)

- FIGURE 30. AETNA FOOT PRODUCTS: REVENUE SHARE, BY SEGMENT, 2023 (%)

- FIGURE 31. AETNA FOOT PRODUCTS: REVENUE SHARE, BY REGION, 2023 (%)

- FIGURE 32. ALVA-AMCO PHARMACAL COMPANIES, LLC: NET SALES, 2021-2023 ($MILLION)

- FIGURE 33. ALVA-AMCO PHARMACAL COMPANIES, LLC: REVENUE SHARE, BY SEGMENT, 2023 (%)

- FIGURE 34. ALVA-AMCO PHARMACAL COMPANIES, LLC: REVENUE SHARE, BY REGION, 2023 (%)

- FIGURE 35. COMBE, INCORPORATED: NET SALES, 2021-2023 ($MILLION)

- FIGURE 36. COMBE, INCORPORATED: REVENUE SHARE, BY SEGMENT, 2023 (%)

- FIGURE 37. COMBE, INCORPORATED: REVENUE SHARE, BY REGION, 2023 (%)

- FIGURE 38. HOMEDICS USA LLC: NET SALES, 2021-2023 ($MILLION)

- FIGURE 39. HOMEDICS USA LLC: REVENUE SHARE, BY SEGMENT, 2023 (%)

- FIGURE 40. HOMEDICS USA LLC: REVENUE SHARE, BY REGION, 2023 (%)

- FIGURE 41. SCHOLLS WELLNESS CO.: NET SALES, 2021-2023 ($MILLION)

- FIGURE 42. SCHOLLS WELLNESS CO.: REVENUE SHARE, BY SEGMENT, 2023 (%)

- FIGURE 43. SCHOLLS WELLNESS CO.: REVENUE SHARE, BY REGION, 2023 (%)

- FIGURE 44. GLAXOSMITHKLINE PLC.: NET SALES, 2021-2023 ($MILLION)

- FIGURE 45. GLAXOSMITHKLINE PLC.: REVENUE SHARE, BY SEGMENT, 2023 (%)

- FIGURE 46. GLAXOSMITHKLINE PLC.: REVENUE SHARE, BY REGION, 2023 (%)

- FIGURE 47. PEDIFIX INC.: NET SALES, 2021-2023 ($MILLION)

- FIGURE 48. PEDIFIX INC.: REVENUE SHARE, BY SEGMENT, 2023 (%)

- FIGURE 49. PEDIFIX INC.: REVENUE SHARE, BY REGION, 2023 (%)