PUBLISHER: Zhar Research | PRODUCT CODE: 1590947

PUBLISHER: Zhar Research | PRODUCT CODE: 1590947

Escape from Batteries Creates Large New Markets milliWh-GWh: Forecasts in 40 lines, Technology 2025-2045

Summary

Battery-free storage will quintuple to become a $250 billion business in 20 years. A new 493-page Zhar Research report has the detail. It is, "Escape from Batteries Creates Large New Markets milliWh-GWh: Forecasts in 40 lines, Technologies 2025-2045".

Pulse and high-power storage

There is growth in the traditional forms - supercapacitors, flywheel generators and pumped hydro. However, most of the growth comes from a host of new forms. Lithium-ion capacitors are now seen in electromagnetic weapons, thermonuclear reactors and mining vehicles. Tantalum hybrid capacitors further penetrate military aircraft applications such as pulsed radar. Massive grid storage is being built based on lifting blocks, underground pumped hydro, compressed air and liquid gas, heat pump thermal storage. With most batteries, to get GWh you just buy more, whereas all alternatives have great economy of scale, they are all non-flammable and they have little or no fade and self-leakage. They better meet the new need of wind and solar power being feeble for a month at a time.

How to manage with little or no storage

The report also covers the elimination of storage as seen in next solar desalination, some drones and some planned 6G Communications devices. Add the in-between option of battery-free sensors, building controls and IOT nodes with energy harvesting sold by Dracula, EnOcean, 8Power and others.

Do not make batteries your first choice

Electronics and electrical designers now first consider if they need batteries - from chip to power station - because the new battery-free options are often far better. This report is their essential reference, assessing hundreds of companies that can now supply and the remarkable new research advances through 2024. It answers questions such as:

- Gaps in the market?

- Emerging competition?

- Full list of technology options?

- 2024 research pipeline analysis?

- Technology sweet spots by parameter?

- Zhar Research appraisals by technology?

- Market forecasts by value and GWh 2025-2045?

- Technology readiness and potential improvement?

- Technology parameters compared against each other?

- Market drivers and forecasts of background parameters?

- Potential winners and losers by company and technology?

- Technologies compared by numbers GW, GWh, delay, duration, etc.?

- Appraisal of proponents, your prospective partners and acquisitions?

- Evolving market needs and technology milestones in roadmaps by year 2025-2045?

Report findings

The Executive Summary and Conclusions (39 pages) is the quick read, with many new infograms and 40 forecast lines with explanation. One image is "Lithium-ion capacitor LIC market positioning by energy density spectrum" showing images of applications over a range of energy density and cycle life. Another shows latest grid and off-grid storage projects - duration vs power - for six battery-free forms compared with battery versions.

Chapter 2. Introduction (7 pages) explains battery limitations, how lithium-ion battery fires are ongoing with many 2024 examples, electrification megatrends, battery adoption, battery elimination. See implications for storage 2025 - 2045: batteries will lose share yet remain the largest value market.

The rest of the report is extremely detailed, starting with a chapter on how to minimise or eliminate storage. Other chapters deep-dive into battery-free storage, - electrostatic, mechanical, thermal, chemical - spanning microWh to GWh, electronics to heavy engineering, pulse to one year of storage. See this formidable virtuosity increasing to replace many batteries and do what batteries can never achieve but realise there is inability impact some other battery applications.

The 63 pages of Chapter 3 concern "Systems that eliminate batteries: backscatter (EAS, RFID, 6G SWIPT), battery elimination circuits, self-powering ultra-low-power circuits and sensors, demand and supply management". Navigate the jargon such as Electronic Article Surveillance EAS , passive RFID, SWIPT, AmBC, CD-ZED for 6G Communications, V2G, V2H, V2V and vehicle charging directly from solar panels. 13 primary energy harvesting technologies are compared. See examples of battery-free desalinators, cameras, drones, IOT nodes and the significance of 25 research advances through 2024.

Chapter 4. "Electrostatic storage: Supercapacitors, pseudocapacitors, lithium-ion capacitors, other BSH" (119 pages) spans activities of 103 companies compared in ten columns, a flood of important research advances in 2024, and a very wide variety of applications emerging. That spans aerospace, electric vehicles: AGV, material handling, car, truck, bus, tram, train, grid, microgrid, peak shaving, renewable energy, uninterrupted power supplies, medical and wearables, data centers, welding, laser cannon, railgun, pulsed linear accelerator weapon, capacitor-supercapacitor hybrids in radar. All have growth ahead but battery-supercapacitor hybrids have the greatest potential 2025-2045.

In electricity generation, your solar house will continue to have a battery. At the other extreme, national and continental grids will suffer massive earthworks and massive delays to get the very lowest levelised cost of storage LCOS up to months. However, there is a very large intermediate requirement emerging from the strong trend to factories, towns and islands being off-grid or capable of being off grid using wind and solar power for around 100MW. They prefer no long delays or major earthworks. Capital cost and long life, low maintenance, small footprint matter here. New redox flow batteries serve well potentially up to one month storage but they have competition from the subject of Chapter 5. "Liquefied gas energy storage LGES: Liquid air LAES or CO2" (22 pages, 5 companies). See SWOT appraisals, parameter comparisons and a niche opportunity in grids as well.

Chapter 6. Compressed air CAES (59 pages) covers the main competitor for pumped hydro grid storage as batteries fail to keep up with ever more wind and solar power demanding ever longer storage duration. Appraise 13 participants, strong research advances and major orders in 2024. Agree with the US Department of Energy that CAES will have one of the lowest LCOS and a splendid lack of expensive or toxic materials?

Chapter 7. "Mechanical storage: Advanced pumped hydro APHES, solid gravity energy storage SGES, flywheels for electricity-to-electricity" (90 pages) delves into a flood of 2024 research, 12 companies, many options. It sees greatest potential in APHES, a large system pumping water into mines being significant in 2024, then SGES for mainstream grid requirements. Flywheels tend to lose out to supercapacitors and their variants for high power density and pulse applications.

Chapter 8. "Hydrogen and other chemical intermediary LDES" (55 pages) reports potentially a very large market extending up to seasonal storage because it could store 10GWh levels underground. However, with only one small minigrid being prepared with tank hydrogen, the scope for extreme arguments for and against is considerable. Of possible chemical intermediaries, only hydrogen has a chance, mostly in salt caverns, but leakage is considerable, causing global warming, and efficiency very poor. Some will be built. Then we shall know the parameters.

Chapter 9. "Thermal energy storage for delayed electricity ETES" reports heating rocks then making steam for turbine generation of electricity has been a failure but 2024 research and the activity of several companies has led to one major installation using heat pumps in thermal storage and there is a wild card of white heat reconverted using photovoltaics. Thermal may be a niche grid/ minigrid storage opportunity.

For those wishing to enjoy this $250 billion opportunity, the essential handbook is Zhar Research report, "Escape from Batteries Creates Large New Markets milliWh-GWh: Forecasts in 40 lines, Technologies 2025-2045".

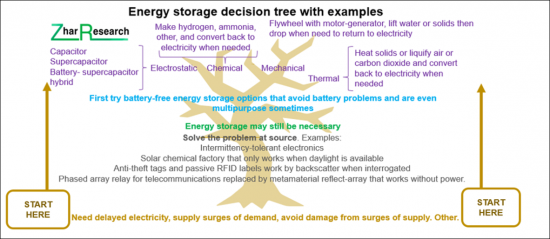

CAPTION: The energy storage decision tree with examples. Source, Zhar Research report, "Escape from Batteries Creates Large New Markets milliWh-GWh: Forecasts in 40 lines, Technologies 2025-2045".

Table of Contents

1. Executive summary and conclusions

- 1.1. Purpose and scope of this report

- 1.2. Methodology of this analysis

- 1.3. Battery current challenges and why alternatives are being adopted

- 1.3.1. General situation in electronics and electrical engineering

- 1.3.2. Battery challenges for 6G Communications and IoT and action arising 2025-2045

- 1.4. Battery-free options: eliminating storage or using alternative storage 2025-2045

- 1.5. Battery elimination options beyond drop-in replacement by battery-less storage devices

- 1.5.1. Electronics, telecommunication, electrical engineering

- 1.5.2. To the rescue: WPT, WIET, SWIPT evolution to 2045

- 1.5.3. Evolution of wireless electronic devices needing no on-board energy storage 1980-2045

- 1.5.4. SWOT appraisal of circuits and infrastructure that eliminate storage

- 1.6. Why batteries may only dominate the middle ground in 2045

- 1.7. Batteryless storage device toolkit 2025-2045

- 1.7.1. Options by size

- 1.7.2. Example: Lithium-ion capacitor LIC market positioning by energy density spectrum

- 1.7.3. Possible scenario: stationary storage batteries vs alternatives TWh cumulative 2025-2045

- 1.7.4. Example: Installed and committed stationary storage projects 2025 showing many battery and battery-less options competing

- 1.7.5. Long duration energy storage LDES toolkit for grids, microgrids, 6G base stations, data centers 2025-2045

- 1.7.6. SWOT appraisal of battery-less storage devices

- 1.8. System strategies to achieve less or no storage: combine and compromise

- 1.9. Market forecasts 2025-2045 in 40 lines

- 1.9.1. Energy storage device market battery vs batteryless $ billion 2025-2045

- 1.9.2. Possible scenario for leading storage technologies TWh cumulative 2025-2045

- 1.9.3. Supercapacitor EDLC, pseudocapacitor and battery-supercapacitor hybrid BSH $ billion 2025-2045

- 1.9.4. Total LDES value market percent in three size categories 2025-2045 table, graphs

- 1.9.5. Total LDES value market $billion X100 in three size categories 2025-2045

- 1.9.6. Total LDES value market $billionX100 by four regions 2025-2045

- 1.9.7. Regional share of LDES value market percent in four regions 2025-2045.

- 1.9.8. LDES market in 9 technology categories $ billion 2025-2045 table, graphs, explanation

- 1.9.9. LDES total value market showing beyond-grid gaining share 2025-2045

- 1.9.10. Total pumped hydro storage market including LDES $ billion 2023-2045

2. Introduction

- 2.1. Overview

- 2.2. Battery limitations

- 2.3. How lithium-ion battery fires are ongoing

- 2.4. Megatrends of electrification, battery adoption and battery elimination

- 2.5. Implications for storage 2025 - 2045

- 2.6. Duration vs power of many battery and batteryless stationary storage technologies deployed and deploying in 2025 showing future trends

- 2.7. How batteries will lose share 2025-2045

3. Systems that eliminate batteries: backscatter (EAS, RFID, 6G SWIPT), battery elimination circuits, self-powering ultra-low-power circuits and sensors, demand and supply management

- 3.1. Overview

- 3.1.1. Battery elimination options beyond drop-in replacement by battery-less storage devices

- 3.1.2. Strategies to achieve less or no storage

- 3.1.3. Enablers of self-powered, battery-free devices that can be combined

- 3.2. Backscatter with SWOT

- 3.2.1. Electronic Article Surveillance EAS , passive RFID and beyond

- 3.2.2. SWIPT AmBC and CD-ZED for 6G Communications and IOT

- 3.2.3. SWOT and 34 other advances in 2024, 2023

- 3.3. Circuit design to minimise batteries

- 3.3.1. Battery elimination circuits BEC in drones and electric cars

- 3.3.2. Intermittency tolerant electronics: BFree

- 3.4. Battery elimination by V2G, V2H, V2V and vehicle charging directly from solar panels

- 3.5. Demand management: storage-free solar desalinators in 2024

- 3.6. Source management: advances in 2024

- 3.7. Specification compromise eliminates batteries

- 3.7.1. Battery-free drones as sensors and IOT

- 3.7.2. Battery-free cameras

- 3.8. Energy harvesting eliminating batteries

- 3.8.1. Overview and 13 primary energy harvesting technologies compared

- 3.8.2. Elements of a harvesting system

- 3.8.3. Mechanical harvesting including acoustic in detail

- 3.8.4. Harvesting of electromagnetic energy in detail

- 3.8.5. Importance of flexible laminar energy harvesting 2025-2045

- 3.8.6. Advances in 2024

4. Electrostatic storage: Supercapacitors, pseudocapacitors, lithium-ion capacitors, other BSH

- 4.1. The place of capacitors and their variants

- 4.2. Spectrum of choice - capacitor to supercapacitor to battery

- 4.3. Research pipeline: pure supercapacitors

- 4.4. Research pipeline: hybrid approaches

- 4.5. Research pipeline: pseudocapacitors

- 4.6. Actual and potential major applications of supercapacitors and their derivatives

- 4.6.1. Overview

- 4.6.2. Aircraft and aerospace

- 4.6.3. Electric vehicles: AGV, material handling, car, truck, bus, tram, train

- 4.6.4. Grid, microgrid, peak shaving, renewable energy and uninterrupted power supplies

- 4.6.5. Medical and wearables

- 4.6.6. Military: Laser cannon, railgun, pulsed linear accelerator weapon, radar, trucks, other

- 4.6.7. Power and signal electronics, data centers

- 4.6.8. Welding

- 4.7 103 supercapacitor companies assessed in 10 columns

- 4.8. Lithium-ion capacitors and other battery-supercapacitor hybrid BSH storage

- 4.8.1. Definitions and choices

- 4.8.2. BSH market positioning and choices and LIC market positioning by energy density spectrum

- 4.8.3. Infograms: the most impactful market needs, comparative solutions, 13 conclusions

- 4.8.4. Research analysis and recommendations 2025-2045

- 4.8.5. Two SWOT appraisals and roadmap 2025-2045

5. Liquefied gas energy storage LGES: Liquid air LAES or CO2

- 5.1. Overview

- 5.2. Liquid air LAES LDES

- 5.2.1. Technology

- 5.2.2. Research advances in 2024

- 5.2.3. CGDG China

- 5.2.4. Highview Energy UK

- 5.2.5. Sumitomo SHI FW Japan and China

- 5.2.6. Phelas Germany

- 5.2.7. SWOT appraisal of LAES for LDES

- 5.2.8. Parameter comparison of LAES for LDES

- 5.3. Liquid carbon dioxide LDES

- 5.3.1. Research advances in 2024

- 5.3.2. Energy Dome Italy

- 5.3.3. SWOT appraisal of Liquid CO2 for LDES

6. Compressed air CAES

- 6.1. Overview

- 6.1.1. Basics

- 6.1.2. System design

- 6.1.3. Research advances in 2024

- 6.2. Undersupply attracts clones

- 6.3. Market positioning of CAES

- 6.4. Parameter appraisal of CAES vs LAES

- 6.5. CAES technology options

- 6.5.1. Thermodynamic

- 6.4.2. Isochoric or isobaric storage

- 6.4.3. Adiabatic choice of cooling

- 6.6. CAES manufacturers, projects, research

- 6.6.1. Overview

- 6.6.2. Siemens Energy Germany

- 6.6.3. MAN Energy Solutions Germany

- 6.6.4. Increasing the CAES storage time and discharge duration

- 6.6.5. Research in UK and European Union

- 6.7. CAES profiles and appraisal of system designers and suppliers

- 6.7.1. ALCAES Switzerland

- 6.7.2. APEX CAES USA

- 6.7.3. Augwind Energy Israel

- 6.7.4. Cheesecake Energy UK

- 6.7.5. Corre Energy Netherlands

- 6.7.6. Gaelectric failure Ireland - lessons

- 6.7.7. Huaneng Group China

- 6.7.8. Hydrostor Canada

- 6.7.9. LiGE Pty South Africa

- 6.7.10. Storelectric UK

- 6.7.11. Terrastor Energy Corporation USA

- 6.8. SWOT appraisal of CAES for LDES

7. Mechanical storage: Advanced pumped hydro APHES, solid gravity energy storage SGES, flywheels for electricity-to-electricity

- 7.1. Advanced pumped hydro APHES

- 7.1.1. Overview and SWOT appraisal

- 7.1.2. Research advances in 2024

- 7.1.3. Pressurised underground: Quidnet Energy USA

- 7.1.4. Mine storage in USA (EDF) and Sweden (Mine Storage Co.)

- 7.1.5. Heavy liquid up mere hills RheEnergise UK

- 7.1.6. S-PHES from the sea to land and using sea dams:

- 7.1.7. Research advances in 2024

- 7.1.8. Sea floor StEnSea Germany, Ocean Grazer Netherlands compared with other underwater LDES

- 7.1.9. SWOT appraisal of underwater energy storage for LDES

- 7.1.10. Brine in salt caverns Cavern Energy USA

- 7.1.11. Conventional pumped hydro: Research advances in 2024, parameter appraisal, SWOT

- 7.2. Solid gravity energy storage SGES

- 7.2.1. Overview

- 7.2.2. Parameter appraisal of SGES for LDES

- 7.2.3. Energy Vault Switzerland

- 7.2.4. SWOT appraisal of SGES for LDES

- 7.3. Flywheels for electricity-to-electricity

- 7.3.1. Overview

- 7.3.2. Amber Kinetics USA

- 7.3.3. Beacon Power USA

- 7.3.4. Torus USA

8. Hydrogen and other chemical intermediary LDES

- 8.1. Overview

- 8.1.1. Hydrogen past and present: successes and failures

- 8.1.2. The proposal of a hydrogen economy: 2024 research advances

- 8.1.3. The UK as an example of contention

- 8.1.4. Wide spread of parameters means interpretation should be cautious

- 8.1.5. How hydrogen is both partner and alternative to electrification

- 8.2. Sweet spot for chemical intermediary LDES

- 8.3 53 research advances reported in 2025 (pre-publication) and 2024

- 8.3.1. Introduction

- 8.3.2. New research on salt caverns, subsea and other options for large scale hydrogen storage

- 8.3.3. New research on complex mechanisms for hydrogen loss

- 8.3.4. New research on hydrogen leakage causing global warming

- 8.3.5. New research on combining grid hydrogen storage with other storage: hybrid systems

- 8.4. Hydrogen compared to methane and ammonia for LDES

- 8.5. Hydrogen LDES leader: Calistoga Resiliency Centre USA 48-hour hydrogen LDES

- 8.6. Calculations finding that hydrogen will win for longest term LDES

- 8.7. Mining giants prudently progress many options

- 8.8. Buildings and other small locations

- 8.9. Technologies for hydrogen storage

- 8.9.1. Overview

- 8.9.2. Choices of underground storage for LDES hydrogen

- 8.9.3. Hydrogen interconnectors for electrical energy transmission and storage

- 8.10. Parameter appraisal of hydrogen storage for LDES

- 8.11. SWOT appraisal of hydrogen, methane, ammonia for LDES

9. Thermal energy storage for delayed electricity ETES

- 9.1. Overview

- 9.2. Research advances in 2024

- 9.3. The heat engine approach succeeds: Echogen USA

- 9.4. Use of extreme temperatures and photovoltaic conversion

- 9.4.1. Antora USA

- 9.4.2. Fourth Power USA

- 9.5. Marketing delayed heat and electricity from one plant

- 9.5.1. Overview

- 9.5.2. MGA Thermal Australia

- 9.5.3. Malta Inc Germany

- 9.6. SWOT appraisal of ETES for LDES

- 9.7. Parameter appraisal of electric thermal energy storage ETES