PUBLISHER: VDC Research Group, Inc. | PRODUCT CODE: 1661291

PUBLISHER: VDC Research Group, Inc. | PRODUCT CODE: 1661291

IoT, Embedded & Mobile Processors: Core to Enabling Widespread Innovation

Inside this Report

Processors are the bedrock of computing innovation and have been the leading force behind rapid advances in edge AI, workload optimization, and operational system capabilities. This report analyzes the global market for merchant microprocessor units/central processing units (MPUs/CPUs), microcontrollers (MCUs), field- programmable gate arrays (FPGAs), and system-on-chips (SoCs) used in IoT, embedded and mobile systems. In addition to extensive market sizing, segmentations, and forecasting, this research also investigates the current requirements, preferences, dependencies, and areas of investment for hardware engineers, software developers, and others at OEMs, integrators, and other engineering organizations.

Report Excerpt

What Questions are Addressed?

- How is insatiable demand for hardware acceleration shaping the market opportunities for different processor types, architectures, and footprints?

- Which industry segments are expected to grow the fastest in the embedded processor market through 2028?

- Who are the leading suppliers of embedded MPUs/CPUs, MCUs, DSPs, FPGAs, SoCs and Mobile SoCs?

- How have leading embedded processor suppliers evolved their product portfolios, software development environments/platforms, and services to align with market needs?

- What does the current architectural landscape look like among processor suppliers?

- Where is the largest growth opportunity for different embedded processor types?

- What do different communities of embedded engineers and developers working at organizations of various sizes and origins expect of embedded processor suppliers?

Key Findings

- The global market for IoT, embedded and mobile processors has flourished over recent years and, despite a turbulent 2024, is expected to regain a steady growth trajectory through 2028.

- With supply and component shortages now largely overcome, some leading suppliers are now contending with large fluctuations in oversupply of existing SKUs and product inventory against current demand in some industries.

- The rapid advancement of AI and machine learning still has significant runway remaining within the embedded processor market for new design wins and retrofits/updates.

- Geopolitical issues are hampering some embedded processor technology access across borders but are also fueling dramatic R&D investments across several leading countries in the market.

- Distributors/resellers and embedded motherboard, modules, and integrated system/server vendors are critical channels to market for aligning with the evolving preferences of processor end users.

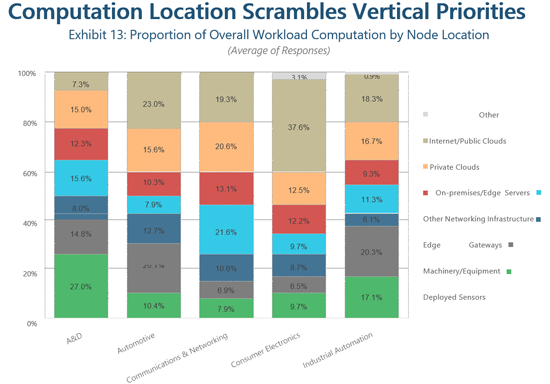

- VDC's survey of embedded engineers and developers found that the amount of computation taking place at the far edge (i.e., endpoint sensors, machinery/equipment) is considerably higher for organizations in A&D, automotive, and industrial automation than others, which have more processing taking place in edge gateways and near-edge infrastructure.

Who Should Read this Report?

This report was written for those making critical decisions regarding product, market, channel, and competitive strategy and tactics. This report is intended for senior decision-makers who are developing embedded solutions, including:

|

|

Table of Contents

Inside this Report

What Questions are Addressed?

Who Should Read this Report?

Technology Suppliers in this Report

Demand-side Research Overview

Executive Summary

- Key Findings

Global Market Overview

- Go-to-market Strategies Must be Multifaceted

- Edge AI is Reaching Mass Market Potential

- Neural Processing Takes Off

- The Generative AI Processor Market is Beginning to Stir

- Chiplets are Still on the Horizon for Embedded

- Recent Developments

- Mergers and Acquisitions

Regional Analysis

- Americas

- Europe, Middle East, and Africa

- Asia-Pacific

- RISC-V Adoption Accelerates Amidst the Escalating Chip War

Vertical Markets

- Automotive

- Aerospace & Defense

- Communications & Networking

- Industrial Automation

- Mobile Devices

- Emerging Verticals

Role of CPU Architectures

- ARM

- Intel Architecture/x86

- RISC-V

- Others

Competitive Landscape & Profiles

- AMD

- Arm

- Infineon Technologies

- Intel

- MediaTek

- Microchip Technology

- NXP Semiconductors

- Qualcomm

- Renesas

- STMicroelectronics

End-user Insights

- Hardware Innovation and Software Development Support Boost Vendor Ratings

- Computation Location Scrambles Vertical Priorities

- Processor Selection Criteria Extends Beyond Price

- Software Stacks Vary Based on Processor Type and End Application

About the Authors

About VDC Research

List of Report Exhibits

- Exhibit 1: Global Shipments of Embedded Processors Segmented by Processor Type, 2023-2028 (Billions of Dollars)

- Exhibit 2: Global Shipments of Embedded Processors Segmented by Processor Type, 2024 & 2028 (Unit Shipments)

- Exhibit 3: Global Shipments of Embedded Processors Segmented by Region, 2024 (Percentage of Revenue)

- Exhibit 4: Global Shipments of Embedded MPUs/CPUs Segmented by Vertical Market (US$ in Billions, Percentage of Revenue)

- Exhibit 5: Global Shipments of Embedded MCUs Segmented by Vertical Market (US$ in Billions, Percentage of Revenue)

- Exhibit 6: Global Shipments of Embedded FPGAs Segmented by Vertical Market (US$ in Billions, Percentage of Revenue)

- Exhibit 7: Global Shipments of Embedded SoCs Segmented by Vertical Market (US$ in Billions, Percentage of Revenue)

- Exhibit 8: Global Shipments of Embedded MSoCs Segmented by Vertical Market (US$ in Billions, Percentage of Revenue)

- Exhibit 9: Current Architectural Support Among Leading Embedded Processor Suppliers

- Exhibit 10: Global Shipments of Embedded Processors Segmented by CPU Architecture, 2024 (Percentage of Unit Shipments) Exhibit 11 Leading Embedded Processor Vendor Shares Segmented by Processor Type, 2024 (Percentage of Revenue)

- Exhibit 12: Rating of Experience with Embedded Processor Suppliers (Average of Responses) Exhibit 13 Amount of Overall Computation Being Done by Location (Average of Responses)

- Exhibit 14: Most Important Characteristics When Choosing an Embedded Processor (Percentage of Respondents) Exhibit 15 Embedded Software Stack Components Required on Current Project (Percentage of Respondents)

List of Market Data Exhibits

Embedded MPU/CPU

- Exhibit 1: Total Embedded MPU/CPU Market, Dollar Volume & Unit Shipments, 2023-2028

- Exhibit 2: Embedded MPU/CPU Market Segmented by Vertical, Dollar Volume Shipments, 2023-2028

- Exhibit 3: Embedded MPU/CPU Market Segmented by Vertical, Unit Shipments, 2023-2028

- Exhibit 4: Embedded MPU/CPU Market Segmented by Geographic Region, Dollar Volume Shipments, 2023-2028

- Exhibit 5: Embedded MPU/CPU Market Segmented by Geographic Region, Unit Shipments, 2023-2028

- Exhibit 6: Embedded MPU/CPU Market Segmented by Distribution Channel, Dollar Volume Shipments, 2023-2028

- Exhibit 7: Embedded MPU/CPU Market Segmented by Distribution Channel, Unit Shipments, 2023-2028

- Exhibit 8: Embedded MPU/CPU Market Segmented by Bit Count, Dollar Volume Shipments, 2023-2028

- Exhibit 9: Embedded MPU/CPU Market Segmented by Bit Count, Unit Shipments, 2023-2028

- Exhibit 10: Embedded MPU/CPU Market Segmented by Core Count, Dollar Volume Shipments, 2023-2028

- Exhibit 11: Embedded MPU/CPU Market Segmented by Core Count, Unit Shipments, 2023-2028

- Exhibit 12: Embedded MPU/CPU Market Segmented by Core Architecture, Dollar Volume Shipments, 2023-2028

- Exhibit 13: Embedded MPU/CPU Market Segmented by Core Architecture, Unit Shipments, 2023-2028

- Exhibit 14: Embedded MPU/CPU Market, Vendor Shares, Dollar Volume Shipments, 2023

Embedded MCU

- Exhibit 1: Total Embedded MCU Market, Dollar Volume & Unit Shipments, 2023-2028

- Exhibit 2: Embedded MCU Market Segmented by Vertical, Dollar Volume Shipments, 2023-2028

- Exhibit 3: Embedded MCU Market Segmented by Vertical, Unit Shipments, 2023-2028

- Exhibit 4: Embedded MCU Market Segmented by Geographic Region, Dollar Volume Shipments, 2023-2028

- Exhibit 5: Embedded MCU Market Segmented by Geographic Region, Unit Shipments, 2023-2028

- Exhibit 6: Embedded MCU Market Segmented by Distribution Channel, Dollar Volume Shipments, 2023-2028

- Exhibit 7: Embedded MCU Market Segmented by Distribution Channel, Unit Shipments, 2023-2028

- Exhibit 8: Embedded MCU Market Segmented by Bit Count, Dollar Volume Shipments, 2023-2028

- Exhibit 9: Embedded MCU Market Segmented by Bit Count, Unit Shipments, 2023-2028

- Exhibit 10: Embedded MCU Market Segmented by Core Count, Dollar Volume Shipments, 2023-2028

- Exhibit 11: Embedded MCU Market Segmented by Core Count, Unit Shipments, 2023-2028

- Exhibit 12: Embedded MCU Market Segmented by CPU Architecture, Dollar Volume Shipments, 2023-2028

- Exhibit 13: Embedded MCU Market Segmented by CPU Architecture, Unit Shipments, 2023-2028

- Exhibit 14: Embedded MCU Market, Vendor Shares, Dollar Volume Shipments, 2023

Embedded FPGA

- Exhibit 1: Total Embedded FPGA Market, Dollar Volume & Unit Shipments, 2023-2028

- Exhibit 2: Embedded FPGA Market Segmented by Vertical, Dollar Volume Shipments, 2023-2028

- Exhibit 3: Embedded FPGA Market Segmented by Vertical, Unit Shipments, 2023-2028

- Exhibit 4: Embedded FPGA Market Segmented by Geographic Region, Dollar Volume Shipments, 2023-2028

- Exhibit 5: Embedded FPGA Market Segmented by Geographic Region, Unit Shipments, 2023-2028

- Exhibit 6: Embedded FPGA Market Segmented by Distribution Channel, Dollar Volume Shipments, 2023-2028

- Exhibit 7: Embedded FPGA Market Segmented by Distribution Channel, Unit Shipments, 2023-2028

- Exhibit 8: Embedded FPGA Market, Vendor Shares, Dollar Volume Shipments, 2023

Embedded System-on-Chip

- Exhibit 1: Total Embedded System-on-Chip Market, Dollar Volume & Unit Shipments, 2023-2028

- Exhibit 2: Embedded System-on-Chip Market Segmented by Vertical, Dollar Volume Shipments, 2023-2028

- Exhibit 3: Embedded System-on-Chip Market Segmented by Vertical, Unit Shipments, 2023-2028

- Exhibit 4: Embedded System-on-Chip Market Segmented by Geographic Region, Dollar Volume Shipments, 2023-2028

- Exhibit 5: Embedded System-on-Chip Market Segmented by Geographic Region, Unit Shipments, 2023-2028

- Exhibit 6: Embedded System-on-Chip Market Segmented by Distribution Channel, Dollar Volume Shipments, 2023-2028

- Exhibit 7: Embedded System-on-Chip Market Segmented by Distribution Channel, Unit Shipments, 2023-2028

- Exhibit 8: Embedded System-on-Chip Market Segmented by Bit Count, Dollar Volume Shipments, 2023-2028

- Exhibit 9: Embedded System-on-Chip Market Segmented by Bit Count, Unit Shipments, 2023-2028

- Exhibit 10: Embedded System-on-Chip Market Segmented by Core Count, Dollar Volume Shipments, 2023-2028

- Exhibit 11: Embedded System-on-Chip Market Segmented by Core Count, Unit Shipments, 2023-2028

- Exhibit 12: Embedded System-on-Chip Market Segmented by CPU Architecture, Dollar Volume Shipments, 2023-2028

- Exhibit 13: Embedded System-on-Chip Market Segmented by CPU Architecture, Unit Shipments, 2023-2028

- Exhibit 14: Embedded System-on-Chip Market, Vendor Shares, Dollar Volume Shipments, 2023

Embedded Mobile System-on-Chip

- Exhibit 1: Total Embedded Mobile System-on-Chip Market, Dollar Volume & Unit Shipments, 2023-2028

- Exhibit 2: Embedded Mobile System-on-Chip Market Segmented by Vertical, Dollar Volume Shipments, 2023-2028

- Exhibit 3: Embedded Mobile System-on-Chip Market Segmented by Vertical, Unit Shipments, 2023-2028

- Exhibit 4: Embedded Mobile System-on-Chip Market Segmented by Region, Dollar Volume Shipments, 2023-2028

- Exhibit 5: Embedded Mobile System-on-Chip Market Segmented by Region, Unit Shipments, 2023-2028

- Exhibit 6: Embedded Mobile System-on-Chip Market Segmented by Channel, Dollar Volume Shipments, 2023-2028

- Exhibit 7: Embedded Mobile System-on-Chip Market Segmented by Channel, Unit Shipments, 2023-2028

- Exhibit 8: Embedded Mobile System-on-Chip Market Segmented by Bit Count, Dollar Volume Shipments, 2023-2028

- Exhibit 9: Embedded Mobile System-on-Chip Market Segmented by Bit Count, Unit Shipments, 2023-2028

- Exhibit 10: Embedded Mobile System-on-Chip Market Segmented by Core Count, Dollar Volume Shipments, 2023-2028

- Exhibit 11: Embedded Mobile System-on-Chip Market Segmented by Core Count, Unit Shipments, 2023-2028

- Exhibit 12: Embedded Mobile System-on-Chip Market Segmented by CPU Architecture, Dollar Volume Shipments, 2023-2028

- Exhibit 13: Embedded Mobile System-on-Chip Market Segmented by CPU Architecture, Unit Shipments, 2023-2028

- Exhibit 14: Embedded Mobile System-on-Chip Market, Vendor Shares, Dollar Volume Shipments, 2023

IoT & Embedded Engineering Survey

- Exhibit 1: Primary Role Within Company/Organization

- Exhibit 2: Respondent's Organization's Primary Industry

- Exhibit 3: Total Number of Employees at Respondent's Organization

- Exhibit 4: Primary Region of Residence

- Exhibit 5: Primary Country of Residence