PUBLISHER: VDC Research Group, Inc. | PRODUCT CODE: 1627224

PUBLISHER: VDC Research Group, Inc. | PRODUCT CODE: 1627224

Edge AI Development Solutions: Navigating the Edge of Innovation

Inside this Report

AI has transformed the global economy. Organizations in every industry are racing to find an AI-powered competitive edge. As a result, the commercial market for edge AI development tools has grown significantly. Edge AI applications often run in resource-constrained environments, creating unique challenges for AI engineers. Edge AI development solutions are needed to enable engineers to select, develop, and optimize models for their specific hardware, use case, and environmental needs. Due to innate challenges with AI/ML development related to model creation and optimization, many solution providers offer extensive professional services to help customers launch projects and comply with evolving regulations.

INFOGRAPHICS

This report includes an in-depth analysis of the leading tools, trends, and strategic considerations relevant to the market for edge AI development solutions. It includes market sizing and forecasts from 2023 to 2028 with commentary and segmentations by product type (solution or service), region (Americas, EMEA, APAC), vertical market, and leading vendors. Qualitatively, the report includes coverage of the impact of relevant mergers and acquisitions, an analysis of regulations by country, and profiles of leading vendors. Additionally, this report includes end-user insights from VDC's 2024 Voice of the Engineer survey.

What Questions are Addressed?

- What factors are driving demand for edge AI development solutions?

- How can solution providers capitalize on current trends to drive business?

- Which geographic regions present the best opportunity for growth?

- When do market-changing regulations take effect?

- Why are traditional AI development platforms unable to meet the needs of engineers developing AI for the edge?

- Which companies are driving product innovation and influencing the market?

Who Should Read this Report?

This report was written for those making critical decisions regarding product, marketing, channel, and competitive strategy and tactics. This report is intended for senior decision-makers who are developing embedded and edge AI solutions, including:

|

|

Key Findings:

- Professional services have become a significant part of the commercial edge AI development solutions market today helping mitigate challenges related to project launch, model development, and regulatory compliance.

- Industrial Automation was the largest vertical market in 2023 and will continue to grow at a double- digit CAGR through 2028 as computer vision and predictive maintenance technology evolve.

- PyTorch adoption is outpacing other deep learning frameworks for embedded and edge AI software.

- The Americas is the largest region for edge AI development solutions due to its favorable regulatory climate, size, and strong automotive segment. However, the rapid adoption of AI for industrial use cases and public investment in AI within the APAC presents significant opportunities as well.

- AI/ML engineers identified improving performance as the greatest AI development challenge.

Organizations Listed in this Report:

|

|

Table of Contents

Inside this Report

What Questions are Addressed?

Who Should Read this Report?

Organizations Listed in this Report

Executive Summary

- Key Findings

- AI Overview

Global Market Overview

- Professional Services

- Freeware as a Form of Hardware Enablement

- Recent Developments

- Mergers and Acquisitions

- Regulations

- European Union

- United States

- China

- Japan

- United Kingdom

- International Guidelines

Comparative Forecasts by Region

- Americas

- Europe, Middle East, and Africa

- Asia-Pacific

Comparative Forecasts by Vertical Market

- A&D

- Automotive

- Communications and Networking

- Energy, Resource, and Utilities

- Industrial Automation

- Retail Automation

- Transport Logistics/Smart City

Competitive Landscape

End-user Insights

About the Authors

About VDC Research

List of Exhibits

- Exhibit 1: Global Revenue of Edge AI Tools & Related Services, Segmented by Product Type

- Exhibit 2: Percentage of Global Revenue from Edge AI Tools & Professional Services

- Exhibit 3: Global Revenue of Edge AI Development Tools & Related Services, Segmented by Geographic Region

- Exhibit 4: Percentage of Global Revenue from Edge AI Development Tools & Related Services, Segmented by Geographic Region

- Exhibit 5: Global Revenue of Edge AI Development Tools & Related Services, Segmented by Vertical Market

- Exhibit 6: Percentage of Global Revenue from Edge AI Development Tools & Related Services, Segmented by Vertical Market

- Exhibit 7: Global Revenue of Edge AI Development Tools & Related Services, Segmented by Leading Vendors

- Exhibit 8: Frameworks and Tools Used for Training AI Models

- Exhibit 9: Greatest Challenges in Developing AI Software

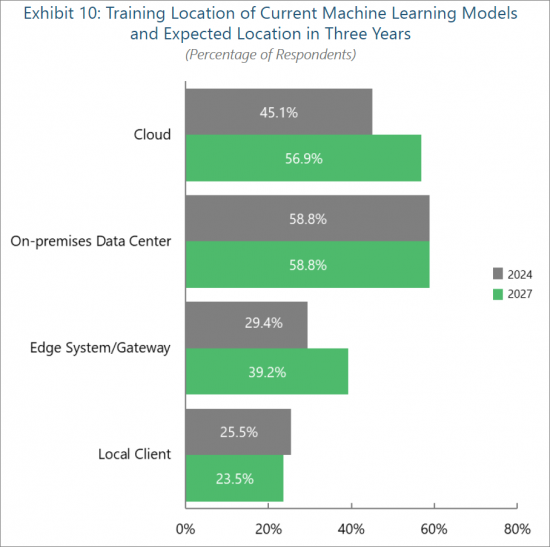

- Exhibit 10 Training Location of Current Machine Learning Models and Expected Location in Three Years

IoT & Embedded Engineering Survey

- Exhibit 1: Primary Role Within Company/Organization

- Exhibit 2: Respondent's Organization's Primary Industry

- Exhibit 3: Total Number of Employees at Respondent's Organization

- Exhibit 4: Primary Region of Residence

- Exhibit 5: Primary Country of Residence

- Exhibit 6: Type of Most Current or Recent Project

- Exhibit 7: Involvement with Engineering of Embedded/Edge, Enterprise/IT, HPC, AI/ML, or Mobile/System Device or Solution

- Exhibit 8: Type of Purchase by Respondent's Organization

- Exhibit 9: Primary Industry Classification of Project

- Exhibit 10 Type of Aerospace & Defense Application for Most Recent Project

- Exhibit 11 Type of Automotive In-Vehicle Application for Most Recent Project

- Exhibit 12 Type of Communications & Networking Application for Most Recent Project

- Exhibit 13 Type of Consumer Electronics Application for Most Recent Project

- Exhibit 14 Type of Digital Security Application for Most Recent Project

- Exhibit 15 Type of Digital Signage Application for Most Recent Project

- Exhibit 16 Type of Energy and Utilities Application for Most Recent Project

- Exhibit 17 Type of Gaming Application for Most Recent Project

- Exhibit 18 Type of Industrial Automation Application for Most Recent Project

- Exhibit 19 Type of Media & Broadcasting Application for Most Recent Project

- Exhibit 20 Type of Medical Device Application for Most Current Project

- Exhibit 21 Type of Mobile Phone

- Exhibit 22 Type of Office/Business Automation Application for Most Recent Project

- Exhibit 23 Type of Transportation Application for Most Recent Project

- Exhibit 24 Type of Retail Automation Application for Most Recent Project

- Exhibit 25 Type of Non-Manufacturing/Services Application for Most Recent Project

- Exhibit 26 Certification/Approval Standards Required for Current Project

- Exhibit 27 Highest Design/Development Assurance Levels (DAL) Required for Project Software (Aerospace)

- Exhibit 28 Highest Software Integrity Levels (SIL) Certification Required for Project Software

- Exhibit 29 Highest Automotive Software Integrity Levels Required for Project Software

- Exhibit 30 Capabilities/Features of Current Project

- Exhibit 36 Consideration of Key Trends: Bill-of-Material/Sub-System Consolidation

For the full list of the 416 IoT & Embedded Technology Voice of the Engineer Survey Exhibits available with this report.