PUBLISHER: VDC Research Group, Inc. | PRODUCT CODE: 1596786

PUBLISHER: VDC Research Group, Inc. | PRODUCT CODE: 1596786

Voice of the IoT Engineer: Dataset & Analysis

Inside this Report:

VDC Research designs, programs, and collects data from many web-based surveys launched every year to its extensive panel of embedded and enterprise technology decision makers, developers, engineers, and end users. The Voice of the loT Engineer report highlights key findings and takeaways from its most recent survey, which completed data collection in Q3 2024. Topics covered within this report include hardware sourcing, embedded software stacks, development tools, cybersecurity requirements, connectivity needs, edge AI adoption, vendor preferences, and others. The analysis and written discussion of survey findings cover segmentations spread across a variety of factors. The report is accompanied by an Excel file containing the full set of survey exhibits with associated cross-tabulations across major demographic and behavioral characteristics.

INFOGRAPHICS

What Questions are Addressed?

- What is most important to organizations of different sizes when considering new suppliers for embedded, edge, and loT computing hardware?

- Which types of embedded hardware offerings are needed most by engineering organizations from different industries to support their integration and development needs?

- Which emerging technologies and maturing practices are leading to shifts in the commercial market for software development tools?

- Which capabilities and functionalities of software development solutions are deciding demand factors for end users?

- What are the most important product selection criteria for software development tools for static analysis, dynamic test, requirements management, virtual prototyping, and others?

- As security becomes a primary concern across loT/embedded systems, how can engineers better protect their projects? How can commercial suppliers aid these efforts?

- How will vendors adapt to the virtualization of hardware, including ECUs and silicon?

Who Should Read this Report?

This report was written for those making critical decisions regarding product, market, channel, and competitive strategy and tactics. This report is intended for senior decision-makers who are developing loT, embedded and edge computing technology, including:

|

|

Table of Contents

Inside this Report

What questions are Addressed?,

Who Should Read this Report?

Executive Summary

- Key Findings

Survey Demographics & Overview

Hardware Trends

- System & Component Needs Vary by Industry

- Organization Size Dictates Specific Needs from Embedded & Edge Hardware Providers

- Edge Systems Becoming More Hardened

- OT Servers Demand High-End Security Capabilities

Software & Tool trend:

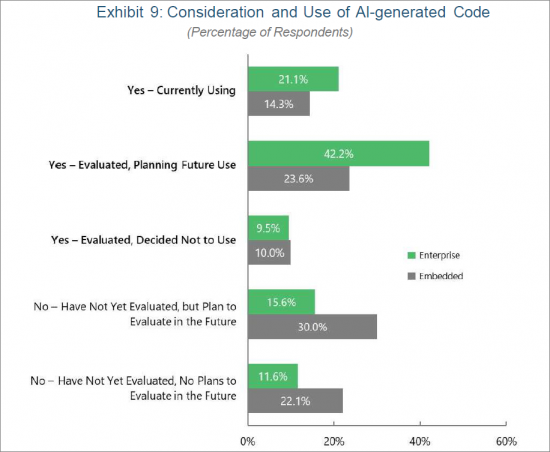

- AI-Generated Code Use Expected to Grow Rapidly

- Open Source Frameworks & Tools Lead AI Model Training

- Security, Language Support & Ease of Use are Key Factors in Static Analysis Selection

- Shifting Software Sources Necessitate Dynamic Approach from SCA Vendors

- Key Decision Characteristics for Selecting Virtual Prototyping Solutions

- Experienced Use of Generative AI among MBSE Users

- Increasing adoption of Cloud-Native Development

- The Importance of Requirements Management Solution Integration

- Addressing Impacts on Time-to-Market by Requirements Management Solutions

- Rising Utilization of Open Source Operating Systems

- Security and Reliability Remain Key Drivers of Purchasing Decision

- Increasing Demand for Real-Time Capabilities

OT Cybersecurity Trends

- Product Developers Acknowledge Importance of Cybersecurity

- OEMs Increasing Efforts to Discover Vulnerabilities

Virtual ECU Development

- The Transition to SDVs is Building Virtual ECU Consideration

- Reducing Time to Market Drives Virtual ECU Adoption

- Virtual Prototyping Driven by E/E System Software Tasks

Appendix: Market Definitions

About the Authors

About VDC Research

List of Report Exhibits

- Exhibit 1: Type of Organization Employing Respondent & Respondent's Primary Role

- Exhibit 2: Respondent's Region of Residence

- Exhibit 3: Respondent's Industry/Vertical Market

- Exhibit 4: Types of Hardware Purchases Mades by Respondent Organizations

- Exhibit 5: Most Important Selection Criteria When Considering Suppliers for Embedded and Edge Hardware Components, Systems, and/or Entire Solutions

- Exhibit 6: Rugged Form Factor Requirements for Current Edge Gateway & OT Server Projects & Expected for Similar Projects Three Years from Now

- Exhibit 7: Factors Driving OT Server Users/Developers to Adopt Virtualization/Hypervisor and Container Technology

- Exhibit 8: Actions OT Server Users/Developers Have Taken in Response to Security Requirements

- Exhibit 9: Consideration and Use of AI-generated Code

- Exhibit 10: Frameworks and Tools Used for Training AI Models

- Exhibit 11: Most Important Factors in Selection of Static Analysis Tool

- Exhibit 12: Most Important Factors in Selection of Dynamic Testing Tools

- Exhibit 13: Origin of Code by Industry, 2022 to 2024

- Exhibit 14: Most Important Characteristics When Selecting Virtual Prototyping Solution

- Exhibit 15: Consideration/Use of AI-generated Software/Code, by Software/System Modeling Tool Use

- Exhibit 16: Plans to Use Cloud-based Solutions to Develop Software, by Software/System Modeling Tool Use

- Exhibit 17: Tools Being Used in the Cloud

- Exhibit 18: Most Important Factors in Selection of Requirements Management/Definition Tools Being Used in Current Project, by Company Size

- Exhibit 19: Attributions of Delays to Project

- Exhibit 20: Primary Operating System Used on Current Project

- Exhibit 21: Primary Operating System Expected to be Used in Three Years

- Exhibit 22: Most Important Characteristics When Selecting the Primary Embedded Operating System for Current Project

- Exhibit 23: Capabilities/Features of Current Project

- Exhibit 24: Type of Real-Time Capabilities for Current Project

- Exhibit 25: Actions Respondent's Organization Has Taken in Response to Security Requirements

- Exhibit 26: Types of Embedded Security Software Included in Current/Most Recent Project

- Exhibit 27: Types of Embedded Security Hardware Included in Current/Most Recent Project

- Exhibit 28: External Exposure of Vulnerabilities/Security Failures

- Exhibit 29: Availability of Programs to Facilitate Reporting of Security Vulnerabilities Discovered by External Security Researchers (e.g., Bug Bounty)

- Exhibit 30: Current Use or Consideration of Virtual ECUs

- Exhibit 31: Biggest Perceived Advantages/Benefits of a Virtual ECU

- Exhibit 32: Type of Tasks in Which Virtual Prototyping Solutions are Used

loT & Embedded Engineering Survey *(Partial list)

- Exhibit 1: Primary Role Within Company/Organization

- Exhibit 2: Respondent's Organization's Primary Industry

- Exhibit 3: Total Number of Employees at Respondent's Organization

- Exhibit 4: Primary Region of Residence

- Exhibit 5: Primary Country of Residence

- Exhibit 6: Type of Most Current or Recent Project

- Exhibit 7: Involvement with Engineering of Embedded/Edge, Enterprise/IT, HPC, AI/ML, or Mobile/System Device or Solution

- Exhibit 8: Type of Purchase by Respondent's Organization

- Exhibit 9: Primary Industry Classification of Project

- Exhibit 10: Type of Aerospace & Defense Application for Most Recent Project

- Exhibit 11: Type of Automotive In-Vehicle Application for Most Recent Project

- Exhibit 12: Type of Communications & Networking Application for Most Recent Project

- Exhibit 13: Type of Consumer Electronics Application for Most Recent Project

- Exhibit 14: Type of Digital Security Application for Most Recent Project

- Exhibit 15: Type of Digital Signage Application for Most Recent Project

- Exhibit 16: Type of Energy and Utilities Application for Most Recent Project

- Exhibit 17: Type of Gaming Application for Most Recent Project

- Exhibit 18: Type of Industrial Automation Application for Most Recent Project

- Exhibit 19: Type of Media & Broadcasting Application for Most Recent Project

- Exhibit 20: Type of Medical Device Application for Most Current Project

- Exhibit 21: Type of Mobile Phone

- Exhibit 22: Type of Office/Business Automation Application for Most Recent Project

- Exhibit 23: Type of Transportation Application for Most Recent Project

- Exhibit 24: Type of Retail Automation Application for Most Recent Project

- Exhibit 25: Type of Non-Manufacturing/Services Application for Most Recent Project

- Exhibit 26: Certification/Approval Standards Required for Current Project

- Exhibit 27: Highest Design/Development Assurance Levels (DAL) Required for Project Software (Aerospace)

- Exhibit 28: Highest Software Integrity Levels (SIL) Certification Required for Project Software

- Exhibit 29: Highest Automotive Software Integrity Levels Required for Project Software

- Exhibit 30: Capabilities/Features of Current Project

- Exhibit 31: Capabilities/Features Expected in a Project Three Years From Now

- Exhibit 32: Type of Real-Time Deadlines for Current Project

- Exhibit 33: Application's Shortest Response Deadline to a Time-Critical Input or Event

- Exhibit 34: Consideration of Key Trends: Electrification of Combustion Fuel Sources

- Exhibit 35: Consideration of Key Trends: Software-defined Functionality

- Exhibit 36: Consideration of Key Trends: Bill-of-Material/Sub-System Consolidation

- Exhibit 37: Estimated Length for Current Project (In Months)

- Exhibit 38: Current Project's Schedule Adherence

- Exhibit 39: Estimated Number of Years Current Project will be Manufactured Once Complete

- Exhibit 40: Estimated Number of Years of Useful Life for Product Once Deployed

- Exhibit 41: Attributions of Delays to Project

- Exhibit 42: Engineering Tasks Personally Involved

- Exhibit 43: Estimated Percent of Time Spent on Engineering Tasks

- Exhibit 44: Estimated Number of Full-Time Staff on Current Project

- Exhibit 45: Engineering and Development Work Outsourced to Third-Party Engineering Services

- Exhibit 46: Percent of Entire Engineering/Development Effort in Each Task that was Outsourced for Current Project

- Exhibit 47: Estimate of Number of Full-Time Engineers or Developers Employed by Organization

- Exhibit 48: Estimated Percent of Organization's Full-Time Engineers/Developers Working in Specific Roles

- Exhibit 49: Estimated Total Cost of Development for Current Project

- Exhibit 50: Estimated Bill of Materials for Current Project

- Exhibit 51: Estimated Units to be Shipped Per Year of Current Project

- Exhibit 52: Estimated Percent of Engineering Tasks/Domains Development Costs Spent on Specific Tasks

- Exhibit 53: Estimated Percent of Engineering Tasks/Domains Development Costs Expected to be Spent on Specific Tasks for a Similar Project Three Years From Now

- Exhibit 54: Estimate of Fully-Loaded Labor Costs for a Typical Engineer Involved with IT/Enterprise/Embedded Systems

- Exhibit 55: Estimation of Number of Defects Reported by Customer Per Year for Most Current Project

- Exhibit 56: Estimation of Number Software Patches Required by Customer Per Year for Most Current Project

- Exhibit 57: Estimated Total Combined Man-Hours of IT and Engineering Time Required for Each Defect Remediation

- Exhibit 58 Estimated Total Combined Man-Hours of IT and Engineering Time Required for Each Software Patch

- Exhibit 59: Estimated Percentage of Devices that Will Become Inoperable Each Year

- Exhibit 60: Primary Method for Updating Devices Once Deployed in Field

- Exhibit 61: Biggest Obstacle to the Development and Growth of the Connected/Software-defined Vehicle Industry

- Exhibit 62: Level of Automation of Respondent's Current Vehicle/Component Work

- Exhibit 63: Current Major Competition in the Software-defined Space, Automotive Respondents Only

- Exhibit 64: Expected Major Competition in the Software-defined Space Three Years From Now, Automotive Respondents Only

*For the full list of the 416 loT & Embedded Technology Voice of the Engineer Survey Exhibits available with this report, please see the Market Data .XLS.