PUBLISHER: TrendForce | PRODUCT CODE: 1491039

PUBLISHER: TrendForce | PRODUCT CODE: 1491039

2024 Micro LED Market Trend and Technology Cost Analysis

Micro LED Chip Market Value Expected to Reach $580 Million by 2028, Focusing on Head-Mounted Devices and Automotive Applications, Says TrendForce

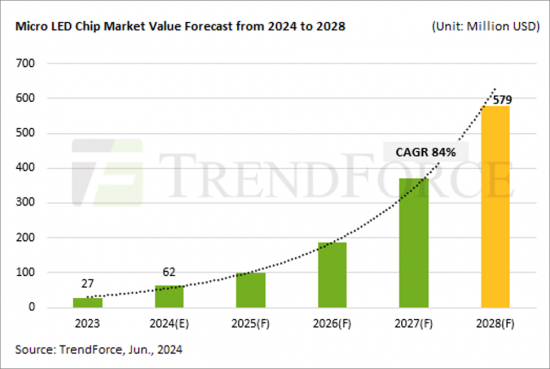

Jun. 3, 2024 ---- Efforts to reduce the cost of Micro LED chips through size miniaturization are ongoing. Companies like LGE, BOE, and Vistar continue to invest in large display applications, while AUO has been focusing on developing smartwatch products. There is also growing demand for new display applications in head-mounted devices and for automotive uses. TrendForce's "2024 Micro LED Market Trend and Cost Analysis Report" reveals that the market value of Micro LED chips is projected to reach $580 million by 2028, with a CAGR of 84% from 2023 to 2028.

Challenges in the Micro LED industry

The inability to reduce costs and technical challenges are major factors behind the cancellation of Apple's Micro LED watch. Therefore, continuous optimization of production processes remains critical for the development of the Micro LED industry. The evolution of mass transfer technology is expected to shift from single to composite technique, such as combining laser transfer with stamp transfer and potentially achieving a transfer solution with bonding capability with no stiction.

Inspection and repair processes are critical for improving yield rates and reducing Micro LED costs. Current electrical testing methods are being upgraded, focusing on high-precision probe cards and contactless testing. These advancements are not only leading the development of electrical testing but also present significant business opportunities for equipment manufacturers.

The cancellation of the Apple Watch has prompted chip supplier ams OSRAM to consider selling its 8-inch plant in Malaysia. If the buyer is a company within the current Micro LED supply chain, this could positively impact the industry's technical development and cost structure optimization. Considering the shift in technology routes and target markets, Chinese compound semiconductor manufacturers developing 8-inch SiC power semiconductors are also potential buyers. This would allow them to expand into international markets, providing chip manufacturers with a means to increase profitability.

Opportunities in the Micro LED industry

Micro LED still retains distinct advantages over competing technologies like Micro OLED. In AR glasses, which require light engines and high brightness and small volume, Micro LED light engines have now achieved sizes smaller than 0.2cc. With brightness levels advancing toward 350,000 nits, Micro LED is well-suited for high-brightness, all-weather, and all-scene recognition. The rapid development of AI-assisted tools is also expected to drive demand for AR glasses with Micro LED displays over the next 1 to 2 years.

In the automotive sector, displays do not require extremely high PPI but demand higher contrast and reliability. Micro LED technology, with its high brightness, contrast, wide color gamut, and fast response, can enhance the driving experience when integrated into smart cockpit display solutions with unique shapes, curves, flexibility, and feedback. This expands the potential applications of Micro LED in automotive scenarios-such as AR-HUDs and P-HUDS-as well as innovative display technologies for car windows using transparent displays.

Table of Contents

Chapter I. Micro LED Market Analysis

- 2024-2028 Micro LED Market Size Analysis: Large-sized Displays

- 2024-2028 Micro LED Market Size Comparison: Large-sized Displays

- 2024-2028 Micro LED Market Size Analysis: Wearable Displays

- 2024-2028 Micro LED Market Size Comparison: Wearable Displays

- 2024-2028 Micro LED Market Size Analysis: Head-mounted Displays

- 2024-2028 Micro LED Market Size Comparison: Head-mounted Displays

- 2024-2028 Micro LED Market Size Analysis: Automotive Displays

- 2024-2028 Micro LED Market Size Comparison: Automotive Displays

- 2024-2028 Micro LED Market Size Comparison: Mobile Devices/IT Displays

- 2024-2028 Market Value Analysis

- 2024 Micro LED Market Share Change Analysis by Applications

- 2024-2028 Wafer Market Demand Analysis

Chapter II. Micro LED Technology Development

- 2.1. Micro LED Mass Transfer Technology Development

- Micro LED TFT Backplane Technology Development

- Mass Transfer Technology Development

- Laser Transfer

- Contact Transfer Vs. Contactless Transfer

- Mass Transfer Technology: Combined Physical Mechanism

- Mass Transfer Technology: Combined Transfer Process

- Mass Transfer Technology: LGE's MDSAT Transfer Technology

- Mass Transfer Technology: Factors Affecting LED Transfer Rate Analysis

- Mass Transfer Technology: Factors Affecting Transfer Efficiency Analysis

- Mass Transfer Technology Development Summary

- 2.2. Micro LED Inspection Technology Development

- Micro LED Inspection Approaches Overview

- Micro LED Electrical Testing Solutions

- High Accuracy Probe Card Contact Electrical Testing-NanoEx

- Contactless Electrical Testing - Top Engineering

Chapter III. Micro LED Large-Sized Displays Market Analysis

- 2024 Micro/Mini LED COG Video Wall Specification and Progress

- 2024 Micro/Mini LED COG Video Wall Specification and Progress

- Micro LED Video Wall Manufacturing Analysis

- 2021-2028 6-inch Micro LED COC Price Trend

- Micro LED Chip Yield Rate and Brand Target

- Micro LED Chip Yield Rate and Brand Target

- Samsung/AUO LTPS Driver Framework Analysis

- Routing For DDI Connection in Spliced Displays

- Side Wiring Technology

- COG (Side Wiring) Technology Challenge Analysis / Player Roadmap

- TGV(Through Glass Via) Technology Analysis

- TGV Solution Provider: Corning

Chapter IV. Micro LED Wearable Display Market Analysis

- Apple Micro LED Watch Specification and Cost Analysis

- Micro LED Watch Manufacturing Analysis

- Apple Micro LED Watch Manufacturing Challenges Analysis

- Apple Cancelled Micro LED Project

- Impact From Apple's Cancellation of Watch Project on Industry

- ams OSRAM 8-inch Factory in Malaysia Situation Analysis

- AUO Circular Micro LED Display Panels Plan

- Touch Taiwan Micro LED

- Tag Heuer Micro LED Watch Specification and Cost Analysis

Chapter V. Micro LED Automotive Display Market Analysis

- Automotive Display Challenges: Solar Load

- 2024 HUD Product Specification Analysis

- 2023-2024 HUD Product Price Analysis

- AR-HUD Technology Analysis

- AR-HUD Technical Barriers

- Panoramic Head-up Display (P-HUD) vs. Transparent Display

- Micro LED Automotive Display Highlight: Brightness

- 2024 Micro LED Automotive Transparent Display Cost Analysis

- Automotive Displays Challenges: Safety and Environmental Protection

Chapter VI. Micro LED Player Dynamic Updates

- Micro LED Industry- Capital Investment, M&A, Alliance, and Joint Venture

- 2024 Micro LED Player Capacity Analysis

- 2024 Micro LED Equipment Highlights

- JBD

- Raysolve

- Innovision

- Sitan

- Saphlux

- Mojo Vision

- Ennostar

- PlayNitride

- Innolux

- 2024 Micro LED Key Products

- 2024 Micro LED Key Products- Continental

- 2024 Micro LED Key Products- Lenovo