PUBLISHER: TrendForce | PRODUCT CODE: 1695333

PUBLISHER: TrendForce | PRODUCT CODE: 1695333

2025 Deep UV LED Market Trend and Product Analysis

Water Sterilization Ushers in a New Era

According to TrendForce 2025 Deep UV LED Market Trend and Product Analysis, supported by stable demand in the UV curing market and the adoption of UV-C LED technology in new applications such as air conditioning, air purification, and flowing water sterilization due to favorable technological maturity and pricing, TrendForce forecasts the UV LED market value to reach USD 338 million by 2029. Most UV LED manufacturers remain optimistic about the market performance in 2025, particularly with UV-C LED likely to enter the flowing water sterilization market thanks to technological advances. Overall, a greater than or equal to10% revenue growth is anticipated for the UV LED segment.

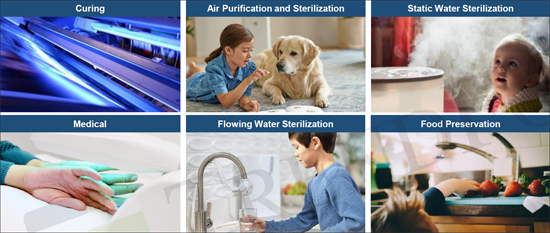

Compared to UV lamps, UV LEDs have a longer lifespan and simpler optical design. Manufacturers such as Nichia, Seoul Viosys, Violumas, and UVT have launched a wide range of UV-A, UV-B, and UV-C LED product lines, aiming to provide comprehensive wavelength solutions to meet the needs of customers looking to replace UV lamps. With the increasing maturity of relevant technologies year by year, DUV LEDs can be used not only for disinfection and purification, phototherapy, and horticultural lighting but also to enhance the quality and stability of curing products.

UV LED Application Market Analysis

Curing: Considering the stable growth in demand for curing-related applications-such as inkjet printing, offset printing, 3D printing, and resin/adhesive curing. In the long term, UV-B and UV-C LED technologies will likely mature and potentially enter the UV curing market, mitigating oxygen inhibition and enhancing curing product quality and stability.

Photocatalytic Air Purification: Combining UV-A LEDs with photocatalytic technology can purify the air and kill bacteria with long-term use, which has been consistently applied to home appliances such as refrigerators, air conditioners, wardrobes, and lighting devices. TrendForce forecasts the market value of photocatalytic air purification applications to increase steadily.

Medical / Life Sciences / Bio-Sensing: UV LED's small size makes it highly suitable for portable phototherapy products. With the increasingly mature UV-B LED technologies, medical device manufacturers have started to adopt UV-B LEDs and implement relevant healthcare certifications. Although such certification process is often strict and time-consuming, collaborations between medical device and UV LED makers will stimulate market growth in the future. Additionally, UV-A, UV-B, and UV-C LEDs can be applied to healthcare, life sciences, and bio-sensing, along with stable demand growth in Europe, North America, and Japan.

Disinfection / Purification: The mass production schedules for new air conditioning, air purification, and flowing water sterilization devices have been delayed to 2025-2027. Compared to UV lamps, UV LEDs have a longer lifespan and simpler optical design. When the wall-plug efficiency (WPE) of UV-C LEDs reaches greater than or equal to7% at 270-280nm or greater than or equal to5% at 260-270nm and obtains NSF/ANSI 55 Class A / Class B certification, these products could be introduced into the industrial and commercial flowing water sterilization segments. Considering the current progress of key manufacturers' product development, TrendForce estimates that from 2025 to 2028, the R&D and sampling phases for industrial and commercial flowing water sterilization applications will likely commence. Overall, the market scale of disinfection and purification applications are projected to have a 15% CAGR from 2024 to 2029.

According to TrendForce's survey, major manufacturers of greater than or equal to100mW UV-C LED single-chip packages will include ams OSRAM, Nichia, Violumas, NKFG, UVT, and LITEON in 1H25. Asahi Kasei (Crystal IS) and Toyoda Gosei will also roll out such package products in FY2026. The single-chip solution features smaller size, better current spreading, a more uniform radiation patterns and a lower heat dissipation cost. As the prices of UV-C LEDs decrease, end-market customers prefer single-chip packages.

Deep UV LED includes UV-B LED and UV-C LED, and that various applications have constantly emerged. The report "2025 Deep UV LED Market Trend and Product Analysis" explores the market value, product specifications and prices, reliability, application market trend, and brand introduction case studies. It is believed that the report can offer comprehensive insights for readers regarding development and marketing of deep UV LED applications.

Table of Contents

Chapter 1. UV LED Market Scale and Application Trend

- UV Wavelength vs. Application Market Analysis

- 2025-2029 UV LED Market Value

- 2025-2029 UV LED Market Value- Application Market Analysis

- 2023-2025(E) UV LED Demand Market Value- Regional Market Analysis

- 2023-2025(E) UV-A LED Demand Market Value- Regional Market Analysis

- 2023-2025(E) DUV LED Demand Market Value- Regional Market Analysis

- 2023-2025(E) China / Japan / Korea UV LED Demand Market

- 2025-2029 UV-C LED Package Market Volume- Optical Power Analysis

- 2014-2025(E) UV-A LED Market Price Analysis- Quartz

- 2014-2025(E) UV-A LED Market Price Analysis- Silicone Resin

- 2015-2025(E) less than or equal to 10mW UV-C LED Market Price Analysis

- 2015-2025(E) 10-20mW UV-C LED Market Price Analysis

- 2015-2029 UV-C LED Price Trend

- Curing Market

- Phototherapy Market

- Life Science Market

- Automotive Surface / Air Sterilization Market

- Sterilization / Disinfection Market

- Home Appliance Eco System and Supply Chain Flow Analysis

- UV-C LED Home Appliance Product Requirements

- European / American Brands- UV LED Product Introduction Results

- Japanese Brands- UV LED Product Introduction Results

- Korean Brands- UV LED Product Introduction Results

- Chinese Brands- UV LED Product Introduction Results

- When Will UV-C LED Enter Industrial Water Treatment Market?

- UV-C LED / UV Lamp Flowing Water Sterilization Reactors Analysis

- 2025 UV-C LED Sterilization Market- Potential Client List

Chapter 2. UV LED Player Revenue Ranking

- UV-C LED Market Value Chain Analysis

- 2022-2024 UV LED Player Revenue Ranking

- 2022-2024 UV-A LED Player Revenue Ranking

- 2022-2024 DUV LED Player Revenue Ranking

Chapter 3. Deep UV LED Product Specification and Price Analysis

- 2025 Deep UV LED Wavelength vs. Optical Power Analysis

- 2025 UV-C LED Optical Power vs. Wall-Plug-Efficiency (WPE) Analysis

- 2024-2025 Deep UV LED Product Specification and Price Analysis

- 2025 UV-C LED Product Reliability (Lifetime) Analysis

- 2025 UV-C LED Package Technology Analysis

Chapter 4. UV-C LED Technology and Patent Analysis

- 2025-2029 UV-C LED Technology Roadmap

- greater than or equal to 100mW UV-C LED Single / Multi-Chip Package Pros-Cons Analysis

- UV-C LED Patent Litigation