PUBLISHER: TECHCET | PRODUCT CODE: 1542848

PUBLISHER: TECHCET | PRODUCT CODE: 1542848

Quartz Equipment Components Market Report 2024-2025 (Critical Materials Report)

This report covers the market and supply-chain for Quartz Fabricated Parts used in semiconductor device fabrication, and the supporting supply chain. The report contains data and analysis from TECHCET's data base and Sr. Analyst experience, as well as that developed from primary and secondary market research. Topics include High Purity Fabricated Quartz Parts market, supply chain from raw sand/powder, and base materials. Effort has been made to provide breakdown of the supply and market by supplier as well as region. Forecasts are based on semiconductor wafer starts growth and equipment systems forecast as well as technology developments and regional dynamics.

INFOGRAPHICS

TABLE OF CONTENTS

1. EXECUTIVE SUMMARY

- 1.1. QUARTZ FABRICATED PARTS BUSINESS - MARKET OVERVIEW

- 1.1.1. QUARTZ FABRICATED PARTS BUSINESS - MARKET STRUCTURAL OVERVIEW

- 1.2. MARKET TRENDS IMPACTING 2024 OUTLOOK

- 1.3. QUARTZ FABRICATED PARTS 5-YEAR UNIT SHIPMENT FORECAST BY SEGMENT

- 1.4. QUARTZ FABRICATED PARTS SEGMENT TRENDS

- 1.5. TECHNOLOGY TRENDS - QUARTZ FABRICATED PARTS

- 1.6. COMPETITIVE LANDSCAPE - QUARTZ FABRICATED PARTS

- 1.7. FIRST QUARTER 2024 FINANCIALS OF TOP-4 SUPPLIERS

- 1.8. EHS, TRADE, AND/OR LOGISTICS ISSUES/CONCERNS - QUARTZ FABRICATED PARTS

- 1.9. ANALYST ASSESSMENT OF QUARTZ FABRICATED PARTS

2. SCOPE, PURPOSE AND METHODOLOGY

- 2.1. SCOPE

- 2.2. PURPOSE & METHODOLOGY

- 2.3. OVERVIEW OF OTHER TECHCET CMR(TM) OFFERINGS

3. SEMICONDUCTOR INDUSTRY MARKET STATUS & OUTLOOK

- 3.1. WORLDWIDE ECONOMY AND OVERALL INDUSTRY OUTLOOK

- 3.1.1. SEMICONDUCTOR INDUSTRIES TIES TO THE GLOBAL ECONOMY

- 3.1.2. SEMICONDUCTOR SALES GROWTH

- 3.1.3. TAIWAN OUTSOURCE MANUFACTURER MONTHLY SALES TRENDS

- 3.2. CHIPS SALES BY ELECTRONIC GOODS SEGMENT

- 3.2.1. ELECTRONICS OUTLOOK

- 3.2.2. AUTOMOTIVE INDUSTRY OUTLOOK

- 3.2.2.1. ELECTRIC VEHICLE (EV) MARKET TRENDS

- 3.2.2.2. INCREASE IN SEMICONDUCTOR CONTENT FOR AUTOS

- 3.2.3. SMARTPHONE OUTLOOK

- 3.2.4. PC OUTLOOK

- 3.2.5. SERVERS / IT MARKET

- 3.3. SEMICONDUCTOR FABRICATION GROWTH & EXPANSION

- 3.3.1. IN THE MIDST OF HUGE INVESTMENT IN CHIP EXPANSIONS

- 3.3.2. NEW FABS IN THE US

- 3.3.3. WW FAB EXPANSION DRIVING GROWTH

- 3.3.4. EQUIPMENT SPENDING TRENDS

- 3.3.5. ADVANCED LOGIC TECHNOLOGY ROADMAPS

- 3.3.5.1. DRAM TECHNOLOGY ROADMAPS

- 3.3.5.2. 3D NAND TECHNOLOGY ROADMAPS

- 3.3.6. FAB INVESTMENT ASSESSMENT

- 3.4. POLICY & TRADE TRENDS AND IMPACT

- 3.5. SEMICONDUCTOR MATERIALS OVERVIEW

- 3.5.1. TECHCET WAFER STARTS FORECAST THROUGH 2028

- 3.5.2. TECHCET MATERIALS MARKET FORECAST THROUGH 2028

4. QUARTZ PARTS MARKET TRENDS

- 4.1. QUARTZ FABRICATED PARTS BUSINESS - MARKET OVERVIEW

- 4.1.1. 2023 QUARTZ FABRICATED PARTS MARKET LEADING INTO 2024

- 4.1.2. QUARTZ FABRICATED PARTS MARKET OUTLOOK

- 4.1.3. QUARTZ FABRICATED PARTS 5-YEAR REVENUE FORECAST BY SEGMENT

- 4.1.4. QUARTZ FABRICATED PARTS PRODUCTION CAPACITY OF TOP SUPPLIERS

- 4.1.5. QUARTZ FABRICATED PARTS PRODUCTION BY REGION

- 4.1.6. QUARTZ FABRICATED PARTS PRODUCTION CAPACITY EXPANSIONS

- 4.1.7. INVESTMENT ANNOUNCEMENTS OVERVIEW

- 4.1.8. QUARTZ FABRICATED PARTS SUPPLY VS. DEMAND BALANCE - OVERVIEW

- 4.1.8.1. SUPPLY VS. DEMAND BALANCE - QUARTZ FABRICATED PARTS

- 4.2. PRICING TRENDS

- 4.3. QUARTZ FABRICATED PARTS GENERAL TECHNOLOGY OVERVIEW

- 4.3.1. QUARTZ FABRICATED PARTS GENERAL TECHNOLOGY OVERVIEW

- 4.3.2. QUARTZ FABRICATED PARTS APPLICATIONS

- 4.3.3. QUARTZ FABRICATED PARTS GENERAL DESCRIPTION

- 4.3.4. QUARTZ FABRICATED PARTS - WAFER SIZE AND EFFECT ON QUARTZ REQUIREMENTS

- 4.3.5. QUARTZ FABRICATED PARTS TECHNOLOGY TRENDS

- 4.4. REGIONAL CONSIDERATIONS - QUARTZ FABRICATED PARTS

- 4.4.1. REGIONAL ASPECTS AND DRIVERS

- 4.5. EHS AND TRADE/LOGISTIC ISSUES

- 4.5.1. RUSSIA INVASION OF UKRAINE

- 4.5.2. YEMEN'S HOUTHI ATTACKS IN THE RED SEA AND GULF OF ADEN DISRUPT GLOBAL SHIPPING

- 4.5.3. NEW MIDDLE EAST CONFLICT COULD DISRUPT GLOBAL TECH SUPPLY CHAIN AND INTEL'S EXPANSION PLANS

- 4.5.4. PANAMA CANAL HISTORIC DROUGHT

- 4.5.5. EHS ISSUES - ENVIRONMENTAL IMPACT

- 4.5.6. TRADE/LOGISTICS ISSUES

- 4.6. ANALYST ASSESSMENT OF QUARTZ FABRICATED PARTS MARKET TRENDS

5. SUPPLY-SIDE MARKET LANDSCAPE

- 5.1. QUARTZ FABRICATED PARTS MARKET SHARE - FABRICATION MARKET

- 5.1.1. QUARTZ FABRICATED PARTS MARKET SHARE - COLD FABRICATION (MACHINING)

- 5.1.2. QUARTZ FABRICATED PARTS MARKET SHARE - HOT FABRICATION (FUSED)

- 5.1.3. CURRENT QUARTER - SUPPLIERS' ACTIVITIES & REPORTED REVENUES - QUARTZ

- 5.1.4. FIRST QUARTER 2024 FINANCIALS OF TOP-4 SUPPLIERS

- 5.1.5. CURRENT QUARTER ACTIVITY - SHIN-ETSU

- 5.1.6. CURRENT QUARTER ACTIVITY - TOSOH QUARTZ

- 5.1.7. CURRENT QUARTER ACTIVITY - FERROTEC

- 5.1.8. CURRENT QUARTER ACTIVITY - WONIK

- 5.1.9. CURRENT ACTIVITY - HERAEUS

- 5.2. M&A ACTIVITY AND PARTNERSHIPS

- 5.3. PLANT CLOSURES - NONE

- 5.4. NEW ENTRANTS

- 5.5. SUPPLIERS OR PARTS/PRODUCT LINES THAT ARE AT RISK OF DISCONTINUATIONS

- 5.6. TECHCET ANALYST ASSESSMENT OF QUARTZ SUPPLIERS

6. SUB-TIER SUPPLY-CHAIN, QUARTZ

- 6.1. SUB-TIER SUPPLY CHAIN: SOURCES & MARKETS OVERVIEW

- 6.1.1. QUARTZ SUB-TIER SUPPLY-CHAIN MARKET BACKGROUND

- 6.1.2. QUARTZ SUB-TIER SUPPLY-CHAIN MARKET TRENDS

- 6.1.3. QUARTZ BASE MATERIALS 5-YEAR REVENUE FORECAST BY SEGMENT

- 6.1.4. SUB-TIER SUPPLY CHAIN: FUSED QUARTZ BASE MATERIALS MARKET SHARE

- 6.1.5. SUB-TIER SUPPLY CHAIN: FUSED QUARTZ BASE MATERIALS - TUBES AND RODS MARKET SHARE

- 6.1.6. SUB-TIER SUPPLY CHAIN: FUSED QUARTZ BASE MATERIALS - INGOTS AND BOULES MARKET SHARE

- 6.1.7. SUB-TIER SUPPLY CHAIN: QUARTZ BASE MATERIALS - SAND/POWDER MARKET SHARE

- 6.1.8. SEMICONDUCTOR-GRADE QUARTZ SUB-TIER SUPPLIER NEWS

- 6.2. SUB-TIER SUPPLY-CHAIN - DISRUPTIONS

- 6.3. SUB-TIER SUPPLY-CHAIN M&A OR PARTNERSHIP ACTIVITY

- 6.4. SUB-TIER SUPPLY-CHAIN EHS AND LOGISTICS ISSUES - SEE SECTION 4.5

- 6.5. SUB-TIER SUPPLY-CHAIN "NEW" ENTRANTS - NONE

- 6.6. SUB-TIER SUPPLY-CHAIN PLANT UPDATES

- 6.7. SUB-TIER SUPPLY-CHAIN PLANT CLOSURES - NONE REPORTED

- 6.8. SUB-TIER SUPPLY-CHAIN PRICING TRENDS

- 6.9. SUB-TIER SUPPLY-CHAIN TECHCET ANALYST ASSESSMENT

7. SUPPLIER PROFILES (FABRICATORS)

- APPLIED CERAMICS, INC.

- BEIJING KAIDE QUARTZ CO., LTD

- DONGHAI HONGWEI QUARTZ PRODUCTS CO., LTD.

- DS TECHNO CO., LTD.

- FERROTEC HOLDINGS CORPORATION

- ...AND 20+ MORE

8. APPENDIX

- 8.1. TECHNOLOGY TRENDS/TECHNICAL DRIVERS - OUTLINE

- 8.1.1. QUARTZ GENERAL TECHNOLOGY OVERVIEW & TECHNOLOGY TRENDS

- 8.1.2. CUSTOMER DRIVEN TECHNOLOGIES

- 8.1.3. NAND ROADMAPS AND CHALLENGES - 3D NAND LEVELS W/ STACKS/TIERS

- 8.1.4 3D NAND PROCESS ADVANCES REQUIRED

- 8.1.5. MICRON UNVEILS BREAKTHROUGH NVDRAM: A DUAL-LAYER 32GBIT NON-VOLATILE FERROELECTRIC MEMORY WITH NEAR-DRAM PERFORMANCE

- 8.1.6. ADVANCED LOGIC ROADMAPS AND CHALLENGES - LOGIC TRANSISTOR EST. ROADMAP

- 8.1.7. ADVANCED LOGIC (FOUNDRY) NODE HVM ESTIMATE

- 8.1.7.1. THE SEMICONDUCTOR SHOWDOWN: SAMSUNG AND TSMC'S GAA FETS VS. INTEL'S RIBBONFET

- 8.1.8. ADV LOGIC FUTURE TECHNOLOGY CHALLENGES

- 8.1.9. ADVANCING TECHNOLOGIES IMPLICATION TO PHOTOLITHOGRAPHY

- 8.1.9.1. ADVANCING TECHNOLOGIES IMPLICATION TO PHOTOLITHOGRAPHY - DSA

- 8.1.9.2. ADVANCING TECHNOLOGIES IMPLICATION TO PHOTOLITHOGRAPHY: CENTURA SCULPTA BY APPLIED MATERIALS: SHAPING THE FUTURE OF SEMICONDUCTOR MANUFACTURING

- 8.1.9.3. ADVANCING TECHNOLOGIES IMPLICATION TO PHOTOLITHOGRAPHY: LINE EDGE ROUGHNESS REDUCTION THRU DEPOSITION

- 8.1.10. CFET ARCHITECTURE: CFET SCALING ADVANTAGE

- 8.1.10.1. CFET ARCHITECTURE: COMPLEMENTARY FETS (CFETS)

- 8.1.10.2. CFET ARCHITECTURE: CFET FUTURE PROSPECTS

- 8.1.11. INORGANIC EUV RESIST - SPIN ON DEPOSITION

- 8.1.11.1. INORGANIC EUV RESIST - ALD DEPOSITED

- 8.1.12. SELF ALIGNED MULTI PATTERNING - SADP

- 8.1.12.1. SELF ALIGNED MULTI PATTERNING - SAQP

- 8.1.12.2. SELF ALIGNED MULTI PATTERNING - PEALD EQUIPMENT

- 8.1.12.3. SELF ALIGNED MULTI PATTERNING - CAN SAQP BYPASS EUV BEYOND 7 NM?

- 8.1.13. EUV, MULTI PATTERNING AND GEOPOLITICS

- 8.1.14. AREA SELECTIVE DEPOSITION (ASD)

- 8.1.14.1. AREA SELECTIVE DEPOSITION (ASD) - TU EINDHOVEN SELECTIVE ALD ENABLED BY PLASMA PRETREATMENT

- 8.1.15. SPECIALTY/EMERGING DIELECTRIC AND APPLICATIONS

FIGURES

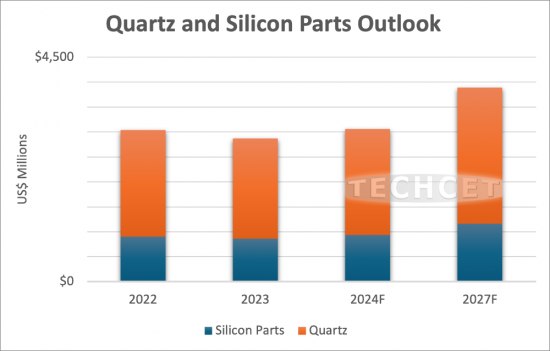

- FIGURE 1.1: QUARTZ FABRICATED PARTS REVENUE FORECAST BY SEGMENT

- FIGURE 1.2: 2023 QUARTZ SUPPLIER MARKET SHARE BY REVENUE

- FIGURE 1.3: TOP-4 QUARTZ MAKERS' QUARTERLY COMBINED SALES (US$M)

- FIGURE 3.1: GLOBAL ECONOMY AND THE ELECTRONICS SUPPLY HAIN (2023)

- FIGURE 3.2: WORLDWIDE SEMICONDUCTOR SALES

- FIGURE 3.3: TECHCET'S TAIWAN SEMICONDUCTOR INDUSTRY INDEX (TTSII) IN 000'S OF NTD

- FIGURE 3.4: 2023 SEMICONDUCTOR CHIP APPLICATIONS

- FIGURE 3.5: GLOBAL LIGHT VEHICLE UNIT SALES (IN MILLIONS OF UNITS)

- FIGURE 3.6: ELECTRIFICATION TREND BY WORLD REGION

- FIGURE 3.7: AUTOMOTIVE SEMICONDUCTOR PRODUCTION

- FIGURE 3.8: MOBILE PHONE SHIPMENTS, WW ESTIMATES

- FIGURE 3.9: WORLDWIDE PC AND TABLET FORECAST

- FIGURE 3.10: TSMC PHOENIX CAMPUS WITH THE 2ND FAB VISIBLE IN THE BACKGROUND

- FIGURE 3.11: ESTIMATED GLOBAL FAB SPENDING 2023-2028

- FIGURE 3.12: FAB EXPANSIONS WITHIN THE US

- FIGURE 3.13: SEMICONDUCTOR CHIP MANUFACTURING REGIONS OF THE WORLD

- FIGURE 3.14: GLOBAL TOTAL EQUIPMENT SPENDING (US$ M) AND Y-O-Y CHANGE

- FIGURE 3.15: ADVANCED LOGIC DEVICE TECHNOLOGY ROADMAP OVERVIEW

- FIGURE 3.16: DRAM TECHNOLOGY ROADMAP OVERVIEW

- FIGURE 3.17: 3D NAND TECHNOLOGY ROADMAP OVERVIEW

- FIGURE 3.18: INTEL OHIO PLANT SITE AS OF FEB. 2024

- FIGURE 3.19: TECHCET WAFER START FORECAST BY NODE SEGMENTS

- FIGURE 3.20: TECHCET WORLDWIDE MATERIALS FORECAST ($M USD)

- FIGURE 4.1: QUARTZ FABRICATED PARTS REVENUE FORECAST BY SEGMENT

- FIGURE 4.2: FABRICATED QUARTZ COMPONENTS MARKET SHARE % BY SUPPLIER

- FIGURE 4.3: 2023 FABRICATED QUARTZ COMPONENTS BY REGION

- FIGURE 4.4: QUARTZ FABRICATED PARTS CAPACITY/DEMAND FORECAST

- FIGURE 4.5: QUARTZ PRODUCTS FOR SEMICONDUCTOR APPLICATIONS

- FIGURE 4.6: QUARTZ PRODUCTS FOR SEMICONDUCTOR APPLICATIONS

- FIGURE 4.7: QUARTZ PRODUCTS FOR DRY ETCH APPLICATIONS

- FIGURE 4.8: QUARTZ PRODUCTS FOR EPI APPLICATIONS

- FIGURE 4.9: 2023 QUARTZ FABRICATED PARTS REVENUE SHARE BY REGION

- FIGURE 4.10: ASSESSED CONTROL OF TERRAIN AROUND DONETSK

- FIGURE 4.11: YEMEN'S HOUTHI ATTACKS DISRUPTING GLOBAL SHIPPING

- FIGURE 4.12: MIDDLE EAST CONFLICT

- FIGURE 4.13: PANAMA CANAL SHIPPING

- FIGURE 4.14: GREENHOUSE GAS PROTOCOL, DETAILED CATEGORIES

- FIGURE 4.15: SCOPE 3 EMISSIONS FOR SEMICONDUCTOR COMPANIES

- FIGURE 5.1: 2023 QUARTZ SUPPLIER MARKET SHARE BY REVENUE (HOT & COLD)

- FIGURE 5.2: 2023 QUARTZ SUPPLIER MARKET SHARE BY REVENUE

- FIGURE 5.3: 2023 QUARTZ SUPPLIER MARKET SHARE BY REVENUE

- FIGURE 5.4: TOP-4 QUARTZ MAKERS' QUARTERLY COMBINED SALES (US$M)

- FIGURE 5.5: TOSS CORP 2024 FINANCIALS

- FIGURE 5.6: WONIK CURRENT QUARTER FINANCIALS

- FIGURE 5.7: #2 HERAEUS CONSOLIDATED 2023 FINANCIALS

- FIGURE 6.1: QUARTZ PRODUCTS FOR SEMICONDUCTOR APPLICATIONS

- FIGURE 6.2: QUARTZ BASE MATERIALS REVENUE FORECAST BY SEGMENT

- FIGURE 6.3: ESTIMATED 2023 FUSED QUARTZ BASE MATERIALS UPPLIER RANKING- BASE MATERIAL

- FIGURE 6.4: ESTIMATED 2023 FUSED QUARTZ BASE MATERIALS SUPPLIER RANKING- TUBES AND RODS

- FIGURE 6.5: ESTIMATED 2023 FUSED QUARTZ BASE MATERIALS SUPPLIER RANKING- INGOT/BOULE

- FIGURE 6.6: ESTIMATED 2023 FUSED QUARTZ BASE MATERIALS SUPPLIER RANKING- 2023 QUARTZ POWDER

- FIGURE 8.1: END USE APPLICATIONS DRIVING NEW DEVICE PROCESSES

- FIGURE 8.2: 3D NAND STACKING DRIVES DIELECTRICS AND METALS PRECURSOR VOLUME

- FIGURE 8.3: 3D NAND PROGRESSION

- FIGURE 8.4: 32 GB NVDRAM WITH 1T 1C MEMORY LAYERS

- FIGURE 8.5: GATE STRUCTURE ROADMAP

- FIGURE 8.6: ADVANCED LOGIC (FOUNDRY) NODE ROAD MAP

- FIGURE 8.7: RIBBON FET

- FIGURE 8.8: MONO LAYER NANO SHEETS CHANNELS

- FIGURE 8.9: NANO IMPRINT LITHOGRAPHY PROCESS FLOW

- FIGURE 8.10: ALD/ALE ENHANCEMENT OF NANO IMPRINT LITHOGRAPHY

- FIGURE 8.11: DIRECTED SELF-ASSEMBLY

- FIGURE 8.12: DSA PATENT FILING BY COMPANY

- FIGURE 8.13: DSA PATEN FILING SINCE 2023

- FIGURE 8.14: WHAT IS PATTERN SHAPING?

- FIGURE 8.15: REFINING EUV PATTERNING BY APPLIED MATERIALS

- FIGURE 8.16: COMPLEMENTARY FET (CFET)

- FIGURE 8.17: CFET IMPROVES PERFORMANCE IN TRACK SCALING

- FIGURE 8.18: MONOLITHIC CFET PROCESS FLOW EXAMPLE

- FIGURE 8.19: MCFET NEW FEATURE- MIDDLE DIELECTRIC ISOLATION

- FIGURE 8.20: LOW TEMPERATURE GATE STACK OPTION EXAMPLES

- FIGURE 8.21: LOW TEMPERATURE SD/CONTACT OPTION EXAMPLES

- FIGURE 8.22: BSPDN ADVANTAGE- IR DROP REDUCTION

- FIGURE 8.23: INCREASING NUMBER OF ALD STEPS REQUIRED BY NEXT GENERATION GAA-FET AND CFET

- FIGURE 8.24: IMEC SUB-1NM TRANSISTOR ROADMAP, 3D-STACKED CMOS 2.0 PLANS

- FIGURE 8.25: INPRIA EUV MOR

- FIGURE 8.26: INPRIA SPIN ON INORGANIC RESIST IS MUCH THINNER THAN STANDARD STACKS OF PHOTO RESIST

- FIGURE 8.27: PATENT FILING FOR MLD DEPOSITED EUV RESIST SEARCH PERFORMED IN PATBASE

- FIGURE 8.28: SADP PROCESS FLOW USING ALD SPACER

- FIGURE 8.29: ONE OF MANY FLAVORS OF SAQP PROCESS FLOW

- FIGURE 8.30: SELECTIVE ALD ENABLED BY PLASMA PRETREATMENT

- FIGURE 8.31: SPECIALTY/EMERGING DIELECTRIC APPLICATIONS FOR HETEROGENOUS INTEGRATIONS (APPLIED MATERIALS)

TABLES

- TABLE 1.1: BREAKOUT OF FABRICATED QUARTZ MARKET BY HOT AND COLD FABRICATION

- TABLE 3.1: GLOBAL GDP AND SEMICONDUCTOR REVENUES

- TABLE 3.2: BATTERY ELECTRIC VEHICLE (BEV) REGIONAL TRENDS

- TABLE 3.3: DATA CENTER SYSTEMS AND COMMUNICATION SERVICES MARKET SPENDING 2023

- TABLE 4.1: BREAKOUT OF FABRICATED QUARTZ MARKET BY HOT AND COLD FABRICATION

- TABLE 4.2: ESTIMATED FABRICATED QUARTZ COMPONENTS SHARE BY SUPPLIER

- TABLE 4.3: QUARTZ FABRICATED PARTS SUPPLIER MANUFACTURING LOCATIONS

- TABLE 4.4: OVERVIEW OF ANNOUNCED 2023/2024 QUARTZ FABRICATED PARTS SUPPLIER INVESTMENTS

- TABLE 4.5: COMPARISON OF TUBES AND BOATS ATTRIBUTES FOR 200MM AND 300MM PROCESSES

- TABLE 4.6: REGIONAL QUARTZ MARKET ATTRIBUTES AND EXPANSION ACTIVITY, (1 OF 2)

- TABLE 4.7: REGIONAL QUARTZ MARKET ATTRIBUTES AND EXPANSION ACTIVITY, (2 OF 2)

- TABLE 5.1: MOST RECENT QUARTERLY QUARTZ SUPPLIER SALES (IN US$M)

- TABLE 5.2: SHIN-ETSU CURRENT QUARTER FINANCIALS (ANNUAL RESULTS)

- TABLE 5.3: FERROTEC YOY FINANCIALS

- TABLE 5.4: FERROTEC ANNUAL (ENDING 3/2024) FINANCIALS

- TABLE 8.1: LEADING EDGE LOGIC DESCRIPTIONS BY NODE (TSMC, INTEL)

- TABLE 8.2: MULTIPATTERNING AT 7NM BY TSMC

- TABLE 8.3: SELECTIVE DEPOSITION - SELECTIVELY DEPOSITED MATERIALS