Need help finding what you are looking for?

Contact Us

PUBLISHER: TECHCET | PRODUCT CODE: 1498834

PUBLISHER: TECHCET | PRODUCT CODE: 1498834

Electronic Wet Chemicals & Specialty Cleans Market Report 2024-2025 (Critical Materials Report)

PUBLISHED:

PAGES: 115 Pages

DELIVERY TIME: 1-2 business days

SELECT AN OPTION

This report covers the market landscape and supply-chain for wet chemicals used in semiconductor device fabrication. It includes information about key suppliers, issues/trends in the material supply chain, estimates on supplier market share, and forecast for the material segments.

SAMPLE VIEW

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY

- 1.1 WET CHEMICALS AND SPECIALTY CLEANS BUSINESS - MARKET OVERVIEW

- 1.2 MARKET TRENDS IMPACTING 2024 OUTLOOK

- 1.3 WET CHEMICALS AND SPECIALTY CLEANS 5-YEAR UNIT SHIPMENT FORECAST BY SEGMENT

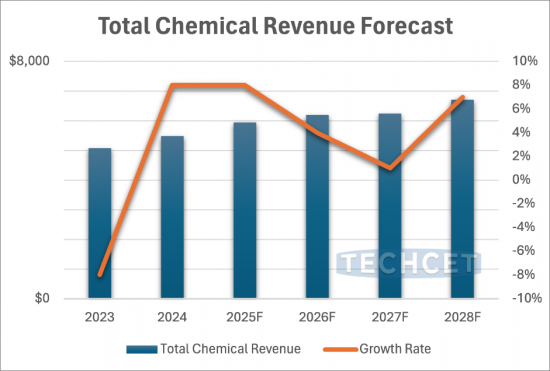

- 1.4 WET CHEMICALS AND SPECIALTY CLEANS 5-YEAR REVENUE FORECAST BY SEGMENT

- 1.5 WET CHEMICALS AND SPECIALTY CLEANS SEGMENT TRENDS

- 1.6 TECHNOLOGY TRENDS

- 1.7 COMPETITIVE LANDSCAPE

- 1.8 EHS, TRADE, AND/OR LOGISTICS ISSUES/CONCERNS

- 1.9 ANALYST ASSESSMENT OF WET CHEMICALS AND SPECIALTY CLEANS

2 SCOPE, PURPOSE AND METHODOLOGY

- 2.1 SCOPE

- 2.2 METHODOLOGY

- 2.3 OVERVIEW OF OTHER TECHCET CMR(TM) OFFERINGS

3 SEMICONDUCTOR INDUSTRY MARKET STATUS & OUTLOOK

- 3.1 WORLDWIDE ECONOMY AND OUTLOOK

- 3.1.1 SEMICONDUCTOR INDUSTRIES TIES TO THE GLOBAL ECONOMY

- 3.1.2 SEMICONDUCTOR SALES GROWTH

- 3.1.3 TAIWAN OUTSOURCE MANUFACTURER MONTHLY SALES TRENDS

- 3.2 CHIPS SALES BY ELECTRONIC GOODS SEGMENT

- 3.2.1 ELECTRONICS OUTLOOK

- 3.2.2 AUTOMOTIVE INDUSTRY OUTLOOK

- 3.2.2.1 ELECTRIC VEHICLE (EV) MARKET TRENDS

- 3.2.2.2 INCREASE IN SEMICONDUCTOR CONTENT FOR AUTOS

- 3.2.3 SMARTPHONE OUTLOOK

- 3.2.4 PC OUTLOOK

- 3.2.5 SERVERS / IT MARKET

- 3.3 SEMICONDUCTOR FABRICATION GROWTH & EXPANSION

- 3.3.1 IN THE MIDST OF HUGE INVESTMENT IN CHIP EXPANSIONS

- 3.3.2 NEW FABS IN THE US

- 3.3.3 WW FAB EXPANSION DRIVING GROWTH

- 3.3.4 EQUIPMENT SPENDING TRENDS

- 3.3.5 ADVANCED LOGIC TECHNOLOGY ROADMAPS

- 3.3.5.1 DRAM TECHNOLOGY ROADMAPS

- 3.3.5.2 3D NAND TECHNOLOGY ROADMAPS

- 3.3.6 FAB INVESTMENT ASSESSMENT

- 3.4 POLICY & TRADE TRENDS AND IMPACT

- 3.5 SEMICONDUCTOR MATERIALS OVERVIEW

- 3.5.1 TECHCET WAFER STARTS FORECAST THROUGH 2028

- 3.5.2 TECHCET MATERIALS MARKET FORECAST THROUGH 2028

4 WET CHEMICALS AND SPECIALTY CLEANS MARKET TRENDS

- 4.1 WET CHEMICALS AND SPECIALTY CLEANS MARKET OUTLOOK

- 4.1.1 2023 WET CHEMICALS AND SPECIALTY CLEANS MARKET LEADING INTO 2024

- 4.2 WET CHEMICALS AND SPECIALTY CLEANS 5-YEAR UNIT SHIPMENT FORECAST BY SEGMENT

- 4.2.1 WET CHEMICALS AND SPECIALTY CLEANS 5-YEAR REVENUE FORECAST BY SEGMENT

- 4.2.2 H2SO4 VOLUME FORECAST

- 4.2.2.1 H2SO4 REVENUE FORECAST

- 4.2.3 H2O2 VOLUME FORECAST

- 4.2.3.1 H2O2 REVENUE FORECAST

- 4.2.4 H3PO4 VOLUME FORECAST

- 4.2.4.1 H3PO4 REVENUE FORECAST

- 4.2.5 NH4OH VOLUME FORECAST

- 4.2.5.1 NH4OH REVENUE FORECAST

- 4.2.6 IPA VOLUME FORECAST

- 4.2.6.1 IPA REVENUE FORECAST

- 4.2.7 HF VOLUME FORECAST

- 4.2.7.1 HF REVENUE FORECAST

- 4.2.8 HCL VOLUME FORECAST

- 4.2.8.1 HCL REVENUE FORECAST

- 4.2.9 HNO3 VOLUME FORECAST

- 4.2.9.1 HNO3 REVENUE FORECAST

- 4.2.10 AL PERR VOLUME FORECAST

- 4.2.10.1 AL PERR REVENUE FORECAST

- 4.2.11 CU PERR VOLUME FORECAST

- 4.2.11.1.CU PERR REVENUE FORECAST

- 4.2.12 PCMP REVENUE FORECAST

- 4.3 WET CHEMICALS AND SPECIALTY CLEANS SUPPLIERS BY REGION

- 4.4 WET CHEMICALS AND SPECIALTY CLEANS PRODUCTION CAPACITY EXPANSIONS

- 4.4.1 INVESTMENT ANNOUNCEMENTS OVERVIEW

- 4.4.2 INVESTMENT ACTIVITY ADDITIONAL COMMENTS

- 4.5 WET CHEMICALS AND SPECIALTY CLEANS SUPPLY VS. DEMAND BALANCE - OVERVIEW

- 4.6 PRICING TRENDS

- 4.7 WET CHEMICALS AND SPECIALTY CLEANS GENERAL TECHNOLOGY OVERVIEW

- 4.7.1 WET CHEMICALS AND SPECIALTY CLEANS TECHNOLOGY TRENDS

- 4.7.2 EMERGING WET CHEMICALS AND SPECIALTY CLEANS APPLICATION

- 4.8 REGIONAL CONSIDERATIONS

- 4.8.1 REGIONAL ASPECTS AND DRIVERS

- 4.9 EHS AND TRADE/LOGISTIC ISSUES

- 4.9.1 EHS ISSUES

- 4.9.2 TRADE/LOGISTICS ISSUES

- 4.10 ANALYST ASSESSMENT OF WET CHEMICALS AND SPECIALTY CLEANS MARKET TRENDS

5 SUPPLY-SIDE MARKET LANDSCAPE

- 5.1 WET CHEMICALS MARKET SHARE

- 5.2 SPECIALTY CLEANS MARKET SHARE

- 5.3 M&A ACTIVITY AND PARTNERSHIPS

- 5.4 PLANT CLOSURES - NONE

- 5.5 NEW ENTRANTS

- 5.6 SUPPLIERS OR PARTS/PRODUCT LINES THAT ARE AT RISK OF DISCONTINUATIONS - NONE

- 5.7 TECHCET ANALYST ASSESSMENT OF WET CHEMICALS AND SPECIALTY CLEANS SUPPLIERS

6 SUB-TIER SUPPLY CHAIN, WET CHEMICALS AND SPECIALTY CLEANS

- 6.1 SUB-TIER SUPPLY CHAIN: SOURCES & MARKETS OVERVIEW

- 6.1.1 SUB-TIER SUPPLIERS: A REPRESENTATIVE BUT NON-COMPREHENSIVE LIST

- 6.1.2 SUB-TIER MATERIAL MARKET BACKGROUND

- 6.1.3 SUB-TIER MATERIAL MARKET TRENDS

- 6.1.4 SUB-TIER MATERIAL INDUSTRIAL VS. SEMICONDUCTOR GRADE

- 6.1.5 SEMICONDUCTOR-GRADE SUB-TIER MATERIAL SUPPLIER NEWS

- 6.2 SUB-TIER SUPPLY CHAIN TECHCET ANALYST ASSESSMENT

7 SUPPLIER PROFILES

- ATOTECH

- AUECC

- AVANTOR

- BASF

- CHANG CHUN PETROCHEMICAL

- ...AND 40+ MORE

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY

- 1.1 WET CHEMICALS AND SPECIALTY CLEANS BUSINESS - MARKET OVERVIEW

- 1.2 MARKET TRENDS IMPACTING 2024 OUTLOOK

- 1.3 WET CHEMICALS AND SPECIALTY CLEANS 5-YEAR UNIT SHIPMENT FORECAST BY SEGMENT

- 1.4 WET CHEMICALS AND SPECIALTY CLEANS 5-YEAR REVENUE FORECAST BY SEGMENT

- 1.5 WET CHEMICALS AND SPECIALTY CLEANS SEGMENT TRENDS

- 1.6 TECHNOLOGY TRENDS

- 1.7 COMPETITIVE LANDSCAPE

- 1.8 EHS, TRADE, AND/OR LOGISTICS ISSUES/CONCERNS

- 1.9 ANALYST ASSESSMENT OF WET CHEMICALS AND SPECIALTY CLEANS

2 SCOPE, PURPOSE AND METHODOLOGY

- 2.1 SCOPE

- 2.2 METHODOLOGY

- 2.3 OVERVIEW OF OTHER TECHCET CMR(TM) OFFERINGS

3 SEMICONDUCTOR INDUSTRY MARKET STATUS & OUTLOOK

- 3.1 WORLDWIDE ECONOMY AND OUTLOOK

- 3.1.1 SEMICONDUCTOR INDUSTRIES TIES TO THE GLOBAL ECONOMY

- 3.1.2 SEMICONDUCTOR SALES GROWTH

- 3.1.3 TAIWAN OUTSOURCE MANUFACTURER MONTHLY SALES TRENDS

- 3.2 CHIPS SALES BY ELECTRONIC GOODS SEGMENT

- 3.2.1 ELECTRONICS OUTLOOK

- 3.2.2 AUTOMOTIVE INDUSTRY OUTLOOK

- 3.2.2.1 ELECTRIC VEHICLE (EV) MARKET TRENDS

- 3.2.2.2 INCREASE IN SEMICONDUCTOR CONTENT FOR AUTOS

- 3.2.3 SMARTPHONE OUTLOOK

- 3.2.4 PC OUTLOOK

- 3.2.5 SERVERS / IT MARKET

- 3.3 SEMICONDUCTOR FABRICATION GROWTH & EXPANSION

- 3.3.1 IN THE MIDST OF HUGE INVESTMENT IN CHIP EXPANSIONS

- 3.3.2 NEW FABS IN THE US

- 3.3.3 WW FAB EXPANSION DRIVING GROWTH

- 3.3.4 EQUIPMENT SPENDING TRENDS

- 3.3.5 ADVANCED LOGIC TECHNOLOGY ROADMAPS

- 3.3.5.1 DRAM TECHNOLOGY ROADMAPS

- 3.3.5.2 3D NAND TECHNOLOGY ROADMAPS

- 3.3.6 FAB INVESTMENT ASSESSMENT

- 3.4 POLICY & TRADE TRENDS AND IMPACT

- 3.5 SEMICONDUCTOR MATERIALS OVERVIEW

- 3.5.1 TECHCET WAFER STARTS FORECAST THROUGH 2028

- 3.5.2 TECHCET MATERIALS MARKET FORECAST THROUGH 2028

4 WET CHEMICALS AND SPECIALTY CLEANS MARKET TRENDS

- 4.1 WET CHEMICALS AND SPECIALTY CLEANS MARKET OUTLOOK

- 4.1.1 2023 WET CHEMICALS AND SPECIALTY CLEANS MARKET LEADING INTO 2024

- 4.2 WET CHEMICALS AND SPECIALTY CLEANS 5-YEAR UNIT SHIPMENT FORECAST BY SEGMENT

- 4.2.1 WET CHEMICALS AND SPECIALTY CLEANS 5-YEAR REVENUE FORECAST BY SEGMENT

- 4.2.2 H2SO4 VOLUME FORECAST

- 4.2.2.1 H2SO4 REVENUE FORECAST

- 4.2.3 H2O2 VOLUME FORECAST

- 4.2.3.1 H2O2 REVENUE FORECAST

- 4.2.4 H3PO4 VOLUME FORECAST

- 4.2.4.1 H3PO4 REVENUE FORECAST

- 4.2.5 NH4OH VOLUME FORECAST

- 4.2.5.1 NH4OH REVENUE FORECAST

- 4.2.6 IPA VOLUME FORECAST

- 4.2.6.1 IPA REVENUE FORECAST

- 4.2.7 HF VOLUME FORECAST

- 4.2.7.1 HF REVENUE FORECAST

- 4.2.8 HCL VOLUME FORECAST

- 4.2.8.1 HCL REVENUE FORECAST

- 4.2.9 HNO3 VOLUME FORECAST

- 4.2.9.1 HNO3 REVENUE FORECAST

- 4.2.10 AL PERR VOLUME FORECAST

- 4.2.10.1 AL PERR REVENUE FORECAST

- 4.2.11 CU PERR VOLUME FORECAST

- 4.2.11.1.CU PERR REVENUE FORECAST

- 4.2.12 PCMP REVENUE FORECAST

- 4.3 WET CHEMICALS AND SPECIALTY CLEANS SUPPLIERS BY REGION

- 4.4 WET CHEMICALS AND SPECIALTY CLEANS PRODUCTION CAPACITY EXPANSIONS

- 4.4.1 INVESTMENT ANNOUNCEMENTS OVERVIEW

- 4.4.2 INVESTMENT ACTIVITY ADDITIONAL COMMENTS

- 4.5 WET CHEMICALS AND SPECIALTY CLEANS SUPPLY VS. DEMAND BALANCE - OVERVIEW

- 4.6 PRICING TRENDS

- 4.7 WET CHEMICALS AND SPECIALTY CLEANS GENERAL TECHNOLOGY OVERVIEW

- 4.7.1 WET CHEMICALS AND SPECIALTY CLEANS TECHNOLOGY TRENDS

- 4.7.2 EMERGING WET CHEMICALS AND SPECIALTY CLEANS APPLICATION

- 4.8 REGIONAL CONSIDERATIONS

- 4.8.1 REGIONAL ASPECTS AND DRIVERS

- 4.9 EHS AND TRADE/LOGISTIC ISSUES

- 4.9.1 EHS ISSUES

- 4.9.2 TRADE/LOGISTICS ISSUES

- 4.10 ANALYST ASSESSMENT OF WET CHEMICALS AND SPECIALTY CLEANS MARKET TRENDS

5 SUPPLY-SIDE MARKET LANDSCAPE

- 5.1 WET CHEMICALS MARKET SHARE

- 5.2 SPECIALTY CLEANS MARKET SHARE

- 5.3 M&A ACTIVITY AND PARTNERSHIPS

- 5.4 PLANT CLOSURES - NONE

- 5.5 NEW ENTRANTS

- 5.6 SUPPLIERS OR PARTS/PRODUCT LINES THAT ARE AT RISK OF DISCONTINUATIONS - NONE

- 5.7 TECHCET ANALYST ASSESSMENT OF WET CHEMICALS AND SPECIALTY CLEANS SUPPLIERS

6 SUB-TIER SUPPLY CHAIN, WET CHEMICALS AND SPECIALTY CLEANS

- 6.1 SUB-TIER SUPPLY CHAIN: SOURCES & MARKETS OVERVIEW

- 6.1.1 SUB-TIER SUPPLIERS: A REPRESENTATIVE BUT NON-COMPREHENSIVE LIST

- 6.1.2 SUB-TIER MATERIAL MARKET BACKGROUND

- 6.1.3 SUB-TIER MATERIAL MARKET TRENDS

- 6.1.4 SUB-TIER MATERIAL INDUSTRIAL VS. SEMICONDUCTOR GRADE

- 6.1.5 SEMICONDUCTOR-GRADE SUB-TIER MATERIAL SUPPLIER NEWS

- 6.2 SUB-TIER SUPPLY CHAIN TECHCET ANALYST ASSESSMENT

7 SUPPLIER PROFILES

- ATOTECH

- AUECC

- AVANTOR

- BASF

- CHANG CHUN PETROCHEMICAL

- ...AND 40+ MORE

LIST OF FIGURES

- FIGURE 1.1: WET CHEMICALS AND SPECIALTY CLEANS SHIPMENT FORECAST BY SEGMENT

- FIGURE 1.2: WET CHEMICALS AND SPECIALTY CLEANS REVENUE FORECAST BY SEGMENT

- FIGURE 1.3: 2023 SPECIALTY CLEANS SUPPLIER MARKET SHARE BY REVENUE

- FIGURE 3.1: GLOBAL ECONOMY AND THE ELECTRONICS SUPPLY CHAIN (2023)

- FIGURE 3.2: WORLDWIDE SEMICONDUCTOR SALES

- FIGURE 3.3: TECHCET'S TAIWAN SEMICONDUCTOR INDUSTRY INDEX (TTSI)

- FIGURE 3.4: 2023 SEMICONDUCTOR CHIP APPLICATIONS

- FIGURE 3.5: GLOBAL LIGHT VEHICLE UNIT SALES (IN MILLIONS OF UNITS)

- FIGURE 3.6: ELECTRIFICATION TREND BY WORLD REGION

- FIGURE 3.7: AUTOMOTIVE SEMICONDUCTOR PRODUCTION

- FIGURE 3.8: MOBILE PHONE SHIPMENTS, WW ESTIMATES

- FIGURE 3.9: WORLDWIDE PC AND TABLET FORECAST

- FIGURE 3.10: TSMC PHOENIX CAMPUS WITH THE 2ND FAB VISIBLE IN THE BACKGROUND

- FIGURE 3.11: ESTIMATED GLOBAL FAB SPENDING 2023-2028

- FIGURE 3.12: FAB EXPANSIONS WITHIN THE US

- FIGURE 3.13: SEMICONDUCTOR CHIP MANUFACTURING REGIONS OF THE WORLD

- FIGURE 3.14: GLOBAL TOTAL EQUIPMENT SPENDING (US$ M) AND Y-O-Y CHANGE

- FIGURE 3.15: ADVANCED LOGIC DEVICE TECHNOLOGY ROADMAP OVERVIEW

- FIGURE 3.16: DRAM TECHNOLOGY ROADMAP OVERVIEW

- FIGURE 3.17: 3D NAND TECHNOLOGY ROADMAP OVERVIEW

- FIGURE 3.18: INTEL OHIO PLANT SITE AS OF FEB. 2024

- FIGURE 3.19: TECHCET WAFER START FORECAST BY NODE SEGMENTS

- FIGURE 3.20: TECHCET WORLDWIDE MATERIALS FORECAST ($M USD)

- FIGURE 4.1: WET CHEMICALS AND SPECIALTY CLEANS SHIPMENT FORECAST BY SEGMENT

- FIGURE 4.2: WET CHEMICALS AND SPECIALTY CLEANS REVENUE FORECAST BY SEGMENT

- FIGURE 4.3: H2SO4 VOLUME FORECAST

- FIGURE 4.4: H2SO4 REVENUE FORECAST

- FIGURE 4.5: H2O2 VOLUME FORECAST

- FIGURE 4.6: H2O2 REVENUE FORECAST

- FIGURE 4.7: H3PO4 VOLUME FORECAST

- FIGURE 4.8: H3PO4 REVENUE FORECAST

- FIGURE 4.9: NH4OH VOLUME FORECAST

- FIGURE 4.10: NH4OH REVENUE FORECAST

- FIGURE 4.11: IPA VOLUME FORECAST

- FIGURE 4.12: IPA REVENUE FORECAST

- FIGURE 4.13: HF VOLUME FORECAST

- FIGURE 4.14: HF REVENUE FORECAST

- FIGURE 4.15: HCL VOLUME FORECAST

- FIGURE 4.16: HCL REVENUE FORECAST

- FIGURE 4.17: HNO3 VOLUME FORECAST

- FIGURE 4.18: HNO3 REVENUE FORECAST

- FIGURE 4.19: AL PERR VOLUME FORECAST

- FIGURE 4.20: AL PERR REVENUE FORECAST

- FIGURE 4.21: CU PERR VOLUME FORECAST

- FIGURE 4.22: CU PERR REVENUE FORECAST

- FIGURE 4.23: PCMP REVENUE FORECAST

- FIGURE 4.24: SELECTIVE ISOTROPIC SIGE ETCH

- FIGURE 4.25: CMP PROCESSES IN FEOL, MOL, BEOL

- FIGURE 4.26: 4NM METALLIZATION STACK EMPLOYING W, CU, TA, CO

- FIGURE 4.27: PHOTORESIST PATTERN COLLAPSE

- FIGURE 4.28: 2023 WET CHEMICALS AND SPECIALTY CLEANS REVENUE SHARE ESTIMATE BY REGION

- FIGURE 5.1: 2023 SPECIALTY CLEANS SUPPLIER MARKET SHARE BY REVENUE

- FIGURE 6.1: MATERIAL DEMAND SEMICONDUCTOR VS. GLOBAL

- FIGURE 6.2: ENERGY COST TRENDS (NATURAL GAS AND CRUDE OIL REPORTED BY ST. LOUIS FED 5/2024)

- FIGURE 6.3: FLUORSPAR PRICING

- FIGURE 6.4: PROPYLENE PRICING

LIST OF TABLES

- TABLE 1.1: WET CHEMICALS AND SPECIALTY CLEANS GROWTH OVERVIEW

- TABLE 3.1: GLOBAL GDP AND SEMICONDUCTOR REVENUES

- TABLE 3.2: WORLD BANK ECONOMIC OUTLOOK (JANUARY 2024)

- TABLE 3.3: BATTERY ELECTRIC VEHICLE (BEV) REGIONAL TRENDS

- TABLE 3.4: DATA CENTER SYSTEMS AND COMMUNICATION SERVICES MARKET SPENDING 2023

- TABLE 4.1: WET CHEMICALS AND SPECIALTY CLEANS LEADING SUPPLIER MANUFACTURING LOCATIONS

- TABLE 4.2: OVERVIEW OF ANNOUNCED 2023/2024 WET CHEMICALS AND SPECIALTY CLEANS SUPPLIER INVESTMENTS

- TABLE 4.3: OVERVIEW OF ANNOUNCED 2023/2024 WET CHEMICALSAND SPECIALTY CLEANS SUPPLIER INVESTMENTS, CONTINUED

- TABLE 4.4: REGIONAL WET CHEMICALS AND SPECIALTY CLEANS MARKETS

- TABLE 4.5: REGIONAL WET CHEMICALS AND SPECIALTY CLEANS MARKETS, CONTINUED

- TABLE 5.1: 2023 TIER 1 WET CHEMICALS SUPPLIER BREADTH OF OFFERINGS

- TABLE 6.1: SUB-TIER SUPPLIERS

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.