Need help finding what you are looking for?

Contact Us

PUBLISHER: TECHCET | PRODUCT CODE: 1498832

PUBLISHER: TECHCET | PRODUCT CODE: 1498832

Dielectric Precursors Market Report 2024-2025 (Critical Materials Report)

PUBLISHED:

PAGES: 134 Pages

DELIVERY TIME: 1-2 business days

SELECT AN OPTION

This report covers the market landscape and supply-chain for Precursors used in semiconductor device fabrication. It includes information about key suppliers, issues/trends in the material supply chain, estimates on supplier market share, and forecast for the material segments.

SAMPLE VIEW

Table of Contents

1 Executive Summary

- 1.1 PRECURSORS BUSINESS - MARKET OVERVIEW

- 1.2 PRECURSORS MARKET TRENDS IMPACTING 2024 OUTLOOK

- 1.3 5-YEAR UNIT SHIPMENT FORECAST BY SEGMENT: DIELECTRIC PRECURSORS

- 1.4 PRECURSOR TRENDS

- 1.5 PRECURSOR TECHNOLOGY TRENDS

- 1.6 COMPETITIVE LANDSCAPE DIELECTRIC PRECURSORS

- 1.7 ANALYST ASSESSMENT OF DIELECTRIC PRECURSORS

2 Scope, Purpose, and Methodology

- 2.1 SCOPE

- 2.2 METHODOLOGY

- 2.3 OVERVIEW OF OTHER TECHCET CMR(TM) OFFERINGS

3 Semiconductor Industry Market Status & Outlook

- 3.1 WORLDWIDE ECONOMY AND OUTLOOK

- 3.1.1 SEMICONDUCTOR INDUSTRIES TIES TO THE GLOBAL ECONOMY

- 3.1.2 SEMICONDUCTOR SALES GROWTH

- 3.1.3 TAIWAN OUTSOURCE MANUFACTURER MONTHLY SALES TRENDS

- 3.2 CHIPS SALES BY ELECTRONIC GOODS SEGMENT

- 3.2.1 ELECTRONICS OUTLOOK

- 3.2.2 AUTOMOTIVE INDUSTRY OUTLOOK

- 3.2.2.1 ELECTRIC VEHICLE (EV) MARKET TRENDS

- 3.2.2.2 INCREASE IN SEMICONDUCTOR CONTENT FOR AUTOS

- 3.2.3 SMARTPHONE OUTLOOK

- 3.2.4 PC OUTLOOK

- 3.2.5 SERVERS / IT MARKET

- 3.3 SEMICONDUCTOR FABRICATION GROWTH - EXPANSION

- 3.3.1 IN THE MIDST OF HUGE INVESTMENT IN CHIP EXPANSIONS

- 3.3.2 NEW FABS IN THE US

- 3.3.3 WW FAB EXPANSION DRIVING GROWTH

- 3.3.4 EQUIPMENT SPENDING TRENDS

- 3.3.5 ADVANCED LOGIC TECHNOLOGY ROADMAPS

- 3.3.5.1 DRAM TECHNOLOGY ROADMAPS

- 3.3.5.2 3D NAND TECHNOLOGY ROADMAPS

- 3.3.6 FAB INVESTMENT ASSESSMENT

- 3.4 POLICY & TRADE TRENDS AND IMPACT

- 3.5 SEMICONDUCTOR MATERIALS OVERVIEW

- 3.5.1 TECHCET WAFER STARTS FORECAST THROUGH 2028

- 3.5.2 TECHCET MATERIALS MARKET FORECAST THROUGH 2028

4 Material Market Trends

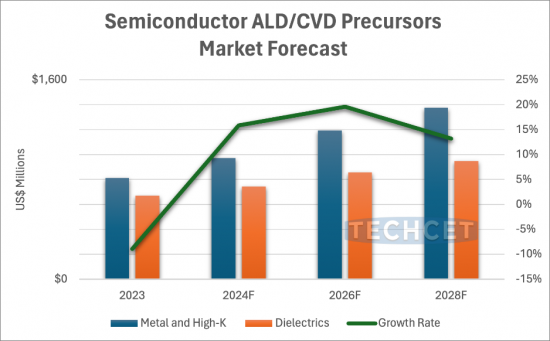

- 4.1 CVD, ALD METAL - HIGH-K AND ADVANCED DIELECTRIC PRECURSORS MARKET TRENDS

- 4.1.1 2023 PRECURSOR MARKET LEADING INTO 2024

- 4.1.2 PRECURSOR MARKET OUTLOOK

- 4.1.3 DIELECTRIC PRECURSORS 5-YEAR UNIT SHIPMENT FORECAST BY SEGMENT

- 4.1.4 DIELECTRIC PRODUCTION OF TOP SUPPLIERS

- 4.1.5 DIELECTRIC PRODUCTION BY REGION

- 4.1.6 ALD/CVD MATERIAL PRODUCTION CAPACITY EXPANSIONS

- 4.1.7 INVESTMENT ANNOUNCEMENTS OVERVIEW

- 4.2 PRICING TRENDS

- 4.3 TECHNOLOGY TRENDS/TECHNICAL DRIVERS - OUTLINE

- 4.3.1 PRECURSOR GENERAL TECHNOLOGY OVERVIEW - TECHNOLOGY TRENDS

- 4.3.2 CUSTOMER DRIVEN TECHNOLOGIES

- 4.3.3 NAND ROADMAPS AND CHALLENGES - 3D NAND LEVELS W/ STACKS/TIERS

- 4.3.4 3D NAND PROCESS ADVANCES REQUIRED

- 4.3.5 MICRON UNVEILS BREAKTHROUGH NVDRAM: A DUAL-LAYER 32GBIT NON-VOLATILEFERROELECTRIC MEMORY WITH NEAR-DRAM PERFORMANCE

- 4.3.6 ADVANCED LOGIC ROADMAPS AND CHALLENGES - LOGIC TRANSISTOR EST. ROADMAP

- 4.3.7 ADVANCED LOGIC (FOUNDRY) NODE HVM ESTIMATE

- 4.3.7.1 THE SEMICONDUCTOR SHOWDOWN: SAMSUNG AND TSMC'S GAA FETS VS. INTEL'S RIBBONFET

- 4.3.8 ADV LOGIC FUTURE TECHNOLOGY CHALLENGES

- 4.3.9 ADVANCING TECHNOLOGIES IMPLICATION TO PHOTOLITHOGRAPHY

- 4.3.9.1 ADVANCING TECHNOLOGIES IMPLICATION TO PHOTOLITHOGRAPHY - DSA

- 4.3.9.2 ADVANCING TECHNOLOGIES IMPLICATION TO PHOTOLITHOGRAPHY: CENTURA SCULPTA BY APPLIED MATERIALS: SHAPING THE FUTURE OF SEMICONDUCTOR MANUFACTURING

- 4.3.9.3 ADVANCING TECHNOLOGIES IMPLICATION TO PHOTOLITHOGRAPHY: LINE EDGE ROUGHNESS REDUCTION THRU DEPOSITION

- 4.3.10 CFET ARCHITECTURE: CFET SCALING ADVANTAGE

- 4.3.10.1 CFET ARCHITECTURE: COMPLEMENTARY FETS (CFETS)

- 4.3.10.2 CFET ARCHITECTURE: CFET FUTURE PROSPECTS

- 4.3.11 INORGANIC EUV RESIST - SPIN ON DEPOSITION

- 4.3.11.1 INORGANIC EUV RESIST - ALD DEPOSITED

- 4.3.12 SELF ALIGNED MULTI PATTERNING - SADP

- 4.3.12.1 SELF ALIGNED MULTI PATTERNING - SAQP

- 4.3.12.2 SELF ALIGNED MULTI PATTERNING - PEALD EQUIPMENT

- 4.3.12.3 SELF ALIGNED MULTI PATTERNING - CAN SAQP BYPASS EUV BEYOND 7 NM?

- 4.3.13 EUV, MULTI PATTERNING AND GEOPOLITICS

- 4.3.14 AREA SELECTIVE DEPOSITION (ASD)

- 4.3.14.1 AREA SELECTIVE DEPOSITION (ASD) - TU EINDHOVEN SELECTIVE ALD ENABLED BY PLASMA PRETREATMENT

- 4.3.15 SPECIALTY/EMERGING DIELECTRIC AND APPLICATIONS

- 4.3.16 REGIONAL CONSIDERATIONS - DIELECTRICS

- 4.3.17 REGIONAL ASPECTS AND DRIVERS

- 4.4 EHS AND TRADE/LOGISTIC ISSUES - METALS, HIGH-K AND DIELECTRICS

- 4.5 ANALYST ASSESSMENT OF DIELECTRIC MARKET TRENDS

5 Supply-Side Market Landscape

- 5.1 PRECURSOR MATERIAL MARKET SHARE

- 5.1.1 CURRENT QUARTER ACTIVITY - MERCK

- 5.1.1.1 MERCK

- 5.1.2 CURRENT QUARTER ACTIVITY - AIR LIQUIDE

- 5.1.2.1 AIR LIQUIDE

- 5.1.3 CURRENT QUARTER ACTIVITY -ENTEGRIS

- 5.1.3.1 ENTEGRIS

- 5.1.4 ADEKA

- 5.1.4.1 ADEKA

- 5.1.1 CURRENT QUARTER ACTIVITY - MERCK

- 5.2 M-A ACTIVITY AND PARTNERSHIPS

- 5.3 PLANT CLOSURES

- 5.4 NEW ENTRANTS

- 5.4.1 MSP LAUNCHES TURBO II(TM) VAPORIZERS: NEXT-GEN EFFICIENCY FOR SEMICONDUCTOR FABRICATION

- 5.5 SUPPLIERS OR PARTS/PRODUCT LINES THAT ARE AT RISK OF DISCONTINUATIONS

- 5.6 TECHCET ANALYST ASSESSMENT OF PRECURSOR SUPPLIERS

6 Sub Tier Supply Chain, Precursors

- 6.1 SUB-TIER SUPPLY CHAIN: SOURCES & MARKETS OVERVIEW

- 6.1.1 SUB-TIER SUPPLY CHAIN: SOURCES & MARKETS OVERVIEW - TIER 2 EXAMPLES NOURYON AND GELEST

- 6.1.2 SUB-TIER SUPPLY CHAIN: SOURCES & MARKETS OVERVIEW - CHEMICAL & GAS MANAGEMENT SYSTEMS

- 6.1.3 SUB-TIER SUPPLY CHAIN: SOURCES & MARKETS OVERVIEW - CHEMICAL DELIVERY CABINETS

- 6.1.4 SUB-TIER SUPPLY CHAIN: SOURCES & MARKETS OVERVIEW - VALVE MANIFOLD BOXES (VMB)

- 6.1.5 SUB-TIER SUPPLY CHAIN: SOURCES & MARKETS OVERVIEW - BULK SPEC GAS SYSTEMS

- 6.1.6 SUB-TIER SUPPLY CHAIN: SOURCES & MARKETS OVERVIEW - GAS CABINETS

- 6.1.7 SUB-TIER SUPPLY CHAIN: SOURCES & MARKETS OVERVIEW - FORMING GAS & DOPANT GAS BLENDERS

- 6.1.8 SUB-TIER SUPPLY CHAIN: SOURCES & MARKETS OVERVIEW CHEMICAL - MONITORING AND ANALYTICAL SYSTEMS

- 6.2 SUB-TIER MATERIAL CVD - ALD PRECURSOR TRENDS

- 6.3 SUB-TIER MATERIAL INDUSTRIAL VS. SEMICONDUCTOR-GRADE

- 6.4 SEMICONDUCTOR-GRADE SUB-TIER MATERIAL SUPPLIER GLOBAL NETWORK MERCK

- 6.5 SEMICONDUCTOR-GRADE SUB-TIER MATERIAL SUPPLIER GLOBAL NETWORK AIR LIQUIDE

- 6.6 SEMICONDUCTOR-GRADE SUB-TIER MATERIAL SUPPLIER NEWS

- 6.7 SUB-TIER SUPPLY-CHAIN DISRUPTORS

- 6.8 SUB-TIER SUPPLY-CHAIN TECHCET ANALYST ASSESSMENT

7 Supplier profiles

- ADEKA CORPORATION

- AIR LIQUIDE (MAKER, PURIFIER, SUPPLIER)

- AZMAX CO., LTD

- CITY CHEMICAL LLC

- DNF CO., LTD

- ...and 20+ more

Table of Contents

1 Executive Summary

- 1.1 PRECURSORS BUSINESS - MARKET OVERVIEW

- 1.2 PRECURSORS MARKET TRENDS IMPACTING 2024 OUTLOOK

- 1.3 5-YEAR UNIT SHIPMENT FORECAST BY SEGMENT: DIELECTRIC PRECURSORS

- 1.4 PRECURSOR TRENDS

- 1.5 PRECURSOR TECHNOLOGY TRENDS

- 1.6 COMPETITIVE LANDSCAPE DIELECTRIC PRECURSORS

- 1.7 ANALYST ASSESSMENT OF DIELECTRIC PRECURSORS

2 Scope, Purpose, and Methodology

- 2.1 SCOPE

- 2.2 METHODOLOGY

- 2.3 OVERVIEW OF OTHER TECHCET CMR(TM) OFFERINGS

3 Semiconductor Industry Market Status & Outlook

- 3.1 WORLDWIDE ECONOMY AND OUTLOOK

- 3.1.1 SEMICONDUCTOR INDUSTRIES TIES TO THE GLOBAL ECONOMY

- 3.1.2 SEMICONDUCTOR SALES GROWTH

- 3.1.3 TAIWAN OUTSOURCE MANUFACTURER MONTHLY SALES TRENDS

- 3.2 CHIPS SALES BY ELECTRONIC GOODS SEGMENT

- 3.2.1 ELECTRONICS OUTLOOK

- 3.2.2 AUTOMOTIVE INDUSTRY OUTLOOK

- 3.2.2.1 ELECTRIC VEHICLE (EV) MARKET TRENDS

- 3.2.2.2 INCREASE IN SEMICONDUCTOR CONTENT FOR AUTOS

- 3.2.3 SMARTPHONE OUTLOOK

- 3.2.4 PC OUTLOOK

- 3.2.5 SERVERS / IT MARKET

- 3.3 SEMICONDUCTOR FABRICATION GROWTH - EXPANSION

- 3.3.1 IN THE MIDST OF HUGE INVESTMENT IN CHIP EXPANSIONS

- 3.3.2 NEW FABS IN THE US

- 3.3.3 WW FAB EXPANSION DRIVING GROWTH

- 3.3.4 EQUIPMENT SPENDING TRENDS

- 3.3.5 ADVANCED LOGIC TECHNOLOGY ROADMAPS

- 3.3.5.1 DRAM TECHNOLOGY ROADMAPS

- 3.3.5.2 3D NAND TECHNOLOGY ROADMAPS

- 3.3.6 FAB INVESTMENT ASSESSMENT

- 3.4 POLICY & TRADE TRENDS AND IMPACT

- 3.5 SEMICONDUCTOR MATERIALS OVERVIEW

- 3.5.1 TECHCET WAFER STARTS FORECAST THROUGH 2028

- 3.5.2 TECHCET MATERIALS MARKET FORECAST THROUGH 2028

4 Material Market Trends

- 4.1 CVD, ALD METAL - HIGH-K AND ADVANCED DIELECTRIC PRECURSORS MARKET TRENDS

- 4.1.1 2023 PRECURSOR MARKET LEADING INTO 2024

- 4.1.2 PRECURSOR MARKET OUTLOOK

- 4.1.3 DIELECTRIC PRECURSORS 5-YEAR UNIT SHIPMENT FORECAST BY SEGMENT

- 4.1.4 DIELECTRIC PRODUCTION OF TOP SUPPLIERS

- 4.1.5 DIELECTRIC PRODUCTION BY REGION

- 4.1.6 ALD/CVD MATERIAL PRODUCTION CAPACITY EXPANSIONS

- 4.1.7 INVESTMENT ANNOUNCEMENTS OVERVIEW

- 4.2 PRICING TRENDS

- 4.3 TECHNOLOGY TRENDS/TECHNICAL DRIVERS - OUTLINE

- 4.3.1 PRECURSOR GENERAL TECHNOLOGY OVERVIEW - TECHNOLOGY TRENDS

- 4.3.2 CUSTOMER DRIVEN TECHNOLOGIES

- 4.3.3 NAND ROADMAPS AND CHALLENGES - 3D NAND LEVELS W/ STACKS/TIERS

- 4.3.4 3D NAND PROCESS ADVANCES REQUIRED

- 4.3.5 MICRON UNVEILS BREAKTHROUGH NVDRAM: A DUAL-LAYER 32GBIT NON-VOLATILEFERROELECTRIC MEMORY WITH NEAR-DRAM PERFORMANCE

- 4.3.6 ADVANCED LOGIC ROADMAPS AND CHALLENGES - LOGIC TRANSISTOR EST. ROADMAP

- 4.3.7 ADVANCED LOGIC (FOUNDRY) NODE HVM ESTIMATE

- 4.3.7.1 THE SEMICONDUCTOR SHOWDOWN: SAMSUNG AND TSMC'S GAA FETS VS. INTEL'S RIBBONFET

- 4.3.8 ADV LOGIC FUTURE TECHNOLOGY CHALLENGES

- 4.3.9 ADVANCING TECHNOLOGIES IMPLICATION TO PHOTOLITHOGRAPHY

- 4.3.9.1 ADVANCING TECHNOLOGIES IMPLICATION TO PHOTOLITHOGRAPHY - DSA

- 4.3.9.2 ADVANCING TECHNOLOGIES IMPLICATION TO PHOTOLITHOGRAPHY: CENTURA SCULPTA BY APPLIED MATERIALS: SHAPING THE FUTURE OF SEMICONDUCTOR MANUFACTURING

- 4.3.9.3 ADVANCING TECHNOLOGIES IMPLICATION TO PHOTOLITHOGRAPHY: LINE EDGE ROUGHNESS REDUCTION THRU DEPOSITION

- 4.3.10 CFET ARCHITECTURE: CFET SCALING ADVANTAGE

- 4.3.10.1 CFET ARCHITECTURE: COMPLEMENTARY FETS (CFETS)

- 4.3.10.2 CFET ARCHITECTURE: CFET FUTURE PROSPECTS

- 4.3.11 INORGANIC EUV RESIST - SPIN ON DEPOSITION

- 4.3.11.1 INORGANIC EUV RESIST - ALD DEPOSITED

- 4.3.12 SELF ALIGNED MULTI PATTERNING - SADP

- 4.3.12.1 SELF ALIGNED MULTI PATTERNING - SAQP

- 4.3.12.2 SELF ALIGNED MULTI PATTERNING - PEALD EQUIPMENT

- 4.3.12.3 SELF ALIGNED MULTI PATTERNING - CAN SAQP BYPASS EUV BEYOND 7 NM?

- 4.3.13 EUV, MULTI PATTERNING AND GEOPOLITICS

- 4.3.14 AREA SELECTIVE DEPOSITION (ASD)

- 4.3.14.1 AREA SELECTIVE DEPOSITION (ASD) - TU EINDHOVEN SELECTIVE ALD ENABLED BY PLASMA PRETREATMENT

- 4.3.15 SPECIALTY/EMERGING DIELECTRIC AND APPLICATIONS

- 4.3.16 REGIONAL CONSIDERATIONS - DIELECTRICS

- 4.3.17 REGIONAL ASPECTS AND DRIVERS

- 4.4 EHS AND TRADE/LOGISTIC ISSUES - METALS, HIGH-K AND DIELECTRICS

- 4.5 ANALYST ASSESSMENT OF DIELECTRIC MARKET TRENDS

5 Supply-Side Market Landscape

- 5.1 PRECURSOR MATERIAL MARKET SHARE

- 5.1.1 CURRENT QUARTER ACTIVITY - MERCK

- 5.1.1.1 MERCK

- 5.1.2 CURRENT QUARTER ACTIVITY - AIR LIQUIDE

- 5.1.2.1 AIR LIQUIDE

- 5.1.3 CURRENT QUARTER ACTIVITY -ENTEGRIS

- 5.1.3.1 ENTEGRIS

- 5.1.4 ADEKA

- 5.1.4.1 ADEKA

- 5.1.1 CURRENT QUARTER ACTIVITY - MERCK

- 5.2 M-A ACTIVITY AND PARTNERSHIPS

- 5.3 PLANT CLOSURES

- 5.4 NEW ENTRANTS

- 5.4.1 MSP LAUNCHES TURBO II(TM) VAPORIZERS: NEXT-GEN EFFICIENCY FOR SEMICONDUCTOR FABRICATION

- 5.5 SUPPLIERS OR PARTS/PRODUCT LINES THAT ARE AT RISK OF DISCONTINUATIONS

- 5.6 TECHCET ANALYST ASSESSMENT OF PRECURSOR SUPPLIERS

6 Sub Tier Supply Chain, Precursors

- 6.1 SUB-TIER SUPPLY CHAIN: SOURCES & MARKETS OVERVIEW

- 6.1.1 SUB-TIER SUPPLY CHAIN: SOURCES & MARKETS OVERVIEW - TIER 2 EXAMPLES NOURYON AND GELEST

- 6.1.2 SUB-TIER SUPPLY CHAIN: SOURCES & MARKETS OVERVIEW - CHEMICAL & GAS MANAGEMENT SYSTEMS

- 6.1.3 SUB-TIER SUPPLY CHAIN: SOURCES & MARKETS OVERVIEW - CHEMICAL DELIVERY CABINETS

- 6.1.4 SUB-TIER SUPPLY CHAIN: SOURCES & MARKETS OVERVIEW - VALVE MANIFOLD BOXES (VMB)

- 6.1.5 SUB-TIER SUPPLY CHAIN: SOURCES & MARKETS OVERVIEW - BULK SPEC GAS SYSTEMS

- 6.1.6 SUB-TIER SUPPLY CHAIN: SOURCES & MARKETS OVERVIEW - GAS CABINETS

- 6.1.7 SUB-TIER SUPPLY CHAIN: SOURCES & MARKETS OVERVIEW - FORMING GAS & DOPANT GAS BLENDERS

- 6.1.8 SUB-TIER SUPPLY CHAIN: SOURCES & MARKETS OVERVIEW CHEMICAL - MONITORING AND ANALYTICAL SYSTEMS

- 6.2 SUB-TIER MATERIAL CVD - ALD PRECURSOR TRENDS

- 6.3 SUB-TIER MATERIAL INDUSTRIAL VS. SEMICONDUCTOR-GRADE

- 6.4 SEMICONDUCTOR-GRADE SUB-TIER MATERIAL SUPPLIER GLOBAL NETWORK MERCK

- 6.5 SEMICONDUCTOR-GRADE SUB-TIER MATERIAL SUPPLIER GLOBAL NETWORK AIR LIQUIDE

- 6.6 SEMICONDUCTOR-GRADE SUB-TIER MATERIAL SUPPLIER NEWS

- 6.7 SUB-TIER SUPPLY-CHAIN DISRUPTORS

- 6.8 SUB-TIER SUPPLY-CHAIN TECHCET ANALYST ASSESSMENT

7 Supplier profiles

- ADEKA CORPORATION

- AIR LIQUIDE (MAKER, PURIFIER, SUPPLIER)

- AZMAX CO., LTD

- CITY CHEMICAL LLC

- DNF CO., LTD

- ...and 20+ more

LIST OF FIGURES

- FIGURE 1.1: DIELECTRIC PRECURSOR REVENUE (M USD) FORECAST BY SEGMENT

- FIGURE 1.2: WW MARKET SHARE - DIELECTRIC PRECURSORS 2023

- FIGURE 3.1: GLOBAL ECONOMY AND THE ELECTRONICS SUPPLY CHAIN (2023)

- FIGURE 3.2: WORLDWIDE SEMICONDUCTOR SALES

- FIGURE 3.3: TECHCET'S TAIWAN SEMICONDUCTOR INDUSTRY INDEX (TTSI)

- FIGURE 3.4: 2023 SEMICONDUCTOR CHIP APPLICATIONS

- FIGURE 3.5: GLOBAL LIGHT VEHICLE UNIT SALES (IN MILLIONS OF UNITS)

- FIGURE 3.6: ELECTRIFICATION TREND BY WORLD REGION

- FIGURE 3.7: AUTOMOTIVE SEMICONDUCTOR PRODUCTION

- FIGURE 3.8: MOBILE PHONE SHIPMENTS, WW ESTIMATES

- FIGURE 3.9: WORLDWIDE PC AND TABLET FORECAST

- FIGURE 3.10: TSMC PHOENIX CAMPUS WITH THE 2ND FAB VISIBLE IN THE BACKGROUND

- FIGURE 3.11: ESTIMATED GLOBAL FAB SPENDING 2023-2028

- FIGURE 3.12: FAB EXPANSIONS WITHIN THE US

- FIGURE 3.13: SEMICONDUCTOR CHIP MANUFACTURING REGIONS OF THE WORLD

- FIGURE 3.14: GLOBAL TOTAL EQUIPMENT SPENDING (US$ M) AND Y-O-Y CHANGE

- FIGURE 3.15: ADVANCED LOGIC DEVICE TECHNOLOGY ROADMAP OVERVIEW

- FIGURE 3.16: DRAM TECHNOLOGY ROADMAP OVERVIEW

- FIGURE 3.17: 3D NAND TECHNOLOGY ROADMAP OVERVIEW

- FIGURE 3.18: INTEL OHIO PLANT SITE AS OF FEB. 2024

- FIGURE 3.19: TECHCET WAFER START FORECAST BY NODE SEGMENTS

- FIGURE 3.20: TECHCET WORLDWIDE MATERIALS FORECAST ($M USD)

- FIGURE 4.1: DIELECTRIC PRECURSOR REVENUE (M USD) FORECAST BY SEGMENT

- FIGURE 4.2: WW MARKET SHARE - DIELECTRIC PRECURSORS 2023

- FIGURE 4.3: DIELECTRIC PRECURSOR MARKET REGIONAL ASSESSMENT 2023

- FIGURE 4.4: END USE APPLICATIONS DRIVING NEW DEVICE PROCESSES

- FIGURE 4.5: 3D NAND STACKING DRIVES DIELECTRICS AND METALS PRECURSOR VOLUME

- FIGURE 4.6: 3D NAND PROGRESSION

- FIGURE 4.7: 32 GB NVDRAM WITH 1T 1C MEMORY LAYERS

- FIGURE 4.8: GATE STRUCTURE ROADMAP

- FIGURE 4.9: ADVANCED LOGIC (FOUNDRY) NODE ROAD MAP

- FIGURE 4.10: RIBBON FET

- FIGURE 4.11: MONO LAYER NANO SHEETS CHANNELS

- FIGURE 4.12: NANO IMPRINT LITHOGRAPHY PROCESS FLOW

- FIGURE 4.13: ALD/ALE ENHANCEMENT OF NANO IMPRINT LITHOGRAPHY

- FIGURE 4.14: DIRECTED SELF-ASSEMBLY

- FIGURE 4.15: DSA PATENT FILING BY COMPANY

- FIGURE 4.16: DSA PATEN FILING SINCE 2023

- FIGURE 4.17: WHAT IS PATTERN SHAPING?

- FIGURE 4.18: REFINING EUV PATTERNING BY APPLIED MATERIALS

- FIGURE 4.19: COMPLEMENTARY FET (CFET)

- FIGURE 4.20: CFET IMPROVES PERFORMANCE IN TRACK SCALING

- FIGURE 4.21: MONOLITHIC CFET PROCESS FLOW EXAMPLE

- FIGURE 4.22: MCFET NEW FEATURE: MIDDLE DIELECTRIC ISOLATION

- FIGURE 4.23: LOW TEMPERATURE GATE STACK OPTION EXAMPLES

- FIGURE 4.24: LOW TEMPERATURE SD/CONTACT OPTION EXAMPLES

- FIGURE 4.25: BSPDN ADVANTAGE: IR DROP REDUCTION

- FIGURE 4.26: INCREASING NUMBER OF ALD STEPS REQUIRED BY NEXT GENERATION GAA-FET AND CFET

- FIGURE 4.27: IMEC SUB-1NM TRANSISTOR ROADMAP, 3D-STACKED CMOS 2.0 PLANS

- FIGURE 4.28: INPRIA EUV MOR

- FIGURE 4.29: INPRIA SPIN ON INORGANIC RESIST IS MUCH THINNER THAN STANDARD STACKS OF PHOTO RESIST

- FIGURE 4.30: PATENT FILING FOR MLD DEPOSITED EUV RESIST SEARCH PERFORMED IN PATBASE

- FIGURE 4.31: SADP PROCESS FLOW USING ALD SPACER

- FIGURE 4.32: ONE OF MANY FLAVORS OF SAQP PROCESS FLOW

- FIGURE 4.33: SELECTIVE ALD ENABLED BY PLASMA PRETREATMENT

- FIGURE 4.34: SPECIALTY/EMERGING DIELECTRIC APPLICATIONS FOR HETEROGENOUS INTEGRATIONS (APPLIED MATERIALS)

- FIGURE 4.35: 2023 DIELECTRIC REVENUE SHARE BY REGION

- FIGURE 5.1: 2023 PRECURSOR MATERIAL SUPPLIER MARKET SHARE BY REVENUE

- FIGURE 5.2: MERCK ELECTRONICS REVENUE 2022-2023 (M EUR), LEFT - SEMICONDUCTOR SOLUTIONS ANNUAL REVENUE FORECAST (M EUR), RIGHT

- FIGURE 5.3: AIR LIQUIDE ELECTRONICS REVENUE FORECAST (M EUR)

- FIGURE 5.4: THE MS (MATERIAL SOLUTIONS) DIVISION OF ENTEGRIS REVENUE FORECAST

- FIGURE 5.5: ADEKA REVENUE ELECTRONICS REVENUE FORECAST (100M JPY)

- FIGURE 6.1: FORMING GAS BLENDER CONFIGURATION

- FIGURE 6.2: TOP COUNTRIES/REGIONS THAT SUPPLY VERSUM MATERIALS US LLC (PANJIVA APRIL 2024)

- FIGURE 6.3: TOP COUNTRIES/REGIONS THAT SUPPLY AIR LIQUIDE AMERICA CORP. (PANJEIVA APRIL 2024)

- FIGURE 6.4: TOP COUNTRIES/REGIONS THAT SUPPLY H.C. STARCK INC. (USA)

LIST OF TABLES

- TABLE 1.1: DIELECTRIC PRECURSOR REVENUES AND GROWTH RATES

- TABLE 1.2: ESTIMATED DIELECTRIC PRECURSOR MARKET SHARE BY SUPPLIER 2023

- TABLE 3.1: GLOBAL GDP AND SEMICONDUCTOR REVENUES

- TABLE 3.2: WORLD BANK ECONOMIC OUTLOOK (JANUARY 2024)

- TABLE 3.3: BATTERY ELECTRIC VEHICLE (BEV) REGIONAL TRENDS

- TABLE 3.4: DATA CENTER SYSTEMS AND COMMUNICATION SERVICES MARKET SPENDING 2023

- TABLE 4.1: PRECURSORS REVENUE AND GROWTH RATES

- TABLE 4.2: DIELECTRIC PRECURSOR REVENUES AND GROWTH RATES

- TABLE 4.3: ESTIMATED DIELECTRIC PRECURSOR MARKET SHARE BY SUPPLIER 2023

- TABLE 4.4: DIELECTRIC PRECURSOR MARKET REGIONAL ASSESSMENT 2023

- TABLE 4.5: OVERVIEW OF ANNOUNCED 2023/2024 MATERIAL SUPPLIER INVESTMENTS

- TABLE 4.6: LEADING EDGE LOGIC DESCRIPTIONS BY NODE (TSMC, INTEL)

- TABLE 4.7: MULTIPATTERNING AT 7NM BY TSMC

- TABLE 4.8: SELECTIVE DEPOSITION - SELECTIVELY DEPOSITED MATERIALS

- TABLE 4.9: REGIONAL PRECURSOR MATERIAL MARKETS

- TABLE 4.10: REGIONAL PRECURSOR MATERIAL MARKETS, CONTINUED

- TABLE 5.1: MERCK QUARTER FINANCIALS

- TABLE 5.2: AIR LIQUIDE CURRENT QUARTER FINANCIALS

- TABLE 5.3: ENTEGRIS SUPPLIER CURRENT QUARTER FINANCIALS

- TABLE 6.1: CVD AND ALD PRECURSOR

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.