PUBLISHER: SNE Research | PRODUCT CODE: 1473268

PUBLISHER: SNE Research | PRODUCT CODE: 1473268

<2024> Semi-Solid Battery Technology: Development and Future Prospects

Major battery manufacturers and automotive OEMs are planning to mass-produce all-solid-state batteries. However, large-scale production of these batteries is expected to take 5-10 years. In the meantime, there's increasing interest in semi-solid-state batteries due to their potential safety, longevity, and cost advantages over conventional lithium-ion batteries (LiBs). This anticipation is driving many companies, especially in China, to announce mass production plans for semi-solid-state batteries.

Semi-solid-state batteries serve as a transitional product between liquid-state and solid-state batteries. They incorporate a portion of electrolyte within the battery to enhance the interface. Compared to liquid-state batteries, semi-solid-state batteries necessitate minimal alterations to the material system, utilize separators and liquid electrolytes, and can decrease the volume of liquid electrolyte present. This reduction can enhance battery energy density and safety. Moreover, the manufacturing processes for semi-solid-state batteries closely align with traditional lithium-ion battery techniques and equipment.

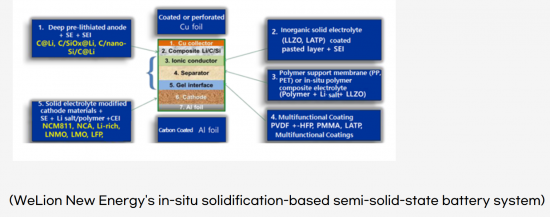

In semi-solid-state batteries, the addition of a liquid can enhance ion transport through the composite material without compromising electron transport, leading to improved electrochemical performance of the electrodes. This requires a low-resistance ion transport through the solid/liquid interface. Recent in-situ polymerization techniques have been employed to reduce the liquid content by solidifying the original liquid components of the semi-solid-state battery.

Organic-inorganic composite solid electrolytes, one of the most prevalent forms in semi-solid-state batteries, combine the advantages of both organic and inorganic solid electrolytes. These composite materials, typically consisting of oxide solid electrolytes and polymer electrolytes, exhibit exceptional tensile strength and mechanical properties, excellent processability, and adequate ion conductivity, making them suitable for large-scale production.

The development of semi-solid-state batteries is primarily being driven by Chinese companies, including CATL, WeLion, Qingtao Energy, Ganfeng Lithium, Guoxuan, Farasis, and Tailan. Additionally, LGES, Factorial Energy, SES, and ProLogium are also independently or collaboratively developing this technology with automotive OEMs.

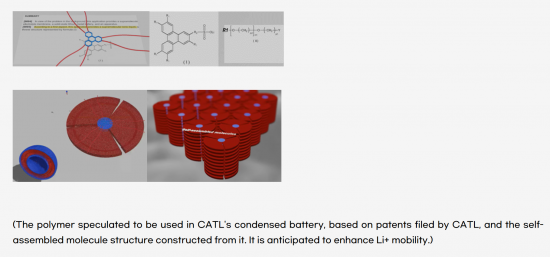

At the 2023 Shanghai Auto Show, CATL unveiled its highly anticipated Condensed Battery, grabbing industry attention. This groundbreaking technology utilizes a high-power bionic condensed electrolyte and features an adaptive micro-level network structure. These innovations enhance dynamic performance and lithium ion transport efficiency, resulting in an impressive cell energy density of 500 Wh/kg, surpassing conventional lithium-ion batteries. Moreover, CATL's innovation extends to stability and production capabilities, promising a reliable and scalable solution for electric vehicles in the future.

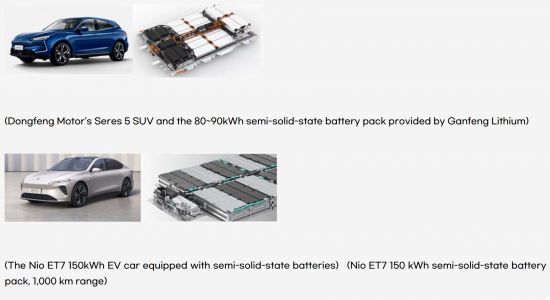

The application of solid-state batteries has already begun, and the NIO ET7 equipped with WeLion's 360Wh/kg semi-solid-state battery, boasting 150kWh, achieved a range of 1145km, surpassing conventional batteries. It's reported that mass production started in April 2024.

According to SNE Research, global solid-state battery production capacity is expected to reach approximately 168GWh by 2030 and 300GWh by 2035. In terms of overall battery market share, it is projected to peak at around 6.55% in 2033 from approximately 5.7% in 2030, before declining to 5.7% again by 2035 as solid-state batteries are widely adopted.

The strong points of this report are as follows.

- 1. Detailed coverage of recent trends surrounding semi-solid-state batteries

- 2. Detailed coverage of major battery manufacturers and automotive OEMs

- 3. Navigating the Competitive Landscape: Semi-Solid-State Batteries vs. Solid-State Batteries

- 4. The development history and current status of semi-solid-state batteries

- 5. Analysis of key patents related to semi-solid-state batteries

Table of Contents

1. Semi-Solid-State Battery Development Trends

- 1.1. Commercialization Challenges for All-Solid-State Batteries

- 1.1.1. Immaturity of All-Solid-State Battery Manufacturing

- 1.2. Semi-Solid-State Batteries: Impact on the Industrial Chain

- 1.2.1. Modifications to the Packaging Process: Intermediate and Rear Stages

- 1.2.2. Solid Electrolyte Film Formation Process

- 1.2.3. Innovation in Core Material Systems

- 1.2.3.1. Polymer Systems

- 1.2.3.2. Oxide Systems

- 1.2.3.3. Sulfide Systems

- 1.2.3.4. Costs

- 1.2.3.5. Electrolyte

- 1.2.3.6. Anode Material

- 1.2.3.7. Binders

- 1.2.3.8. Pre-lithiation

- 1.2.3.9. Separators

- 1.2.3.10. Dry Electrode Process (DBE)

- 1.2.3.11. Industrialization Status of Semi-Solid Batteries

- 1.2.3.12. Gel-Type Solid Electrolyte

- 1.3. Reducing the Cost of Semi-Solid-State Batteries

- 1.3.1. Using Lithium Metal Anodes

- 1.3.2. Need for Economies of Scale

- 1.4. Semi-Solid State Batteries: Key Advantages

2. Classification of Solid-State, Semi-Solid-State, and Hybrid Batteries

- 2.1. Types of Solid Electrolytes

- 2.2. Classification of Electrolyte Systems

- 2.3. Classification of Solid Electrolytes and Their Pros and Cons

- 2.4. Types of Hybrid Electrolyte

- 2.5~7. Properties of Hybrid Electrolyte

- 2.8. Hybrid Inorganic Polymer Composite Electrolyte (IPC)

- 2.9~10. Organic-Inorganic Hybrid Solid-State Electrolyte

3. Polymer/Inorganic Composite Electrolytes for Semi-Solid-State Batteries

- 3.1. Overview

- 3.2. Introduction

- 3.2.1. Lithium Ion Conductivity

- 3.2.2. Electrochemical Stability

- 3.2.3. Dendrite Suppression

- 3.2.4. Contact Stability

- 3.3. Polymer/Inorganic Composite Electrolyte Fillers

- 3.3.1. Components of Polymer/Inorganic Composite Electrolytes

- 3.3.2. Inert Fillers

- 3.3.2.1. Oxide Fillers

- 3.3.2.2. Ferroelectric Fillers

- 3.3.2.3. Porous fillers

- 3.3.2.4. Other Inert Fillers

- 3.3.3. Active Fillers

- 3.3.3.1. Garnet-Type Solid Electrolytes

- 3.3.3.2. NASICON-Type Solid Electrolytes

- 3.3.3.3. Perovskite-Type Solid Electrolytes

- 3.3.3.4. Sulfide-Type Solid Electrolyte

- 3.3.4. Synthesis of Polymeric/Inorganic Complex Electrolytes

- 3.4. Conclusion and Summary

4. In-Depth Analysis of All/Semi-Solid-State Batteries

- 4.1. All/Semi-Solid-State Battery Advantage (Energy Density)

- 4.2. All/Semi-Solid-State Battery Advantage (Safety)

- 4.3. Semi-Solid-State Batteries Disadvantage

- 4.4. Semi-Solid-State Battery Costs and Future Outlook

- 4.5. All/Semi-Solid-State Battery Policies by Country

- 4.6. All/Semi-Solid-State Battery Application Market

- 4.7. Semi-Solid-State Battery Application Trends

- 4.8. Oxide Solid Electrolyte Production Capacity by Company

5. Semi-Solid-State Batteries: The Optimal Solution for EVs?

- 5.1. Semi-Solid-State Batteries vs. Other Batteries

- 5.2. Semi-Solid-State Battery Industry Chains

- 5.2.1. Cathode/Anode Materials

- 5.2.2. Solid Electrolytes

- 5.2.3. EV Market

- 5.2.4. Market Analysis (Chinese Market)

6. Quasi-Solid Lithium Battery Development: Interlayer Application

- 6.1. Research Overview

- 6.2. The Role of the Interplayer

- 6.3. Integrating Ag-C Composites into LLZTO

- 6.3.1. Introducing Additional Layers

- 6.3.2. Enhancement of Ag Adhesion

- 6.4. Analysis of Lithium Metal Cell Characteristics

- 6.4.1. Electrochemical Cell

- 6.4.2. .Electrochemical Performance of LLZTO

- 6.4.3. Li-Ag-C/Ag/LLZTO/IL-LCO Cell

- 6.5. Conclusion and Discussion

7. Solid-State Battery Hybrid Interface (SLEI)

- 7.1. Definition of SLEI(Solid-Liquid Electrolyte Interphase)

- 7.2. Difference between LIBs and All-Solid-State Batteries

- 7.3. Hybrid Solid Electrolyte/Liquid Electrolyte(SE/LE) Systems

- 7.4. Similarities and differences between SLEI and SEI

- 7.5. Oxide-Based Hybrid System

- 7.6. Sulfide-Based Hybrid System

- 7.6.1. Research on Pristine Solvents

- 7.6.2. Electrochemical Performance for Liquid Electrolytes

8. High-Efficiency Li Metal Batteries with Quasi-Solid Electrolytes (Introduction of MOFs)

- 8.1. Research Overview

- 8.2. Fabrication of Quasi-Solid Electrolytes

- 8.2.1. CuBTC MOF as a Host Material

- 8.2.2. Physicochemical Properties of Quasi-Solid Electrolytes

- 8.2.3. Compatibility of Quasi-Solid Electrolytes with Electrodes

- 8.2.4. Electrochemical Performance of NCM-811//Li Pouch Cells

- 8.3. Conclusion

9. Li-S Batteries with Quasi-Solid Electrolytes

- 9.1. Li-S Battery Overveiw

- 9.2. Solid-State Li-S Batteries

- 9.2.1. Operating Principle

- 9.2.2. . Charge/Discharge Profile

- 9.2.3. Ion Conduction Mechanisms

- 9.2.4. Technical Issues

- 9.3. Electrolyte Material Design Strategies

- 9.4. Polymer Electrolyte Applications

- 9.4.1. Gel/Quasi-Solid Polymer Electrolyte

- 9.4.2. Solid-Polymer Electrolyte

- 9.5. Inorganic Solid Electrolyte

- 9.5.1. Sulfide Solid Electrolyte

- 9.5.2. Oxide Solid Electrolyte

- 9.6. Hybrid Electrolyte

- 9.6.1. Inorganic-Organic Composite Electrolyte

- 9.6.2. Inorganic Solid-Liquid Electrolyte

- 9.7. Conclusion and Outlook

10. Semi-Solid-State Battery Industry Trends

- 10.1. The State of Semi-Solid-State Batteries in China

- 10.2. .All-Solid-State Battery R&D in China

- 10.3. Each Company's Investment Status

- 10.4. Outlook on All(Semi)-Solid-State Batteries in China

- 10.5. Commercialization of Next-Generation Batteries

- 10.5.1. Limitations in Improving Current LiBs

- 10.5.2. Continued Development of Semi-Solid-State Batteries

- 10.5.3. Growing Recognition of Semi-Solid-State Batteries

- 10.5.4. Solid-State Battery Production from 2026

- 10.5.5. Japanese Companies Lagging Behind by 3-7 Years

- 10.5.6. Global Trends in Semi-Solid-State-Batteries

- 10.5.7. Trends in Cathode/Anode Material Development

- 10.5.8. Demodularization of the Battery Structure

- 10.5.9. Mass Production of Semi-Solid-State Batteries Initiated

11. Semi-Solid-State Battery Manufacturers and Operations

- 11.1. LGES

- 11.2. SK On

- 11.3. WeLion

- 11.4. BAK

- 11.5. CATL

- 11.6. NIO

- 11.7. KAERI(Korea)

- 11.8. ProLogium

- 11.9. SES

- 11.10. Factorial Energy

- 11.11. KIERKorea)

- 11.12. imec

- 11.13. Qingtao Energy

- 11.14. Ganfeng Lithium

- 11.15. Yiwei Lithium Energy (EVE)

- 11.16. Guoxuan Hi-Tech

- 11.17. Farasis Energy

- 11.18. SVOLT

- 11.19. SEMCORP

- 11.20. NGK

- 11.21. Kyocera

- 11.22. Talent New Energy

12. Semi-Solid State Battery Market Outlook

- 12.1. Current Status of Semi-Solid-State Battery Industry in China

- 12.2. History of Semi-Solid-State Battery Industry

- 12.3. Policies for China's Semi-Solid-State Battery

- 12.4. China's Semi-Solid-State Battery Demand Outlook for EVs

- 12.5. Market Penetration Rate of Semi-Solid-State Batteries in China

- 12.6. Global Semi-Solid-State Battery Market Outlook

13. Patent Analysis of Semi-Solid-State Batteries

- 13.1. Korea Institute of Energy Technology

- 13.2. Qingtao New Energy

- 13.3. LGES

- 13.4. Arkema

- 13.5. Global Graphene Group Inc.

- 13.6. WeLion New Energy

- 13.7. Ganfeng Lithium

- 13.8. Sion Power

- 13.9. Factorial Energy

- 13.10. StoreDot

- 13.11. SVOLT

References