PUBLISHER: SNE Research | PRODUCT CODE: 1374456

PUBLISHER: SNE Research | PRODUCT CODE: 1374456

<2023> Single Crystal (Single Particle) Cathode Technology Development Trend and Market Outlook

The mass production of single-crystal cathodes, poised to significantly enhance electric vehicle battery performance, is imminent, heralding an anticipated escalation in competition between Chinese and Korean companies.

In commercial electric vehicle batteries, the cathode materials currently employed consist of polycrystalline structures comprising multiple metal compound crystals. However, cracks often develop between these particles during the rolling process to achieve uniform thickness, as well as during charging and discharging. With repeated cycles, these cracks expand, resulting in material deterioration, increased gas generation within the battery, and a decline in charging/discharging cycles, ultimately diminishing battery longevity.

Single crystals, unlike their polycrystalline counterparts, are immune to this issue as their particles remain intact. Moreover, as nickel content rises to boost capacity, structural stability decreases, heightening the risk of fire. Hence, the development of single crystal cathodes emerges as a solution to this challenge.

Single crystal cathodes offer cost savings and enhanced yields by eliminating residual materials, thereby lowering defect probability and obviating the need for a washing process. This step, crucial in cathode manufacturing for impurity removal, becomes unnecessary with single crystal technology.

The commercialization of single-crystal cathodes is poised to broaden the utilization of high-nickel cathodes. With reduced gas generation, battery lifespan extends while accommodating more active material, boosting energy density. Implementing this in electric vehicle battery packs could enable over 500 km of driving range on a single charge with fewer cells, facilitating longer-range vehicle models. This potential game-changer promises both cost reduction and performance enhancement simultaneously.

Yet, single crystal cathodes also pose drawbacks. Unlike polycrystalline counterparts, large single crystal materials exhibit high initial resistance, challenging the application of desired voltage. Consequently, output remains low, impeding battery performance enhancement.

However, single crystal cathodes entail extra processing steps and operate at higher voltages, potentially raising battery temperatures. Moreover, single crystal particles are susceptible to damage during the calendering process, a crucial part of electrode manufacturing.

Consequently, in the initial stages of mass production, single crystals are likely to be blended with polycrystals rather than being produced in their pure form.

Chinese companies are already producing single crystal cathodes for NCM523 and 622, and domestic companies such as LG Chem, Ecopro BEM, L&F, and POSCO FutureM have also completed development and are conducting quality tests with clients. The targets are single crystal NCA and NCM, and it can be seen that they are ready for mass production.

Industry experts anticipate that the performance and quality of single crystal cathodes will hinge on coating technology to ensure durability and the manufacturing process of single crystals. Essentially, the focus lies in effectively conducting surface treatment while simultaneously augmenting particle size.

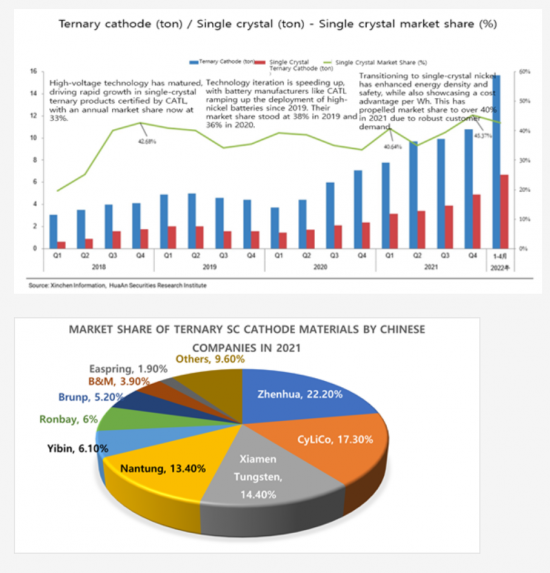

Currently, the market for mass-produced single crystal cathodes is dominated by the top 5 Chinese companies, which account for about 75% of the total market.

According to announcements by Korean cathode material companies, SNE Research predicts that they will start supplying samples this year (2023) and produce more than 120,000 tons in 2025. Currently, in the case of Chinese ternary single crystal cathodes, the proportion of 5 series single crystals, such as NCM 523, is the highest at 60% to 70%. The proportion of 6 series single crystals, such as NCM622, is 18 to 25%. In the case of 8 series with a Ni content of 80% or higher, the production ratio has increased since 2021 and currently accounts for about 15%. This proportion is expected to continue to increase.

According to SNE Research, it is difficult to predict the market for Korea at this time because there is no data on production volume by Ni content. However, in the case of China, Hi-Ni is expected to be about $4.2 billion and Mid-Ni is expected to be $9.2 billion in 2025. In 2030, Hi-Ni is expected to be about $24 billion and Mid-Ni is expected to be $23.8 billion, so the market for Hi-Ni is expected to be larger.

Strong Points of this report:

- 1. Cover fundamental and advances in the development of single-crystal Ni-rich cathode materials

- 2. Include a very detailed study of research trends and future prospects for single-crystal Ni-rich cathode materials.

- 3. Include content on research regarding the capacity degradation mechanism of single-crystal Ni-rich cathodes.

- 4. Compare major synthesis methods for single-crystal NCM cathode materials

- 5. Detailed recent developments and patent analysis of single-crystal cathode material manufacturers

- 6. Market outlook for single-crystal cathode materials

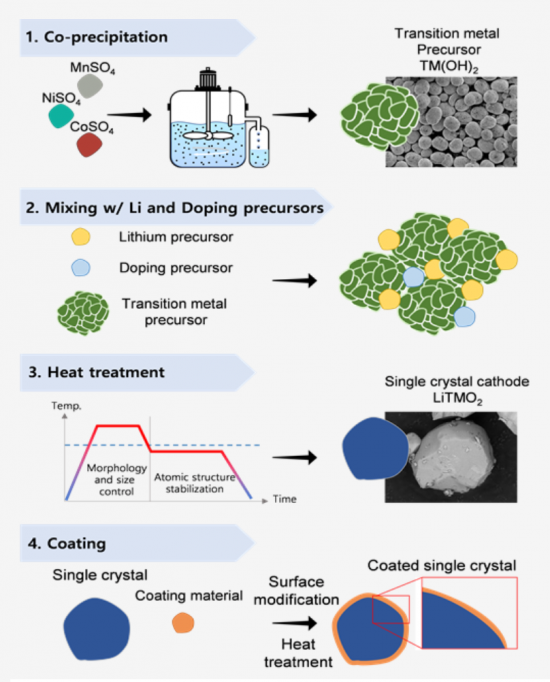

[Schematic diagram of general single-crystal Ni-rich layered cathode material synthesis and additional modification process]

Table of Contents

1. Overview of Cathode Materials

- 1.1. History of Cathode Material Development

- 1.2. Recent Trends in Cathode Materials

- 1.2.1. Layered Oxide Cathode Materials

- 1.2.2. Spinel Oxide Cathode Material

- 1.2.3. Polyanionic Oxide (PAO) Cathode Materials

- 1.3. Development Status of Cathode Materials by Type

- 1.3.1. Microstructure Modification

- 1.3.2. Removal of Cathode Cracks

- 1.3.3. Application of the One-Pot process

- 1.3.4. Microwave Processing

2. Research Trends and Future Prospects of Single Crystal Ni-rich Layered Cathodes

- 2.1. Need for Research on Single Crystal Ni-rich Layered Materials

- 2.1.1. The Need for Ni-rich Layered Materials (Advantages)

- 2.1.2. Degradation Mechanisms of Ni-rich Layered Cathode Materials

- 2.1.3. Need for Single Crystallization (Monoparticulation) of Ni-rich Layered Cathode Materials

- 2.2. Definition of Single-crystal Cathode Material

- 2.3. Development Status of Single-crystal Cathode Material Technology

- 2.3.1. Single-particle Ni-rich Layered Material Synthesis Research

- 2.3.2. Research on Sintering Methods for Synthesis of Single-particle Ni-rich Layered Materials

- 2.3.3. Study on Modifying Materials to Enhance Performance of Single-particle Ni-rich Layered Materials

- 2.3.3.1. Surface Coating Research

- 2.3.3.2. Elemental Substitution Study (Doping)

- 2.3.3.2.1. Single Doping

- 2.3.3.2.2. Dual Doping

- 2.3.3.3. Electrolyte Optimization

- 2.3.4. Utilization Strategies for Single-Crystal Ni-Based Layered Materials

- 2.3.4.1. Advantages of Single-Crystallization in Ni-Based Layered Cathodes for Electrode Design

- 2.3.4.2. Disadvantages of Single-Crystallization in Ni-Based Layered Cathodes for Electrode Design

- 2.3.4.3. Research on Addressing Challenges in Single-Crystallization of Ni-Based Layered Materials

- 2.4. Improvement Through Material Single-Particle Formation

- 2.4.1. Mitigation of Particle Breakage Characteristics

- 2.4.4.1. Pressing Stage in Electrode Manufacturing

- 2.4.2. Particle Breakage During Charge-Discharge Processes

- 2.4.3. Quantitative Reduction of Surface Degradation through Reduced Specific Surface Area

- 2.4.4. Energy Density Increase

- 2.4.5. Washing Process Omission

- 2.4.1. Mitigation of Particle Breakage Characteristics

- 2.5. Limitations of Current SC Cathode Material Technology Development and Research for Overcoming Them

- 2.5.1. Degradation of Material Crystal Structure Due to Difficulties in Optimizing Synthesis Conditions

- 2.5.2. Particle Size Limit

3. Single-Crystal Ni-Based Cathode Materials: Fundamentals and Advances

- 3.1. Overview

- 3.2. Ni-based Cathode Materials

- 3.2.1. Chemical Structure

- 3.2.2. Electronic Structure

- 3.3. Challenges of Ni-based Layered Oxides

- 3.3.1. Synthesis Difficulties

- 3.3.2. Structural Instability

- 3.3.3. Chemical Instability

- 3.3.4. Mechanical Performance Degradation

- 3.3.5. Safety Issues

- 3.4. Origin of Single-Crystal Ni-Based Layered Oxides

- 3.5. Synthesis of Single-Crystal Ni-based Layered Oxides

- 3.5.1. Synthesis Methods

- 3.6. Comparative Study of Single-Crystal and Polycrystalline Materials

- 3.7. Recent Advances in Single-Crystal Ni-Based Cathode Materials

- 3.7.1. Doping and Surface Coating

- 3.7.2. Mechanical Research

- 3.8. Results and Conclusion

4. Study of Capacity Fading Mechanism of Single-crystal Ni-rich NCM Cathode

- 4.1. Overview

- 4.2. Assessment of Fundamental Properties in Ni-rich Single-crystal and Polycrystalline Cathodes

- 4.2.1. Single-crystal and Polycrystalline Cathode Synthesis

- 4.2.2. Composition and Analysis of Single-crystal and Polycrystalline Cathodes

- 4.2.3. Electrochemical Properties of Single-crystal and Polycrystalline Cathodes

- 4.2.4. Structural Stress Analysis of Single-crystal and Polycrystalline Cathode Materials

- 4.2.5. In-situ XRD Analysis of Single-crystal and Polycrystalline Cathodes

- 4.2.6. TEM Analysis of Single-crystal and Polycrystalline Cathode Materials

- 4.2.7. Results and Conclusions

5. Particle Control of Ni-rich Monocrystalline Cathode Materials (Application of Sintering Process)

- 5.1. Overview

- 5.2. Experiment Description

- 5.3. Experimental Results

- 5.3.1. Optimization of Sintering Additives for Promoting Crystal Growth

- 5.3.2. Crystal Growth Mechanism

- 5.3.3. Ni-rich Structure of a Single Crystal Cathode

- 5.3.4. Performance of Ni-rich Single Crystal Cathodes

- 5.4. Application Results of Sintering Treatment

6. All-Dry Synthesis of Single-Crystal NMC Cathode Materials

- 6.1. Overview

- 6.2. Dry Synthesis

- 6.3. Dry Synthesis Results and Discussion

- 6.3.1. Precursor Structure and Morphology

- 6.3.2. Effect of Sintering Conditions on NMC Formation

- 6.3.3. Single-crystal NCM from Ball-milled Precursors

- 6.3.4. Conclusion

7. One-Spot Synthesis of Single Crystal NCM523 Cathode Material

- 7.1. Overview

- 7.2. Synthesis of NCM523

- 7.3. Characterization of Materials

- 7.4. Electrochemical Properties

- 7.5. Experiment Results and Discussion

- 7.5.1. Cathode Material Synthesis Product Analysis

- 7.5.2. Electrochemical Properties of Cathode Materials

- 7.5.3. Conclusion

8. Synthesis and Modification of Single-Crystal NCM Cathode Materials:Growth Mechanism

- 8.1. Overview

- 8.2. Growth Mechanism for NCM Cathodes

- 8.3. Solid State Reaction

- 8.4. Solid-Liquid Rheological Reaction

- 8.5. Crystal Growth in Molten Salt Flux

- 8.6. Modification of morphology

- 8.6.1. Control of Shape

- 8.6.2. Facet Control

- 8.6.3. Conclusion

9. Development of Single-Crystal Cathodes: DOE Program

- 9.1. Ultrafast Hydrothermal Synthesis of Ni-rich Single-Crystal Cathodes

- 9.2. Scaling up of High Performance Single Crystalline Ni-rich Cathode Materials with Advanced Lithium

- 9.3. Single-Crystal Cathodes for High-Performance All-Solid-State LIBs

10. Patent Analysis of Single Crystal Cathode Material Companies

- 10.1. Tesla

- 10.2. LG Chem

- 10.3. SM Lab

- 10.4. Nano One Materials

- 10.5. POSCO Future M

- 10.6. COSMO Advanced Materials & Technology

- 10.7. L&F

- 10.8. Easpring

- 10.9. BASF Shan Shan

- 10.10. GEM

- 10.11. XTC (Xiamen Tungsten)

- 10.12. Henan Kelong

- 10.13. Hyundai Motor Company / Kia Corporation

- 10.14. 6K Inc.

- 10.15. Dynanonic

- 10.16. Suzhou Long Power

- 10.17. Fengchao Energy

- 10.18. Ecopro BM

- 10.19. Umicore

11. Single-Crystal Cathode Material Industry Trends

- 11.1. LG Chem

- 11.2. POSCO FutureM

- 11.3. EcoPro BM

- 11.4. Zhenhua E-Chem(ZEC)

- 11.5. Chanyuan Lico

- 11.6. Ronbay

- 11.7. XTC (Xiamen Tungsten)

- 11.8. Tianjin B&M

- 11.9. Easpring

- 11.10. Reshane

- 11.11. Yibin Libode

- 11.12. Wanxing 123

- 11.13. GEM

12. Single Crystal Cathode Market Outlook

- 12-1. 2017~2022H1 China Single Crystal Production Volume

- 12-2. 2019~2022.04 Production Volume and Share of Single Crystal Cathode Materials in China

- 12-3. 2019~2022Q1 Distribution of production volume by SC ternary cathode materials in China

- 12-4. 2019~2022Q1 Share of production by ternary SC cathode material in China

- 12-5. 2019~2022Q1 Market Penetration by Ternary SC Cathode Materials in China

- 12-6. Market Share of Ternary SC Cathode Materials by Chinese Companies in 2021

- 12-7. Production Volume and Market Share of Ternary SC cathode Material Companies in China in 2021

- 12-8. Korea-China Ternary Single Crystal Production Forecast

- 12-9. Korean Ternary SC Cathode Material Mroduction Volume and Market Outlook

- 12-10. Percentage of Single-crystal Cathodes among Ternary Cathode Materials in China

- 12-11. Forecast of Production Volume Ratio by Chinese Ternary Single Crystal Cathode Material

- 12-12. China Market Forecast by Ternary Single Crystal Cathode Material

References