PUBLISHER: Roots Analysis | PRODUCT CODE: 1677739

PUBLISHER: Roots Analysis | PRODUCT CODE: 1677739

Ultrasound Market by Type of Product Offered, Device Portability, Device Display, Type of Technology, Application Area, End User, Geographical Regions and Key Players: Industry Trends and Global Forecasts, Till 2035

ULTRASOUND MARKET

As per Roots Analysis, the global ultrasound market size is estimated to grow from USD 8.9 billion in the current year to USD 16.0 billion by 2035, at a CAGR of 5.4% during the forecast period, till 2035.

The opportunity for ultrasound market has been distributed across the following segments:

Type of Product Offered

- Diagnostic Ultrasound Systems

- Therapeutic Ultrasound Systems

Device Portability

- Trolley / Cart-based Ultrasound Devices

- Handheld / Point-of-Care Ultrasound Devices

Device Display

- Colored Display

- Black / White Display

Type of Technology

- 2D Technology

- 3D / 4D Technology

- Doppler Imaging Technology

- Contrast Enhanced Ultrasound Technology

- High Intensity Focused Ultrasound Technology

- Extracorporeal Shockwave Lithotripsy Technology

Application Area

- Radiology / General Imaging

- Cardiology

- Obstetrics / Gynecology

- Urology

- Musculoskeletal Systems

- Other Application Areas

End User

- Hospitals

- Diagnostic Centers

- Ambulatory and Surgical Centers

- Research and Academic Centers

Geographical Regions

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and North Africa

Leading Players

ULTRASOUND MARKET: GROWTH AND TRENDS

Ultrasound is a medical imaging technique, which transmits high frequency sound pulses (between 2 and 20 MHz) into the body's internal tissues using a probe, for the purpose of non-invasive diagnosis. It is used by healthcare providers in the assessment of various body parts, such as vascular scanning, cancer screening, urologic scanning, and pulmonary scanning. Notably, ultrasound imaging is predominantly being used by obstetricians to monitor the growth and development of the fetus and detect certain pregnancy complications. Over the past decades, ultrasound, often regarded as the first line of medical evaluation technique, has evolved significantly and possesses the ability to treat / manage various conditions, including musculoskeletal pathologies, guided biopsies, tumor ablation and puncture.

Notably, the Medtech industry has been witnessing a significant shift towards the development of portable ultrasound systems, in response to the challenges associated with conventional ultrasound systems, including their high maintenance and operating costs, the difficulty of transporting patients to radiology departments, the high risk of hard drive failure and battery degradation, the requirement for highly skilled personnel, and their limited uptake in developing nations. On the other hand, portable ultrasound systems, further classified as trolley / cart-based ultrasound systems and handheld / point-of-care ultrasound systems, allow patients' bedside assessment and image transmission to smartphones or tablets for visualization.

It is worth noting that, in recent years, the integration of artificial intelligence and machine learning with imaging technologies has accelerated the use of ultrasound systems for real-time accurate diagnosis, driving innovation and positioning the market for substantial growth in the forthcoming years. Further, driven by the growing research and development initiatives and the rising demand for precise imaging-based clinical diagnosis, the ultrasound market is anticipated to grow steadily in the foreseen future.

ULTRASOUND MARKET: KEY INSIGHTS

The report delves into the current state of the ultrasound market and identifies potential growth opportunities within the industry. Some key findings from the report include:

- Several companies claim to have the required expertise and capabilities to develop various diagnostic and therapeutic ultrasound devices in order to cater to the evolving needs of different end users.

- Both cart-based and point-of-care ultrasound devices utilize various types of technologies to enhance the medical imaging and / or automate the diagnosis process.

- More than 490 scientific articles have been published recently, signifying the efforts being led by researchers to identify and develop ultrasound devices.

- The growing demand for point-of-care ultrasound devices and advancements in imaging technology have emerged as key driving factors supporting the rapid evolution of the ultrasound market.

- With the rising preference for advanced imaging solutions for medical imaging, the market opportunity associated with ultrasound devices is anticipated to witness an annualized growth of 5.4% over the next decade.

ULTRASOUND MARKET: KEY SEGMENTS

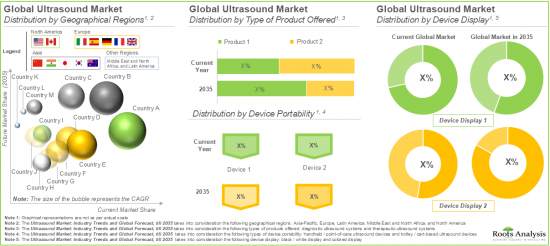

Diagnostic Ultrasound Systems are Likely to Hold the Largest Share of the Ultrasound Market During the Forecast Period

Based on the type of product offered, the global market is segmented into diagnostic ultrasound systems and therapeutic ultrasound systems. Currently, diagnostic ultrasound systems are likely to dominate and drive the overall market growth. This can be attributed to the ability of this system to generate real-time diagnostic imaging of body parts at a rapid rate.

Handheld Ultrasound Market Segment is the Fastest Growing Segment of the Ultrasound Market

Based on the type of portability, the global ultrasound market is distributed into trolley / cart-based ultrasound devices and handheld / point-of-care ultrasound devices. Whilst the trolley / cart-based segment holds the majority of the market share, it is worth noting that the handheld segment is likely to grow at a relatively higher CAGR during the forecast period. This is due to the fact that handled ultrasound systems offer an easy user interface and improved image processing capabilities.

By Device Display, Colored Display Segment is Likely to Dominate the Market During the Forecast Period

Based on the device display, the global ultrasound market is segmented into colored, and black / white display. Notably, owing to the capability of providing improved visualization of blood flow and tissue perfusion compared to black and white displays, it is likely to dominate the ultrasound market during the forecast period.

Ultrasound Market for 3D / 4D Technology is Likely to Grow at a Higher CAGR During the Forecast Period

Based on the type of technology, the global market is segmented across 2D technology, 3D / 4D technology, doppler imaging technology, contrast enhanced ultrasound technology, high intensity focused ultrasound technology and extracorporeal shockwave lithotripsy technology. Currently, 2D technology holds a larger share of the overall market. However, this trend is likely to change during the forecast period, owing to the capability of 3D / 4D imaging to provide a comprehensive view of anatomy, allowing for better identification of abnormalities and improved diagnostic accuracy.

By Application Area, Ultrasound Systems for Radiology / General Imaging are Likely to Dominate the Market During the Forecast Period

Based on the application area, the global market for ultrasound is distributed across different application areas, such as radiology / general imaging, cardiology, obstetrics / gynecology, urology, musculoskeletal systems and other application areas. It is worth highlighting that the radiology / general imaging segment holds the maximum share, and this trend is likely to remain unchanged in the future. This can be attributed to the fact that the combination of wide applicability, safety, affordability, and real-time imaging capabilities makes ultrasound systems a preferred choice for radiology and general imaging.

Currently, Hospitals Hold the Largest Share of the Ultrasound Market

Based on the end users, the global ultrasound market is segmented into hospitals, diagnostic centers, ambulatory and surgical centers, and research and academic centers. Currently, hospitals hold the largest market share. This can be attributed to the fact that ultrasound plays a critical role in facilitating quick decision-making in emergency rooms and intensive care units, thereby increasing its demand within these settings. Further, the high market share for ultrasound technology in hospitals is driven by their high patients' count across multiple specialties.

North America Accounts for the Largest Share of the Market

Based on geographical regions, the market is segmented into North America, Europe, Asia-Pacific, Middle East and North Africa, and Latin America. In the current scenario, North America is likely to capture the largest market share, and this trend is likely to remain unchanged in the future. The vast adoption of ultrasound systems in North America can be attributed to the rising prevalence of chronic diseases, advanced healthcare infrastructure, along with high healthcare spending in this region.

Example Players in the Ultrasound Market

- CHISON Medical Technologies

- Clarius

- Dawei Medical

- Draminski

- Edan Instruments

- Esaote

- FUJIFILM

- GE HealthCare

- Hologic

- Konica Minolta Healthcare Americas

- Lepu Medical

- MedGyn

- MEDITECH

- Narang Medical

- Philips

- Promed Technology

- Samsung Healthcare

- Shenzhen Mindray Bio-Medical Electronics

- Siemens Healthineers

- SIUI

- SonoScape

ULTRASOUND MARKET: RESEARCH COVERAGE

The report on Ultrasound Market features insights on various sections, including:

- Market Sizing and Opportunity Analysis: An in-depth analysis of the ultrasound market, focusing on key market segments, including [A] type of product offered, [B] device portability, [C] device display, [D] type of technology, [E] application area, [F] end user, [G] geographical regions and [H] leading players.

- Market Impact Analysis: A thorough analysis of various factors, such as drivers, restraints, opportunities, and existing challenges that are likely to impact market growth.

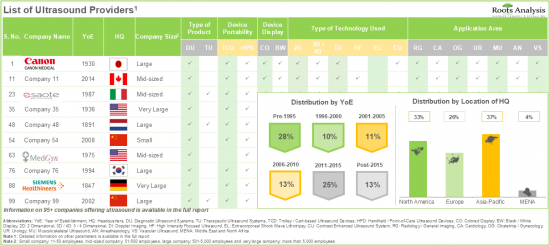

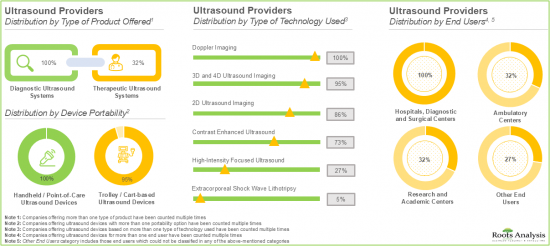

- Ultrasound Market Landscape: The report features a list of ultrasound providers, along with analyses, based on several relevant parameters, such as [A] type of product offered, [B] device portability, [C] device display, [D] type of technology, [E] application area, [F] end user, [G] year of establishment, [H] company size, and [I] location of headquarters.

- Competitiveness Analysis: A detailed competitive analysis of the leading players engaged in the ultrasound market based on [A] company strength, [B] portfolio strength. The section also features a relative benchmarking of the leading players, focusing on [A] company strength, [B] device portability, [C] type of technology, [D] application areas, and [E] end users.

- Company Profiles: In-depth profiles of key industry players offering ultrasound devices across various geographies, focusing on [A] company overviews, [B] financial information (if available), [C] ultrasound portfolio, [D] recent developments and [E] an informed future outlook.

- New Product Launches: A general overview of the recent launches of ultrasound devices by various industry stakeholders, with a focus on their key features.

- Publication Analysis: A detailed analysis of peer-reviewed, scientific articles related to the ultrasound domain, based on a number of relevant parameters, such as [A] year of publication, [B] type of publication, [C] key copyright holders, [D] most active publishers, and [E] key journals.

- Porter's Five Forces Analysis: An analysis of five competitive forces prevailing in the ultrasound market, including threats of new entrants, bargaining power of buyers, bargaining power of ultrasound providers, threats of substitute products and rivalry among existing competitors.

- Value Chain Analysis: An in-depth analysis of various steps of developing ultrasound systems, highlighting the opportunities to improve efficiency / gain a competitive edge over competitors.

KEY QUESTIONS ANSWERED IN THIS REPORT

- How many companies are currently engaged in this market?

- Which are the leading companies in this market?

- What factors are likely to influence the evolution of this market?

- What is the current and future market size?

- What is the CAGR of this market?

- How is the current and future market opportunity likely to be distributed across key market segments?

REASONS TO BUY THIS REPORT

- The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. By analyzing the competitive landscape, businesses can make informed decisions to optimize their market positioning and develop effective go-to-market strategies.

- The report offers stakeholders a comprehensive overview of the market, including key drivers, barriers, opportunities, and challenges. This information empowers stakeholders to stay abreast of market trends and make data-driven decisions to capitalize on growth prospects.

ADDITIONAL BENEFITS

- Complimentary PPT Insights Packs

- Complimentary Excel Data Packs for all Analytical Modules in the Report

- 10% Free Content Customization

- Detailed Report Walkthrough Session with Research Team

- Free Updated report if the report is 6-12 months old or older

TABLE OF CONTENTS

1. BACKGROUND

- 1.1. Context

- 1.2. Project Objectives

2. RESEARCH METHODOLOGY

3. MARKET DYNAMICS

4. ECONOMIC AND OTHER PROJECT SPECIFIC CONSIDERATIONS

5. EXECUTIVE SUMMARY

6. INTRODUCTION

- 6.1. Overview of Ultrasound

- 6.2. Schematic Mechanism of Action of Ultrasound

- 6.3. Types of Ultrasound Systems

- 6.3.1. Trolley / Cart-based Ultrasound Systems

- 6.3.2. Handheld Ultrasound Systems

- 6.4. Primary Applications of Ultrasound Systems

- 6.5. Advantages of Ultrasound Systems

- 6.6. Recent Trends in Ultrasound Domain

7. MARKET IMPACT ANALYSIS

- 7.1. Market Drivers

- 7.2. Market Restraints

- 7.3. Market Opportunities

- 7.4. Market Challenges

8. GLOBAL ULTRASOUND MARKET

- 8.1. Key Assumptions and Methodology

- 8.2. Global Ultrasound Market, Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 8.2.1. Scenario Analysis

- 8.2.1.1. Conversative Scenario

- 8.2.1.2. Optimistic Scenario

- 8.2.1. Scenario Analysis

- 8.3. Key Market Segmentations

9. ULTRASOUND MARKET, BY TYPE OF PRODUCT OFFERED

- 9.1. Key Assumptions and Methodology

- 9.2. Ultrasound Market: Distribution by Type of Product Offered

- 9.2.1. Ultrasound Market for Diagnostic Ultrasound Systems: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 9.2.2. Ultrasound Market for Therapeutic Ultrasound Systems: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 9.3. Data Triangulation and Validation

10. ULTRASOUND MARKET, BY DEVICE PORTABILITY

- 10.1. Key Assumptions and Methodology

- 10.2. Ultrasound Market: Distribution by Device Portability

- 10.2.1. Ultrasound Market for Trolley / Cart based Ultrasound Devices: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 10.2.2. Ultrasound Market for Handheld / Point-of-Care Ultrasound Devices: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 10.3. Data Triangulation and Validation

11. ULTRASOUND MARKET, BY TYPE OF DEVICE DISPLAY

- 11.1. Key Assumptions and Methodology

- 11.2. Ultrasound Market: Distribution by Type of Device Display

- 11.2.1. Ultrasound Market for Colored Display: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 11.2.2. Ultrasound Market for Black / White Display: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 11.3. Data Triangulation and Validation

12. ULTRASOUND MARKET, BY TYPE OF TECHNOLOGY

- 12.1. Key Assumptions and Methodology

- 12.2. Ultrasound Market: Distribution by Type of Technology

- 12.2.1. Ultrasound Market for 2D Technology: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 12.2.2. Ultrasound Market for 3D / 4D Technology: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 12.2.3. Ultrasound Market for Doppler Imaging Technology: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 12.2.4. Ultrasound Market for Contrast Enhanced Ultrasound Technology: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 12.2.5. Ultrasound Market for High Intensity Focused Ultrasound Technology: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 12.2.6. Ultrasound Market for Extracorporeal Shock Wave Lithotripsy Technology: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 12.3. Data Triangulation and Validation

13. ULTRASOUND MARKET, BY APPLICATION AREA

- 13.1. Key Assumptions and Methodology

- 13.2. Ultrasound Market: Distribution by Application Area

- 13.2.1. Ultrasound Market for Radiology / General Imaging: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 13.2.2. Ultrasound Market for Cardiology: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 13.2.3. Ultrasound Market for Obstetrics / Gynecology: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 13.2.4. Ultrasound Market for Urology: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 13.2.5. Ultrasound Market for Musculoskeletal Systems: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 13.2.6. Ultrasound Market for Other Application Areas: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 13.3. Data Triangulation and Validation

14. ULTRASOUND MARKET, BY END USER

- 14.1. Key Assumptions and Methodology

- 14.2. Ultrasound Market: Distribution by End User

- 14.2.1. Ultrasound Market for Hospitals: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 14.2.2. Ultrasound Market for Diagnostic Centers: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 14.2.3. Ultrasound Market for Ambulatory and Surgical Centers: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 14.2.4. Ultrasound Market for Maternity Centers: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 14.2.5. Ultrasound Market for Research and Academic Centers: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 14.3. Data Triangulation and Validation

15. ULTRASOUND MARKET, BY GEOGRAPHICAL REGIONS

- 15.1. Key Assumptions and Methodology

- 15.2. Ultrasound Market: Distribution by Geographical Regions

- 15.2.1. Ultrasound Market in North America: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 15.2.1.1. Ultrasound Market in the US: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 15.2.1.2. Ultrasound Market in Canada: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 15.2.2. Ultrasound Market in Europe: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 15.2.2.1. Ultrasound Market in Germany: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 15.2.2.2. Ultrasound Market in France: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 15.2.2.3. Ultrasound Market in Italy: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 15.2.2.4. Ultrasound Market in Spain: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 15.2.2.5. Ultrasound Market in the UK: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 15.2.2.6. Ultrasound Market in Switzerland: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 15.2.2.7. Ultrasound Market in Rest of Europe: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 15.2.3. Ultrasound Market in Asia-Pacific: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 15.2.3.1. Ultrasound Market in Japan: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 15.2.3.2. Ultrasound Market in China: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 15.2.3.3. Ultrasound Market in India: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 15.2.3.4. Ultrasound Market in South Korea: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 15.2.3.5. Ultrasound Market in Australia: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 15.2.3.6. Ultrasound Market in Rest of Asia-Pacific: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 15.2.4. Ultrasound Market in Middle East and North Africa: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 15.2.4.1. Ultrasound Market in Saudi Arabia: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 15.2.4.2. Ultrasound Market in Egypt: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 15.2.4.3. Ultrasound Market in Israel: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 15.2.4.4. Ultrasound Market in Rest of Middle East and North Africa: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 15.2.5. Ultrasound Market in Latin America: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 15.2.5.1. Ultrasound Market in Brazil: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 15.2.5.2. Ultrasound Market in Mexico: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 15.2.5.3. Ultrasound Market in Argentina: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 15.2.5.4. Ultrasound Market in Rest of Latin America: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 15.2.1. Ultrasound Market in North America: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 15.3. Ultrasound Market, by Geographical Regions: Market Dynamics Assessment

- 15.3.1. Penetration-Growth (P-G) Matrix

- 15.3.2. Market Movement Analysis

- 15.3.3. Data Triangulation and Validation

16. ULTRASOUND MARKET, BY KEY PLAYERS

17. MARKET LANDSCAPE: ULTRASOUND PROVIDERS

- 17.1. Chapter Overview

- 17.2. Leading Ultrasound Providers: Market Landscape

- 17.2.1. Analysis by Type of Product Offered

- 17.2.2. Analysis by Device Portability

- 17.2.3. Analysis by Type of Device Display

- 17.2.4. Analysis by Type of Technology

- 17.2.5. Analysis by Application Area

- 17.2.6. Analysis by End User

- 17.3. Ultrasound Providers: Developer Landscape

- 17.3.1. Analysis by Year of Establishment

- 17.3.2. Analysis by Location of Headquarters

- 17.3.3. Analysis by Company Size

18. COMPANY COMPETITIVENESS ANALYSIS: LEADING ULTRASOUND PROVIDERS

- 18.1. Key Parameters and Methodology

- 18.2. Company Competitiveness Analysis: Leading Ultrasound Providers

- 18.3. Parameter-wise Benchmarking of Top Five Leading Players

19. COMPANY PROFILES: LEADING ULTRASOUND PROVIDERS HEADQUARTERED IN NORTH AMERICA

- 19.1. Chapter Overview

- 19.2. Leading Ultrasound Providers Headquartered in North America

- 19.2.1. GE HealthCare

- 19.2.1.1. Company Overview

- 19.2.1.2. Ultrasound Portfolio

- 19.2.1.3. Financial Details

- 19.2.1.4. Recent Developments and Future Outlook

- 19.2.2. Hologic

- 19.2.3. Konica Minolta Healthcare Americas

- 19.2.1. GE HealthCare

- 19.3. Other Leading Ultrasound Providers Headquartered in North America

- 19.3.1. Clarius

- 19.3.2. MedGyn

20. COMPANY PROFILES: LEADING ULTRASOUND PROVIDERS HEADQUARTERED IN EUROPE

- 20.1. Chapter Overview

- 20.2. Leading Ultrasound Providers Headquartered in Europe

- 20.2.1. Philips

- 20.2.1.1. Company Overview

- 20.2.1.2. Ultrasound Portfolio

- 20.2.1.3. Financial Details

- 20.2.1.4. Recent Developments and Future Outlook

- 20.2.2. Siemens Healthineers

- 20.2.1. Philips

- 20.3. Other Leading Ultrasound Providers Headquartered in Europe

- 20.3.1. Draminski

- 20.3.2. Esaote

21. COMPANY PROFILES: LEADING ULTRASOUND PROVIDERS HEADQUARTERED IN ASIA-PACIFIC

- 21.1. Chapter Overview

- 21.2. Leading Ultrasound Providers Headquartered in Asia-Pacific

- 21.2.1. Canon Medical Systems

- 21.2.1.1. Company Overview

- 21.2.1.2. Ultrasound Portfolio

- 21.2.1.3. Financial Details

- 21.2.1.4. Recent Developments and Future Outlook

- 21.2.2. FUJIFILM

- 21.2.3. Lepu Medical

- 21.2.4. Shenzhen Mindray Bio-Medical Electronics

- 21.2.1. Canon Medical Systems

- 21.3. Other Leading Ultrasound Providers Headquartered in Asia-Pacific

- 21.3.1. CHISON Medical Technologies

- 21.3.2. Dawei Medical

- 21.3.3. Edan Instruments

- 21.3.4. Narang Medical

- 21.3.5. Meditech Equipment

- 21.3.6. Promed Technology

- 21.3.7. Samsung Healthcare

- 21.3.8. SIUI

- 21.3.9. Sonoscape

22. NEW PRODUCT LAUNCHES IN ULTRASOUND DOMAIN

- 22.1. Chapter Overview

- 22.2. Historical Trends in Ultrasound Domain

- 22.3. Recent Products

- 22.3.1. Aplio Me

- 22.3.2. Butterfly IQ3

- 22.3.3. HERA Z20

- 22.3.4. LOGIQ E10 and LOGIQ Fortis

- 22.3.5. My LabTM 80

23. PUBLICATION ANALYSIS

- 23.1. Chapter Overview

- 23.2. Scope and Methodology

- 23.3. Publication Analysis: Ultrasound Domain

- 23.3.1. Analysis by Year of Publication

- 23.3.2. Analysis by Type of Publication

- 23.3.3. Analysis by Copyright Holders

- 23.3.4. Most Active Publishers: Analysis by Number of Publications

- 23.3.5. Key Journals: Analysis by Number of Publications

- 23.3.6. Key Journals: Analysis by Impact Factor

24. PORTER'S FIVE FORCES ANALYSIS

- 24.1. Methodology and Assumptions

- 24.2. Key Parameters

- 24.2.1. Threats of New Entrants

- 24.2.2. Bargaining Power of Buyers

- 24.2.3. Bargaining Power of Suppliers

- 24.2.4. Threats of Substitute Products

- 24.2.5. Rivalry among Existing Competitors

- 24.3. Porter's Five Force Analysis: Harvey Ball Analysis

- 24.4. Concluding Remarks

25. VALUE CHAIN ANALYSIS: ULTRASOUND MARKET

- 25.1. Overview of Ultrasound Process and Stakeholders Involved

- 25.2. Schematic Representation of Ultrasound from Conception to Usage

26. EXECUTIVE INSIGHTS

27. APPENDIX 1: TABULATED DATA

28. APPENDIX 2: LIST OF COMPANIES AND ORGANIZATIONS

List of Tables

- Table 17.1 List of Leading Ultrasound Providers: Market Landscape

- Table 17.2 List of Ultrasound Providers: Developers Landscape

- Table 19.1 GE HealthCare: Ultrasound Providers Portfolio

- Table 19.2 Hologic: Ultrasound Providers Portfolio

- Table 19.3 Konica Minolta Healthcare Americas: Ultrasound Providers Portfolio

- Table 20.1 Philips: Ultrasound Providers Portfolio

- Table 20.2 Siemens Healthineers: Ultrasound Providers Portfolio

- Table 21.1 Canon Medical Systems: Ultrasound Providers Portfolio

- Table 21.2 FUJIFILM: Ultrasound Providers Portfolio

- Table 21.3 Lepu Medical: Ultrasound Providers Portfolio

- Table 21.4 Shenzhen Mindray Bio-Medical Electronics: Ultrasound Providers Portfolio

- Table 27.1 Global Ultrasound Market: Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Table 27.2 Global Ultrasound Market: Forecasted Estimates (till 2035): Conservative Scenario (USD Billion)

- Table 27.3 Global Ultrasound Market: Forecasted Estimates (till 2035): Optimistic Scenario (USD Billion)

- Table 27.4 Ultrasound Market: Distribution by Type of Product Offered

- Table 27.5 Ultrasound Market for Diagnostic Ultrasound Systems: Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Table 27.6 Ultrasound Market for Therapeutic Ultrasound Systems: Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Table 27.7 Ultrasound Market: Distribution by Device Portability

- Table 27.8 Ultrasound Market for Trolley / Cart-based Ultrasound Devices: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- Table 27.9 Ultrasound Market for Handheld / Point-of-Care Ultrasound Devices: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- Table 27.10 Ultrasound Market: Distribution by Type of Display

- Table 27.11 Ultrasound Market for Colored Display: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- Table 27.12 Ultrasound Market for Black / White Display: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- Table 27.13 Ultrasound Market: Distribution by Type of Technology

- Table 27.14 Ultrasound Market for 2D Technology: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- Table 27.15 Ultrasound Market for 3D / 4D Technology: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- Table 27.16 Ultrasound Market for Doppler Imaging Technology: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- Table 27.17 Ultrasound Market for Contrast Enhanced Ultrasound Technology: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- Table 27.18 Ultrasound Market for High Intensity Focused Ultrasound Technology: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- Table 27.19 Ultrasound Market for Extracorporeal Shock Wave Lithotripsy Technology: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- Table 27.20 Ultrasound Market: Distribution by Application Area

- Table 27.21 Ultrasound Market for Radiology / General Imaging: Historical Trends (since 2019) and Forecasted Estimates (till 2035))

- Table 27.22 Ultrasound Market for Cardiology: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- Table 27.23 Ultrasound Market for Obstetrics / Gynecology: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- Table 27.24 Ultrasound Market for Urology: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- Table 27.25 Ultrasound Market for Musculoskeletal Systems: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- Table 27.26 Ultrasound Market for Other Application Areas: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- Table 27.27 Ultrasound Market: Distribution by End User

- Table 27.28 Ultrasound Market for Hospitals: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- Table 27.29 Ultrasound Market for Diagnostic Centers: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- Table 27.30 Ultrasound Market for Ambulatory and Surgical Centers: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- Table 27.31 Ultrasound Market for Maternity Centers: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- Table 27.32 Ultrasound Market for Research and Academic Centers: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- Table 27.33 Ultrasound Market: Distribution by Geographical Regions

- Table 27.34 Ultrasound Market in North America: Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Table 27.35 Ultrasound Market in the US: Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Table 27.36 Ultrasound Market in Canada: Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Table 27.37 Ultrasound Market in Europe: Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Table 27.38 Ultrasound Market in Germany: Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Table 27.39 Ultrasound Market in France: Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Table 27.40 Ultrasound Market in Italy: Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Table 27.41 Ultrasound Market in Spain: Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Table 27.42 Ultrasound Market in the UK: Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Table 27.43 Ultrasound Market in Switzerland: Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Table 27.44 Ultrasound Market in Rest of Europe: Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Table 27.45 Ultrasound Market in Asia-Pacific: Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Table 27.46 Ultrasound Market in Japan: Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Table 27.47 Ultrasound Market in China: Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Table 27.48 Ultrasound Market in India: Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Table 27.49 Ultrasound Market in South Korea: Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Table 27.50 Ultrasound Market in Australia: Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Table 27.51 Ultrasound Market in Rest of Asia-Pacific: Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Table 27.52 Ultrasound Market in Middle East and North Africa: Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Table 27.53 Ultrasound Market in Saudi Arabia: Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Table 27.54 Ultrasound Market in Egypt: Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Table 27.55 Ultrasound Market in Israel: Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Table 27.56 Ultrasound Market in Rest of Middle East and North Africa: Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Table 27.57 Ultrasound Market in Latin America: Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Table 27.58 Ultrasound Market in Brazil: Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Table 27.59 Ultrasound Market in Mexico: Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Table 27.60 Ultrasound Market in Argentina: Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Table 27.61 Ultrasound Market in Rest of Latin America: Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Table 27.62 Ultrasound Market: Distribution by Key Players

- Table 27.63 Leading Ultrasound Providers: Distribution by Type of Product Offered

- Table 27.64 Leading Ultrasound Providers: Distribution by Device Portability

- Table 27.65 Leading Ultrasound Providers: Distribution by Type of Device Display

- Table 27.66 Leading Ultrasound Providers: Distribution by Type of Technology

- Table 27.67 Leading Ultrasound Providers: Distribution by Application Area

- Table 27.68 Leading Ultrasound Providers: Distribution by End User

- Table 27.69 Ultrasound Providers: Distribution by Year of Establishment

- Table 27.70 Ultrasound Providers: Distribution by Company Size

- Table 27.71 Ultrasound Providers: Distribution by Location of Headquarters

- Table 27.72 GE HealthCare: Financial Information (USD Million)

- Table 27.73 Hologic: Financial Information (USD Million)

- Table 27.74 Konica Minolta Healthcare Americas: Financial Information (YEN Billion)

- Table 27.75 Philips: Financial Information (EUR Million)

- Table 27.76 Siemens Healthineers: Financial Information (SEK Million)

- Table 27.77 Canon Medical Systems: Financial Information (YEN Million)

- Table 27.78 FUJIFILM: Financial Information (SEK Million)

- Table 27.79 Lepu Medical: Financial Information (SEK Million)

- Table 27.80 Shenzhen Mindray Bio-Medical Electronics: Financial Information (SEK Million)

- Table 27.81 Publication Analysis: Cumulative Year-Wise Trend, since 2020

- Table 27.82 Publication Analysis: Distribution by Type of Publication

- Table 27.83 Publication Analysis: Distribution by Copyright Holders

- Table 27.84 Most Active Publishers: Distribution by Number of Publications

- Table 27.85 Key Journals: Distribution by Number of Publications

- Table 27.86 Key Journals: Distribution by Impact Factor

List of Figures

- Figure 2.1 Research Methodology: Project Methodology

- Figure 2.2 Research Methodology: Forecast Methodology

- Figure 2.3 Research Methodology: Robust Quality Control

- Figure 2.4 Research Methodology: Key Market Segmentations

- Figure 5.1 Executive Summary: Ultrasound Providers Market Landscape

- Figure 5.2 Executive Summary: Publication Analysis

- Figure 5.3 Executive Summary: Market Forecast and Opportunity Analysis

- Figure 6.1 Schematic Mechanism of Action of Ultrasound Systems

- Figure 6.2 Advantages of Ultrasound Systems

- Figure 7.1 Market Drivers

- Figure 7.2 Market Restraints

- Figure 7.3 Market Opportunities

- Figure 7.4 Market Challenges

- Figure 8.1 Global Ultrasound Market: Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 8.2 Global Ultrasound Market: Forecasted Estimates (till 2035): Conservative Scenario (USD Billion)

- Figure 8.3 Global Ultrasound Market: Forecasted Estimates (till 2035): Optimistic Scenario (USD Billion)

- Figure 9.1 Ultrasound Market: Distribution by Type of Product Offered

- Figure 9.2 Ultrasound Market for Diagnostic Ultrasound Systems: Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 9.3 Ultrasound Market for Therapeutic Ultrasound Systems: Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 10.1 Ultrasound Market: Distribution by Device Portability

- Figure 10.2 Ultrasound Market for Trolley / Cart-based Ultrasound Devices: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- Figure 10.3 Ultrasound Market for Handheld / Point-of-Care Ultrasound Devices: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- Figure 11.1 Ultrasound Market: Distribution by Type of Display

- Figure 11.2 Ultrasound Market for Colored Display: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- Figure 11.3 Ultrasound Market for Black / White Display: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- Figure 12.1 Ultrasound Market: Distribution by Type of Technology

- Figure 12.2 Ultrasound Market for 2D Technology: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- Figure 12.3 Ultrasound Market for 3D / 4D Technology: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- Figure 12.4 Ultrasound Market for Doppler Imaging Technology: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- Figure 12.5 Ultrasound Market for Contrast Enhanced Ultrasound Technology: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- Figure 12.6 Ultrasound Market for High Intensity Focused Ultrasound Technology: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- Figure 12.7 Ultrasound Market for Extracorporeal Shock Wave Lithotripsy Technology: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- Figure 13.1 Ultrasound Market: Distribution by Application Area

- Figure 13.2 Ultrasound Market for Radiology / General Imaging: Historical Trends (since 2019) and Forecasted Estimates (till 2035))

- Figure 13.3 Ultrasound Market for Cardiology: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- Figure 13.4 Ultrasound Market for Obstetrics / Gynecology: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- Figure 13.5 Ultrasound Market for Urology: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- Figure 13.6 Ultrasound Market for Musculoskeletal Systems: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- Figure 13.7 Ultrasound Market for Other Application Areas: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- Figure 14.1 Ultrasound Market: Distribution by End User

- Figure 14.2 Ultrasound Market for Hospitals: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- Figure 14.3 Ultrasound Market for Diagnostic Centers: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- Figure 14.4 Ultrasound Market for Ambulatory and Surgical Centers: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- Figure 14.5 Ultrasound Market for Maternity Centers: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- Figure 14.6 Ultrasound Market for Research and Academic Centers: Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- Figure 15.1 Ultrasound Market: Distribution by Geographical Regions

- Figure 15.2 Ultrasound Market in North America: Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 15.3 Ultrasound Market in the US: Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 15.4 Ultrasound Market in Canada: Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 15.5 Ultrasound Market in Europe: Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 15.6 Ultrasound Market in Germany: Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 15.7 Ultrasound Market in France: Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 15.8 Ultrasound Market in Italy: Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 15.9 Ultrasound Market in Spain: Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 15.10 Ultrasound Market in the UK: Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 15.11 Ultrasound Market in Switzerland: Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 15.12 Ultrasound Market in Rest of Europe: Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 15.13 Ultrasound Market in Asia-Pacific: Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 15.14 Ultrasound Market in Japan: Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 15.15 Ultrasound Market in China: Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 15.16 Ultrasound Market in India: Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 15.17 Ultrasound Market in South Korea: Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 15.18 Ultrasound Market in Australia: Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 15.19 Ultrasound Market in Rest of Asia-Pacific: Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 15.20 Ultrasound Market in Middle East and North Africa: Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 15.21 Ultrasound Market in Saudi Arabia: Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 15.22 Ultrasound Market in Egypt: Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 15.23 Ultrasound Market in Israel: Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 15.24 Ultrasound Market in Rest of Middle East and North Africa: Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 15.25 Ultrasound Market in Latin America: Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 15.26 Ultrasound Market in Brazil: Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 15.27 Ultrasound Market in Argentina: Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 15.28 Ultrasound Market in Rest of Latin America: Historical Trends (since 2019) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 16.1 Ultrasound Market: Distribution by Key Players

- Figure 17.1 Leading Ultrasound Providers: Distribution by Type of Product Offered

- Figure 17.2 Leading Ultrasound Providers: Distribution by Device Portability

- Figure 17.3 Leading Ultrasound Providers: Distribution by Type of Technology

- Figure 17.4 Leading Ultrasound Providers: Distribution by Application Area

- Figure 17.5 Leading Ultrasound Providers: Distribution by End User

- Figure 17.6 Ultrasound Providers: Distribution by Year of Establishment

- Figure 17.7 Ultrasound Providers: Distribution by Company Size

- Figure 17.8 Ultrasound Providers: Distribution by Location of Headquarters

- Figure 18.1 Leading Ultrasound Providers: Competitiveness Analysis

- Figure 18.2 Siemens Healthineers: Benchmarking Analysis

- Figure 18.3 Philips: Benchmarking Analysis

- Figure 18.4 FUJIFILM: Benchmarking Analysis

- Figure 18.5 Canon Medical Systems: Benchmarking Analysis

- Figure 18.6 GE HealthCare: Benchmarking Analysis

- Figure 19.1 GE HealthCare: Financial Information (USD Million)

- Figure 19.2 Hologic: Financial Information (USD Million)

- Figure 19.3 Konica Minolta Healthcare Americas: Financial Information (YEN Billion)

- Figure 20.1 Philips: Financial Information (EUR Million)

- Figure 20.2 Siemens Healthineers: Financial Information (SEK Million)

- Figure 21.1 Canon Medical Systems: Financial Information (YEN Million)

- Figure 21.2 FUJIFILM: Financial Information (SEK Million)

- Figure 21.3 Lepu Medical: Financial Information (SEK Million)

- Figure 21.4 Shenzhen Mindray Bio-Medical Electronics: Financial Information (SEK Million)

- Figure 22.1 Historical Trends in Ultrasound Domain

- Figure 23.1 Publication Analysis: Cumulative Year-wise Trend, since 2020

- Figure 23.2 Publication Analysis: Distribution by Type of Publication

- Figure 23.3 Publication Analysis: Distribution by Copyright Holders

- Figure 23.4 Most Active Publishers: Distribution by Number of Publications

- Figure 23.5 Key Journals: Distribution by Number of Publications

- Figure 23.6 Key Journals: Distribution by Impact Factor

- Figure 24.1 Threat of New Entrants

- Figure 24.2 Bargaining Power of Buyers

- Figure 24.3 Bargaining Power of Suppliers

- Figure 24.4 Threat of Substitute Products

- Figure 24.5 Rivalry among Existing Competitors

- Figure 24.6 Porter's Five Force Analysis: Harvey Ball Analysis

- Figure 25.1 Overview on Ultrasound Process and Stakeholders Involved

- Figure 25.2 Ultrasound from Conception to Usage