PUBLISHER: Roots Analysis | PRODUCT CODE: 1648559

PUBLISHER: Roots Analysis | PRODUCT CODE: 1648559

Lipid Nanoparticle Manufacturing Market by Type of Lipid Nanoparticle, Type of Molecule Delivered, Company Size, Target Therapeutic Area, Type of End-user and Key Geographical Regions : Industry Trends and Global Forecasts, Till 2035

LIPID NANOPARTICLE MANUFACTURING MARKET: OVERVIEW

As per Roots Analysis, the global lipid nanoparticle manufacturing market is estimated to grow from USD 0.37 billion in the current year to USD 2.53 billion by 2035, at a CAGR of 18.86% during the forecast period, till 2035.

The market sizing and opportunity analysis has been segmented across the following parameters:

Type of Lipid Nanoparticle

- Solid Lipid Nanoparticles

- Nanostructured Lipid Carriers

Type of Molecule Delivered

- Nucleic Acids

- Small Molecules

- Peptides/ Proteins

- Others

Company Size

- Very Large and Large

- Mid-sized

- Small

Therapeutic Area

- Infectious Diseases

- Oncological Disorders

- Blood Disorders

- Rare Diseases

- Other Disorders

Type of End-user

- Pharmaceutical and Biotechnology Companies

- Academic and Research Institutes

- Other End-users

Key Geographical Regions

- North America

- Europe

- Asia-Pacific

- Rest of the World

LIPID NANOPARTICLE MANUFACTURING MARKET: GROWTH AND TRENDS

Over the past few decades, the pharmaceutical industry has witnessed significant growth. This is evident from the continuously growing pipeline of drug candidates that have been marketed or are being evaluated across several development stages. However, low drug solubility / permeability is one of the primary concerns associated with certain pharmacological products. Therefore, players engaged in the pharmaceutical domain are actively trying to identify ways to improve / augment physiochemical properties and drug-like behavior of pharmacological products. Amidst other alternatives, the use of lipid nanoparticles (LNPs) has garnered the attention of many drug developers. This can be attributed to the great versatility of LNPs, in terms of structure and functionality, as well as the ability to enhance the solubility and bioavailability of poorly water-soluble drugs.

Considering the routine operations-related and technical challenges, an increased number of pharmaceutical companies have demonstrated the preference to outsource their respective LNP production operations to specialized service providers. There are numerous benefits of engaging contract manufacturing firms for LNP manufacturing, such as access to new technologies (available with the service provider), larger capacities and greater operational flexibility. As a result, many of the companies are actively trying to consolidate their presence in this field, by entering into strategic alliances to broaden their respective service portfolios and LNP manufacturing capabilities. Given the benefits of using LNPs to improve drug-like properties, the demand for high quality LNPs nanoparticles is likely to drive considerable growth within the specialty contract manufacturing market in the coming years.

LIPID NANOPARTICLE MANUFACTURING MARKET: KEY INSIGHTS

The report delves into the current state of the lipid nanoparticle manufacturing market and identifies potential growth opportunities within the industry. Some key findings from the report include:

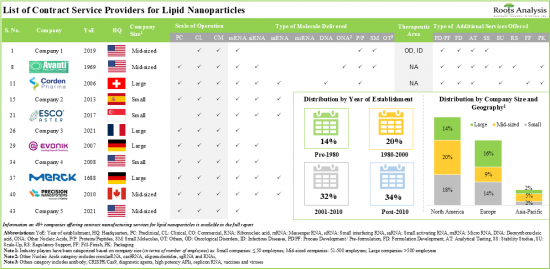

- Over 40 companies claim to offer contract manufacturing services for lipid nanoparticles; majority of these firms are mid-sized players, based in North America.

- Several service providers have the necessary capabilities to offer lipid nanoparticle contract manufacturing, across different scales of operation and for encapsulating various types of molecules.

- Presently, close to 35 lipid nanoparticle technologies are being offered by companies worldwide in order to manufacture LNP based therapeutics; the market is characterized by the presence of small companies.

- Stakeholders have adopted various business models to maximize the gain from LNP technologies; majority of these technologies are intended for drug delivery via injectable route, primarily targeting oncological disorders.

- Currently, close to 60 players across the world, claim to provide contract manufacturing services to support the development and production of other types of lipids for various therapeutic purposes.

- In order to cater to the rising demand for lipid nanoparticles, service providers are continuously expanding their existing capabilities to drive compliance to evolving industry benchmarks.

- In pursuit of obtaining a competitive edge, industry stakeholders are actively advancing and innovating new LNP manufacturing technologies to enhance their respective portfolios.

- In order to expand their lipid nanoparticle service portfolios and gain access to emerging technologies, companies are actively entering into various strategic partnerships with various international and local players.

- Various mRNA-based therapeutic / vaccine developers across the world are anticipated to forge strategic alliances with LNP contract manufacturing service providers, to further augment their drug portfolio.

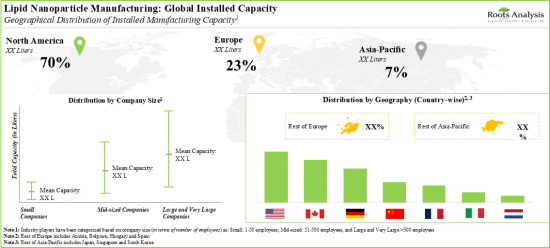

- The global installed lipid nanoparticle manufacturing capacity is spread across various geographies; majority of this capacity is installed in the production plants located in the US.

- Driven by the increasing number of chronic indications (requiring novel personalized therapies), and ongoing research on lipid nanoparticle-based therapeutics, this market is anticipated to grow at a CAGR of 12%, till 2035.

- The projected future opportunity for the lipid nanoparticle manufacturing market is likely to be well distributed across different target therapeutic areas, end-users and key geographical regions.

LIPID NANOPARTICLE MANUFACTURING MARKET: KEY SEGMENTS

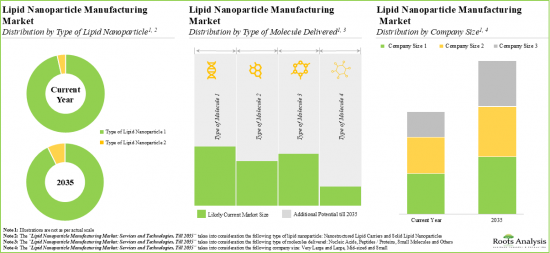

Currently, Solid Lipid Nanoparticles Occupy the Largest Share of the Lipid Nanoparticle Manufacturing Market

Based on the type of lipid nanoparticle, the market is segmented into solid lipid nanoparticles and nanostructured lipid carriers. At present, the solid lipid nanoparticles segment holds the maximum share of the lipid nanoparticle manufacturing market. This trend is likely to remain the same in the forthcoming years. It is worth highlighting that the lipid nanoparticle manufacturing market for nanostructured lipid carriers is likely to grow at a relatively higher CAGR.

Small Molecules are the Fastest Growing Segment of the Lipid Nanoparticle Manufacturing Market

Based on the type of molecule delivered, the market is segmented into nucleic acids, small molecules, proteins/peptides and others. Currently, nucleic acid holds the maximum share of the lipid nanoparticle manufacturing market. However, the small molecules segment is likely to dominate the lipid nanoparticle manufacturing market in the forthcoming decade.

Large and Very Large Companies are Likely to Dominate the Lipid Nanoparticle Manufacturing Market

Based on the company size, the market is segmented into very large and large companies, mid-sized companies and small companies. At present, very large and large companies hold the maximum share of the lipid nanoparticle manufacturing market. This trend is likely to remain the same in the forthcoming years. It is worth highlighting that the lipid nanoparticle manufacturing market for mid-sized companies is likely to grow at a relatively higher CAGR.

Oncological Disorders is the Fastest Growing Segment of the Lipid Nanoparticle Manufacturing Market

Based on the target therapeutic area, the market is segmented into infectious diseases, oncological disorders, blood disorders, rare diseases and other disorders. It is worth highlighting that currently, the oncological disorders segment holds a larger share of the lipid nanoparticle manufacturing market. This trend is likely to remain the same in the coming decade.

Currently, Pharmaceutical and Biotechnology Companies Occupy the Largest Share of the Lipid Nanoparticle Manufacturing Market

Based on the type of end-user, the market is segmented into pharmaceutical and biotechnology companies, academic and research institutes, and other end-users. It is worth highlighting that the majority of the current lipid nanoparticle manufacturing market is captured by pharmaceutical and biotechnology companies. This trend is likely to remain the same in the near future.

North America Accounts for the Largest Share of the Market

Based on key geographical regions, the market is segmented into North America, Europe, Asia-Pacific and Rest of the world. It is worth highlighting that, over the years, the market in Europe is expected to grow at a higher CAGR.

Example Players in the Lipid Nanoparticle Manufacturing Market

- Acuitas Therapeutics

- Ascendia Pharmaceuticals

- Avanti Polar Lipids

- BIOVECTRA

- CordenPharma

- Creative Biolabs

- Curapath

- Curia

- Emergent Biosolutions

- EUROAPI

- Evonik

- Formumax Scientific

- Fresinius Kabi

- Fujifilm

- Integrated Nanotherapeutics

- leon-nanodrugs

- Matinas BioPharma

- Merck

- Pantherna Therapeutics

- Precision NanoSystems

- TLC Biosciences

Primary Research Overview

The opinions and insights presented in this study were influenced by discussions conducted with multiple stakeholders. The research report features detailed transcripts of interviews held with the following industry stakeholders:

- Founder and Chief Executive Officer, LIPOSOMA

- Former Director, Process Development - Chemistry and Former Acting Manager, Biotech Process Development, BIOVECTRA

- Formulation Scientist, OZ Biosciences

LIPID NANOPARTICLE MANUFACTURING MARKET: RESEARCH COVERAGE

- Market Sizing and Opportunity Analysis: The report features an in-depth analysis of the lipid nanoparticle manufacturing market, focusing on key market segments, including [A] type of lipid nanoparticle, [B] type of molecule delivered, [C] company size, [D] target therapeutic area, [E] type of end-user and [F] key geographical regions.

- Market Landscape (Lipid Nanoparticles Manufacturers): A comprehensive evaluation of lipid nanoparticles manufacturers, considering various parameters, such as [A] year of establishment, [B] company size, [C] location of headquarters, [D] location of manufacturing facility, [E] scale of operation, [F] type of molecule delivered, [F] therapeutic area and [G] type of additional services offered.

- Market Landscape (Lipid Nanoparticles Technology Developers): A comprehensive evaluation of lipid nanoparticle technology developers, considering various parameters, such as [A] type of formulation method, [B] type of molecule delivered, [C] compatible dosage form, [D] route of administration, [E] therapeutic area. Additionally, the chapter includes information on the lipid nanoparticle technology developers, including [F] year of establishment, [G] company size (in terms of employee count), [H] location of headquarters, [I] business model and [J] most active players (in terms of number of technologies developed).

- Market Landscape (Lipid Contract Manufacturers): A comprehensive evaluation of lipid contract manufacturers, considering various parameters, such as [A] year of establishment, [B] company size (in terms of employee count), [C] location of headquarters, [D] location of manufacturing facilities, [E] scale of operation, [F] type of lipid manufactured, [G] type of product and [H] type of additional services offered.

- Company Competitiveness Analysis (Lipid Nanoparticle Contract Manufacturers): A comprehensive competitive analysis of lipid nanoparticle contract manufacturing organizations, examining factors, such as [A] company strength, [B] service strength and [C] number of LNP manufacturing facilities.

- Technology Competitiveness Analysis: A comprehensive competitive analysis of lipid nanoparticle technologies, examining factors, such as [A] developer strength, [B] technology strength and [C] technology applicability.

- Company Profiles: In-depth profiles of key industry players offering LNP manufacturing services and LNP technology, focusing on [A] company overviews, [B] LNP service / technology portfolio, [C] recent developments and [D] an informed future outlook.

- Partnerships and Collaborations: An analysis of partnerships established in this sector, since 2019, covering [A] year of partnership, [B] type of partnership, [C] type of molecule, [D] therapeutic area, [E] type of partner, [F] most active players (in terms of the number of partnerships signed) and [G] regional distribution of partnership activity.

- Likely Partner Analysis: A detailed evaluation of mRNA vaccines and therapeutics developers that are most likely to collaborate with lipid nanoparticle manufacturers. This analysis considers various relevant parameters, including [A] developer strength (which takes into account a company's size and experience in this field), [B] pipeline strength (which takes into account the number of mRNA drugs in the pipeline), as well as [C] other mRNA drug related capabilities (which takes into account the target therapeutic area, route of administration and type of candidate).

- Make versus Buy Decision Framework: A comprehensive make-or-buy framework that highlights the crucial factors influencing companies (referred to as sponsors in later sections) in their decision to either outsource LNP manufacturing operations or establish in-house capabilities.

- Capacity Analysis: Estimation of global installed lipid nanoparticle contract manufacturing capacity, derived from data provided by various stakeholders in the public domain. This analysis emphasizes the distribution of the available capacity on the basis of [A] company size (small, mid-sized, and large and very large companies), [B] scale of operation (preclinical, clinical and commercial) and [C] geography (North America, Europe and Asia-Pacific).

- Market Impact Analysis: The report analyzes various factors such as drivers, restraints, opportunities, and challenges affecting the market growth.

KEY QUESTIONS ANSWERED IN THIS REPORT

- How many companies are currently engaged in this market?

- Which are the leading companies in this market?

- What is the global installed capacity of lipid nanoparticle contract manufacturers?

- What factors are likely to influence the evolution of this market?

- What is the current and future market size?

- What is the CAGR of this market?

- How is the current and future market opportunity likely to be distributed across key market segments?

REASONS TO BUY THIS REPORT

- The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. By analyzing the competitive landscape, businesses can make informed decisions to optimize their market positioning and develop effective go-to-market strategies.

- The report offers stakeholders a comprehensive overview of the market, including key drivers, barriers, opportunities, and challenges. This information empowers stakeholders to stay abreast of market trends and make data-driven decisions to capitalize on growth prospects.

ADDITIONAL BENEFITS

- Complimentary PPT Insights Packs

- Complimentary Excel Data Packs for all Analytical Modules in the Report

- 10% Free Content Customization

- Detailed Report Walkthrough Session with Research Team

- Free Updated report if the report is 6-12 months old or older

TABLE OF CONTENTS

1. PREFACE

- 1.1. Introduction

- 1.2. Key Market Insights

- 1.3. Scope of the Report

- 1.4. Inclusions and Exclusions

- 1.5. Key Questions Answered

- 1.6. Chapter Outlines

2. RESEARCH METHODOLOGY

- 2.1. Chapter Overview

- 2.2. Research Assumptions

- 2.3. Project Methodology

- 2.4. Forecast Methodology

- 2.5. Robust Quality Control

- 2.6. Key Market Segmentations

- 2.7. Key Considerations

- 2.7.1. Demographics

- 2.7.2. Economic Factors

- 2.7.3. Government Regulations

- 2.7.4. Supply Chain

- 2.7.5. COVID Impact / Related Factors

- 2.7.6. Market Access

- 2.7.7. Healthcare Policies

- 2.7.8. Industry Consolidation

3. ECONOMIC AND OTHER PROJECT SPECIFIC CONSIDERATIONS

- 3.1. Chapter Overview

- 3.2. Market Dynamics

- 3.2.1. Time Period

- 3.2.1.1. Historical Trends

- 3.2.1.2. Current and Forecasted Estimates

- 3.2.2. Currency Coverage

- 3.2.2.1. Overview of Major Currencies Affecting the Market

- 3.2.2.2. Impact of Currency Fluctuations on the Industry

- 3.2.3. Foreign Exchange Impact

- 3.2.3.1. Evaluation of Foreign Exchange Rates and Their Impact on Market

- 3.2.3.2. Strategies for Mitigating Foreign Exchange Risk

- 3.2.4. Recession

- 3.2.4.1. Historical Analysis of Past Recessions and Lessons Learnt

- 3.2.4.2. Assessment of Current Economic Conditions and Potential Impact on the Market

- 3.2.5. Inflation

- 3.2.5.1. Measurement and Analysis of Inflationary Pressures in the Economy

- 3.2.5.2. Potential Impact of Inflation on the Market Evolution

- 3.2.1. Time Period

4. EXECUTIVE SUMMARY

5. INTRODUCTION

- 5.1. Chapter Overview

- 5.2. Overview of Lipids

- 5.3 Introduction to Lipid Nanoparticles

- 5.3.1. Types of Lipid Nanoparticles

- 5.3.1.1. Solid Lipid Nanoparticles

- 5.3.1.2. Nanostructured Lipid Carriers

- 5.3.2. Advantages of Lipid Nanoparticles

- 5.3.3. Applications of Lipid Nanoparticles in Pharmaceutical Industry

- 5.3.3.1. Cancer Treatment

- 5.3.3.2. Gene Therapy

- 5.3.3.3. Vaccine Development

- 5.3.3.4. Medical Imaging / Diagnostics

- 5.3.3.5. Additional Applications

- 5.3.1. Types of Lipid Nanoparticles

- 5.4. Challenges Associated with Lipid Nanoparticle Manufacturing

- 5.5. Need for Outsourcing Lipid Nanoparticle Manufacturing

- 5.6. Concluding Remarks

6. LIPID NANOPARTICLES: SERVICE PROVIDERS LANDSCAPE

- 6.1. Chapter Overview

- 6.2. Lipid Nanoparticle Manufacturing: List of Service Providers

- 6.2.1 Analysis by Year of Establishment

- 6.2.2 Analysis by Company Size

- 6.2.3 Analysis by Location of Headquarters

- 6.2.4 Analysis by Company Size and Location of Headquarters

- 6.2.5 Analysis by Location of Lipid Nanoparticle Manufacturing Facility

- 6.2.6 Analysis by Scale of Operation

- 6.2.7 Analysis by Type of Molecule Delivered

- 6.2.8 Analysis by Therapeutic Area

- 6.2.9 Analysis by Type of Additional Services Offered

7. LIPID NANOPARTICLES: TECHNOLOGY LANDSCAPE

- 7.1. Chapter Overview

- 7.2. Lipid Nanoparticle: Technology Landscape

- 7.2.1. Analysis by Type of Formulation Method

- 7.2.2. Analysis by Type of Molecule Delivered

- 7.2.3. Analysis by Compatible Dosage Form

- 7.2.4. Analysis by Routes of Administration

- 7.2.5. Analysis by Therapeutic Area

- 7.3. Lipid Nanoparticle Technologies: List of Technology Developers

- 7.3.1. Analysis by Year of Establishment

- 7.3.2. Analysis by Company Size

- 7.3.3. Analysis by Location of Headquarters

- 7.3.4. Analysis by Company Size and Location of Headquarters

- 7.3.5. Analysis by Business Model

- 7.3.6. Most Active Players: Analysis by Number of Technologies

8. OTHER TYPES OF LIPIDS: SERVICE PROVIDERS LANDSCAPE

- 8.1. Chapter Overview

- 8.2. Other Types of Lipids: List of Service Providers

- 8.2.1 Analysis by Year of Establishment

- 8.2.2 Analysis by Company Size

- 8.2.3 Analysis by Location of Headquarters

- 8.2.4 Analysis by Company Size and Location of Headquarters

- 8.2.5. Analysis by Location of Manufacturing Facility

- 8.2.6. Analysis by Scale of Operation

- 8.2.7 Analysis by Type of Lipid Manufactured

- 8.2.8. Analysis by Scale of Operation and Type of Lipid Manufactured

- 8.2.9. Analysis by Type of Product

- 8.2.10. Analysis by Type of Additional Services Offered

- 8.2.11. Analysis by Type of Product and Type of Additional Services Offered

9. COMPANY COMPETITIVENESS ANALYSIS

- 9.1. Chapter Overview

- 9.2. Assumptions and Key Parameters

- 9.3. Methodology

- 9.4. Lipid Nanoparticle Manufacturing Service Providers: Company Competitiveness Analysis

- 9.4.1. Company Competitiveness Analysis: Small Players

- 9.4.2. Company Competitiveness Analysis: Mid-sized Players

- 9.4.3. Company Competitiveness Analysis: Large and Very Large Players

10. TECHNOLOGY COMPETITIVENESS ANALYSIS

- 10.1. Chapter Overview

- 10.2. Assumptions and Key Parameters

- 10.3. Methodology

- 10.4. Lipid Nanoparticle Technology Developers: Technology Competitiveness Analysis

- 10.4.1. Technology Competitiveness Analysis: Players based in North America

- 10.4.2. Technology Competitiveness Analysis: Players based in Europe and Asia-Pacific

11. COMPANY PROFILES: SERVICE PROVIDERS OF LIPID NANOPARTICLES

- 11.1. Chapter Overview

- 11.2. Curia

- 11.2.1. Company Overview

- 11.2.2. Service Portfolio

- 11.2.3. Recent Developments and Future Outlook

- 11.3. Emergent BioSolutions

- 11.3.1. Company Overview

- 11.3.2. Service Portfolio

- 11.3.3. Recent Developments and Future Outlook

- 11.4. EUROAPI

- 11.4.1. Company Overview

- 11.4.2. Service Portfolio

- 11.4.3. Recent Developments and Future Outlook

- 11.5. Evonik

- 11.5.1. Company Overview

- 11.5.2. Service Portfolio

- 11.5.3. Recent Developments and Future Outlook

- 11.6. Ardena

- 11.6.1. Company Overview

- 11.6.2. Service Portfolio

- 11.7. BIOVECTRA

- 117.1. Company Overview

- 11.7.2. Service Portfolio

- 11.8. Precision NanoSystems

- 11.8.1. Company Overview

- 11.8.2. Service Portfolio

12. COMPANY PROFILES: LIPID NANOPARTICLE TECHNOLOGY DEVELOPERS

- 12.1. Chapter Overview

- 12.2. Ascendia Pharmaceuticals

- 12.2.1. Company Overview

- 12.2.2. Lipid Nanoparticle Technology Portfolio

- 12.2.3. Recent Developments and Future Outlook

- 12.3. leon-nanodrugs

- 12.3.1. Company Overview

- 12.3.2. Lipid Nanoparticle Technology Portfolio

- 12.3.3. Recent Developments and Future Outlook

- 12.4. Pantherna Therapeutics

- 12.4.1. Company Overview

- 12.4.2. Lipid Nanoparticle Technology Portfolio

- 12.4.3. Recent Developments and Future Outlook

- 12.5. TLC Biosciences

- 12.5.1. Company Overview

- 12.5.2. Lipid Nanoparticle Technology Portfolio

- 12.5.3. Recent Developments and Future Outlook

- 12.6. Acuitas Therapeutics

- 12.6.1. Company Overview

- 12.6.2. Service Portfolio

- 12.7. Integrated Nanotherapeutics

- 12.7.1. Company Overview

- 12.7.2. Service Portfolio

- 12.8. Matinas BioPharma

- 12.8.1. Company Overview

- 12.8.2. Service Portfolio

13. COMPANY PROFILES: SERVICE PROVIDERS OF OTHER TYPES OF LIPIDS

- 13.1. Chapter Overview

- 13.2. Avanti Polar Lipids

- 13.2.1. Company Overview

- 13.2.2. Service Portfolio

- 13.2.3. Recent Developments and Future Outlook

- 13.3. Corden Pharma

- 13.3.1. Company Overview

- 13.3.2. Service Portfolio

- 13.3.3. Recent Developments and Future Outlook

- 13.4. Fujifilm

- 13.4.1. Company Overview

- 13.4.2. Service Portfolio

- 13.4.3. Recent Developments and Future Outlook

- 13.5. Merck

- 13.5.1. Company Overview

- 13.5.2. Service Portfolio

- 13.5.3. Recent Developments and Future Outlook

13..6. FormuMax Scientific

- 13.6.1. Company Overview

- 12.6.2. Service Portfolio

- 13.7. Creative Biolabs

- 13.7.1. Company Overview

- 13.7.2. Service Portfolio

- 13.8. Fresenius Kabi

- 13.8.1. Company Overview

- 13.8.2. Service Portfolio

14. PARTNERSHIPS AND COLLABORATIONS

- 14.1. Chapter Overview

- 14.2. Partnership Models

- 14.3. Lipid Nanoparticles Services and Technologies: List of Partnerships and Collaborations

- 14.3.1. Analysis by Year of Partnership

- 14.3.2. Analysis by Type of Partnership

- 14.3.3. Analysis by Year and Type of Partnership

- 14.3.4. Analysis by Type of Molecule

- 14.3.5. Analysis by Therapeutic Area

- 14.3.6. Analysis by Type of Partner

- 14.3.7. Most Active Players: Analysis by Number of Partnerships

- 14.3.8. Analysis by Geography

- 14.3.8.1. Intracontinental and Intercontinental Deals

- 14.3.8.2. International and Local Deals

15. LIKELY PARTNER ANALYSIS

- 15.1. Chapter Overview

- 15.2. Methodology

- 15.2. Likely Partners based in North America

- 15.3. Likely Partners based in Europe and Asia-Pacific

16. MAKE VERSUS BUY DECISION FRAMEWORK

- 16.1. Chapter Overview

- 16.2. Assumptions and Key Parameters

- 16.3. Lipid Nanoparticle Service Providers: Make versus Buy Decision Making Framework

- 16.3.1. Scenario 1

- 16.3.2. Scenario 2

- 16.3.3. Scenario 3

- 16.3.4. Scenario 4

- 16.4. Concluding Remarks

17. CAPACITY ANALYSIS

- 17.1. Chapter Overview

- 17.2. Key Assumptions and Methodology

- 17.3. Lipid Nanoparticle Service Providers: Annual Global Capacity

- 17.3.1. Analysis by Range of Installed Capacity

- 17.3.2. Analysis by Company Size

- 17.3.3. Analysis by Scale of Operation

- 17.3.4. Analysis by Location of Manufacturing Facility

- 17.3.4.1. Analysis of Lipid Contract Manufacturing Capacity Installed in North America

- 17.3.4.2. Analysis of Lipid Contract Manufacturing Capacity Installed in Europe

- 17.3.4.3. Analysis of Lipid Contract Manufacturing Capacity Installed in Asia-Pacific

- 17.3.5. Concluding Remarks

18. MARKET IMPACT ANALYSIS: DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES

- 18.1. Chapter Overview

- 18.2. Market Drivers

- 18.3. Market Restraints

- 18.4. Market Opportunities

- 18.5. Market Challenges

- 18.6. Conclusion

19. GLOBAL LIPID NANOPARTICLE MANUFACTURING MARKET

- 19.1. Chapter Overview

- 19.2. Assumptions and Methodology

- 19.3. Global Lipid Nanoparticle Manufacturing Market, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 19.3.1. Scenario Analysis

- 19.4. Key Market Segmentations

- 19.5. Dynamic Dashboard

20. LIPID NANOPARTICLE MANUFACTURING MARKET, BY TYPE OF MOLECULE DELIVERED

- 20.1. Chapter Overview

- 20.2. Key Assumptions and Methodology

- 20.3. Lipid Nanoparticle Manufacturing Market for Nucleic Acids: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 20.4. Lipid Nanoparticle Manufacturing Market for Small Molecules: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 20.5. Lipid Nanoparticle Manufacturing Market for Peptides / Proteins: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 20.6. Lipid Nanoparticle Manufacturing Market for Other Molecules: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 20.7. Data Triangulation

- 20.7.1. Insights based on Secondary Research

- 20.7.2. Insights from In-house Repository

21. LIPID NANOPARTICLE MANUFACTURING MARKET, BY SCALE OF OPERATION

- 21.1. Chapter Overview

- 21.2. Key Assumptions and Methodology

- 21.3. Lipid Nanoparticle Manufacturing Market for Preclinical Operations: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 21.4. Lipid Nanoparticle Manufacturing Market for Clinical Operations: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 21.5. Lipid Nanoparticle Manufacturing Market for Commercial Operations: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 21.6. Data Triangulation

- 21.6.1. Insights based on Secondary Research

- 21.6.2. Insights from In-house Repository

22. LIPID NANOPARTICLE MANUFACTURING MARKET, BY COMPANY SIZE

- 22.1. Chapter Overview

- 22.2. Key Assumptions and Methodology

- 22.3. Lipid Nanoparticle Manufacturing Market for Large Companies: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 22.4. Lipid Nanoparticle Manufacturing Market for Mid-sized Companies: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 22.5. Lipid Nanoparticle Manufacturing Market for Small Companies: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 22.6. Data Triangulation

- 22.6.1. Insights based on Secondary Research

- 22.6.2. Insights from In-house Repository

23. LIPID NANOPARTICLE MANUFACTURING MARKET, BY KEY GEOGRAPHICAL REGIONS

- 23.1. Chapter Overview

- 23.2. Key Assumptions and Methodology

- 23.3. Lipid Nanoparticle Manufacturing Market for North America: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 23.4. Lipid Nanoparticle Manufacturing Market for Europe: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 23.5. Lipid Nanoparticle Manufacturing Market for Asia-Pacific: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 23.6. Lipid Nanoparticle Manufacturing Market for Rest of the World: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 23.7. Data Triangulation

- 23.7.1. Insights based on Secondary Research

- 23.7.2. Insights from In-house Repository

24. CONCLUSION

25. EXECUTIVE INSIGHTS

- 25.1. Chapter Overview

- 25.2. LIPOSOMA

- 25.2.1. Company Snapshot

- 25.2.2. Interview Transcript: Founder and Chief Executive Officer

- 25.3. BIOVECTRA

- 25.3.1. Company Snapshot

- 25.3.2. Interview Transcript: Former

Director, Process Development Chemistry and Former Acting Manager, Biotech Process Development

- 25.4. OZ Biosciences

- 25.4.1. Company Snapshot

- 25.4.2. Interview Transcript: Formulation Scientist

26. APPENDIX 1: TABULATED DATA

27. APPENDIX 2: LIST OF COMPANIES AND ORGANIZATION

List of Tables

- Table 6.1 Lipid Nanoparticle Manufacturing: List of Service Providers

- Table 6.2 Lipid Nanoparticle Manufacturing Service Providers: Information on Scale of Operation and Type of Molecule Delivered

- Table 6.3 Lipid Nanoparticle Manufacturing Service Providers: Information on Therapeutic Area and Additional Services Offered

- Table 7.1 Lipid Nanoparticle Technologies: Information on Formulation Method and Type of Molecule Delivered

- Table 7.2 Lipid Nanoparticle Technologies: Information on Compatible Dosage Form and Routes of Administration

- Table 7.3 Lipid Nanoparticle Technologies: Information on Therapeutic Area

- Table 7.4 Lipid Nanoparticle Technologies: List of Technology Developers

- Table 8.1 Other Types of Lipids: List of Service Providers

- Table 8.2 Service Providers of Other Types of Lipids: Information on Scale of Operation and Type of Lipid Manufactured

- Table 8.3 Service Providers of Other Types of Lipids: Information on Type of Product and Additional Services Offered

- Table 11.1 Leading Service Providers of Lipid Nanoparticles: List of Companies Profiled

- Table 11.2 Curia: Company Snapshot

- Table 11.3 Curia: Manufacturing Service Portfolio for LNPs

- Table 11.4 Curia: Recent Developments and Future Outlook

- Table 11.5 Emergent BioSolutions: Company Snapshot

- Table 11.6 Emergent BioSolutions: Manufacturing Service Portfolio for LNPs

- Table 11.7 Emergent BioSolutions: Recent Developments and Future Outlook

- Table 11.8 EUROAPI: Company Snapshot

- Table 11.9 EUROAPI: Manufacturing Service Portfolio for LNPs

- Table 11.10 EUROAPI: Recent Developments and Future Outlook

- Table 11.11 Evonik: Company Snapshot

- Table 11.12 Evonik: Manufacturing Service Portfolio for LNPs

- Table 11.13 BIOVECTRA: Company Snapshot

- Table 11.14 BIOVECTRA: Manufacturing Service Portfolio for LNPs

- Table 11.15 Curapath: Company Snapshot

- Table 11.16 Curapath: Manufacturing Service Portfolio for LNPs

- Table 11.17 Precision NanoSystems: Company Snapshot

- Table 11.18 Precision NanoSystems: Manufacturing Service Portfolio for LNPs

- Table 12.1 Leading LNP Technology Providers: List of Companies Profiled

- Table 12.2 Ascendia Pharmaceuticals: Company Snapshot

- Table 12.3 Ascendia Pharmaceuticals: Lipid Nanoparticle Technology Portfolio

- Table 12.4 Ascendia Pharmaceuticals: Recent Developments and Future Outlook

- Table 12.5 leon-nanodrugs: Company Snapshot

- Table 12.6 leon-nanodrugs: Lipid Nanoparticle Technology Portfolio

- Table 12.7 leon-nanodrugs: Recent Developments and Future Outlook

- Table 12.8 Pantherna Therapeutics: Company Snapshot

- Table 12.9 Pantherna Therapeutics: Lipid Nanoparticle Technology Portfolio

- Table 12.10 Pantherna Therapeutics: Recent Developments and Future Outlook

- Table 12.11 TLC Biosciences: Company Snapshot

- Table 12.12 TLC Biosciences: Lipid Nanoparticle Technology Portfolio

- Table 12.13 TLC Biosciences: Recent Developments and Future Outlook

- Table 12.14 Acuitas Therapeutics: Company Snapshot

- Table 12.15 Acuitas Therapeutics: Lipid Nanoparticle Technology Portfolio

- Table 12.16 Integrated Nanotherapeutics: Company Snapshot

- Table 12.17 Integrated Nanotherapeutics: Lipid Nanoparticle Technology Portfolio

- Table 12.18 Matinas BioPharma: Company Snapshot

- Table 12.19 Matinas BioPharma: Lipid Nanoparticle Technology Portfolio

- Table 13.1 Leading Service Providers of Other Types of Lipids: List of Companies Profiled

- Table 13.2 Avanti Polar Lipids: Company Snapshot

- Table 13.3 Avanti Polar Lipids: Manufacturing Service Portfolio for Other Types of Lipids

- Table 13.4 CordenPharma: Company Snapshot

- Table 13.5 CordenPharma: Manufacturing Service Portfolio for Other Types of Lipids

- Table 13.6 CordenPharma: Recent Developments and Future Outlook

- Table 13.7 FUJIFILM: Company Snapshot

- Table 13.8 FUJIFILM: Manufacturing Service Portfolio for Other Types of Lipids

- Table 13.9 FUJIFILM: Recent Developments and Future Outlook

- Table 13.10 Merck: Company Snapshot

- Table 13.11 Merck: Manufacturing Service Portfolio for Other Types of Lipids

- Table 13.12 Merck: Recent Developments and Future Outlook

- Table 13.13 FormuMax Scientific: Company Snapshot

- Table 13.14 FormuMax Scientific: Manufacturing Service Portfolio for Other Types of Lipids

- Table 13.15 Creative Biolabs: Company Snapshot

- Table 13.16 Creative Biolabs: Manufacturing Service Portfolio for Other Types of Lipids

- Table 13.17 Fresenius Kabi: Company Snapshot

- Table 13.18 Fresenius Kabi: Manufacturing Service Portfolio for Other Types of Lipids

- Table 14.1 Lipid Nanoparticle Services and Technologies: List of Partnerships and Collaborations, since 2019

- Table 16.1 Likely Partner Analysis: Likely Partners based in North America

- Table 16.2 Likely Partner Analysis: Likely Partners based in Europe and Asia-Pacific

- Table 17.1 Capacity Analysis: Information on Company Size of CMO

- Table 17.2 Capacity Analysis: Information on Average Capacity by Company Size of CMO

- Table 17.3 Lipid Manufacturing Global Installed Capacity: Information on Total Capacity by Company Size (Liters)

- Table 25.1 LIPOSOMA: Company Snapshot

- Table 25.2 BIOVECTRA: Company Snapshot

- Table 25.3 OZ Biosciences: Company Snapshot

- Table 27.1 Lipid Nanoparticle Manufacturing Service Providers: Distribution by Year of Establishment

- Table 27.2 Lipid Nanoparticle Manufacturing Service Providers: Distribution by Company Size

- Table 27.3 Lipid Nanoparticle Manufacturing Service Providers: Distribution by Location of Headquarters

- Table 27.4 Lipid Nanoparticle Manufacturing Service Providers: Distribution by Company Size and Location of Headquarters

- Table 27.5 Lipid Nanoparticle Manufacturing Service Providers: Distribution by Location of Lipid Nanoparticle Manufacturing Facility

- Table 27.6 Lipid Nanoparticle Manufacturing Service Providers: Distribution by Scale of Operation

- Table 27.7 Lipid Nanoparticles Manufacturing Service Providers: Distribution by Type of Molecule Delivered

- Table 27.8 Lipid Nanoparticle Manufacturing Service Providers: Distribution by Therapeutic Area

- Table 27.9 Lipid Nanoparticle Manufacturing Service Providers: Distribution by Type of Additional Services Offered

- Table 27.10 Lipid Nanoparticle Technologies: Distribution by Type of Formulation Method

- Table 27.11 Lipid Nanoparticle Technologies: Distribution by Type of Molecule Delivered

- Table 27.12 Lipid Nanoparticle Technologies: Distribution by Compatible Dosage Form

- Table 27.13 Lipid Nanoparticle Technologies: Distribution by Route of Administration

- Table 27.14 Lipid Nanoparticle Technologies: Distribution by Therapeutic Area

- Table 27.15 Lipid Nanoparticle Technology Developers: Distribution by Year of Establishment

- Table 27.16 Lipid Nanoparticle Technology Developers: Distribution by Company Size

- Table 27.17 Lipid Nanoparticle Technology Developers: Distribution by Location of Headquarters

- Table 27.18 Lipid Nanoparticle Technology Developers: Distribution by Company Size and Location of Headquarters

- Table 27.19 Lipid Nanoparticle Technology Developers: Distribution by Business Model

- Table 27.20 Most Active Players: Distribution by Number of Technologies

- Table 27.21 Service Providers of Other Types of Lipids: Distribution by Year of Establishment

- Table 27.22 Service Providers of Other Types of Lipids: Distribution by Company Size

- Table 27.23 Service Providers of Other Types of Lipids: Distribution by Location of Headquarters

- Table 27.24 Service Providers of Other Types of Lipids: Distribution by Company Size and Location of Headquarters

- Table 27.25 Service Providers of Other Types of Lipids: Distribution by Location of Manufacturing Facility

- Table 27.26 Service Providers of Other Types of Lipids: Distribution by Scale of Operation

- Table 27.27 Service Providers of Other Types of Lipids: Distribution by Type of Lipid Manufactured

- Table 27.28 Service Providers of Other Types of Lipids: Distribution by Scale of Operation and Type of Lipid Manufactured

- Table 27.29 Service Providers of Other Types of Lipids: Distribution by Type of Product

- Table 27.30 Service Providers of Other Types of Lipids: Distribution by Type of Additional Services Offered

- Table 27.31 Service Providers of Other Types of Lipids: Distribution by Type of Product and Type of Services Offered

- Table 27.32 Partnerships and Collaborations: Cumulative Year-wise Trend, since 2019

- Table 27.33 Partnerships and Collaborations: Distribution by Type of Partnership

- Table 27.34 Partnerships and Collaborations: Distribution by Year and Type of Partnership

- Table 27.35 Partnerships and Collaborations: Distribution by Type of Molecule

- Table 27.36 Partnerships and Collaborations: Distribution by Therapeutic Area

- Table 27.37 Partnerships and Collaborations: Distribution by Type of Partner

- Table 27.38 Most Active Players: Distribution by Number of Partnerships

- Table 27.39 Partnerships and Collaborations: Intracontinental and Intercontinental Deals

- Table 27.40 Partnerships and Collaborations: International and Local Deals

- Table 27.41 Lipid Manufacturing Global Installed Capacity: Distribution by Range of Installed Capacity (Liters)

- Table 27.42 Lipid Contract Manufacturing Installed Capacity: Distribution by Company Size

- Table 27.43 Lipid Contract Manufacturing Installed Capacity: Distribution by Scale of Operation

- Table 27.44 Lipid Contract Manufacturing Installed Capacity: Distribution by Location of Manufacturing Facility

- Table 27.45 Lipid Contract Manufacturing Capacity Installed in North America

- Table 27.46 Lipid Contract Manufacturing Capacity Installed in Europe

- Table 27.47 Lipid Contract Manufacturing Capacity Installed in Asia-Pacific

- Table 27.48 Global Lipid Nanoparticle Manufacturing Market, Historical Trends (since 2018) (USD Billion)

- Table 27.49 Global Lipid Nanoparticle Manufacturing Market, Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 27.50 Lipid Nanoparticle Manufacturing Market: Distribution by Type of Molecule Delivered, Historical Trends (since 2018) (USD Billion)

- Table 27.51 Lipid Nanoparticle Manufacturing Market: Distribution by Type of Molecule Delivered, Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios

- Table 27.52 Lipid Nanoparticle Manufacturing Market: Distribution by Scale of Operation, Historical Trends (since 2018) (USD Billion)

- Table 27.53 Lipid Nanoparticle Manufacturing Market: Distribution by Scale of Operation, Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 27.54 Lipid Nanoparticle Manufacturing Market: Distribution by Company Size, Historical Trends (since 2018) (USD Billion)

- Table 27.55 Lipid Nanoparticle Manufacturing Market: Distribution by Company Size, Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 27.56 Lipid Nanoparticle Manufacturing Market: Distribution by Geography, Historical Trend (since 2018) (USD Billion)

- Table 27.57 Lipid Nanoparticle Manufacturing Market: Distribution by Geography, Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

List of Figures

- Figure 2.1 Research Methodology: Research Assumptions

- Figure 2.2 Research Methodology: Project Methodology

- Figure 2.3 Research Methodology: Forecast Methodology

- Figure 2.4 Research Methodology: Robust Quality Control

- Figure 2.5 Research Methodology: Key Market Segmentations

- Figure 4.1 Executive Summary: Lipid Nanoparticle Manufacturing Service Providers Market Landscape

- Figure 4.2 Executive Summary: Lipid Nanoparticle Technology Developers Market Landscape

- Figure 4.3 Executive Summary: Service Providers of Other Types of Lipids Market Landscape

- Figure 4.4 Executive Summary: Partnership and Collaborations

- Figure 4.5 Executive Summary: Capacity Analysis

- Figure 4.6 Executive Summary: Market Sizing and Opportunity Analysis

- Figure 5.1 Classification of Lipids

- Figure 5.2 Historical Development of Lipid Nanoparticles

- Figure 5.3 Orientation of Drug in Solid Lipid Nanoparticles and Nanostructured Lipid Carriers

- Figure 5.4 Commonly Outsourced Lipid Nanoparticles Contract Manufacturing Services

- Figure 6.1 Lipid Nanoparticle Manufacturing Service Providers: Distribution by Year of Establishment

- Figure 6.2 Lipid Nanoparticle Manufacturing Service Providers: Distribution by Company Size

- Figure 6.3 Lipid Nanoparticle Manufacturing Service Providers: Distribution by Location of Headquarters

- Figure 6.4 Lipid Nanoparticle Manufacturing Service Providers: Distribution by Company Size and Location of Headquarters

- Figure 6.5 Lipid Nanoparticle Manufacturing Service Providers: Distribution by Location of Lipid Nanoparticle Manufacturing Facility

- Figure 6.6 Lipid Nanoparticle Manufacturing Service Providers: Distribution by Scale of Operation

- Figure 6.7 Lipid Nanoparticles Manufacturing Service Providers: Distribution by Type of Molecule Delivered

- Figure 6.8 Lipid Nanoparticle Manufacturing Service Providers: Distribution by Therapeutic Area

- Figure 6.9 Lipid Nanoparticle Manufacturing Service Providers: Distribution by Type of Additional Services Offered

- Figure 7.1 Lipid Nanoparticle Technologies: Distribution by Type of Formulation Method

- Figure 7.2 Lipid Nanoparticle Technologies: Distribution by Type of Molecule Delivered

- Figure 7.3 Lipid Nanoparticle Technologies: Distribution by Compatible Dosage Form

- Figure 7.4 Lipid Nanoparticle Technologies: Distribution by Route of Administration

- Figure 7.5 Lipid Nanoparticle Technologies: Distribution by Therapeutic Area

- Figure 7.6 Lipid Nanoparticle Technology Developers: Distribution by Year of Establishment

- Figure 7.7 Lipid Nanoparticle Technology Developers: Distribution by Company Size

- Figure 7.8 Lipid Nanoparticle Technology Developers: Distribution by Location of Headquarters

- Figure 7.9 Lipid Nanoparticle Technology Developers: Distribution by Company Size and Location of Headquarters

- Figure 7.10 Lipid Nanoparticle Technology Developers: Distribution by Business Model

- Figure 7.11 Most Active Players: Distribution by Number of Technologies

- Figure 8.1 Service Providers of Other Types of Lipids: Distribution by Year of Establishment

- Figure 8.2 Service Providers of Other Types of Lipids: Distribution by Company Size

- Figure 8.3 Service Providers of Other Types of Lipids: Distribution by Location of Headquarters

- Figure 8.4 Service Providers of Other Types of Lipids: Distribution by Company Size and Location of Headquarters

- Figure 8.5 Service Providers of Other Types of Lipids: Distribution by Location of Manufacturing Facility

- Figure 8.6 Service Providers of Other Types of Lipids: Distribution by Scale of Operation

- Figure 8.7 Service Providers of Other Types of Lipids: Distribution by Type of Lipid Manufactured

- Figure 8.8 Service Providers of Other Types of Lipids: Distribution by Scale of Operation and Type of Lipid Manufactured

- Figure 8.9 Service Providers of Other Types of Lipids: Distribution by Type of Product

- Figure 8.10 Service Providers of Other Types of Lipids: Distribution by Type of Additional Services Offered

- Figure 8.11 Service Providers of Other Types of Lipids: Distribution by Type of Product and Type of Additional Services Offered

- Figure 9.1 Company Competitiveness Analysis: Small Players

- Figure 9.2 Company Competitiveness Analysis: Mid-sized Players

- Figure 9.3 Company Competitiveness Analysis: Large and Very Large Players

- Figure 10.1 Technology Competitiveness Analysis: Players based in North America

- Figure 10.2 Technology Competitiveness Analysis: Players based in Europe and Asia-Pacific

- Figure 14.1 Partnerships and Collaborations: Cumulative Year-wise Trend, since 2019

- Figure 14.2 Partnerships and Collaborations: Distribution by Type of Partnership

- Figure 14.3 Partnerships and Collaborations: Distribution by Year and Type of Partnership

- Figure 14.4 Partnerships and Collaborations: Distribution by Type of Molecule

- Figure 14.5 Partnerships and Collaborations: Distribution by Therapeutic Area

- Figure 14.6 Partnerships and Collaborations: Distribution by Type of Partner

- Figure 14.7 Most Active Players: Distribution by Number of Partnerships

- Figure 14.8 Partnerships and Collaborations: Intracontinental and Intercontinental Deals

- Figure 14.9 Partnerships and Collaborations: International and Local Deals

- Figure 15.1 Likely Partners Analysis: Likely Partners based in North America

- Figure 15.2 Likely Partners Analysis: Likely Partners based in Europe and Asia-Pacific

- Figure 16.1 Make versus Buy Decision Making Framework

- Figure 16.2 Make versus Buy Decision Making: Possible Scenarios

- Figure 17.1 Lipid Manufacturing Global Installed Capacity: Distribution by Range of Installed Capacity (Liters)

- Figure 17.2 Lipid Contract Manufacturing Installed Capacity: Distribution by Company Size

- Figure 17.3 Lipid Contract Manufacturing Installed Capacity: Distribution by Scale of Operation

- Figure 17.4 Lipid Contract Manufacturing Installed Capacity: Distribution by Location of Manufacturing Facility

- Figure 17.5 Lipid Contract Manufacturing Capacity Installed in North America

- Figure 17.6 Lipid Contract Manufacturing Capacity Installed in Europe

- Figure 17.7 Lipid Contract Manufacturing Capacity Installed in Asia-Pacific

- Figure 19.1 Global Lipid Nanoparticle Manufacturing Market, Historical Trends (since 2018)

- Figure 19.2 Global Lipid Nanoparticle Manufacturing Market, Forecasted Estimates (till 2035), Conservative Scenario (USD Billion)

- Figure 19.3 Global Lipid Nanoparticle Manufacturing Market, Forecasted Estimates (till 2035), Optimistic Scenario (USD Billion)

- Figure 20.1 Lipid Nanoparticle Manufacturing Market: Distribution by Type of Molecule Delivered

- Figure 20.2 Lipid Nanoparticle Manufacturing Market for Nucleic Acids, Historical Trends (since 2018) and Forecasted Estimates (2023-2035) (USD Billion)

- Figure 20.3 Lipid Nanoparticle Manufacturing Market for Small Molecules, Historical Trends (since 2018) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 20.4 Lipid Nanoparticle Manufacturing Market for Proteins/Peptides, Historical Trends (since 2018) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 20.5 Lipid Nanoparticle Manufacturing Market for Other Types of Molecules Delivered, Historical Trends (since 2018) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 21.1 Lipid Nanoparticle Manufacturing Market: Distribution by Scale of Operation

- Figure 21.2 Lipid Nanoparticle Manufacturing Market for Preclinical Operations, Historical Trends (since 2018) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 21.3 Lipid Nanoparticle Manufacturing Market for Clinical Operations, Historical Trends (since 2018) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 21.4 Lipid Nanoparticle Manufacturing Market for Commercial Operations, Historical Trends (since 2018) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 22.1 Lipid Nanoparticle Manufacturing Market: Distribution by Company Size

- Figure 22.2 Lipid Nanoparticle Manufacturing Market for Very Large and Large Companies, Historical Trends (since 2018) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 22.3 Lipid Nanoparticle Manufacturing Market for Mid-sized Companies, Historical Trends (since 2018) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 22.4 Lipid Nanoparticle Manufacturing Market for Small Companies, Historical Trends (since 2018) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 23.1 Lipid Nanoparticle Manufacturing Market: Distribution by Geography

- Figure 23.2 Lipid Nanoparticle Manufacturing Market in North America, Historical Trends (since 2018) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 23.3 Lipid Nanoparticle Manufacturing Market in Europe, Historical Trends (since 2018) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 23.4 Lipid Nanoparticle Manufacturing Market in Asia-Pacific, Historical Trends (since 2018) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 23.5 Lipid Nanoparticle Manufacturing Market in Rest of the World, Historical Trends (since 2018) and Forecasted Estimates (till 2035) (USD Billion)

- Figure 24.1 Concluding Remarks: Lipid Nanoparticle Manufacturing Service Providers Market Landscape

- Figure 24.2 Concluding Remarks Lipid Nanoparticle Technology Developers Market Landscape

- Figure 24.3 Concluding Remarks: Service Providers of Other Types of Lipids Market Landscape

- Figure 24.4 Concluding Remarks: Company Competitiveness Analysis

- Figure 24.5 Concluding Remarks: Technology Competitiveness Analysis

- Figure 24.6 Concluding Remarks: Partnerships and Collaborations

- Figure 24.7 Concluding Remarks: Capacity Analysis

- Figure 24.8 Concluding Remarks: Market Forecast and Opportunity Analysis (I/II)

- Figure 24.9 Concluding Remarks: Market Forecast and Opportunity Analysis (II/II)

- Figure 24.10 Concluding Remarks: Key Growth Drivers and Restraints