PUBLISHER: Roots Analysis | PRODUCT CODE: 1648557

PUBLISHER: Roots Analysis | PRODUCT CODE: 1648557

Aseptic Fill Finish Manufacturing Market by Type of Molecule, Type of Packaging Container Offered, Type of Drug Product, Scale of Operation, Company Size, Target Therapeutic Area and Geographical Regions : Industry Trends and Global Forecasts, Till 2035

ASEPTIC FILL FINISH MANUFACTURING MARKET: OVERVIEW

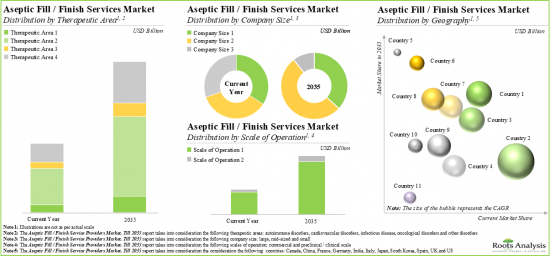

As per Roots Analysis, the global aseptic fill finish manufacturing market is estimated to grow from USD 5.4 billion in the current year to USD 15 billion by 2035, at a CAGR of 9% during the forecast period, till 2035.

The market sizing and opportunity analysis has been segmented across the following parameters:

Type of Molecules

- Small Molecules

- Biologics

Type of Packaging Containers Offered

- Vials

- Syringes

- Ampoules

- Cartridges

Type of Drug Products

- Vaccine

- Recombinant Proteins

- Antibodies

- Oligonucleotides

- Gene Therapies

- Cell Therapies

- Other Products

Target Therapeutic Area

- Autoimmune Disorders

- Cardiovascular Disorders

- Infectious Disorders

- Oncological Disorders

- Other Disorders

Scale of Operation

- Preclinical / Clinical

- Commercial

Company Size

- Large

- Mid-sized

- Small

Key Geographical Regions

- North America

- Europe

- Asia-Pacific

- Middle East and North Africa

- Latin America

ASEPTIC FILL FINISH MANUFACTURING MARKET: GROWTH AND TRENDS

Fill / finish is the final step in the downstream processing of a product, wherein the purified bulk formulation of the drug product is mixed with the necessary excipients and stabilizers and formulated and aliquoted into the appropriate dosage forms for clinical use or commercial distribution. These operations are usually carried out under aseptic conditions and are mostly automated. It is worth mentioning that aseptic fill finish manufacturing requires specialized automated equipment, clean room setup, skilled personnel, and continuous supervision to maintain the sterility and safety of the final drug product. Given the challenges associated with improper filling of drugs and to ensure the quality of end-products, innovators have developed a preference for outsourcing their aseptic fill / finish operations to contract service providers. Presently, contract fill-and-finish services are among the most outsourced services in the pharmaceutical domain. Driven by the growing trend of outsourcing, the opportunity within the aseptic fill / finish services market is anticipated to increase at a steady pace in the foreseen future.

ASEPTIC FILL FINISH MANUFACTURING MARKET: KEY INSIGHTS

The report delves into the current state of the aseptic fill finish manufacturing market and identifies potential growth opportunities within the industry. Some key findings from the report include:

- Over 175 companies claim to offer fill / finish services for various types of biopharmaceutical drug products; the growth initiatives, in this segment, are being led by large and mid-sized players.

- More than 70% of the service providers offer fill / finish for proteins and peptides; in addition, ~80% of the players have the required capabilities to carry out lyophilization operations.

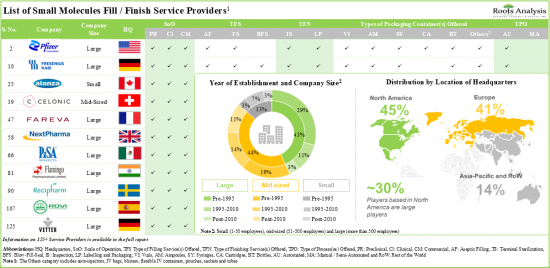

- Around 125 industry players offer fill / finish services for various types of small molecule drug products, across different scales of operation.

- Leveraging their expertise, 85% of stakeholders extend services for labelling and packaging, both for clinical and commercial scale operations.

- In order to expand their aseptic fill / finish service portfolios and gain access to emerging technologies, companies are actively entering into strategic partnerships.

- The aseptic fill / finish services market is likely to grow at a CAGR of ~11%, till 2035; this opportunity is expected to be well distributed across different types of molecules, packaging containers and drug products.

- In the long-term, the US (~30%) is likely to significantly contribute towards the market growth, followed by Asia-Pacific countries; specifically, within Europe, Germany and France are likely to account for ~5% market share, each.

ASEPTIC FILL FINISH MANUFACTURING MARKET: KEY SEGMENTS

Currently, Biologics Occupy the Largest Share of the Aseptic Fill Finish Manufacturing Market

Based on the type of molecule, the market is segmented into small molecules and biologics. At present, the biologic segment holds the maximum share of the aseptic fill finish manufacturing market. This trend is unlikely to change in the near future.

Syringes is the Fastest Growing Segment of the Aseptic Fill Finish Manufacturing Market

Based on the type of packaging container, the market is segmented into vials, syringes, ampoules, cartridges. Currently, vials hold the maximum share of the aseptic fill finish manufacturing market. It is worth highlighting that aseptic fill finish manufacturing market for syringes is likely to grow at a relatively higher CAGR.

Antibodies are Likely to Dominate the Aseptic Fill Finish Manufacturing Market During the Forecast Period

Based on the type of drug products, the market is segmented into vaccines, recombinant proteins, antibodies, oligonucleotides, gene therapies, cell therapies, other products. At present, antibodies hold the maximum share of the aseptic fill finish manufacturing market. This trend is likely to remain the same in the forthcoming years.

Oncological Disorders Account for the Largest Share of the Aseptic Fill Finish Manufacturing Market

Based on the therapeutic area, the market is segmented into autoimmune disorders, cardiovascular disorders, infectious disorders, oncological disorders, other disorders. While oncological disorders account for a relatively higher market share, it is worth highlighting that the autoimmune disorders segment is expected to witness substantial market growth in the coming years.

Based on the Scale of Operation, Commercial Scale is Likely to Dominate the Aseptic Fill Finish Manufacturing Market During the Forecast Period

Based on the scale of operation, the market is segmented into preclinical / clinical and commercial scale. Whilst commercial scale manufacturing will be the primary driver of the overall market, it is worth highlighting that the aseptic fill finish manufacturing market at preclinical / clinical scale is likely to grow at a relatively higher CAGR.

Large Companies Segment is the Fastest Growing Segment of the Aseptic Fill Finish Manufacturing Market During the Forecast Period

Based on the company size, the market is segmented into large, mid-sized and small companies. At present, large companies hold the maximum share of the aseptic fill finish manufacturing market. It is worth highlighting that the aseptic fill finish manufacturing market for small companies is likely to grow at a relatively higher CAGR.

North America Accounts for the Largest Share of the Market

Based on key geographical regions, the market is segmented into North America, Europe, Asia-Pacific and Rest of the World. Majority share is expected to be captured by players based in North America. It is worth highlighting that, over the years, the market in Asia-Pacific is expected to grow at a higher CAGR.

Example Players in the Aseptic Fill Finish Manufacturing Market

- AbbVie Contract Manufacturing

- Asymchem

- Aenova

- APL

- BioPharma Solutions

- BioReliance

- Boehringer Ingelheim BioXcellence

- Catalent Biologics

- Charles River Laboratories

- CordenPharma

- Delpharm

- Fareva

- Fresenius Kabi

- Glaxo SmithKline

- Hetero Drugs

- Intas Pharmaceuticals

- Lonza

- Pierre Fabre

- Pfizer CentreOne

- Plastikon Healthcare

- Patheon

- PiSA Farmaceutica

- Recipharm

- Wacker Biotech

- Syngene

- Sharp Services

- Siegfried

- Takara Bio

- WuXi Biologics

- Wockhardt

Primary Research Overview

The opinions and insights presented in this study were influenced by discussions conducted with multiple stakeholders. The research report features detailed transcripts of interviews held with the following industry stakeholders:

- Former Chief Commercial Officer, IDT Biologika

- Former Vice President of Business Development and Marketing, Cytovance Biologics

- Vice President and Head of Formulation Development, Syngene

- Head of Business Development, oncomed manufacturing

- Former Technology Watch Manager, Yposkesi

- International Business Developer, HALIX

ASEPTIC FILL FINISH MANUFACTURING MARKET: RESEARCH COVERAGE

- Market Sizing and Opportunity Analysis: The report features an in-depth analysis of the aseptic fill / finish manufacturing market, focusing on key market segments, including [A] type of molecule, [B] type of packaging container offered, [C] type of drug product, [D] scale of operation, [E] company size, [F] target therapeutic area and [G] key geographical regions.

- Market Landscape 1: A comprehensive evaluation of sterile fill / finish service providers, considering various parameters, such as [A] year of establishment, [B] company size (in terms of number of employees), [C] location of headquarters, [D] type of molecule(s) and [E] type of packaging container(s) offered.

- Market Landscape 2: A comprehensive evaluation of companies offering aseptic fill / finish services for biologics, considering various parameters, such as [A] year of establishment, [B] company size, [C] location of headquarters, [D] location of fill / finish manufacturing facility, [E] type of packaging container(s) used, [F] type of biologic(s) manufactured, [G] scale of operation and [H] type of additional drug product-related service(s) offered.

- Market Landscape 3: A comprehensive evaluation of companies offering aseptic fill / finish services for small molecules, considering various parameters, such as [A] year of establishment, [B] company size, [C] location of headquarters, [D] location of fill finish manufacturing facility, [E] type of filling service(s) offered, [F] type of finishing service(s) offered, [G] type of packaging container(s) offered, [H] scale of operation, [I] types of dosage forms filled and [J] type of process(es).

- Company Profiles: In-depth profiles of key aseptic fill / finish service providers based in North America, Europe and Asia Pacific, focusing on [A] company overviews, [B] service portfolio, [C] fill-finish manufacturing facility, [D] financial information (if available), [E] recent developments and [F] an informed future outlook.

- Partnerships and Collaborations: An analysis of partnerships established in this sector based on multiple relevant parameters, such as [A] year of partnership, [B] type of partnership, [C] scale of operation, [D] type of molecule(s), [E] type of service(s) offered, [F] type of process(es) involved, [G] type of drug product(s) filled and [H] most active companies (in terms of number of partnerships) in the industry.

- Case Study 1: A general discussion on the use of robotic systems in aseptic fill and finish operations. It provides a list of equipment used by fill / finish service providers, highlighting the purpose of robotics in various manufacturing operations. Additionally, it includes a list of companies offering robots for use in the manufacturing processes which are carried out in the pharmaceutical sector.

- Case Study 2: A general discussion on the use of ready-to-use packaging components in aseptic fill / finish operations. It also includes information related to the advantages and disadvantages of ready-to-use packaging components, along with a list of suppliers providing these components.

KEY QUESTIONS ANSWERED IN THIS REPORT

- How many companies are currently engaged in this market?

- Which are the leading companies in this market?

- What kind of partnership models are commonly adopted by industry stakeholders?

- What factors are likely to influence the evolution of this market?

- What is the current and future market size?

- What is the CAGR of this market?

- How is the current and future market opportunity likely to be distributed across key market segments?

REASONS TO BUY THIS REPORT

- The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. By analyzing the competitive landscape, businesses can make informed decisions to optimize their market positioning and develop effective go-to-market strategies.

- The report offers stakeholders a comprehensive overview of the market, including key drivers, barriers, opportunities, and challenges. This information empowers stakeholders to stay abreast of market trends and make data-driven decisions to capitalize on growth prospects.

ADDITIONAL BENEFITS

- Complimentary PPT Insights Packs

- Complimentary Excel Data Packs for all Analytical Modules in the Report

- 10% Free Content Customization

- Detailed Report Walkthrough Session with Research Team

- Free Updated report if the report is 6-12 months old or older

TABLE OF CONTENTS

1. PREFACE

- 1.1. Chapter Overview

- 1.2. Key Insights

- 1.3. Scope of the Report

- 1.4. Research Methodology

- 1.5. Frequently Asked Questions

- 1.6. Chapter Outlines

2. EXECUTIVE SUMMARY

3. INTRODUCTION

- 3.1. Chapter Overview

- 3.2. Introduction to Contract Manufacturing

- 3.3. Commonly Outsourced Operations in Biopharmaceutical Industry

- 3.3.1. Aseptic Fill / Finish Operations

- 3.4. Basic Guidelines for Selecting a Fill / Finish Service Provider

- 3.5. Advantages of Outsourcing Fill / Finish Operations

- 3.6. Risks and Challenges Associated with Outsourcing Fill / Finish Operations

- 3.7. Concluding Remarks

4. ASEPTIC FILL / FINISH SERVICE PROVIDERS LANDSCAPE

- 4.1. Chapter Overview

- 4.2. Aseptic Fill / Finish: Service Providers Landscape

- 4.2.1. Analysis by Year of Establishment

- 4.2.2. Analysis by Company Size

- 4.2.3. Analysis by Location of Headquarters

- 4.2.4. Analysis by Type of Molecule(s)

- 4.2.5. Analysis by Type of Packaging Container(s) Offered

5. BIOLOGICS FILL / FINISH SERVICE PROVIDERS LANDSCAPE

- 5.1. Chapter Overview

- 5.2. Biologics Fill / Finish: Service Providers Landscape

- 5.2.1. Analysis by Year of Establishment

- 5.2.2. Analysis by Company Size

- 5.2.3. Analysis by Location of Headquarters

- 5.2.4. Analysis by Location of Fill / Finish Facilities

- 5.2.5. Analysis by Type of Packaging Container(s) Offered

- 5.2.6. Analysis by Type of Drug Product(s) Involved

- 5.2.7. Analysis by Scale of Operation

- 5.2.8. Analysis by Additional Drug Product-related Services Offered

- 5.2.9. Information on Fill / Finish Capacity

6. SMALL MOLECULE FILL / FINISH SERVICE PROVIDERS LANDSCAPE

- 6.1. Chapter Overview

- 6.2. Small Molecule Fill / Finish: Service Providers Landscape

- 6.2.1. Analysis by Year of Establishment

- 6.2.2. Analysis by Company Size

- 6.2.3. Analysis by Location of Headquarters

- 6.2.4. Analysis by Location of Fill / Finish Facilities

- 6.2.5. Analysis by Type of Filling Service(s) Offered

- 6.2.6. Analysis by Type of Finishing Service(s) Offered

- 6.2.7. Analysis by Type of Packaging Container(s) Offered

- 6.2.8. Analysis by Scale of Operation

- 6.2.9. Analysis by Type of Dosage Form(s) Filled

- 6.2.10. Analysis by Type of Process(es)

- 6.2.11. Information on Fill / Finish Capacity

7. COMPANY PROFILES: ASEPTIC FILL / FINISH SERVICE PROVIDERS IN NORTH AMERICA

- 7.1. Chapter Overview

- 7.2. Companies Offering Aseptic Fill / Finish Services for Biologics

- 7.2.1. AbbVie Contract Manufacturing

- 7.2.1.1. Company Snapshot

- 7.2.1.2. Financial Information

- 7.2.1.3. Service Portfolio

- 7.2.1.4. Fill / Finish Services Offered

- 7.2.1.5. Recent Developments and Future Outlook

- 7.2.2. BioPharma Solutions

- 7.2.2.1. Company Snapshot

- 7.2.2.2. Financial Information

- 7.2.2.3. Service Portfolio

- 7.2.2.4. Fill / Finish Services Offered

- 7.2.2.5. Recent Developments and Future Outlook

- 7.2.3. BioReliance

- 7.2.3.1. Company Snapshot

- 7.2.3.2. Financial Information

- 7.2.3.3. Service Portfolio

- 7.2.3.4. Fill / Finish Services Offered

- 7.2.3.5. Recent Developments and Future Outlook

- 7.2.4. Catalent Biologics

- 7.2.4.1. Company Snapshot

- 7.2.4.2. Financial Information

- 7.2.4.3. Service Portfolio

- 7.2.4.4. Fill / Finish Services Offered

- 7.2.4.5. Recent Developments and Future Outlook

- 7.2.5. Charles River Laboratories

- 7.2.5.1. Company Snapshot

- 7.2.5.2. Financial Information

- 7.2.5.3. Fill / Finish Services Offered

- 7.2.5.4. Recent Developments and Future Outlook

- 7.2.6. Patheon

- 7.2.6.1. Company Snapshot

- 7.2.6.2. Financial Information

- 7.2.6.3. Service Portfolio

- 7.2.6.4. Fill / Finish Services Offered

- 7.2.6.5. Recent Developments and Future Outlook

- 7.2.1. AbbVie Contract Manufacturing

- 7.3. Companies Offering Aseptic Fill / Finish Services for Small Molecules

- 7.3.1.1. Pfizer CentreOne

- 7.3.1.2. Company Snapshot

- 7.3.1.3. Service Portfolio

- 7.3.1.4. Fill / Finish Services Offered

- 7.3.1.5. Recent Developments and Future Outlook

- 7.3.2. Plastikon Healthcare

- 7.3.2.1. Company Snapshot

- 7.3.2.2. Service Portfolio

- 7.3.2.3. Fill / Finish Services Offered

- 7.3.2.4. Recent Developments and Future Outlook

- 7.3.3. Sharp Services

- 7.3.3.1. Company Snapshot

- 7.3.3.2. Service Portfolio

- 7.3.3.3. Fill / Finish Services Offered

- 7.3.3.4. Recent Developments and Future Outlook

8. COMPANY PROFILES: ASEPTIC FILL / FINISH SERVICE PROVIDERS IN EUROPE

- 8.1. Company Overview

- 8.2. Companies Offering Aseptic Fill / Finish Services for Biologics

- 8.2.1. Boehringer Ingelheim BioXcellence

- 8.2.1.1. Company Snapshot

- 8.2.1.2. Financial Information

- 8.2.1.3. Service Portfolio

- 8.2.1.4. Fill / Finish Services Offered

- 8.2.1.5. Recent Developments and Future Outlook

- 8.2.2. Fareva

- 8.2.2.1. Company Snapshot

- 8.2.2.2. Fill / Finish Services Offered

- 8.2.2.3. Recent Developments and Future Outlook

- 8.2.3. GlaxoSmithKline

- 8.2.3.1. Company Snapshot

- 8.2.3.2. Financial Information

- 8.2.3.3. Fill / Finish Services Offered

- 8.2.3.4. Recent Developments and Future Outlook

- 8.2.4. Lonza

- 8.2.4.1. Company Snapshot

- 8.2.4.2. Financial Information

- 8.2.4.3. Service Portfolio

- 8.2.4.4. Fill / Finish Services Offered

- 8.2.4.5. Recent Developments and Future Outlook

- 8.2.5. Pierre Fabre

- 8.2.5.1. Company Snapshot

- 8.2.5.2. Financial Information

- 8.2.5.3. Service Portfolio

- 8.2.5.4. Fill / Finish Services Offered

- 8.2.5.5. Recent Developments and Future Outlook

- 8.2.6. Wacker Biotech

- 8.2.6.1. Company Snapshot

- 8.2.6.2. Financial Information

- 8.2.6.3. Service Portfolio

- 8.2.6. 4. Fill / Finish Services Offered

- 8.2.6.5. Recent Developments and Future Outlook

- 8.2.1. Boehringer Ingelheim BioXcellence

- 8.3. Companies Offering Aseptic Fill / Finish Services for Small Molecules

- 8.3.1. Aenova

- 8.3.1.1. Company Snapshot

- 8.3.1.2. Financial Information

- 8.3.1.3. Service Portfolio

- 8.3.1.4. Fill / Finish Services Offered

- 8.3.1.5. Recent Developments and Future Outlook

- 8.3.2. APL

- 8.3.2.1. Company Snapshot

- 8.3.2.2. Service Portfolio

- 8.3.2.3. Fill / Finish Services Offered

- 8.3.2.4. Recent Developments and Future Outlook

- 8.3.3. CordenPharma

- 8.3.3.1. Company Snapshot

- 8.3.3.2. Service Portfolio

- 8.3.3.3. Fill / Finish Services Offered

- 8.3.3.4. Recent Developments and Future Outlook

- 8.3.4. Delpharm

- 8.3.4.1. Company Snapshot

- 8.3.4.2. Service Portfolio

- 8.3.4.3. Fill / Finish Services Offered

- 8.3.4.4. Recent Developments and Future Outlook

- 8.3.5. PiSA Farmaceutica

- 8.3.5.1. Company Snapshot

- 8.3.5.2. Service Portfolio

- 8.3.5.3. Fill / Finish Services Offered

- 8.3.5.4. Recent Developments and Future Outlook

- 8.3.1. Aenova

- 8.4. Companies Offering Aseptic Fill / Finish Services for Biologics and Small Molecules

- 8.4.1. Fresenius Kabi

- 8.4.1.1. Company Snapshot

- 8.4.1.2 Financial Information

- 8.4.1.3. Service Portfolio

- 8.4.1.4. Fill / Finish Services Offered

- 8.4.1.5. Recent Developments and Future Outlook

- 8.4.2. Recipharm

- 8.4.2.1. Company Snapshot

- 8.4.2.2. Financial Information

- 8.4.2.3. Service Portfolio

- 8.4.2.4. Fill / Finish Services Offered

- 8.4.2.5. Recent Developments and Future Outlook

- 8.4.1. Fresenius Kabi

9. COMPANY PROFILES: ASEPTIC FILL / FINISH SERVICE PROVIDERS IN ASIA-PACIFIC

- 9.1. Company Overview

- 9.2. Companies Offering Aseptic Fill / Finish Services for Biologics

- 9.2.1. Asymchem

- 9.2.1.1. Company Snapshot

- 9.2.1.2. Financial Information

- 9.2.1.3. Service Portfolio

- 9.2.1.4. Fill / Finish Services Offered

- 9.2.1.5. Recent Developments and Future Outlook

- 9.2.2. Samsung Biologics

- 9.2.2.1. Company Snapshot

- 9.2.2.2. Financial Information

- 9.2.2.3. Service Portfolio

- 9.2.2.4. Fill / Finish Services Offered

- 9.2.2.5. Recent Developments and Future Outlook

- 9.2.3. Syngene

- 9.2.3.1. Company Snapshot

- 9.2.3.2. Financial Information

- 9.2.3.3. Service Portfolio

- 9.2.3.4. Fill / Finish Services Offered

- 9.2.3.5. Recent Developments and Future Outlook

- 9.2.4. Takara Bio

- 9.2.4.1. Company Snapshot

- 9.2.4.2. Financial Information

- 9.2.4.3. Service Portfolio

- 9.2.4.4. Fill / Finish Services Offered

- 9.2.4.5. Recent Developments and Future Outlook

- 9.2.5. WuXi Biologics

- 9.2.5.1. Company Snapshot

- 9.2.5.2. Financial Information

- 9.2.5.3. Service Portfolio

- 9.2.5.4. Fill / Finish Services Offered

- 9.2.5.5. Recent Developments and Future Outlook

- 9.2.6. Hetero Drugs

- 9.2.6.1. Company Snapshot

- 9.2.6.2. Fill / Finish Services Offered

- 9.2.6.3. Recent Developments and Future Outlook

- 9.2.7. Intas Pharmaceuticals

- 9.2.7.1. Company Snapshot

- 9.2.7.2. Fill / Finish Services Offered

- 9.2.7.3. Recent Developments and Future Outlook

- 9.2.1. Asymchem

- 9.3. Companies Offering Aseptic Fill / Finish Services for Small Molecules

- 9.3.1. Siegfried

- 9.3.1.1. Company Snapshot

- 9.3.1.2. Financial Information

- 9.3.1.3. Service Portfolio

- 9.3.1.4. Fill / Finish Services Offered

- 9.3.1.5. Recent Developments and Future Outlook

- 9.3.2. Wockhardt

- 9.3.2.1. Company Snapshot

- 9.3.2.2. Financial Information

- 9.3.2.3. Service Portfolio

- 9.3.2.4. Fill / Finish Services Offered

- 9.3.2.5. Recent Developments and Future Outlook

- 9.3.1. Siegfried

10. PARTNERSHIPS AND COLLABORATIONS

- 10.1. Chapter Overview

- 10.2. Partnership Models

- 10.3. Aseptic Fill / Finish Service Providers: List of Partnerships and Collaborations

- 10.3.1. Analysis by Year of Partnership

- 10.3.2. Analysis by Type of Partnership

- 10.3.3. Analysis by Scale of Operation

- 10.3.4. Analysis by Type of Molecule(s) Involved

- 10.3.5. Analysis by Type of Service(s) Offered

- 10.3.6. Analysis by Type of Process(es) Involved

- 10.3.7. Analysis by Type of Drug Product(s) Involved

- 10.3.8. Most Active Players: Analysis by Number of Partnerships

- 10.3.9. Analysis by Geography

- 10.3.9.1. Intercontinental and Intracontinental Agreements

11. MARKET SIZING AND OPPORTUNITY ANALYSIS

- 11.1. Chapter Overview

- 11.2. Forecast Methodology

- 11.3. Overall Aseptic Fill / Finish Services Market, till 2035

- 11.3.1. Aseptic Fill / Finish Services Market: Analysis by Type of Molecule, till 2035

- 11.3.2. Aseptic Fill / Finish Services Market: Analysis by Type of Packaging Container Offered, till 2035

- 11.3.3. Aseptic Fill / Finish Services Market: Analysis by Type of Drug Product, till 2035

- 11.3.4. Aseptic Fill / Finish Services Market: Analysis by Target Therapeutic Area, till 2035

- 11.3.5. Aseptic Fill / Finish Services Market: Analysis by Scale of Operation, till 2035

- 11.3.6. Aseptic Fill / Finish Services Market: Analysis by Company Size, till 2035

- 11.3.7. Aseptic Fill / Finish Services Market: Analysis by Geography, till 2035

- 11.4. Aseptic Fill / Finish Services Market for Biologics, till 2035

- 11.4.1. Aseptic Fill / Finish Services Market for Biologics: Analysis by Type of Packaging Container Offered, till 2035

- 11.4.2. Aseptic Fill / Finish Services Market: Analysis by Type of Drug Product, till 2035

- 11.4.3. Aseptic Fill / Finish Services Market for Biologics: Analysis by Target Therapeutic Area, till 2035

- 11.4.4. Aseptic Fill / Finish Services Market for Biologics: Analysis by Scale of Operation, till 2035

- 11.4.5. Aseptic Fill / Finish Services Market for Biologics: Analysis by Company Size, till 2035

- 11.4.6. Aseptic Fill / Finish Services Market for Biologics: Analysis by Geography, till 2035

- 11.5. Aseptic Fill / Finish Services Market for Small Molecules, till 2035

- 11.5.1. Aseptic Fill / Finish Services Market for Small Molecules: Analysis by Type of Packaging Container Offered, till 2035

- 11.5.2. Aseptic Fill / Finish Services Market for Small Molecules: Analysis by Scale of Operation, till 2035

- 11.5.3. Aseptic Fill / Finish Services Market for Small Molecules: Analysis by Company Size, till 2035

- 11.5.4. Aseptic Fill / Finish Services Market for Small Molecules: Analysis by Geography, till 2035

12. CASE STUDY: ROBOTICS IN PHARMACEUTICAL PACKAGING

- 12.1. Chapter Overview

- 12.2. Role of Robotic Systems in Pharmaceutical Industry

- 12.3. Role of Robotic Systems in Fill / Finish Operation

- 12.3.1. Types of Robots Used in Pharmaceutical Operations

- 12.3.2. Advantages Associated with Robotic Systems

- 12.3.3. Disadvantages Associated with Robotic Systems

- 12.3.4. Key Considerations for Selecting a Robotic System

- 12.4. Contract Service Providers: List of Fill / Finish Equipment

- 12.5. Companies Providing Robots for Use in the Pharmaceutical Industry

- 12.6. Companies Providing Isolator based Aseptic Filling Systems

- 12.7. Concluding Remarks

13. CASE STUDY: READY-TO-USE PACKAGING COMPONENTS FOR ASEPTIC FILL / FINISH

- 13.1. Chapter Overview

- 13.2. Role of Ready-to-Use Packaging Components in Aseptic Fill / Finish Operations

- 13.2.1. Advantages of Ready-to-Use Packaging Components

- 13.2.2. Disadvantages of Ready-to-Use Packaging Components

- 13.3. Companies Providing Ready-to-Use Packaging Components

- 13.4. Concluding Remarks

14. CONCLUDING REMARKS

15. EXECUTIVE INSIGHTS

- 15.1. Chapter Overview

- 15.2. IDT Biologika

- 15.2.1. Company Snapshot

- 15.2.1. Interview Transcript: Former Chief Commercial Officer

- 15.3. Cytovance Biologics

- 15.3.1. Company Snapshot

- 15.3.2. Interview Transcript: Former Vice President of Business Development and Marketing

- 15.4. Syngene

- 15.4.1. Company Snapshot

- 15.4.2. Interview Transcript: Vice President and Head of Formulation Development

- 15.5. oncomed manufacturing

- 15.5.1. Company Snapshot

- 15.5.2. Interview Transcript: Head of Business Development

- 15.6. Yposkesi

- 15.6.1. Company Snapshot

- 15.6.2. Interview Transcript: Former Technology Watch Manager

- 15.7. HALIX

- 15.7.1. Company Snapshot

- 15.7.2. Interview Transcript: International Business Developer

16. APPENDIX 1: TABULATED DATA

17. APPENDIX 2: LIST OF COMPANIES AND ORGANIZATIONS

List of Tables

- Table 4.1 Aseptic Fill / Finish Service Providers: List of Companies

- Table 4.2 Aseptic Fill / Finish Service Providers: Information on Type of Packaging Container(s) Offered

- Table 5.1 Biologics Fill / Finish Service Providers: List of Companies

- Table 5.2 Biologics Fill / Finish Service Providers: Information on Type of Packaging Container(s) Offered

- Table 5.3 Biologics Fill / Finish Service Providers: Information on Type of Drug Product(s) Involved

- Table 5.4 Biologics Fill / Finish Service Providers: Information on Scale of Operation

- Table 5.5 Biologics Fill / Finish Service Providers: Information on Additional Drug Product-related Services Offered

- Table 5.6 Biologics Fill / Finish Service Providers: Information on Fill / Finish Capacity

- Table 6.1 Small Molecules Fill / Finish Service Providers: List of Companies

- Table 6.2 Small Molecules Fill / Finish Service Providers: Information on Fill / Finish Technique

- Table 6.3 Small Molecules Fill / Finish Service Providers: Information on Type of Packaging Container(s) Offered

- Table 6.4 Small Molecules Fill / Finish Service Providers: Information on Scale of Operation

- Table 6.5 Small Molecules Fill / Finish Service Providers: Information on Type of Dosage Form(s) Filled and Type of Process(es)

- Table 6.6 Small Molecules Fill / Finish Service Providers: Information on Fill / Finish Capacity

- Table 7.1 Biologics Fill / Finish Service Providers: List of Companies Profiled

- Table 7.2 AbbVie Contract Manufacturing: Company Snapshot

- Table 7.3 AbbVie Contract Manufacturing: Service Portfolio

- Table 7.4 AbbVie Contract Manufacturing: Fill / Finish Services

- Table 7.5 AbbVie Contract Manufacturing: Sterile Manufacturing Facilities

- Table 7.6 AbbVie Contract Manufacturing: Recent Developments and Future Outlook

- Table 7.7 BioPharma Solutions: Company Snapshot

- Table 7.8 BioPharma Solutions: Service Portfolio

- Table 7.9 BioPharma Solutions: Fill / Finish Services

- Table 7.10 BioPharma Solutions: Sterile Manufacturing Facilities

- Table 7.11 BioPharma Solutions: Recent Developments and Future Outlook

- Table 7.12 BioReliance: Company Snapshot

- Table 7.13 BioReliance: Service Portfolio

- Table 7.14 BioReliance: Fill / Finish Services

- Table 7.15 BioReliance: Sterile Manufacturing Facilities

- Table 7.16 BioReliance: Recent Developments and Future Outlook

- Table 7.17 Catalent Biologics: Company Snapshot

- Table 7.18 Catalent Biologics: Service Portfolio

- Table 7.19 Catalent Biologics: Fill / Finish Services

- Table 7.20 Catalent Biologics: Sterile Manufacturing Facilities

- Table 7.21 Catalent Biologics: Recent Developments and Future Outlook

- Table 7.22 Charles River Laboratories: Company Snapshot

- Table 7.23 Charles River Laboratories: Fill / Finish Services

- Table 7.24 Charles River Laboratories: Sterile Manufacturing Facilities

- Table 7.25 Charles River Laboratories: Recent Developments and Future Outlook

- Table 7.26 Patheon: Company Snapshot

- Table 7.27 Patheon: Service Portfolio

- Table 7.28 Patheon: Fill / Finish Services

- Table 7.29 Patheon: Recent Developments and Future Outlook

- Table 7.30 Small Molecules Fill / Finish Service Providers: List of Companies Profiled

- Table 7.31 Pfizer CentreOne: Company Snapshot

- Table 7.32 Pfizer CentreOne: Service Portfolio

- Table 7.33 Pfizer CentreOne: Fill / Finish Services

- Table 7.34 Pfizer CentreOne: Recent Developments and Future Outlook

- Table 7.35 Plastikon Healthcare: Company Snapshot

- Table 7.36 Plastikon Healthcare: Service Portfolio

- Table 7.37 Plastikon Healthcare: Fill / Finish Services

- Table 7.38 Sharp Services: Company Snapshot

- Table 7.39 Sharp Services: Service Portfolio

- Table 7.40 Sharp Services: Fill / Finish Services

- Table 7.41 Sharp Services: Recent Developments and Future Outlook

- Table 8.1 Biologics Fill / Finish Service Providers in Europe: List of Companies Profiled

- Table 8.2 Boehringer Ingelheim BioXcellence: Company Snapshot

- Table 8.3 Boehringer Ingelheim BioXcellence: Service Portfolio

- Table 8.4 Boehringer Ingelheim BioXcellence: Fill / Finish Services

- Table 8.5 Boehringer Ingelheim BioXcellence: Sterile Manufacturing Facilities

- Table 8.6 Boehringer Ingelheim BioXcellence: Recent Developments and Future Outlook

- Table 8.7 Fareva: Company Snapshot

- Table 8.8 Fareva: Fill / Finish Services

- Table 8.9 Fareva: Recent Developments and Future Outlook

- Table 8.10 Glaxo SmithKline: Company Snapshot

- Table 8.11 Glaxo SmithKline: Fill / Finish Services

- Table 8.12 Glaxo SmithKline: Recent Developments and Future Outlook

- Table 8.13 Lonza: Company Snapshot

- Table 8.14 Lonza: Service Portfolio

- Table 8.15 Lonza: Fill / Finish Services

- Table 8.16 Lonza: Recent Developments and Future Outlook

- Table 8.17 Pierre Fabre: Company Snapshot

- Table 8.18 Pierre Fabre: Service Portfolio

- Table 8.19 Pierre Fabre: Fill / Finish Services

- Table 8.20 Pierre Fabre: Sterile Manufacturing Facilities

- Table 8.21 Pierre Fabre: Recent Developments and Future Outlook

- Table 8.22 Wacker Biotech: Company Snapshot

- Table 8.23 Wacker Biotech: Service Portfolio

- Table 8.24 Wacker Biotech: Fill / Finish Services

- Table 8.25 Wacker Biotech: Sterile Manufacturing Facilities

- Table 8.26 Wacker Biotech: Recent Developments and Future Outlook

- Table 8.27 Small Molecules Fill / Finish Service Providers in Europe: List of Companies Profiled

- Table 8.28 Aenova: Company Snapshot

- Table 8.29 Aenova: Service Portfolio

- Table 8.30 Aenova: Fill / Finish Services

- Table 8.31 Aenova: Recent Developments and Future Outlook

- Table 8.32 APL: Company Snapshot

- Table 8.33 APL: Service Portfolio

- Table 8.34 APL: Fill / Finish Services

- Table 8.35 CordenPharma: Company Snapshot

- Table 8.36 CordenPharma: Service Portfolio

- Table 8.37 CordenPharma: Fill / Finish Services

- Table 8.38 CordenPharma: Recent Developments and Future Outlook

- Table 8.39 Delpharm: Company Snapshot

- Table 8.40 Delpharm: Service Portfolio

- Table 8.41 Delpharm: Fill / Finish Services

- Table 8.42 Delpharm: Recent Developments and Future Outlook

- Table 8.43 PiSA Farmaceutica: Company Snapshot

- Table 8.44 PiSA Farmaceutica: Fill / Finish Services

- Table 8.45 Biologics and Small Molecules Fill / Finish Service Providers in Europe: List of Companies Profiled

- Table 8.46 Fresenius Kabi: Company Snapshot

- Table 8.47 Fresenius Kabi: Fill / Finish Services

- Table 8.48 Recipharm: Company Snapshot

- Table 8.49 Recipharm: Service Portfolio

- Table 8.50 Recipharm: Fill / Finish Services

- Table 8.51 Recipharm: Recent Developments and Future Outlook

- Table 9.1 Biologics Fill / Finish Service Providers in Asia-Pacific: List of Companies Profiled

- Table 9.2 Asymchem: Company Snapshot

- Table 9.3 Asymchem: Service Portfolio

- Table 9.4 Asymchem: Fill / Finish Services

- Table 9.5 Asymchem: Sterile Manufacturing Facilities

- Table 9.6 Asymchem: Recent Developments and Future Outlook

- Table 9.7 Samsung Biologics: Company Snapshot

- Table 9.8 Samsung Biologics: Service Portfolio

- Table 9.9 Samsung Biologics: Fill / Finish Services

- Table 9.10 Samsung Biologics: Recent Developments and Future Outlook

- Table 9.11 Syngene: Company Snapshot

- Table 9.12 Syngene: Service Portfolio

- Table 9.13 Syngene: Fill / Finish Services

- Table 9.14 Syngene: Recent Developments and Future Outlook

- Table 9.15 Takara Bio: Company Snapshot

- Table 9.16 Takara Bio: Service Portfolio

- Table 9.17 Takara Bio: Fill / Finish Services

- Table 9.18 Takara Bio: Recent Developments and Future Outlook

- Table 9.19 WuXi Biologics: Company Snapshot

- Table 9.20 WuXi Biologics: Services Portfolio

- Table 9.21 Wuxi Biologics: Fill / Finish Services

- Table 9.22 WuXi Biologics: Sterile Manufacturing Facilities

- Table 9.23 WuXi Biologics: Recent Developments and Future Outlook

- Table 9.24 Hetero Drugs: Company Snapshot

- Table 9.25 Hetero Drugs: Fill / Finish Services

- Table 9.26 Intas Pharmaceuticals: Company Snapshot

- Table 9.27 Intas Pharmaceuticals: Fill / Finish Services

- Table 9.28 Small Molecules Fill / Finish Service Providers in Asia-Pacific: List of Companies Profiled

- Table 9.29 Siegfried: Company Snapshot

- Table 9.30 Siegfried: Service Portfolio

- Table 9.31 Siegfried: Fill / Finish Services

- Table 9.32 Siegfried: Recent Developments and Future Outlook

- Table 9.33 Wockhardt: Company Snapshot

- Table 9.34 Wockhardt: Fill / Finish Services

- Table 9.35 Wockhardt: Recent Developments and Future Outlook

- Table 10.1 Aseptic Fill / Finish Service Providers: Partnerships and Collaborations

- Table 10.2 Partnerships and Collaborations: Information on Type of Molecule(s) Involved and Type of Service(s) Offered

- Table 10.3 Partnerships and Collaborations: Information on Type of Drug Product(s) Involved and Type of Process(es) Involved

- Table 12.1 Contract Service Providers: Information on Fill / Finish Equipment

- Table 12.2 List of Pharmaceutical Robotics Manufacturers

- Table 12.3 Isolator based Aseptic Filling Systems: Information on Compatible Primary Container

- Table 13.1 List of Companies Supplying Ready-to-Use Aseptic Packaging Components

- Table 16.1 Aseptic Fill / Finish Service Providers: Distribution by Year of Establishment

- Table 16.2 Aseptic Fill / Finish Service Providers: Distribution by Company Size

- Table 16.3 Aseptic Fill / Finish Service Providers: Distribution by Location of Headquarters

- Table 16.4 Aseptic Fill / Finish Service Providers: Distribution by Type of Molecule(s)

- Table 16.5 Aseptic Fill / Finish Service Providers: Distribution by Type of Packaging Container(s) Offered

- Table 16.6 Biologics Fill / Finish Service Providers: Distribution by Year of Establishment

- Table 16.7 Biologics Fill / Finish Service Providers: Distribution by Company Size

- Table 16.8 Biologics Fill / Finish Service Providers: Distribution by Location of Headquarters

- Table 16.9 Biologics Fill / Finish Service Providers: Distribution by Location of Fill / Finish Facilities

- Table 16.10 Biologics Fill / Finish Service Providers: Distribution by Type of Packaging Container(s) Offered

- Table 16.11 Biologics Fill / Finish Service Providers: Distribution by Type of Packaging Container(s) Offered and Type of Drug Product(s) Involved

- Table 16.12 Biologics Fill / Finish Service Providers: Distribution by Scale of Operation

- Table 16.13 Biologics Fill / Finish Service Providers: Distribution by Additional Drug Product-related Services Offered

- Table 16.14 Small Molecules Fill / Finish Service Providers: Distribution by Year of Establishment

- Table 16.15 Small Molecules Fill / Finish Service Providers: Distribution by Company Size

- Table 16.16 Small Molecules Fill / Finish Service Providers: Distribution by Location of Headquarters

- Table 16.17 Small Molecules Fill / Finish Service Providers: Distribution by Location of Fill / Finish Facilities

- Table 16.18 Small Molecules Fill / Finish Service Providers: Distribution by Type of Filling Service(s) Offered

- Table 16.19 Small Molecules Fill / Finish Service Providers: Distribution by Type of Finishing Service(s) Offered

- Table 16.19 Small Molecules Fill / Finish Service Providers: Distribution by Type of Packaging Container(s) Offered

- Table 16.20 Small Molecules Fill / Finish Service Providers: Distribution by Scale of Operation

- Table 16.21 Small Molecules Fill / Finish Service Providers: Distribution by Type of Dosage Form(s) Filled

- Table 16.22 Small Molecules Fill / Finish Service Providers: Distribution by Type of Process(es)

- Table 16.23 AbbVie: Annual Revenues, 2017-H1 2022 (USD Billion)

- Table 16.24 Baxter (a parent company of BioPharma Solutions): Annual Revenues, FY 2017 Onwards (USD Billion)

- Table 16.25 Merck (a parent company of BioReliance): Annual Revenues, FY 2017 Onwards (EUR Billion)

- Table 16.26 Catalent Biologics: Annual Revenues, FY 2017 Onwards (USD Billion)

- Table 16.27 Charles River Laboratories: Annual Revenues, FY 2017 Onwards (USD Billion)

- Table 16.28 Thermo Fisher Scientific (a parent company of Patheon): Annual Revenues, FY 2017 Onwards (USD Billion)

- Table 16.29 Pfizer CentreOne: Annual Revenues, FY 2017 Onwards (USD Million)

- Table 16.30 Boehringer Ingelheim (a parent company of Boehringer Ingelheim BioXcellence): Annual Revenues, FY 2017 Onwards (EUR Billion)

- Table 16.31 GlaxoSmithKline: Annual Revenues, FY 2017 Onwards (GBP Billion)

- Table 16.32 Lonza: Annual Revenues, FY 2017 Onwards (CHF Billion)

- Table 16.33 Pierre Fabre: Annual Revenues, FY 2018 Onwards (EUR Billion)

- Table 16.34 Wacker Chemie (a parent company of Wacker Biotech): Annual Revenues, FY 2017 Onwards (EUR Billion)

- Table 16.35 Aenova: Annual Revenues, FY 2018 Onwards (EUR Million)

- Table 16.36 Fresenius Kabi: Annual Revenues, FY 2017 Onwards (EUR Billion)

- Table 16.37 Recipharm: Annual Revenues, FY 2017 Onwards (SEK Billion)

- Table 16.38 Recipharm: Revenues by Business Divisions, 2020 (SEK Billion)

- Table 16.39 Asymchem: Annual Revenues, FY 2017 Onwards (USD Billion)

- Table 16.40 Samsung Biologics: Annual Revenues, FY 2017 Onwards (KRW Billion)

- Table 16.41 Syngene: Annual Revenues, FY 2017 Onwards (INR Million)

- Table 16.42 Takara Bio: Annual Revenues, FY 2017 Onwards (JPY Billion)

- Table 16.43 WuXi Biologics: Annual Revenues, FY 2017 Onwards (RMB Million)

- Table 16.44 Siegfried: Annual Revenues, FY 2017 Onwards (CHF Million)

- Table 16.45 Wockhardt: Annual Revenues, FY 2017 Onwards (INR Billion)

- Table 16.46 Partnerships and Collaborations: Cumulative Year wise Trend, since 2013

- Table 16.47 Partnerships and Collaborations: Distribution by Type of Partnership

- Table 16.48 Partnerships and Collaborations: Distribution by Scale of Operation

- Table 16.49 Partnerships and Collaborations: Distribution by Type of Molecule(s) Involved

- Table 16.50 Partnerships and Collaborations: Distribution by Type of Service(s) Offered

- Table 16.51 Partnerships and Collaborations: Distribution by Type of Process(es) Involved

- Table 16.52 Partnerships and Collaborations: Distribution by Type of Drug Product(s) Involved

- Table 16.53 Most Active Players: Distribution by Number of Partnerships

- Table 16.54 Partnerships and Collaborations: Distribution by Geography

- Table 16.55 Partnerships and Collaborations: Intercontinental and Intracontinental Agreements

- Table 16.56 Global Aseptic Fill / Finish Services Market, till 2035 (USD Billion)

- Table 16.57 Aseptic Fill / Finish Services Market, Conservative, Base and Optimistic Scenarios: Distribution by Type of Molecule, till 2035 (USD Billion)

- Table 16.58 Aseptic Fill / Finish Services Market, Conservative, Base and Optimistic Scenarios: Distribution by Type of Packaging Container Offered, till 2035 (USD Billion)

- Table 16.59 Aseptic Fill / Finish Services Market, Conservative, Base and Optimistic Scenarios: Distribution by Type of Drug Product, till 2035 (USD Billion)

- Table 16.60 Aseptic Fill / Finish Services Market, Conservative, Base and Optimistic Scenarios: Distribution by Target Therapeutic Area, till 2035 (USD Billion)

- Table 16.61 Aseptic Fill / Finish Services Market, Conservative, Base and Optimistic Scenarios: Distribution by Scale of Operation, till 2035 (USD Billion)

- Table 16.62 Aseptic Fill / Finish Services Market, Conservative, Base and Optimistic Scenarios: Distribution by Company Size, till 2035 (USD Billion)

- Table 16.63 Aseptic Fill / Finish Services Market, Conservative, Base and Optimistic Scenarios: Distribution by Geography, till 2035 (USD Billion)

- Table 16.64 Aseptic Fill / Finish Services Market for Biologics, Conservative, Base and Optimistic Scenarios, till 2035 (USD Billion)

- Table 16.65 Aseptic Fill / Finish Services Market for Biologics, Conservative, Base and Optimistic Scenarios: Distribution by Type of Packaging Container Offered, till 2035 (USD Billion)

- Table 16.66 Aseptic Fill / Finish Services Market for Biologics, Conservative, Base and Optimistic Scenarios: Distribution by Type of Drug Product, till 2035 (USD Billion)

- Table 16.67 Aseptic Fill / Finish Services Market for Biologics, Conservative, Base and Optimistic Scenarios: Distribution by Target Therapeutic Area, till 2035 (USD Billion)

- Table 16.68 Aseptic Fill / Finish Services Market for Biologics, Conservative, Base and Optimistic Scenarios: Distribution by Scale of Operation, till 2035 (USD Billion)

- Table 16.69 Aseptic Fill / Finish Services Market for Biologics, Conservative, Base and Optimistic Scenarios: Distribution by Company Size, till 2035 (USD Billion)

- Table 16.70 Aseptic Fill / Finish Services Market for Biologics, Conservative, Base and Optimistic Scenarios: Distribution by Geography, till 2035 (USD Billion)

- Table 16.71 Aseptic Fill / Finish Services Market for Small Molecules, Conservative, Base and Optimistic Scenarios, till 2035 (USD Billion)

- Table 16.72 Aseptic Fill / Finish Services Market for Small Molecules, Conservative, Base and Optimistic Scenarios: Distribution by Type of Packaging Container Offered, till 2035 (USD Billion)

- Table 16.73 Aseptic Fill / Finish Services Market for Small Molecules, Conservative, Base and Optimistic Scenarios: Distribution by Scale of Operation, till 2035 (USD Billion)

- Table 16.74 Aseptic Fill / Finish Services Market for Small Molecules, Conservative, Base and Optimistic Scenarios: Distribution by Company Size, till 2035 (USD Billion)

- Table 16.75 Aseptic Fill / Finish Services Market for Small Molecules, Conservative, Base and Optimistic Scenarios: Distribution by Geography, till 2035 (USD Billion)

List of Figures

- Figure 2.1 Executive Summary: Market Landscape of Biologics Fill / Finish Service Providers

- Figure 2.2 Executive Summary: Market Landscape of Small Molecules Fill / Finish Service Providers

- Figure 2.3 Executive Summary: Partnerships and Collaborations

- Figure 2.4 Executive Summary: Market Forecast and Opportunity Analysis

- Figure 3.1 Types of Third-Party Service Providers

- Figure 3.2 Commonly Outsourced Fill / Finish Operations

- Figure 3.3 Steps Involved in Aseptic Fill / Finish Process

- Figure 3.4 Blow-Fill-Seal Process

- Figure 3.5 Key Considerations for Selecting a CMO Partner

- Figure 3.6 Risks and Challenges Associated with Outsourcing Aseptic Fill / Finish Operations

- Figure 4.1 Aseptic Fill / Finish Service Providers: Distribution by Year of Establishment

- Figure 4.2 Aseptic Fill / Finish Service Providers: Distribution by Company Size

- Figure 4.3 Aseptic Fill / Finish Service Providers: Distribution by Location of Headquarters

- Figure 4.4 Aseptic Fill / Finish Service Providers: Distribution by Type of Molecule(s)

- Figure 4.5 Aseptic Fill / Finish Service Providers: Distribution by Type of Packaging Container(s) Offered

- Figure 5.1 Biologics Fill / Finish Service Providers: Distribution by Year of Establishment

- Figure 5.2 Biologics Fill / Finish Service Providers: Distribution by Company Size

- Figure 5.3 Biologics Fill / Finish Service Providers: Distribution by Location of Headquarters

- Figure 5.4 Biologics Fill / Finish Service Providers: Distribution by Location of Fill / Finish Facilities

- Figure 5.5 Biologics Fill / Finish Service Providers: Distribution by Type of Packaging Container(s) Offered

- Figure 5.6 Biologics Fill / Finish Service Providers: Distribution by Type of Packaging Container(s) Offered and Type of Drug Product(s) Involved

- Figure 5.7 Biologics Fill / Finish Service Providers: Distribution by Scale of Operation

- Figure 5.8 Biologics Fill / Finish Service Providers: Distribution by Additional Drug Product-related Services Offered

- Figure 6.1 Small Molecules Fill / Finish Service Providers: Distribution by Year of Establishment

- Figure 6.2 Small Molecules Fill / Finish Service Providers: Distribution by Company Size

- Figure 6.3 Small Molecules Fill / Finish Service Providers: Distribution by Location of Headquarters

- Figure 6.4 Small Molecules Fill / Finish Service Providers: Distribution by Location of Fill / Finish Facilities

- Figure 6.5 Small Molecules Fill / Finish Service Providers: Distribution by Type of Filling Service(s) Offered

- Figure 6.6 Small Molecules Fill / Finish Service Providers: Distribution by Type of Finishing Service(s) Offered

- Figure 6.7 Small Molecules Fill / Finish Service Providers: Distribution by Type of Packaging Container(s) Offered

- Figure 6.8 Small Molecules Fill / Finish Service Providers: Distribution by Scale of Operation

- Figure 6.9 Small Molecules Fill / Finish Service Providers: Distribution by Type of Dosage Form(s) Filled

- Figure 6.10 Small Molecules Fill / Finish Service Providers: Distribution by Type of Process(es)

- Figure 7.1 AbbVie: Annual Revenues, FY 2017 Onwards (USD Billion)

- Figure 7.2 Baxter (a parent company of BioPharma Solutions): Annual Revenues, FY 2017 Onwards (USD Billion)

- Figure 7.3 Merck (a parent company of BioReliance): Annual Revenues, FY 2017 Onwards (EUR Billion)

- Figure 7.4 Catalent Biologics: Annual Revenues, FY 2017 Onwards (USD Billion)

- Figure 7.5 Charles River Laboratories: Annual Revenues, FY 2017 Onwards (USD Billion)

- Figure 7.6 Thermo Fisher Scientific (a parent company of Patheon): Annual Revenues, FY 2017 Onwards (USD Billion)

- Figure 7.7 Pfizer CentreOne: Annual Revenues, FY 2017 Onwards (USD Million)

- Figure 8.1 Boehringer Ingelheim (a parent company of Boehringer Ingelheim BioXcellence): Annual Revenues, FY 2017 Onwards (EUR Billion)

- Figure 8.2 GlaxoSmithKline: Annual Revenues, FY 2017 Onwards (GBP Billion)

- Figure 8.3 Lonza: Annual Revenues, FY 2017 Onwards (CHF Billion)

- Figure 8.4 Pierre Fabre: Annual Revenues, FY 2018 Onwards (EUR Billion)

- Figure 8.5 Wacker Chemie (a parent company of Wacker Biotech): Annual Revenues, FY 2017 Onwards (EUR Billion)

- Figure 8.6 Aenova: Annual Revenues, FY 2018 Onwards (EUR Million)

- Figure 8.7 Fresenius Kabi: Annual Revenues, FY 2017 Onwards (EUR Billion)

- Figure 8.8 Recipharm: Annual Revenues, FY 2017 Onwards (SEK Billion)

- Figure 8.9 Recipharm: Revenues by Business Divisions, 2020 (SEK Billion)

- Figure 9.1 Asymchem: Annual Revenues, FY 2017 Onwards (USD Billion)

- Figure 9.2 Samsung Biologics: Annual Revenues, FY 2017 Onwards (KRW Billion)

- Figure 9.3 Syngene: Annual Revenues, FY 2017 Onwards (INR Million)

- Figure 9.4 Takara Bio: Annual Revenues, FY 2017 Onwards (JPY Billion)

- Figure 9.5 WuXi Biologics: Annual Revenues, FY 2017 Onwards (RMB Million)

- Figure 9.6 Siegfried: Annual Revenues, FY 2017 Onwards (CHF Million)

- Figure 9.7 Wockhardt: Annual Revenues, FY 2017 Onwards (INR Billion)

- Figure 10.1 Partnerships and Collaborations: Cumulative Year wise Trend, since 2013

- Figure 10.2 Partnerships and Collaborations: Distribution by Type of Partnership

- Figure 10.3 Partnerships and Collaborations: Distribution by Scale of Operation

- Figure 10.4 Partnerships and Collaborations: Distribution by Type of Molecule(s) Involved

- Figure 10.5 Partnerships and Collaborations: Distribution by Type of Service(s) Offered

- Figure 10.6 Partnerships and Collaborations: Distribution by Type of Process(es) Involved

- Figure 10.7 Partnerships and Collaborations: Distribution by Type of Drug Product(s) Involved

- Figure 10.8 Most Active Players: Distribution by Number of Partnerships

- Figure 10.9 Partnerships and Collaborations: Distribution by Geography

- Figure 10.10 Partnerships and Collaborations: Intercontinental and Intracontinental Agreements

- Figure 11.1 Global Aseptic Fill / Finish Services Market, till 2035 (USD Billion)

- Figure 11.2 Aseptic Fill / Finish Services Market: Distribution by Type of Molecule, till 2035 (USD Billion)

- Figure 11.3 Aseptic Fill / Finish Services Market: Distribution by Type of Packaging Container Offered, till 2035 (USD Billion)

- Figure 11.4 Aseptic Fill / Finish Services Market: Distribution by Type of Drug Product, till 2035 (USD Billion)

- Figure 11.5 Aseptic Fill / Finish Services Market: Distribution by Target Therapeutic Area, till 2035 (USD Billion)

- Figure 11.6 Aseptic Fill / Finish Services Market: Distribution by Scale of Operation, till 2035 (USD Billion)

- Figure 11.7 Aseptic Fill / Finish Services Market: Distribution by Company Size, till 2035 (USD Billion)

- Figure 11.8 Aseptic Fill / Finish Services Market: Distribution by Geography, till 2035 (USD Billion)

- Figure 11.9 Aseptic Fill / Finish Services Market for Biologics, till 2035 (USD Billion)

- Figure 11.10 Aseptic Fill / Finish Services Market for Biologics: Distribution by Type of Packaging Container Offered, till 2035 (USD Billion)

- Figure 11.11 Aseptic Fill / Finish Services Market for Biologics: Distribution by Type of Drug Product, till 2035 (USD Billion)

- Figure 11.12 Aseptic Fill / Finish Services Market for Biologics: Distribution by Target Therapeutic Area, till 2035 (USD Billion)

- Figure 11.13 Aseptic Fill / Finish Services Market for Biologics: Distribution by Scale of Operation, till 2035 (USD Billion)

- Figure 11.14 Aseptic Fill / Finish Services Market for Biologics: Distribution by Company Size, till 2035 (USD Billion)

- Figure 11.15 Aseptic Fill / Finish Services Market for Biologics: Distribution by Geography, till 2035 (USD Billion)

- Figure 11.16 Aseptic Fill / Finish Services Market for Small Molecules, till 2035 (USD Billion)

- Figure 11.17 Aseptic Fill / Finish Services Market for Small Molecules: Distribution by Type of Packaging Container Offered, till 2035 (USD Billion)

- Figure 11.18 Aseptic Fill / Finish Services Market for Small Molecules: Distribution by Scale of Operation, till 2035 (USD Billion)

- Figure 11.19 Aseptic Fill / Finish Services Market for Small Molecules: Distribution by Company Size, till 2035 (USD Billion)

- Figure 11.20 Aseptic Fill / Finish Services Market for Small Molecules: Distribution by Geography, till 2035 (USD Billion)

- Figure 12.1 Key Considerations for Selecting a Robotic System

- Figure 12.2 Advantages of Robotic Systems in Pharmaceutical Operations

- Figure 13.1 Key Drivers of Ready-to-Use Platform

- Figure 14.1 Concluding Remarks: Current Biologic Fill / Finish Service Providers Market Landscape

- Figure 14.2 Concluding Remarks: Current Small Molecule Fill / Finish Service Providers Market Landscape

- Figure 14.3 Concluding Remarks: Partnerships and Collaborations

- Figure 14.4 Concluding Remarks: Market Sizing and Opportunity Analysis