PUBLISHER: Roots Analysis | PRODUCT CODE: 1624836

PUBLISHER: Roots Analysis | PRODUCT CODE: 1624836

Prefilled Syringes Market by Purpose of Syringe, Therapeutic Area, Type of Molecule, Type of Barrel Material, Usability of Syringe, Type of Syringe, Type of Packaging and Key Geographical Regions: Industry Trends and Global Forecasts, Till 2035

PREFILLED SYRINGES MARKET: OVERVIEW

As per Roots Analysis, the global prefilled syringes market is estimated to grow from USD 3.02 billion in the current year to USD 4.97 billion by 2035, at a CAGR of 4.6% during the forecast period, till 2035.

The market sizing and opportunity analysis has been segmented across the following parameters:

Purpose of Syringe

- Specialty Prefilled Syringes

- Therapeutic Prefilled Syringes

- Cosmetic Prefilled Syringes

Therapeutic Area (Therapeutic Syringes)

- Blood Disorders

- Infectious Diseases

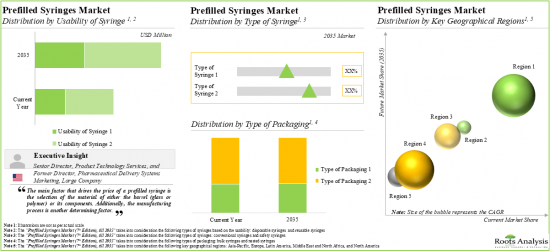

- Autoimmune Disorders

- Oncological Disorders

- Cardiovascular Disorders

- Respiratory Disorders

- Neurological Disorders

- Metabolic Disorders

- Ophthalmic Disorders

- Orthopedic Disorders

- Others

Type of Molecule (Therapeutic Syringes)

- Proteins

- Antibodies

- Peptides

- Small Molecules

- Vaccines

- Cell Therapies

Type of Barrel Material

- Glass Syringe

- Plastic Syringe

Number of Barrel Chamber

- Single Chamber Syringe

- Dual Chamber Syringe

Type of Needle System

- Staked Needle Syringe

- Luer Syringe

Usability of Syringe

- Disposable Syringe

- Reusable Syringe

Type of Syringe

- Conventional Syringe

- Safety Syringe

Type of Packaging

- Bulk Syringe

- Nested Syringe

Key Geographical Regions

- North America (US and Canada)

- Europe (Germany, France, Italy, Spain, UK, Rest of Europe)

- Asia-Pacific (Japan, India, China, Australia, South Korea, Rest of Asia Pacific)

- Middle East and North Africa

- Latin America

PREFILLED SYRINGES MARKET: GROWTH AND TRENDS

With the increasing prevalence of chronic diseases and the growing need to administer injectable medications on a frequent basis, there is a notable rise in preference for self-administration of drugs / therapeutics. According to a recent study, close to 133 million individuals annually suffer from one or more chronic disorders in the US alone and this number is likely to reach 170 million by 2030. As a result, a number of drug delivery devices that can be used for self-medication have been developed and introduced into the market. Examples include autoinjectors, large volume wearable injectors, pen injectors and prefilled syringes. It is worth highlighting that among the aforementioned devices, prefilled syringes are the most established range of products. In fact, given the advantages it offers over other traditional drug administration solutions, the applications of this drug packaging and delivery system have increased over the years. Moreover, with the increase in development of parenteral drugs, the consumption of prefilled syringes has tripled. The current demand for safer, easier to administer technologies along with the industry's efforts to reduce costs and increase efficiency are expected to drive the growth of the prefilled syringes market in the future.

PREFILLED SYRINGES MARKET: KEY INSIGHTS

The report delves into the current state of the prefilled syringes market and identifies potential growth opportunities within the industry. Some key findings from the report include:

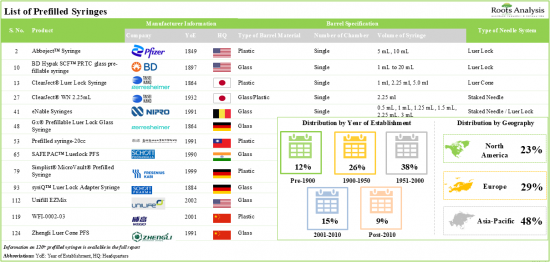

1. Presently, more than 120 prefilled syringes are available / being manufactured across the world; majority of the prefilled syringe manufacturers are based in Asia-Pacific.

2. Prefilled syringes are developed using different materials, needle systems and in different volume formats, to cater to the preferences and requirements of clients in the healthcare industry.

3. In pursuit of obtaining a competitive edge, companies are actively undertaking initiatives to integrate advanced features in their respective prefilled syringe portfolios.

4. Since 2019, more than 1,300 patents related to prefilled syringes and its related components have been filed / granted by various stakeholders to protect the intellectual property generated within this domain.

5. Several scientists, clinicians and industry veterans, affiliated to academic / medical / commercial organizations, are spearheading research related to prefilled syringes.

6. More than 170 prefilled syringe combination products are either commercially available or being evaluated for a variety of dosage forms.

7. Around 70% of the prefilled syringe combination products are currently in the later phases of development (Phase III and IV); the majority of these are being administered through the subcutaneous route.

8. Several big pharma players are actively carrying out initiatives to strengthen their injectable drug pipeline, across various therapeutic areas.

9. Close to 50 players are engaged in offering fill / finish services for prefilled syringes; majority of these players are based in Europe, followed by North America.

10. Identifying the driving factors (that fuel advancements) as well as barriers (that slow down the research progress) helps improve strategic planning and results in efficient operations in the prefilled syringes domain.

11. Owing to the growing demand for biologics and biosimilars (requiring precise dosing), and higher adoption of self-injection devices (in emergency conditions), the prefilled syringes market is likely to grow at a steady rate, till 2035.

12. Glass prefilled syringes capture majority share of this market; dual chamber prefilled syringes are anticipated to grow at a faster pace as compared to single chamber prefilled syringes.

13. The projected future opportunity for prefilled syringes market is likely to be well distributed in terms of usability of syringe, type of syringe, type of packaging and key geographical regions.

PREFILLED SYRINGES MARKET: KEY SEGMENTS

Currently, Specialty Syringes Segment Occupies the Largest Share of the Prefilled Syringes Market

Based on the purpose of the syringe, the market is segmented into specialty syringes, therapeutic syringes and cosmetic pre-filled syringes. At present, the specialty syringes segment holds the maximum share of the prefilled syringes market. It is worth highlighting that the prefilled syringes market for cosmetic pre-filled syringes is likely to grow at a relatively higher CAGR, during the forecast period.

Blood Disorders Segment Accounts for the Largest Share of the Prefilled Syringes Market

Based on the therapeutic area (therapeutic syringes), the market is segmented into blood disorders, infectious diseases, autoimmune disorders, oncological disorders, cardiovascular disorders, respiratory disorders, neurological disorders, metabolic disorders, ophthalmic disorders, orthopedic disorders and others. While blood disorders account for a relatively higher market share, it is worth highlighting that the oncological disorders segment is expected to witness substantial market growth in the coming years.

Protein Molecules are Likely to Dominate the Prefilled Syringes Market During the Forecast Period

Based on the type of molecule, the market is segmented into proteins, antibodies, peptides, small molecules, vaccines and cell therapies. At present, protein molecules hold the maximum share of the prefilled syringes market. It is worth highlighting that the prefilled syringes market for cell therapy is likely to grow at a relatively higher CAGR, during the forecast period.

Glass Material Accounts for the Largest Share of the Prefilled Syringes Market

Based on the type of barrel material, the market is segmented into glass syringes and plastic syringes. Currently, glass syringes hold the maximum share of the prefilled syringes market. It is worth highlighting that the prefilled syringes market for plastic syringes is likely to grow at a relatively higher CAGR, during the forecast period.

Currently, Single Chambered Segment Occupies the Largest Share of the Prefilled Syringes Market

Based on the number of barrel chambers, the market is segmented into single chambered and dual chambered. At present, glass syringes hold the maximum share of the prefilled syringes market. It is worth highlighting that the prefilled syringes market for dual chambered is likely to grow at a relatively higher CAGR, during the forecast period.

Luer Syringes Segment is the Fastest Growing Segment of the Prefilled Syringes Market During the Forecast Period

Based on the type of needle system, the market is segmented into staked needle syringes and luer syringes. At present, the staked needle syringe segment holds the maximum share of the prefilled syringes market. This can be attributed to the fact that these syringes have a low risk of needle detachment and are preferred in emergency medical conditions. It is worth highlighting that the prefilled syringes market for luer syringes is likely to grow at a relatively higher CAGR, during the forecast period.

Currently, Disposable Syringes Segment Occupies the Largest Share of the Prefilled Syringes Market

Based on the usability of syringes, the market is segmented into disposable syringes and reusable syringes. At present, disposable syringes hold maximum share of the prefilled syringes market. It is worth highlighting that the prefilled syringes market for reusable syringes is likely to grow at a relatively higher CAGR, during the forecast period.

Safety Prefilled Syringes Segment is Likely to Dominate the Prefilled Syringes Market During the Forecast Period

Based on the types of syringes, the market is segmented into conventional syringes and safety syringes. It is worth highlighting that, at present, safety prefilled syringes hold a larger share in the prefilled syringes market. This trend is likely to remain the same in the coming decade.

Currently, Nested Syringe Segment Occupies the Largest Share of the Prefilled Syringes Market

Based on the type of packaging, the market is segmented into nested syringe and bulk syringe. It is worth highlighting that, at present, nested syringe holds larger share in the prefilled syringes market. This trend is likely to remain the same in the coming decade.

Europe Accounts for the Largest Share of the Market

Based on key geographical regions, the market is segmented into North America, Europe, Asia-Pacific, Middle East and North Africa, and Latin America. It is worth highlighting that, over the years, the market in Asia-Pacific is expected to grow at a higher CAGR.

Example Players in the Prefilled Syringes Market

- Becton Dickinson

- Credence MedSystems

- Gerresheimer

- J.O.Pharma

- Medefil

- MedXL

- Mitsubishi Gas Chemical

- Nipro PharmaPackaging

- Novartis

- Pfizer

- SCHOTT

- Shandong Pharmaceutical Glass

- Shandong Weigao

- Shin Yan Sheno Precision Industrial

- Stevanato

- Taisei Kako

- Vetter Pharma

- West Pharmaceutical

Primary Research Overview

The opinions and insights presented in this study were influenced by discussions conducted with multiple stakeholders. The research report features detailed transcripts of interviews held with the following industry stakeholders:

- Founder and Chief Technology Officer, Oval Medical Technologies

- Chief Technical Officer, Intas Pharmaceuticals

- Senior Director and Former Director, West Pharmaceutical

- Head of R&D and Product Strategy, Lonstroff

- Senior Portfolio Director, IDEO

- Former Chief Commercial Officer, IDT Biologika

- Chief Executive Officer, A Small Medical Device Company

PREFILLED SYRINGES MARKET: RESEARCH COVERAGE

- Market Sizing and Opportunity Analysis: The report features an in-depth analysis of the prefilled syringes market, focusing on key market segments, including [A] purpose of syringe, [B] therapeutic area (therapeutic syringes), [C] type of molecule (therapeutic syringes), [D] type of barrel material, [E] number of barrel chamber, [F] type of needle system, [G] usability of syringe, [H] type of syringe, [I] type of packaging and [J] key geographical regions.

- Market Landscape: A comprehensive evaluation of the current prefilled syringes market, considering various parameters, such as [A] type of barrel fabrication material, [B] number of barrel chamber, [C] type of needle system and [D] volume of syringe. Further, the chapter provides a detailed analysis of prefilled syringe manufacturers, along with information on their [E] year of establishment, [F] company size (in terms of employee count), [G] location of headquarters, [H] location of their manufacturing facilities and [I] most active players (in terms of number of prefilled syringes manufactured).

- Product Competitiveness Analysis: A comprehensive competitive analysis of prefilled syringes, examining factors, such as [A] manufacturer strength and [B] product strength and [C] number of type of needle system.

- Company Profiles: In-depth profiles of key prefilled syringes manufacturers based in North America, Europe and Asia Pacific, focusing on [A] company overviews, [B] financial information (if available) [C] prefilled syringes portfolio, [D] recent developments and [D] an informed future outlook.

- Regulatory Landscape: A discussion on general regulatory guidelines for the approval of prefilled syringes, across different countries / geographical regions.

- Combination Products Analysis: A comprehensive examination of various combination products currently under evaluation or available as prefilled syringes, with a primary emphasis on injectable medications and vaccines. This analysis includes a thorough review of approved drugs, based on several relevant parameters, including [A] type of drug molecule, [B] year of approval, [C] region of approval, [D] route of administration and [E] target therapeutic area. Additionally, it includes analysis for products that are in clinical stage, for parameters such as [F] type of drug molecule, [G] phase of development, [H] route of administration and [I] target therapeutic area. The chapter also includes insights into the drug developers involved in developing these products, detailing their [J] year of establishment, [K] company size, [L] location of headquarters, and [M] manufacturing facility sites.

- Key Therapeutic Areas: An extensive discussion on the most commonly targeted therapeutic indications, including [A] information on the approved / marketed injectable drug products available for the treatment of such clinical conditions (across different target therapeutic areas) and [B] their respective biosimilars.

- Likely Drug Candidates Analysis: An in-depth analysis of marketed drugs / therapies that are likely to be available in prefilled syringe format in the near future. This analysis considers various relevant parameters, including [A] historical annual sales information, [B] type of drug molecule, [C] therapeutic area, [D] route of administration and [E] other available dosage forms.

- Big Pharma Analysis: A comprehensive examination of various initiatives focused on prefilled syringe combination products undertaken by major pharmaceutical companies. This analysis includes various relevant parameters, such as [A] number of prefilled syringe combination products (approved and under development), [B] target therapeutic area and [C] type of drug molecule.

- Recent Developments: A detailed analysis of recent developments in the prefilled syringes domain, based on relevant parameters such as [A] year of initiative, [B] type of initiative (partnerships and collaborations, expansions, funding and product launches), [C] geographical distribution and [D] most active players (in terms of number of recent developments).

- Patent Analysis: Detailed analysis of various patents filed / granted related to prefilled syringes based on [A] type of patent, [B] publication year, [C] application year, [D] type of applicant, [E] geographical location, [F] CPC symbols and [G] most active players (in terms of the number of patents filed / granted). It also includes a patent benchmarking analysis and a detailed valuation analysis.

- Key Opinion Leader Analysis: An in-depth examination that emphasizes the key opinion leaders (KOLs) within this field based on several relevant parameters, such as [A] role of KOL, [B] type of sponsor organization, [C] affiliated organization, [D] target indication and [E] geographical location of KOLs. In addition, the chapter highlights the most prominent KOLs, based on our proprietary scoring criteria.

- Specialty Prefilled Syringes: Detailed information on specialty syringes, specifically prefilled flush syringes, prefilled diluent systems, and prefilled syringes with contrast agents. Each type of specialty syringe is accompanied by [A] a brief overview and [B] information on various products available in the market, along with [C] their respective advantages.

- Technological Advances Related to Prefilled Syringes: A detailed description of the recent technological advancements in this domain and their applications. The chapter highlights the advancements in design technology and manufacturing of prefilled syringes, that have enabled pharmaceutical companies to market lyophilized drugs in dual chambered syringe systems. The chapter also highlights novel lubrication and sterilization technologies.

- Key Growth Drivers: A detailed discussion on the various factors that are likely to impact the prefilled syringes market, such as [A] increase in incidence of chronic diseases, [B] rising preference for self-administration of medications, [C] evolving patient landscape, [D] introduction and [D] growing adoption of biologics / biosimilars, [E] evolving pharmaceutical strategies, [F] initiatives focused on the prevention of needlestick injuries, and [G] the various potential applications of prefilled syringes.

- SWOT Analysis: A SWOT analysis, focusing on key drivers and challenges that are likely to impact the industry's evolution. Further, it includes a Harvey ball analysis, highlighting the relative effect of each SWOT parameter on the overall industry.

- Additional Insight: The chapter discusses the growing concern associated with needlestick injuries and the various steps (including regional and global legislations) that have been taken to prevent these mishaps. In addition, it provides detailed information on the various safety features (add-on and integrated devices) installed in recent versions of prefilled syringes, and the companies engaged in development and manufacturing of such solutions.

KEY QUESTIONS ANSWERED IN THIS REPORT

- How many companies are currently engaged in this market?

- Which are the leading companies in this market?

- What factors are likely to influence the evolution of this market?

- What is the current and future market size?

- What is the CAGR of this market?

- How is the current and future market opportunity likely to be distributed across key market segments?

REASONS TO BUY THIS REPORT

- The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. By analyzing the competitive landscape, businesses can make informed decisions to optimize their market positioning and develop effective go-to-market strategies.

- The report offers stakeholders a comprehensive overview of the market, including key drivers, barriers, opportunities, and challenges. This information empowers stakeholders to stay abreast of market trends and make data-driven decisions to capitalize on growth prospects.

ADDITIONAL BENEFITS

- Complimentary PPT Insights Packs

- Complimentary Excel Data Packs for all Analytical Modules in the Report

- 10% Free Content Customization

- Detailed Report Walkthrough Session with Research Team

- Free Updated report if the report is 6-12 months old or older

TABLE OF CONTENTS

1. PREFACE

- 1.1. Prefilled Syringes Market

- 1.2. Market Share Insights

- 1.2.1 Market Segmentation Overview

- 1.3. Key Market Insights

- 1.4. Report Coverage

- 1.5. Key Questions Answered

- 1.6. Chapter Outlines

2. RESEARCH METHODOLOGY

- 2.1. Chapter Overview

- 2.2. Research Assumptions

- 2.3. Project Methodology

- 2.4. Forecast Methodology

- 2.5. Robust Quality Control

- 2.6. Key Market Segmentations

- 2.7. Key Considerations

- 2.7.1. Demographics

- 2.7.2. Economic Factors

- 2.7.3. Government Regulations

- 2.7.4. Supply Chain

- 2.7.5. COVID Impact / Related Factors

- 2.7.6. Market Access

- 2.7.7. Healthcare Policies

- 2.7.8. Industry Consolidation

3. ECONOMIC AND OTHER PROJECT SPECIFIC CONSIDERATIONS

- 3.1. Chapter Overview

- 3.2. Market Dynamics

- 3.2.1. Time Period

- 3.2.1.1. Historical Trends

- 3.2.1.2. Current and Forecasted Estimates

- 3.2.2. Currency Coverage

- 3.2.2.1. Overview of Major Currencies Affecting the Market

- 3.2.2.2. Impact of Currency Fluctuations on the Industry

- 3.2.3. Foreign Exchange Impact

- 3.2.3.1. Evaluation of Foreign Exchange Rates and Their Impact on Market

- 3.2.3.2. Strategies for Mitigating Foreign Exchange Risk

- 3.2.4. Recession

- 3.2.4.1. Historical Analysis of Past Recessions and Lessons Learnt

- 3.2.4.2. Assessment of Current Economic Conditions and Potential Impact on the Market

- 3.2.5. Inflation

- 3.2.5.1. Measurement and Analysis of Inflationary Pressures in the Economy

- 3.2.5.2. Potential Impact of Inflation on the Market Evolution

- 3.2.1. Time Period

4. EXECUTIVE SUMMARY

5. INTRODUCTION

- 5.1. Chapter Overview

- 5.2. History of Prefilled Syringes

- 5.3. Benefits of Prefilled Syringes Over Traditional Injectable Devices

- 5.3.1. Benefits of Prefilled Syringes for Healthcare Professionals and End Users

- 5.3.2. Benefits of Prefilled Syringes for Manufacturers

- 5.3.3. Transition from Existing Dosing Forms to Prefilled Syringes

- 5.4. Prefilled Syringe Components

- 5.5. Classification of Prefilled Syringes

- 5.5.1. Classification based on Barrel Fabrication Material

- 5.5.1.1. Glass Barrel Prefilled Syringes

- 5.5.1.1.1. Limitations of Glass Barrel Prefilled Syringes

- 5.5.1.1.2. Addressing the Limitations of Glass Barrel Prefilled Syringes

- 5.5.1.2. Plastic Barrel Prefilled Syringes

- 5.5.1.2.1. Limitations of Plastic Barrel Prefilled Syringes

- 5.5.1.2.2. Addressing the Limitations of Plastic Barrel Prefilled Syringes

- 5.5.1.2.3. Factors Likely to Drive the Use of Plastic Prefilled Syringes

- 5.5.1.1. Glass Barrel Prefilled Syringes

- 5.5.2. Classification based on Number of Chambers in the Barrel

- 5.5.3. Classification based on Type of Needle

- 5.5.4. Classification based on Type of Packaging

- 5.5.1. Classification based on Barrel Fabrication Material

- 5.6. Critical Attributes of Prefilled Syringe Design

- 5.7. Key Manufacturing Steps for Prefilled Syringes

- 5.7.1. Production of Barrels

- 5.7.1.1. Glass Barrels

- 5.7.1.2. Plastic Barrels

- 5.7.2. Production of Syringes

- 5.7.3. Barrel Siliconization

- 5.7.4. Syringe Sterilization

- 5.7.5. Validation of Sterilization

- 5.7.6. Syringe Filling

- 5.7.7. Syringe Testing

- 5.7.1. Production of Barrels

- 5.8. Future Perspectives

6. PREFILLED SYRINGES: MARKET OVERVIEW

- 6.1. Chapter Overview

- 6.2. Prefilled Syringes: Overall Market Landscape

- 6.2.1. Analysis by Type of Barrel Fabrication Material

- 6.2.2. Analysis by Number of Barrel Chambers

- 6.2.3. Analysis by Type of Needle System

- 6.2.4. Analysis by Volume of Syringe

- 6.3. Prefilled Syringes Manufacturers: Overall Market Landscape

- 6.3.1. Analysis by Year of Establishment

- 6.3.2. Analysis by Company Size

- 6.3.3. Analysis by Location of Headquarters

- 6.3.4. Analysis by Company Size and Location of Headquarters

- 6.3.5. Analysis by Location of Manufacturing Facilities

- 6.3.6. Most Active Players: Analysis by Number of Prefilled Syringes

7. PRODUCT COMPETITIVENESS ANALYSIS

- 7.1. Chapter Overview

- 7.2. Assumptions and Key Parameters

- 7.3. Methodology

- 7.4. Product Competitiveness Analysis: Prefilled Syringes

- 7.4.1. Glass Barrel Prefilled Syringes

- 7.4.2. Plastic Barrel Prefilled Syringes

8. COMPANY PROFILES: PREFILLED SYRINGE MANUFACTURERS IN NORTH AMERICA

- 8.1. Chapter Overview

- 8.2. Detailed Company Profiles of Leading Prefilled Syringe Manufacturers

- 8.3.1 Becton, Dickinson and Company

- 8.3.1.1. Company Overview

- 8.3.1.2. Financial Information

- 8.3.1.3. Becton, Dickinson and Company Prefilled Syringes Portfolio

- 8.3.1.4. Recent Developments and Future Outlook

- 8.3.2. Medefil

- 8.3.2.1. Company Overview

- 8.3.2.2. Medefil Prefilled Syringes Portfolio

- 8.3.2.3. Recent Developments and Future Outlook

- 8.3.3. West Pharmaceutical

- 8.3.3.1. Company Overview

- 8.3.3.2. Financial Information

- 8.3.3.2. West Pharmaceutical Prefilled Syringes Portfolio

- 8.3.3.3. Recent Developments and Future Outlook

- 8.3.1 Becton, Dickinson and Company

- 8.4. Short Profiles of Other Prominent Prefilled Syringe Manufacturers

- 8.4.1. Medline

- 8.4.1.1. Company Overview

- 8.4.1.2. Prefilled Syringes Portfolio

- 8.4.2. MedXL

- 8.4.2.1. Company Overview

- 8.4.2.2. Prefilled Syringes Portfolio

- 8.4.3 Pfizer

- 8.4.3.1. Company Overview

- 8.4.3.2. Prefilled Syringes Portfolio

- 8.4.1. Medline

9. COMPANY PROFILES: PREFILLED SYRINGE MANUFACTURERS IN EUROPE

- 9.1. Chapter Overview

- 9.2. Detailed Company Profiles of Leading Prefilled Syringe Manufacturers

- 9.3.1. Gerresheimer

- 9.3.1.1. Company Overview

- 9.3.1.2. Financial Information

- 9.3.1.3. Gerresheimer Prefilled Syringes Portfolio

- 9.3.1.4. Recent Developments and Future Outlook

- 9.3.2 SCHOTT

- 9.3.2.1. Company Overview

- 9.3.2.2. Financial Information

- 9.3.2.3. Schott Prefilled Syringes Portfolio

- 9.3.2.4. Recent Developments and Future Outlook

- 9.3.3. Stevanato

- 9.3.3.1. Company Overview

- 9.3.2.2. Financial Information

- 9.3.3.3. Stevanato Prefilled Syringes Portfolio

- 9.3.3.4. Recent Developments and Future Outlook

- 9.3.1. Gerresheimer

- 9.4. Short Profiles of Other Prominent Prefilled Syringe Manufacturers

- 9.4.1 B. Braun

- 9.4.1.1. Company Overview

- 9.4.1.2. Prefilled Syringes Portfolio

- 9.4.2. Nipro Europe

- 9.4.2.1. Company Overview

- 9.4.2.2. Prefilled Syringes Portfolio

- 9.4.3. Vetter Pharma

- 9.4.3.1. Company Overview

- 9.4.3.2. Prefilled Syringes Portfolio

- 9.4.1 B. Braun

10. COMPANY PROFILES: PREFILLED SYRINGE MANUFACTURERS IN ASIA-PACIFIC

- 10.1. Chapter Overview

- 10.2. Detailed Company Profiles of Leading Prefilled Syringe Manufacturers

- 10.2.1 Shandong Zibo Minkang Pharmaceutical Packing

- 10.2.1.1. Company Overview

- 10.2.12. Shandong Zibo Minkang Pharmaceutical Packing Prefilled Syringes Portfolio

- 10.2.1.3. Recent Developments and Future Outlook

- 10.2.2. Shin Yan Sheno Precision Industrial

- 10.2.2.1. Company Overview

- 10.2.2.2. Taisei Kako Prefilled Syringes Portfolio

- 10.2.2.3. Recent Developments and Future Outlook

- 10.2.3. Taisei Kako

- 10.2.3.1. Company Overview

- 10.2.3.2. Taisei Kako Prefilled Syringes Portfolio

- 10.2.3.3. Recent Developments and Future Outlook

- 10.2.1 Shandong Zibo Minkang Pharmaceutical Packing

- 10.3. Short Profiles of Other Prominent Prefilled Syringe Manufacturers

- 10.3.1 J.O.Pharma

- 10.3.1.1. Company Overview

- 10.3.1.2. Prefilled Syringes Portfolio

- 10.3.2. Shandong Pharmaceutical Glass

- 10.3.2.1. Company Overview

- 10.3.2.2. Prefilled Syringes Portfolio

- 10.3.3. Shandong Weigao Group Medical Polymer

- 10.3.3.1. Company Overview

- 10.3.3.2. Prefilled Syringes Portfolio

- 10.3.1 J.O.Pharma

11. NEEDLESTICK INJURIES

- 11.1. Chapter Overview

- 11.2. Incidence and Associated Financial Burden

- 11.3. Government Legislations for Prevention of Needlestick Injuries

- 11.4. Safety Mechanisms used in Modern Prefilled Syringes

- 11.4.1. Safety Systems: Add-On Safety Device Manufacturers

- 11.4.1.1. Becton Dickinson and Company

- 11.4.1.2. Nemera

- 11.4.1.3. Nipro PharmaPackagin

- 11.4.1.4. Terumo

- 11.4.1.5. West Pharmaceutical

- 11.4.2. Safety Systems: Integrated Safety Device Manufacturers

- 11.4.2.1. Gerresheimer

- 11.4.2.2. Injecto

- 11.4.2.3. MedicalChain International

- 11.4.2.4. Stevanato

- 11.4.2.5. Owen Mumford

- 11.4.2.6. SHL Group

- 11.4.2.7. Taisei Kako

- 11.4.1. Safety Systems: Add-On Safety Device Manufacturers

12. REGULATORY LANDSCAPE FOR PREFILLED SYRINGES

- 12.1. Chapter Overview

- 12.2. Regulatory Approval of Combination Products in North America

- 12.2.1. Regulatory Approval of Combination Products in the US

- 12.2.1.1. Overview

- 12.2.1.2. Historical Background

- 12.1.1.3. Role of Regulatory Bodies in Product Approval

- 12.1.1.4. Regulatory Approval of Prefilled Syringes

- 12.1.1.4.1. Reimbursement Landscape in the US

- 12.1.1.4.2. Payer Mix

- 12.1.1.4.3.. Reimbursement Process in the US

- 12.2.2. Regulatory Approval of Combination Products in Canada

- 12.2.2.1. Overview

- 12.2.2.2. Role of Regulatory Bodies in Product Approval

- 12.2.2.3. Regulatory Approval for Prefilled Syringes

- 12.2.2.3.1. Reimbursement Landscape in Canada

- 12.2.2.3.2. Payer Mix

- 12.2.2.3.3. Reimbursement Process in Canada

- 12.2.1. Regulatory Approval of Combination Products in the US

- 12.3. Regulatory Approval of Combination Products in Europe

- 12.3.1. Overview

- 12.3.2. Role of Regulatory Bodies in Product Approval

- 12.3.3. Regulatory Approval of Prefilled Syringes

- 12.3.4. Regulatory Approval of Combination Products in the UK

- 12.3.4.1. Reimbursement Landscape in the UK

- 12.3.4.2. Payer Mix

- 12.3.4.3. Reimbursement Process in the UK

- 12.3.5. Regulatory Approval of Combination Products in France

- 12.3.5.1. Reimbursement Landscape in France

- 12.3.5.2. Payer Mix

- 12.3.5.3. Reimbursement Process in France

- 12.3.6. Regulatory Approval of Combination Products in Spain

- 12.3.6.1. Reimbursement Landscape in Spain

- 12.3.6.2. Payer Mix

- 12.3.6.3. Reimbursement Process in Spain

- 12.3.7. Regulatory Approval of Combination Products in Spain

- 12.3.7.1. Reimbursement Landscape in Germany

- 12.3.7.2. Payer Mix

- 12.3.7.3. Reimbursement Process in Germany

- 12.3.8. Regulatory Approval of Combination Products in Italy

- 12.3.8.1. Reimbursement Landscape in Italy

- 12.3.8.2. Payer Mix

- 12.3.8.3. Reimbursement Process in Italy

- 12.4. Regulatory Approval of Combination Products in Asia-Pacific

- 12.4.1. Regulatory Approval of Combination Products in Japan

- 12.4.1.1 Overview

- 12.4.1.2 Role of Regulatory Bodies in Product Approval

- 12.4.1.3. Regulatory Approval of Prefilled Syringes

- 12.4.1.3.1. Reimbursement Landscape in Japan

- 12.4.1.3.2. Payer Mix

- 12.4.1.3.3. Reimbursement Process in Japan

- 12.4.2. Regulatory Approval of Combination Products in China

- 12.4.2.1. Overview

- 12.4.2.2. Role of Regulatory Bodies in Product Approval

- 12.4.2.3. Regulatory Approval for Prefilled syringes

- 12.4.2.3.1. Reimbursement Landscape in China

- 12.4.2.3.2. Payer Mix

- 12.4.2.3.3. Reimbursement Process in China

- 12.4.3. Regulatory Approval of Combination Products in India

- 12.4.3.1. Overview

- 12.4.3.2. Role of Regulatory Bodies in Product Approval

- 12.4.3.3. Regulatory Approval of Prefilled Syringes

- 12.4.3.3.1. Reimbursement Landscape in India

- 12.4.3.3.2. Payer Mix

- 12.4.4. Regulatory Approval of Combination Products in South Korea

- 12.4.4.1. Overview

- 12.4.4.2. Role of Regulatory Bodies in Product Approval

- 12.4.4.3. Regulatory Approval of Prefilled Syringes

- 12.4.4.3.1. Reimbursement Landscape in South Korea

- 12.4.4.3.2. Payer Mix

- 12.4.4.3.3. Reimbursement Process in South Korea

- 12.4.5. Regulatory Approval of Combination Products in Saudi Arabia

- 12.4.5.1. Overview

- 12.4.5.2. Role of Regulatory Bodies in Product Approval

- 12.4.5.3. Regulatory Approval of Prefilled syringes

- 12.4.5.3.1. Reimbursement Landscape in Saudi Arabia

- 12.4.5.3.2. Payer Mix

- 12.4.5.3.3. Reimbursement Process in Saudi Arabia

- 12.4.6. Regulatory Approval of Combination Products in United Arab Emirates

- 12.4.6.1. Overview

- 12.4.6.2. Role of Regulatory Bodies in Product Approval

- 12.4.6.3. Regulatory Approval of Prefilled syringes

- 12.4.6.3.1. Reimbursement Landscape in United Arab Emirates

- 12.4.6.3.2. Payer Mix

- 12.4.6.3.3. Reimbursement Process in United Arab Emirates

- 12.4.1. Regulatory Approval of Combination Products in Japan

- 12.5. Regulatory Approval of Combination Products in Rest of the World

- 12.5.1. Regulatory Approval of Combination Products in Brazil

- 12.5.1.1 Overview

- 12.5.1.2 Role of Regulatory Bodies in Product Approval

- 12.5.1.3. Regulatory Approval of Prefilled Syringes

- 12.5.1.3.1. Reimbursement Landscape in Brazil

- 12.5.1.3.2. Payer Mix

- 12.5.1.3.3. Reimbursement Process in Brazil

- 12.5.2. Regulatory Approval of Combination Products in Australia

- 12.5.2.1 Overview

- 12.5.2.2 Role of Regulatory Bodies in Product Approval

- 12.5.2.3. Regulatory Approval of Prefilled Syringes

- 12.5.2.3.1. Reimbursement Landscape in Australia

- 12.5.2.3.2. Payer Mix

- 12.5.2.3.3. Reimbursement Process in Australia

- 12.5.1. Regulatory Approval of Combination Products in Brazil

13. PREFILLED SYRINGE COMBINATION PRODUCTS

- 13.1. Chapter Overview

- 13.2. Prefilled Syringe Combination Products: Approved Drugs

- 13.2.1. Analysis by Type of Drug Molecule

- 13.2.2. Analysis by Product Approval

- 13.2.3. Analysis by Route of Administration

- 13.2.4. Analysis by Target Therapeutic Area

- 13.2.5. Analysis by Region of Product Analysis

- 13.2.6. Analysis by Other Approved Primary Packaging Systems

- 13.3. Prefilled Syringe Combination Products: Clinical Stage Drugs

- 13.3.1. Analysis by Type of Drug Molecule

- 13.3.2. Analysis by Phase of Development

- 13.3.3. Analysis by Route of Administration

- 13.3.4. Analysis by Target Therapeutic Area

- 13.4. Prefilled Syringe Combination Products: Developers Landscape

- 13.4.1. Analysis by Year of Establishment

- 13.4.2. Analysis by Company Size

- 13.4.3. Analysis by Location of Headquarters

- 13.5. Leading Drugs in Prefilled Syringe Format

- 13.6. Other Drugs Available in Prefilled Syringe Format

- 13.7. Most Popular Drug Available in Prefilled Syringe Format: Humira (adalimumab), AbbVie / Eisai

- 13.7.1. Target Indications and Available Dosage Forms

- 13.7.2. Shift from Vials to Prefilled Syringes

- 13.7.3. Humira Annual Sales, FY 2010-FY 2022

14. KEY THERAPEUTIC AREAS

- 14.1. Chapter Overview

- 14.2. Autoimmune Disorders

- 14.2.1. Approved Drugs

- 14.2.2. Key Developments

- 14.2.3. Upcoming / Commercialized Biosimilars for Autoimmune Drugs

- 14.3. Infectious Diseases

- 14.3.1. Approved Drugs

- 14.3.2. Key Developments

- 14.4. Neurological Disorders

- 14.4.1. Approved Drugs

- 14.4.2. Key Developments

15. PREFILLED SYRINGES: LIKELY DRUG CANDIDATES ANALYSIS

- 15.1. Chapter Overview

- 15.2. Likely Drug Candidates

- 15.2.1. Assumption and Key Parameters

- 15.2.2. Methodology

- 15.2.3. Most Likely Candidates for Delivery via Prefilled Syringes

- 15.2.4. Likely Candidates for Delivery via Prefilled Syringes

- 15.2.5. Less Likely Candidates for Delivery Via Prefilled Syringe

16. COMBINATION PRODUCTS: BIG PHARMA ACTIVITY

- 16.1. Chapter Overview

- 16.2. Methodology

- 16.3. Combination Products: Big Pharma Activity

- 16.3.1. Analysis by Target Therapeutic Area

- 16.3.1.1. Autoimmune Disorders

- 16.3.1.2. Infectious Diseases

- 16.3.1.3. Neurological Disorders

- 16.3.1.4. Blood Disorders

- 16.3.1.5. Oncological Disorders

- 16.3.2. Analysis by Type of Molecule

- 16.3.2.1. Antibodies

- 16.3.2.2. Vaccines

- 16.3.2.3. Proteins

- 16.3.2.4. Peptides

- 16.3.2.5. Small Molecules

- 16.3.2.6. Other Biologics

- 16.3.1. Analysis by Target Therapeutic Area

17. RECENT DEVELOPMENTS

- 17.1. Chapter Overview

- 17.2. Prefilled Syringes: Recent Developments

- 17.3. Analysis by Year of Initiative

- 17.4. Analysis by Type of Initiative

- 17.5. Analysis by Year and Type of Initiative

- 17.5.1. Analysis by Location of Expansion

- 17.5.2. Analysis by Type of Expansion

- 17.5.3 Analysis by Type of Partnership

- 17.6. Analysis by Geography

- 17.7. Most Active Players: Distribution by Number of Recent Initiatives

- 17.8. Analysis of Player by Type of Initiatives

18. PATENT ANALYSIS

- 18.1. Chapter Overview

- 18.2. Scope and Methodology

- 18.3. Prefilled Syringes: Patent Analysis

- 18.3.1. Analysis by Patent Publication Year

- 18.3.2. Analysis by Type of Patent and Publication Year

- 18.3.3. Analysis by Patent Application Year

- 18.3.4. Analysis by Patent Jurisdiction

- 18.3.5. Analysis by CPC Symbols

- 18.3.6. Analysis by Type of Applicant

- 18.3.7. Leading Players: Analysis by Number of Patents

- 18.3.8. Leading Individual Assignees: Analysis by Number of Patents

- 18.4. Prefilled Syringes: Patent Benchmarking Analysis

- 18.4.1. Analysis by Patent Characteristics

- 18.5. Prefilled Syringes: Patent Valuation Analysis

- 18.6. Leading Patents by Number of Citations

19. KOL ANALYSIS

- 19.1. Chapter Overview

- 19.2. Assumption and Key Parameters

- 19.3. Methodology

- 19.4. Prefilled Syringes: Key Opinion Leaders

- 19.4.1. Analysis by Role of KOL

- 19.4.2. Analysis by Type of Sponsor Organization

- 19.4.3. Analysis by Affiliated Organization

- 19.4.4. Analysis by Target Disease Indication

- 19.4.5. Analysis by Geographical Location

- 19.4.6. Most Prominent KOLs: Analysis by Activeness, Expertise and Strength of KOL

- 19.4.7. Most Prominent KOLs: Analysis by RA score

20. SPECIALTY PREFILLED SYRINGES

- 20.1. Chapter Overview

- 20.2. Prefilled Flush Syringes

- 20.2.1. Overview

- 20.2.2. Advantages of Prefilled Flush Syringes

- 20.2.3. Prefilled Flush Syringes Available in the Market

- 20.3. Prefilled Diluent Syringes

- 20.3.1. Overview

- 20.3.2. Advantages of Prefilled Diluent Syringes

- 20.3.3. Lyophilized Drugs Available in Prefilled Diluent Syringes

- 20.4. Contrast Agent Prefilled Syringes

- 20.4.1. Overview

- 20.4.2. Advantages of Using Prefilled Syringes for Contrast Agents

- 20.4.3. Contrast Agents Available in Prefilled Syringes

21. TECHNOLOGICAL ADVANCES RELATED TO PREFILLED SYRINGES

- 21.1. Chapter Overview

- 21.2. Prefilled Syringes for Lyophilized Drugs

- 21.2.1. Prefilled Diluent Syringes

- 21.2.2. Prefilled Dual-Chamber Syringes

- 21.3. Multilayer Plastic Prefilled Syringes with Oxygen Barrier

- 21.4. Prefilled Syringes with Low Risk of Particle Formation

- 21.5. Advanced Lubrication Technology for Prefilled Syringes

- 21.6. Advances in Terminal Sterilization of Prefilled Syringes

- 21.7. Prefilled Syringe Usage Aids for Patients and Healthcare Providers

- 21.8. Additional Advancements

22. KEY GROWTH DRIVERS

- 22.1. Chapter Overview

- 22.2. Rising Incidence of Chronic Diseases

- 22.3. Growing Preference for Self-Injection

- 22.4. Evolving Patient Demographics

- 22.5. Growth of Biologics and Biosimilars Market

- 22.6. Changing Pharmaceutical Practices

- 22.7. Increasing Focus on Prevention of Needlestick Injuries

- 22.8. Prefilled Syringes in Autoinjectors and Pen Injectors

23. SWOT ANALYSIS

- 23.1. Chapter Overview

- 23.2. Strengths

- 23.2.1. Ease of Use

- 23.2.2. Ability to Reduce / Eliminate Medication Errors

- 23.2.3. Reducing the Risk of Accidental Transmission of Blood-Borne Pathogens

- 23.2.4. Economic Advantages

- 23.2.5. Drug Life Cycle Management

- 23.3. Weaknesses

- 23.3.1. Manufacturing Complexities

- 23.3.2. High Packaging and Transportation Costs

- 23.3.3. Product Stability and Quality Related Issues

- 23.3.4. Challenges Associated with Drug Filing

- 23.4. Opportunities

- 23.4.1. Rich and Growing Pipeline of Biologics and Biosimilars

- 23.4.2. Growing Preference for Self-Injecting

- 23.4.3. Application in Advanced Drug Delivery Devices

- 23.4.4. Innovation in Design and Technical Advancement

- 23.4.5. Rising Popularity across the Globe

- 23.4.6. Widespread Use in Vaccination Programs

- 23.5. Threats

- 23.5.1. Material Compatibility Issues

- 23.5.2. Availability of Alternative Drug Delivery Devices

- 23.5.3. Concern Related to Numerous Product Recalls In Past

- 23.6. Concluding Remarks

24. GLOBAL PREFILLED SYRINGES MARKET

- 24.1. Chapter Overview

- 24.2. Assumptions and Methodology

- 24.3. Global Prefilled Syringes Market, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 24.3.1. Scenario Analysis

- 24.4. Key Market Segmentations

25. PREFILLED SYRINGES MARKET, BY PURPOSE OF SYRINGE

- 25.1. Chapter Overview

- 25.2. Key Assumptions and Methodology

- 25.3. Prefilled Syringes Market: Distribution by Purpose of Syringe, 2018, 2023 and 2035

- 25.3.1. Specialty Prefilled Syringe: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 25.3.2. Therapeutic Prefilled Syringe: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 25.3.3. Cosmetic Prefilled Syringe: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 25.4. Data Triangulation and Validation

26. PREFILLED SYRINGES MARKET, BY TYPE OF MOLECULE

- 26.1. Chapter Overview

- 26.2. Key Assumptions and Methodology

- 26.3. Prefilled Syringes Market: Distribution by Type of Molecule, 2018, 2023 and 2035

- 26.3.1. Prefilled Syringes Market for Proteins: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 26.3.2. Prefilled Syringes Market for Antibodies: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 26.3.3. Prefilled Syringes Market for Peptides: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 26.3.4. Prefilled Syringes Market for Small Molecules: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 26.3.5. Prefilled Syringes Market for Vaccines: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 26.3.6. Prefilled Syringes Market for Cell Therapies: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 26.4. Data Triangulation and Validation

27. PREFILLED SYRINGES MARKET, BY THERAPEUTIC AREA

- 27.1. Chapter Overview

- 27.2. Key Assumptions and Methodology

- 27.3. Prefilled Syringes Market: Distribution by Therapeutic Area, 2018, 2023 and 2035

- 27.3.1. Prefilled Syringes Market for Blood Disorders: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 27.3.2. Prefilled Syringes Market for Infectious Diseases: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 27.3.3. Prefilled Syringes Market for Autoimmune Disorders: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 27.3.4. Prefilled Syringes Market for Oncological Disorders: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 27.3.5. Prefilled Syringes Market for Cardiovascular Disorders: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 27.3.6. Prefilled Syringes Market for Respiratory Disorders: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 27.3.7. Prefilled Syringes Market for Neurological Disorders: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 27.3.8. Prefilled Syringes Market for Metabolic Disorders: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 27.3.9. Prefilled Syringes Market for Ophthalmic Disorders: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 27.3.10. Prefilled Syringes Market for Orthopedic Disorders: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 27.3.11 Prefilled Syringes Market for Other Disorders: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 27.4. Data Triangulation and Validation

28. PREFILLED SYRINGES MARKET, BY TYPE OF BARREL MATERIAL

- 28.1. Chapter Overview

- 28.2. Key Assumptions and Methodology

- 28.3. Prefilled Syringes Market: Distribution by Type of Barrel Material, 2018, 2023 and 2035

- 28.3.1. Glass Prefilled Syringes: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 28.3.2. Plastic Prefilled Syringes: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 28.4. Data Triangulation and Validation

29. PREFILLED SYRINGES MARKET, BY NUMBER OF CHAMBER

- 29.1. Chapter Overview

- 29.2. Key Assumptions and Methodology

- 29.3. Prefilled Syringes Market: Distribution by Number of Chamber, 2018, 2023 and 2035

- 29.3.1. Single Chamber Prefilled Syringes: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 29.3.2. Dual Chamber Prefilled Syringes: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 29.4. Data Triangulation and Validation

30. PREFILLED SYRINGES MARKET, BY TYPE OF NEEDLE SYSTEM

- 30.1. Chapter Overview

- 30.2. Key Assumptions and Methodology

- 30.3. Prefilled Syringes Market: Distribution by Type of Needle System, 2018, 2023 and 2035

- 30.3.1. Staked Needle Prefilled Syringes: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 30.3.2. Luer Prefilled Syringes: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 30.4. Data Triangulation and Validation

31. PREFILLED SYRINGES MARKET, BY USABILITY OF SYRINGE

- 31.1. Chapter Overview

- 31.2. Key Assumptions and Methodology

- 31.3. Prefilled Syringes Market: Distribution by Usability of Syringe, 2018, 2023 and 2035

- 31.3.1. Disposable Prefilled Syringes: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 31.3.2. Reusable Prefilled Syringes: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 31.4. Data Triangulation and Validation

32. PREFILLED SYRINGES MARKET, BY TYPE OF SYRINGE

- 32.1. Chapter Overview

- 32.2. Key Assumptions and Methodology

- 32.3. Prefilled Syringes Market: Distribution by Type of Syringe, 2018, 2023 and 2035

- 32.3.1. Conventional Prefilled Syringes: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 32.3.1. Safety Prefilled Syringes: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 32.4. Data Triangulation and Validation

33. PREFILLED SYRINGES MARKET, BY TYPE OF PACKAGING

- 33.1. Chapter Overview

- 33.2. Key Assumptions and Methodology

- 33.3. Prefilled Syringes Market: Distribution by Type of Packaging, 2018, 2023 and 2035

- 33.3.1. Bulk Prefilled Syringes: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 33.3.2. Nested Prefilled Syringes: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 33.4. Data Triangulation and Validation

34. PREFILLED SYRINGES MARKET, BY KEY GEOGRAPHICAL REGIONS

- 34.1. Chapter Overview

- 34.2. Key Assumptions and Methodology

- 34.3. Prefilled Syringes Market: Distribution by Key Geographical Region, 2018, 2023 and 2035

- 34.3.1 Prefilled Syringes Market in North America: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 34.3.2. Prefilled Syringes Market in Europe: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 34.3.3. Prefilled Syringes Market in Asia-Pacific: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 34.3.4. Prefilled Syringes Market in Middle East and South Africa: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 34.3.5 Prefilled Syringes Market in Latin America: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 34.4. Data Triangulation and Validation

35. PREFILLED SYRINGES MARKET, FOR BLOOD DISORDERS

- 35.1. Chapter Overview

- 35.2. Key Assumptions and Methodology

- 35.3. Prefilled Syringes Market for Blood Disorders: Distribution by Type of Molecule

- 35.3.1. Proteins Market for Blood Disorders, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 35.3.2. Small Molecules Market for Blood Disorders, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 35.4. Prefilled Syringes Market for Blood Disorders: Distribution by Type of Barrel Material

- 35.4.1. Glass Prefilled Syringes Market for Blood Disorders, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 35.4.2. Plastic Prefilled Syringes Market for Blood Disorders, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 35.5. Prefilled Syringes Market for Blood Disorders: Distribution by Number of Chamber

- 35.5.1. Single Chamber Prefilled Syringes Market for Blood Disorders, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 35.5.2. Dual Chamber Prefilled Syringes, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 35.6. Prefilled Syringes Market for Blood Disorders: Distribution by Type of Needle System

- 35.6.1. Staked Needle Prefilled Syringes Market for Blood Disorders, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 35.6.2. Luer Prefilled Syringes Market for Blood Disorders, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 35.7. Prefilled Syringes Market for Blood Disorders: Distribution by Usability of Syringe

- 35.7.1. Disposable Prefilled Syringes Market for Blood Disorders, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 35.7.2. Reusable Prefilled Syringes Market For Blood Disorders, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 35.8. Prefilled Syringes Market for Blood Disorders: Distribution by Type of Syringe

- 35.8.1. Conventional Prefilled Syringes Market for Blood Disorders, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 35.8.2. Safety Prefilled Syringes Market for Blood Disorders, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 35.9. Prefilled Syringes Market for Blood Disorders: Distribution by Type of Packaging

- 35.9.1. Bulk Prefilled Syringes Market for Blood Disorders, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 35.9.2. Nested Prefilled Syringes Market for Blood Disorders, Historical Trends (2018- 2022) and Forecasted Estimates (till 2035)

- 35.10. Prefilled Syringes Market for Blood Disorders: Distribution by Key Geographical Region

- 35.10.1. Prefilled Syringes Market for Blood Disorders in North America, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 35.10.2. Prefilled Syringes Market for Blood Disorders in Europe, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 35.10.3. Prefilled Syringes Market for Blood Disorders in Asia- Pacific, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 35.10.4. Prefilled Syringes Market for Blood Disorders in Middle East and North Africa, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 35.10.5. Prefilled Syringes Market for Blood Disorders in Latin America, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

36. PREFILLED SYRINGES MARKET, FOR INFECTIOUS DISEASES

36. Prefilled Syringes Market for Infectious Diseases

- 36.1. Chapter Overview

- 36.2. Key Assumptions and Methodology

- 36.3. Prefilled Syringes Market for Infectious Diseases: Distribution by Type of Molecule

- 36.3.1. Proteins Market for Infectious Diseases, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 36.3.2. Vaccines Market for Infectious Diseases, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 36.4. Prefilled Syringes Market for Infectious Diseases: Distribution by Type of Barrel Material

- 36.4.1. Glass Prefilled Syringes Market for Infectious Diseases, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 36.4.2. Plastic Prefilled Syringes Market for Infectious Diseases, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 36.5. Prefilled Syringes Market for Infectious Diseases: Distribution by Number of Chamber

- 36.5.1. Single Chamber Prefilled Syringes Market for Infectious Diseases, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 36.5.2. Dual Chamber Prefilled Syringes Market for Infectious Diseases, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 36.6. Prefilled Syringes Market for Infectious Diseases: Distribution by Type of Needle System

- 36.6.1. Staked Needle Prefilled Syringes Market for Infectious Diseases, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 36.6.2. Luer Prefilled Syringes Market for Infectious Diseases, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 36.7. Prefilled Syringes Market for Infectious Diseases: Distribution by Usability of Syringe

- 36.7.1. Disposable Prefilled Syringes Market for Infectious Diseases, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 36.7.2. Reusable Prefilled Syringes Market for Infectious Diseases, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 36.8. Prefilled Syringes Market for Infectious Diseases: Distribution by Type of Syringe

- 36.8.1. Conventional Prefilled Syringes Market for Infectious Diseases, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 36.8.2. Safety Prefilled Syringes Market for Infectious Diseases, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 36.9. Prefilled Syringes Market for Infectious Diseases: Distribution by Type of Packaging

- 36.9.1. Bulk Prefilled Syringes Market for Infectious Diseases, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 36.9.2. Nested Prefilled Syringes Market for Infectious Diseases, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 36.10. Prefilled Syringes Market for Infectious Diseases: Distribution by Key Geographical Region

- 36.10.1. Prefilled Syringes Market for Infectious Diseases in North America, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 36.10.2. Prefilled Syringes Market for Infectious Diseases in Europe, Historical Trends (since 2018) and Forecasted Estimates(till 2035)

- 36.10.3. Prefilled Syringes Market for Infectious Diseases in Asia-Pacific, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 36.10.4. Prefilled Syringes Market for Infectious Diseases in Middle East and North Africa, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 36.10.5. Prefilled Syringes Market for Infectious Diseases in Latin America, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

37. PREFILLED SYRINGES MARKET, FOR AUTOIMMUNE DISORDERS

- 37.1. Chapter Overview

- 37.2. Key Assumptions and Methodology

- 37.3. Prefilled Syringe Market for Autoimmune Disorders: Distribution by Type of Molecule

- 37.3.1. Proteins Market for Autoimmune Disorders, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 37.3.2. Antibodies Market for Autoimmune Disorders, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 37.3.3. Peptides Market for Autoimmune Disorders, Historical Trends (since 2020) and Forecasted Estimates (till 2035)

- 37.3.4. Small Molecule Market for Autoimmune Disorders, Historical Trends (since 2020) and Forecasted Estimates (till 2035)

- 37.4. Prefilled Syringe Market for Autoimmune Disorders: Distribution by Type of Barrel Material

- 37.4.1. Glass Barrel Prefilled Syringes Market for Autoimmune Disorders, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 37.4.2. Plastic Barrel Prefilled Syringes Market for Autoimmune Disorders, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 37.5. Prefilled Syringe Market for Autoimmune Disorders: Distribution by Number of Chamber

- 37.5.1. Single Chamber Prefilled Syringes Market for Autoimmune Disorders, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 37.5.2. Dual Chamber Prefilled Syringes Market for Autoimmune Disorders, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 37.6. Prefilled Syringe Market for Autoimmune Disorders: Distribution by Type of Needle System

- 37.6.1. Staked Needle Prefilled Syringes Market for Autoimmune Disorders, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 37.6.2. Luer Prefilled Syringes Market for Autoimmune Disorders, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 37.7. Prefilled Syringe Market for Autoimmune Disorders: Distribution by Usability of Syringe

- 37.7.1. Disposable Prefilled Syringes Market for Autoimmune Disorders, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 37.7.2. Reusable Prefilled Syringes Market for Autoimmune Disorders, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 37.8. Prefilled Syringe Market for Autoimmune Disorders: Distribution by Type of Syringe

- 37.8.1. Conventional Prefilled Syringes Market for Autoimmune Disorders, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 37.8.2. Safety Prefilled Syringes Market for Autoimmune Disorders, Historical Trends (2018- 2022) and Forecasted Estimates (till 2035)

- 37.9. Prefilled Syringe Market for Autoimmune Disorders: Distribution by Type of Packaging

- 37.9.1. Bulk Prefilled Syringes Market for Autoimmune Disorders, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 37.9.2. Nested Prefilled Syringes Market for Autoimmune Disorders, Historical Trends (2018- 2022) and Forecasted Estimates (till 2035)

- 37.10. Prefilled Syringe Market for Autoimmune Disorders: Distribution by Key Geographical Region

- 37.10.1. Prefilled Syringes Market for Autoimmune Disorders in North America, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 37.10.2. Prefilled Syringes Market for Autoimmune Disorders in Europe, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 37.10.3. Prefilled Syringes Market for Autoimmune Disorders in Asia-Pacific, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 37.10.4. Prefilled Syringes Market for Autoimmune Disorders in Middle East and North Africa, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 37.10.5. Prefilled Syringes Market for Autoimmune Disorders in Latin America, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

38. PREFILLED SYRINGES MARKET, FOR ONCOLOGICAL DISORDERS

- 38.1. Chapter Overview

- 38.2. Key Assumptions and Methodology

- 38.3. Prefilled Syringe Market for Oncological disorders: Distribution by Type of Molecule

- 38.3.1. Proteins Market for Oncological Disorders, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 38.3.2. Antibodies Market for Oncological Disorders, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 38.3.3. Peptides Market for Oncological Disorders, Historical Trends (since 2020) and Forecasted Estimates (till 2035)

- 38.3.4. Small Molecules Market for Oncological Disorders, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 38.3.5. Vaccines Market for Oncological Disorders, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 38.4. Prefilled Syringe Market for Oncological disorders: Distribution by Type of Barrel Material

- 38.4.1. Glass Prefilled Syringes Market for Oncological Disorders, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 38.4.2. Plastic Prefilled Syringes Market for Oncological Disorders, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 38.5. Prefilled Syringe Market for Oncological disorders: Distribution by Number of Chamber

- 38.5.1. Single Chamber Prefilled Syringes Market for Oncological Disorders, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 38.5.2. Dual Chamber Prefilled Syringes Market for Oncological Disorders, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 38.6. Prefilled Syringe Market for Oncological disorders: Distribution by Type of Needle System

- 38.6.1. Staked Needle Prefilled Syringes Market for Oncological Disorders, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 38.6.2. Luer Prefilled Syringes Market for Oncological Disorders, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 38.7. Prefilled Syringe Market for Oncological disorders: Distribution by Usability of Syringe

- 38.7.1. Disposable Prefilled Syringes Market for Oncological Disorders, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 38.7.2. Reusable Barrel Prefilled Syringes, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 38.8. Prefilled Syringe Market for Oncological Disorders: Distribution by Type of Syringe

- 38.8.1. Conventional Prefilled Syringes Market for Oncological Disorders, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 38.8.2. Safety Prefilled Syringes Market for Oncological Disorders, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 38.9. Prefilled Syringe Market for Oncological disorders: Distribution by Type of Packaging

- 38.9.1. Bulk Prefilled Syringes Market for Oncological Disorders, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 38.9.2. Nested Prefilled Syringes Market for Oncological Disorders, Historical Trends (2018- 2022) and Forecasted Estimates (till 2035)

- 38.10. Prefilled Syringes Market for Oncological disorders: Distribution by Key Geographical Regions

- 38.10.1. Prefilled Syringes Market for Oncological disorders in North America, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 38.10.2. Prefilled Syringes Market for Oncological disorders in Europe, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 38.10.3. Prefilled Syringes Market for Oncological Disorders in Asia- Pacific, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 38.10.4. Prefilled Syringes Market for Oncological Disorders in Middle East and North Africa, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 38.10.5. Prefilled Syringes Market for Oncological Disorders in Latin America, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

39. PREFILLED SYRINGES MARKET, FOR CARDIOVASCULAR DISORDERS

- 39.1. Chapter Overview

- 39.2. Key Assumptions and Methodology

- 39.3. Prefilled Syringes Market for Cardiovascular Disorders: Distribution by Type of Molecule

- 39.3.1. Antibodies Market for Cardiovascular Disorders, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 39.3.2. Cell Therapies Market for Cardiovascular Disorders, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 39.4. Prefilled Syringes Market for Cardiovascular disorders: Distribution by Type of Barrel Material

- 39.4.1. Glass Prefilled Syringes Market for Cardiovascular Disorders, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 39.4.2. Plastic Prefilled Syringes Market for Cardiovascular Disorders, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 39.5. Prefilled Syringes Market for Cardiovascular disorders: Distribution by Number of Chamber

- 39.5.1. Single Chamber Prefilled Syringes Market for Cardiovascular Disorders, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 39.5.2. Dual Chamber Prefilled Syringes Market for Cardiovascular Disorders, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 39.6. Prefilled Syringes Market for Cardiovascular disorders: Distribution by Type of Needle System

- 39.6.1. Staked Needle Prefilled Syringes Market for Cardiovascular Disorders, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 39.6.2. Luer Prefilled Syringes Market for Cardiovascular Disorders, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 39.7. Prefilled Syringes Market for Cardiovascular disorders: Distribution by Usability of Syringe

- 39.7.1. Disposable Prefilled Syringes Market for Cardiovascular Disorders, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 39.7.2. Reusable Barrel Prefilled Syringes Market for Cardiovascular Disorders, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 39.8. Prefilled Syringes Market for Cardiovascular disorders: Distribution by Type of Syringe

- 39.8.1. Conventional Prefilled Syringes Market for Cardiovascular Disorders, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 39.8.2. Safety Prefilled Syringes Market for Cardiovascular Disorders, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 39.9. Prefilled Syringes Market for Cardiovascular Disorders: Distribution by Type of Packaging

- 39.9.1. Bulk Prefilled Syringes Market for Cardiovascular Disorders, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 39.9.2. Nested Prefilled Syringes Market for Cardiovascular Disorders, Historical Trends (2018- 2022) and Forecasted Estimates (till 2035)

- 39.10. Prefilled Syringes Market for Cardiovascular Disorders: Distribution by Key Geographical Regions

- 39.10.1. Prefilled Syringes Market for Cardiovascular Disorders in North America, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 39.10.2. Prefilled Syringes Market for Cardiovascular Disorders in Europe, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 39.10.3. Prefilled Syringes Market for Cardiovascular Disorders in Asia-Pacific, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 39.10.4. Prefilled Syringes Market for Cardiovascular Disorders in Middle East and North Africa, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 39.10.5. Prefilled Syringes Market for Cardiovascular Disorders in Latin America, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

40. PREFILLED SYRINGES MARKET, FOR RESPIRATORY DISORDERS

- 40.1. Chapter Overview

- 40.2. Key Assumptions and Methodology

- 40.3. Prefilled Syringes Market for Respiratory disorders: Distribution by Type of Molecule

- 40.3.1. Antibodies Market for Respiratory Disorders, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 40.4. Prefilled Syringes Market for Respiratory disorders: Distribution by Type of Barrel Material

- 40.4.1. Glass Barrel Prefilled Syringes Market for Respiratory Disorders, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 40.4.2. Plastic Barrel Prefilled Syringes Market for Respiratory Disorders, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 40.5. Prefilled Syringes Market for Respiratory disorders: Distribution by Number of Chamber

- 40.5.1. Single Chamber Prefilled Syringes Market for Respiratory Disorders, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 40.5.2. Dual Chamber Prefilled Syringes Market for Respiratory Disorders, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 40.6. Prefilled Syringes Market for Respiratory disorders: Distribution by Type of Needle System

- 40.6.1. Staked Needle Prefilled Syringes Market for Respiratory Disorders, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 40.6.2. Luer Prefilled Syringes Market for Respiratory Disorders, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 40.7. Prefilled Syringes Market for Respiratory Disorders: Distribution by Usability of Syringe

- 40.7.1. Disposable Prefilled Syringes Market for Respiratory Disorders, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 40.7.2. Reusable Barrel Prefilled Syringes Market for Respiratory Disorders, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 40.8. Prefilled Syringes Market for Respiratory Disorders: Distribution by Type of Syringe

- 40.8.1. Conventional Prefilled Syringes Market for Respiratory Disorders, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 40.8.2. Safety Prefilled Syringes Market for Respiratory Disorders, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 40.9. Prefilled Syringes Market for Respiratory Disorders: Distribution by Type of Packaging

- 40.9.1. Bulk Prefilled Syringes Market for Respiratory Disorders, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 40.9.2. Nested Prefilled Syringes Market for Respiratory Disorders, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 40.10. Prefilled Syringes Market for Respiratory Disorders: Distribution by Key Geographical Regions

- 40.10.1. Prefilled Syringes Market for Respiratory Disorders in North America, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 40.10.2. Prefilled Syringes Market for Respiratory Disorders in Europe, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 40.10.3. Prefilled Syringes Market for Respiratory Disorders in Asia- Pacific, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 40.10.4. Prefilled Syringes Market for Respiratory Disorders in Middle East and North Africa, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 40.10.5. Prefilled Syringes Market for Respiratory Disorders in Latin America, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

41. PREFILLED SYRINGES MARKET, FOR NEUROLOGICAL DISORDERS

- 41.1. Chapter Overview

- 41.2. Key Assumptions and Methodology

- 41.3. Prefilled Syringes Market for Neurological Disorders: Distribution by Type of Molecule

- 41.3.1. Antibodies Market for Neurological Disorders, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 41.3.2. Proteins Market for Neurological Disorders, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 41.3.3. Peptides Market for Neurological Disorders, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 41.3.4. Small Molecules Market for Neurological Disorders, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 41.4. Prefilled Syringes Market for Neurological Disorders: Distribution by Type of Barrel Material

- 41.4.1. Glass Prefilled Syringes Market for Neurological Disorders, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 41.4.2. Plastic Prefilled Syringes Market for Neurological Disorders, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 41.5. Prefilled Syringes Market for Neurological Disorders: Distribution by Number of Chamber

- 41.5.1. Single Chamber Prefilled Syringes Market for Neurological Disorders, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 41.5.2. Dual Chamber Prefilled Syringes Market for Neurological Disorders, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 41.6. Prefilled Syringes Market for Neurological Disorders: Distribution by Type of Needle System

- 41.6.1. Staked Needle Prefilled Syringes Market for Neurological Disorders, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 41.6.2. Luer Prefilled Syringes Market for Neurological Disorders, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 41.7. Prefilled Syringes Market for Neurological Disorders: Distribution by Usability of Syringe

- 41.7.1. Disposable Prefilled Syringes Market for Neurological Disorders, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 41.7.2. Reusable Barrel Prefilled Syringes Market for Neurological Disorders, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 41.8. Prefilled Syringes Market for Neurological Disorders: Distribution by Type of Syringe

- 41.8.1. Conventional Prefilled Syringes Market for Neurological Disorders, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 41.8.2. Safety Prefilled Syringes Market for Neurological Disorders, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 41.9. Prefilled Syringes Market for Neurological Disorders: Distribution by Type of Packaging

- 41.9.1. Bulk Prefilled Syringes Market for Neurological Disorders, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 41.9.2. Nested Prefilled Syringes Market for Neurological Disorders, Historical Trends (2018- 2022) and Forecasted Estimates (till 2035)

- 41.10. Prefilled Syringes Market for Neurological Disorders: Distribution by Key Geographical Regions

- 41.10.1. Prefilled Syringes Market for Neurological Disorders in North America, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 41.10.2. Prefilled Syringes Market for Neurological Disorders in Europe, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 41.10.3. Prefilled Syringes Market for Neurological Disorders in Asia-Pacific, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 41.10.4. Prefilled Syringes Market for Neurological Disorders in Middle East and North Africa, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 41.10.5. Prefilled Syringes Market for Neurological Disorders in Latin America, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

42. PREFILLED SYRINGES MARKET, FOR METABOLIC DISORDERS

- 42.1. Chapter Overview

- 42.2. Key Assumptions and Methodology

- 42.3. Prefilled Syringes Market for Metabolic Disorders: Distribution by Type of Molecule

- 42.3.1. Proteins Market for Metabolic Disorders, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 42.3.2. Small Molecule Market for Metabolic Disorders, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 42.3.3. Peptides Market for Metabolic Disorders, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 42.4. Prefilled Syringes Market for Metabolic disorders: Distribution by Type of Barrel Material

- 42.4.1. Glass Prefilled Syringes Market for Metabolic Disorders, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 42.4.2. Plastic Prefilled Syringes Market for Metabolic Disorders, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 42.5. Prefilled Syringes Market for Metabolic Disorders: Distribution by Number of Chamber

- 42.5.1. Single Chamber Prefilled Syringes Market for Metabolic Disorders, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 42.5.2. Dual Chamber Prefilled Syringes Market for Metabolic Disorders, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 42.6. Prefilled Syringes Market for Metabolic Disorders: Distribution by Type of Needle System

- 42.6.1. Staked Needle Prefilled Syringes Market for Metabolic Disorders, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 42.6.2. Luer Prefilled Syringes Market for Metabolic Disorders, Historical Trends (since 2018) and Forecasted Estimates (till 2035)