PUBLISHER: Roots Analysis | PRODUCT CODE: 1624831

PUBLISHER: Roots Analysis | PRODUCT CODE: 1624831

Sustainable Packaging Market by Type of Eco Friendly Packaging, Type of Packaging, Type of Packaging Container, Type of End users and Key Geographical Regions : Industry Trends and Global Forecasts, Till 2035

SUSTAINABLE PACKAGING MARKET: OVERVIEW

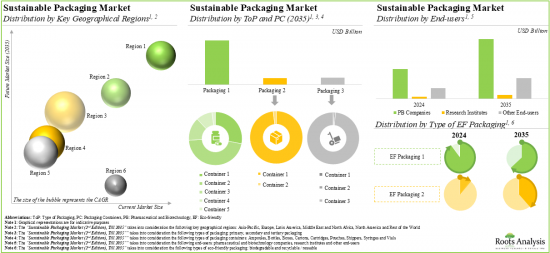

As per Roots Analysis, the global sustainable packaging market is estimated to grow from USD 9.67 billion in the current year to USD 19.19 billion by 2035, at a CAGR of 6.43% during the forecast period, till 2035.

The market sizing and opportunity analysis has been segmented across the following parameters:

Type of Eco Friendly Packaging

- Biodegradable

- Recyclable / Reusable

Type of Packaging

- Primary Packaging

- Secondary Packaging

- Tertiary Packaging

Type of Packaging Container

- Ampoules

- Bottles

- Boxes

- Cartons

- Cartridges

- Pouches

- Shippers

- Syringes

- Vials

End User

- Pharmaceutical and Biotechnology Companies

- Research Institutes

- Other End-users

Key Geographical Regions

- North America (US, Canada)

- Europe (Germany, France, Italy, Spain, UK, Rest of Europe)

- Asia-Pacific (Japan, India, China, Australia, Rest of Asia-Pacific)

- Latin America

- Middle East and North Africa

- Rest of the World

SUSTAINABLE PACKAGING MARKET: GROWTH AND TRENDS

In the pharmaceutical industry, glass, plastic, metals, cardboard and wood are some of the most commonly used raw materials for primary packaging. However, a significant amount of waste is produced from these conventional raw materials, primarily due to their inability to decompose naturally. It is worth highlighting that over 500 million tons of waste is generated through pharmaceutical packaging globally. Notably, 30% of the plastic packaging materials are either too complex or too small to recycle; examples include sachets and wrappers. This has led to a negative impact on the environment. Moreover, the steadily expanding pipeline of pharmaceutical drug candidates has resulted in a growing demand for packaging solutions. This has compelled packaging providers to develop sustainable / green packaging materials in order to reduce the harmful impact posed on the environment.

In recent years, plastics made from corn starch, sugarcane and cassava have emerged as a promising alternative to conventional packaging solutions. These novel and sustainable packaging raw materials are likely to eliminate the risk of environmental pollution arising from the pharmaceutical industry. Owing to the growing need for sustainable packaging materials, increasing consumer awareness, numerous advantages over conventional packaging materials and rising interest of investors in this domain, the sustainable packaging market is anticipated to experience significant market growth during the forecast period.

SUSTAINABLE PACKAGING MARKET: KEY INSIGHTS

The report delves into the current state of the sustainable packaging market and identifies potential growth opportunities within the industry. Some key findings from the report include:

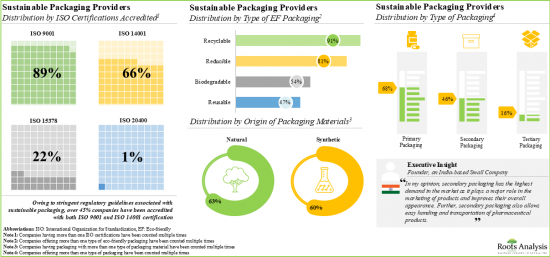

1. Presently, over 110 players are engaged in offering sustainable packaging products and / or services; around 85% of these players are headquartered in the developed markets.

2. Over 90% of sustainable packaging providers offer products and / or services related to recyclable packaging; among these, more than 60% of the providers use raw materials of natural origin for their products.

3. In pursuit of building a competitive edge, stakeholders are actively upgrading their existing capabilities and enhancing their respective sustainable packaging portfolio to comply with the evolving industry benchmarks.

4. The growing interest in this domain is evident from the rise in partnership activity; in fact, the maximum number of collaborations related to sustainable packaging in the last few years.

5. Foreseeing lucrative returns, many public and private investors have made investments worth over USD 10 billion; the funding activity is well distributed across North America and Europe.

6. Driven by the growing environmental degradation due to conventional packaging materials, the demand for sustainable packaging has steadily risen; by 2035, this demand is anticipated to cross over 110 billion units.

7. Owing to the shift in consumer preferences towards sustainable packaging, the market is poised to witness substantial growth in the next decade.

8. With the rapid increase in the waste generated due to conventional packaging materials, the opportunity for companies offering sustainable packaging is poised to grow at a CAGR of close to 7%.

SUSTAINABLE PACKAGING MARKET: KEY SEGMENTS

Biodegradable Packaging is the Fastest Growing Segment of the Sustainable Packaging Market

Based on the type of eco-friendly packaging, the market is segmented into biodegradable and recyclable / reusable. Biodegradable packaging material segment is likely to grow at a relatively higher CAGR during the forecast period. These materials have lesser deleterious effects when compared to recyclable / reusable packaging materials as they do not release harmful toxins and chemicals while their decomposition in the environment. It is worth highlighting that majority of the current sustainable packaging market is captured by recyclable / reusable packaging. This can be attributed to the high production rates, ease of availability and increased shelf life of recyclable / reusable packaging materials.

Primary Packaging Segment Occupies the Largest Share of the Sustainable Packaging Market During the Forecast Period

Based on the type of packaging, the market is segmented into primary, secondary and tertiary packaging. It is worth highlighting that primary packaging is likely to dominate the market in the coming decade. This can be attributed to the fact that primary packaging plays an essential role in ensuring the quality and hygiene of the product.

Boxes / Cartons Segment is Likely to Dominate the Sustainable Packaging Market During the Forecast Period

Based on the type of pharmaceutical secondary packaging container, the market is segmented into boxes / cartons and pouches. The sustainable packaging market for boxes / cartons is likely to grow at a higher CAGR during the forecast period. It is worth noting that boxes / cartons are suitable to transport a huge number of products with increased strength and durability.

Pharmaceutical and Biotechnology Companies Segment Accounts for the Largest Share of the Sustainable Packaging Market

Based on the end-users, the market is segmented into pharmaceutical and biotechnology companies, research institutes and other users. It is worth highlighting that the market is primarily driven by revenues generated by pharmaceutical and biotechnology companies. This can be attributed to the widespread adoption of sustainable packaging by pharmaceutical and biotechnology companies to enclose various drugs and medical devices. This trend is unlikely to change in the near future.

Asia-Pacific Accounts for the Largest Share of the Market

Based on key geographical regions, the market is segmented into North America, Europe, Asia-Pacific, Middle East and North Africa, Latin America, and the Rest of the World. Currently, Asia-Pacific holds the maximum share of the sustainable packaging market. This can be attributed to the growing consumer awareness, stringent regulations and increasing demand for sustainable packaging solutions. Additionally, the growing population and expanding customer base for pharmaceutical and healthcare products have also fueled market growth in this region. It is worth highlighting that, over the years, the market in Latin America is expected to grow at a higher CAGR.

Example Players in the Sustainable Packaging Market

- Amcor

- Berry Global

- Bormioli Pharma

- Drug Plastics

- DS SMITH

- EPL

- Gerresheimer

- Greiner Packaging

- Huhtamaki

- International Paper

- MM Board & Paper

- Mondi

- PGP GLASS

- PPC Flexible Packaging

- SGD Pharma

- Smurfit Kappa

- Stoelzle Glass

- Syntegon

- Takemoto Packaging

- Tekni-Plex

Primary Research Overview

The opinions and insights presented in this study were influenced by discussions conducted with multiple stakeholders. The research report features detailed transcripts of interviews held with the following industry stakeholders:

- Founder, Packaging Guru

- International Key Account Manager, eutecma

- Chief Executive Officer, Softbox Systems

- Head of Product Development / Technical Support Medical, Coveris

- Head of Strategic Marketing and Business Development, Korber

- Innovation Manager, Bormioli Pharma

- Anonymous, A Finland-Based Large Company

SUSTAINABLE PACKAGING MARKET: RESEARCH COVERAGE

- Market Sizing and Opportunity Analysis: The report features an in-depth analysis of the sustainable packaging market, focusing on key market segments, including [A] type of eco-friendly packaging, [B] type of packaging, [C] type of packaging container, [D] type of end users and [E] key geographical regions.

- Market Landscape: A comprehensive evaluation of sustainable packaging providers, considering various parameters, such as [A] year of establishment, [B] company size, [C] location of headquarters, [D] type of offering, [E] ISO certifications / accreditations, [F] type of packaging, [G] type of eco-friendly packaging, [H] origin of packaging material, [I] type of packaging material used and [J] packaging applications. Further, this section presents the most active players based on the number of packaging products offered.

- Company Competitiveness Analysis: A comprehensive competitive analysis of sustainable packaging providers, examining factors such as [A] company strength and [B] portfolio strength.

- Demand Analysis: Informed estimates of the annual commercial and clinical demand for sustainable packaging based on several relevant parameters, such as [A] type of packaging, [B] primary packaging containers, [C] secondary packaging containers and [D] tertiary packaging containers.

- Company Profiles: In-depth profiles of key sustainable packaging providers, focusing on [A] company overviews, [B] financial information (if available), [C] sustainable packaging offerings, [D] recent developments and [E] an informed future outlook.

- Partnerships and Collaborations: An analysis of partnerships established in this sector, since 2019, based on several parameters, such as [A] year of partnership, [B] type of partnership, [C] type of partner, [D] type of eco-friendly packaging, [E] most active players (in terms of number of partnerships) and [F] geographical distribution of partnership activity.

- Funding and Investment Analysis: A detailed evaluation of the investments made in the sustainable packaging domain, encompassing grants, private placement offerings, capital raised from IPOs, debt financing, and subsequent offerings based on several parameters, such as [A] year-wise trend of funding instances, [B] type of funding, [C] amount invested, [D] geographical analysis, [E] leading players (in terms of number of funding instances and amount raised) and [F] leading investors (in terms of number of funding instances).

- Market Impact Analysis: The report analyzes various factors such as drivers, restraints, opportunities, and challenges affecting the market growth.

KEY QUESTIONS ANSWERED IN THIS REPORT

- How many companies are currently engaged in this market?

- Which are the leading companies in this market?

- What kind of partnership models are commonly adopted by industry stakeholders?

- What is the current annual demand for sustainable packaging solutions?

- What factors are likely to influence the evolution of this market?

- What is the current and future market size?

- What is the CAGR of this market?

- How is the current and future market opportunity likely to be distributed across key market segments?

REASONS TO BUY THIS REPORT

- The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. By analyzing the competitive landscape, businesses can make informed decisions to optimize their market positioning and develop effective go-to-market strategies.

- The report offers stakeholders a comprehensive overview of the market, including key drivers, barriers, opportunities, and challenges. This information empowers stakeholders to stay abreast of market trends and make data-driven decisions to capitalize on growth prospects.

ADDITIONAL BENEFITS

- Complimentary PPT Insights Packs

- Complimentary Excel Data Packs for all Analytical Modules in the Report

- 10% Free Content Customization

- Detailed Report Walkthrough Session with Research Team

- Free Updated report if the report is 6-12 months old or older

TABLE OF CONTENTS

1. PREFACE

- 1.1. Introduction

- 1.2. Market Share Insights

- 1.3. Key Market Insights

- 1.4. Report Coverage

- 1.5. Key Questions Answered

- 1.6. Chapter Outlines

2. RESEARCH METHODOLOGY

- 2.1. Chapter Overview

- 2.2. Research Assumptions

- 2.3. Project Methodology

- 2.4. Forecast Methodology

- 2.5. Robust Quality Control

- 2.6. Key Market Segmentation

- 2.7. Key Considerations

- 2.7.1. Demographics

- 2.7.2. Economic Factors

- 2.7.3. Government Regulations

- 2.7.4. Supply Chain

- 2.7.5. COVID Impact

- 2.7.6. Market Access

- 2.7.7. Healthcare Policies

- 2.7.8. Industry Consolidation

3. ECONOMIC AND OTHER PROJECT SPECIFIC CONSIDERATIONS

- 3.1. Chapter Overview

- 3.2. Market Dynamics

- 3.2.1. Time Period

- 3.2.1.1. Historical Trends

- 3.2.1.2. Current and Future Estimates

- 3.2.2. Currency Coverage and Foreign Exchange Rate

- 3.2.2.1. Major Currencies Affecting the Market

- 3.2.2.2. Factors Affecting Currency Fluctuations and Foreign Exchange Rate

- 3.2.2.3. Impact of Foreign Exchange Rate Volatility on the Market

- 3.2.2.4. Strategies for Mitigating Foreign Exchange Risk

- 3.2.3. Trade Policies

- 3.2.3.1. Impact of Trade Barriers on the Market

- 3.2.3.2. Strategies for Mitigating the Risk Associated with Trade Barriers

- 3.2.4. Recession

- 3.2.4.1. Historical Analysis of Past Recessions and Lessons Learnt

- 3.2.4.2. Assessment of Current Economic Conditions and Potential Impact on the Market

- 3.2.5. Inflation

- 3.2.5.1. Measurement and Analysis of Inflationary Pressures in the Economy

- 3.2.5.2. Potential Impact of Inflation on the Market Evolution

- 3.2.1. Time Period

4. EXECUTIVE SUMMARY

5. INTRODUCTION

- 5.1. Chapter Overview

- 5.2. Overview of Pharmaceutical Packaging

- 5.3. Advantages of Pharmaceutical Packaging

- 5.4. Types of Pharmaceutical Packaging

- 5.5. Need for Sustainable Pharmaceutical Packaging

- 5.6. Sustainable Pharmaceutical Packaging Solutions

- 5.7. Regulatory Framework

- 5.8. Advantages of Sustainable Packaging Materials

- 5.9. Limitations of Sustainable Packaging Materials

- 5.10. Future Perspectives

6. MARKET LANDSCAPE

- 6.1. Chapter Overview

- 6.2. Sustainable Packaging Providers: Overall Market Landscape

- 6.2.1. Analysis by Year of Establishment

- 6.2.2. Analysis by Company Size

- 6.2.3. Analysis by Location of Headquarters (Region)

- 6.2.4. Analysis by Location of Headquarters (Country)

- 6.2.5. Analysis by Company Size and Location of Headquarters (Region)

- 6.2.6. Analysis by Type of Offering

- 6.2.7. Analysis by ISO Certifications / Accreditations

- 6.2.8. Analysis by Type of Packaging

- 6.2.9. Analysis by Location of Headquarters (Region) and Type of Packaging

- 6.2.10. Analysis by Type of Eco-friendly Packaging

- 6.2.11. Analysis by Location of Headquarters (Region) and Type of Eco-friendly Packaging

- 6.2.12. Analysis by Origin of Packaging Material

- 6.2.13. Analysis by Type of Packaging Material Used

- 6.2.14. Analysis by Packaging Applications

- 6.2.15. Most Active Players: Distribution by Number of Packaging Products Offered

7. DETAILED COMPANY PROFILES

- 7.1. Chapter Overview

- 7.2. Drug Plastics

- 7.2.1. Company Overview

- 7.2.2. Sustainable Packaging Offerings

- 7.2.3. Recent Developments and Future Outlook

- 7.3. DS SMITH

- 7.3.1. Company Overview

- 7.3.2. Financial Information

- 7.3.3. Sustainable Packaging Offerings

- 7.3.4. Recent Developments and Future Outlook

- 7.4. MM Board & Paper

- 7.4.1. Company Overview

- 7.4.2. Financial Information

- 7.4.3. Sustainable Packaging Offerings

- 7.4.4. Recent Developments and Future Outlook

- 7.5. Mondi

- 7.5.1. Company Overview

- 7.5.2. Financial Information

- 7.5.3. Sustainable Packaging Offerings

- 7.5.4. Recent Developments and Future Outlook

- 7.6. PGP GLASS

- 7.6.1. Company Overview

- 7.6.2. Financial Information

- 7.6.3. Sustainable Packaging Offerings

- 7.6.4. Recent Developments and Future Outlook

- 7.7. Smurfit Kappa

- 7.7.1. Company Overview

- 7.7.2. Financial Information

- 7.7.3. Sustainable Packaging Offerings

- 7.7.4. Recent Developments and Future Outlook

- 7.8. Syntegon

- 7.8.1. Company Overview

- 7.8.2. Sustainable Packaging Offerings

- 7.8.3. Recent Developments and Future Outlook

- 7.9. Berry Global

- 7.9.1. Company Overview

- 7.9.2. Financial Information

- 7.9.3. Sustainable Packaging Offerings

- 7.9.4. Recent Developments and Future Outlook

- 7.10. Huhtamaki

- 7.10.1. Company Overview

- 7.10.2. Financial Information

- 7.10.3. Sustainable Packaging Offerings

- 7.10.4. Recent Developments and Future Outlook

- 7.11. SGD Pharma

- 7.11.1. Company Overview

- 7.11.2. Sustainable Packaging Offerings

- 7.11.3. Recent Developments and Future Outlook

8. SHORT COMPANY PROFILES

- 8.1. Chapter Overview

- 8.2. Amcor

- 8.2.1. Company Overview

- 8.2.2. Sustainable Packaging Offerings

- 8.3. Bormioli Pharma

- 8.3.1. Company Overview

- 8.3.2. Sustainable Packaging Offerings

- 8.4. EPL

- 8.4.1. Company Overview

- 8.4.2. Sustainable Packaging Offerings

- 8.5. Gerresheimer

- 8.5.1. Company Overview

- 8.5.2. Sustainable Packaging Offerings

- 8.6. Greiner Packaging

- 8.6.1. Company Overview

- 8.6.2. Sustainable Packaging Offerings

- 8.7. International Paper

- 8.7.1. Company Overview

- 8.7.2. Sustainable Packaging Offerings

- 8.8. PPC Flexible Packaging

- 8.8.1. Company Overview

- 8.8.2. Sustainable Packaging Offerings

- 8.9. Stoelzle Glass

- 8.9.1. Company Overview

- 8.9.2. Sustainable Packaging Offerings

- 8.10. Takemoto Packaging

- 8.10.1. Company Overview

- 8.10.2. Sustainable Packaging Offerings

- 8.11. Tekni-Plex

- 8.11.1. Company Overview

- 8.11.2. Sustainable Packaging Offerings

9. COMPANY COMPETITIVENESS ANALYSIS

- 9.1. Chapter Overview

- 9.2. Assumptions and Key Parameters

- 9.3. Methodology

- 9.4. Sustainable Packaging Providers: Company Competitiveness Analysis

- 9.4.1. Sustainable Packaging Providers Based in North America

- 9.4.2. Sustainable Packaging Providers Based in Europe

- 9.4.3. Sustainable Packaging Providers Based in Asia-Pacific

10. PARTNERSHIPS AND COLLABORATIONS

- 10.1. Chapter Overview

- 10.2. Partnership Models

- 10.3. Sustainable Packaging Providers: Partnerships and Collaborations

- 10.3.1. Analysis by Year of Partnership

- 10.3.2. Analysis by Type of Partnership

- 10.3.3. Analysis by Year and Type of Partnership

- 10.3.4. Analysis by Type of Partner

- 10.3.5. Analysis by Type of Eco-friendly Packaging

- 10.3.6. Most Active Players: Analysis by Number of Partnerships

- 10.3.7. Analysis by Geography

- 10.3.7.1. Local and International Agreements

- 10.3.7.2. Intracontinental and Intercontinental Agreements

11. FUNDING AND INVESTMENTS

- 11.1. Chapter Overview

- 11.2. Funding Models

- 11.3. Sustainable Packaging Providers: Funding and Investments

- 11.3.1. Analysis by Year of Funding

- 11.3.2. Analysis by Type of Funding

- 11.3.3. Analysis by Year and Type of Funding

- 11.3.4. Analysis by Amount Invested

- 11.3.5. Analysis by Type of Funding and Amount Invested

- 11.3.6. Analysis by Geography

- 11.3.7. Most Active Players: Analysis by Number of Funding Instances

- 11.3.8. Most Active Players: Analysis by Amount Raised

- 11.3.9. Leading Investors: Analysis by Number of Funding Instances

- 11.4. Concluding Remarks

12. MARKET IMPACT ANALYSIS: DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES

- 12.1. Chapter Overview

- 12.2. Market Drivers

- 12.3. Market Restraints

- 12.4. Market Opportunities

- 12.5. Market Challenges

- 12.6. Conclusion

13. DEMAND ANALYSIS

- 13.1. Chapter Overview

- 13.2. Key Assumptions and Methodology

- 13.3. Global Demand for Sustainable Packaging in Healthcare Industry, till 2035

- 13.3.1. Analysis by Type of Packaging

- 13.3.2. Analysis by Packaging Containers

- 13.3.2.1. Analysis by Primary Packaging Containers

- 13.3.2.2. Analysis by Secondary Packaging Containers

- 13.3.2.3. Analysis by Tertiary Packaging Containers

14. GLOBAL SUSTAINABLE PACKAGING MARKET

- 14.1. Chapter Overview

- 14.2. Key Assumptions and Methodology

- 14.3. Global Sustainable Packaging Market, till 2035

- 14.3.1. Scenario Analysis

- 14.3.1.1. Conservative Scenario

- 14.3.1.2. Optimistic Scenario

- 14.3.1. Scenario Analysis

- 14.4. Key Market Segmentations

15. SUSTAINABLE PACKAGING MARKET, BY TYPE OF ECO-FRIENDLY PACKAGING

- 15.1. Chapter Overview

- 15.2. Key Assumptions and Methodology

- 15.3. Sustainable Packaging Market: Distribution by Eco-friendly Packaging, 2024, 2028 and 2035

- 15.3.1. Sustainable Packaging Market for Biodegradable Packaging, till 2035

- 15.3.2. Sustainable Packaging Market for Recyclable / Reusable Packaging, till 2035

- 15.4. Data Triangulation and Validation

16. SUSTAINABLE PACKAGING MARKET, BY TYPE OF PACKAGING

- 16.1. Chapter Overview

- 16.2. Key Assumptions and Methodology

- 16.3. Sustainable Packaging Market: Distribution by Type of Packaging, 2024, 2028 and 2035

- 16.3.1. Sustainable Packaging Market for Primary Packaging, till 2035

- 16.3.2. Sustainable Packaging Market for Secondary Packaging, till 2035

- 16.3.3. Sustainable Packaging Market for Tertiary Packaging, till 2035

- 16.4. Data Triangulation and Validation

17. SUSTAINABLE PACKAGING MARKET, BY TYPE OF PACKAGING CONTAINER

- 17.1. Chapter Overview

- 17.2. Key Assumptions and Methodology

- 17.3. Sustainable Packaging Market for Primary Packaging Containers

- 17.3.1. Sustainable Packaging Market: Distribution by Primary Packaging Containers, 2024, 2028 and 2035

- 17.3.1.1. Sustainable Packaging Market for Ampoules, till 2035

- 17.3.1.2. Sustainable Packaging Market for Bottles, till 2035

- 17.3.1.3. Sustainable Packaging Market for Cartridges, till 2035

- 17.3.1.4. Sustainable Packaging Market for Syringes, till 2035

- 17.3.1.5. Sustainable Packaging Market for Vials, till 2035

- 17.3.1. Sustainable Packaging Market: Distribution by Primary Packaging Containers, 2024, 2028 and 2035

- 17.4. Sustainable Packaging Market for Secondary Packaging Containers

- 17.4.1. Sustainable Packaging Market: Distribution by Secondary Packaging Containers, 2024, 2028 and 2035

- 17.4.1.1. Sustainable Packaging Market for Boxes / Cartons, till 2035

- 17.4.1.2. Sustainable Packaging Market for Pouches, till 2035

- 17.4.1. Sustainable Packaging Market: Distribution by Secondary Packaging Containers, 2024, 2028 and 2035

- 17.5. Sustainable Packaging Market for Tertiary Packaging Containers

- 17.5.1. Sustainable Packaging Market: Distribution by Tertiary Packaging Containers, 2024, 2028 and 2035

- 17.5.1.1. Sustainable Packaging Market for Boxes, till 2035

- 17.5.1.2. Sustainable Packaging Market for Shippers, till 2035

- 17.5.1. Sustainable Packaging Market: Distribution by Tertiary Packaging Containers, 2024, 2028 and 2035

- 17.6. Data Triangulation and Validation

18. SUSTAINABLE PACKAGING MARKET, BY TYPE OF END-USERS

- 18.1. Chapter Overview

- 18.2. Key Assumptions and Methodology

- 18.3. Sustainable Packaging Market: Distribution by End-users, 2024, 2028 and 2035

- 18.3.1. Sustainable Packaging Market for Pharmaceutical and Biotechnology Companies, till 2035

- 18.3.2. Sustainable Packaging Market for Research Institutes, till 2035

- 18.3.3. Sustainable Packaging Market for Other Users, till 2035

- 18.4. Data Triangulation and Validation

19. SUSTAINABLE PACKAGING MARKET, BY KEY GEOGRAPHICAL REGIONS

- 19.1. Chapter Overview

- 19.2. Key Assumptions and Methodology

- 19.3. Sustainable Packaging Market: Distribution by Key Geographical Regions, 2024, 2028 and 2035

- 19.3.1. Sustainable Packaging Market in North America, till 2035

- 19.3.2. Sustainable Packaging Market in Europe, till 2035

- 19.3.3. Sustainable Packaging Market in Asia-Pacific, till 2035

- 19.3.4. Sustainable Packaging Market in Middle East and North Africa, till 2035

- 19.3.5. Sustainable Packaging Market in Latin America, till 2035

- 19.3.6. Sustainable Packaging Market in Rest of the World, till 2035

- 19.4. Data Triangulation and Validation

20. CONCLUSION

21. EXECUTIVE INSIGHTS

- 21.1. Chapter Overview

- 21.2. Packaging Guru

- 21.2.1. Company Snapshot

- 21.2.2. Interview Transcript

- 21.3. eutecma

- 21.3.1. Company Snapshot

- 21.3.2. Interview Transcript

- 21.4. Softbox Systems

- 21.4.1. Company Snapshot

- 21.4.2. Interview Transcript

- 21.5. Coveris

- 21.5.1. Company Snapshot

- 21.5.2. Interview Transcript

- 21.6. Korber

- 21.6.1. Company Snapshot

- 21.6.2. Interview Transcript

- 21.7. Bormioli Pharma

- 21.7.1. Company Snapshot

- 21.7.2. Interview Transcript

- 21.8. Anonymous

- 21.8.1. Company Snapshot

- 21.8.2. Interview Transcript

22. APPENDIX 1: TABULATED DATA

23. APPENDIX 2: LIST OF COMPANIES AND ORGANIZATIONS

List of Tables

- Table 6.1 Sustainable Packaging Providers: Information on Year of Establishment, Company Size and Location of Headquarters

- Table 6.2 Sustainable Packaging Providers: Information on Type of Offering and ISO Certifications / Accreditations

- Table 6.3 Sustainable Packaging Providers: Information on Type of Packaging

- Table 6.4 Sustainable Packaging Providers: Information on Type of Eco-friendly Packaging and Technology Used

- Table 6.5 Sustainable Packaging Providers: Information on Origin of Packaging Material and Type of Packaging Material Used

- Table 6.6 Sustainable Packaging Providers: Information on Dosage Form

- Table 6.7 Sustainable Packaging Providers: Information on Packaging Applications

- Table 7.1 List of Companies: Detailed Profiles

- Table 7.2 Drug Plastics: Company Overview

- Table 7.3 Drug Plastics: Sustainable Packaging Offerings

- Table 7.4 DS Smith: Company Overview

- Table 7.5 DS Smith: Sustainable Packaging Offerings

- Table 7.6 MM Board & Paper: Company Overview

- Table 7.7 MM Board & Paper: Sustainable Packaging Offerings

- Table 7.8 Mondi: Company Overview

- Table 7.9 Mondi: Sustainable Packaging Offerings

- Table 7.10 Mondi: Recent Developments and Future Outlook

- Table 7.11 PGP Glass: Company Overview

- Table 7.12 PGP Glass: Sustainable Packaging Offerings

- Table 7.13 Smurfit Kappa: Company Overview

- Table 7.14 Smurfit Kappa: Sustainable Packaging Offerings

- Table 7.15 Smurfit Kappa: Recent Developments and Future Outlook

- Table 7.16 Syntegon: Company Overview

- Table 7.17 Syntegon: Sustainable Packaging Offerings

- Table 7.18 Syntegon: Recent Developments and Future Outlook

- Table 7.19 List of Other Companies Profiled

- Table 7.20 Berry Global: Company Overview

- Table 7.21 Berry Global: Sustainable Packaging Offerings

- Table 7.22 Berry Global: Recent Developments and Future Outlook

- Table 7.23 Huhtamaki: Company Overview

- Table 7.24 Huhtamaki: Sustainable Packaging Offerings

- Table 7.25 SGD Pharma: Company Overview

- Table 7.26 SGD Pharma: Sustainable Packaging Offerings

- Table 7.27 SGD Pharma: Recent Developments and Future Outlook

- Table 8.1 List of Companies: Short Profiles

- Table 8.2 Amcor: Company Overview

- Table 8.3 Amcor: Sustainable Packaging Offerings

- Table 8.4 Bormioli Pharma: Company Overview

- Table 8.5 Bormioli Pharma: Sustainable Packaging Offerings

- Table 8.6 EPL: Company Overview

- Table 8.7 EPL: Sustainable Packaging Offerings

- Table 8.8 Gerresheimer: Company Overview

- Table 8.9 Gerresheimer: Sustainable Packaging Offerings

- Table 8.10 Greiner Packaging: Company Overview

- Table 8.11 Greiner Packaging: Sustainable Packaging Offerings

- Table 8.12 International Paper: Company Overview

- Table 8.13 International Paper: Sustainable Packaging Offerings

- Table 8.14 PPC Flexible Packaging: Company Overview

- Table 8.15 PPC Flexible Packaging: Sustainable Packaging Offerings

- Table 8.16 Stoelzle Glass: Company Overview

- Table 8.17 Stoelzle Glass: Sustainable Packaging Offerings

- Table 8.18 Takemoto Packaging: Company Overview

- Table 8.19 Takemoto Packaging: Sustainable Packaging Offerings

- Table 8.20 Tekni-Plex: Company Overview

- Table 8.21 Tekni-Plex: Sustainable Packaging Offerings

- Table 10.1 Sustainable Packaging Providers: List of Partnerships and Collaborations, since 2019

- Table 10.2 Partnerships and Collaborations: Information on Location of Headquarters (Country and Region) and Type of Agreement (Country and Region)

- Table 11.1 Sustainable Packaging Market: List of Funding and Investments, since 2019

- Table 21.1 Packaging Guru: Company Snapshot

- Table 21.2 eutecma: Company Snapshot

- Table 21.3 Softbox Systems: Company Snapshot

- Table 21.4 Coveris: Company Snapshot

- Table 21.5 Korber: Company Snapshot

- Table 21.6 Bormioli Pharma: Company Snapshot

- Table 22.1 Sustainable Packaging Providers: Distribution by Year of Establishment

- Table 22.2 Sustainable Packaging Providers: Distribution by Company Size

- Table 22.3 Sustainable Packaging Providers: Distribution by Location of Headquarters (Region)

- Table 22.4 Sustainable Packaging Providers: Distribution by Location of Headquarters (Country)

- Table 22.5 Sustainable Packaging Providers: Distribution by Company Size and Location of Headquarters (Region)

- Table 22.6 Sustainable Packaging Providers: Distribution by Type of Offering

- Table 22.7 Sustainable Packaging Providers: Distribution by ISO Certifications / Accreditations

- Table 22.8 Sustainable Packaging Providers: Distribution by Type of Packaging

- Table 22.9 Sustainable Packaging Providers: Distribution by Location of Headquarters (Region) and Type of Packaging

- Table 22.10 Sustainable Packaging Providers: Distribution by Type of Eco-friendly Packaging

- Table 22.11 Sustainable Packaging Providers: Distribution by Location of Headquarters (Region) and Type of Eco-friendly Packaging

- Table 22.12 Sustainable Packaging Providers: Distribution by Origin of Packaging Material

- Table 22.13 Sustainable Packaging Providers: Distribution by Type of Packaging Material Used

- Table 22.14 Sustainable Packaging Providers: Distribution by Packaging Applications

- Table 22.15 Most Active Players: Distribution by Number of Packaging Products Offered

- Table 22.16 DS Smith: Annual Revenues, FY 2019 Onwards (GBP Million)

- Table 22.17 MM Board & Paper: Annual Revenues, FY 2019 Onwards (EUR Million)

- Table 22.18 Mondi: Annual Revenues, FY 2019 Onwards (EUR Million)

- Table 22.19 PGP Glass: Annual Revenues, FY 2022 Onwards (INR Billion)

- Table 22.20 Smurfit Kappa: Annual Revenues, FY 2019 Onwards (EUR Million)

- Table 22.21 Berry Global: Annual Revenues, FY 2019 Onwards (USD Million)

- Table 22.22 Huhtamaki: Annual Revenues, FY 2019 Onwards (EUR Million)

- Table 22.23 Partnerships and Collaborations: Cumulative Year-wise Trend, since 2019

- Table 22.24 Partnerships and Collaborations: Distribution by Type of Partnership

- Table 22.25 Partnerships and Collaborations: Distribution by Year and Type of Partnership, since 2019

- Table 22.26 Partnerships and Collaborations: Distribution by Type of Partner

- Table 22.27 Partnerships and Collaborations: Distribution by Type of Eco-friendly Packaging

- Table 22.28 Most Active Players: Distribution by Number of Partnerships

- Table 22.29 Partnership and Collaborations: Local and International Agreements

- Table 22.30 Partnerships and Collaborations: Intracontinental and Intercontinental Agreements

- Table 22.31 Funding and Investments: Cumulative Year-wise Trend, since 2019

- Table 22.32 Funding and Investments: Distribution of Instances by Type of Funding

- Table 22.33 Funding and Investments: Distribution by Year and Type of Funding, since 2019

- Table 22.34 Funding and Investments: Distribution by Amount Invested, since 2020 (USD Million)

- Table 22.35 Funding and Investments: Distribution of Type of Funding and Amount Invested (USD Million)

- Table 22.36 Funding and Investments: Distribution by Geography (Region)

- Table 22.37 Most Active Players: Distribution by Number of Funding Instances

- Table 22.38 Most Active Players: Distribution by Amount Raised (USD Million)

- Table 22.39 Leading Investors: Distribution by Number of Funding Instances

- Table 22.40 Funding and Investments Summary, since 2019 (USD Million)

- Table 22.41 Global Demand for Sustainable Packaging, till 2035 (Billion Units)

- Table 22.42 Global Demand for Sustainable Packaging: Distribution by Type of Packaging, till 2035 (Billion Units)

- Table 22.43 Global Sustainable Packaging Demand for Primary Packaging Containers, till 2035 (Billion Units)

- Table 22.44 Global Sustainable Packaging Demand for Secondary Packaging Containers, till 2035 (Billion Units)

- Table 22.45 Global Sustainable Packaging Demand for Tertiary Packaging Containers, till 2035 (Billion Units)

- Table 22.46 Global Sustainable Packaging Market, till 2035 (USD Billion)

- Table 22.47 Global Sustainable Packaging Market, Forecasted Estimates (till 2035): Conservative Scenario (USD Billion)

- Table 22.48 Global Sustainable Packaging Market, Forecasted Estimates (till 2035): Optimistic Scenario (USD Billion)

- Table 22.49 Sustainable Packaging Market: Distribution by Type of Eco-friendly Packaging, 2024, 2028 and 2035

- Table 22.50 Sustainable Packaging Market for Biodegradable Packaging, till 2035 (USD Billion)

- Table 22.51 Sustainable Packaging Market for Recyclable / Reusable Packaging, till 2035, Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 22.52 Sustainable Packaging Market: Distribution by Type of Packaging, 2024, 2028 and 2035

- Table 22.53 Sustainable Packaging Market for Primary Packaging, till 2035, Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 22.54 Sustainable Packaging Market for Secondary Packaging, till 2035, Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 22.55 Sustainable Packaging Market for Tertiary Packaging, till 2035, Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 22.56 Sustainable Packaging Market: Distribution by Type of Primary Packaging Container, 2024, 2028 and 2035

- Table 22.57 Primary Sustainable Packaging Market for Vials, till 2035, Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 22.58 Primary Sustainable Packaging Market for Ampoules, till 2035, Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 22.59 Primary Sustainable Packaging Market for Bottles, till 2035, Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 22.60 Primary Sustainable Packaging Market for Cartridges, till 2035, Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 22.61 Primary Sustainable Packaging Market for Syringes, till 2035, Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 22.62 Sustainable Packaging Market: Distribution by Type of Secondary Packaging Container, 2024, 2028 and 2035

- Table 22.63 Secondary Sustainable Packaging Market for Boxes / Cartons, till 2035, Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 22.64 Secondary Sustainable Packaging Market for Pouches, till 2035, Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 22.65 Sustainable Packaging Market: Distribution by Type of Tertiary Packaging Container, 2024, 2028 and 2035

- Table 22.66 Tertiary Sustainable Packaging Market for Boxes, till 2035, Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 22.67 Tertiary Sustainable Packaging Market for Cartons, till 2035, Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 22.68 Tertiary Sustainable Packaging Market for Shippers, till 2035, Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 22.69 Sustainable Packaging Market: Distribution by End-user, 2024, 2028 and 2035

- Table 22.70 Sustainable Packaging Market for Pharmaceutical and Biotechnology Companies, till 2035, Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 22.71 Sustainable Packaging Market for Research Institutes, till 2035, Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 22.72 Sustainable Packaging Market for Other End-users, till 2035, Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 22.73 Sustainable Packaging Market: Distribution by Key Geographical Regions, 2024, 2028 and 2035

- Table 22.74 Sustainable Packaging Market in North America, till 2035, Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 22.75 Sustainable Packaging Market in Europe, till 2035, Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 22.76 Sustainable Packaging Market in Asia-Pacific, till 2035, Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 22.77 Sustainable Packaging Market in Middle East and North Africa, till 2035, Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 22.78 Sustainable Packaging Market in Latin America, till 2035, Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 22.79 Sustainable Packaging Market in Rest of the World, till 2035, Conservative, Base and Optimistic Scenarios (USD Billion)

List of Figures

- Figure 2.1 Research Methodology: Project Methodology

- Figure 2.2 Research Methodology: Forecast Methodology

- Figure 2.3 Research Methodology: Robust Quality Control

- Figure 2.4 Research Methodology: Key Market Segmentation

- Figure 3.1 Lessons Learnt from Past Recessions

- Figure 4.1 Executive Summary: Market Landscape

- Figure 4.2 Executive Summary: Partnerships and Collaborations

- Figure 4.3 Executive Summary: Funding and Investments

- Figure 4.4 Executive Summary: Demand Analysis

- Figure 4.5 Executive Summary: Market Forecast and Opportunity Analysis

- Figure 5.1 Steps Involved in Pharmaceutical Aseptic Packaging

- Figure 5.2 Advantages of Pharmaceutical Packaging

- Figure 5.3 Types of Pharmaceutical Packaging

- Figure 5.4 Drawbacks of Conventional Pharmaceutical Packaging Materials

- Figure 5.5 Raw Materials for Packaging

- Figure 5.6 ISO Standards for Pharmaceutical Packaging

- Figure 5.7 Advantages of Sustainable Packaging Materials

- Figure 5.8 Limitations of Sustainable Packaging Materials

- Figure 6.1 Sustainable Packaging Providers: Distribution by Year of Establishment

- Figure 6.2 Sustainable Packaging Providers: Distribution by Company Size

- Figure 6.3 Sustainable Packaging Providers: Distribution by Location of Headquarters (Region)

- Figure 6.4 Sustainable Packaging Providers: Distribution by Location of Headquarters (Country)

- Figure 6.5 Sustainable Packaging Providers: Distribution by Company Size and Location of Headquarters (Region)

- Figure 6.6 Sustainable Packaging Providers: Distribution by Type of Offering

- Figure 6.7 Sustainable Packaging Providers: Distribution by ISO Certifications / Accreditations

- Figure 6.8 Sustainable Packaging Providers: Distribution by Type of Packaging

- Figure 6.9 Sustainable Packaging Providers: Distribution by Location of Headquarters (Region) and Type of Packaging

- Figure 6.10 Sustainable Packaging Providers: Distribution by

Type of Eco-friendly Packaging

- Figure 6.11 Sustainable Packaging Providers: Distribution by Location of Headquarters (Region) and Type of Eco-friendly Packaging

- Figure 6.12 Sustainable Packaging Providers: Distribution by Origin of Packaging Material

- Figure 6.13 Sustainable Packaging Providers: Distribution by Type of Packaging Material Used

- Figure 6.14 Sustainable Packaging Providers: Distribution by Packaging Applications

- Figure 6.15 Most Active Players: Distribution by Number of Packaging Products Offered

- Figure 7.1 DS Smith: Annual Revenues, FY 2019 Onwards (GBP Million)

- Figure 7.2 MM Board & Paper: Annual Revenues, FY 2019 Onwards (EUR Million)

- Figure 7.3 Mondi: Annual Revenues, FY 2019 Onwards (EUR Million)

- Figure 7.4 PGP Glass: Annual Revenues, FY 2022 Onwards (INR Billion)

- Figure 7.5 Smurfit Kappa: Annual Revenues, FY 2019 Onwards (EUR Million)

- Figure 7.6 Berry Global: Annual Revenues, FY 2019 Onwards (USD Million)

- Figure 7.7 Huhtamaki: Annual Revenues, FY 2019 Onwards (EUR Million)

- Figure 9.1 Company Competitiveness Analysis: Companies Based in North America (Peer Group I)

- Figure 9.2 Company Competitiveness Analysis: Companies Based in Europe (Peer Group IIa)

- Figure 9.3 Company Competitiveness Analysis: Companies Based in Europe (Peer Group IIb)

- Figure 9.4 Company Competitiveness Analysis: Companies Based in Asia-Pacific (Peer Group III)

- Figure 10.1 Partnerships and Collaborations: Cumulative Year-wise Trend, since 2019

- Figure 10.2 Partnerships and Collaborations: Distribution by Type of Partnership

- Figure 10.3 Partnerships and Collaborations: Distribution by Year and Type of Partnership, since 2019

- Figure 10.4 Partnerships and Collaborations: Distribution by Type of Partner

- Figure 10.5 Partnerships and Collaborations: Distribution by Type of Eco-friendly Packaging

- Figure 10.6 Most Active Players: Distribution by Number of Partnerships

- Figure 10.7 Partnership and Collaborations: Local and International Agreements

- Figure 10.8 Partnerships and Collaborations: Intracontinental and Intercontinental Agreements

- Figure 11.1 Funding and Investments: Cumulative Year-wise Trend, since 2019

- Figure 11.2 Funding and Investments: Distribution of Instances by Type of Funding

- Figure 11.3 Funding and Investments: Distribution by Year and Type of Funding, since 2019

- Figure 11.4 Funding and Investments: Distribution by Amount Invested, since 2020 (USD Million)

- Figure 11.5 Funding and Investments: Distribution of Type of Funding and Amount Invested (USD Million)

- Figure 11.6 Funding and Investments: Distribution by Geography (Region)

- Figure 11.7 Most Active Players: Distribution by Number of Funding Instances

- Figure 11.8 Most Active Players: Distribution by Amount Raised (USD Million)

- Figure 11.9 Leading Investors: Distribution by Number of Funding Instances

- Figure 11.10 Funding and Investment Summary, since 2019 (USD Million)

- Figure 12.1 Sustainable Packaging; Market Drivers

- Figure 12.2 Sustainable Packaging; Market Restraints

- Figure 12.3 Sustainable Packaging; Market Opportunities

- Figure 12.4 Sustainable Packaging; Market Challenges

- Figure 13.1 Global Demand for Sustainable Packaging, till 2035 (Billion Units)

- Figure 13.2 Global Demand for Sustainable Packaging: Distribution by Type of Packaging, till 2035 (Billion Units)

- Figure 13.3 Global Sustainable Packaging Demand for Primary Packaging Containers, till 2035 (Billion Units)

- Figure 13.4 Global Sustainable Packaging Demand for Secondary Packaging Containers, till 2035 (Billion Units)

- Figure 13.5 Global Sustainable Packaging Demand for Tertiary Packaging Containers, till 2035 (Billion Units)

- Figure 14.1 Global Sustainable Packaging Market, till 2035 (USD Billion)

- Figure 14.2 Global Sustainable Packaging Market, Forecasted Estimates (till 2035): Conservative Scenario (USD Billion)

- Figure 14.3 Global Sustainable Packaging Market, Forecasted Estimates (till 2035): Optimistic Scenario (USD Billion)

- Figure 15.1 Sustainable Packaging Market: Distribution by Type of Eco-friendly Packaging, 2024, 2028 and 2035

- Figure 15.2 Sustainable Packaging Market for Biodegradable Packaging, till 2035 (USD Billion)

- Figure 15.3 Sustainable Packaging Market for Recyclable / Reusable Packaging, till 2035 (USD Billion)

- Figure 16.1 Sustainable Packaging Market: Distribution by Type of Packaging, 2024, 2028 and 2035

- Figure 16.2 Sustainable Packaging Market for Primary Packaging, till 2035 (USD Billion)

- Figure 16.3 Sustainable Packaging Market for Secondary Packaging, till 2035 (USD Billion)

- Figure 16.4 Sustainable Packaging Market for Tertiary Packaging, till 2035 (USD Billion)

- Figure 17.1 Sustainable Packaging Market: Distribution by Type of Primary Packaging Containers, 2024, 2028 and 2035

- Figure 17.2 Primary Sustainable Packaging Market for Ampoules, till 2035 (USD Billion)

- Figure 17.3 Primary Sustainable Packaging Market for Bottles, till 2035 (USD Billion)

- Figure 17.4 Primary Sustainable Packaging Market for Cartridges, till 2035 (USD Billion)

- Figure 17.5 Primary Sustainable Packaging Market for Syringes, till 2035 (USD Billion)

- Figure 17.6 Primary Sustainable Packaging Market for Vials, till 2035 (USD Billion)

- Figure 17.7 Sustainable Packaging Market: Distribution by Type of Secondary Packaging Containers, 2024, 2028 and 2035

- Figure 17.8 Secondary Sustainable Packaging Market for Boxes / Cartons, till 2035 (USD Billion)

- Figure 17.9 Secondary Sustainable Packaging Market for Pouches, till 2035 (USD Billion)

- Figure 17.10 Sustainable Packaging Market: Distribution by Type of Tertiary Packaging Containers, 2024, 2028 and 2035 (USD Billion)

- Figure 17.11 Tertiary Sustainable Packaging Market for Boxes, till 2035 (USD Billion)

- Figure 17.12 Tertiary Sustainable Packaging Market for Cartons, till 2035 (USD Billion)

- Figure 17.13 Tertiary Sustainable Packaging Market for Shippers, till 2035 (USD Billion)

- Figure 18.1 Sustainable Packaging Market: Distribution by End-user, 2024, 2028 and 2035

- Figure 18.2 Sustainable Packaging Market for Pharmaceutical and Biotechnology Companies, till 2035 (USD Billion)

- Figure 18.3 Sustainable Packaging Market for Research Institutes, till 2035 (USD Billion)

- Figure 18.4 Sustainable Packaging Market for Other End-users, till 2035 (USD Billion)

- Figure 19.1 Sustainable Packaging Market: Distribution by Key Geographical Regions, 2024, 2028 and 2035

- Figure 19.2 Sustainable Packaging Market in North America, till 2035 (USD Billion)

- Figure 19.3 Sustainable Packaging Market in Europe, till 2035 (USD Billion)

- Figure 19.4 Sustainable Packaging Market in Asia-Pacific, till 2035 (USD Billion)

- Figure 19.5 Sustainable Packaging Market in Middle East and North Africa, till 2035 (USD Billion)

- Figure 19.6 Sustainable Packaging Market in Latin America, till 2035 (USD Billion)

- Figure 19.7 Sustainable Packaging Market in Rest of the World, till 2035 (USD Billion)

- Figure 20.1 Conclusion: Market Landscape

- Figure 20.2 Conclusion: Partnerships and Collaborations

- Figure 20.3 Conclusion: Funding and Investments

- Figure 20.4 Conclusion: Demand Analysis

- Figure 20.5 Conclusion: Market Forecast and Opportunity Analysis