PUBLISHER: Roots Analysis | PRODUCT CODE: 1616876

PUBLISHER: Roots Analysis | PRODUCT CODE: 1616876

DNA Encoded Library Market by Application Area, Therapeutic Area, End-users, Type of Payment Model Employed and Key Geographical Regions : Industry Trends and Global Forecasts, Till 2035

DNA ENCODED LIBRARY MARKET: OVERVIEW

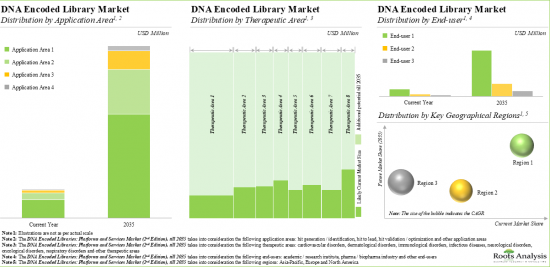

As per Roots Analysis, the global DNA encoded library market is estimated to grow from USD 0.8 billion in the current year to USD 5 billion by 2035, at a CAGR of 16.04% during the forecast period, till 2035.

The market sizing and opportunity analysis has been segmented across the following parameters:

Application Area

- Hit Generation / Identification

- Hit to Lead

- Hit Validation / Optimization

- Other Application Areas

Therapeutic Area

- Oncological Disorders

- Immunological Disorders

- Neurological Disorders

- Respiratory Disorders

- Dermatological Disorders

- Cardiovascular Disorders

- Infectious Diseases

- Other Therapeutic Areas

End-users

- Pharma / Biopharma Industry

- Academic / Research Institute

- Other End-users

Type of Payment Model Employed

- Upfront Payment

- Milestone Payment

Key Geographical Regions

- North America (US)

- Europe (UK, Germany, Denmark, France, Switzerland and Rest of the Europe)

- Asia-Pacific (China)

DNA ENCODED LIBRARY MARKET: GROWTH AND TRENDS

Drug discovery and development is a complex and tedious process requiring a significant amount of time and resources. In fact, on average, the entire drug development process, from the demonstration of proof-of -concept to commercial launch, takes around 10-15 years and requires huge capital investments (USD 4-10 billion). In addition, technological advancements in key disciplines, such as molecular biology and the emergence of new-generation biologics, has made the process even more complicated.

In order to optimize resources and efforts, drug developers are gradually shifting their focus towards the use of novel discovery techniques, which include screening combinatorial chemistry based large collections of compounds. In the recent past, DNA-encoded library technology has captured the attention of drug developers among all the screening techniques. This can be primarily attributed to its various advantages, including rapid and effective screening of a large number of compounds, low investment and less requirement of storage space, and streamlined drug discovery process. Moreover, the growing demand for advanced therapies to treat complex diseases, such as neurological disorders and oncological disorders, has resulted in a significant rise in the development of DNA-encoded libraries. Additionally, the rising adoption of DNA encoded chemical library by pharmaceutical and biotechnology companies, academic institutions and contract research organizations has further propelled the market growth of this industry.

DNA ENCODED LIBRARY MARKET: KEY INSIGHTS

The report delves into the current state of the DNA encoded library market and identifies potential growth opportunities within the industry. Some key findings from the report include:

1. Presently, around 50 companies claim to offer DNA encoded libraries and affiliated services for drug discovery across different regions of the world.

2. Leveraging their expertise, stakeholders are offering DNA encoded libraries for a myriad of drug discovery services; around 70% of the companies provide different types of library screening services.

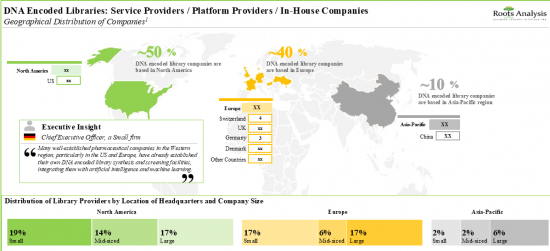

3. Majority of the companies engaged in this field of research are based in developed geographies; the market landscape is fragmented, featuring the presence of both small firms and established players.

4. Stakeholders have adopted various business models to maximize the gain from DNA encoded libraries; a significant number of in-house players have started out-licensing their DNA encoded library platforms.

5. In pursuit of building a competitive edge, companies are actively upgrading their existing capabilities to enhance their respective service offerings and comply with the evolving industry benchmarks.

6. The growing interest is evident from the rise in partnership activity; in fact, the maximum number of collaborations related to DNA encoded libraries were inked in the past few years.

7. Several investors, having realized the opportunity within this domain, have invested over USD 4 billion across various funding rounds in the past six years.

8. More than 400 patents have been filed / granted by various stakeholders in order to protect the intellectual property generated within this field.

9. Big pharma players have undertaken several initiatives, ranging from proprietary library development to strategic investments, to tap the lucrative opportunity in this rapidly growing market.

10. With an aim to provide support to DNA encoded library focused companies / organizations, several stakeholders offer ancillary tools such as building blocks, scaffolds as well screening assistance services.

11. In the short term, the opportunity is likely to be driven by licensing activity; this activity is likely to increase as the industry realizes the capability of DNA encoded libraries to discover high-value therapeutic leads.

12. The market is expected to grow at an annualized rate of 16% till 2035; the projected opportunity is anticipated to be well distributed across various market segments.

DNA ENCODED LIBRARY MARKET: KEY SEGMENTS

Currently, Hit Generation / Identification Occupies the Largest Share of the DNA Encoded Library Platforms and Services Market

Based on the application area, the global DNA encoded library platforms and services market is segmented into hit generation / identification, hit to lead, hit validation / optimization and other application areas. At present, hit generation / identification holds the maximum share within the DNA encoded library platforms and services market. It is worth highlighting that DNA encoded library platforms and services market for hit to lead is likely to grow at a relatively higher CAGR, during the forecast period.

Oncological Disorders Segment is Likely to Dominate the DNA Encoded Library Platforms and Services Market During the Forecast Period

Based on the therapeutic area, the global DNA encoded library platforms and services market is segmented into oncological disorders, immunological disorders, neurological disorders, respiratory disorders, dermatological disorders, cardiovascular diseases, infectious diseases and other therapeutic areas. It is worth highlighting that the oncological disorders segment is likely to dominate the market in the coming decade.

Pharma / Biopharma Industry is Likely to Capture the Largest Share of the DNA Encoded Library Platforms and Services Market During the Forecast Period

Based on the end users, the global DNA encoded library platforms and services market is segmented into pharma / biopharma industry, academic / research institute and other users. At present, pharma / biopharma industry holds maximum share within the DNA encoded library platforms and services market. This trend is likely to remain the same in the coming decade.

North America Accounts for the Largest Share of the Market

Based on key geographical regions, the market is segmented into North America, Europe and Asia-Pacific. Majority share is expected to be captured by service providers based in North America. It is worth highlighting that over the years, the market for Asia-Pacific is expected to grow at a higher CAGR.

Example Players in the DNA Encoded Library Market

- BOC Sciences

- DyNAbind

- Edelris

- GenScript

- HitGen

- NovAliX

- PROVendis

- SpiroChem

- Vipergen

- WuXi AppTec

- X-Chem

Primary Research Overview

The opinions and insights presented in this study were influenced by discussions conducted with multiple stakeholders. The research report features detailed transcripts of interviews held with the following industry stakeholders:

- Chief Executive Officer, Vipergen

- Chief Executive Officer, Serengen

- Co-Founder and Ofelia Utset, President, Deluge Biotechnologies

- Director of Business Development, NovAliX

- Senior Scientist, Orbit Discovery

DNA ENCODED LIBRARY MARKET: RESEARCH COVERAGE

- Market Sizing and Opportunity Analysis: The report features an in-depth analysis of the DNA encoded library market, focusing on key market segments, including [A] application areas, [B] therapeutic area, [C] end-user, [D] type of payment method and [E] key geographical regions.

- Market Landscape: A comprehensive evaluation of service providers / platform providers / in-house companies involved in DNA encoded library market, considering various parameters, such as [A] year of establishment, [B] company size (in terms of employee count), [C] location of headquarters, [D] type of organization, [E] library size, [F] library screening method(s), [G] type of product(s) offered, [H] type of service(s) offered, [I] type of pharmacological lead(s), [J] therapeutic target(s), [K] therapeutic area(s) and [L] end user(s) (academic / research institute and pharma / biopharma industry).

- Business Model Analysis: A detailed discussion on the business models that are commonly adopted by the companies providing DNA encoded library platforms and services, including operational model, service centric model and product centric model.

- Company Competitiveness Analysis: A comprehensive competitive analysis of DNA encoded libraries platform and service providers, examining factors, such as [A] supplier strength and [B] company competitiveness.

- Company Profiles: In-depth profiles of key platform and service providers engaged in DNA encoded library market, focusing on [A] company overviews, [B] DNA encoded library platform and service portfolio, [C] recent developments and [D] an informed future outlook.

- Partnerships and Collaborations: An analysis of partnerships established in this sector, since 2010, covering research agreements, R&D agreements, license agreements (specific to technology platforms and product candidates), product development agreements, product development and commercialization agreements, mergers and acquisitions and other relevant agreements.

- Funding and Investment Analysis: A detailed evaluation of the investments made in the companies having proprietary DNA encoded chemical library, encompassing venture capital financing, capital raised from IPOs and subsequent offerings, grants, and debt financing.

- Patent Analysis: Detailed analysis of various patents filed / granted related to DNA encoded chemical library based on [A] publication year, [B] application year, [C] patent jurisdiction, [D] CPC symbols, [E] leading players (in terms of number of patents filled / granted) and [F] type of organization. It also includes a [G] patent benchmarking analysis and [H] a detailed valuation analysis.

- Big Pharma Analysis: A comprehensive examination of various initiatives focused on DNA-encoded libraries undertaken by major pharmaceutical companies. This analysis includes heat map visualizations that illustrate the distribution of leading pharmaceutical firms, as well as spider web diagrams that compare their initiatives across multiple relevant parameters.

- Case Study: A case study on companies / organizations that are presently engaged in supporting the development of DNA encoded libraries. In addition, the chapter includes a detailed analysis based on various relevant parameters, such as [A] year of establishment, [B] company size (in terms of employee count), [C] location of headquarters (North America, Europe and Asia-Pacific), [D] type of organization (pharma / biopharma industry and academic / research institutes) and [E] types of support services / ancillary tools offered (building blocks, oligos, scaffolds and other support services / ancillary tools).

KEY QUESTIONS ANSWERED IN THIS REPORT

- How many companies are currently engaged in this market?

- Which are the leading companies in this market?

- What kind of partnership models are commonly adopted by industry stakeholders?

- What factors are likely to influence the evolution of this market?

- What is the current and future market size?

- What is the CAGR of this market?

- How is the current and future market opportunity likely to be distributed across key market segments?

REASONS TO BUY THIS REPORT

- The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. By analyzing the competitive landscape, businesses can make informed decisions to optimize their market positioning and develop effective go-to-market strategies.

- The report offers stakeholders a comprehensive overview of the market, including key drivers, barriers, opportunities, and challenges. This information empowers stakeholders to stay abreast of market trends and make data-driven decisions to capitalize on growth prospects.

ADDITIONAL BENEFITS

- Complimentary PPT Insights Packs

- Complimentary Excel Data Packs for all Analytical Modules in the Report

- 10% Free Content Customization

- Detailed Report Walkthrough Session with Research Team

- Free Updated report if the report is 6-12 months old or older

TABLE OF CONTENTS

1. PREFACE

- 1.1. DNA Encoded Library Market Overview

- 1.2. Key Market Insights

- 1.3. Scope of the Report

- 1.4. Research Methodology

- 1.5. Frequently Asked Questions

- 1.6. Chapter Outlines

2. EXECUTIVE SUMMARY

3. INTRODUCTION

- 3.1. Chapter Overview

- 3.2. Overview of Drug Development

- 3.3. Drug Discovery Process

- 3.3.1. Target Identification

- 3.3.2. Target Validation

- 3.3.3. Hit Generation

- 3.3.3.1. High-throughput Screening

- 3.3.3.2. Fragment-based Screening

- 3.3.3.3. Virtual Screening

- 3.3.3.4. DNA Encoded Library Screening

- 3.3.4. Lead Generation

- 3.3.5. Lead Optimization

- 3.4. Overview of DNA Encoded Libraries

- 3.4.1. Encoding Strategies for Library Construction

- 3.4.2. Historical Evolution of DNA Encoded Libraries

- 3.4.3. Comparison of Traditional Libraries and DNA Encoded Libraries

- 3.4.4. Key Advantages of DNA Encoded Libraries

- 3.4.5. Challenges and Limitations Associated with DNA Encoded Libraries

- 3.5. Future Perspectives and Opportunity Areas

4. MARKET LANDSCAPE

- 4.1. Chapter Overview

- 4.2. DNA Encoded Library: Overall Market Landscape of Service Providers / Platform Providers / In-House Companies

- 4.2.1. Analysis by Year of Establishment

- 4.2.2. Analysis by Company Size

- 4.2.3. Analysis by Location of Headquarters

- 4.2.4. Analysis by Company Size and Location of Headquarters

- 4.2.5. Analysis by Type of Company / Organization

- 4.2.6. Analysis by Library Size

- 4.2.7. Analysis by Library Synthesis Method(s)

- 4.2.8. Analysis by Library Screening Method(s)

- 4.2.9. Analysis by Type of Product(s) Offered

- 4.2.10. Analysis by Type of Service(s) Offered

- 4.2.10.1. Analysis by Type of Library Design Service(s) Offered

- 4.2.10.2. Analysis by Type of Library Screening Service(s) Offered

- 4.2.11. Analysis by Type of Pharmacological Lead(s)

- 4.2.12. Analysis by Therapeutic Target(s)

- 4.2.13. Analysis by Therapeutic Area(s)

- 4.2.14. Analysis by End-user(s)

5. BUSINESS MODEL ANALYSIS

- 5.1. Chapter Overview

- 5.2. DNA Encoded Library Companies: Business Model Analysis

- 5.2.1. Analysis by Operational Model

- 5.2.1.1. Analysis by Company Size and Operational Model

- 5.2.1.2. Analysis by Location of Headquarters and Operational Model

- 5.2.2. Analysis by Business Model

- 5.2.2.1. Analysis by Service Centric Model

- 5.2.2.2. Analysis by Product Centric Model

- 5.2.1. Analysis by Operational Model

- 5.3. Concluding Remarks

6. COMPANY COMPETITIVENESS ANALYSIS

- 6.1. Chapter Overview

- 6.2. Assumptions and Key Parameters

- 6.3. Methodology

- 6.4. Company Competitiveness Analysis: DNA Encoded Library Service Providers / Platform Providers / In-House Companies

- 6.4.1. DNA Encoded Library Companies based in North America

- 6.4.2. DNA Encoded Library Companies based in Europe

- 6.4.3. DNA Encoded Library Companies based in Asia-Pacific

7. COMPANY PROFILES

- 7.1. Chapter Overview

- 7.2. AlphaMa

- 7.2.1. Company Overview

- 7.2.2. DNA Encoded Library Platform and Service Portfolio

- 7.2.3. Recent Developments and Future Outlook

- 7.3. DICE Therapeutics

- 7.3.1. Company Overview

- 7.3.2. DNA Encoded Library Platform and Service Portfolio

- 7.3.3. Recent Developments and Future Outlook

- 7.4. DyNAbind

- 7.4.1. Company Overview

- 7.4.2. DNA Encoded Library Platform and Service Portfolio

- 7.4.3. Recent Developments and Future Outlook

- 7.5. HitGen

- 7.5.1. Company Overview

- 7.5.2. DNA Encoded Library Platform and Service Portfolio

- 7.5.3. Recent Developments and Future Outlook

- 7.6. NovAliX

- 7.6.1. Company Overview

- 7.6.2. DNA Encoded Library Platform and Service Portfolio

- 7.6.3. Recent Developments and Future Outlook

- 7.7. Vipergen

- 7.7.1. Company Overview

- 7.7.2. DNA Encoded Library Platform and Service Portfolio

- 7.7.3. Recent Developments and Future Outlook

- 7.8. WuXi AppTec

- 7.8.1. Company Overview

- 7.8.2. DNA Encoded Library Platform and Service Portfolio

- 7.8.3. Recent Developments and Future Outlook

- 7.9. X-Chem

- 7.9.1. Company Overview

- 7.9.2. DNA Encoded Library Platform and Service Portfolio

- 7.9.3. Recent Developments and Future Outlook

8. PARTNERSHIPS AND COLLABORATIONS

- 8.1. Chapter Overview

- 8.2. Partnership Models

- 8.3. DNA Encoded Libraries: Partnerships and Collaborations

- 8.3.1. Analysis by Year of Partnership

- 8.3.2. Analysis by Type of Partnership

- 8.3.3. Analysis by Year and Type of Partnership

- 8.3.4. Analysis by Focus Area

- 8.3.5. Analysis by Therapeutic Area

- 8.3.6. Analysis by Type of Partner

- 8.3.6.1 Analysis by Partner Company Size

- 8.3.7. Most Active Players: Analysis by Number of Partnerships

- 8.3.8. Analysis by Geography

- 8.3.8.1. International and Local Agreements

- 8.3.8.2. Intercontinental and Intracontinental Agreements

9. FUNDING AND INVESTMENT ANALYSIS

- 9.1. Chapter Overview

- 9.2. Types of Funding

- 9.3. DNA Encoded Libraries: Funding and Investment Analysis

- 9.3.1. Analysis of Instances by Year of Funding

- 9.3.2. Analysis of Amount Invested by Year of Funding

- 9.3.3. Analysis of Instances by Type of Funding

- 9.3.4. Analysis of Amount Invested by Type of Funding

- 9.3.5. Most Active Players: Analysis by Number of Funding Instances

- 9.3.6. Most Active Players: Analysis by Amount Raised

- 9.3.7. Most Active Investors: Analysis by Number of Instances

- 9.3.8. Analysis by Geography

- 9.3.9. Concluding Remarks

10. PATENT ANALYSIS

- 10.1. Chapter Overview

- 10.2. Scope and Methodology

- 10.3. DNA Encoded Libraries: Patent Analysis

- 10.3.1. Analysis by Patent Publication Year

- 10.3.2. Analysis by Patent Application Year

- 10.3.3. Analysis by Type of Patent and Publication Year

- 10.3.4. Analysis by Patent Jurisdiction

- 10.3.5. Analysis by CPC Symbols

- 10.3.6. Analysis by Type of Applicant

- 10.3.7. Leading Industry Players: Analysis by Number of Patents

- 10.3.8. Leading Non-Industry Players: Analysis by Number of Patents

- 10.3.9. Leading Individual Assignees: Analysis by Number of Patents

- 10.4. DNA Encoded Libraries: Patent Benchmarking Analysis

- 10.4.1. Analysis by Patent Characteristics

- 10.5. DNA Encoded Libraries: Patent Valuation Analysis

- 10.6. Leading Patents by Number of Citations

11. BIG PHARMA INITIATIVES

- 11.1. Chapter Overview

- 11.2. Scope and Methodology

- 11.3. DNA Encoded Libraries Related Initiatives of Big Pharma Players

- 11.4. Benchmark Analysis of Big Pharma Players

- 11.4.1. Spider Web Analysis: AbbVie

- 11.4.2. Spider Web Analysis: Amgen

- 11.4.3. Spider Web Analysis: AstraZeneca

- 11.4.4. Spider Web Analysis: Bayer

- 11.4.5. Spider Web Analysis: Boehringer Ingelheim

- 11.4.6. Spider Web Analysis: Eli Lilly

- 11.4.7. Spider Web Analysis: GlaxoSmithKline (GSK)

- 11.4.8. Spider Web Analysis: Johnson & Johnson

- 11.4.9. Spider Web Analysis: Merck

- 11.4.10. Spider Web Analysis: Novartis

- 11.4.11. Spider Web Analysis: Pfizer

- 11.4.12. Spider Web Analysis: Sanofi

- 11.5. Concluding Remarks

12. CASE STUDY: COMPANIES / ORGANIZATIONS SUPPORTING THE DEVELOPMENT OF DNA ENCODED LIBRARIES

- 12.1. Chapter Overview

- 12.2. DNA Encoded Libraries: Overall Market Landscape of Supporting Companies / Organizations

- 12.2.1. Analysis by Year of Establishment

- 12.2.2. Analysis by Company Size

- 12.2.3. Analysis by Location of Headquarters

- 12.2.4. Analysis by Company Size and Location of Headquarters

- 12.2.5. Analysis by Type of Company / Organization

- 12.2.6. Analysis by Type of Support Services / Ancillary Tools Offered

- 12.2.7. Analysis by Location of Headquarters and Type of Support Services / Ancillary Tools Offered

13. MARKET FORECAST AND OPPORTUNITY ANALYSIS

- 13.1. Chapter Overview

- 13.2. Forecast Methodology and Key Assumptions

- 13.3. Global DNA Encoded Library Market (Platforms and Services): Historical, Base and Forecasted Scenario, till 2035

- 13.3.1. DNA Encoded Library Market (Platforms and Services): Distribution by Application Area, Current Year and 2035

- 13.3.1.1. DNA Encoded Library Market for Hit Generation / Identification, till 2035

- 13.3.1.2. DNA Encoded Library Market for Hit to Lead, till 2035

- 13.3.1.3. DNA Encoded Library Market for Hit Validation / Optimization, till 2035

- 13.3.1.4. DNA Encoded Library Market for Other Application Areas, till 2035

- 13.3.2. DNA Encoded Library Market (Platforms and Services): Distribution by Therapeutic Area, Current Year and 2035

- 13.3.2.1. DNA Encoded Library Market for Oncological Disorders, till 2035

- 13.3.2.2. DNA Encoded Library Market for Immunological Disorders, till 2035

- 13.3.2.3. DNA Encoded Library Market for Neurological Disorders, till 2035

- 13.3.2.4. DNA Encoded Library Market for Respiratory Disorders, till 2035

- 13.3.2.5. DNA Encoded Library Market for Dermatological Disorders, till 2035

- 13.3.2.6. DNA Encoded Library Market for Cardiovascular Disorders, till 2035

- 13.3.2.7. DNA Encoded Library Market for Infectious Diseases, till 2035

- 13.3.2.8. DNA Encoded Library Market for Other Therapeutic Areas, till 2035

- 13.3.3. DNA Encoded Library Market (Platforms and Services): Distribution by End-user, Current Year and 2035

- 13.3.3.1. DNA Encoded Library Market for Pharma / Biopharma Industry, till 2035

- 13.3.3.2. DNA Encoded Library Market for Academic / Research Institute, till 2035

- 13.3.3.3. DNA Encoded Library Market for Other End-users, till 2035

- 13.3.4. DNA Encoded Library Market (Platforms and Services): Distribution by Type of Payment Model Employed, Current Year and 2035

- 13.3.4.1. DNA Encoded Library Market: Upfront Payments, till 2035

- 13.3.4.2. DNA Encoded Library Market: Milestone Payments, till 2035

- 13.3.5. DNA Encoded Library Market (Platforms and Services): Distribution by Key Geographical Regions, Current Year and 2035

- 13.3.5.1. DNA Encoded Library Market in North America, till 2035

- 13.3.5.1.1. DNA Encoded Library Market in the US, till 2035

- 13.3.5.2. DNA Encoded Library Market in Europe, till 2035

- 13.3.5.2.1. DNA Encoded Library Market in Denmark, till 2035

- 13.3.5.2.2. DNA Encoded Library Market in Germany, till 2035

- 13.3.5.2.3. DNA Encoded Library Market in the UK, till 2035

- 13.3.5.2.4. DNA Encoded Library Market in Switzerland, till 2035

- 13.3.5.2.5. DNA Encoded Library Market in France, till 2035

- 13.3.5.2.6. DNA Encoded Library Market in Rest of the Europe, till 2035

- 13.3.5.3. DNA Encoded Library Market in Asia-Pacific, till 2035

- 13.3.5.3.1. DNA Encoded Library Market in China, till 2035

- 13.3.5.1. DNA Encoded Library Market in North America, till 2035

- 13.3.1. DNA Encoded Library Market (Platforms and Services): Distribution by Application Area, Current Year and 2035

14. CONCLUDING REMARKS

15. EXECUTIVE INSIGHTS

- 15.1. Chapter Overview

- 15.2. Vipergen

- 15.2.1. Company Snapshot

- 15.2.2. Interview Transcript: Nils Jakob Vest Hansen, Chief Executive Officer

- 15.3. Serengen

- 15.3.1. Company Snapshot

- 15.3.2. Interview Transcript: Thorsten Genski, Chief Executive Officer

- 15.4. Deluge Biotechnologies

- 15.4.1. Company Snapshot

- 15.4.2. Interview Transcript: Thomas Kodadek, Co-Founder and Ofelia Utset, President

- 15.5. NovAliX

- 15.5.1. Company Snapshot

- 15.5.2. Interview Transcript: Frank Moffatt, Director of Business Development

- 15.6. Orbit Discovery

- 15.6.1. Company Snapshot

- 15.6.2. Interview Transcript: Christos Tsiamantas, Senior Scientist

- 15.7. Anonymous

16. APPENDIX 1: TABULATED DATA

17. APPENDIX 2: LIST OF COMPANIES AND ORGANIZATIONS

List of Tables

- Table 4.1 DNA Encoded Libraries: List of Service Providers / Platform Providers / In-House Companies

- Table 4.2 DNA Encoded Libraries: Information on Library Size, Library Synthesis Method(s) and Library Screening Method(s)

- Table 4.3 DNA Encoded Libraries: Information on Type of Product(s) and Service(s) Offered

- Table 4.4 DNA Encoded Libraries: Information on Type of Pharmacological Lead(s) and Therapeutic Target(s)

- Table 4.5 DNA Encoded Libraries: Information on Therapeutic Area(s) and End-user(s)

- Table 5.1 DNA Encoded Libraries: Information on Company Size, Location of Headquarters and Operational Model

- Table 5.2 DNA Encoded Libraries: Information on Business Model

- Table 7.1 DNA Encoded Libraries: List of Companies Profiled

- Table 7.2 AlphaMa: Company Snapshot

- Table 7.3 AlphaMa: DNA Encoded Library Platform and Service Portfolio

- Table 7.4 AlphaMa: Recent Developments and Future Outlook

- Table 7.5 DICE Therapeutics: Company Snapshot

- Table 7.6 DICE Therapeutics: DNA Encoded Library Platform and Service Portfolio

- Table 7.7 DICE Therapeutics: Recent Developments and Future Outlook

- Table 7.8 DyNAbind: Company Snapshot

- Table 7.9 DyNAbind: DNA Encoded Library Platform and Service Portfolio

- Table 7.10 DyNAbind: Recent Developments and Future Outlook

- Table 7.11 HitGen: Company Snapshot

- Table 7.12 HitGen: DNA Encoded Library Platform and Service Portfolio

- Table 7.13 HitGen: Recent Developments and Future Outlook

- Table 7.14 NovAliX: Company Snapshot

- Table 7.15 NovAliX: DNA Encoded Library Platform and Service Portfolio

- Table 7.16 NovAliX: Recent Developments and Future Outlook

- Table 7.17 Vipergen: Company Snapshot

- Table 7.18 Vipergen: DNA Encoded Library Platform and Service Portfolio

- Table 7.19 Vipergen: Recent Developments and Future Outlook

- Table 7.20 WuXi AppTec: Company Snapshot

- Table 7.21 WuXi AppTec: DNA Encoded Library Platform and Service Portfolio

- Table 7.22 X-Chem: Company Snapshot

- Table 7.23 X-Chem: DNA Encoded Library Platform and Service Portfolio

- Table 7.24 X-Chem: Recent Developments and Future Outlook

- Table 8.1 DNA Encoded Libraries: List of Partnerships and Collaborations, since 2010

- Table 9.1 DNA Encoded Libraries: List of Funding and Investments, since 2018

- Table 10.1 Patent Analysis: Top CPC Sections

- Table 10.2 Patent Analysis: Top CPC Symbols

- Table 10.3 Patent Analysis: Top CPC Codes

- Table 10.4 Patent Analysis: Summary of Benchmarking Analysis

- Table 10.5 Patent Analysis: Categorization based on Weighted Valuation Scores

- Table 10.6 Patent Portfolio: List of Leading Patents (by Highest Relative Valuation)

- Table 10.7 Patent Portfolio: List of Leading Patents (by Number of Citations)

- Table 12.1 DNA Encoded Libraries: List of Supporting Companies / Organizations

- Table 12.2 DNA Encoded Libraries: Information on Type of Support Services / Ancillary Tools Offered

- Table 13.1 DNA Encoded Libraries: Average Upfront Payment and Average Milestone Payment, 2016-2022 (USD Million)

- Table 13.2 Library Licensing Deals: Tranches of Milestone Payments

- Table 15.1 Vipergen: Company Key Highlights

- Table 15.2 Serengen: Company Key Highlights

- Table 15.3 Deluge Biotechnologies: Company Key Highlights

- Table 15.4 NovAliX: Company Key Highlights

- Table 15.5 Orbit Discovery: Company Key Highlights

- Table 16.1 DNA Encoded Libraries: Distribution by Year of Establishment

- Table 16.2 DNA Encoded Libraries: Distribution by Company Size

- Table 16.3 DNA Encoded Libraries: Distribution by Location of Headquarters (Region-wise)

- Table 16.4 DNA Encoded Libraries: Distribution by Location of Headquarters (Country-wise)

- Table 16.5 DNA Encoded Libraries: Distribution by Company Size and Location of Headquarters

- Table 16.6 DNA Encoded Libraries: Distribution by Type of Company / Organization

- Table 16.7 DNA Encoded Libraries: Distribution by Library Size

- Table 16.8 DNA Encoded Libraries: Distribution by Library Synthesis Method(s)

- Table 16.9 DNA Encoded Libraries: Distribution by Library Screening Method(s)

- Table 16.10 DNA Encoded Libraries: Distribution by Type of Product(s) Offered

- Table 16.11 DNA Encoded Libraries: Distribution by Type of Library Design Service(s) Offered

- Table 16.12 DNA Encoded Libraries: Distribution by Type of Library Screening Service(s) Offered

- Table 16.13 DNA Encoded Libraries: Distribution by Type of Pharmacological Lead(s)

- Table 16.14 DNA Encoded Libraries: Distribution by Therapeutic Target(s)

- Table 16.15 DNA Encoded Libraries: Distribution by Therapeutic Area(s)

- Table 16.16 DNA Encoded Libraries: Distribution by End-user(s)

- Table 16.17 DNA Encoded Libraries: Distribution by Operational Model

- Table 16.18 DNA Encoded Libraries: Distribution by Company Size and Operational Model

- Table 16.19 DNA Encoded Libraries: Distribution by Location of Headquarters and Operational Model

- Table 16.20 DNA Encoded Libraries: Distribution by Business Model

- Table 16.21 DNA Encoded Libraries: Distribution by Service Centric Model

- Table 16.22 DNA Encoded Libraries: Distribution by Product Centric Model

- Table 16.23 Partnerships and Collaborations: Cumulative Year-wise Trend, since 2010

- Table 16.24 Partnerships and Collaborations: Distribution by Type of Partnership

- Table 16.25 Partnerships and Collaborations: Distribution by Year and Type of Partnership

- Table 16.26 Partnerships and Collaborations: Distribution by Type of Partnership

- Table 16.27 Partnerships and Collaborations: Distribution by Focus Area

- Table 16.28 Partnerships and Collaborations: Distribution by Therapeutic Area

- Table 16.29 Partnerships and Collaborations: Distribution by Type of Partner

- Table 16.30 Partnerships and Collaborations: Distribution by Partner Company Size

- Table 16.31 Most Active Players: Distribution by Number of Partnerships

- Table 16.32 Partnerships and Collaborations: International and Local Agreements

- Table 16.33 Partnerships and Collaborations: Intercontinental and Intracontinental Agreements

- Table 16.34 Funding and Investment: Distribution by Year, Type of Funding and Amount Invested, since 2018 (USD Million)

- Table 16.35 Funding and Investment: Distribution of Instances by Year of Funding, since 2018

- Table 16.36 Funding and Investment: Distribution of Amount Invested by Year of Funding, since 2018 (USD Million)

- Table 16.37 Funding and Investment: Distribution of Instances by Type of Funding

- Table 16.38 Funding and Investment: Distribution of Amount Invested by Type of Funding (USD Million)

- Table 16.39 Most Active Players: Distribution by Number of Funding Instances

- Table 16.40 Most Active Players: Distribution by Amount Raised (USD Million)

- Table 16.41 Most Active Investors: Distribution by Number of Instances

- Table 16.42 Funding and Investment Analysis: Distribution of Number of Instances and Amount Invested by Geography (Region-wise) (USD Million)

- Table 16.43 Funding and Investment Analysis: Distribution of Number of Instances by Geography (Country-wise)

- Table 16.44 Funding and Investment Analysis: Summary of Investments by Number of Instances and Amount Invested (USD Million)

- Table 16.45 Patent Analysis: Distribution by Type of Patent

- Table 16.46 Patent Analysis: Distribution by Patent Publication Year

- Table 16.47 Patent Analysis: Distribution by Patent Application Year

- Table 16.48 Patent Analysis: Distribution by Type of Patent and Publication Year

- Table 16.49 Patent Analysis: Distribution by Patent Jurisdiction (Region-wise)

- Table 16.50 Patent Analysis: Distribution by Patent Jurisdiction (Country-wise)

- Table 16.51 Patent Analysis: Distribution by CPC Symbols

- Table 16.52 Patent Analysis: Cumulative Year-wise Distribution by Type of Applicant

- Table 16.53 Leading Industry Players: Distribution by Number of Patents

- Table 16.54 Leading Non-Industry Players: Distribution by Number of Patents

- Table 16.55 Leading Individual Assignees: Distribution by Number of Patents

- Table 16.56 Patent Benchmarking Analysis: Distribution of Patent Characteristics (CPC Codes) by Leading Industry Players

- Table 16.57 Patent Analysis: Distribution by Patent Age

- Table 16.58 Patent Analysis: Distribution by Relative Patent Valuation

- Table 16.59 Big Pharma Players: Heat Map Analysis of Top Pharma Companies

- Table 16.60 DNA Encoded Libraries Supporting Companies / Organizations: Distribution by Year of Establishment

- Table 16.61 DNA Encoded Libraries Supporting Companies / Organizations: Distribution by Company Size

- Table 16.62 DNA Encoded Libraries Supporting Companies / Organizations: Distribution by Location of Headquarters

- Table 16.63 DNA Encoded Libraries Supporting Companies / Organizations: Distribution by Company Size and Location of Headquarters

- Table 16.64 DNA Encoded Libraries Supporting Companies / Organizations: Distribution by Type of Company / Organization

- Table 16.65 DNA Encoded Libraries Supporting Companies / Organizations: Distribution by Type of Support Services / Ancillary Tools Offered

- Table 16.66 DNA Encoded Libraries Supporting Companies / Organizations: Distribution by Location of Headquarters and Type of Support Services / Ancillary Tools Offered

- Table 16.67 Global DNA Encoded Library Market (Platforms and Services): Historical, Base and Forecasted Opportunity, Conservative, Base and Optimistic Scenarios, 2017-2035 (USD Million)

- Table 16.68 DNA Encoded Library Market (Platforms and Services): Distribution by Application Area, Current Year and 2035 (USD Million)

- Table 16.69 DNA Encoded Library Market for Hit Generation / Identification, Conservative, Base and Optimistic Scenarios, till 2035 (USD Million)

- Table 16.70 DNA Encoded Library Market for Hit to Lead, Conservative, Base and Optimistic Scenarios, till 2035(USD Million)

- Table 16.71 DNA Encoded Library Market for Hit Validation / Optimization, Conservative, Base and Optimistic Scenarios, till 2035 (USD Million)

- Table 16.72 DNA Encoded Library Market for Other Application Areas, Conservative, Base and Optimistic Scenarios, till 2035 (USD Million)

- Table 16.73 DNA Encoded Library Market (Platforms and Services): Distribution by Therapeutic Area, Current Year and 2035 (USD Million)

- Table 16.74 DNA Encoded Library Market for Oncological Disorders, Conservative, Base and Optimistic Scenarios, till 2035 (USD Million)

- Table 16.75 DNA Encoded Library Market for Immunological Disorders, Conservative, Base and Optimistic Scenarios, till 2035 (USD Million)

- Table 16.76 DNA Encoded Library Market for Neurological Disorders, Conservative, Base and Optimistic Scenarios, till 2035 (USD Million)

- Table 16.77 DNA Encoded Library Market for Respiratory Disorders, Conservative, Base and Optimistic Scenarios, till 2035 (USD Million)

- Table 16.78 DNA Encoded Library Market for Dermatological Disorders, Conservative, Base and Optimistic Scenarios, till 2035 (USD Million)

- Table 16.79 DNA Encoded Library Market for Cardiovascular Disorders, Conservative, Base and Optimistic Scenarios, till 2035 (USD Million)

- Table 16.80 DNA Encoded Library Market for Infectious Diseases, Conservative, Base and Optimistic Scenarios, till 2035 (USD Million)

- Table 16.81 DNA Encoded Library Market for Other Therapeutic Areas, Conservative, Base and Optimistic Scenarios, till 2035 (USD Million)

- Table 16.82 DNA Encoded Library Market (Platforms and Services): Distribution by End-user, Current Year and 2035 (USD Million)

- Table 16.83 DNA Encoded Library Market for Pharma / Biopharma Industry, Conservative, Base and Optimistic Scenarios, till 2035 (USD Million)

- Table 16.84 DNA Encoded Library Market for Academic / Research Institute, Conservative, Base and Optimistic Scenarios, till 2035 (USD Million)

- Table 16.85 DNA Encoded Library Market for Other End-users, Conservative, Base and Optimistic Scenarios, till 2035 (USD Million)

- Table 16.86 DNA Encoded Library Market (Platforms and Services): Distribution by Type of Payment Model Employed, Current Year and 2035 (USD Million)

- Table 16.87 DNA Encoded Library Market: Upfront Payments, Conservative, Base and Optimistic Scenarios, till 2035 (USD Million)

- Table 16.88 DNA Encoded Library Market: Milestone Payments, Conservative, Base and Optimistic Scenarios, till 2035 (USD Million)

- Table 16.89 DNA Encoded Library Market (Platforms and Services): Distribution by Key Geographical Regions, Current Year and 2035 (USD Million)

- Table 16.90 DNA Encoded Library Market in the US, Conservative, Base and Optimistic Scenarios, till 2035 (USD Million)

- Table 16.91 DNA Encoded Library Market in Europe, Conservative, Base and Optimistic Scenarios, till 2035 (USD Million)

- Table 16.92 DNA Encoded Library Market in Denmark, Conservative, Base and Optimistic Scenarios, till 2035 (USD Million)

- Table 16.93 DNA Encoded Library Market in Germany, Conservative, Base and Optimistic Scenarios, till 2035 (USD Million)

- Table 16.94 DNA Encoded Library Market in UK, Conservative, Base and Optimistic Scenarios, till 2035 (USD Million)

- Table 16.95 DNA Encoded Library Market in Switzerland, Conservative, Base and Optimistic Scenarios, till 2035 (USD Million)

- Table 16.96 DNA Encoded Library Market in France, Conservative, Base and Optimistic Scenarios, till 2035 (USD Million)

- Table 16.97 DNA Encoded Library Market in Rest of the Europe, Conservative, Base and Optimistic Scenarios, till 2035 (USD Million)

- Table 16.98 DNA Encoded Library Market in China, Conservative, Base and Optimistic Scenarios, till 2035 (USD Million)

List of Figures

- Figure 2.1 Executive Summary: Market Landscape

- Figure 2.2 Executive Summary: Business Model Analysis

- Figure 2.3 Executive Summary: Partnerships and Collaborations

- Figure 2.4 Executive Summary: Funding and Investment Analysis

- Figure 2.5 Executive Summary: Patent Analysis

- Figure 2.6 Executive Summary: Market Forecast and Opportunity Analysis

- Figure 3.1 Drug Discovery and Development Timeline

- Figure 3.2 Drug Discovery Process

- Figure 3.3 Construction Process of a DNA Encoded Library

- Figure 3.4 Encoding Strategies for Constructing DNA Encoded Libraries

- Figure 3.5 Historical Evolution of DNA Encoded Libraries

- Figure 3.6 Comparison of Traditional Libraries and DNA Encoded Libraries

- Figure 3.7 Key Advantages of DNA Encoded Libraries

- Figure 3.8 Challenges and Limitations Associated with DNA Encoded Libraries

- Figure 4.1 DNA Encoded Libraries: Distribution by Year of Establishment

- Figure 4.2 DNA Encoded Libraries: Distribution by Company Size

- Figure 4.3 DNA Encoded Libraries: Distribution by Location of Headquarters (Region-wise)

- Figure 4.4 DNA Encoded Libraries: Distribution by Location of Headquarters (Country-wise)

- Figure 4.5 DNA Encoded Libraries: Distribution by Company Size and Location of Headquarters

- Figure 4.6 DNA Encoded Libraries: Distribution by Type of Company / Organization

- Figure 4.7 DNA Encoded Libraries: Distribution by Library Size

- Figure 4.8 DNA Encoded Libraries: Distribution by Library Synthesis Method(s)

- Figure 4.9 DNA Encoded Libraries: Distribution by Library Screening Method(s)

- Figure 4.10 DNA Encoded Libraries: Distribution by Type of Product(s) Offered

- Figure 4.11 DNA Encoded Libraries: Distribution by Type of Library Design Service(s) Offered

- Figure 4.12 DNA Encoded Libraries: Distribution by Type of Library Screening Service(s) Offered

- Figure 4.13 DNA Encoded Libraries: Distribution by Type of Pharmacological Lead(s)

- Figure 4.14 DNA Encoded Libraries: Distribution by Therapeutic Target(s)

- Figure 4.15 DNA Encoded Libraries: Distribution by Therapeutic Area(s)

- Figure 4.16 DNA Encoded Libraries: Distribution by End-user(s)

- Figure 5.1 DNA Encoded Libraries: Distribution by Operational Model

- Figure 5.2 DNA Encoded Libraries: Distribution by Company Size and Operational Model

- Figure 5.3 DNA Encoded Libraries: Distribution by Location of Headquarters and Operational Model

- Figure 5.4 DNA Encoded Libraries: Distribution by Business Model

- Figure 5.5 DNA Encoded Libraries: Distribution by Service Centric Model

- Figure 5.6 DNA Encoded Libraries: Distribution by Product Centric Model

- Figure 6.1 Company Competitiveness Analysis: DNA Encoded Library Companies based in North America

- Figure 6.2 Company Competitiveness Analysis: DNA Encoded Library Companies based in Europe

- Figure 6.3 Company Competitiveness Analysis: DNA Encoded Library Companies based in Asia-Pacific

- Figure 8.1 Partnerships and Collaborations: Cumulative Year-wise Trend, since 2010

- Figure 8.2 Partnerships and Collaborations: Distribution by Type of Partnership

- Figure 8.3 Partnerships and Collaborations: Distribution by Year and Type of Partnership

- Figure 8.4 Partnerships and Collaborations: Distribution by Type of Partnership

- Figure 8.5 Partnerships and Collaborations: Distribution by Focus Area

- Figure 8.6 Partnerships and Collaborations: Distribution by Therapeutic Area

- Figure 8.7 Partnerships and Collaborations: Distribution by Type of Partner

- Figure 8.8 Partnerships and Collaborations: Distribution by Partner Company Size

- Figure 8.9 Most Active Players: Distribution by Number of Partnerships

- Figure 8.10 Partnerships and Collaborations: International and Local Agreements

- Figure 8.11 Partnerships and Collaborations: Intercontinental and Intracontinental Agreements

- Figure 9.1 Funding and Investment: Distribution by Year, Type of Funding and Amount Invested, since 2018 (USD Million)

- Figure 9.2 Funding and Investment: Distribution of Instances by Year of Funding, since 2018

- Figure 9.3 Funding and Investment: Distribution of Amount Invested by Year of Funding, since 2018 (USD Million)

- Figure 9.4 Funding and Investment : Distribution of Instances by Type of Funding

- Figure 9.5 Funding and Investment: Distribution of Amount Invested by Type of Funding (USD Million)

- Figure 9.6 Most Active Players: Distribution by Number of Funding Instances

- Figure 9.7 Most Active Players: Distribution by Amount Raised (USD Million)

- Figure 9.8 Most Active Investors: Distribution by Number of Instances

- Figure 9.9 Funding and Investment: Distribution of Number of Instances and Amount Invested by Geography (Region-wise) (USD Million)

- Figure 9.10 Funding and Investment: Distribution of Number of Instances by Geography (Country-wise)

- Figure 9.11 Funding and Investment: Summary of Investments by Number of Instances and Amount Invested (USD Million)

- Figure 10.1 Patent Analysis: Distribution by Type of Patent

- Figure 10.2 Patent Analysis: Distribution by Patent Publication Year

- Figure 10.3 Patent Analysis: Distribution by Patent Application Year

- Figure 10.4 Patent Analysis: Distribution by Type of Patent and Publication Year

- Figure 10.5 Patent Analysis: Distribution by Patent Jurisdiction (Region-wise)

- Figure 10.6 Patent Analysis: Distribution by Patent Jurisdiction (Country-wise)

- Figure 10.7 Patent Analysis: Distribution by CPC Symbols

- Figure 10.8 Patent Analysis: Cumulative Year-wise Distribution by Type of Applicant

- Figure 10.9 Leading Industry Players: Distribution by Number of Patents

- Figure 10.10 Leading Non-Industry Players: Distribution by Number of Patents

- Figure 10.11 Leading Individual Assignees: Distribution by Number of Patents

- Figure 10.12 Patent Benchmarking Analysis: Distribution of Patent Characteristics (CPC Codes) by Leading Industry Players

- Figure 10.13 Patent Analysis: Distribution by Patent Age

- Figure 10.14 Patent Analysis: Distribution by Relative Patent Valuation

- Figure 11.1 Big Pharma Initiatives: Heat Map Analysis of Top Pharma Companies

- Figure 11.2 Spider Web Analysis: AbbVie

- Figure 11.3 Spider Web Analysis: Amgen

- Figure 11.4 Spider Web Analysis: AstraZeneca

- Figure 11.5 Spider Web Analysis: Bayer

- Figure 11.6 Spider Web Analysis: Boehringer Ingelheim

- Figure 11.7 Spider Web Analysis: Eli Lilly

- Figure 11.8 Spider Web Analysis: GlaxoSmithKline (GSK)

- Figure 11.9 Spider Web Analysis: Johnson & Johnson

- Figure 11.10 Spider Web Analysis: Merck

- Figure 11.11 Spider Web Analysis: Novartis

- Figure 11.12 Spider Web Analysis: Pfizer

- Figure 11.13 Spider Web Analysis: Sanofi

- Figure 12.1 DNA Encoded Libraries Supporting Companies / Organizations: Distribution by Year of Establishment

- Figure 12.2 DNA Encoded Libraries Supporting Companies / Organizations: Distribution by Company Size

- Figure 12.3 DNA Encoded Libraries Supporting Companies / Organizations: Distribution by Location of Headquarters

- Figure 12.4 DNA Encoded Libraries Supporting Companies / Organizations: Distribution by Company Size and Location of Headquarters

- Figure 12.5 DNA Encoded Libraries Supporting Companies / Organizations: Distribution by Type of Company / Organization

- Figure 12.6 DNA Encoded Libraries Supporting Companies / Organizations: Distribution by Type of Support Services / Ancillary Tools Offered

- Figure 12.7 DNA Encoded Libraries Supporting Companies / Organizations: Distribution by Location of Headquarters and Type of Support Services / Ancillary Tools Offered

- Figure 13.1 Licensing Agreements: Distribution of Financial Components

- Figure 13.2 Licensing Agreements: Illustrative Scenario based Opportunity Estimation

- Figure 13.3 Global DNA Encoded Library Market (Platforms and Services): Historical, Base and Forecasted Scenario, since 2017 (USD Billion)

- Figure 13.4 DNA Encoded Library Market (Platforms and Services): Distribution by Application Area, Current Year and 2035 (USD Million)

- Figure 13.5 DNA Encoded Library Market for Hit Generation / Identification, till 2035 (USD Million)

- Figure 13.6 DNA Encoded Library Market for Hit to Lead, till 2035(USD Million)

- Figure 13.7 DNA Encoded Library Market for Hit Validation / Optimization, till 2035 (USD Million)

- Figure 13.8 DNA Encoded Library Market for Other Application Areas, till 2035 (USD Million)

- Figure 13.9 DNA Encoded Library Market (Platforms and Services): Distribution by Therapeutic Area, Current Year and 2035 (USD Million)

- Figure 13.10 DNA Encoded Library Market for Oncological Disorders, till 2035 (USD Million)

- Figure 13.11 DNA Encoded Library Market for Immunological Disorders, till 2035 (USD Million)

- Figure 13.12 DNA Encoded Library Market for Neurological Disorders, till 2035 (USD Million)

- Figure 13.13 DNA Encoded Library Market for Respiratory Disorders, till 2035 (USD Million)

- Figure 13.14 DNA Encoded Library Market for Dermatological Disorders, till 2035 (USD Million)

- Figure 13.15 DNA Encoded Library Market for Cardiovascular Disorders, till 2035 (USD Million)

- Figure 13.16 DNA Encoded Library Market for Infectious Diseases, till 2035 (USD Million)

- Figure 13.17 DNA Encoded Library Market for Other Therapeutic Areas, till 2035 (USD Million)

- Figure 13.18 DNA Encoded Library Market (Platforms and Services): Distribution by End-user, Current Year and 2035 (USD Million)

- Figure 13.19 DNA Encoded Library Market for Pharma / Biopharma Industry, till 2035 (USD Million)

- Figure 13.20 DNA Encoded Library Market for Academic / Research Institute, till 2035 (USD Million)

- Figure 13.21 DNA Encoded Library Market for Other End-users, till 2035 (USD Million)

- Figure 13.22 DNA Encoded Library Market (Platforms and Services): Distribution by Type of Payment Model Employed, Current Year and 2035 (USD Million)

- Figure 13.23 DNA Encoded Library Market: Upfront Payments, till 2035 (USD Million)

- Figure 13.24 DNA Encoded Library Market: Milestone Payments, till 2035 (USD Million)

- Figure 10.25 DNA Encoded Library Market (Platforms and Services): Distribution by Key Geographical Regions, Current Year and 2035 (USD Million)

- Figure 13.26 DNA Encoded Library Market in the US, till 2035 (USD Million)

- Figure 13.27 DNA Encoded Library Market in Europe, till 2035 (USD Million)

- Figure 13.28 DNA Encoded Library Market in Denmark, till 2035 (USD Million)

- Figure 13.29 DNA Encoded Library Market in Germany, till 2035 (USD Million)

- Figure 10.30 DNA Encoded Library Market in UK, till 2035 (USD Million)

- Figure 13.31 DNA Encoded Library Market in Switzerland, till 2035 (USD Million)

- Figure 13.32 DNA Encoded Library Market in France, till 2035 (USD Million)

- Figure 13.33 DNA Encoded Library Market in Rest of the Europe, till 2035 (USD Million)

- Figure 13.34 DNA Encoded Library Market in China, till 2035 (USD Million)

- Figure 14.1 Concluding Remarks: Market Landscape

- Figure 14.2 Concluding Remarks: Business Model Analysis

- Figure 14.3 Concluding Remarks: Partnerships and Collaborations

- Figure 14.4 Concluding Remarks: Funding and Investment Analysis

- Figure 14.5 Concluding Remarks: Patent Analysis

- Figure 14.6 Concluding Remarks: Market Forecast and Opportunity Analysis