PUBLISHER: Roots Analysis | PRODUCT CODE: 1616873

PUBLISHER: Roots Analysis | PRODUCT CODE: 1616873

Gene Therapy Market by Therapeutic Area, Type of Vector, Type of Therapy, Type of Gene Delivery Method, Route of Administration, Geographical Regions, Leading Players and Sales Forecast: Industry Trends and Global Forecasts, Till 2035

GENE THERAPY MARKET: OVERVIEW

As per Roots Analysis, the global gene therapy market is estimated to grow from USD 2.4 billion in the current year to USD 16.5 billion by 2035, at a CAGR of 19.25% during the forecast period, till 2035.

The market sizing and opportunity analysis has been segmented across the following parameters:

Therapeutic Area

- Cardiovascular Disorders

- Dermatological Disorders

- Genetic Disorders

- Hematological Disorders

- Metabolic Disorders

- Muscle Disorders

- Oncological Disorders

- Ophthalmic Disorders

- Other Disorders

Type of Vector

- Adeno-associated Virus Vectors

- Adenovirus Vectors

- Herpes Simplex Virus Vectors

- Lentivirus Vectors

- Non-viral Vectors

- Retrovirus Vectors

- Other Viral Vectors

Type of Therapy

- Gene Augmentation

- Gene Editing

- Gene Regulation

- Oncolytic Immunotherapies

- Other Therapies

Type of Gene Delivery Method

- Ex vivo Gene Delivery

- In vivo Gene Delivery

Route of Administration

- Intramuscular Route

- Intratumoral Route

- Intravenous Route

- Subretinal Route

- Other Routes of Administration

Key Geographical Regions

- North America

- Europe

- Asia-Pacific

- Latin America

- Rest of the World

GENE THERAPY MARKET: GROWTH AND TRENDS

Congenital abnormalities and inherited genetic mutations encompass a diverse range of disorders, including oncological disorders, genetic disorders, autoimmune disorders and neurological disorders. According to the World Health Organization (WHO), genetic disorders affect 10 out of every 1,000 individuals, resulting in over 70 million people living with these conditions globally. Notably, more than 40% of infant mortality worldwide is linked to various genetic disorders. At present, several research initiatives are underway to develop safe and effective methods to selectively correct (the mutated, disease-causing) genes of individual patients. Of these, gene therapies have emerged as a promising option. These therapies are designed to target the underlying genetic cause of a disease, either by introducing a healthy version of the mutated gene or by disabling the functions of genes that cause the disease within the body. It is worth highlighting that over 1,100 clinical trials related to gene therapies have been registered in the past few years, indicating substantial research activity. Additionally, as per the USFDA, 10 to 20 therapies are expected to gain market access, each year, till 2025. Driven by the collaborative efforts of gene therapy companies and an increasing preference for effective single-dose treatments, the gene therapy market is set to experience significant growth during the forecast period.

GENE THERAPY MARKET: KEY INSIGHTS

The report delves into the current state of the gene therapy market and identifies potential growth opportunities within the industry. Some key findings from the report include:

1. Presently, 345 developers, worldwide, are engaged in the development of gene therapies targeting various disorders; of these, more than 50% of the stakeholders are headquartered in the US, alone.

2. 70% of the gene therapies being evaluated in phase III clinical trials are gene augmentation therapies; it is worth noting that more than 35% of the candidates have received fast track designation.

3. Close to 95% of the preclinical stage gene therapies are in vivo therapies; more than 20% of the gene therapy candidates are being developed for the treatment of neurological disorders.

4. Over the years, the intellectual capital related to gene therapies has grown at a commendable pace; several patents have been filed by both industry stakeholders and academic players.

5. Over 500 patents focused on gene editing have been filed in the past five years; till date, 6% of such patents have been granted.

6. Rising interest of the stakeholders in this domain is reflected by the number of mergers and acquisitions reported over the last few years; 26% of these initiatives were focused on gaining access to novel platforms.

7. Foreseeing lucrative opportunities, many public and private investors have made investments worth USD 36.4 billion, across more than 560 funding instances.

8. In the recent past, more than 18,000 patients have been enrolled in clinical trials focused on gene therapies; close to 45% trials are evaluating gene therapies for the treatment of oncological disorders.

9. Start-ups are spearheading the innovation in the gene therapy domain; the valuation of a start-up is not solely dependent on profits, instead, it depends on experience and amount previously invested by industry stakeholders.

10. In order to tap into the lucrative opportunity associated with gene therapies, big pharma players have adopted various approaches, from proprietary product development to strategic investments, to advance their portfolios.

11. Given the growing incidence of inherited disorders, the demand for gene therapies (in terms of number of patients) has risen; by 2035, it is anticipated to grow at an annualized rate of 11.67%, across various geographies.

12. Owing to the growing interest towards personalized medicines and high specificity, the market for gene therapies is expected to rise steadily in the foreseeable future.

13. The gene therapy market is anticipated to grow at an annualized rate (CAGR) of 19.25%, till 2035; North America is expected to capture the majority share (close to 65%) of the market by 2035.

GENE THERAPY MARKET: KEY SEGMENTS

Currently, Muscle Disorders Segment Occupies the Largest Share of the Gene Therapy Market

Based on the therapeutic area, the market is segmented into cardiovascular disorders, dermatological disorders, genetic disorders, hematological disorders, metabolic disorders, muscle disorders, oncological diseases, ophthalmic disorders and other disorders. At present, muscle disorders segment holds the maximum share of the gene therapy market. This can be attributed to the growing prevalence of muscle disorders and proven efficacy of gene therapies in treating such conditions.

Adeno-Associated Virus (AAV) Vector-Based Gene Therapies is Likely to Dominate the Gene Therapies Market During the Forecast Period

Based on the type of vector, the market is segmented into adeno-associated virus vectors, adenovirus vectors, herpes simplex virus vectors, lentivirus vectors, non-viral vectors, retrovirus vectors and other viral vectors. At present, AAV vector-based gene therapies holds the maximum share within the gene therapies market. It is worth highlighting that, owing to the numerous advantages of AAV vector, such as high target specificity, greater efficacy and infectivity, AAV vector-based gene therapies are likely to capture larger share in the coming decade.

Currently, Gene Augmentation Segment Occupies the Largest Share of the Gene Therapies Market

Based on the type of therapy, the market is segmented into gene augmentation, gene editing, gene regulation, oncolytic immunotherapies and other therapies. Owing to their ability to deliver therapeutic genes to the patient's genome, fewer side effects and precisely correcting the genomic mutations, the gene therapy market is currently dominated by gene augmentation therapies. This trend is likely to remain the same in the mid-to-long term.

In Vivo Gene Delivery Method is Likely to Dominate the Gene Therapies Market During the Forecast Period

Based on the type of gene delivery method, the market is segmented into ex vivo and in vivo gene delivery methods. It is worth highlighting that, at present, in vivo gene delivery method holds a larger share of the gene therapy market. This trend is likely to remain the same in the coming decade.

Intravenous Route of Administration is Likely to Dominate the Gene Therapy Market During the Forecast Period

Based on the route of administration, the market is segmented into intramuscular, intratumoral, intravenous, subretinal and other routes of administration. It is worth highlighting that majority of the current gene therapy market is captured by the intravenous route of administration and this trend is unlikely to change in mid-long term. This can be attributed to the fact that gene therapies allow widespread distribution of the gene-carrying therapeutic vector to multiple target organs. In addition, intravenous administration is easier to administer and minimally invasive compared to other methods like intralesional or intratumoral injection.

North America Accounts for the Largest Share of the Market

Based on the key geographical regions, the market is segmented into North America, Europe, Asia-Pacific, Latin America and Rest of the World. Majority share is expected to be captured by drug developers based in North America. It is worth highlighting that, over the years, the market for Europe is expected to grow at a higher CAGR.

Example Players in the Gene Therapy Market

- Amgen

- Artgen Biotech

- BioMarin Pharmaceutical

- bluebird bio

- CRISPR Therapeutics

- CSL Behring

- Ferring Pharmaceuticals

- Kolon TissueGene

- Krystal Biotech

- Novartis

- Orchard Therapeutics

- Pfizer

- PTC Therapeutics

- Sarepta Therapeutics

- Shanghai Sunway Biotech

- Sibiono GeneTech

- Spark Therapeutics

Primary Research Overview

The opinions and insights presented in this study were influenced by discussions conducted with multiple stakeholders. The research report features detailed transcripts of interviews held with the following industry stakeholders:

- Former Corporate Communications Manager, Orchard Therapeutics

- Co-Founder and Chief Executive Officer, Vivet Therapeutics

- Chief Executive Officer, Chairman and President, Kubota Pharmaceutical

- Former Chief Executive Officer and President, Eyevensys

- Former Chief Executive Officer and President, AGTC

- Former Chief Business Officer, LogicBio Therapeutics

- Founder and Chief Executive Officer, AAVogen

- Chief Executive Officer, Hemera Biosciences

- Ex Co-Founder, Chief Executive Officer and President, Myonexus Therapeutics

- Former Chief Executive Officer, Arthrogen

- Project Manager and Tatjana Buchholz, Former Marketing Manager, PlasmidFactory

- Former Executive and Scientific Director, Delphi Genetics

- Former Chief Commercial Officer, Vigene Biosciences

- Chief Executive Officer and Chairman, Gene Biotherapeutics

- Chief Executive Officer, Milo Biotechnology

GENE THERAPY MARKET: RESEARCH COVERAGE

- Market Sizing and Opportunity Analysis: The report features an in-depth analysis of the gene therapy market, focusing on key market segments, including [A] therapeutic area, [B] type of vector, [C] type of therapy, [D] type of gene delivery method, [E] route of administration, [F] geographical regions and [H] leading players.

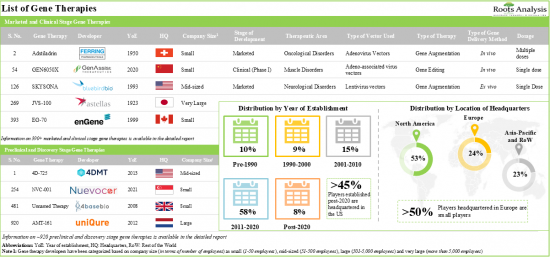

- Market Landscape (Gene Therapies): A comprehensive evaluation of marketed and clinical stage gene therapies, considering various parameters, such as [A] stage of development, [B] drug designations, [C] therapeutic area, [D] target gene, [E] type of vector used, [F] type of therapy, [G] type of gene delivery method, [H] route of administration and [I] dosing frequency. The chapter also provides a detailed analysis of the current landscape of discovery and preclinical stage gene therapies based on parameters, such as [J] stage of development, [K] therapeutic area, [L] target gene, [M] type of vector used, [N] type of therapy and [O] type of gene delivery method.

- Market Landscape (Gene Therapy Developers): A comprehensive evaluation of gene therapy developers, considering various parameters, such as [A] year of establishment, [B] company size (in terms of number of employees), [C] location of headquarters and [D] most active players (in terms of the number of gene therapies developed).

- Company Profiles: In-depth profiles of key industry players engaged in the development of gene therapies, focusing on [A] company overviews, [B] financial information (if available), [C] gene therapy portfolio, [D] recent developments and [E] an informed future outlook.

- Drug Profiles: In-depth profiles of marketed and late stage (phase II / III and above) gene therapies, along with information on the [A] development timeline of the therapy, [B] mechanism of action, [C] type of vector used, [D] dosage and manufacturing details, [E] target indication, as well as [F] details related to the developer company.

- Commercialization Strategy: An elaborate discussion on the various commercialization strategies that have been adopted by drug developers engaged in the gene therapy domain across different stages of therapy development, including prior to drug launch, at / during drug launch and post-marketing stage.

- Patent Analysis: Detailed analysis of various patents filed / granted related to gene therapies and gene editing therapies based on [A] type of patent, [B] publication year, [C] regional applicability, [D] CPC symbols, [E] emerging focus areas, [F] leading industry players (in terms of the number of patents filed / granted), and [G] patent valuation. It also includes a [H] patent benchmarking analysis and [I] a detailed valuation analysis.

- Merger and Acquisitions: A comprehensive examination of the various mergers and acquisitions, focusing on multiple relevant parameters, including [A] year of agreement, [B] type of deal, [C] geographical location of the companies involved, [D] key value drivers, [E] highest phase of development of the acquired company' product, [F] target therapeutic area and [G] deal multiples.

- Funding and Investment Analysis: A detailed evaluation of the investments made in the gene therapy domain, encompassing seed financing, venture capital financing, IPOs, secondary offerings, debt financing, grants and other equity offerings.

- Clinical Trial Analysis: Examination of completed, ongoing, and planned clinical studies of various gene therapies, based on parameters, such as [A] trial registration year, [B] trial status, [C] trial phase, [D] target therapeutic area, [E] geography, [F] type of sponsor, [G] prominent treatment sites and [H] enrolled patient population.

- Pricing Analysis: An analysis of the various factors that are likely to influence the pricing of gene therapies, featuring different models / approaches that may be adopted by developers / manufacturers to decide the prices of these therapies.

- Start-up Valuation Analysis: An analysis of the startup companies engaged in this domain (since 2017) based on year of experience.

- Big Pharma Analysis: A comprehensive examination of various gene therapy-based initiatives undertaken by major pharmaceutical companies, based on several relevant parameters, such as [A] therapeutic area, [B] type of vector used, [C] type of therapy and [D] type of gene delivery method used. In addition, it includes a detailed benchmarking analysis across key parameters, such as [E] number of gene therapies under development, [F] funding information, [G] partnership activity and [H] patent portfolio strength.

- Demand Analysis: Informed estimates of the annual commercial and clinical demand for gene therapies based on several relevant parameters, such as [A] target patient population, [B] dosing frequency and [C] dose strength.

- Additional Insight 1: A review of the various emerging technologies and therapy development platforms that are being used to manufacture gene therapies, featuring detailed profiles of technologies that are being used for the development of gene therapies.

- Additional Insight 2: A case study examining the current and emerging trends in vector manufacturing, along with details on companies that provide contract services for producing viral vectors utilized in gene therapy products. The analysis also includes an in-depth discussion of the manufacturing processes associated with different types of vectors.

- Additional Insight 3: Assessment of the supply chain model adopted by gene therapy developers highlighting the stakeholders involved, factors affecting the supply of therapeutic products and challenges encountered by developers across the different stages of the gene therapy supply chain.

- Market Impact Analysis: The report analyzes various factors such as drivers, restraints, opportunities, and challenges affecting the market growth.

KEY QUESTIONS ANSWERED IN THIS REPORT

- How many companies are currently engaged in this market?

- Which are the leading companies in this market?

- What is the annual demand for gene therapies?

- What factors are likely to influence the evolution of this market?

- What is the current and future market size?

- What is the CAGR of this market?

- How is the current and future market opportunity likely to be distributed across key market segments?

REASONS TO BUY THIS REPORT

- The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. By analyzing the competitive landscape, businesses can make informed decisions to optimize their market positioning and develop effective go-to-market strategies.

- The report offers stakeholders a comprehensive overview of the market, including key drivers, barriers, opportunities, and challenges. This information empowers stakeholders to stay abreast of market trends and make data-driven decisions to capitalize on growth prospects.

ADDITIONAL BENEFITS

- Complimentary PPT Insights Packs

- Complimentary Excel Data Packs for all Analytical Modules in the Report

- 10% Free Content Customization

- Detailed Report Walkthrough Session with Research Team

- Free Updated report if the report is 6-12 months old or older

TABLE OF CONTENTS

1. PREFACE

- 1.1. Introduction

- 1.2. Market Share Insights

- 1.3. Key Market Insights

- 1.4. Report Coverage

- 1.5. Key Questions Answered

- 1.6. Chapter Outlines

2. RESEARCH METHODOLOGY

- 2.1. Chapter Overview

- 2.2. Research Assumptions

- 2.2.1. Market Landscape and Market Trends

- 2.2.2. Market Forecast and Opportunity Analysis

- 2.2.3. Comparative Analysis

- 2.3. Database Building

- 2.3.1. Data Collection

- 2.3.2. Data Validation

- 2.3.3. Data Analysis

- 2.4. Project Methodology

- 2.4.1. Secondary Research

- 2.4.1.1. Annual Reports

- 2.4.1.2. Academic Research Papers

- 2.4.1.3. Company Websites

- 2.4.1.4. Investor Presentations

- 2.4.1.5. Regulatory Filings

- 2.4.1.6. White Papers

- 2.4.1.7. Industry Publications

- 2.4.1.8. Conferences and Seminars

- 2.4.1.9. Government Portals

- 2.4.1.10. Media and Press Releases

- 2.4.1.11. Newsletters

- 2.4.1.12. Industry Databases

- 2.4.1.13. Roots Proprietary Databases

- 2.4.1.14. Paid Databases and Sources

- 2.4.1.15. Social Media Portals

- 2.4.1.16. Other Secondary Sources

- 2.4.2. Primary Research

- 2.4.2.1. Types of Primary Research

- 2.4.2.1.1. Qualitative Research

- 2.4.2.1.2. Quantitative Research

- 2.4.2.1.3. Hybrid Approach

- 2.4.2.2. Advantages of Primary Research

- 2.4.2.3. Techniques for Primary Research

- 2.4.2.3.1. Interviews

- 2.4.2.3.2. Surveys

- 2.4.2.3.3. Focus Groups

- 2.4.2.3.4. Observational Research

- 2.4.2.3.5. Social Media Interactions

- 2.4.2.4. Key Opinion Leaders Considered in Primary Research

- 2.4.2.4.1. Company Executives (CXOs)

- 2.4.2.4.2. Board of Directors

- 2.4.2.4.3. Company Presidents and Vice Presidents

- 2.4.2.4.4. Research and Development Heads

- 2.4.2.4.5. Technical Experts

- 2.4.2.4.6. Subject Matter Experts

- 2.4.2.4.7. Scientists

- 2.4.2.4.8. Doctors and Other Healthcare Providers

- 2.4.2.5. Ethics and Integrity

- 2.4.2.5.1. Research Ethics

- 2.4.2.5.2. Data Integrity

- 2.4.2.1. Types of Primary Research

- 2.4.3. Analytical Tools and Databases

- 2.4.1. Secondary Research

3. MARKET DYNAMICS

- 3.1. Chapter Overview

- 3.2. Forecast Methodology

- 3.2.1. Top-down Approach

- 3.2.2. Bottom-up Approach

- 3.2.3. Hybrid Approach

- 3.3. Market Assessment Framework

- 3.3.1. Total Addressable Market (TAM)

- 3.3.2. Serviceable Addressable Market (SAM)

- 3.3.3. Serviceable Obtainable Market (SOM)

- 3.3.4. Currently Acquired Market (CAM)

- 3.4. Forecasting Tools and Techniques

- 3.4.1. Qualitative Forecasting

- 3.4.2. Correlation

- 3.4.3. Regression

- 3.4.4. Extrapolation

- 3.4.5. Convergence

- 3.4.6. Sensitivity Analysis

- 3.4.7. Scenario Planning

- 3.4.8. Data Visualization

- 3.4.9. Time Series Analysis

- 3.4.10. Forecast Error Analysis

- 3.5. Key Considerations

- 3.5.1. Demographics

- 3.5.2. Government Regulations

- 3.5.3. Reimbursement Scenarios

- 3.5.4. Market Access

- 3.5.5. Supply Chain

- 3.5.6. Industry Consolidation

- 3.5.7. Pandemic / Unforeseen Disruptions Impact

- 3.6. Key Market Segmentation

- 3.7. Robust Quality Control

- 3.8. Limitations

4. ECONOMIC CONSIDERATONS

- 4.1. Chapter Overview

- 4.2. Market Dynamics

- 4.2.1. Time Period

- 4.2.1.1. Historical Trends

- 4.2.1.2. Current and Forecasted Estimates

- 4.2.2. Currency Coverage

- 4.2.2.1. Overview of Major Currencies Affecting the Market

- 4.2.2.2. Impact of Currency Fluctuations on the Industry

- 4.2.3. Foreign Exchange Impact

- 4.2.3.1. Evaluation of Foreign Exchange Rates and Their Impact on Market

- 4.2.3.2. Strategies for Mitigating Foreign Exchange Risk

- 4.2.4. Recession

- 4.2.4.1. Historical Analysis of Past Recessions and Lessons Learnt

- 4.2.4.2. Assessment of Current Economic Conditions and Potential Impact on the Market

- 4.2.5. Inflation

- 4.2.5.1. Measurement and Analysis of Inflationary Pressures in the Economy

- 4.2.5.2. Potential Impact of Inflation on the Market Evolution

- 4.2.1. Time Period

5. EXECUTIVE SUMMARY

6. INTRODUCTION

- 6.1. Chapter Overview

- 6.2. Evolution of Gene Therapies

- 6.3. Classification of Gene Therapies

- 6.3.1. Based on Source of Origin

- 6.3.2. Based on Method of Delivery

- 6.3.2.1. Ex vivo Gene Therapies

- 6.3.2.2. In vivo Gene Therapies

- 6.4. Routes of Administration

- 6.5. Mechanism of Action of Gene Therapies

- 6.6. Advantages and Disadvantages of Gene Therapies

- 6.7. Challenges associated with Gene Therapies

- 6.7.1. Ethical and Social Challenges

- 6.7.2. Therapy Development Challenges

- 6.7.3. Manufacturing Challenges

- 6.7.4. Commercial Viability Challenges

- 6.8. Introduction to Genome Editing

- 6.8.1. Evolution of Genome Editing

- 6.8.2. Applications of Genome Editing

- 6.8.3. Types of Genome Editing Techniques

- 6.9. Concluding Remarks

7. GENE DELIVERY VECTORS

- 7.1. Chapter Overview

- 7.2. Methods of Gene Transfer

- 7.3. Viral Vectors for Genetically Modified Therapies

- 7.3.1. Types of Viral Vectors

- 7.3.1.1. Adeno-associated Viral Vectors

- 7.3.1.2. Adenoviral Vectors

- 7.3.1.3. Lentiviral Vectors

- 7.3.1.4. Retroviral Vectors

- 7.3.1.5. Other Viral Vectors

- 7.3.1. Types of Viral Vectors

- 7.4. Non-Viral Vectors for Genetically Modified Therapies

- 7.4.1. Types of Non-Viral Vectors

- 7.4.1.1. Plasmid DNA

- 7.4.1.2. Liposomes, Lipoplexes and Polyplexes

- 7.4.1.3. Oligonucleotides

- 7.4.1.4. Nanoparticles

- 7.4.1.5. Hybrid System Vectors

- 7.4.1.6. Other Non-Viral Vectors

- 7.4.2. Gene Delivery using Non-Viral Vectors

- 7.4.2.1. Biolistic Methods

- 7.4.2.2. Electroporation

- 7.4.2.3. Receptor Mediated Gene Delivery

- 7.4.2.4. Gene Activated matrix (GAM)

- 7.4.1. Types of Non-Viral Vectors

8. REGULATORY LANDSCAPE AND REIMBURSEMENT SCENARIOS

- 8.1. Chapter Overview

- 8.2. Regulatory Guidelines in North America

- 8.2.1. The US Scenario

- 8.2.2. Canadian Scenario

- 8.3. Regulatory Guidelines in Europe

- 8.3.1. Quality Documentation for Gene Therapy Products

- 8.3.2. Non-Clinical Development

- 8.3.3. Clinical Development

- 8.4. Regulatory Guidelines in Asia-Pacific

- 8.4.1. Chinese Scenario

- 8.4.1.1. Construction of DNA Expression Cassette and Gene Delivery Systems

- 8.4.1.2. Generation and Characterization of Cell Banks and Engineered Bacteria Banks

- 8.4.1.2.1. Cell Bank

- 8.4.1.2.2. Bacterial Cell Bank

- 8.4.1.3. Manufacturing of Gene Therapy Products

- 8.4.1.4. Quality Control

- 8.4.1.5. Evaluation of Efficacy of Gene Therapy Products

- 8.4.1.6. Evaluation of Safety of Gene Therapy Products

- 8.4.1.7. Clinical Trial of Gene Therapy Products

- 8.4.1.8. Ethics Study

- 8.4.2. Japanese Scenario

- 8.4.3. South Korean Scenario

- 8.4.4. Australian Scenario

- 8.4.5. Hong Kong Scenario

- 8.4.1. Chinese Scenario

- 8.5. Reimbursement Scenario

- 8.5.1. Challenges Related to Reimbursement

- 8.6. Concluding Remarks and Future Outlook

9. MARKET LANDSCAPE

- 9.1. Chapter Overview

- 9.2. Marketed and Clinical Stage Gene Therapies: Market Landscape

- 9.2.1. Analysis by Stage of Development

- 9.2.2. Analysis by Drug Designation

- 9.2.3. Analysis by Therapeutic Area

- 9.2.4. Analysis by Target Gene

- 9.2.5. Analysis by Type of Vector Used

- 9.2.6. Analysis by Type of Therapy

- 9.2.7. Analysis by Type of Gene Delivery Method

- 9.2.8. Analysis by Route of Administration

- 9.2.9. Analysis by Dosing Frequency

- 9.3. Preclinical and Discovery Stage Gene Therapies: Market Landscape

- 9.3.1. Analysis by Stage of Development

- 9.3.2. Analysis by Therapeutic Area

- 9.3.3. Analysis by Target Gene

- 9.3.4. Analysis by Type of Vector Used

- 9.3.5. Analysis by Type of Therapy

- 9.3.6. Analysis by Type of Gene Delivery Method

10. DEVELOPER LANDSCAPE

- 10.1. Chapter Overview

- 10.2. Gene Therapy: Competitive Landscape

- 10.2.1. Analysis by Year of Establishment

- 10.2.2. Analysis by Company Size

- 10.2.3. Analysis by Location of Headquarters

- 10.2.4. Most Active Players: Analysis by Number of Gene Therapies Developed

11. COMPANY PROFILES

- 11.1. Chapter Overview

- 11.2. Gene Therapy Developers in North America

- 11.2.1. Amgen

- 11.2.1.1. Company Overview

- 11.2.1.2. Gene Therapy Portfolio

- 11.2.1.3. Recent Developments and Future Outlook

- 11.2.2. BioMarin Pharmaceutical

- 11.2.2.1. Company Overview

- 11.2.2.2. Gene Therapy Portfolio

- 11.2.2.3. Recent Developments and Future Outlook

- 11.2.3. bluebird bio

- 11.2.3.1. Company Overview

- 11.2.3.2. Gene Therapy Portfolio

- 11.2.3.3. Recent Developments and Future Outlook

- 11.2.4. CRISPR Therapeutics

- 11.2.4.1. Company Overview

- 11.2.4.2. Gene Therapy Portfolio

- 11.2.4.3. Recent Developments and Future Outlook

- 11.2.5. Kolon TissueGene

- 11.2.5.1. Company Overview

- 11.2.5.2. Gene Therapy Portfolio

- 11.2.5.3. Recent Developments and Future Outlook

- 11.2.6. Krystal Biotech

- 11.2.6.1. Company Overview

- 11.2.6.2. Gene Therapy Portfolio

- 11.2.6.3. Recent Developments and Future Outlook

- 11.2.7. Pfizer

- 11.2.7.1. Company Overview

- 11.2.7.2. Gene Therapy Portfolio

- 11.2.7.3. Recent Developments and Future Outlook

- 11.2.8. PTC Therapeutics

- 11.2.8.1. Company Overview

- 11.2.8.2. Gene Therapy Portfolio

- 11.2.8.3. Recent Developments and Future Outlook

- 11.2.9. Sarepta Therapeutics

- 11.2.9.1. Company Overview

- 11.2.9.2. Gene Therapy Portfolio

- 11.2.9.3. Recent Developments and Future Outlook

- 11.2.10. Spark Therapeutics

- 11.2.10.1. Company Overview

- 11.2.10.2. Gene Therapy Portfolio

- 11.2.10.3. Recent Developments and Future Outlook

- 11.2.1. Amgen

- 11.3. Gene Therapy Developers in Europe

- 11.3.1. Artgen Biotech

- 11.3.1.1. Company Overview

- 11.3.1.2. Gene Therapy Portfolio

- 11.3.1.3. Recent Developments and Future Outlook

- 11.3.2. Ferring Pharmaceuticals

- 11.3.2.1. Company Overview

- 11.3.2.2. Gene Therapy Portfolio

- 11.3.2.3. Recent Developments and Future Outlook

- 11.3.3. Novartis

- 11.3.3.1. Company Overview

- 11.3.3.2. Gene Therapy Portfolio

- 11.3.3.3. Recent Developments and Future Outlook

- 11.3.4. Orchard Therapeutics

- 11.3.4.1. Company Overview

- 11.3.4.2. Gene Therapy Portfolio

- 11.3.4.3. Recent Developments and Future Outlook

- 11.3.1. Artgen Biotech

- 11.4. Gene Therapy Developers in Asia-Pacific and Rest of the World

- 11.4.1. CSL Behring

- 11.4.1.1. Company Overview

- 11.4.1.2. Gene Therapy Portfolio

- 11.4.1.3. Recent Developments and Future Outlook

- 11.4.2. Shanghai Sunway Biotech

- 11.4.2.1. Company Overview

- 11.4.2.2. Gene Therapy Portfolio

- 11.4.2.3. Recent Developments and Future Outlook

- 11.4.3. Sibiono GeneTech

- 11.4.3.1. Company Overview

- 11.4.3.2. Gene Therapy Portfolio

- 11.4.3.3. Recent Developments and Future Outlook

- 11.4.1. CSL Behring

12. MARKETED GENE THERAPIES

- 12.1. Chapter Overview

- 12.2. Gendicine(R) (Shenzhen Sibiono GeneTech)

- 12.2.1. Company Overview

- 12.2.2. Development Timeline

- 12.2.3. Mechanism of Action and Vector Used

- 12.2.4. Target Indication

- 12.2.5. Current Stage of Development

- 12.2.6. Manufacturing, Dosage and Sales

- 12.3. Oncorine(R) (Shanghai Sunway Biotech)

- 12.3.1. Company Overview

- 12.3.2. Development Timeline

- 12.3.3. Mechanism of Action and Vector Used

- 12.3.4. Target Indication

- 12.3.5. Current Stage of Development

- 12.3.6. Manufacturing, Dosage and Sales

- 12.4. Rexin-G(R) (Epeius Biotechnologies)

- 12.4.1. Company Overview

- 12.4.2. Development Timeline

- 12.4.3. Mechanism of Action and Vector Used

- 12.4.4. Target Indication

- 12.4.5. Current Stage of Development

- 12.4.6. Manufacturing, Dosage and Sales

- 12.5. Neovasculgen(R) (Human Stem Cells Institute)

- 12.5.1. Company Overview

- 12.5.2. Development Timeline

- 12.5.3. Mechanism of Action and Vector Used

- 12.5.4. Target Indication

- 12.5.5. Current Stage of Development

- 12.5.6. Manufacturing, Dosage and Sales

- 12.6. Imlygic(R) (Amgen)

- 12.6.1. Company Overview

- 12.6.2. Development Timeline

- 12.6.3. Mechanism of Action and Vector Used

- 12.6.4. Target Indication

- 12.6.5. Current Stage of Development

- 12.6.6. Manufacturing, Dosage and Sales

- 12.7. Strimvelis(R) (Orchard Therapeutics)

- 12.7.1. Company Overview

- 12.7.2. Development Timeline

- 12.7.3. Mechanism of Action and Vector Used

- 12.7.4. Target Indication

- 12.7.5. Current Stage of Development

- 12.7.6. Manufacturing, Dosage and Sales

- 12.8. Luxturna(TM) (Spark Therapeutics)

- 12.8.1. Company Overview

- 12.8.2. Development Timeline

- 12.8.3. Mechanism of Action and Vector Used

- 12.8.4. Target Indication

- 12.8.5. Current Stage of Development

- 12.8.6. Manufacturing, Dosage and Sales

- 12.9. Zolgensa(TM) (Novartis)

- 12.9.1. Company Overview

- 12.9.2. Development Timeline

- 12.9.3. Mechanism of Action and Vector Used

- 12.9.4. Target Indication

- 12.9.5. Current Stage of Development

- 12.9.6. Manufacturing, Dosage and Sales

- 12.10. Collategene(R) (AnGes)

- 12.10.1. Company Overview

- 12.10.2. Development Timeline

- 12.10.3. Mechanism of Action and Vector Used

- 12.10.4. Target Indication

- 12.10.5. Current Stage of Development

- 12.10.6. Manufacturing, Dosage and Sales

- 12.11. Zyntelgo(TM) (bluebird bio)

- 12.11.1. Company Overview

- 12.11.2. Development Timeline

- 12.11.3. Mechanism of Action and Vector Used

- 12.11.4. Target Indication

- 12.11.5. Current Stage of Development

- 12.11.6. Manufacturing, Dosage and Sales

- 12.12. Libmeldy(TM) (Orchard Therapeutics)

- 12.12.1. Company Overview

- 12.12.2. Development Timeline

- 12.12.3. Mechanism of Action and Vector Used

- 12.12.4. Target Indication

- 12.12.5. Current Stage of Development

- 12.12.6. Manufacturing, Dosage and Sales

13. KEY COMMERCIALIZATION STRATEGIES

- 13.1. Chapter Overview

- 13.2. Successful Drug Launch Strategy: ROOTS Framework

- 13.3. Successful Drug Launch Strategy: Product Differentiation

- 13.4. Commonly Adopted Commercialization Strategies based on Phase of Development

- 13.5. List of Approved Gene Therapies

- 13.6. Key Commercialization Strategies Adopted by Gene Therapy Developers

- 13.6.1. Strategies Adopted before Therapy Approval

- 13.6.1.1. Participation in Global Events

- 13.6.1.2. Collaborations with Stakeholders and Pharmaceutical Firms

- 13.6.1.3. Indication Expansion

- 13.6.2. Strategies adopted During / Post Therapy Approval

- 13.6.2.1. Geographical Expansion

- 13.6.2.2. Participation in Global Events

- 13.6.2.3. Patient Assistance Programs

- 13.6.2.4. Awareness through Product Websites

- 13.6.2.5. Collaboration with Stakeholders and Pharmaceutical Firms

- 13.6.1. Strategies Adopted before Therapy Approval

- 13.7. Concluding Remarks

14. LATE-STAGE GENE THERAPIES

- 14.1. Chapter Overview

- 14.2. LUMEVOQ (GS010)

- 14.3. OTL-103

- 14.4. PTC-AADC

- 14.5. BMN 270

- 14.6. rAd-IFN/Syn3

- 14.7. beti-cel

- 14.8. eli-cel

- 14.9. lovo-cel

- 14.10. SRP-9001

- 14.11. EB-101

- 14.12. ProstAtak

- 14.13. D-Fi

- 14.14. CG0070

- 14.15. Vigil-EWS

- 14.16. Engensis

- 14.17. VGX-3100

- 14.18. INVOSSA (TG-C)

- 14.19. VYJUVEKT

- 14.20. PF-06939926

- 14.21. PF06838435

- 14.22. PF-07055480

- 14.23. SPK-8011

- 14.24. AMT-061

- 14.25. VB-111

- 14.26. Generx

- 14.27. ADXS-HPV

- 14.28. AGTC 501

- 14.29. LYS-SAF302

- 14.30. NFS-01

- 14.31. AG0302-COVID19

- 14.32. RGX-314

- 14.33. Hologene 5

15. PATENT ANALYSIS

- 15.1. Chapter Overview

- 15.2 Gene Therapy: Patent Analysis

- 15.2.1. Scope and Methodology

- 15.2.1.1. Analysis by Publication Year

- 15.2.1.2. Analysis by Publication Year and Type of Patent

- 15.2.1.3. Analysis by Geography

- 15.2.1.3.1. Analysis by Geography (North America)

- 15.2.1.3.2. Analysis by Geography (Europe)

- 15.2.1.3.3. Analysis by Geography (Asia-Pacific)

- 15.2.1.4. Analysis by CPC Symbols

- 15.2.1.5. Analysis by Emerging Focus Areas

- 15.2.1.6. Leading Players: Analysis by Number of Patents

- 15.2.1.7. Patent Benchmarking Analysis

- 15.2.1.7.1. Analysis by Patent Characteristics

- 15.2.1.7.1.1. Sanofi and Genethon

- 15.2.1.7.1.2. Other Leading Patent Assignees

- 15.2.1.7.1. Analysis by Patent Characteristics

- 15.2.1.8. Patent Valuation Analysis

- 15.2.1. Scope and Methodology

- 15.3. Gene Editing Market: Patent Analysis

- 15.3.1. Scope and Methodology

- 15.3.1.1. Analysis by Publication Year

- 15.3.1.2. Analysis by Publication Year and Type of Patent

- 15.3.1.3. Analysis by Geography

- 15.3.1.3.1. Analysis by Geography (North America)

- 15.3.1.3.2. Analysis by Geography (Europe)

- 15.3.1.3.3. Analysis by Geography (Asia-Pacific)

- 15.3.1.4. Analysis by CPC Symbols

- 15.3.1.5. Analysis by Emerging Focus Areas

- 15.3.1.6. Leading Players: Analysis by Number of Patents

- 15.3.1.7. Patent Benchmarking Analysis

- 15.3.1.7.1. Analysis by Patent Characteristics

- 15.3.1.7.1.1. Intellia Therapeutics and CRISPR Therapeutics

- 15.3.1.7.1.2. Other Leading Patent Assignees

- 15.3.1.7.1. Analysis by Patent Characteristics

- 15.3.1.8. Patent Valuation Analysis

- 15.3.1. Scope and Methodology

- 15.4. Overall Intellectual Property Portfolio: Analysis by Type of Organization

16. MERGERS AND ACQUISITIONS

- 16.1. Chapter Overview

- 16.2. Merger and Acquisition Models

- 16.3. Gene Therapy: Mergers and Acquisitions

- 16.3.1. Analysis by Year of Merger / Acquisition

- 16.3.2. Analysis by Type of Agreement

- 16.3.3. Analysis by Geography

- 16.3.3.1. Intercontinental and Intracontinental Deals

- 16.3.3.2. Local and International Deals

- 16.3.4. Analysis by Key Value Drivers

- 16.3.4.1. Analysis by Key Value Drivers and Year of Acquisition

- 16.3.5. Analysis by Stage of Development of the Acquired Company's Product

- 16.3.6. Analysis by Therapeutic Area

- 16.4. Analysis by Deal Multiples

17. FUNDING AND INVESTMENTS

- 17.1. Chapter Overview

- 17.2. Types of Funding

- 17.3. Gene Therapy: Funding and Investment Analysis

- 17.3.1. Analysis by Year of Funding

- 17.3.2. Analysis by Amount Invested

- 17.3.3. Analysis by Funding Instance and Amount Invested by Type of Funding

- 17.3.4. Analysis by Funding Instances and Amount Invested by Year and Type of Funding

- 17.3.5. Analysis by Funding Instances and Amount Invested by Type of Therapy

- 17.3.6. Analysis by Funding Instances and Amount Invested by Geography

- 17.3.7. Analysis by Funding Instances and Amount Invested by Highest Phase of Development

- 17.3.8. Analysis by Funding Instances by Therapeutic Area

- 17.3.9. Most Active Players: Analysis by Funding Instances and Amount Invested

- 17.3.10. Key Investors: Analysis by Number of Funding Instances

- 17.4. Concluding Remarks

18. CLINICAL TRIAL ANALYSIS

- 18.1. Chapter Overview

- 18.2. Scope and Methodology

- 18.3. Gene Therapy: Clinical Trial Analysis

- 18.3.1. Analysis by Trial Registration Year

- 18.3.2. Analysis by Trial Status

- 18.3.3. Analysis by Trial Phase

- 18.3.4. Analysis by Therapeutic Area

- 18.3.5. Analysis by Geography

- 18.3.6. Analysis by Trial Registration Year and Geography

- 18.3.7. Analysis by Trial Status and Geography

- 18.3.8. Analysis by Trial Status, Trial Phase and Geography

- 18.3.9. Analysis by Therapeutic Area and Geography

- 18.4. Analysis by Type of Sponsor / Collaborator

- 18.5. Analysis by Prominent Treatment Sites

- 18.6. Gene Therapy: Analysis of Enrolled Patient Population

- 18.6.1. Analysis by Trial Registration Year

- 18.6.2. Analysis by Trial Status

- 18.6.3. Analysis by Trial Phase

- 18.6.4. Analysis by Therapeutic Area

- 18.6.5. Analysis by Location of Trial Site

- 18.6.6. Analysis by Trial Status and Location of Trial Site

- 18.6.7. Analysis by Trial Status, Trial Phase and Location of Trial Site

- 18.6.8. Analysis by Therapeutic Area and Location of Trial Site

- 18.7. Concluding Remarks

19. COST PRICE ANALYSIS

- 19.1. Chapter Overview

- 19.2. Factors Contributing to the High Price of Gene Therapies

- 19.3. Gene Therapy Market: Price Models

- 19.3.1. Based on Associated Product / Component Costs

- 19.3.2. Based on Competition

- 19.3.3. Based on Patient Segment

- 19.3.4. Based Opinion of Industry Experts

20. START-UP VALUATION

- 20.1. Chapter Overview

- 20.2. Valuation by Years of Experience of Start-ups

- 20.2.1. Methodology

- 20.2.2. Results and Interpretation

21. BIG PHARMA INITIATIVES

- 21.1. Chapter Overview

- 21.2. Gene Therapy: List of Most Prominent Big Pharmaceutical Players

- 21.2.1. Analysis by Therapeutic Area

- 21.2.2. Analysis by Type of Vector Used

- 21.2.3. Analysis by Type of Therapy

- 21.2.4. Analysis by Type of Gene Delivery Method Used

- 21.3. Benchmarking Analysis of Key Parameters

- 21.3.1. Spider Web Analysis: Pipeline Strength

- 21.3.2. Spider Web Analysis: Mergers and Acquisitions

- 21.3.3. Spider Web Analysis: Funding and Investments

- 21.3.4. Spider Web Analysis: Clinical Trials

- 21.3.5. Spider Web Analysis: Technologies

- 21.3.6. Spider Web Analysis: Patents

- 21.4. Benchmarking Analysis of Big Pharmaceutical Players

- 21.4.1. Spider Web Analysis: Novartis

- 21.4.2. Spider Web Analysis: Takeda Pharmaceutical

- 21.4.3. Spider Web Analysis: Roche

- 21.4.4. Spider Web Analysis: Merck

- 21.4.5. Spider Web Analysis: Pfizer

- 21.4.6. Spider Web Analysis: Johnson & Johnson

- 21.4.7. Spider Web Analysis: AbbVie

- 21.4.8. Spider Web Analysis: Bristol Myers Squibb

- 21.4.9. Spider Web Analysis: AstraZeneca

- 21.4.10. Spider Web Analysis: Sanofi

22. DEMAND ANALYSIS

- 22.1. Chapter Overview

- 22.2. Assumptions and Methodology

- 22.3. Gene Therapy Market: Global Demand Analysis

- 22.3.1. Analysis by Stage of Development

- 22.3.2. Analysis by Therapeutic Area

- 22.3.3. Analysis by Type of Therapy

- 22.3.4. Analysis by Type of Gene Delivery Method

- 22.3.5. Analysis by Geography

23. MARKET IMPACT ANALYSIS: DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES

- 23.1. Chapter Overview

- 23.2. Market Drivers

- 23.3. Market Restraints

- 23.4. Market Opportunities

- 23.5. Market Challenges

- 23.6. Conclusion

24. GLOBAL GENE THERAPY MARKET

- 24.1. Chapter Overview

- 24.2. Key Assumptions and Methodology

- 24.3. Global Gene Therapy Market, till 2035

- 24.3.1. Scenario Analysis

- 24.3.1.1. Conservative Scenario

- 24.3.1.2. Optimistic Scenario

- 24.3.1. Scenario Analysis

- 24.4. Key Market Segmentations

25. GENE THERAPIES MARKET, BY THERAPEUTIC AREA

- 25.1. Chapter Overview

- 25.2. Key Assumptions and Methodology

- 25.3. Gene Therapy Market: Distribution by Therapeutic Area, 2024, 2029 and 2035

- 25.3.1. Gene Therapy Market for Muscle Disorders, till 2035

- 25.3.2. Gene Therapy Market for Hematological Disorders, till 2035

- 25.3.3. Gene Therapy Market for Dermatological Disorders, till 2035

- 25.3.4. Gene Therapy Market for Oncological Disorders, till 2035

- 25.3.5. Gene Therapy Market for Genetic Disorders, till 2035

- 25.3.6. Gene Therapy Market for Ophthalmic Disorders, till 2035

- 25.3.7. Gene Therapy Market for Metabolic Disorders, till 2035

- 25.3.8. Gene Therapy Market for Cardiovascular Disorders, till 2035

- 25.3.9. Gene Therapy Market for Other Disorders, till 2035

- 25.4. Data Triangulation and Validation

26. GENE THERAPIES MARKET, BY TYPE OF VECTOR

- 26.1. Chapter Overview

- 26.2. Key Assumptions and Methodology

- 26.3. Gene Therapy Market: Distribution by Type of Vector, 2024, 2029 and 2035

- 26.3.1. Gene Therapy Market for Adeno-associated Virus Vectors, till 2035

- 26.3.2. Gene Therapy Market for Herpes Simplex Virus Vectors, till 2035

- 26.3.3. Gene Therapy Market for Lentivirus Vectors, till 2035

- 26.3.4. Gene Therapy Market for Adenovirus Vectors, till 2035

- 26.3.5. Gene Therapy Market for Non-viral Vectors, till 2035

- 26.3.6. Gene Therapy Market for Retrovirus Vectors, till 2035

- 26.3.7. Gene Therapy Market for Other Viral Vectors, till 2035

- 26.4. Data Triangulation and Validation

27. GENE THERAPIES MARKET, BY TYPE OF THERAPY

- 27.1. Chapter Overview

- 27.2. Key Assumptions and Methodology

- 27.3. Gene Therapy Market: Distribution by Type of Therapy, 2024, 2029 and 2035

- 27.3.1. Gene Therapy Market for Gene Augmentation, till 2035

- 27.3.2. Gene Therapy Market for Oncolytic Immunotherapies, till 2035

- 27.3.3. Gene Therapy Market for Gene Editing, till 2035

- 27.3.4. Gene Therapy Market for Gene Regulation, till 2035

- 27.3.5. Gene Therapy Market for Other Therapies, till 2035

- 27.4. Data Triangulation and Validation

28. GENE THERAPIES MARKET, BY TYPE OF GENE DELIVERY METHOD

- 28.1. Chapter Overview

- 28.2. Key Assumptions and Methodology

- 28.3. Gene Therapy Market: Distribution by Type of Gene Delivery Method, 2024, 2029 and 2035

- 28.3.1. Gene Therapy Market for In vivo Gene Delivery, till 2035

- 28.3.2. Gene Therapy Market for Ex vivo Gene Delivery, till 2035

- 28.4. Data Triangulation and Validation

29. GENE THERAPIES MARKET, BY ROUTE OF ADMINISTRATION

- 29.1. Chapter Overview

- 29.2. Key Assumptions and Methodology

- 29.3. Gene Therapy Market: Distribution by Route of Administration, 2024, 2029 and 2035

- 29.3.1. Gene Therapy Market for Intravenous Route, till 2035

- 29.3.2. Gene Therapy Market for Subretinal Route, till 2035

- 29.3.3. Gene Therapy Market for Intratumoral Route, till 2035

- 29.3.4. Gene Therapy Market for Intramuscular Route, till 2035

- 29.3.5. Gene Therapy Market for Other Routes of Administration, till 2035

- 29.4. Data Triangulation and Validation

30. GENE THERAPIES MARKET, BY GEOGRAPHICAL REGIONS

- 30.1. Chapter Overview

- 30.2. Key Assumptions and Methodology

- 30.3. Gene Therapy Market: Distribution by Geographical Regions, 2024, 2029 and 2035

- 30.3.1. Gene Therapy Market in North America, till 2035

- 30.3.2. Gene Therapy Market in Europe, till 2035

- 30.3.3. Gene Therapy Market in Asia-Pacific, till 2035

- 30.3.4. Gene Therapy Market in Latin America, till 2035

- 30.3.5. Gene Therapy Market in Rest of the World, till 2035

- 30.4. Data Triangulation and Validation

31. GENE THERAPIES MARKET, BY LEADING PLAYERS

- 31.1. Chapter Overview

- 31.2. Gene Therapy Market: Distribution by Leading Gene Therapy Developers

- 31.3. Data Triangulation and Validation

32. GENE THERAPIES MARKET, SALES FORECAST OF THERAPIES

- 32.1. Chapter Overview

- 32.2. Key Assumptions and Methodology

- 32.3. Commercialized Gene Therapies Market: Sales Forecast

- 32.3.1. Adstiladrin(R)

- 32.3.1.1. Sales Forecast

- 32.3.1.2. Net Present Value

- 32.3.1.3. Value Creation Analysis

- 32.3.2. BEQVEZ(TM)

- 32.3.2.1. Sales Forecast

- 32.3.2.2. Net Present Value

- 32.3.2.3. Value Creation Analysis

- 32.3.3. Casgevy(TM)

- 32.3.3.1. Sales Forecast

- 32.3.3.2. Net Present Value

- 32.3.3.3. Value Creation Analysis

- 32.3.4. Elevidys(R)

- 32.3.4.1. Sales Forecast

- 32.3.4.2. Net Present Value

- 32.3.4.3. Value Creation Analysis

- 32.3.5. Gendicine(R)

- 32.3.5.1. Sales Forecast

- 32.3.5.2. Net Present Value

- 32.3.5.3. Value Creation Analysis

- 32.3.6. Hemgenix(R)

- 32.3.6.1. Sales Forecast

- 32.3.6.2. Net Present Value

- 32.3.6.3. Value Creation Analysis

- 32.3.7. IMLYGIC(R)

- 32.3.7.1. Sales Forecast

- 32.3.7.2. Net Present Value

- 32.3.7.3. Value Creation Analysis

- 32.3.8. Libmeldy(R)

- 32.3.8.1. Sales Forecast

- 32.3.8.2. Net Present Value

- 32.3.8.3. Value Creation Analysis

- 32.3.9. Luxturna(R)

- 32.3.9.1. Sales Forecast

- 32.3.9.2. Net Present Value

- 32.3.9.3. Value Creation Analysis

- 32.3.10. LYFGENIA(TM)

- 32.3.10.1. Sales Forecast

- 32.3.10.2. Net Present Value

- 32.3.10.3. Value Creation Analysis

- 32.3.11. Neovasculgen(R)

- 32.3.11.1. Sales Forecast

- 32.3.11.2. Net Present Value

- 32.3.11.3. Value Creation Analysis

- 32.3.12. Oncorine(R)

- 32.3.12.1. Sales Forecast

- 32.3.12.2. Net Present Value

- 32.3.12.3. Value Creation Analysis

- 32.3.13. Roctavian(TM)

- 32.3.13.1. Sales Forecast

- 32.3.13.2. Net Present Value

- 32.3.13.3. Value Creation Analysis

- 32.3.14. SKYSONA(R)

- 32.3.14.1. Sales Forecast

- 32.3.14.2. Net Present Value

- 32.3.14.3. Value Creation Analysis

- 32.3.15. Strimvelis(TM)

- 32.3.15.1. Sales Forecast

- 32.3.15.2. Net Present Value

- 32.3.15.3. Value Creation Analysis

- 32.3.16. Upstaza(TM)

- 32.3.16.1. Sales Forecast

- 32.3.16.2. Net Present Value

- 32.3.16.3. Value Creation Analysis

- 32.3.17. VYJUVEKT(R)

- 32.3.17.1. Sales Forecast

- 32.3.17.2. Net Present Value

- 32.3.17.3. Value Creation Analysis

- 32.3.18. Zolgensma(R)

- 32.3.18.1. Sales Forecast

- 32.3.18.2. Net Present Value

- 32.3.18.3. Value Creation Analysis

- 32.3.19. Zynteglo(TM)

- 32.3.19.1. Sales Forecast

- 32.3.19.2. Net Present Value

- 32.3.19.3. Value Creation Analysis

- 32.3.1. Adstiladrin(R)

- 32.4. Phase III Gene Therapies Market: Sales Forecast

- 32.4.1. AAV-RPE65

- 32.4.1.1. Sales Forecast

- 32.4.1.2. Net Present Value

- 32.4.1.3. Value Creation Analysis

- 32.4.2. ABO-102 (UX111)

- 32.4.2.1. Sales Forecast

- 32.4.2.2. Net Present Value

- 32.4.2.3. Value Creation Analysis

- 32.4.3. AGTC 501 (rAAV2tYF-GRK1-RPGR)

- 32.4.3.1. Sales Forecast

- 32.4.3.2. Net Present Value

- 32.4.3.3. Value Creation Analysis

- 32.4.4. Cretostimogene Grenadenorepvec (CG0070)

- 32.4.4.1. Sales Forecast

- 32.4.4.2. Net Present Value

- 32.4.4.3. Value Creation Analysis

- 32.4.5. Dirloctocogene samoparvovec (SPK-8011)

- 32.4.5.1. Sales Forecast

- 32.4.5.2. Net Present Value

- 32.4.5.3. Value Creation Analysis

- 32.4.6. DTx-301

- 32.4.6.1. Sales Forecast

- 32.4.6.2. Net Present Value

- 32.4.6.3. Value Creation Analysis

- 32.4.7. DTx-401

- 32.4.7.1. Sales Forecast

- 32.4.7.2. Net Present Value

- 32.4.7.3. Value Creation Analysis

- 32.4.8. Generx(R) (Ad5FGF-4)

- 32.4.8.1. Sales Forecast

- 32.4.8.2. Net Present Value

- 32.4.8.3. Value Creation Analysis

- 32.4.9. Giroctocogene fitelparvovec (SB-525 / PF-07055480)

- 32.4.9.1. Sales Forecast

- 32.4.9.2. Net Present Value

- 32.4.9.3. Value Creation Analysis

- 32.4.10. Hologene 5

- 32.4.10.1. Sales Forecast

- 32.4.10.2. Net Present Value

- 32.4.10.3. Value Creation Analysis

- 32.4.11. INVOSSA(TM) (TG-C)

- 32.4.11.1. Sales Forecast

- 32.4.11.2. Net Present Value

- 32.4.11.3. Value Creation Analysis

- 32.4.12. LUMEVOQ(R)

- 32.4.12.1. Sales Forecast

- 32.4.12.2. Net Present Value

- 32.4.12.3. Value Creation Analysis

- 32.4.13. NFS-01 (rAAV2-ND4)

- 32.4.13.1. Sales Forecast

- 32.4.13.2. Net Present Value

- 32.4.13.3. Value Creation Analysis

- 32.4.14. NTLA-2001

- 32.4.14.1. Sales Forecast

- 32.4.14.2. Net Present Value

- 32.4.14.3. Value Creation Analysis

- 32.4.15. Olvi-Vec (Olvimulogene nanivacirepvec)

- 32.4.15.1. Sales Forecast

- 32.4.15.2. Net Present Value

- 32.4.15.3. Value Creation Analysis

- 32.4.16. ProstAtak(R)

- 32.4.16.1. Sales Forecast

- 32.4.16.2. Net Present Value

- 32.4.16.3. Value Creation Analysis

- 32.4.17. pz-cel (prademagene zamikeracel / EB-101)

- 32.4.17.1. Sales Forecast

- 32.4.17.2. Net Present Value

- 32.4.17.3. Value Creation Analysis

- 32.4.18. RGX-121

- 32.4.18.1. Sales Forecast

- 32.4.18.2. Net Present Value

- 32.4.18.3. Value Creation Analysis

- 32.4.19. RGX-314

- 32.4.19.1. Sales Forecast

- 32.4.19.2. Net Present Value

- 32.4.19.3. Value Creation Analysis

- 32.4.20. VGX-3100

- 32.4.20.1. Sales Forecast

- 32.4.20.2. Net Present Value

- 32.4.20.3. Value Creation Analysis

- 32.4.1. AAV-RPE65

33. GENE THERAPY MARKET: EMERGING TECHNOLOGIES

- 33.1. Chapter Overview

- 33.2. Gene Editing Technologies

- 33.2.1. Applications of Gene Editing

- 33.3. Emerging Gene Editing Platforms

- 33.3.1. CRISPR / Cas9 System

- 33.3.1.1. Technology Providers

- 33.3.2. Zinc Finger Nuclease

- 33.3.2.1. Technology Providers

- 33.3.3. TALENs

- 33.3.4. megaTAL

- 33.3.4.1. Technology Providers

- 33.3.1. CRISPR / Cas9 System

- 33.4. Gene Therapy Regulation Technologies (Gene Switch Technology)

- 33.4.1. Technology Providers

- 33.5. Other Emerging Technologies

- 33.6. Technology Platforms for Developing / Delivering Gene Therapies

- 33.7. Concluding Remarks

34. VECTOR MANUFACTURING FOR GENE THERAPIES

- 34.1. Chapter Overview

- 34.2. Viral Vector Manufacturing Process

- 34.2.1. Mode of Vector Production

- 34.2.2. Adherent and Suspension Cultures

- 34.2.3. Unit Processes and Multiple Parallel Processes

- 34.2.4. Cell Culture Systems for Production of Viral Vectors

- 34.2.4.1. Small-Scale / Laboratory Scale Cell Culture Systems

- 34.2.4.2. Large-Scale Cell Culture Systems

- 34.2.4.2.1. Stirred Tank Reactor Systems

- 34.2.4.2.2. Fixed Bed Reactor / Packed Bed Reactor

- 34.2.4.2.3. WAVE Bioreactor System

- 34.2.5. Culture Media Specifications

- 34.3. Bioprocessing of Viral Vectors

- 34.3.1. AAV Vector Production

- 34.3.2. Adenoviral Vector Production

- 34.3.3. Lentiviral Vector Production

- 34.3.4. Y - Retroviral Vector Production

- 34.4. Challenges Associated with Vector Manufacturing

- 34.5. Contract Manufacturing Organizations Involved in Viral Vector Production

35. CASE STUDY: GENE THERAPY SUPPLY CHAIN

- 35.1. Chapter Overview

- 35.2. Overview of Gene Therapy Supply Chain

- 35.3. Implementation of Supply Chain Models

- 35.4. Logistics in Gene Therapy

- 35.4.1. Logistic Processes for Autologous and Allogenic Therapies

- 35.5. Regulatory Supply Chain Across the Globe

- 35.6. Challenges Associated with Gene Therapy Supply Chain

- 35.7. Software Applications for Gene Therapy Supply Chain Management

- 35.7.1. Enterprise Manufacturing System

- 35.7.2. Laboratory Information Management System

- 35.7.3. Inventory Management System

- 35.7.4. Quality Management System

- 35.7.5. Logistics Management System

- 35.7.6. Patient Management System

- 35.7.7. Electronic Clinical Outcome Assessments System

- 35.7.8. Supply Chain Orchestration Platform

- 35.8. Recent Developments and Upcoming Trends

36. EXECUTIVE INSIGHTS

37. CONCLUSION

38. APPENDIX I: TABULATED DATA

39. APPENDIX II: LIST OF COMPANIES AND ORGANIZATIONS

List of Tables

- Table 6.1 Comparison of Ex vivo and In vivo Techniques

- Table 6.2 Routes of Administration of Gene Therapies: Advantages and Disadvantages

- Table 6.3 Advantages and Disadvantages of Gene Therapies

- Table 7.1 Key Features of Viral Vectors

- Table 8.1 Payment Options Available for Gene Therapies

- Table 8.2 Approved Advanced Therapies Medicinal Products (ATMPs) and their Reimbursement Status in Europe

- Table 9.1 Marketed and Clinical Stage Gene Therapies: Information on Developer, Stage of Development and Drug Designation

- Table 9.2 Marketed and Clinical Stage Gene Therapies: Information on Developer, Therapeutic Area and Biological Target

- Table 9.3 Marketed and Clinical Stage Gene Therapies: Information on Developer and Type of Vector Used

- Table 9.4 Marketed and Clinical Stage Gene Therapies: Information on Developer, Type of Therapy and Type of Gene Delivery Method

- Table 9.5 Marketed and Clinical Stage Gene Therapies: Information on Developer, Route of Administration and Dosage

- Table 9.6 Preclinical and Discovery Stage Gene Therapies: Information on Developer, Stage of Development, Therapeutic Area and Biological Target

- Table 9.7 Preclinical and Discovery Stage Gene Therapies: Information on Developer and Type of Vector Used

- Table 9.8 Preclinical and Discovery Stage Gene Therapies: Information on Developer, Type of Therapy and Type of Gene Delivery Method

- Table 10.1 Gene Therapy Developers: Information on Year of Establishment, Company Size and Location of Headquarters

- Table 11.1 Gene Therapy: List of Companies Profiled

- Table 11.2 Amgen: Company Overview

- Table 11.3 Amgen: Marketed Gene Therapy Portfolio

- Table 11.4 Amgen: Clinical Stage Gene Therapy Portfolio

- Table 11.5 bluebird bio: Company Overview

- Table 11.6 bluebird bio: Marketed Gene Therapy Portfolio

- Table 11.7 bluebird bio: Preclinical and Discovery Stage Gene Therapy Portfolio

- Table 11.8 bluebird bio: Recent Developments and Future Outlook

- Table 11.9 BioMarin Pharmaceutical: Company Overview

- Table 11.10 BioMarin Pharmaceutical: Marketed Gene Therapy Portfolio

- Table 11.11 BioMarin Pharmaceutical: Preclinical Stage Gene Therapy Portfolio

- Table 11.12 BioMarin Pharmaceutical: Recent Developments and Future Outlook

- Table 11.13 CRISPR Therapeutics: Company Overview

- Table 11.14 CRISPR Therapeutics: Marketed Gene Therapy Portfolio

- Table 11.15 CRISPR Therapeutics: Preclinical and Discovery Stage Gene Therapy Portfolio

- Table 11.16 CRISPR Therapeutics: Recent Developments and Future Outlook

- Table 11.17 Kolon TissueGene: Company Overview

- Table 11.18 Kolon TissueGene: Marketed Gene Therapy Portfolio

- Table 11.19 Kolon TissueGene: Clinical Stage Gene Therapy Portfolio

- Table 11.20 Kolon TissueGene: Prelinical Stage Gene Therapy Portfolio

- Table 11.21 Kolon TissueGene: Recent Developments and Future Outlook

- Table 11.21 Krystal Biotech: Company Overview

- Table 11.22 Krystal Biotech: Marketed Gene Therapy Portfolio

- Table 11.23 Krystal Biotech: Clinical Stage Gene Therapy Portfolio

- Table 11.24 Krystal Biotech: Preclinical and Discovery Stage Gene Therapy Portfolio

- Table 11.25 Krystal Biotech: Recent Developments and Future Outlook

- Table 11.26 Pfizer: Company Overview

- Table 11.27 Pfizer: Marketed Gene Therapy Portfolio

- Table 11.28 Pfizer: Clinical Stage Gene Therapy Portfolio

- Table 11.29 Pfizer: Preclinical and Discovery Stage Gene Therapy Portfolio

- Table 11.30 Pfizer: Recent Developments and Future Outlook

- Table 11.31 PTC Therapeutics: Company Overview

- Table 11.32 PTC Therapeutics: Marketed Gene Therapy Portfolio

- Table 11.33 PTC Therapeutics: Preclinical Stage Gene Therapy Portfolio

- Table 11.34 PTC Therapeutics: Recent Developments and Future Outlook

- Table 11.35 Sarepta Therapeutics: Company Overview

- Table 11.36 Sarepta Therapeutics: Marketed Gene Therapy Portfolio

- Table 11.37 Sarepta Therapeutics: Clinical Stage Gene Therapy Portfolio

- Table 11.38 Sarepta Therapeutics: Preclinical and Discovery Gene Therapy Portfolio

- Table 11.39 Sarepta Therapeutics: Recent Developments and Future Outlook

- Table 11.40 Spark Therapeutics: Company Overview

- Table 11.41 Spark Therapeutics: Marketed Gene Therapy Portfolio

- Table 11.42 Spark Therapeutics: Clinical Stage Gene Therapy Portfolio

- Table 11.43 Spark Therapeutics: Preclinical and Discovery Stage Gene Therapy Portfolio

- Table 11.44 Spark Therapeutics: Recent Developments and Future Outlook

- Table 11.45 Artgen Biotech: Company Overview

- Table 11.46 Artgen Biotech: Marketed Gene Therapy Portfolio

- Table 11.47 Artgen Biotech: Preclinical and Discovery Stage Gene Therapy Portfolio

- Table 11.48 Artgen Biotech: Recent Developments and Future Outlook

- Table 11.49 Ferring Pharmaceuticals: Company Overview

- Table 11.50 Ferring Pharmaceuticals: Marketed Gene Therapy Portfolio

- Table 11.51 Ferring Pharmaceuticals: Clinical Stage Gene Therapy Portfolio

- Table 11.52 Ferring Pharmaceuticals: Recent Developments and Future Outlook

- Table 11.53 Novartis: Company Overview

- Table 11.54 Novartis: Marketed Gene Therapy Portfolio

- Table 11.55 Novartis: Clinical Stage Gene Therapy Portfolio

- Table 11.56 Novartis: Preclinical and Discovery Stage Gene Therapy Portfolio

- Table 11.57 Novartis: Recent Developments and Future Outlook

- Table 11.58 Orchard Therapeutics: Company Overview

- Table 11.59 Orchard Therapeutics: Marketed Gene Therapy Portfolio

- Table 11.60 Orchard Therapeutics: Clinical Stage Gene Therapy Portfolio

- Table 11.61 Orchard Therapeutics: Preclinical Stage Gene Therapy Portfolio

- Table 11.62 Orchard Therapeutics: Recent Developments and Future Outlook

- Table 11.63 CSL Behring: Company Overview

- Table 11.64 CSL Behring: Marketed Gene Therapy Portfolio

- Table 11.65 CSL Behring: Discovery Stage Gene Therapy Portfolio

- Table 11.66 CSL Behring: Recent Developments and Future Outlook

- Table 11.67 Shanghai Sunway Biotech: Company Overview

- Table 11.68 Shanghai Sunway Biotech: Marketed Gene Therapy Portfolio

- Table 11.69 Sibiono GeneTech: Company Overview

- Table 11.70 Sibiono GeneTech: Marketed Gene Therapy Portfolio

- Table 12.1 Gene Therapies: Marketed and Approved Products

- Table 12.2 Company Overview: Sibiono GeneTech

- Table 12.3 Gendicine: Patent Portfolio

- Table 12.4 Gendicine: Stage of Development

- Table 12.5 Company Overview: Shanghai Sunway Biotech

- Table 12.6 Oncorine: Stage of Development

- Table 12.7 Company Overview: Human Stem Cell Institute

- Table 12.8 Neovasculgen: Stage of Development

- Table 12.9 Company Overview: Amgen

- Table 12.10 Imlygic: Stage of Development

- Table 12.11 Imlygic: Recommended Dose and Schedule

- Table 12.12 Imlygic: Determination of Injection Volume based upon Lesion Size

- Table 12.13 Company Overview: Orchard Therapeutics

- Table 12.14 Strimvelis: Stage of Development

- Table 12.15 Company Overview: Spark Therapeutics

- Table 12.16 Luxturna: Stage of Development

- Table 12.17 Company Overview: Novartis

- Table 12.18 Zolgensma: Stage of Development

- Table 12.19 Company Overview: bluebird bio

- Table 12.20 Zynteglo: Stage of Development

- Table 12.21 Libmeldy: Stage of Development

- Table 13.1 Libmeldy: Presentations in Conferences Before Product Approval

- Table 13.2 Luxturna: Presentations in Conferences Before Product Approval

- Table 13.3 Zolgensma: Presentations in Conferences Before Product Approval

- Table 13.4 Zynteglo: Presentations in Conferences Before Product Approval

- Table 13.5 Imlygic: Presentations in Conferences After Product Approval

- Table 13.6 Libmeldy: Presentations in Conferences After Product Approval

- Table 13.7 Luxturna: Presentations in Conferences After Product Approval

- Table 13.8 Strimvelis: Presentations in Conferences After Product Approval

- Table 13.9 Zolgensma: Presentations in Conferences After Product Approval

- Table 13.10 Zynteglo: Presentations in Conferences After Product Approval

- Table 13.11 Approved Gene Therapies: Patient Support Services Available on Product Websites (Comparative Analysis)

- Table 14.1 Gene Therapies: Phase II / III and Above Drugs

- Table 14.2 Drug Profile: LUMEVOQ (GS010)

- Table 14.3 Drug Profile: OTL-103

- Table 14.4 Drug Profile: PTC-AADC

- Table 14.5 Drug Profile: BMN 270

- Table 14.6 Drug Profile: nadofaragene firadenovec (rAd-IFN/Syn3)

- Table 14.7 Drug Profile: beti-cel

- Table 14.8 Drug Profile: eli-cel

- Table 14.9 Drug Profile: lovo-cel

- Table 14.10 Drug Profile: SRP-9001

- Table 14.11 Drug Profile: EB-101

- Table 14.12 Drug Profile: ProstAtak

- Table 14.13 Drug Profile: D-Fi

- Table 14.14 Drug Profile: CG0070

- Table 14.15 Drug Profile: Vigil-EWS

- Table 14.16 Drug Profile: Engensis

- Table 14.17 Drug Profile: VGX-3100

- Table 14.18 Drug Profile: INVOSSA (TG-C)

- Table 14.19 Drug Profile: VYJUVEKT

- Table 14.20 Drug Profile: PF-06939926

- Table 14.21 Drug Profile: PF-06838435

- Table 14.22 Drug Profile: PF-07055480

- Table 14.23 Drug Profile: SPK-8011

- Table 14.24 Drug Profile: AMT-061

- Table 14.25 Drug Profile: VB-111

- Table 14.26 Drug Profile: Generx

- Table 14.27 Drug Profile: ADXS-HPV

- Table 14.28 Drug Profile: AGTC 501

- Table 14.29 Drug Profile: LYS-SAF302

- Table 14.30 Drug Profile: NFS-01

- Table 14.31 Drug Profile: AG0302-COVID19

- Table 14.32 Drug Profile: RGX-314

- Table 14.33 Drug Profile: Hologene 5

- Table 15.1 Gene Therapy Patent Portfolio: List of Top CPC Symbols

- Table 15.2 Gene Therapy Patent Portfolio: Summary of Benchmarking Analysis

- Table 15.3 Gene Therapy Patent Portfolio: Categorizations based on Weighted Valuation Scores

- Table 15.4 Gene Therapy Patent Portfolio: List of Leading Patents (In terms of Highest Relative Valuation)

- Table 15.5 Gene Editing Patent Portfolio: List of Top CPC Classifications

- Table 15.6 Gene Editing Patent Portfolio: Summary of Benchmarking Analysis

- Table 15.7 Gene Editing Patent Portfolio: Categorizations based on Weighted Valuation Scores

- Table 15.8 Gene Editing Patent Portfolio: List of Leading Patents (in terms of Highest Relative Valuation)

- Table 16.1 Gene Therapy: List of Mergers and Acquisitions, since 2015

- Table 16.2 Acquisitions: Key Value Drivers

- Table 16.3 Mergers and Acquisitions: Information on Phase of Development and Therapeutic Area of the Acquired Company's Gene Therapy Product

- Table 16.4 Mergers and Acquisitions: Information on Deal Multiple based on Acquisition Amount

- Table 17.1 Gene Therapy Market: Funding and Investments, since 2015

- Table 17.2 Funding and Investments: Summary of Investments

- Table 17.3 Funding and Investments: Summary of Venture Capital Funding

- Table 18.1 Clinical Trial Analysis: Emerging Molecules to Watch

- Table 18.2 Clinical Trial Analysis: Most Important Trials to Watch

- Table 19.1 Pricing Model: Price of Marketed Gene / Cell Therapies

- Table 19.2 Pricing Model: Price of Marketed Targeted Drugs (Antibody Drug Conjugates and Monoclonal Antibodies)

- Table 19.3 Pricing Model: Opinions of Experts / Other Analysts

- Table 20.1 Start-up Valuation: Estimates based on Overall Experience

- Table 22.1 Global Clinical Demand for Gene Therapies: Information on Trial Phase, Distribution of Patient Enrolment and Average Number of Patients Enrolled

- Table 24.1 Gene Therapy Market: List of Forecasted Therapies along with Information on Developer, Stage of Development and First Launch Year / Likely Approval Year

- Table 32.1 Adstiladrin(R): Net Present Value (USD Million)

- Table 32.2 Adstilarin(R): Value Creation Analysis (USD Million)

- Table 32.3 BEQVEZ(TM): Net Present Value (USD Million)

- Table 32.4 BEQVEZ(TM): Value Creation Analysis (USD Million)

- Table 32.5 Casgevy(TM): Net Present Value (USD Million)

- Table 32.6 Casgevy(TM): Value Creation Analysis (USD Million)

- Table 32.7 Elevidys(R): Net Present Value (USD Million)

- Table 32.8 Elevidys(R): Value Creation Analysis (USD Million)

- Table 32.9 Gendicine(R): Net Present Value (USD Million)

- Table 32.10 Gendicine(R): Value Creation Analysis (USD Million)

- Table 32.11 Hemgenix(R): Net Present Value (USD Million)

- Table 32.12 Hemgenix(R): Value Creation Analysis (USD Million)

- Table 32.13 IMLYGIC(R): Net Present Value (USD Million)

- Table 32.14 IMLYGIC(R): Value Creation Analysis (USD Million)

- Table 32.15 Libmeldy(R): Net Present Value (USD Million)

- Table 32.16 Libmeldy(R): Value Creation Analysis (USD Million)

- Table 32.17 Luxturna(R): Net Present Value (USD Million)

- Table 32.18 Luxturna(R): Value Creation Analysis (USD Million)

- Table 32.19 LYFGENIA(TM): Net Present Value (USD Million)

- Table 32.20 LYFGENIA(TM): Value Creation Analysis (USD Million)

- Table 32.21 Neovasculgen(R): Net Present Value (USD Million)

- Table 32.22 Neovasculgen(R): Value Creation Analysis (USD Million)

- Table 32.23 Oncorine(R): Net Present Value (USD Million)

- Table 32.24 Oncorine(R): Value Creation Analysis (USD Million)

- Table 32.25 Roctavian(TM): Net Present Value (USD Million)

- Table 32.26 Roctavian(TM): Value Creation Analysis (USD Million)

- Table 32.27 SKYSONA(R): Net Present Value (USD Million)

- Table 32.28 SKYSONA(R): Value Creation Analysis (USD Million)

- Table 32.29 Strimvelis(TM): Net Present Value (USD Million)

- Table 32.30 Strimvelis(TM): Value Creation Analysis (USD Million)

- Table 32.31 Upstaza(TM): Net Present Value (USD Million)

- Table 32.32 Upstaza(TM): Value Creation Analysis (USD Million)

- Table 32.33 VYJUVEKT(R): Net Present Value (USD Million)

- Table 32.34 VYJUVEKT(R): Value Creation Analysis (USD Million)

- Table 32.35 Zolgensma(R): Net Present Value (USD Million)

- Table 32.36 Zolgensma(R): Value Creation Analysis (USD Million)

- Table 32.37 Zynteglo(TM): Net Present Value (USD Million)

- Table 32.38 Zynteglo(TM): Value Creation Analysis (USD Million)

- Table 32.39 AAV-RPE65: Net Present Value (USD Million)

- Table 32.40 AAV-RPE65: Value Creation Analysis (USD Million)

- Table 32.41 ABO-102 (UX111): Net Present Value (USD Million)

- Table 32.42 ABO-102 (UX111): Value Creation Analysis (USD Million)

- Table 32.43 AGTC 501 (rAAV2tYF-GRK1-RPGR): Net Present Value (USD Million)

- Table 32.44 AGTC 501 (rAAV2tYF-GRK1-RPGR): Value Creation Analysis (USD Million)

- Table 32.45 Cretostimogene Grenadenorepvec (CG0070): Net Present Value (USD Million)

- Table 32.46 Cretostimogene Grenadenorepvec (CG0070: Value Creation Analysis (USD Million)

- Table 32.47 Dirloctocogene samoparvovec (SPK-8011): Net Present Value (USD Million)

- Table 32.48 Dirloctocogene samoparvovec (SPK-8011): Value Creation Analysis (USD Million)

- Table 32.49 DTx-301: Net Present Value (USD Million)

- Table 32.50 DTx-301: Value Creation Analysis (USD Million)

- Table 32.51 DTx-401: Net Present Value (USD Million)

- Table 32.52 DTx-401: Value Creation Analysis (USD Million)

- Table 32.53 Generx(R) (Ad5FGF-4): Net Present Value (USD Million)

- Table 32.54 Generx(R) (Ad5FGF-4): Value Creation Analysis (USD Million)

- Table 32.55 Giroctocogene fitelparvovec (SB-525 / PF-07055480): Net Present Value (USD Million)

- Table 32.56 Giroctocogene fitelparvovec (SB-525 / PF-07055480): Value Creation Analysis (USD Million)

- Table 32.57 Hologene 5: Net Present Value (USD Million)

- Table 32.58 Hologene 5: Value Creation Analysis (USD Million)

- Table 32.59 INVOSSA(TM) (TG-C): Net Present Value (USD Million)

- Table 32.60 INVOSSA(TM) (TG-C): Value Creation Analysis (USD Million)

- Table 32.61 LUMEVOQ(R): Net Present Value (USD Million)

- Table 32.62 LUMEVOQ(R): Value Creation Analysis (USD Million)

- Table 32.63 NFS-01 (rAAV2-ND4): Net Present Value (USD Million)

- Table 32.64 NFS-01 (rAAV2-ND4): Value Creation Analysis (USD Million)

- Table 32.65 NTLA-2001: Net Present Value (USD Million)

- Table 32.66 NTLA-2001: Value Creation Analysis (USD Million)

- Table 32.67 Olvi-Vec (Olvimulogene nanivacirepvec): Net Present Value (USD Million)

- Table 32.68 Olvi-Vec (Olvimulogene nanivacirepvec): Value Creation Analysis (USD Million)

- Table 32.69 ProstAtak(R): Net Present Value (USD Million)

- Table 32.70 ProstAtak(R): Value Creation Analysis (USD Million)

- Table 32.71 pz-cel (prademagene zamikeracel / EB-101): Net Present Value (USD Million)

- Table 32.72 pz-cel (prademagene zamikeracel / EB-101): Value Creation Analysis (USD Million)

- Table 32.73 RGX-121: Net Present Value (USD Million)

- Table 32.74 RGX-121: Value Creation Analysis (USD Million)

- Table 32.75 RGX-314: Net Present Value (USD Million)

- Table 32.76 RGX-314: Value Creation Analysis (USD Million)

- Table 32.77 VGX-3100: Net Present Value (USD Million)

- Table 32.78 VGX-3100: Value Creation Analysis (USD Million)

- Table 32.79 Summary of Variations in Forecasted Sales Revenue of Gene Therapies (Compared to 5th Edition)

- Table 33.1 Gene Editing Technologies: Information on Developer and Highest Phase of Drug Development Supported

- Table 33.2 Key Features of Gene Editing Platforms

- Table 33.3 ASC Therapeutics: Collaborations

- Table 33.4 CRISPR Therapeutics: Funding Instances

- Table 33.5 CRISPR Therapeutics: Collaborations

- Table 33.6 Editas Medicine: Funding Instances

- Table 33.7 Editas Medicine: Collaborations

- Table 33.8 Emendo Biotherapeutics: Collaborations

- Table 33.9 Excision Biotherapeutics: Funding Instances

- Table 33.10 Intellia Therapeutics: Funding Instances

- Table 33.11 Intellia Therapeutics: Collaborations

- Table 33.12 Sarepta Therapeutics: Funding Instances

- Table 33.13 Sarepta Therapeutics: Collaborations

- Table 33.14 ToolGen: Collaborations

- Table 33.15 Sangamo Therapeutics: Funding Instances

- Table 33.16 Sangamo Therapeutics: Collaborations

- Table 33.17 bluebird bio: Funding Instances

- Table 34.18 bluebird bio: Collaborations

- Table 34.19 Gene Switch Technology Platforms

- Table 33.20 Precigen: Funding Instances

- Table 33.21 MeiraGTx: Funding Instances

- Table 33.22 MeiraGTx: Collaborations

- Table 33.23 Gene Therapy Developers: Information on Headquarters, Technology / Platform and Type of Gene Delivery Method

- Table 34.1 Key Features of Small-scale Cell Culture Systems

- Table 34.2 List of Viral Vector Contract Manufacturing Organizations: Information on Type of Viral Vector Manufactured

- Table 36.1 Orchard Therapeutics: Company Snapshot

- Table 36.2 Vivet Therapeutics: Company Snapshot

- Table 36.3 Kubota Pharmaceutical: Company Snapshot

- Table 36.4 Eyevensys: Company Snapshot

- Table 36.5 AGTC: Company Snapshot

- Table 36.6 LogicBio Therapeutics: Company Snapshot

- Table 36.7 AAVogen: Company Snapshot

- Table 36.8 Hemera Biosciences: Company Snapshot

- Table 36.9 Myonexus Therapeutics: Company Snapshot

- Table 36.10 Arthrogen: Company Snapshot

- Table 36.11 PlasmidFactory: Company Snapshot

- Table 36.12 Delphi Genetics: Company Snapshot

- Table 36.13 Vigene Biosciences: Company Snapshot

- Table 36.14 Gene Biotherapeutics: Company Snapshot

- Table 36.15 Milo Biotechnology: Company Snapshot

- Table 38.1 Marketed and Clinical Stage Gene Therapies: Distribution by Stage of Development

- Table 38.2 Marketed and Clinical Stage Gene Therapies: Distribution by Drug Designation

- Table 38.3 Marketed and Clinical Stage Gene Therapies: Distribution by Therapeutic Area

- Table 38.4 Marketed and Clinical Stage Gene Therapies: Distribution by Biological Target

- Table 38.5 Marketed and Clinical Stage Gene Therapies: Distribution by Type of Vector Used

- Table 38.6 Marketed and Clinical Stage Gene Therapies: Distribution by Type of Therapy

- Table 38.7 Marketed and Clinical Stage Gene Therapies: Distribution by Type of Gene Delivery Method

- Table 38.8 Marketed and Clinical Stage Gene Therapies: Distribution by Route of Administration

- Table 38.9 Marketed and Clinical Stage Gene Therapies: Distribution by Dosage

- Table 38.10 Preclinical and Discovery Stage Gene Therapies: Distribution by Stage of Development

- Table 38.11 Preclinical and Discovery Stage Gene Therapies: Distribution by Therapeutic Area

- Table 38.12 Preclinical and Discovery Stage Gene Therapies: Distribution by Biological Target

- Table 38.13 Preclinical and Discovery Stage Gene Therapies: Distribution by Type of Vector Used

- Table 38.14 Preclinical and Discovery Stage Gene Therapies: Distribution by Type of Therapy

- Table 38.15 Preclinical and Discovery Stage Gene Therapies: Distribution by Type of Gene Delivery Method Used

- Table 38.16 Gene Therapy Developers: Distribution by Year of Establishment

- Table 38.17 Gene Therapy Developers: Distribution by Company Size

- Table 38.18 Gene Therapy Developers: Distribution by Location of Headquarters

- Table 38.19 Most Active Players: Distribution by Number of Gene Therapies

- Table 38.20 Gene Therapy Patent Portfolio: Distribution by Type of Patent