PUBLISHER: Roots Analysis | PRODUCT CODE: 1616881

PUBLISHER: Roots Analysis | PRODUCT CODE: 1616881

Connected Drug Delivery Devices Market by Type of Device, Mode of Connectivity, Route of Administration, Therapeutic Area, and Geographical Regions: Industry Trends and Global Forecasts, Till 2035

CONNECTED DRUG DELIVERY DEVICES MARKET: OVERVIEW

As per Roots Analysis, the global connected drug delivery devices market is estimated to grow from USD 4.4 billion in the current year to USD 12.7 billion by 2035, at a CAGR of 10.1% during the forecast period, till 2035.

The market sizing and opportunity analysis has been segmented across the following parameters:

Type of Device

- Connected / Smart Wearable Injectors

- Connected / Smart Inhalers

- Connected / Smart Pen Injectors

- Connected / Smart Autoinjectors

- Connected / Smart Needle-free Injection Systems

Mode of Connectivity

- Bluetooth-enabled Devices

- Near Field Communication-enabled Devices

- Cellular-enabled Devices

- Wide Area Network-enabled Devices

Route of Administration

- Parenteral

- Inhalational

Therapeutic Area

- Metabolic Disorders

- Respiratory Disorders

- Autoimmune Disorders

- Other Disorders

Key Geographical Regions

- North America (US and Canada)

- Europe (UK, Germany, France, Italy, Spain and Rest of the Europe)

- Asia-Pacific (China, India, Japan and Rest of the Asia-Pacific)

- Middle East and North Africa (Egypt, Israel, Argentina and Rest of the Middle East and North Africa)

- Latin America and Rest of the World (Brazil, Argentina and Rest of the World)

CONNECTED DRUG DELIVERY DEVICES MARKET: GROWTH AND TRENDS

Currently, a significant proportion of the global healthcare burden is being attributed to non-adherence to the medication that is prescribed to patients. Poor medication adherence is one of the leading causes of discrepancies between results obtained from randomized clinical studies and real-world health data (captured outside clinical settings). According to the World Health Organization (WHO), two-thirds of the population is prescribed at least one medication. Of these, an estimated 50% of the patients do not follow the treatment regimen as prescribed by the doctors. Some of the factors that have influenced non-adherence amongst the patient population include challenges linked to accessing medications and healthcare services, and the inability to understand complex dosing schedules.

Over the years, several strategies have been developed by various pharmaceutical companies and healthcare providers to improve patient compliance towards their treatment regimens. One such alternative that has gained popularity in the last few years is connected / smart drug delivery devices and other digital health solutions that enable patients / healthcare providers to track the medication activity of patients and thereby, help improve drug adherence. Notably, the integration of connected / smart drug delivery devices with emerging technologies, such as artificial intelligence and blockchain can further enhance the prospects for these devices. With the growing demand for accurate and effective digital health solutions and advancement in technologies (integration with telehealth platforms), the global connected drug delivery devices market is poised to witness steady growth, in the foreseen future.

CONNECTED DRUG DELIVERY DEVICES MARKET: KEY INSIGHTS

The report delves into the current state of the connected drug delivery devices market and identifies potential growth opportunities within the industry. Some key findings from the report include:

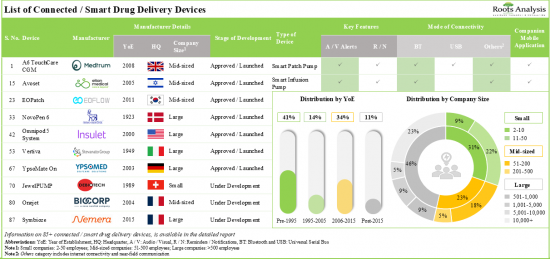

1. More than 85 connected / smart drug delivery devices have been launched / approved or are currently under development; notably, the market landscape features the presence of both established players and new entrants.

2. Smart wearable injectors emerged as the most prominent connected drug delivery device; further, majority of these devices are intended for the administration of medications via subcutaneous route.

3. At present, 30 innovative add-on sensors are available / under development for integration with conventional drug delivery devices; most of the add-on sensor manufacturers are start-ups based in Europe.

4. Close to 50% of the add-on sensors are compatible with inhalers; of these, more than 55% can support all three features, namely audio / visual alerts, bluetooth connectivity and companion mobile application.

5. In pursuit of gaining a competitive edge, stakeholders are actively enhancing their existing capabilities by improving their respective product portfolios and complying to the evolving industry standards.

6. Several clinical trials have been registered related to connected / smart drug delivery devices, across different geographies.

7. More than 25% of the deals related to connected / smart drug delivery devices were inked in the last three years; majority of the intercontinental deals were signed by players based in North America.

8. Several investors have realized the opportunity within the domain by investing multi-billion dollars in the past few years; further, majority of the amount was raised by players based in North America.

9. By analyzing the key drivers and barriers affecting the evolution of connected drug delivery devices market, valuable insights can be generated regarding current and future opportunities within this domain.

10. Owing to the ability of connected drug delivery devices to provide precise dosing and remote patient monitoring, the market is anticipated to witness an annualized growth of 10.1% over the next decade.

CONNECTED DRUG DELIVERY DEVICES MARKET: KEY SEGMENTS

Currently, Connected / Smart Wearable Injectors Segment Holds the Maximum Share of the Connected Drug Delivery Devices Market

Based on the type of device, the market is segmented into connected / smart wearable injectors, connected / smart inhalers, connected / smart pen injectors, connected / smart autoinjectors and connected / smart needle-free injection systems. It is worth highlighting that the current connected drug delivery devices market is dominated by connected / smart wearable injectors. This trend is likely to remain the same in the near future. This can be attributed to the growing prevalence of chronic conditions and the continuous efforts of stakeholders to develop advanced devices.

Connected Drug Delivery Devices Supporting Bluetooth are Likely to Dominate the Connected Drug Delivery Devices Market During the Forecast Period

Based on the mode of connectivity, the market is segmented into Bluetooth-enabled devices, near field communication-enabled devices, cellular-enabled devices, and wide area network-enabled devices. The current market is expected to be driven by connected drug delivery devices supporting Bluetooth and a similar trend is anticipated in the long term. This can be attributed to the widespread adoption of Bluetooth connectivity due to its easy setup process, absence of any need for additional equipment and universal availability on smartphones. Additionally, the reliability and established presence of Bluetooth technology in the market make it a trusted choice for patients seeking connectivity solutions.

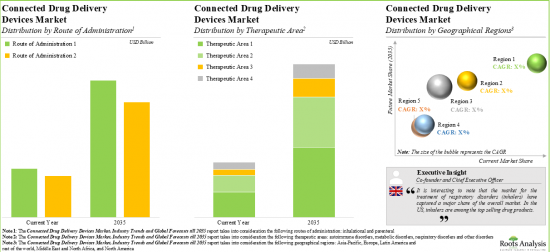

Inhalational Route is the Fastest Growing Segment of the Connected Drug Delivery Devices Market During the Forecast Period

Based on the route of administration, the market is segmented into parenteral and inhalational. It is anticipated that the devices delivering drugs via inhalational route are likely to grow at a higher CAGR during the forecast period. This can be attributed to the fact that administration of drugs via inhalational route is flexible, painless, and offers sustained localized action.

Metabolic Disorders Segment Accounts for the Largest Share of the Connected Drug Delivery Devices Market

Based on the therapeutic area, the market is segmented into metabolic disorders, respiratory disorders, autoimmune disorders and other disorders. While metabolic disorders account for a relatively higher market share, it is worth highlighting that the autoimmune disorders segment is expected to witness substantial market growth in the coming years.

North America Accounts for the Largest Share of the Market

Based on key geographical regions, the market is segmented into North America, Europe and Asia-Pacific. Majority share is expected to be captured by North America and Europe. It is worth highlighting that over the years, the market for Asia-Pacific is expected to grow at a higher CAGR. This can be attributed to the growing research and development activity for novel drug delivery solutions, the increasing number of biopharmaceutical start-ups and the upcoming device approvals in the region.

Example Players in the Connected Drug Delivery Devices Market

- Bigfoot Biomedical

- BIOCORP

- Eitan Medical

- E3D Elcam Drug Delivery Device

- EoFlow

- Gerresheimer

- Insulet

- Medtronic

- Medtrum

- Nemera

- Phillips-Medisize

- Roche

- Sonceboz

- SOOIL Development

- Tandem Diabetes Care

- West Pharmaceutical Services

- Ypsomed

Primary Research Overview

The opinions and insights presented in this study were influenced by discussions conducted with multiple stakeholders. The research report features detailed transcripts of interviews held with the following industry stakeholders:

- Senior Director, Global Strategic Marketing, Medical, Phillips-Medisize

- Co-founder and Chief Executive Officer, Cognita Labs

- Founder and Chief Executive Officer, Portal Instruments

- Chief Executive Officer and President, Enable Injections

- Chief Executive Officer, Amiko

- Vice President and Chief Scientist, Elcam Medical

- Director (Global Communications) and Graham Reynolds, Former Vice President (Strategic Partnerships and Business Development), West Pharmaceutical Services

- Former Chief Executive Officer, Avoset Health (acquired by Eitan Medical)

- Former Director (Front-end Innovation and Head of Connected Health), Phillips-Medisize

- Former Vice President (Marketing and Alliance Management), Sorrel Medical (acquired by LTS lohmann therapie-systeme)

- Advisor (Strategy and Business Development), etectRx

CONNECTED DRUG DELIVERY DEVICES MARKET: RESEARCH COVERAGE

- Market Sizing and Opportunity Analysis: The report features an in-depth analysis of the connected drug delivery devices market, focusing on key market segments, including [A] type of device, [B] mode of connectivity, [C] route of administration, [D] therapeutic area and [E] key geographical regions.

- Market Landscape (Connected / Smart Drug Delivery Devices): A comprehensive evaluation of integrated connected drug delivery devices, considering various parameters, such as [A] stage of development, [B] launch year of device, [C] type of integrated device, [D] route of administration, [E] therapeutic area, [F] target indication, [G] key features, [H] mode of connectivity, [I] availability of companion mobile application and [J] availability of data storage / cloud platform. In addition, it also includes tabulated information on regulatory approvals, geographical reach and drugs compatible with connected / smart drug delivery devices. Further, the chapter provides a detailed list of companies engaged in manufacturing connected drug delivery devices, along with detailed analysis based on various parameters, such as [K] year of establishment, [L] company size (in terms of employee count), [M] location of headquarters and [N] most active players (in terms of the number of integrated connected drug delivery devices manufactured).

- Market Landscape (Add-on Sensors): A comprehensive evaluation of add-on sensors, considering various parameters, such as [A] stage of development, [B] launch year of device, [C] compatible device, [D] route of administration, [E] therapeutic area, [F] target indication, [G] key features, [H] mode of connectivity, [I] availability of companion mobile application and [J] availability of data storage / cloud platform. It also includes detailed information on regulatory approvals, geographical reach and drugs that can be delivered using add-on sensors (in combination with conventional drug delivery devices). In addition, it provides a detailed list of companies engaged in manufacturing add-on sensors for drug delivery devices, along with detailed analysis based on various parameters, such as [K] year of establishment, [L] company size (in terms of employee count), [M] location of headquarters and [N] most active players (in terms of the number of add-on sensors manufactured).

- Product Competitiveness Analysis: A comprehensive competitive analysis of connected drug delivery devices and add-on sensors, examining factors, such as manufacturer strength and portfolio strength.

- Company Profiles: In-depth profiles of key connected drug delivery device providers, based in North America, Europe and Asia-Pacific, focusing on [A] company overviews, [B] financial information (if available), [C] product portfolio, [D] recent developments, and [F] an informed future outlook.

- Clinical Trial Analysis: Examination of completed, ongoing, and planned clinical studies of various connected drug delivery devices based on parameters like [A] trial registration year, [B] enrolled patient population, [C] trial phase, [D] trial status, [E] type of device, [F] type of sponsor / collaborator, [G] therapeutic area, [H] study design, [I] leading industry players (based on number of clinical trials), [J] leading connected / smart drug delivery devices (based on number of clinical trials) and [K] geography.

- Partnerships and Collaborations: An analysis of partnerships established in this sector, since 2020, based on several parameters, such as [A] year of partnership, [B] type of partnership, [C] class of device, [D] type of integrated device, [E] compatible device [F] most active players (in terms of number of partnerships signed) and [G] regional distribution.

- Funding and Investment Analysis: A detailed evaluation of the investments made in the connected drug delivery devices domain, based on several parameters, such as [A] year of funding, amount invested (USD million), [B] type of funding, [C] class of device, [D] geography, [E] most active players (in terms of number of funding instances and amount raised), and [F] most active investors (in terms of number of funding instances).

- Value Chain Analysis: A comprehensive value chain analysis that explores the various stages involved in the development of connected or smart drug delivery devices. This includes a discussion on research and development (R&D), product manufacturing and assembly, distribution, marketing and sales, and post-market surveillance, as well as details on the cost requirements at each of these stages.

- Case Study: Detailed case studies on two most common indications (namely asthma and diabetes), featuring a brief description of the disease, its epidemiology, economic burden (imposed due to non-adherence to prescribed treatments), and a summary of the evolution of drug delivery devices and other strategies focused on improving therapy adherence among patients suffering from the indication.

- Regulatory Landscape: A discussion on general regulatory guidelines issued by major regulatory bodies for the approval of connected drug delivery devices, across different countries / geographical regions.

- SWOT Analysis: A SWOT analysis, focusing on key drivers and challenges that are likely to impact the industry's evolution. Further, it includes a Harvey ball analysis, highlighting the relative effect of each SWOT parameter on the overall industry.

KEY QUESTIONS ANSWERED IN THIS REPORT

- How many companies are currently engaged in this market?

- Which are the leading companies in this market?

- What kind of partnership models are commonly adopted by industry stakeholders?

- What factors are likely to influence the evolution of this market?

- What is the current and future market size?

- What is the CAGR of this market?

- How is the current and future market opportunity likely to be distributed across key market segments?

REASONS TO BUY THIS REPORT

- The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. By analyzing the competitive landscape, businesses can make informed decisions to optimize their market positioning and develop effective go-to-market strategies.

- The report offers stakeholders a comprehensive overview of the market, including key drivers, barriers, opportunities, and challenges. This information empowers stakeholders to stay abreast of market trends and make data-driven decisions to capitalize on growth prospects.

ADDITIONAL BENEFITS

- Complimentary PPT Insights Packs

- Complimentary Excel Data Packs for all Analytical Modules in the Report

- 10% Free Content Customization

- Detailed Report Walkthrough Session with Research Team

- Free Updated report if the report is 6-12 months old or older

TABLE OF CONTENTS

1. PREFACE

- 1.1. Introduction

- 1.2. Market Share Insights

- 1.3. Key Market Insights

- 1.4. Report Coverage

- 1.5. Key Questions Answered

- 1.6. Chapter Outlines

2. RESEARCH METHODOLOGY

- 2.1. Chapter Overview

- 2.2. Research Assumptions

- 2.2.1. Market Landscape and Market Trends

- 2.2.2. Market Forecast and Opportunity Analysis

- 2.2.3. Comparative Analysis

- 2.3. Database Building

- 2.3.1. Data Collection

- 2.3.2. Data Validation

- 2.3.3. Data Analysis

- 2.4. Project Methodology

- 2.4.1. Secondary Research

- 2.4.1.1. Annual Reports

- 2.4.1.2. Academic Research Papers

- 2.4.1.3. Company Websites

- 2.4.1.4. Investor Presentations

- 2.4.1.5. Regulatory Filings

- 2.4.1.6. White Papers

- 2.4.1.7. Industry Publications

- 2.4.1.8. Conferences and Seminars

- 2.4.1.9. Government Portals

- 2.4.1.10. Media and Press Releases

- 2.4.1.11. Newsletters

- 2.4.1.12. Industry Databases

- 2.4.1.13. Roots Proprietary Databases

- 2.4.1.14. Paid Databases and Sources

- 2.4.1.15. Social Media Portals

- 2.4.1.16. Other Secondary Sources

- 2.4.2. Primary Research

- 2.4.2.1. Types of Primary Research

- 2.4.2.1.1. Qualitative Research

- 2.4.2.1.2. Quantitative Research

- 2.4.2.1.3. Hybrid Approach

- 2.4.2.2. Advantages of Primary Research

- 2.4.2.3. Techniques for Primary Research

- 2.4.2.3.1. Interviews

- 2.4.2.3.2. Surveys

- 2.4.2.3.3. Focus Groups

- 2.4.2.3.4. Observational Research

- 2.4.2.3.5. Social Media Interactions

- 2.4.2.4. Key Opinion Leaders Considered in Primary Research

- 2.4.2.4.1. Company Executives (CXOs)

- 2.4.2.4.2. Board of Directors

- 2.4.2.4.3. Company Presidents and Vice Presidents

- 2.4.2.4.4. Research and Development Heads

- 2.4.2.4.5. Technical Experts

- 2.4.2.4.6. Subject Matter Experts

- 2.4.2.4.7. Scientists

- 2.4.2.4.8. Doctors and Other Healthcare Providers

- 2.4.2.5. Ethics and Integrity

- 2.4.2.5.1. Research Ethics

- 2.4.2.5.2. Data Integrity

- 2.4.2.1. Types of Primary Research

- 2.4.3. Analytical Tools and Databases

- 2.4.1. Secondary Research

3. MARKET DYNAMICS

- 3.1. Chapter Overview

- 3.2. Forecast Methodology

- 3.2.1. Top-down Approach

- 3.2.2. Bottom-up Approach

- 3.2.3. Hybrid Approach

- 3.3. Market Assessment Framework

- 3.3.1. Total Addressable Market (TAM)

- 3.3.2. Serviceable Addressable Market (SAM)

- 3.3.3. Serviceable Obtainable Market (SOM)

- 3.3.4. Currently Acquired Market (CAM)

- 3.4. Forecasting Tools and Techniques

- 3.4.1. Qualitative Forecasting

- 3.4.2. Correlation

- 3.4.3. Regression

- 3.4.4. Extrapolation

- 3.4.5. Convergence

- 3.4.6. Sensitivity Analysis

- 3.4.7. Scenario Planning

- 3.4.8. Data Visualization

- 3.4.9. Time Series Analysis

- 3.4.10. Forecast Error Analysis

- 3.5. Key Considerations

- 3.5.1. Demographics

- 3.5.2. Government Regulations

- 3.5.3. Reimbursement Scenarios

- 3.5.4. Market Access

- 3.5.5. Supply Chain

- 3.5.6. Industry Consolidation

- 3.5.7. Pandemic / Unforeseen Disruptions Impact

- 3.6. Key Market Segmentation

- 3.7. Robust Quality Control

- 3.8. Limitations

4. ECONOMIC AND OTHER PROJECT SPECIFIC CONSIDERATIONS

- 4.1. Chapter Overview

- 4.2. Market Dynamics

- 4.2.1. Time Period

- 4.2.1.1. Historical Trends

- 4.2.1.2. Current and Forecasted Estimates

- 4.2.2. Currency Coverage

- 4.2.2.1. Overview of Major Currencies Affecting the Market

- 4.2.2.2. Impact of Currency Fluctuations on the Industry

- 4.2.3. Foreign Exchange Impact

- 4.2.3.1. Evaluation of Foreign Exchange Rates and Their Impact on Market

- 4.2.3.2. Strategies for Mitigating Foreign Exchange Risk

- 4.2.4. Recession

- 4.2.4.1. Historical Analysis of Past Recessions and Lessons Learnt

- 4.2.4.2. Assessment of Current Economic Conditions and Potential Impact on the Market

- 4.2.5. Inflation

- 4.2.5.1. Measurement and Analysis of Inflationary Pressures in the Economy

- 4.2.5.2. Potential Impact of Inflation on the Market Evolution

- 4.2.1. Time Period

5. EXECUTIVE SUMMARY

6. INTRODUCTION

- 6.1. Chapter Overview

- 6.2. Medication Adherence

- 6.2.1. Digital Tools for Improving Medication Adherence

- 6.3. Overview of Connected / Smart Drug Delivery Devices

- 6.4. Key Design Features and Development Process

- 6.5. Classification of Connected / Smart Drug Delivery Devices

- 6.5.1. Type of Device

- 6.5.1.1. Connected Inhalers

- 6.5.1.2. Connected Handheld Injectors

- 6.5.1.3. Smart Pills

- 6.5.1.4. Smart Implantable Devices

- 6.5.2. Type of Technology

- 6.5.1. Type of Device

- 6.6. Regulatory Guidelines for Connected / Smart Drug Delivery Devices

- 6.7. Advantages and Limitations of Connected / Smart Drug Delivery Devices

- 6.8. Impact of COVID-19 on Connected / Smart Drug Delivery Devices Domain

- 6.9. Future Perspectives

7. MARKET LANDSCAPE: CONNECTED / SMART DRUG DELIVERY DEVICES

- 7.1. Chapter Overview

- 7.2. Connected / Smart Drug Delivery Devices: Overall Market Landscape

- 7.2.1. Analysis by Stage of Development

- 7.2.2. Analysis by Launch Year

- 7.2.3. Analysis by Type of Integrated Device

- 7.2.4. Analysis by Route of Administration

- 7.2.5. Analysis by Therapeutic Area

- 7.2.6. Analysis by Target Indication

- 7.2.7. Analysis by Key Features

- 7.2.8. Analysis by Mode of Connectivity

- 7.2.9. Analysis by Availability of Companion Mobile Application

- 7.2.10. Analysis by Availability of Data Storage / Cloud Platform

- 7.3. Connected / Smart Drug Delivery Device Manufacturers: Overall Market Landscape

- 7.3.1. Analysis by Year of Establishment

- 7.3.2. Analysis by Company Size

- 7.3.3. Analysis by Location of Headquarters

- 7.3.4. Analysis by Year of Establishment and Location of Headquarters

- 7.3.5. Analysis by Company Size and Location of Headquarters

- 7.3.6. Most Active Players: Analysis by Number of Connected / Smart Drug Delivery Devices Manufactured

8. MARKET LANDSCAPE: ADD-ON SENSORS

- 8.1. Chapter Overview

- 8.2. Add-on Sensors: Overall Market Landscape

- 8.2.1. Analysis by Stage of Development

- 8.2.2. Analysis by Launch Year

- 8.2.3. Analysis by Compatible Device

- 8.2.4. Analysis by Route of Administration

- 8.2.5. Analysis by Therapeutic Area

- 8.2.6. Analysis by Target Indication

- 8.2.7. Analysis by Key Features

- 8.2.8. Analysis by Mode of Connectivity

- 8.2.9. Analysis by Availability of Companion Mobile Application

- 8.2.10. Analysis by Availability of Data Storage / Cloud Platform

- 8.3. Add-on Sensor Manufacturers: Overall Market Landscape

- 8.3.1. Analysis by Year of Establishment

- 8.3.2. Analysis by Company Size

- 8.3.3. Analysis by Location of Headquarters

- 8.3.4. Analysis by Year of Establishment and Location of Headquarters

- 8.3.5. Analysis by Company Size and Location of Headquarters

- 8.3.6. Most Active Players: Analysis by Number of Add-on Sensors Manufactured

9. PRODUCT COMPETITIVENESS ANALYSIS

- 9.1. Chapter Overview

- 9.2. Assumptions and Key Parameters

- 9.3. Methodology

- 9.4. Connected Drug Delivery Devices and Add-on Sensors: Product Competitiveness Analysis

- 9.4.1. Connected / Smart Drug Delivery Devices

- 9.4.1.1. Smart Handheld Injectors (Peer Group 1a)

- 9.4.1.2. Smart Wearable Injectors (Peer Group 1b)

- 9.4.1.3. Other Integrated Devices (Peer Group 1c)

- 9.4.2. Add-on Sensors ((Peer Group 2)

- 9.4.1. Connected / Smart Drug Delivery Devices

10. COMPANY PROFILES: CONNECTED / SMART DRUG DELIVERY DEVICE MANUFACTURERS BASED IN NORTH AMERICA

- 10.1. Chapter Overview

- 10.2. Leading Connected / Smart Drug Delivery Device Manufacturers

- 10.2.1. Medtronic

- 10.2.1.1. Company Overview

- 10.2.1.2. Financial Information

- 10.2.1.3. Connected / Smart Drug Delivery Devices Portfolio

- 10.2.1.4. Recent Developments and Future Outlook

- 10.2.2. Insulet

- 10.2.2.1. Company Overview

- 10.2.2.2. Financial Information

- 10.2.2.3. Connected / Smart Drug Delivery Devices Portfolio

- 10.2.2.4. Recent Developments and Future Outlook

- 10.2.3. Tandem Diabetes Care

- 10.2.3.1. Company Overview

- 10.2.3.2. Financial Information

- 10.2.3.3. Connected / Smart Drug Delivery Devices Portfolio

- 10.2.3.4. Recent Developments and Future Outlook

- 10.2.1. Medtronic

- 10.3. Other Prominent Connected / Smart Drug Delivery Device Manufacturers

- 10.3.1. Bigfoot Biomedical

- 10.3.1.1. Company Overview

- 10.3.1.2. Connected / Smart Drug Delivery Devices Portfolio

- 10.3.2. Phillips-Medisize

- 10.3.2.1. Company Overview

- 10.3.2.2. Connected / Smart Drug Delivery Devices Portfolio

- 10.3.3. West Pharmaceutical Services

- 10.3.3.1. Company Overview

- 10.3.3.2. Connected / Smart Drug Delivery Devices Portfolio

- 10.3.1. Bigfoot Biomedical

11. COMPANY PROFILES: CONNECTED / SMART DRUG DELIVERY DEVICE MANUFACTURERS BASED IN EUROPE

- 11.1. Chapter Overview

- 11.2. Leading Connected / Smart Drug Delivery Device Manufacturers

- 11.2.1. BIOCORP

- 11.2.1.1. Company Overview

- 11.2.1.2. Financial Information

- 11.2.1.3. Connected / Smart Drug Delivery Devices Portfolio

- 11.2.1.4. Recent Developments and Future Outlook

- 11.2.2. Gerresheimer

- 11.2.2.1. Company Overview

- 11.2.2.2. Financial Information

- 11.2.2.3. Connected / Smart Drug Delivery Devices Portfolio

- 11.2.2.4. Recent Developments and Future Outlook

- 11.2.3. Roche

- 11.2.3.1. Company Overview

- 11.2.3.2. Financial Information

- 11.2.3.3. Connected / Smart Drug Delivery Devices Portfolio

- 11.2.3.4. Recent Developments and Future Outlook

- 11.2.4. Ypsomed

- 11.2.4.1. Company Overview

- 11.2.4.2. Financial Information

- 11.2.4.3. Connected / Smart Drug Delivery Devices Portfolio

- 11.2.4.4. Recent Developments and Future Outlook

- 11.2.1. BIOCORP

- 11.3. Other Prominent Connected / Smart Drug Delivery Device Manufacturers

- 11.3.1. Nemera

- 11.3.1.1. Company Overview

- 11.3.1.2. Connected / Smart Drug Delivery Devices Portfolio

- 11.3.2. Sonceboz

- 11.3.2.1. Company Overview

- 11.3.2.2. Connected / Smart Drug Delivery Devices Portfolio

- 11.3.1. Nemera

12. COMPANY PROFILES: CONNECTED / SMART DRUG DELIVERY DEVICE MANUFACTURERS BASED IN ASIA-PACIFIC AND REST OF THE WORLD

- 12.1. Chapter Overview

- 12.2. Leading Connected / Smart Drug Delivery Device Manufacturers

- 12.2.1. Medtrum

- 12.2.1.1. Company Overview

- 12.2.1.2. Connected / Smart Drug Delivery Devices Portfolio

- 12.2.1.3. Recent Developments and Future Outlook

- 12.2.2. SOOIL Development

- 12.2.2.1. Company Overview

- 12.2.2.2. Connected / Smart Drug Delivery Devices Portfolio

- 12.2.2.3. Recent Developments and Future Outlook

- 12.2.3. EOFlow

- 12.2.3.1. Company Overview

- 12.2.3.2. Financial Information

- 12.2.3.3. Connected / Smart Drug Delivery Devices Portfolio

- 12.2.3.4. Recent Developments and Future Outlook

- 12.2.1. Medtrum

- 12.3. Other Prominent Connected / Smart Drug Delivery Device Manufacturers

- 12.3.1. Eitan Medical

- 12.3.1.1. Company Overview

- 12.3.1.2. Connected / Smart Drug Delivery Devices Portfolio

- 12.3.2. E3D Elcam Drug Delivery Device

- 12.3.2.1. Company Overview

- 12.3.2.2. Connected / Smart Drug Delivery Devices Portfolio

- 12.3.1. Eitan Medical

13. CLINICAL TRIAL ANALYSIS

- 13.1. Chapter Overview

- 13.2. Scope and Methodology

- 13.3. Connected / Smart Drug Delivery Devices and Add-on Sensors: Clinical Trial Analysis

- 13.3.1. Analysis by Trial Registration Year

- 13.3.2. Analysis of Enrolled Patient Population by Trial Registration Year

- 13.3.3. Analysis by Trial Phase

- 13.3.4. Analysis by Trial Status

- 13.3.5. Analysis by Type of Device

- 13.3.6. Analysis by Type of Sponsor / Collaborator

- 13.3.7. Analysis by Therapeutic Area

- 13.3.8. Analysis by Study Design

- 13.3.9. Leading Industry Players: Analysis by Number of Registered Trials

- 13.3.10. Leading Connected / Smart Drug Delivery Devices and Add-on Sensors: Analysis by Number of Registered Trials

- 13.3.11. Analysis by Geography

- 13.3.11.1. Analysis of Number of Registered Trials by Trial Status and Geography

- 13.3.11.2. Analysis of Enrolled Patient Population by Trial Status and Geography

14. PARTNERSHIPS AND COLLABORATIONS

- 14.1. Chapter Overview

- 14.2. Partnership Models

- 14.3. Connected / Smart Drug Delivery Devices: Partnerships and Collaborations

- 14.3.1. Analysis by Year of Partnership

- 14.3.2. Analysis by Type of Partnership

- 14.3.3. Analysis by Year and Type of Partnership

- 14.3.4. Analysis by Class of Device

- 14.3.5. Analysis by Type of Integrated Device

- 14.3.6. Analysis by Compatible Device

- 14.3.7. Most Active Players: Analysis by Number of Partnerships

- 14.3.8. Analysis by Geography

- 14.3.8.1. Intracontinental and Intercontinental Deals

- 14.3.8.2. Local and International Deals

15. FUNDING AND INVESTMENTS

- 15.1. Chapter Overview

- 15.2. Funding Models

- 15.3. Connected / Smart Drug Delivery Devices: Funding and Investments, since 2015

- 15.3.1. Analysis by Year of Funding

- 15.3.2. Analysis by Amount Invested

- 15.3.3. Analysis by Type of Funding

- 15.3.3.1. Analysis of Funding Instances

- 15.3.3.2. Analysis of Amount Invested

- 15.3.4. Analysis of Funding Instances by Year and Type of Funding

- 15.3.5. Analysis by Class of Device

- 15.3.6. Analysis by Geography

- 15.3.7. Most Active Players: Analysis by Number of Funding Instances

- 15.3.8. Most Active Players: Analysis by Amount Raised

- 15.3.9. Leading Investors: Analysis by Number of Funding Instances

- 15.4. Summary of Funding and Investments

- 15.5. Connected / Smart Drug Delivery Devices: Funding and Investments, since 2021

16. VALUE CHAIN / COST PRICE ANALYSIS

- 16.1. Chapter Overview

- 16.2. Connected / Smart Drug Delivery Devices: Value Chain

- 16.3. Cost Distribution Across the Value Chain

- 16.3.1. Concept Development and Proof of Concept

- 16.3.2. Research and Product Development

- 16.3.3. Conduct of Clinical Trials

- 16.3.4. Regulatory Approvals

- 16.3.5. Manufacturing and Product Assembly

- 16.3.6. Application Development

- 16.3.7. Marketing and Sales

17. REGULATORY LANDSCAPE FOR CONNECTED / SMART DRUG DELIVERY DEVICES

- 17.1. Chapter Overview

- 17.2. Regulatory Approval of Combination Products in North America

- 17.2.1. Regulatory Approval of Combination Products in the US

- 17.2.1.1. Overview

- 17.2.1.2. Historical Background

- 17.2.1.3. Role of Regulatory Bodies in Product Approval

- 17.2.2. Regulatory Approval of Combination Products in Canada

- 17.2.2.1. Overview

- 17.2.2.2. Role of Regulatory Bodies in Product Approval

- 17.2.3. Regulatory Approval of Combination Products in Mexico

- 17.2.3.1. Overview

- 17.2.3.2. Role of Regulatory Bodies in Product Approval

- 17.2.1. Regulatory Approval of Combination Products in the US

- 17.3. Regulatory Approval of Combination Products in Europe

- 17.3.1. Regulatory Approval of Combination Products in EU5 Countries

- 17.3.1.1. Overview

- 17.3.1.2. Role of Regulatory Bodies in Product Approval

- 17.3.1. Regulatory Approval of Combination Products in EU5 Countries

- 17.4. Regulatory Approval of Combination Products in Asia-Pacific

- 17.4.1. Regulatory Approval of Combination Products in Japan

- 17.4.1.1. Overview

- 17.4.1.2. Role of Regulatory Bodies in Product Approval

- 17.4.2. Regulatory Approval of Combination Products in China

- 17.4.2.1. Overview

- 17.4.2.2. Role of Regulatory Bodies in Product Approval

- 17.4.3. Regulatory Approval of Combination Products in India

- 17.4.3.1. Overview

- 17.4.3.2. Role of Regulatory Bodies in Product Approval

- 17.4.4. Regulatory Approval of Combination Products in South Korea

- 17.4.4.1. Overview

- 17.4.4.2. Role of Regulatory Bodies in Product Approval

- 17.4.5. Regulatory Approval of Combination Products in Australia

- 17.4.5.1. Overview

- 17.4.5.2. Role of Regulatory Bodies in Product Approval

- 17.4.1. Regulatory Approval of Combination Products in Japan

- 17.5. Regulatory Approval of Combination Products in Middle East and North Africa

- 17.5.1. Regulatory Approval of Combination Products in Saudi Arabia

- 17.5.1.1. Overview

- 17.5.1.2. Role of Regulatory Bodies in Product Approval

- 17.5.2. Regulatory Approval of Combination Products in United Arab Emirates

- 17.5.2.1. Overview

- 17.5.2.2. Role of Regulatory Bodies in Product Approval

- 17.5.1. Regulatory Approval of Combination Products in Saudi Arabia

- 17.6. Regulatory Approval of Combination Products in Latin America

- 17.6.1. Regulatory Approval of Combination Products in Brazil

- 17.6.1.1. Overview

- 17.6.1.2. Role of Regulatory Bodies in Product Approval

- 17.6.2. Regulatory Approval of Combination Products in Argentina

- 17.6.2.1. Overview

- 17.6.2.2. Role of Regulatory Bodies in Product Approval

- 17.6.1. Regulatory Approval of Combination Products in Brazil

- 17.7. Connected Devices: Other Measures for Testing Safety, Effectiveness and Performance

- 17.8. Ensuring Security of Data Captured

- 17.9. Concluding Remarks

18. CASE STUDIES: APPLICATION OF CONNECTED DRUG DELIVERY DEVICES TO IMPROVE MEDICATION ADHERENCE

- 18.1. Chapter Overview

- 18.2. Case Study I: Diabetes

- 18.2.1. Disease Overview

- 18.2.2. Key Statistics

- 18.2.3. Economic Burden due to Non-Adherence

- 18.2.4. Evolution of Connected / Smart Drug Delivery Devices for Improving Adherence

- 18.3. Case Study II: Asthma

- 18.3.1. Disease Overview

- 18.3.2. Key Statistics

- 18.3.3. Economic Burden due to Non-Adherence

- 18.3.4. Evolution of Connected / Smart Drug Delivery Devices for Improving Adherence

19. SWOT ANALYSIS

- 19.1. Chapter Overview

- 19.2. Strengths

- 19.2.1. Ability to Minimize / Eliminate Medication Errors

- 19.2.2. Economic Advantages

- 19.2.3. Technological Advancements

- 19.3. Weaknesses

- 19.3.1. Cybersecurity

- 19.3.2. Stringent Regulatory Approvals

- 19.3.3. High Developmental Costs

- 19.4. Opportunities

- 19.4.1. Growing Prevalence of Chronic Disorders

- 19.4.2. Increasing Adoption of Digital Health Technologies

- 19.4.3. Rising Partnership and Investment Activity

- 19.5. Threats

- 19.5.1. Material Compatibility Issues

- 19.5.2. Availability of Alternative Drug Delivery Devices

- 19.5.3. Concern Related to Product Recalls in Past

- 19.6. Comparison of SWOT Factors

20. GLOBAL CONNECTED DRUG DELIVERY DEVICES MARKET

- 20.1. Chapter Overview

- 20.2. Assumptions and Methodology

- 20.3. Global Connected Drug Delivery Devices Market, till 2035

- 20.3.1. Scenario Analysis

- 20.3.1.1. Conservative Scenario

- 20.3.1.2. Optimistic Scenario

- 20.3.1. Scenario Analysis

- 20.4. Key Market Segmentations

- 20.5. Leading Industry Players

21. CONNECTED DRUG DELIVERY DEVICES MARKET, BY TYPE OF DEVICE

- 21.1. Chapter Overview

- 21.2. Assumptions and Methodology

- 21.3. Connected Drug Delivery Devices Market: Distribution by Type of Device, 2020, 2024 and 2035

- 21.3.1. Connected Drug Delivery Devices Market for Connected / Smart Wearable Injectors, till 2035

- 21.3.2. Connected Drug Delivery Devices Market for Connected / Smart Inhalers, till 2035

- 21.3.3. Connected Drug Delivery Devices Market for Connected / Smart Pen Injectors, till 2035

- 21.3.4. Connected Drug Delivery Devices Market for Connected / Smart Autoinjectors, till 2035

- 21.3.5. Connected Drug Delivery Devices Market for Connected / Smart Needle-free Injection Systems, till 2035

- 21.4. Data Triangulation and Validation

22. CONNECTED DRUG DELIVERY DEVICES MARKET, BY MODE OF CONNECTIVITY

- 22.1. Chapter Overview

- 22.2. Assumptions and Methodology

- 22.3. Connected Drug Delivery Devices Market: Distribution by Mode of Connectivity, 2020, 2024 and 2035

- 22.3.1. Connected Drug Delivery Devices Market for Bluetooth-enabled Devices, till 2035

- 22.3.2. Connected Drug Delivery Devices Market for Near-field Communication-enabled Devices, till 2035

- 22.3.3. Connected Drug Delivery Devices Market for Cellular-enabled Devices, till 2035

- 22.3.4. Connected Drug Delivery Devices Market for Wide Area Network-enabled Devices, till 2035

- 22.4. Data Triangulation and Validation

23. CONNECTED DRUG DELIVERY DEVICES MARKET, BY ROUTE OF ADMINISTRATION

- 23.1. Chapter Overview

- 23.2. Assumptions and Methodology

- 23.3. Connected Drug Delivery Devices Market: Distribution by Route of Administration, 2020, 2024 and 2035

- 23.3.1. Connected Drug Delivery Devices Market for Parenteral Administration, till 2035

- 23.3.2. Connected Drug Delivery Devices Market for Inhalational Administration, till 2035

- 23.4. Data Triangulation and Validation

24. CONNECTED DRUG DELIVERY DEVICES MARKET, BY THERAPEUTIC AREA

- 24.1. Chapter Overview

- 24.2. Assumptions and Methodology

- 24.3. Connected Drug Delivery Devices Market: Distribution by Therapeutic Area, 2020, 2024 and 2035

- 24.3.1. Connected Drug Delivery Devices Market for Metabolic Disorders, till 2035

- 24.3.2. Connected Drug Delivery Devices Market for Respiratory Disorders, till 2035

- 24.3.3. Connected Drug Delivery Devices Market for Autoimmune Disorders, till 2035

- 24.3.4. Connected Drug Delivery Devices Market for Other Disorders, till 2035

- 24.4. Data Triangulation and Validation

25. CONNECTED DRUG DELIVERY DEVICES MARKET, BY GEOGRAPHICAL REGIONS

- 25.1. Chapter Overview

- 25.2. Assumptions and Methodology

- 25.3. Connected Drug Delivery Devices Market: Distribution by Geographical Regions, 2020, 2024 and 2035

- 25.3.1. Connected Drug Delivery Devices Market in North America, till 2035

- 25.3.1.1. Connected Drug Delivery Devices Market in the US, till 2035

- 25.3.1.2. Connected Drug Delivery Devices Market in Canada, till 2035

- 25.3.2. Connected Drug Delivery Devices Market in Europe, till 2035

- 25.3.2.1. Connected Drug Delivery Devices Market in the UK, till 2035

- 25.3.2.2. Connected Drug Delivery Devices Market in Germany, till 2035

- 25.3.2.3. Connected Drug Delivery Devices Market in France, till 2035

- 25.3.2.4. Connected Drug Delivery Devices Market in Italy, till 2035

- 25.3.2.5. Connected Drug Delivery Devices Market in Spain, till 2035

- 25.3.2.6. Connected Drug Delivery Devices Market in Rest of the Europe, till 2035

- 25.3.3. Connected Drug Delivery Devices Market in Asia-Pacific, till 2035

- 25.3.3.1. Connected Drug Delivery Devices Market in China, till 2035

- 25.3.3.2. Connected Drug Delivery Devices Market in India, till 2035

- 25.3.3.3. Connected Drug Delivery Devices Market in Japan, till 2035

- 25.3.3.4. Connected Drug Delivery Devices Market in Rest of the Asia-Pacific, till 2035

- 25.3.4. Connected Drug Delivery Devices Market in Middle East and North Africa, till 2035

- 25.3.4.1. Connected Drug Delivery Devices Market in Egypt, till 2035

- 25.3.4.2. Connected Drug Delivery Devices Market in Israel, till 2035

- 25.3.4.3. Connected Drug Delivery Devices Market in Saudi Arabia, till 2035

- 25.3.4.4. Connected Drug Delivery Devices Market in Rest of the Middle East and North Africa, till 2035

- 25.3.5. Connected Drug Delivery Devices Market in Latin America and Rest of the World, till 2035

- 25.3.5.1. Connected Drug Delivery Devices Market in Brazil, till 2035

- 25.3.5.2. Connected Drug Delivery Devices Market in Argentina, till 2035

- 25.3.5.3. Connected Drug Delivery Devices Market in Other Countries, till 2035

- 25.3.1. Connected Drug Delivery Devices Market in North America, till 2035

- 25.4. Data Triangulation and Validation

26. CONCLUDING REMARKS

27. EXECUTIVE INSIGHTS

- 27.1. Chapter Overview

- 27.2. Phillips-Medisize

- 27.2.1. Company Snapshot

- 27.2.2. Interview Transcript: Candace Bowering, Senior Director, Global Strategic Marketing, Medical

- 27.3. Cognita Labs

- 27.3.1. Company Snapshot

- 27.3.2. Interview Transcript: Gaurav Patel, Co-founder and Chief Executive Officer

- 27.4. Portal Instruments

- 27.4.1. Company Snapshot

- 27.4.2. Interview Transcript: Patrick Anquetil, Founder and Chief Executive Officer

- 27.5. Enable Injections

- 27.5.1. Company Snapshot

- 27.5.2. Interview Transcript: Michael D. Hooven, Chief Executive Officer and President

- 27.6. Amiko

- 27.6.1. Company Snapshot

- 27.6.2. Interview Transcript: Duilio Macchi, Chief Executive Officer

- 27.7. Elcam Medical

- 27.7.1. Company Snapshot

- 27.7.2. Interview Transcript: Menachem Zucker, Vice President and Chief Scientist

- 27.8 West Pharmaceutical Services

- 27.8.1. Company Snapshot

- 27.8.2. Interview Transcript: Tiffany Burke, Director (Global Communications) and Graham Reynolds, Former Vice President (Strategic Partnerships and Business Development)

- 27.9. Avoset Health (acquired by Eitan Medical)

- 27.9.1. Company Snapshot

- 27.9.2. Interview Transcript: Shaul Eitan, Former Chief Executive Officer

- 27.10 Phillips-Medisize

- 27.10.1. Company Snapshot

- 27.10.2. Interview Transcript: Neil Williams, Former Director (Front-end Innovation and Head of Connected Health)

- 27.11. Sorrel Medical (acquired by LTS lohmann therapie-systeme)

- 27.11.1. Company Snapshot

- 27.11.2. Interview Transcript: Mindy Katz, Former Vice President (Marketing and Alliance Management)

- 27.12. etectRx

- 27.12.1. Company Snapshot

- 27.12.2. Interview Transcript: Anonymous, Advisor (Strategy and Business Development)

28. APPENDIX 1: TABULATED DATA

29. APPENDIX 2: LIST OF COMPANIES AND ORGANIZATIONS

30. APPENDIX 3: PARTNERSHIPS AND COLLABORATIONS, since 2015

List of Tables

- Table 7.1 Connected / Smart Drug Delivery Devices: Information on Manufacturer, Stage of Development, Launch Year, Type of Integrated Device and Route of Administration

- Table 7.2 Connected / Smart Drug Delivery Devices: Information on Therapeutic Area, Target Indication and Key Features

- Table 7.3 Connected / Smart Drug Delivery Devices: Information on Mode of Connectivity, Availability of Companion Mobile Application, Compatible Operating System and Availability of Data Storage / Cloud Platform

- Table 7.4 Connected / Smart Drug Delivery Devices: Information on Regulatory Approvals, Geographical Reach and Compatible Drug

- Table 7.5 Connected / Smart Drug Delivery Device Manufacturers: Information on Year of Establishment, Company Size and Location of Headquarters

- Table 8.1 Add-on Sensors: Information on Manufacturer, Stage of Development, Launch Year, Type of Device and Route of Administration

- Table 8.2 Add-on Sensors: Information on Therapeutic Area, Target Indication and Key Features

- Table 8.3 Add-on Sensors: Information on Connectivity Solution, Availability of Companion Mobile Application, Compatible Operating System and Availability of Data Storage / Cloud Platform

- Table 8.4 Add-on Sensors: Information on Regulatory Approvals, Geographical Reach and Drug Delivered

- Table 8.5 Add-on Sensor Manufacturers: Information on Year of Establishment, Company Size and Location of Headquarters

- Table 9.1 Product Competitiveness Analysis: Connected / Smart Drug Delivery Devices

- Table 10.1 Connected / Smart Drug Delivery Device Manufacturers in North America: List of Companies Profiled

- Table 10.2 Medtronic: Company Overview

- Table 10.3 Medtronic: Connected / Smart Drug Delivery Devices Portfolio

- Table 10.4 Medtronic: Recent Developments and Future Outlook

- Table 10.5 Insulet: Company Overview

- Table 10.6 Insulet: Connected / Smart Drug Delivery Devices Portfolio

- Table 10.7 Insulet: Recent Developments and Future Outlook

- Table 10.8 Tandem Diabetes Care: Company Overview

- Table 10.9 Tandem Diabetes Care: Connected / Smart Drug Delivery Devices Portfolio

- Table 10.10 Tandem Diabetes Care: Recent Developments and Future Outlook

- Table 10.11 Bigfoot Biomedical: Company Overview

- Table 10.12 Bigfoot Biomedical: Connected / Smart Drug Delivery Devices Portfolio

- Table 10.13 Phillips-Medsize: Company Overview Table 10.3 BIOCORP: Connected / Smart Drug Delivery Devices Portfolio

- Table 10.14 Phillips-Medsize: Connected / Smart Drug Delivery Devices Portfolio

- Table 10.15 West Pharmaceutical Services: Company Overview

- Table 10.16 West Pharmaceutical Services: Connected / Smart Drug Delivery Devices Portfolio

- Table 11.1 Connected / Smart Drug Delivery Device Manufacturers in Europe: List of Companies Profiled

- Table 11.2 BIOCORP: Company Overview

- Table 11.3 BIOCORP: Connected / Smart Drug Delivery Devices Portfolio

- Table 11.4 BIOCORP: Recent Developments and Future Outlook

- Table 11.5 Gerresheimer: Company Overview

- Table 11.6 Gerresheimer: Connected / Smart Drug Delivery Devices Portfolio

- Table 11.7 Gerresheimer: Recent Developments and Future Outlook

- Table 11.8 Roche: Company Overview

- Table 11.9 Roche: Connected / Smart Drug Delivery Devices Portfolio

- Table 11.10 Roche: Recent Developments and Future Outlook

- Table 11.11 Ypsomed: Company Overview

- Table 11.12 Ypsomed: Connected / Smart Drug Delivery Devices Portfolio

- Table 11.13 Ypsomed: Recent Developments and Future Outlook

- Table 11.14 Nemera: Company Overview

- Table 11.15 Nemera: Connected / Smart Drug Delivery Devices Portfolio

- Table 11.16 Sonceboz: Company Overview

- Table 11.17 Sonceboz: Connected / Smart Drug Delivery Devices Portfolio

- Table 12.1 Connected / Smart Drug Delivery Device Manufacturers in Asia-Pacific and Rest of the World: List of Companies Profiled

- Table 12.2 Medtrum: Company Overview

- Table 12.3 Medtrum: Connected / Smart Drug Delivery Devices Portfolio

- Table 12.4 SOOIL Development: Company Overview

- Table 12.5 SOOIL Development: Connected / Smart Drug Delivery Devices Portfolio

- Table 12.6 SOOIL Development: Recent Developments and Future Outlook

- Table 12.7 EOFlow: Company Overview

- Table 12.8 EOFlow: Connected / Smart Drug Delivery Devices Portfolio

- Table 12.9 EOFlow: Recent Developments and Future Outlook

- Table 12.10 Eitan Medical: Company Overview

- Table 12.11 Eitan Medical: Connected / Smart Drug Delivery Devices Portfolio

- Table 12.12 E3D Elcam Drug Delivery Device: Company Overview

- Table 12.13 E3D Elcam Drug Delivery Device: Connected / Smart Drug Delivery Devices Portfolio

- Table 14.1 Connected / Smart Drug Delivery Devices: List of Partnerships and Collaborations, Since 2021

- Table 14.2 Partnerships and Collaborations: Information on Type of Agreement (Country and Region)

- Table 15.1 Connected / Smart Drug Delivery Devices: List of Funding and Investments, Since 2015

- Table 15.2 Connected / Smart Drug Delivery Devices: Information on Type of Device and Type of Integrated Device

- Table 15.3 Connected / Smart Drug Delivery Devices: List of Funding and Investments, Since 2021

- Table 17.1 FDA Centers for Drug and Device Approval

- Table 17.2 Regulatory Review Timelines for Combination Products in the US

- Table 17.3 Regulatory Bodies in EU5 Countries

- Table 17.4 SFDA: Regulatory Review Timeline

- Table 20.1 Connected Drug Delivery Devices Market: Leading Industry Players

- Table 27.1 Phillips-Medisize: Company Overview

- Table 27.2 Cognita Labs: Company Overview

- Table 27.3 Portal Instruments: Company Overview

- Table 27.4 Enable Injections: Company Overview

- Table 27.5 Amiko: Company Overview

- Table 27.6 Elcam Medical: Company Overview

- Table 27.7 West Pharmaceutical Services: Company Overview

- Table 27.8 Avoset Health: Company Overview

- Table 27.9 Phillips-Medisize: Company Overview

- Table 27.10 Sorrel Medical: Company Overview

- Table 27.11 etectRx: Company Overview

- Table 28.1 Connected / Smart Drug Delivery Devices: Distribution by Stage of Development

- Table 28.2 Connected / Smart Drug Delivery Devices: Distribution by Launch Year

- Table 28.3 Connected / Smart Drug Delivery Devices: Distribution by Type of Integrated Device

- Table 28.4 Connected / Smart Drug Delivery Devices: Distribution by Route of Administration

- Table 28.5 Connected / Smart Drug Delivery Devices: Distribution by Therapeutic Area

- Table 28.6 Connected / Smart Drug Delivery Devices: Distribution by Target Indication

- Table 28.7 Connected / Smart Drug Delivery Devices: Distribution by Key Features

- Table 28.8 Connected / Smart Drug Delivery Devices: Distribution by Mode of Connectivity

- Table 28.9 Connected / Smart Drug Delivery Devices: Distribution by Availability of Companion Mobile Application

- Table 28.10 Connected / Smart Drug Delivery Devices: Distribution by Availability of Data Storage / Cloud Platform

- Table 28.11 Connected / Smart Drug Delivery Device Manufacturers: Distribution by Year of Establishment

- Table 28.12 Connected / Smart Drug Delivery Device Manufacturers: Distribution by Company Size

- Table 28.13 Connected / Smart Drug Delivery Device Manufacturers: Distribution by Location of Headquarters

- Table 28.14 Connected / Smart Drug Delivery Device Manufacturers: Distribution by Year of Establishment and Location of Headquarters (Region)

- Table 28.15 Connected / Smart Drug Delivery Device Manufacturers: Distribution by Company Size and Location of Headquarters (Region)

- Table 28.16 Most Active Players: Distribution by Number of Connected / Smart Drug Delivery Devices Manufactured

- Table 28.17 Add-on Sensors: Distribution by Stage of Development

- Table 28.18 Add-on Sensors: Distribution by Launch Year

- Table 28.19 Add-on Sensors: Distribution by Compatible Device

- Table 28.20 Add-on Sensors: Distribution by Route of Administration

- Table 28.21 Add-on Sensors: Distribution by Therapeutic Area

- Table 28.22 Add-on Sensors: Distribution by Target Indication

- Table 28.23 Add-on Sensors: Distribution by Key Features

- Table 28.24 Add-on Sensors: Distribution by Mode of Connectivity

- Table 28.25 Add-on Sensors: Distribution by Availability of Companion Mobile Application

- Table 28.26 Add-on Sensors: Distribution by Availability of Data Storage / Cloud Platform

- Table 28.27 Add-on Sensor Manufacturers: Distribution by Year of Establishment

- Table 28.28 Add-on Sensor Manufacturers: Distribution by Company Size

- Table 28.29 Add-on Sensor Manufacturers: Distribution by Location of Headquarters

- Table 28.30 Add-on Sensor Manufacturers: Distribution by Year of Establishment and Location of Headquarters (Region)

- Table 28.31 Add-on Sensor Manufacturers: Distribution by Company Size and Location of Headquarters (Region)

- Table 28.32 Most Active Players: Distribution by Number of Add-on Sensors Manufactured

- Table 28.33 Medtronic: Business Segment-wise Revenues and Consolidated Financial Details (USD Billion)

- Table 28.34 Insulet: Business Segment-wise Revenues and Consolidated Financial Details (USD Million)

- Table 28.35 Tandem Diabetes Care: Consolidated Financial Details (USD Million)

- Table 28.36 Gerresheimer: Business Segment-wise Revenues and Consolidated Financial Details (EUR Million)

- Table 28.37 Roche: Business Segment-wise Revenues and Consolidated Financial Details (CHF Billion)

- Table 28.38 Ypsomed: Business Segment-wise Revenues and Consolidated Financial Details (CHF Million)

- Table 28.39 Clinical Trial Analysis: Distribution by Trial Registration Year

- Table 28.40 Clinical Trial Analysis: Year-wise Trend of Patients Enrolled by Trial Registration Year

- Table 28.41 Clinical Trial Analysis: Distribution by Trial Phase

- Table 28.42 Clinical Trial Analysis: Distribution by Trial Status

- Table 28.43 Clinical Trial Analysis: Distribution by Type of Device

- Table 28.44 Clinical Trial Analysis: Distribution by Type of Sponsor / Collaborator

- Table 28.45 Clinical Trial Analysis: Distribution of Number of Registered Trials by Therapeutic Area

- Table 28.46 Clinical Trial Analysis: Distribution of Enrolled Patient Population by Therapeutic Area

- Table 28.47 Clinical Trial Analysis: Distribution by Study Design

- Table 28.48 Leading Industry Players: Distribution by Number of Registered Trials

- Table 28.49 Leading Connected / Smart Drug Delivery Devices and Add-on Sensors: Distribution by Number of Registered Trials

- Table 28.50 Clinical Trial Analysis: Distribution of Number of Registered Trials by Trial Status and Geography

- Table 28.51 Clinical Trial Analysis: Distribution of Enrolled Patient Population by Trial Status and Geography

- Table 28.52 Partnerships and Collaborations: Cumulative Year-wise Trend

- Table 28.53 Partnerships and Collaborations: Distribution by Type of Partnership

- Table 28.54 Partnerships and Collaborations: Distribution by Year and Type of Partnership

- Table 28.55 Partnerships and Collaborations: Distribution by Class of Device

- Table 28.56 Partnerships and Collaborations: Distribution by Type of Integrated Device

- Table 28.57 Partnerships and Collaborations: Distribution by Compatible Device

- Table 28.58 Most Active Players: Distribution by Number of Partnerships

- Table 28.59 Partnerships and Collaborations: Intercontinental and Intracontinental Deals

- Table 28.60 Partnerships and Collaborations: Local and International Deals

- Table 28.61 Funding and Investment Analysis: Cumulative Year-wise Trend

- Table 28.62 Funding and Investment Analysis: Distribution by Amount Invested (USD Million)

- Table 28.63 Funding and Investment Analysis: Distribution of Funding Instances by Type of Funding

- Table 28.64 Funding and Investments: Distribution by Amount Invested by Type of Funding (USD Million)

- Table 28.65 Distribution of Funding Instances by Year and Type of Funding, Since 2015

- Table 28.66 Funding and Investments: Distribution of Funding Instances by Class of Device

- Table 28.67 Funding and Investments: Distribution of Funding Instances by Geography

- Table 28.68 Funding and Investments: Distribution of Funding Instances by Geography and Amount Invested (USD Million)

- Table 28.69 Most Active Players: Distribution by Number of Funding Instances

- Table 28.70 Most Active Players: Distribution by Amount Raised (USD Million)

- Table 28.71 Leading Investors: Distribution by Number of Funding Instances

- Table 28.72 Funding and Investments Summary, till 2020 (USD Million)

- Table 28.73 Global Connected Drug Delivery Devices Demand, Historical Trends, since 2020 (Million Units Sold)

- Table 28.74 Global Connected Drug Delivery Devices Demand, till 2035 (Million Units Sold)

- Table 28.75 Global Connected Drug Delivery Devices Market, Historical Trends, since 2020 (USD Million)

- Table 28.76 Global Connected Drug Delivery Devices Market, till 2035 (USD Million)

- Table 28.77 Connected Drug Delivery Devices Market: Distribution by Type of Device, 2020, 2024 and 2035 (USD Million)

- Table 28.78 Connected Drug Delivery Devices Demand for Connected / Smart Wearable Injectors, Historical Trends, since 2020 (Million Units Sold)

- Table 28.79 Connected Drug Delivery Devices Demand for Connected / Smart Wearable Injectors, till 2035 (Million Units Sold)

- Table 28.80 Connected Drug Delivery Devices Market for Connected / Smart Wearable Injectors, Historical Trends, since 2020 (USD Million)

- Table 28.81 Connected Drug Delivery Devices Market for Connected / Smart Wearable Injectors, till 2035 (USD Million)

- Table 28.82 Connected Drug Delivery Devices Demand for Connected / Smart Inhalers, Historical Trends, since 2020 (Million Units Sold)

- Table 28.83 Connected Drug Delivery Devices Demand for Connected / Smart Inhalers, till 2035 (Million Units Sold)

- Table 28.84 Connected Drug Delivery Devices Market for Connected / Smart Inhalers, Historical Trends, since 2020 (USD Million)

- Table 28.85 Connected Drug Delivery Devices Market for Connected / Smart Inhalers, till 2035(USD Million)

- Table 28.86 Connected Drug Delivery Devices Demand for Connected / Smart Pen Injectors, Historical Trends, since 2020 (Million Units Sold)

- Table 28.87 Connected Drug Delivery Devices Demand for Connected / Smart Pen Injectors, till 2035 (Million Units Sold)

- Table 28.88 Connected Drug Delivery Devices Market for Connected / Smart Pen Injectors, Historical Trends, since 2020 (USD Million)

- Table 28.89 Connected Drug Delivery Devices Market for Connected / Smart Pen Injectors, till 2035 (USD Million)

- Table 28.90 Connected Drug Delivery Devices Demand for Connected / Smart Autoinjectors, Historical Trends, since 2020 (Million Units Sold)

- Table 28.91 Connected Drug Delivery Devices Demand for Connected / Smart Autoinjectors, till 2035 (Million Units Sold)

- Table 28.92 Connected Drug Delivery Devices Market for Connected / Smart Autoinjectors, Historical Trends, since 2020 (USD Million)

- Table 28.93 Connected Drug Delivery Devices Market for Connected / Smart Autoinjectors, till 2035 (USD Million)

- Table 28.94 Connected Drug Delivery Devices Demand for Connected / Smart Needle-free Injection Systems, till 2035 (Million Units Sold)

- Table 28.95 Connected Drug Delivery Devices Demand for Connected / Smart Needle-free Injection Systems, till 2035 (USD Million)

- Table 28.96 Connected Drug Delivery Devices Market: Distribution by Mode of Connectivity, 2020, 2024 and 2035 (USD Million)

- Table 28.97 Connected Drug Delivery Devices Demand for Bluetooth-enabled Devices, Historical Trends, since 2020 (Million Units Sold)

- Table 28.98 Connected Drug Delivery Devices Demand for Bluetooth-enabled Devices, till 2035 (Million Units Sold)

- Table 28.99 Connected Drug Delivery Devices Market for Bluetooth-enabled Devices, Historical Trends, since 2020 (USD Million)

- Table 28.100 Connected Drug Delivery Devices Market for Bluetooth-enabled Devices, till 2035 (USD Million)

- Table 28.101 Connected Drug Delivery Devices Demand for Near-field Communication-enabled Devices, Historical Trends, since 2020 (Million Units Sold)

- Table 28.102 Connected Drug Delivery Devices Demand for Near-field Communication-enabled Devices, till 2035 (Million Units Sold)

- Table 28.103 Connected Drug Delivery Devices Market for Near-field Communication-enabled Devices, Historical Trends, since 2020 (USD Million)

- Table 28.104 Connected Drug Delivery Devices Market for Near-field Communication-enabled Devices, till 2035 (USD Million)

- Table 28.105 Connected Drug Delivery Devices Demand for Cellular-enabled Devices, Historical Trends, since 2020 (Million Units Sold)

- Table 28.106 Connected Drug Delivery Devices Demand for Cellular-enabled Devices, till 2035 (Million Units Sold)

- Table 28.107 Connected Drug Delivery Devices Market for Cellular-enabled Devices, HistoricalTrends, since 2020 (USD Million)

- Table 28.108 Connected Drug Delivery Devices Market for Cellular-enabled Devices, till 2035 (USD Million)

- Table 28.109 Connected Drug Delivery Devices Demand for Wide Area Network-enabled Devices, Historical Trends, since 2020 (Million Units Sold)

- Table 28.110 Connected Drug Delivery Devices Demand for Wide Area Network-enabled Devices, till 2035 (Million Units Sold)

- Table 28.111 Connected Drug Delivery Devices Market for Wide Area Network-enabled Devices, Historical Trends, since 2020 (USD Million)

- Table 28.112 Connected Drug Delivery Devices Market for Wide Area Network-enabled Devices, till 2035 (USD Million)

- Table 28.113 Connected Drug Delivery Devices Market: Distribution by Route of Administration, 2020, 2024 and 2035 (USD Million)

- Table 28.114 Connected Drug Delivery Demand for Parenteral Administration, Historical Trends, since 2020 (Million Units Sold)

- Table 28.115 Connected Drug Delivery Devices Demand for Parenteral Administration, till 2035 (Million Units Sold)

- Table 28.116 Connected Drug Delivery Devices Market for Parenteral Administration, Historical Trends, since 2020 (USD Million)

- Table 28.117 Connected Drug Delivery Devices Market for Parenteral Administration, till 2035 (USD Million)

- Table 28.118 Connected Drug Delivery Devices Demand for Inhalational Administration, Historical Trends, since 2020 (Million Units Sold)

- Table 28.119 Connected Drug Delivery Devices Demand for Inhalational Administration, till 2035 (Million Units Sold)

- Table 28.120 Connected Drug Delivery Devices Market for Inhalational Administration, Since 2020 (USD Million)

- Table 28.121 Connected Drug Delivery Devices Market for Inhalational Administration, till 2035 (USD Million)

- Table 28.122 Connected Drug Delivery Devices Market: Distribution by Therapeutic Area, 2020, 2024 and 2035 (USD Million)

- Table 28.123 Connected Drug Delivery Devices Demand for Metabolic Disorders, Historical Trends, since 2020 (Million Units Sold)

- Table 28.124 Connected Drug Delivery Devices Demand for Metabolic Disorders, till 2035 (Million Units Sold)

- Table 28.125 Connected Drug Delivery Devices Market for Metabolic Disorders, Historical Trends, since 2020 (USD Million)

- Table 28.126 Connected Drug Delivery Devices Market for Metabolic Disorders, till 2035 (USD Million)

- Table 28.127 Connected Drug Delivery Devices Demand for Respiratory Disorders, Historical Trends, since 2020 (Million Units Sold)

- Table 28.128 Connected Drug Delivery Devices Demand for Respiratory Disorders, till 2035 (Million Units Sold)

- Table 28.129 Connected Drug Delivery Devices Market for Respiratory Disorders, HistoricalTrends, since 2020 (USD Million)

- Table 28.130 Connected Drug Delivery Devices Market for Respiratory Disorders, till 2035 (USD Million)

- Table 28.131 Connected Drug Delivery Devices Demand for Autoimmune Disorders, Historical Trends, since 2020 (Million Units Sold)

- Table 28.132 Connected Drug Delivery Devices Demand for Autoimmune Disorders, till 2035 (Million Units Sold)

- Table 28.133 Connected Drug Delivery Devices Market for Autoimmune Disorders, HistoricalTrends, since 2020 (USD Million)

- Table 28.134 Connected Drug Delivery Devices Market for Autoimmune Disorders, till 2035 (USD Million)

- Table 28.135 Connected Drug Delivery Devices Demand for Other Disorders, Historical Trends, since 2020 (Million Units Sold)

- Table 28.136 Connected Drug Delivery Devices Demand for Other Disorders, till 2035 (Million Units Sold)

- Table 28.137 Connected Drug Delivery Devices Market for Other Disorders, Historical Trends, since 2020 (USD Million)

- Table 28.138 Connected Drug Delivery Devices Market for Other Disorders, till 2035 (USD Million)

- Table 28.139 Connected Drug Delivery Devices Market: Distribution by Geographical Regions, 2020, 2024 and 2035 (USD Million)

- Table 28.140 Connected Drug Delivery Devices Demand in North America, Historical Trends, since 2020 (Million Units Sold)

- Table 28.141 Connected Drug Delivery Devices Demand in North America, till 2035 (Million Units Sold)

- Table 28.142 Connected Drug Delivery Devices Market in North America, Historical Trends, since 2020 (USD Million)

- Table 28.143 Connected Drug Delivery Devices Market in North America, till 2035 (USD Million)

- Table 28.144 Connected Drug Delivery Devices Market in the US, Historical Trends, Since 2020 (USD Million)

- Table 28.145 Connected Drug Delivery Devices Market in the US, till 2035 (USD Million)28.146 Connected Drug Delivery Devices Market in Canada, Historical Trends, since 2020 (USD Million)

- Table 28.147 Connected Drug Delivery Devices Market in Canada, till 2035 (USD Million)

- Table 28.148 Connected Drug Delivery Devices Demand in Europe, Historical Trends, since 2020 (Million Units Sold)

- Table 28.149 Connected Drug Delivery Devices Demand in Europe, till 2035 (Million Units Sold)

- Table 28.150 Connected Drug Delivery Devices Market in Europe, Historical Trends, since2020 (USD Million)

- Table 28.151 Connected Drug Delivery Devices Market in Europe, till 2035 (USD Million)

- Table 28.152 Connected Drug Delivery Devices Market in the UK, Historical Trends, since 2020 (USD Million)

- Table 28.153 Connected Drug Delivery Devices Market in the UK, till 2035 (USD Million)

- Table 28.154 Connected Drug Delivery Devices Market in Germany, Historical Trends, since 2020 (USD Million)

- Table 28.155 Connected Drug Delivery Devices Market in Germany, till 2035 (USD Million)

- Table 28.156 Connected Drug Delivery Devices Market in France, Historical Trends, Since 2020 (USD Million)

- Table 28.157 Connected Drug Delivery Devices Market in France, till 2035 (USD Million)

- Table 28.158 Connected Drug Delivery Devices Market in Italy, Historical Trends, since 2020 (USD Million)

- Table 28.159 Connected Drug Delivery Devices Market in Italy, till 2035 (USD Million)

- Table 28.160 Connected Drug Delivery Devices Market in Spain, Historical Trends, since 2020 (USD Million)

- Table 28.161 Connected Drug Delivery Devices Market in Spain, till 2035 (USD Million)

- Table 28.162 Connected Drug Delivery Devices Market in Rest of Europe, Historical Trends, since 2020 (USD Million)

- Table 28.163 Connected Drug Delivery Devices Market in Rest of Europe, till 2035 (USD Million)

- Table 28.164 Connected Drug Delivery Devices Demand in Asia-Pacific, Historical Trends, since 2020 (Million Units Sold)

- Table 28.165 Connected Drug Delivery Devices Demand in Asia-Pacific, till 2035 (Million Units Sold)

- Table 28.166 Connected Drug Delivery Devices Market in Asia-Pacific, Historical Trends, since 2020 (USD Million)

- Table 28.167 Connected Drug Delivery Devices Market in Asia-Pacific, till 2035 (USD Million)

- Table 28.168 Connected Drug Delivery Devices Market in China, Historical Trends, since 2020 (USD Million)

- Table 28.169 Connected Drug Delivery Devices Market in China, till 2035 (USD Million)

- Table 28.170 Connected Drug Delivery Devices Market in India, Historical Trends, Since 2020 (USD Million)

- Table 28.171 Connected Drug Delivery Devices Market in India, till 2035 (USD Million)

- Table 28.172 Connected Drug Delivery Devices Market in Japan, Historical Trends, Since 2020 (USD Million)

- Table 28.173 Connected Drug Delivery Devices Market in Japan, till 2035 (USD Million)

- Table 28.174 Connected Drug Delivery Devices Market in Rest of the Asia-Pacific, Historical Trends, since 2020 (USD Million)

- Table 28.175 Connected Drug Delivery Devices Market in Rest of the Asia-Pacific, till 2035 (USD Million)

- Table 28.176 Connected Drug Delivery Devices Demand in Middle East and North Africa, Historical Trends, since 2020 (Million Units Sold)

- Table 28.177 Connected Drug Delivery Devices Demand in Middle East and North Africa, till 2035 (Million Units Sold)

- Table 28.178 Connected Drug Delivery Devices Market in Middle East and North Africa, Historical Trends, Since 2020 (USD Million)

- Table 28.179 Connected Drug Delivery Devices Market in Middle East and North Africa, till 2035 (USD Million)

- Table 28.180 Connected Drug Delivery Devices Market in Egypt, Historical Trends, since 2020 (USD Million)

- Table 28.181 Connected Drug Delivery Devices Market in Egypt, till 2035 (USD Million)

- Table 28.182 Connected Drug Delivery Devices Market in Israel, Historical Trends, since 2020 (USD Million)

- Table 28.183 Connected Drug Delivery Devices Market in Israel, till 2035 (USD Million)

- Table 28.184 Connected Drug Delivery Devices Market in Saudi Arabia, Historical Trends, since 2020 (USD Million)

- Table 28.185 Connected Drug Delivery Devices Market in Saudi Arabia, till 2035 (USD Million)

- Table 28.186 Connected Drug Delivery Devices Market in Rest of the Middle East and North Africa, Historical Trends, since 2020 (USD Million)

- Table 28.187 Connected Drug Delivery Devices Market in Rest of the Middle East and North Africa, till 2035 (USD Million)

- Table 28.188 Connected Drug Delivery Devices Demand in Latin America and Rest of the World, Historical Trends, since 2020 (Million Units Sold)

- Table 28.189 Connected Drug Delivery Devices Demand in Latin America and Rest of the World, till 2035 (Million Units Sold)

- Table 28.190 Connected Drug Delivery Devices Market in Latin America and Rest of the World, Historical Trends, since 2020 (USD Million)

- Table 28.191 Connected Drug Delivery Devices Market in Latin America and Rest of the World, till 2035 (USD Million)

- Table 28.192 Connected Drug Delivery Devices Market in Brazil, Historical Trends, since 2020 (USD Million)

- Table 28.193 Connected Drug Delivery Devices Market in Brazil, till 2035 (USD Million)

- Table 28.194 Connected Drug Delivery Devices Market in Argentina, Historical Trends, since 2020 (USD Million)

- Table 28.195 Connected Drug Delivery Devices Market in Argentina, till 2035 (USD Million)

- Table 28.196 Connected Drug Delivery Devices Market in Rest of the World, Historical Trends, since 2020 (USD Million)

- Table 28.197 Connected Drug Delivery Devices Market in Rest of the World, till 2035 (USD Million)

List of Figures

- Figure 2.1 Research Methodology: Project Methodology

- Figure 2.2 Research Methodology: Data Sources for Secondary Research

- Figure 3.1 Market Dynamics: Forecast Methodology

- Figure 3.2 Market Dynamics: Key Market Segmentation

- Figure 3.3 Market Dynamics: Robust Quality Control

- Figure 4.1 Lessons Learnt from Past Recessions

- Figure 5.1 Executive Summary: Connected / Smart Drug Delivery Devices Market Landscape

- Figure 5.2 Executive Summary: Add-on Sensors Market Landscape

- Figure 5.3 Executive Summary: Market Trends

- Figure 5.4 Executive Summary: Market Forecast and Opportunity Analysis

- Figure 6.1 IoT Ecosystem: Different Components

- Figure 6.2 Framework of Connected / Smart Drug Delivery Devices

- Figure 6.3 Designing and Developing a Connected / Smart Drug Delivery Device: Key Considerations

- Figure 6.4 Development of Connected Drug Delivery Devices: Stack Model

- Figure 6.5 Connected / Smart Drug Delivery Device: Type of Technology Used

- Figure 6.6 Advantages of Connected / Smart Drug Delivery Devices

- Figure 7.1 Connected / Smart Drug Delivery Devices: Distribution by Stage of Development

- Figure 7.2 Connected / Smart Drug Delivery Devices: Distribution by Launch Year

- Figure 7.3 Connected / Smart Drug Delivery Devices: Distribution by Type of Integrated Device

- Figure 7.4 Connected / Smart Drug Delivery Devices: Distribution by Route of Administration

- Figure 7.5 Connected / Smart Drug Delivery Devices: Distribution by Therapeutic Area

- Figure 7.6 Connected / Smart Drug Delivery Devices: Distribution by Target Indication

- Figure 7.7 Connected / Smart Drug Delivery Devices: Distribution by Key Features

- Figure 7.8 Connected / Smart Drug Delivery Devices: Distribution by Mode of Connectivity

- Figure 7.9 Connected / Smart Drug Delivery Devices: Distribution by Availability of Companion Mobile Application

- Figure 7.10 Connected / Smart Drug Delivery Devices: Distribution by Availability of Data Storage / Cloud Platform

- Figure 7.11 Connected / Smart Drug Delivery Device Manufacturers: Distribution by Year of Establishment

- Figure 7.12 Connected / Smart Drug Delivery Device Manufacturers: Distribution by Company Size

- Figure 7.13 Connected / Smart Drug Delivery Device Manufacturers: Distribution by Location of Headquarters

- Figure 7.14 Connected / Smart Drug Delivery Device Manufacturers: Distribution by Year of Establishment and Location of Headquarters

- Figure 7.15 Connected / Smart Drug Delivery Device Manufacturers: Distribution by Company Size and Location of Headquarters

- Figure 7.16 Most Active Players: Distribution by Number of Connected / Smart Drug Delivery Devices Manufactured

- Figure 8.1 Add-on Sensors: Distribution by Stage of Development

- Figure 8.2 Add-on Sensors: Distribution by Launch Year

- Figure 8.3 Add-on Sensors: Distribution by Compatible Device

- Figure 8.4 Add-on Sensors: Distribution by Route of Administration

- Figure 8.5 Add-on Sensors: Distribution by Therapeutic Area

- Figure 8.6 Add-on Sensors: Distribution by Target Indication

- Figure 8.7 Add-on Sensors: Distribution by Key Features

- Figure 8.8 Add-on Sensors: Distribution by Mode of Connectivity

- Figure 8.9 Add-on Sensors: Distribution by Availability of Companion Mobile Application

- Figure 8.10 Add-on Sensors: Distribution by Availability of Data Storage / Cloud Platform

- Figure 8.11 Add-on Sensor Manufacturers: Distribution by Year of Establishment

- Figure 8.12 Add-on Sensor Manufacturers: Distribution by Company Size

- Figure 8.13 Add-on Sensor Manufacturers: Distribution by Location of Headquarters

- Figure 8.14 Add-on Sensor Manufacturers: Distribution by Year of Establishment and Location of Headquarters

- Figure 8.15 Add-on Sensor Manufacturers: Distribution by Company Size and Location of Headquarters

- Figure 8.16 Most Active Players: Distribution by Number of Add-on Sensors Manufactured

- Figure 9.1 Product Competitiveness Analysis: Smart Handheld Injectors (Peer Group 1a)

- Figure 9.2 Product Competitiveness Analysis: Smart Wearable Injectors (Peer Group 1b)

- Figure 9.3 Product Competitiveness Analysis: Other Integrated Devices (Peer Group 1c)

- Figure 9.4 Product Competitiveness Analysis: Add-on Sensors (Peer Group 2)

- Figure 10.1 Medtronic: Business Segment-wise Revenues and Consolidated Financial Details (USD Billion)

- Figure 10.2 Insulet: Business Segment-wise Revenues and Consolidated Financial Details (USD Million)

- Figure 10.3 Tandem Diabetes Care: Consolidated Financial Details (USD Million)

- Figure 11.1 Gerresheimer: Business Segment-wise Revenues and Consolidated Financial Details (EUR Million)

- Figure 11.2 Roche: Business Segment-wise Revenues and Consolidated Financial Details (CHF Billion)

- Figure 11.3 Ypsomed: Business Segment-wise Revenues and Consolidated Financial Details (CHF Million)

- Figure 13.1 Clinical Trial Analysis: Cumulative Year-wise Trend, till 2020

- Figure 13.2 Clinical Trial Analysis: Year-wise Trend of Enrolled Patient Population by Trial Registration Year

- Figure 13.3 Clinical Trial Analysis: Distribution by Trial Phase

- Figure 13.4 Clinical Trial Analysis: Distribution by Trial Status

- Figure 13.5 Clinical Trial Analysis: Cumulative Year-wise Trend by Trial Status, till 2020

- Figure 13.6 Clinical Trial Analysis: Distribution by Type of Device