PUBLISHER: Roots Analysis | PRODUCT CODE: 1920861

PUBLISHER: Roots Analysis | PRODUCT CODE: 1920861

Cell Therapy Manufacturing Market (7th Edition): Trends and Forecast Till 2035 - Distribution by Type of Cell Therapy, Source of Cells, Scale of Operation, Type of Manufacturer, and Geography

Cell Therapy Manufacturing Market: Overview

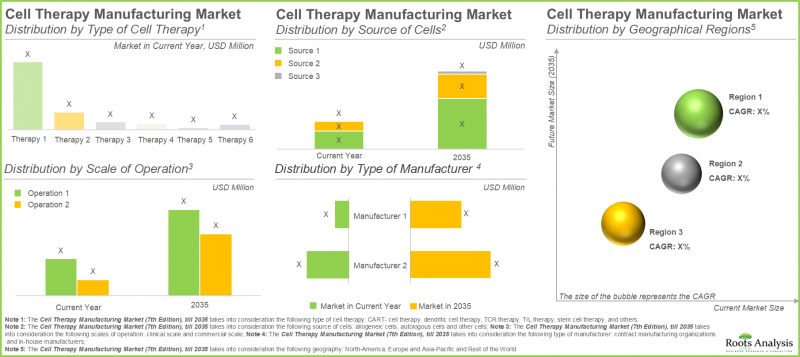

As per Roots Analysis, the cell therapy manufacturing market is estimated to grow from USD 7,172 million in the current year to USD 14,017 million by 2035, at a CAGR of 7.7% during the forecast period, till 2035.

Cell Therapy Manufacturing Market: Growth and Trends

Over the years, numerous technological innovations and discoveries have transformed the field of medicine. One notable advancement is the emergence of cell-based therapies, which have shown substantial therapeutic promise and are largely free from many of the toxicity issues linked to traditional pharmacological treatments. Researchers are exploring over 1,000 cell and gene therapy candidates targeting a wide range of disease indications. Of these, approximately 45 cell-based therapies have already received approval from various global regulatory agencies. In addition, several organizations are implementing initiatives to tackle manufacturing challenges and ensure the ongoing success of these innovative therapies.

The manufacturing of cell and gene therapies is a complex process that occurs in a meticulously controlled, contamination-free environment and involves multiple critical stages, such as isolating, modifying, and expanding immune cells, including T-cells and stem cells. Each of these stages demand the use of specialized closed systems and rigorous compliance with regulatory standards to guarantee the safety and effectiveness of the final products. Companies are focused on enhancing cell handling and processing equipment, improving ancillary materials and cell counting techniques, and addressing current logistical challenges. Consequently, it is becoming increasingly essential for cell therapy developers to invest in flexible and automated technologies to mitigate the risks associated with human error during the production of these advanced therapeutic candidates. These improvements are expected to help companies maintain quality and consistency of products while keeping costs manageable.

Growth Drivers: Strategic Enablers of Market Expansion

The field of cell therapy is experiencing rapid growth, characterized by an increase in clinical trial and a rise in regulatory approvals. With a greater number of therapies advancing from initial research to late-stage clinical trials, patients have more opportunities to access these treatments. A report from the American Society of Gene & Cell Therapy (ASGCT) indicates that there are currently 4,418 active programs in the combined gene, cell, and RNA therapy pipeline, comprising 2,155 gene therapies and 966 non-genetically modified cell therapies, along with 79 new gene therapy trials (57% focused on oncology) and 27 new cell therapy trials (74% in non-oncology) that were initiated during that quarter. This progress will be bolstered by the establishment of local manufacturing facilities for cell therapies.

Market Challenges: Critical Barriers Impeding Progress

Despite strong demand, the cell therapy manufacturing sector faces multiple challenges in moving cell-based therapy products from the lab to clinical scale. These obstacles include a shortage of skilled workers, regulatory compliance issues, and insufficient advanced facilities and infrastructure. The manufacturing processes for cell therapy necessitate sterile, high-grade clean rooms and strict monitoring of containment levels to ensure product integrity and compliance. Due to these intricate procedures, scaling up cell therapy manufacturing can be considerably difficult.

Cell Therapy Manufacturing Market: Key Insights

The report delves into the current state of the cell therapy manufacturing market and identifies potential growth opportunities within industry. Some key findings from the report include:

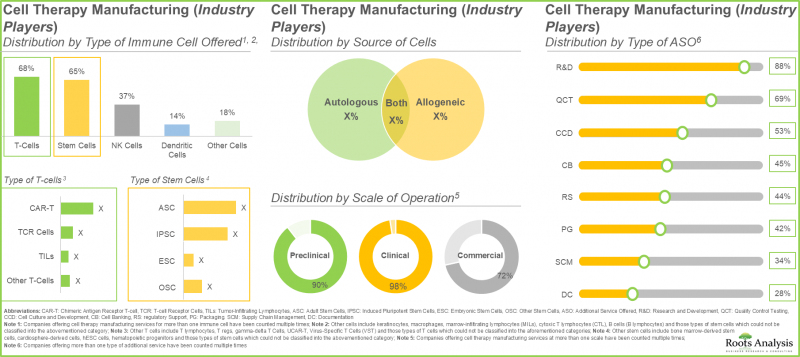

- Currently, close to 200 industry players are engaged in cell therapy manufacturing; of these, ~45% of players are headquartered in the US.

- More than 40% of industry players offer both T-cells and stem cells, as T-cells have a lower risk of rejection while stem cells possess a unique ability to regenerate or repair damaged cells and tissues.

- More than 80 non-industry players are currently engaged in the manufacturing of cell therapies; around 55% of these players are based in the US.

- ~30% of the non-industry cell therapy manufacturers were established before 2001; among these, more than 60% of players utilize both autologous and allogeneic source of cells.

- Several clinical trials evaluating immune cell therapies have been registered till date; majority (65%) of these studies have been conducted across various trial sites in Asia-Pacific.

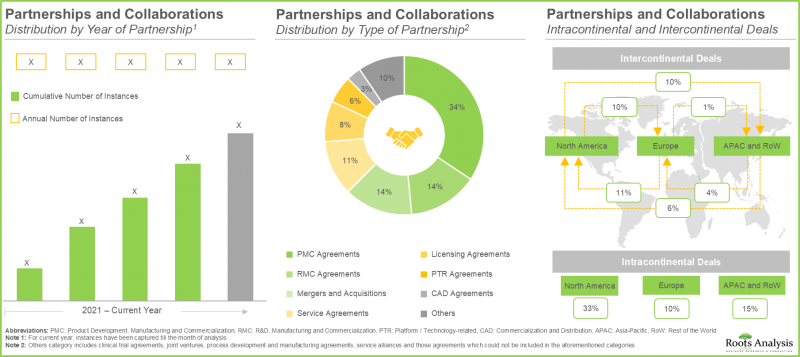

- The rising interest in this market is reflected from the diverse partnerships established among various stakeholders in the recent past; in fact, >55% of the deals have been inked post 2022.

- 70% of the industry players have expanded their existing capacities and capabilities through establishment of new facilities; more than 40% facilities are dedicated to manufacturing of T cells.

- Over 55% of major big pharma initiatives in this domain have been pursued through partnerships and collaborations; of these, a sizeable proportion of the initiatives were undertaken by Bristol-Myers Squibb.

- ~95% of the current installed cell therapy manufacturing capacity (in terms of number of cleanrooms) is presently available with industry players; maximum capacity is installed in facilities based in North America.

- The rising demand for cell-based therapies stems from increasing product approvals, advancing therapies, expanding healthcare infrastructure, and growing patient awareness.

- The cell therapy manufacturing domain is poised to grow at a CAGR of 8.25%, owing to high capital costs and advanced technologies; ~60% of manufacturing activities are expected to be outsourced to CMOs.

- Owing to the rising prevalence of cancer, and shift in patient preferences towards tailored cell therapies and advancements in cell therapy manufacturing technologies, the market is poised for a steady growth in the future.

- North America is expected to capture a significant share of the cell therapy manufacturing market in the current year owing to rapid innovation of technologies within the region.

- Driven by the success of approved cell therapies developed by prominent players in the US, the commercial cell therapy manufacturing market is expected to grow at CAGR of 12.93%.

- Given the rapid clinical success and rising demand for cell therapies, coupled with their extensive potential in treating disorders like blood cancer, the industry is well-positioned for future growth.

Cell Therapy Manufacturing Market

The market sizing and opportunity analysis has been segmented across the following parameters:

By Type of Cell Therapy

- CAR-T Cell Therapy

- Stem Cell Therapy

- TCR Therapy

- TIL Therapy

- Dendritic Cell Therapy

- Others

By Source of Cells

- Autologous Cells

- Allogeneic Cells

- Unspecified Cells

By Scale of Operation

- Clinical Scale

- Commercial Scale

By Type of Manufacturer

- In-house Manufacturers

- Contract Manufacturing Organizations

By Geographical Regions

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- Spain

- UK

- Rest of Europe

Asia-Pacific and Rest of the World

- Argentina

- Australia

- Brazil

- China

- India

- Israel

- Japan

- Singapore

- South Africa

- South Korea

- Taiwan

Cell Therapy Manufacturing Market: Key Segments

CAR-T Cell Therapies Accounts for the Largest Share in the Cell Therapy Manufacturing Market

In the present year, the CAR-T cell therapies segment holds the largest market share (approximately 65%), attributed to the shorter treatment regimen that requires fewer infusions. Further, the segment of other cell therapies, which includes natural killer cell therapies and gene-modified cell therapies, is anticipated to experience a higher compound annual growth rate (CAGR) of 16.15% throughout the forecast period. The favorable safety profile of NK cells reduces the risk of conditions such as graft-versus-host disease. Additionally, their potential to function as off-the-shelf therapies propels this growth.

Autologous Cells Hold the Highest Share in the Cell Therapy Manufacturing Market

In 2035, the autologous segment is projected to hold a larger share of the cell therapy manufacturing market, accounting for over 50%. Additionally, this segment is expected to experience a notable growth rate throughout the forecast period. This can be attributed mainly to the focus of autologous cell therapy manufacturing on the patient's own cells, which minimizes the risk of immune rejection that can result in severe complications such as graft-versus-host disease.

North America Dominates the Market by Securing Highest Share

Based on our market forecast, North America is expected to hold the largest share of the cell therapy manufacturing market, accounting for approximately 45% by 2025. Further, we anticipate that North America will experience a comparatively faster growth rate of 9.70% until 2035. It is important to highlight that around 60% of this market derives from clinical cell therapy manufacturing. In the clinical cell therapy manufacturing sector, the U.S. has become a central hub for manufacturers, bolstered by their innovation-friendly regulatory framework and highly qualified workforce. This regional concentration enables efficient scaling of cell therapy production, from initial development stages to commercial supply.

Primary Research Overview

The opinions and insights presented in the market report were also influenced by discussions held with senior stakeholders in the industry. The market report includes detailed transcripts of interviews conducted with the following individuals:

- Marketing Manager, Cell Therapy, Mid-sized Company, Australia

- Director, UK

- Marketing Director, Small Company, Belgium

- Management Board Vice-President, Large Company, Poland

- Senior Director of Sales Advanced Therapies; Vice President of Marketing, Small Company, US

- Business Administration Department Manager, Mid-sized Company, Japan

- Chief Business Officer, Small Company, Netherlands

- Director of Finance and Facility Operations, US

- Senior Director, Very Large Company, Japan

- Chief Executive Officer, Mid-sized Company, UK

- Former Chief Technical Officer, Large Company, US

- Former Chief Executive Officer, Small Company, Netherlands

- Former General Manager, Small Company, France

- Chief Executive Officer, Large Company, China

- Executive Vice President Research and Development, Small Company, Israel

- Former Business Development Manager, Mid-sized Company, UK

- Professor and American Red Cross Chair in Transfusion Medicine, US

- Former Co-Founder and Chief Executive Officer, Small Company, Singapore

- Former Manager, Business Development and Operations-cGMP Manufacturing Unit, Mid-sized Company, Canada

- Manager of Business Development, Small Company, US

- Former Department Leader, Cell Therapy Innovation and Development, Mid-sized Company, France

- Former Chief Executive Officer, Mid-sized Company, Australia

- Chief Executive Officer, Small Company, Netherlands

Example Players in Cell Therapy Manufacturing Market

- Advanced Therapies

- AGC Biologics

- Astellas Pharma

- Catalent

- Charles River Laboratories

- City of Hope

- Clinical Cell and Vaccine Production Facility (CVPF)

- Evotec

- Fraunhofer Institute for Cell Therapy and Immunology

- ImmunityBio

- Lonza

- Merck Millipore

- Miltenyi Biotec

- Minaris Advanced Therapies

- Newcastle Advanced Therapies

- NHS Blood and Transplant

- OBiO Tech

- Pharmaron

- Rayne Cell Therapy Suite

- Resilience

- Sartorius

- Scottish National Blood Transfusion Service (SNBTS) Cellular Therapy Facility

- SK pharmteco (Subsidiary of SK Inc.)

- Takara Bio

- Thermo Fisher Scientific

Cell Therapy Manufacturing Market: Research Coverage

- Market Sizing and Opportunity Analysis: The report features an in-depth analysis of the cell therapy manufacturing market, focusing on key market segments, including [A] type of cell therapy, [B] source of cells, [C] scale of operation, [D] type of manufacturer, and [E] geographical regions.

- Industry Players - Market Landscape 1: A detailed overview of the current market landscape of companies engaged of industry players in cell therapy manufacturing domain, featuring information on, along with information on several relevant parameters, such as [A] year of establishment, [B] company size, [C] location of headquarters, [D] location of manufacturing facility, [E] type of immune cell offered, [F] source of cells, [G] scale of operation, and [H] type of additional service offered.

- Non-industry Players - Market Landscape 2: A detailed overview of the current market landscape of non-industry players in cell therapy manufacturing domain along with information on several relevant parameters, such as [A] year of establishment, [B] company size, [C] location of headquarters, [D] location of manufacturing facility, [E] type of immune cell offered, [F] source of cells, [G] scale of operation, and [H] type of additional service offered.

- Regulatory Landscape: An overview of cell therapy manufacturing related regulations across various geographies, including North America (focusing on the US), Europe and Asia (focusing on Japan and China), featuring an analysis of the diverse certifications / accreditations awarded to the manufacturing facilities by important regulatory bodies across the globe.

- Case Study 1: An overview of the various roadmaps published by different agencies across the globe in order to provide strategies to advance cell therapy manufacturing process.

- Case Study 2: A detailed role of technology automation in cell therapy manufacturing in order to optimize the current manufacturing practices with the use of closed and single use systems. Further, it features a roadmap that provides information on the steps to develop automation devices, supported by two case studies

- Company Profiles: In-depth profiles of prominent industry and non-industry players in North America, Europe and Asia-Pacific that are involved in cell therapy manufacturing based on [A] year of establishment, [B] location of headquarters, [C] product portfolio, [D] recent developments and [E] an informed future outlook.

- Clinical Trial Analysis: An analysis of completed, ongoing and planned clinical trial, based on several relevant parameters, such as trial registration year, enrolled patient population, trial status, trial phase, patient gender, study design, type of allocation, intervention model, type of masking, type of sponsor / collaborator most active players (in terms of number of clinical trial conducted) and geographical distribution of trials.

- Partnerships and Collaborations: An in-depth analysis of the partnerships and collaborations that have been inked by cell therapy manufacturers, based on several relevant parameters, such as year of partnership, type of partnership, type of immune cell offered, scale of operation and most active players (in terms of number of partnerships). The chapter also highlights the regional distribution of partnership activity in this market.

- Recent Expansions: A detailed analysis of expansions reported in the domain, along with analysis on several relevant parameters, such as [A] year of expansion, [B] status of expansion, [C] type of expansion, [D] location of facility, [E] amount invested, [F] type of immune cell offered, [G] type of service offered and [H] most active players.

- Big Pharma Initiatives: An in-depth analysis of the various cell therapy manufacturing focused initiatives undertaken by big pharma players, based on several relevant parameters, such as [A] year of initiative, [B] type of initiative, [C] number of initiatives, [D] type of partnership, [E] number of partnerships, [F] type of facility expansion, [G] number of facility expansions, [H] region of facility expansion, [I] number of mergers and acquisitions, [J] number of funding and investment, [K] type of immune cell offered, and [L]scale of operation.

- Capacity Analysis: An estimate an estimate of the overall installed capacity for the manufacturing of cell-based therapies, based on information reported by various industry stakeholders in the public domain, highlighting the distribution of the available capacity in terms of cleanroom area and number of cleanrooms.

- Demand Analysis: An informed estimate of the annual commercial and clinical demand for cell therapies, across several relevant parameters, such as [A] type of cell therapy, and [B] key geographical regions.

- Cost Price Analysis: A detailed analysis of various factors that are likely to influence the price of cell-based therapies, featuring different models / approaches adopted by manufacturers in order to determine the price of their proprietary offerings.

- Make Versus Buy Decision Making Framework: A qualitative analysis that highlights the various factors that need to be taken into consideration by cell therapy developers, while deciding whether to manufacture their respective products in-house or engage the services of a CMO.

- Total Cost of Ownership: A detailed total cost of ownership analysis based on company size, for cell therapy manufacturing organizations, over a period of 20 years.

- SWOT Analysis: a discussion on strength, weaknesses, opportunities and threats, highlighting the relative effect of each SWOT parameter on the overall market dynamics.

Key Questions Answered in this Report

- Which are the leading companies in cell therapy manufacturing market?

- Which region dominates the cell therapy contract manufacturing market?

- What are the key trends observed in the cell therapy manufacturing market?

- What factors are likely to influence the evolution of this market?

- What are the primary challenges faced by cell therapy contract manufacturers?

- What is the current and future market size?

- What is the CAGR of this market?

- How is the current and future market opportunity likely to be distributed across key market segments?

Reasons to Buy this Report

- The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- The report offers stakeholders a comprehensive overview of the market, including key drivers, barriers, opportunities, and challenges. This information empowers stakeholders to stay abreast of market trends and make data-driven decisions to capitalize on growth prospects.

- The report can aid businesses in identifying future opportunities in any sector. It also helps in understanding if those opportunities are worth pursuing.

- The report helps in identifying customer demand by understanding the needs, preferences, and behavior of the target audience in order to tailor products or services effectively.

- The report equips new entrants with requisite information regarding a particular market to help them build successful business strategies.

- The report allows for more effective communication with the audience and in building strong business relations.

Additional Benefits

- Complementary PPT Insights Pack

- Complimentary Excel Data Packs for all Analytical Modules in the Report

- 15% Free Content Customization

- Detailed Report Walkthrough Session with Research Team

- Free Updated report if the report is 6-12 months old or older

TABLE OF CONTENTS

1. PREFACE

- 1.1. Introduction

- 1.2. Market Share Insights

- 1.3. Key Market Insights

- 1.4. Report Coverage

- 1.5. Key Questions Answered

- 1.6. Chapter Outlines

2. RESEARCH METHODOLOGY

- 2.1. Chapter Overview

- 2.2. Research Assumptions

- 2.2.1. Market Landscape and Market Trends

- 2.2.2. Market Forecast and Opportunity Analysis

- 2.2.3. Comparative Analysis

- 2.3. Database Building

- 2.3.1. Data Collection

- 2.3.2. Data Validation

- 2.3.3. Data Analysis

- 2.4. Project Methodology

- 2.4.1. Secondary Research

- 2.4.1.1. Annual Reports

- 2.4.1.2. Academic Research Papers

- 2.4.1.3. Company Websites

- 2.4.1.4. Investor Presentations

- 2.4.1.5. Regulatory Filings

- 2.4.1.6. White Papers

- 2.4.1.7. Industry Publications

- 2.4.1.8. Conferences and Seminars

- 2.4.1.9. Government Portals

- 2.4.1.10. Media and Press Releases

- 2.4.1.11. Newsletters

- 2.4.1.12. Industry Databases

- 2.4.1.13. Roots Proprietary Databases

- 2.4.1.14. Paid Databases and Sources

- 2.4.1.15. Social Media Portals

- 2.4.1.16. Other Secondary Sources

- 2.4.2. Primary Research

- 2.4.2.1. Types of Primary Research

- 2.4.2.1.1. Qualitative Research

- 2.4.2.1.2. Quantitative Research

- 2.4.2.1.3. Hybrid Approach

- 2.4.2.2. Advantages of Primary Research

- 2.4.2.3. Techniques for Primary Research

- 2.4.2.3.1. Interviews

- 2.4.2.3.2. Surveys

- 2.4.2.3.3. Focus Groups

- 2.4.2.3.4. Observational Research

- 2.4.2.3.5. Social Media Interactions

- 2.4.2.4. Key Opinion Leaders Considered in Primary Research

- 2.4.2.4.1. Company Executives (CXOs)

- 2.4.2.4.2. Board of Directors

- 2.4.2.4.3. Company Presidents and Vice Presidents

- 2.4.2.4.4. Research and Development Heads

- 2.4.2.4.5. Technical Experts

- 2.4.2.4.6. Subject Matter Experts

- 2.4.2.4.7. Scientists

- 2.4.2.4.8. Doctors and Other Healthcare Providers

- 2.4.2.5. Ethics and Integrity

- 2.4.2.5.1. Research Ethics

- 2.4.2.5.2. Data Integrity

- 2.4.2.1. Types of Primary Research

- 2.4.3. Analytical Tools and Databases

- 2.4.1. Secondary Research

- 2.5. Robust Quality Control

3. MARKET DYNAMICS

- 3.1. Chapter Overview

- 3.2. Forecast Methodology

- 3.2.1. Top-down Approach

- 3.2.2. Bottom-up Approach

- 3.2.3. Hybrid Approach

- 3.3. Market Assessment Framework

- 3.3.1. Total Addressable Market (TAM)

- 3.3.2. Serviceable Addressable Market (SAM)

- 3.3.3. Serviceable Obtainable Market (SOM)

- 3.3.4. Currently Acquired Market (CAM)

- 3.4. Forecasting Tools and Techniques

- 3.4.1. Qualitative Forecasting

- 3.4.2. Correlation

- 3.4.3. Regression

- 3.4.4. Extrapolation

- 3.4.5. Convergence

- 3.4.6. Sensitivity Analysis

- 3.4.7. Scenario Planning

- 3.4.8. Data Visualization

- 3.4.9. Time Series Analysis

- 3.4.10. Forecast Error Analysis

- 3.5. Key Considerations

- 3.5.1. Demographics

- 3.5.2. Government Regulations

- 3.5.3. Reimbursement Scenarios

- 3.5.4. Market Access

- 3.5.5. Supply Chain

- 3.5.6. Industry Consolidation

- 3.5.7. Pandemic / Unforeseen Disruptions Impact

- 3.6. Limitations

4. MACRO-ECONOMIC INDICATORS

- 4.1. Chapter Overview

- 4.2. Market Dynamics

- 4.2.1. Time Period

- 4.2.1.1. Historical Trends

- 4.2.1.2. Current and Forecasted Estimates

- 4.2.2. Currency Coverage

- 4.2.2.1. Major Currencies Affecting the Market

- 4.2.2.2. Factors Affecting Currency Fluctuations

- 4.2.2.3. Impact of Currency Fluctuations on the Industry

- 4.2.3. Foreign Currency Exchange Rate

- 4.2.3.1. Impact of Foreign Exchange Rate Volatility on the Market

- 4.2.3.2. Strategies for Mitigating Foreign Exchange Risk

- 4.2.4. Recession

- 4.2.4.1. Assessment of Current Economic Conditions and Potential Impact on the Market

- 4.2.4.2. Historical Analysis of Past Recessions and Lessons Learnt

- 4.2.5. Inflation

- 4.2.5.1. Measurement and Analysis of Inflationary Pressures in the Economy

- 4.2.5.2. Potential Impact of Inflation on the Market Evolution

- 4.2.6. Interest Rates

- 4.2.6.1. Interest Rates and Their Impact on the Market

- 4.2.6.2. Strategies for Managing Interest Rate Risk

- 4.2.7. Commodity Flow Analysis

- 4.2.7.1. Type of Commodity

- 4.2.7.2. Origins and Destinations

- 4.2.7.3. Values and Weights

- 4.2.7.4. Modes of Transportation

- 4.2.8. Global Trade Dynamics

- 4.2.8.1. Import Scenario

- 4.2.8.2. Export Scenario

- 4.2.8.3. Trade Policies

- 4.2.8.4. Strategies for Mitigating the Risks Associated with Trade Barriers

- 4.2.8.5. Impact of Trade Barriers on the Market

- 4.2.9. War Impact Analysis

- 4.2.9.1. Russian-Ukraine War

- 4.2.9.2. Israel-Hamas War

- 4.2.10. COVID Impact / Related Factors

- 4.2.10.1. Global Economic Impact

- 4.2.10.2. Industry-specific Impact

- 4.2.10.3. Government Response and Stimulus Measures

- 4.2.10.4. Future Outlook and Adaptation Strategies

- 4.2.11. Other Indicators

- 4.2.11.1. Fiscal Policy

- 4.2.11.2. Consumer Spending

- 4.2.11.3. Gross Domestic Product

- 4.2.11.4. Employment

- 4.2.11.5. Taxes

- 4.2.11.6. Stock Market Performance

- 4.2.11.7. Cross Border Dynamics

- 4.2.1. Time Period

- 4.3. Conclusion

5. EXECUTIVE SUMMARY

- 5.1. Executive Summary: Market Landscape

- 5.2. Executive Summary: Market Trends

- 5.3. Executive Summary: Market Forecast and Opportunity Analysis

6. INTRODUCTION

- 6.1. Chapter Overview

- 6.2. Introduction to Cell-based Therapies

- 6.2.1. Comparison of Cell-based Therapies and Other Biotechnology Products

- 6.2.2. Classification of Advanced Therapy Medicinal Products (ATMPs)

- 6.2.3. Current Market Landscape of ATMPs

- 6.3. Overview of Cell Therapy Manufacturing

- 6.4. Cell Therapy Manufacturing Models

- 6.4.1. Centralized Manufacturing

- 6.4.2. Decentralized Manufacturing

- 6.5. Scalability of Cell Therapy Manufacturing Processes

- 6.5.1. Scale-up

- 6.5.2. Scale-out

- 6.6. Types of Cell Therapy Manufacturers

- 6.7. Key Challenges for Manufacturing Cell Therapies

- 6.8. Key Factors Influencing Cell Therapy Manufacturing

- 6.8.1. Cell Characterization

- 6.8.2. Cost of Goods

- 6.9. Automation of Cell Therapy Manufacturing

- 6.10. Cell Therapy Manufacturing Supply Chain

- 6.11. Future Perspectives

7. CELL THERAPY MANUFACTURERS (INDUSTRY PLAYERS): MARKET LANDSCAPE

- 7.1. Chapter Overview

- 7.2. Industry Players: Overall Market Landscape

- 7.2.1. Analysis by Year of Establishment

- 7.2.2. Analysis by Company Size

- 7.2.3. Analysis by Location of Headquarters (Region)

- 7.2.4. Analysis by Location of Headquarters (Country)

- 7.2.5. Analysis by Company Size and Location of Headquarters (Region)

- 7.2.6. Analysis by Location of Manufacturing Facility

- 7.2.7. Analysis by Type of Immune Cell Offered

- 7.2.8. Analysis by Source of Cells

- 7.2.9. Analysis by Scale of Operation

- 7.2.10. Analysis by Type of Additional Service Offered

8. CELL THERAPY MANUFACTURERS (NON-INDUSTRY PLAYERS): MARKET LANDSCAPE

- 8.1. Chapter Overview

- 8.2. Non-Industry Players: Overall Market Landscape

- 8.2.1. Analysis by Year of Establishment

- 8.2.2. Analysis by Location of Headquarters (Region)

- 8.2.3. Analysis by Location of Headquarters (Country)

- 8.2.4. Analysis by Location of Manufacturing Facility

- 8.2.5. Analysis by Type of Immune Cell Offered

- 8.2.6. Analysis by Source of Cell

- 8.2.7. Analysis by Scale of Operation

- 8.2.8. Analysis by Type of Additional Service Offered

9. REGULATORY LANDSCAPE

- 9.1. Chapter Overview

- 9.2. Current Scenario

- 9.2.1. Regulatory Guidelines in North America

- 9.2.2. Regulatory Guidelines in Europe

- 9.2.3. Regulatory Guidelines in Asia-Pacific

- 9.2.3.1. Regulatory Guidelines in Japan

- 9.2.3.2. Regulatory Guidelines in China

- 9.2.4. Conditional Approvals

- 9.3. Regulatory Authorities for Cell Therapy Manufacturing

- 9.3.1. Cell Therapy Manufacturing (Industry Players): Regulatory Authorities

- 9.4. Summary of Guidelines for Early-Stage Manufacturing of Cell Therapies

- 9.5. Existing Challenges to Early-Stage Manufacturing of Cell Therapies

- 9.6. Variability in Regulatory Guidelines across Different Geographies

10. CASE STUDY: ROADMAPS FOR OVERCOMING CHALLENGES RELATED TO CELL THERAPY MANUFACTURING

- 10.1. Chapter Overview

- 10.2. Roadmap for the US

- 10.2.1. Cell Processing

- 10.2.2. Cell Preservation, Distribution and Handling

- 10.2.3. Process Automation and Data Analytics

- 10.2.4. Process Monitoring and Quality Control

- 10.2.5. Standardization and Regulatory Support

- 10.2.6. Workforce Development

- 10.2.7. Supply Chain and Logistics

- 10.3. Roadmaps for Other Geographies

- 10.3.1. Europe

- 10.3.2. Asia-Pacific

11. CASE STUDY: AUTOMATION TECHNOLOGIES FOR CELL THERAPY MANUFACTURING

- 11.1. Chapter Overview

- 11.2. Automation of Cell Therapy Manufacturing Processes

- 11.2.1. Closed Systems

- 11.2.2. Single-use Systems

- 11.2.3. Modular Systems

- 11.3. Growth Drivers and Roadblocks

- 11.4. Case Studies

- 11.4.1. Roadmap to Develop an Automated Cell Manufacturing / Processing Device

- 11.4.2. Automating the Cell Therapy Manufacturing Process

- 11.4.3. Advancement to Automation of Cell Therapy Manufacturing Process

- 11.4.4. GMP-in-a-Box

- 11.4.5. List of Automated and Closed Cell Therapy Processing Systems

12. COMPANY PROFILES: INDUSTRY PLAYERS

- 12.1. Chapter Overview

- 12.2. Service Providers in North America

- 12.2.1. Advanced Therapies

- 12.2.1.1. Company Overview

- 12.2.1.2. Financial Information

- 12.2.1.3. Service Portfolio

- 12.2.1.4. Manufacturing Facilities and Capabilities

- 12.2.1.5. Recent Developments and Future Outlook

- 12.2.1. Advanced Therapies

- similar details are presented for other below mentioned players based on information in the public domain

- 12.2.2. AGC Biologics

- 12.2.3. Catalent

- 12.2.4. Charles River Laboratories

- 12.2.5. ImmunityBio

- 12.2.6. Merck Millipore

- 12.2.7. Minaris Advanced Therapies

- 12.2.8. Resilience

- 12.2.9. SK pharmteco (Subsidiary of SK Inc.)

- 12.2.10. Thermo Fisher Scientific

- 12.3. Service Providers in Europe

- 12.3.1. Evotec

- 12.3.2. Lonza

- 12.3.3. Miltenyi Biotec

- 12.3.4. Sartorius

- 12.4. Service Providers in Asia-Pacific

- 12.4.1. Astellas Pharma

- 12.4.2. OBiO Tech

- 12.4.3. Pharmaron

- 12.4.4. Takara Bio

13. COMPANY PROFILES: NON-INDUSTRY PLAYERS

- 13.1. Chapter Overview

- 13.2. City of Hope

- 13.2.1. Overview

- 13.2.2. Service Portfolio

- 13.2.3. Type of Additional Service Offered

- similar details are presented for other below mentioned players based on information in the public domain

- 13.3. Clinical Cell and Vaccine Production Facility (CVPF)

- 13.4. Fraunhofer Institute for Cell Therapy and Immunology

- 13.5. Newcastle Advanced Therapies

- 13.6. NHS Blood and Transplant

- 13.7. Rayne Cell Therapy Suite (King's College London)

- 13.8. Scottish National Blood Transfusion Service (SNBTS) Cellular Therapy Facility

14. NON-PROFIT ORGANIZATIONS IN CELL THERAPY MANUFACTURING

- 14.1. Chapter Overview

- 14.2. Cell Therapy Manufacturing: Non-Profit Organizations

- 14.2.1. CellCAN

- 14.2.2. Cell Therapy Manufacturing Cooperative Research Center

- 14.2.3. National Cell Manufacturing Consortium (NCMC)

- 14.2.4. California Institute of Regenerative Medicine (CIRM)

- 14.3. Cell Therapy Manufacturing: International Societies

15. CLINICAL TRIAL ANALYSIS

- 15.1. Chapter Overview

- 15.2. Scope and Methodology

- 15.3. Cell Therapies: Clinical Trial Analysis

- 15.3.1. Analysis by Trial Registration Year

- 15.3.2. Analysis by Trial Registration Year and Enrolled Patient Population

- 15.3.3. Analysis by Trial Status

- 15.3.4. Analysis by Trial Registration Year and Trial Status

- 15.3.5. Analysis by Trial Phase

- 15.3.6. Analysis of Enrolled Patient Population by Trial Phase

- 15.3.7. Analysis by Patient Gender

- 15.3.8. Analysis by Study Design

- 15.3.8.1. Analysis by Type of Allocation

- 15.3.8.2. Analysis by Intervention Model

- 15.3.8.3. Analysis by Type of Masking

- 15.3.9. Analysis by Type of Sponsor / Collaborator

- 15.3.10. Most Active Players: Analysis by Number of Registered Trials

- 15.3.11. Analysis by Geography

- 15.3.11.1. Analysis of Clinical Trials by Geography

- 15.3.11.2. Analysis of Clinical Trials by Trial Status and Geography

- 15.3.11.3. Analysis of Enrolled Patient Population by Trial Status and Geography

16. PARTNERSHIPS AND COLLABORATIONS

- 16.1. Chapter Overview

- 16.2. Partnership Models

- 16.3. Cell Therapy Manufacturing: List of Partnerships

- 16.3.1. Analysis by Year of Partnership

- 16.3.2. Analysis by Type of Partnership

- 16.3.3. Analysis by Year and Type of Partnership

- 16.4. Analysis by Type of Immune Cell Offered

- 16.5. Analysis by Scale of Operation

- 16.6. Most Active Players: Analysis by Number of Partnerships

- 16.7. Analysis by Geography

- 16.7.1. Local and International Agreements

- 16.7.2. Intracontinental and Intercontinental Agreements

17. RECENT EXPANSIONS

- 17.1. Chapter Overview

- 17.2. Type of Expansions

- 17.3. Cell Therapy Manufacturing: Recent Expansions

- 17.3.1. Analysis by Year of Expansion

- 17.3.2. Analysis by Type of Expansion

- 17.3.3. Analysis by Year and Type of Expansion

- 17.3.4. Analysis by Location of Expanded Facility (Region)

- 17.3.5. Analysis by Location of Expanded Facility (Country)

- 17.3.6. Analysis by Type of Expansion and Location of Headquarters (Country)

- 17.3.7. Analysis by Type of Immune Cell Offered

- 17.3.8. Analysis by Type of Expansion and Type of Immune Cell Offered

- 17.3.9. Analysis by Scale of Operation

- 17.3.10. Most Active Players: Analysis by Number of Expansions

- 17.3.11. Most Active Players: Analysis by Area of Expansion

18. BIG PHARMA INITIATIVES

- 18.1. Chapter Overview

- 18.2. Cell Therapy Manufacturing: List of Big Pharma Players

- 18.3. Cell Therapy Manufacturing: List of Initiatives by Big Pharma Players

- 18.3.1. Analysis by Year of Initiative

- 18.3.2. Analysis by Type of Initiative

- 18.3.3. Analysis by Year and Type of Initiative

- 18.3.4. Big Players: Analysis by Number of Initiatives

- 18.3.5. Analysis by Type of Partnership

- 18.3.6. Big Players: Analysis by Number of Partnerships

- 18.3.7. Analysis by Type of Facility Expansion

- 18.3.8. Big Players: Analysis by Number of Facility Expansions

- 18.3.9. Big Players: Analysis by Region of Facility Expansion

- 18.3.10. Big Players: Analysis by Number of Mergers and Acquisitions

- 18.3.11. Big Players: Analysis by Number of Funding and Investment

- 18.3.12. Analysis by Type of Immune Cell Offered

- 18.3.13. Analysis by Scale of Operation

- 18.3.14. Analysis of Big Pharma Players by Scale of Operation

- 18.3.15. Big Pharma Initiatives Summary

19. CAPACITY ANALYSIS

- 19.1. Chapter Overview

- 19.2. Industry Players: Key Assumptions and Methodology

- 19.2.1. Cell Therapy Manufacturing: Global Installed Capacity (Number of Cleanrooms)

- 19.2.1.1. Analysis by Company Size

- 19.2.1.2. Analysis by Scale of Operation

- 19.2.1.3. Analysis by Location of Manufacturing Facility

- 19.2.1.4. Analysis by Company Size and Location of Manufacturing Facility

- 19.2.1.5. Analysis by Scale of Operation and Location of Manufacturing Facility

- 19.2.2. Cell Therapy Manufacturing: Global Installed Capacity (Cleanroom Area)

- 19.2.2.1. Analysis by Company Size

- 19.2.2.2. Analysis by Scale of Operation

- 19.2.2.3. Analysis by Location of Manufacturing Facility

- 19.2.2.4. Analysis by Company Size and Location of Manufacturing Facility

- 19.2.2.5. Analysis by Scale of Operation and Location of Manufacturing Facility

- 19.2.1. Cell Therapy Manufacturing: Global Installed Capacity (Number of Cleanrooms)

- 19.3. Non- Industry Players: Key Assumptions and Methodology

- 19.3.1. Cell Therapy Manufacturing: Global Installed Capacity (Number of Cleanrooms)

- 19.3.1.1. Analysis by Scale of Operation

- 19.3.1.2. Analysis by Location of Manufacturing Facility

- 19.3.2. Cell Therapy Manufacturing: Global Installed Capacity (Cleanroom Area)

- 19.3.2.1. Analysis by Scale of Operation

- 19.3.2.2. Analysis by Location of Manufacturing Facility

- 19.3.1. Cell Therapy Manufacturing: Global Installed Capacity (Number of Cleanrooms)

- 19.4. Concluding Remarks

20. DEMAND ANALYSIS

- 20.1. Chapter Overview

- 20.2. Assumptions and Methodology

- 20.3. Global Demand for Cell Therapy Manufacturing

- 20.4. Global Clinical Demand for Cell Therapy Manufacturing

- 20.4.1. Clinical Demand: Analysis by Type of Cell Therapy

- 20.4.2. Clinical Demand: Analysis by Geography

- 20.5. Global Commercial Demand for Cell Therapy Manufacturing

- 20.5.1. Commercial Demand: Analysis by Type of Cell Therapy

- 20.5.2. Commercial Demand: Analysis by Geography

21. COST PRICE ANALYSIS

- 21.1. Chapter Overview

- 21.2. Factors Contributing to the High Price of Cell Therapies

- 21.3. Pricing Models for Cell Therapies

- 21.3.1. Based on Associated Costs for T-cell Therapies

- 21.3.2. Based on Associated Costs for Stem Cell Therapies

- 21.3.3. Based on Availability of Competing Products

- 21.3.4. Based on Target Patient Segment

- 21.3.5. Based on the Opinions of Industry Experts

- 21.4. Cell Therapy Cost Optimization

- 21.4.1. Role of Cost of Goods Sold

- 21.4.2. Role of Automation

- 21.5. Role of Cell Therapy Contract Manufacturing Organizations

- 21.6. Reimbursement-related Considerations for Cell Therapies

- 21.6.1. Case Study: The National Institute for Health and Care Excellence's (NICE) Appraisal of CAR-T Therapies

22. MAKE VERSUS BUY DECISION MAKING FRAMEWORK

- 22.1. Chapter Overview

- 22.2. Assumptions and Key Parameters

- 22.3. Cell Therapy Manufacturing: Make versus Buy Decision Making

- 22.3.1. Scenario 1

- 22.3.2. Scenario 2

- 22.3.3. Scenario 3

- 22.3.4. Scenario 4

23. TOTAL COST OF OWNERSHIP FOR CELL THERAPY MANUFACTURING ORGANIZATIONS

- 23.1. Chapter Overview

- 23.2. Key Parameters

- 23.3. Assumptions and Methodology

- 23.4. Sample Dataset for the Estimation of Total Cost of Ownership

- 23.5. Total Cost of Ownership for Mid-sized Cell Therapy Manufacturing Organizations, Y0-Y20

- 23.6. Total Cost of Ownership for Mid-sized Cell Therapy Manufacturing Organizations: Analysis by CAPEX and OPEX, Y0 and Y20

- 23.6.1. Total Cost of Ownership for Mid-sized Cell Therapy Manufacturing Organizations: Analysis by CAPEX, Y0

- 23.6.2. Total Cost of Ownership for Mid-sized Cell Therapy Manufacturing Organizations: Analysis by OPEX, Y1-Y20

24. SWOT ANALYSIS

- 24.1. Chapter Overview

- 24.2. Strengths

- 24.3. Weaknesses

- 24.4. Opportunities

- 24.5. Threats

- 24.6. Comparison of SWOT Factors

25. SURVEY ANALYSIS

- 25.1. Chapter Overview

- 25.2. Analysis by Designation of Respondents

- 25.3. Analysis by Type of Cell Therapy

- 25.4. Analysis by Scale of Operation

- 25.5. Analysis by Source of Cells

- 25.6. Analysis by Type of Cell Culture System Used

- 25.7. Analysis by Availability of Fill / Finish Services

26. GLOBAL CELL THERAPY MANUFACTURING MARKET

- 26.1. Chapter Overview

- 26.2. Assumptions and Methodology

- 26.3. Global Cell Therapy Manufacturing Market, Historical Trends (since 2023) and Forecasted Estimates (till 2035)

- 26.4. Roots Analysis Perspective on Market Growth

- 26.5. Scenario Analysis

- 26.5.1. Conservative Scenario

- 26.5.2. Optimistic Scenario

- 26.6. Key Market Segmentations

27. CELL THERAPY MANUFACTURING MARKET, BY TYPE OF CELL THERAPY

- 27.1. Chapter Overview

- 27.2. Key Assumptions and Methodology

- 27.3. Cell Therapy Manufacturing Market: Distribution by Type of Cell Therapy

- 27.3.1. Cell Therapy Manufacturing Market for CAR-T Cell Therapies, Historical Trends (since 2023) and Forecasted Estimates (till 2035)

- 27.3.2. Cell Therapy Manufacturing Market for Stem Cell Therapies, Historical Trends (since 2023) and Forecasted Estimates (till 2035)

- 27.3.3. Cell Therapy Manufacturing Market for TCR Cell Therapies, Historical Trends (since 2023) and Forecasted Estimates (till 2035)

- 27.3.4. Cell Therapy Manufacturing Market for TIL Cell Therapies, Historical Trends (since 2023) and Forecasted Estimates (till 2035)

- 27.3.5. Cell Therapy Manufacturing Market for Dendritic Cell Therapies, Historical Trends (since 2023) and Forecasted Estimates (till 2035)

- 27.3.6. Cell Therapy Manufacturing Market for Other Cell Therapies, Historical Trends (since 2023) and Forecasted Estimates (till 2035)

- 27.4. Data Triangulation and Validation

28. CELL THERAPY MANUFACTURING MARKET, BY SOURCE OF CELLS

- 28.1. Chapter Overview

- 28.2. Key Assumptions and Methodology

- 28.3. Cell Therapy Manufacturing Market: Distribution by Source of Cells

- 28.3.1. Cell Therapy Manufacturing Market for Autologous Cells, Historical Trends (since 2023) and Forecasted Estimates (till 2035)

- 28.3.2. Cell Therapy Manufacturing Market for Allogeneic Cells, Historical Trends (since 2023) and Forecasted Estimates (till 2035)

- 28.3.3. Cell Therapy Manufacturing Market for Other Cells, Historical Trends (since 2023) and Forecasted Estimates (till 2035)

- 28.4. Data Triangulation and Validation

29. CELL THERAPY MANUFACTURING MARKET, BY SCALE OF OPERATION

- 29.1. Chapter Overview

- 29.2. Key Assumptions and Methodology

- 29.3. Cell Therapy Manufacturing Market: Distribution by Scale of Operation

- 29.3.1. Cell Therapy Manufacturing Market for Clinical Scale, Historical Trends (since 2023) and Forecasted Estimates (till 2035)

- 29.3.2. Cell Therapy Manufacturing Market for Commercial Scale, Historical Trends (since 2023) and Forecasted Estimates (till 2035)

30. CELL THERAPY MANUFACTURING MARKET, BY TYPE OF MANUFACTURER

- 30.1. Chapter Overview

- 30.2. Key Assumptions and Methodology

- 30.3. Cell Therapy Manufacturing Market: Distribution by Type of Manufacturer

- 30.3.1. Cell Therapy Manufacturing Market for Contract Manufacturing Organizations, Historical Trends (since 2023) and Forecasted Estimates (till 2035)

- 30.3.2. Cell Therapy Manufacturing Market for In-House Manufacturers, Historical Trends (since 2023) and Forecasted Estimates (till 2035)

- 30.4. Data Triangulation and Validation

31. CELL THERAPY MANUFACTURING MARKET, BY GEOGRAPHY

- 31.1. Chapter Overview

- 31.2. Key Assumptions and Methodology

- 31.3. Cell Therapy Manufacturing Market: Distribution by Geography

- 31.3.1. Clinical Cell Therapy Manufacturing Market

- 31.3.1.1. Clinical Cell Therapy Manufacturing Market in North America, Historical Trends (since 2023) and Forecasted Estimates (till 2035)

- 31.3.1.1.1. Clinical Cell Therapy Manufacturing Market in the US, Historical Trends (since 2023) and Forecasted Estimates (till 2035)

- 31.3.1.1.2. Clinical Cell Therapy Manufacturing Market in Canada, Historical Trends (since 2023) and Forecasted Estimates (till 2035)

- 31.3.1.2. Clinical Cell Therapy Manufacturing Market in Europe, Historical Trends (since 2023) and Forecasted Estimates (till 2035)

- 31.3.1.2.1. Clinical Cell Therapy Manufacturing Market in Spain, Historical Trends (since 2023) and Forecasted Estimates (till 2035)

- 31.3.1.2.2. Clinical Cell Therapy Manufacturing Market in France, Historical Trends (since 2023) and Forecasted Estimates (till 2035)

- 31.3.1.2.3. Clinical Cell Therapy Manufacturing Market in Germany, Historical Trends (since 2023) and Forecasted Estimates (till 2035)

- 31.3.1.2.4. Clinical Cell Therapy Manufacturing Market in the UK, Historical Trends (since 2023) and Forecasted Estimates (till 2035)

- 31.3.1.2.5. Clinical Cell Therapy Manufacturing Market in Italy, Historical Trends (since 2023) and Forecasted Estimates (till 2035)

- 31.3.1.3. Clinical Cell Therapy Manufacturing Market in Asia-Pacific and Rest of the World, Historical Trends (since 2023) and Forecasted Estimates (till 2035)

- 31.3.1.3.1. Clinical Cell Therapy Manufacturing Market in China, Historical Trends (since 2023) and Forecasted Estimates (till 2035)

- 31.3.1.3.2. Clinical Cell Therapy Manufacturing Market in Singapore, Historical Trends (since 2023) and Forecasted Estimates (till 2035)

- 31.3.1.3.3. Clinical Cell Therapy Manufacturing Market in South Korea, Historical Trends (since 2023) and Forecasted Estimates (till 2035)

- 31.3.1.3.4. Clinical Cell Therapy Manufacturing Market in Israel, Historical Trends (since 2023) and Forecasted Estimates (till 2035)

- 31.3.1.3.5. Clinical Cell Therapy Manufacturing Market in Japan, Historical Trends (since 2023) and Forecasted Estimates (till 2035)

- 31.3.1.3.6. Clinical Cell Therapy Manufacturing Market in Taiwan, Historical Trends (since 2023) and Forecasted Estimates (till 2035)

- 31.3.1.3.7. Clinical Cell Therapy Manufacturing Market in Brazil, Historical Trends (since 2023) and Forecasted Estimates (till 2035)

- 31.3.1.3.8. Clinical Cell Therapy Manufacturing Market in Argentina, Historical Trends (since 2023) and Forecasted Estimates (till 2035)

- 31.3.1.3.9. Clinical Cell Therapy Manufacturing Market in South Africa, Historical Trends (since 2023) and Forecasted Estimates (till 2035)

- 31.3.1.1. Clinical Cell Therapy Manufacturing Market in North America, Historical Trends (since 2023) and Forecasted Estimates (till 2035)

- 31.3.2. Commercial Cell Therapy Manufacturing Market

- 31.3.2.1. Commercial Cell Therapy Manufacturing Market in North America, Historical Trends (since 2023) and Forecasted Estimates (till 2035)

- 31.3.2.1.1. Commercial Cell Therapy Manufacturing Market in the US, Historical Trends (since 2023) and Forecasted Estimates (till 2035)

- 31.3.2.1.2. Commercial Cell Therapy Manufacturing Market in Canada, Historical Trends (since 2023) and Forecasted Estimates (till 2035)

- 31.3.2.2. Commercial Cell Therapy Manufacturing Market in Europe, Historical Trends (since 2023) and Forecasted Estimates (till 2035)

- 31.3.2.2.1. Commercial Cell Therapy Manufacturing Market in Germany, Historical Trends (since 2023) and Forecasted Estimates (till 2035)

- 31.3.2.2.2. Commercial Cell Therapy Manufacturing Market in France, Historical Trends (since 2023) and Forecasted Estimates (till 2035)

- 31.3.2.2.3. Commercial Cell Therapy Manufacturing Market in the UK, Historical Trends (since 2023) and Forecasted Estimates (till 2035)

- 31.3.2.2.4. Commercial Cell Therapy Manufacturing Market in Italy, Historical Trends (since 2023) and Forecasted Estimates (till 2035)

- 31.3.2.2.5. Commercial Cell Therapy Manufacturing Market in Spain, Historical Trends (since 2023) and Forecasted Estimates (till 2035)

- 31.3.2.2.6. Commercial Cell Therapy Manufacturing Market in Rest of Europe, Historical Trends (since 2023) and Forecasted Estimates (till 2035)

- 31.3.2.3. Commercial Cell Therapy Manufacturing Market in Asia-Pacific and Rest of the World, Historical Trends (since 2023) and Forecasted Estimates (till 2035)

- 31.3.2.3.1. Commercial Cell Therapy Manufacturing Market in China, Historical Trends (since 2023) and Forecasted Estimates (till 2035)

- 31.3.2.3.2. Commercial Cell Therapy Manufacturing Market in Japan, Historical Trends (since 2023) and Forecasted Estimates (till 2035)

- 31.3.2.3.3. Commercial Cell Therapy Manufacturing Market in Australia, Historical Trends (since 2023) and Forecasted Estimates (2025-2035)

- 31.3.2.3.4. Commercial Cell Therapy Manufacturing Market in India, Historical Trends (since 2023) and Forecasted Estimates (till 2035)

- 31.3.2.3.5. Commercial Cell Therapy Manufacturing Market in South Korea, Historical Trends (since 2023) and Forecasted Estimates (till 2035)

- 31.3.2.3.6. Commercial Cell Therapy Manufacturing Market in Brazil, Historical Trends (since 2024) and Forecasted Estimates (till 2035)

- 31.3.2.1. Commercial Cell Therapy Manufacturing Market in North America, Historical Trends (since 2023) and Forecasted Estimates (till 2035)

- 31.3.1. Clinical Cell Therapy Manufacturing Market

- 31.4. Penetration Growth (P-G) Matrix

- 31.5. Market Dynamics Assessment

32. CELL THERAPY MANUFACTURING MARKET OPPORTUNITY ANALYSIS: NORTH AMERICA

- 32.1. Cell Therapy Manufacturing Market in North America: Distribution by Type of Cell therapy

- 32.1.1. Cell Therapy Manufacturing Market in North America for CAR-T Cell Therapies, Historical Trends (since 2022) and Forecasted Estimates (till 2035)

- 32.1.2. Cell Therapy Manufacturing Market in North America for Stem Cell Therapies, Historical Trends (since 2022) and Forecasted Estimates (till 2035)

- 32.1.3. Cell Therapy Manufacturing Market in North America for TCR Cell Therapies, Historical Trends (since 2022) and Forecasted Estimates (till 2035)

- 32.1.4. Cell Therapy Manufacturing Market in North America for TIL Cell Therapies, Historical Trends (since 2022) and Forecasted Estimates (till 2035)

- 32.1.5. Cell Therapy Manufacturing Market in North America for Dendritic Cell Therapies, Historical Trends (since 2022) and Forecasted Estimates (till 2035)

- 32.1.6. Cell Therapy Manufacturing Market in North America for Other Cell Therapies, Historical Trends (since 2022) and Forecasted Estimates (till 2035)

- 32.2. Cell Therapy Manufacturing Market in North America: Distribution by Source of Cells

- 32.2.1. Cell Therapy Manufacturing Market in North America for Autologous Cells, Historical Trends (since 2022) and Forecasted Estimates (till 2035)

- 32.2.2. Cell Therapy Manufacturing Market in North America for Allogeneic Cells, Historical Trends (since 2022) and Forecasted Estimates (till 2035)

- 32.2.3. Cell Therapy Manufacturing Market in North America for Other Cells, Historical Trends (since 2022) and Forecasted Estimates (till 2035)

- 32.3. Cell Therapy Manufacturing Market in North America: Distribution by Scale of Operation

- 32.3.1. Cell Therapy Manufacturing Market in North America for Clinical Scale, Historical Trends (since 2022) and Forecasted Estimates (till 2035)

- 32.3.2. Cell Therapy Manufacturing Market in North America for Commercial Scale, Historical Trends (since 2022) and Forecasted Estimates (till 2035)

- 32.4. Cell Therapy Manufacturing Market in North America: Distribution by Type of Manufacturer

- 32.4.1. Cell Therapy Manufacturing Market in North America for Contract Manufacturing Organizations, Historical Trends (since 2022) and Forecasted Estimates (till 2035)

- 32.4.2. Cell Therapy Manufacturing Market in North America for In-House Manufacturers, Historical Trends (since 2022) and Forecasted Estimates (till 2035)

33. CELL THERAPY MANUFACTURING MARKET OPPORTUNITY ANALYSIS: EUROPE

- 33.1. Cell Therapy Manufacturing Market in Europe: Distribution by Type of Cell therapy

- 33.1.1. Cell Therapy Manufacturing Market in Europe for CAR-T Cell Therapies, Historical Trends (since 2022) and Forecasted Estimates (till 2035)

- 33.1.2. Cell Therapy Manufacturing Market in Europe for Stem Cell Therapies, Historical Trends (since 2022) and Forecasted Estimates (till 2035)

- 33.1.3. Cell Therapy Manufacturing Market in Europe for TCR Cell Therapies, Historical Trends (since 2022) and Forecasted Estimates (till 2035)

- 33.1.4. Cell Therapy Manufacturing Market in Europe for TIL Cell Therapies, Historical Trends (since 2022) and Forecasted Estimates (till 2035)

- 33.1.5. Cell Therapy Manufacturing Market in Europe for Dendritic Cell Therapies, Historical Trends (since 2022) and Forecasted Estimates (till 2035)

- 33.1.6. Cell Therapy Manufacturing Market in Europe for Other Cell Therapies, Historical Trends (since 2022) and Forecasted Estimates (till 2035)

- 33.2. Cell Therapy Manufacturing Market in Europe: Distribution by Source of Cells

- 33.2.1. Cell Therapy Manufacturing Market in Europe for Autologous Cells, Historical Trends (since 2022) and Forecasted Estimates (till 2035)

- 33.2.2. Cell Therapy Manufacturing Market in Europe for Allogeneic Cells, Historical Trends (since 2022) and Forecasted Estimates (till 2035)

- 33.2.3. Cell Therapy Manufacturing Market in Europe for Other Cells, Historical Trends (since 2022) and Forecasted Estimates (till 2035)

- 33.3. Cell Therapy Manufacturing Market in Europe: Distribution by Scale of Operation

- 33.3.1. Cell Therapy Manufacturing Market in Europe for Clinical Scale, Historical Trends (since 2022) and Forecasted Estimates (till 2035)

- 33.3.2. Cell Therapy Manufacturing Market in Europe for Commercial Scale, Historical Trends (since 2022) and Forecasted Estimates (till 2035)

- 33.4. Cell Therapy Manufacturing Market in Europe: Distribution by Type of Manufacturer

- 33.4.1. Cell Therapy Manufacturing Market in Europe for Contract Manufacturing Organizations, Historical Trends (since 2022) and Forecasted Estimates (till 2035)

- 33.4.2. Cell Therapy Manufacturing Market in Europe for In-House Manufacturers, Historical Trends (since 2022) and Forecasted Estimates (till 2035)

34. CELL THERAPY MANUFACTURING MARKET OPPORTUNITY ANALYSIS: ASIA-PACIFIC AND REST OF THE WORLD

- 34.1. Cell Therapy Manufacturing Market in Asia-Pacific and Rest of the World: Distribution by Type of Cell therapy

- 34.1.1. Cell Therapy Manufacturing Market in Asia-Pacific and Rest of the World for CAR-T Cell Therapies, Historical Trends (since 2022) and Forecasted Estimates (till 2035)

- 34.1.2. Cell Therapy Manufacturing Market in Asia-Pacific and Rest of the World for Stem Cell Therapies, Historical Trends (since 2022) and Forecasted Estimates (till 2035)

- 34.1.3. Cell Therapy Manufacturing Market in Asia-Pacific and Rest of the World for TCR Cell Therapies, Historical Trends (since 2022) and Forecasted Estimates (till 2035)

- 34.1.4. Cell Therapy Manufacturing Market in Asia-Pacific and Rest of the World for TIL Cell Therapies, Historical Trends (since 2022) and Forecasted Estimates (till 2035)

- 34.1.5. Cell Therapy Manufacturing Market in Asia-Pacific and Rest of the World for Dendritic Cell Therapies, Historical Trends (since 2022) and Forecasted Estimates (till 2035)

- 34.1.6. Cell Therapy Manufacturing Market in Asia-Pacific and Rest of the World for Other Cell Therapies, Historical Trends (since 2022) and Forecasted Estimates (till 2035)

- 34.2. Cell Therapy Manufacturing Market in Asia-Pacific and Rest of the World: Distribution by Source of Cells

- 34.2.1. Cell Therapy Manufacturing Market in Asia-Pacific and Rest of the World for Autologous Cells, Historical Trends (since 2022) and Forecasted Estimates (till 2035)

- 34.2.2. Cell Therapy Manufacturing Market in Asia-Pacific and Rest of the World for Allogeneic Cells, Historical Trends (since 2022) and Forecasted Estimates (till 2035)

- 34.2.3. Cell Therapy Manufacturing Market in Asia-Pacific and Rest of the World for Other Cells, Historical Trends (since 2022) and Forecasted Estimates (till 2035)

- 34.3. Cell Therapy Manufacturing Market in Asia-Pacific and Rest of the World: Distribution by Scale of Operation

- 34.3.1. Cell Therapy Manufacturing Market in Asia-Pacific and Rest of the World for Clinical Scale, Historical Trends (since 2022) and Forecasted Estimates (till 2035)

- 34.3.2. Cell Therapy Manufacturing Market in Asia-Pacific and Rest of the World for Commercial Scale, Historical Trends (since 2022) and Forecasted Estimates (till 2035)

- 34.4. Cell Therapy Manufacturing Market in Asia-Pacific and Rest of the World: Distribution by Type of Manufacturer

- 34.4.1. Cell Therapy Manufacturing Market in Asia-Pacific and Rest of the World for Contract Manufacturing Organizations, Historical Trends (since 2022) and Forecasted Estimates (till 2035)

- 34.4.2. Cell Therapy Manufacturing Market in Asia-Pacific and Rest of the World for In-House Manufacturers, Historical Trends (since 2022) and Forecasted Estimates (till 2035)

- *Detailed information on Chapters 32-34 is available in the Excel Data Packs shared along with the report**

35. CONCLUDING REMARKS

36. EXECUTIVE INSIGHTS

- 36.1. Chapter Overview

- 36.2. Company A (Mid-sized Company, Australia)

- 36.2.1. Company Snapshot

- 36.2.2. Interview Transcript: Marketing Manager, Cell Therapy

- 36.3. Company B (UK)

- 36.3.1. Company Snapshot

- 36.3.2. Interview Transcript: Director

- 36.4. Company C (Small Company, Belgium)

- 36.4.1. Company Snapshot

- 36.4.2. Interview Transcript: Marketing Director

- 36.5. Company D (Large Company, Poland)

- 36.5.1. Company Snapshot

- 36.5.2. Interview Transcript: Management Board Vice-President

- 36.6. Company E (Small Company, US)

- 36.6.1. Company Snapshot

- 36.6.2. Interview Transcript: Senior Director of Sales Advanced Therapies; Vice President of Marketing

- 36.7. Company F (Mid-sized Company, Japan)

- 36.7.1. Company Snapshot

- 36.7.2. Interview Transcript: Business Administration Department Manager

- 36.8. Company G (Small Company, Netherlands)

- 36.8.1. Company Snapshot

- 36.8.2. Interview Transcript: Chief Business Officer

- 36.9. Company H (US)

- 36.9.1. Company Snapshot

- 36.9.2. Interview Transcript: Director of Finance and Facility Operations

- 36.10. Company I (Very Large Company, Japan)

- 36.10.1. Company Snapshot

- 36.10.2. Interview Transcript: Senior Director

- 36.11. Company J (Mid-sized Company, UK)

- 36.11.1. Company Snapshot

- 36.11.2. Interview Transcript: Chief Executive Officer

- 36.12. Company K (Large Company, US)

- 36.12.1. Company Snapshot

- 36.12.2. Interview Transcript: Former Chief Technical Officer

- 36.13. Company L (Small Company, Netherlands)

- 36.13.1. Company Snapshot

- 36.13.2. Interview Transcript: Former Chief Executive Officer,

- 36.14. Company M (Small Company, France)

- 36.14.1. Company Snapshot

- 36.14.2. Interview Transcript: Former General Manager

- 36.15. Company N (Large Company, China)

- 36.15.1. Company Snapshot

- 36.15.2. Interview Transcript: Chief Executive Officer

- 36.16. Company O (Small Company, Israel)

- 36.16.1. Company Snapshot

- 36.16.2. Interview Transcript: Executive Vice President Research and Development

- 36.17. Company P (Mid-sized Company, UK)

- 36.17.1. Company Snapshot

- 36.17.2. Interview Transcript: Former Business Development Manager

- 36.18. Company Q (US)

- 36.18.1. Company Snapshot

- 36.18.2. Interview Transcript: Professor and American Red Cross Chair in Transfusion Medicine

- 36.19. Company R (Small Company, Singapore)

- 36.19.1. Company Snapshot

- 36.19.2. Interview Transcript: Former Co-Founder and Chief Executive Officer

- 36.20. Company S (Mid-sized Company, Canada)

- 36.20.1. Company Snapshot

- 36.20.2. Interview Transcript: Former Manager, Business Development and Operations-cGMP Manufacturing Unit

- 36.21. Company T (Small Company, US)

- 36.21.1. Company Snapshot

- 36.21.2. Interview Transcript: Manager of Business Development

- 36.22. Company U (Mid-sized Company, France)

- 36.22.1. Company Snapshot

- 36.22.2. Interview Transcript: Former Department Leader, Cell Therapy Innovation and Development

- 36.23. Company V (Mid-sized Company, Australia)

- 36.23.1. Company Snapshot

- 36.23.2. Interview Transcript: Former Chief Executive Officer

- 36.24. Company W (Small Company, Netherlands)

- 36.24.1. Company Snapshot

- 36.24.2. Interview Transcript: Chief Executive Officer

37. APPENDIX I: TABULATED DATA

38. APPENDIX II: LIST OF COMPANIES AND ORGANIZATIONS

List of Tables

- Table 6.1 Cell-based Therapies: Applications

- Table 6.2 Differences between Cell Therapy and Biotechnological Products

- Table 6.3 Cell-based Therapies: Commercialized Products

- Table 6.4 Assessment of Cell Therapy Manufacturing Steps

- Table 6.5 Advantages and Disadvantages of Centralized and Decentralized Manufacturing Models

- Table 7.1 Industry Players: Information on Year of Establishment, Company Size, Location of Headquarters, Number of Manufacturing Facilities and Location of Manufacturing Facility

- Table 7.2 Industry Players: Information on Type of Immune Cell Offered

- Table 7.3 Industry Players: Information on Source of Cells and Scale of Operation

- Table 7.4 Industry Players: Information on Type of Additional Service Offered

- Table 8.1 Non-Industry Players: Information on Year of Establishment, Location of Headquarters, Number of Manufacturing Facilities and Location of Manufacturing Facility

- Table 8.2 Non-Industry Players: Information on Type of Immune Cell Offered

- Table 8.3 Non-Industry Players: Information on Source of Cell and Scale of Operation

- Table 8.4 Non-Industry Players: Information on Type of Additional Service Offered

- Table 9.1 Cell Therapy Manufacturing (Industry Players): Regulatory Authorities

- Table 9.2 Cell Therapy Manufacturing (Non-Industry Players): Regulatory Authorities

- Table 9.3 Summary of Guidelines for Early-Stage Manufacturing of Cell Therapies

- Table 10.1 Cell Therapy Manufacturing: Roadmap for the US

- Table 10.2 Cell Processing: Challenges and Strategies

- Table 10.3 Cell Preservation, Distribution and Handling: Challenges and Strategies

- Table 10.4 Process Monitoring and Quality Control: Challenges and Strategies

- Table 10.5 Standardization and Regulatory Support: Challenges and Strategies

- Table 10.6 Workforce Development: Challenges and Strategies

- Table 10.7 Supply Chain and Logistics: Challenges and Strategies

- Table 10.8 Cell Therapy Manufacturing: Roadmap for the Asia Pacific Economic Cooperation (APEC)

- Table 11.1 Cell Therapy Manufacturing: List of Automated and Closed Cell Therapy Processing Systems

- Table 12.1 Cell Therapy Manufacturing Industry Players: List of Companies Profiled

- Table 12.2 Advanced Therapies: Company Snapshot

- Table 12.3 Advanced Therapies: Information on Manufacturing Facilities and Capabilities

- Table 12.4 Advanced Therapies: Recent Developments and Future Outlook

- Table 12.5 AGC Biologics: Company Snapshot

- Table 12.6 AGC Biologics: Information on Manufacturing Facilities and Capabilities

- Table 12.7 AGC Biologics: Recent Developments and Future Outlook

- Table 12.8 Catalent: Company Snapshot

- Table 12.9 Catalent: Information on Manufacturing Facilities and Capabilities

- Table 12.10 Catalent: Recent Developments and Future Outlook

- Table 12.11 Charles River Laboratories: Company Snapshot

- Table 12.12 Charles River Laboratories: Information on Manufacturing Facilities and Capabilities

- Table 12.13 Charles River Laboratories: Recent Developments and Future Outlook

- Table 12.14 ImmunityBio: Company Snapshot

- Table 12.15 ImmunityBio: Information on Manufacturing Facilities and Capabilities

- Table 12.16 ImmunityBio: Recent Developments and Future Outlook

- Table 12.17 Merck Millipore: Company Snapshot

- Table 12.18 Merck Millipore: Information on Manufacturing Facilities and Capabilities

- Table 12.19 Merck Millipore: Recent Developments and Future Outlook

- Table 12.20 Minaris Advanced Therapies: Company Snapshot

- Table 12.21 Minaris Advanced Therapies: Information on Manufacturing Facilities and Capabilities

- Table 12.22 Minaris Advanced Therapies: Recent Developments and Future Outlook

- Table 12.23 Resilience: Company Snapshot

- Table 12.24 Resilience: Information on Manufacturing Facilities and Capabilities

- Table 12.25 Resilience: Recent Developments and Future Outlook

- Table 12.26 SK pharmteco (Subsidiary of SK Inc.): Company Snapshot

- Table 12.27 SK pharmteco (Subsidiary of SK Inc.): Information on Manufacturing Facilities and Capabilities

- Table 12.28 SK pharmteco (Subsidiary of SK Inc.): Recent Developments and Future Outlook

- Table 12.29 Thermo Fisher Scientific: Company Snapshot

- Table 12.30 Thermo Fisher Scientific: Information on Manufacturing Facilities and Capabilities

- Table 12.31 Thermo Fisher Scientific: Recent Developments and Future Outlook

- Table 13.1 Cell Therapy Manufacturing (Non-Industry Players): List of Organizations Profiled

- Table 13.2 City of Hope: Overview

- Table 13.3 City of Hope: Service Portfolio

- Table 13.4 Clinical Cell and Vaccine Production Facility (CVPF): Overview

- Table 13.5 Clinical Cell and Vaccine Production Facility (CVPF): Service Portfolio

- Table 13.6 Fraunhofer Institute for Cell Therapy and Immunology: Overview

- Table 13.7 Fraunhofer Institute for Cell Therapy and Immunology: Service Portfolio

- Table 13.8 Newcastle Advanced Therapies: Overview

- Table 13.9 Newcastle Advanced Therapies: Service Portfolio

- Table 13.10 NHS Blood and Transplant: Overview

- Table 13.11 NHS Blood and Transplant: Service Portfolio

- Table 13.12 Rayne Cell Therapy Suite (King's College London): Overview

- Table 13.13 Rayne Cell Therapy Suite (King's College London): Service Portfolio

- Table 13.14 Scottish National Blood Transfusion Service (SNBTS) Cellular Therapy Facility: Overview

- Table 13.15 Scottish National Blood Transfusion Service (SNBTS) Cellular Therapy Facility: Service Portfolio

- Table 14.1 Cell Therapy Manufacturing: List of Non-Profit Organizations

- Table 14.2 CellCAN: Overview

- Table 14.3 Cell Therapy Manufacturing Cooperative Research Center: Overview

- Table 14.4 National Cell Manufacturing Consortium: Overview

- Table 14.5 California's Institute of Regenerative Medicine: Overview

- Table 16.1 Cell Therapy Manufacturing: List of Partnerships and Collaborations

- Table 16.2 Partnerships and Collaborations: Information on Type of Immune Cell Offered and Scale of Operation

- Table 16.3 Partnerships and Collaborations: Information on Location of Headquarters (Country and Region) and Type of Agreement (Country and Region)

- Table 17.1 Cell Therapy Manufacturing: List of Expansions

- Table 17.2 Cell Therapy Manufacturing: Type of Immune Cell Offered and Scale of Operation

- Table 18.1 List of Top 10 Big Pharma Players

- Table 18.2 Big Pharma Players: List of Cell Therapy Manufacturing Focused Initiatives, Since 2021

- Table 18.3 Big Pharma Initiatives: Information on Type of Immune Cell Offered and Scale of Operation

- Table 19.1 Average Installed Cell Therapy Manufacturing Capacity (Number of Cleanrooms): Sample Data Set for Industry Players

- Table 19.2 Average Installed Cell Therapy Manufacturing Capacity (Cleanroom Area): Sample Data Set for Industry Players

- Table 19.3 Global Installed capacity of industry players for cell therapy manufacturing (Number of Cleanrooms): Distribution by Company Size

- Table 19.4 Global Installed capacity of industry players for cell therapy manufacturing (Cleanroom Area): Distribution by Company Size

- Table 19.5 Median Installed Cell Therapy Manufacturing Capacity (Number of Cleanrooms): Data Set for Non-Industry Players

- Table 19.6 Median Installed Cell Therapy Manufacturing Capacity (Cleanroom Area): Dat Set for Non-Industry Players

- Table 21.1 Costs Associated with Manufacturing Stem Cell Therapies

- Table 21.2 Pricing Model: Price of Marketed Drugs (Antibody Drug Conjugates and Monoclonal Antibodies)

- Table 21.3 T-cell Immunotherapies: Expert Opinions on Pricing

- Table 21.4 CAR-T Cell Therapies: Reimbursement Landscape

- Table 23.1 Total Cost of Ownership for Mid-sized Cell Therapy Manufacturing Organizations, Y0-Y20 (USD Million)

- Table 23.2 Total Cost of Ownership: Sample Dataset

- Table 25.1 Survey Insights: Overview of Respondents

- Table 25.2 Survey Insights: Designations and Seniority Levels

- Table 25.3 Survey Insights: Type of Cell Therapy

- Table 25.4 Survey Insights: Scale of Operation

- Table 25.5 Survey Insights: Source of Cells

- Table 25.6 Survey Insights: Cell Culture System

- Table 25.7 Survey Insights: Availability of Fill / Finish Services

- Table 37.1 Industry Players: Distribution by Year of Establishment

- Table 37.2 Industry Players: Distribution by Company Size

- Table 37.3 Industry Players: Distribution by Location of Headquarters (Region)

- Table 37.4 Industry Players: Distribution by Location of Headquarters (Country)

- Table 37.5 Industry Players: Distribution by Company Size and Location of Headquarters (Region)

- Table 37.6 Industry Players: Distribution by Location of Manufacturing Facility (Region)

- Table 37.7 Industry Players: Distribution by Location of Manufacturing Facility (Country)

- Table 37.8 Industry Players: Distribution by Type of Immune Cell Offered

- Table 37.9 Industry Players: Distribution by Source of Cells

- Table 37.10 Industry Players: Distribution by Scale of Operation

- Table 37.11 Industry Players: Distribution by Type of Additional Service Offered

- Table 37.12 Non-Industry Players: Distribution by Year of Establishment

- Table 37.13 Non-Industry Players: Distribution by Location of Headquarters (Region)

- Table 37.14 Non-Industry Players: Distribution by Location of Headquarters (Country)

- Table 37.15 Non-Industry Players: Distribution by Location of Manufacturing Facility (Region)

- Table 37.16 Non-Industry Players: Distribution by Location of Manufacturing Facility (Country)

- Table 37.17 Non-Industry Players: Distribution by Type of Immune Cell Offered

- Table 37.18 Non-Industry Players: Distribution by Source of Cell

- Table 37.19 Non-Industry Players: Distribution by Scale of Operation

- Table 37.20 Non-Industry Players: Distribution by Type of Additional Service Offered

- Table 37.21 Cell Therapy Manufacturing (Industry Players): Distribution by Regulatory Authorities / Certifications

- Table 37.22 Cell Therapy Manufacturing (Non-Industry Players): Distribution by Regulatory Authorities / Certifications

- Table 37.23 WuXi AppTec (parent company of Advanced Therapies): Annual Revenues, FY 2022 - H1 FY 2025 (RMB Billion)

- Table 37.24 AGC Biologics: Annual Revenues, FY 2022 - H1 FY 2025 (JPY Billion)

- Table 37.25 Catalent: Annual Revenues, FY 2021 - Q1 FY 2025 (USD Billion)

- Table 37.26 Charles River Laboratories: Annual Revenues, FY 2022- H1 FY 2025 (USD Billion)

- Table 37.27 ImmunityBio: Annual Revenues, FY 2023- H1 FY 2025 (USD Million)

- Table 37.28 Merck KGaA (Parent company of Merck Millipore): Annual Revenues, FY 2022- H1 FY 2025 (EUR Billion)

- Table 37.29 Thermo Fisher Scientific: Annual Revenues, FY 2022 - 9M FY 2025 (JPY Billion)

- Table 37.30 Evotec: Annual Revenues, FY 2022 - H1 FY 2025 (EUR Million)

- Table 37.31 Lonza: Annual Revenues, FY 2022 - H1 FY 2025 (CHF Billion)

- Table 37.32 Sartorius: Annual Revenues, FY 2022 - 9M FY 2025 (EUR Billion)

- Table 37.33 Astellas Pharma: Annual Revenues, FY 2022 - Q1 FY 2025 (YEN Billion)

- Table 37.34 Pharmaron: Annual Revenues, FY 2022 - H1 FY 2025 (RMB Billion)

- Table 37.35 Takara Bio: Annual Revenues, FY 2023 - Q1 FY 2026 (YEN Billion)

- Table 37.36 Clinical Trial Analysis: Distribution by Trial Registration Year, Since 2021

- Table 37.37 Clinical Trial Analysis: Distribution by Trial Registration Year and Enrolled Patient Population, Since 2021

- Table 37.38 Clinical Trial Analysis: Distribution by Trial Status

- Table 37.39 Clinical Trial Analysis: Distribution by Trial Registration Year and Trial Status

- Table 37.40 Clinical Trial Analysis: Distribution by Trial Phase

- Table 37.41 Clinical Trial Analysis: Distribution of Enrolled Patient Population by Trial Phase

- Table 37.42 Clinical Trial Analysis: Distribution by Patient Gender

- Table 37.43 Clinical Trial Analysis: Distribution by Type of Allocation

- Table 37.44 Clinical Trial Analysis: Distribution by Type of Intervention Model

- Table 37.45 Clinical Trial Analysis: Distribution by Type of Masking

- Table 37.46 Clinical Trial Analysis: Distribution by Type of Sponsor / Collaborator

- Table 37.47 Most Active Industry Players: Distribution by Number of Registered Trials

- Table 37.48 Most Active Non-Industry Players: Distribution by Number of Registered Trials

- Table 37.49 Clinical Trial Analysis: Distribution of Clinical Trials by Geography

- Table 37.50 Clinical Trial Analysis: Distribution of Clinical Trials by Trial Status and Geography

- Table 37.51 Clinical Trial Analysis: Distribution of Enrolled Patient Population by Trial Status and Geography

- Table 37.52 Partnerships and Collaborations: Cumulative Year-wise Trend, Since 2021

- Table 37.53 Partnerships and Collaborations: Distribution by Type of Partnership

- Table 37.54 Partnerships and Collaborations: Distribution by Year and Type of Partnership

- Table 37.55 Partnerships and Collaborations: Distribution by Type of Immune Cell

- Table 37.56 Partnerships and Collaborations: Distribution by Scale of Operation

- Table 37.57 Most Active Players: Distribution by Number of Partnerships

- Table 37.58 Partnerships and Collaborations: Local and International Agreements

- Table 37.59 Partnerships and Collaborations: Intracontinental and Intercontinental Agreements

- Table 37.60 Recent Expansions: Cumulative Year-wise Trend, Since 2021

- Table 37.61 Recent Expansions: Distribution by Type of Expansion

- Table 37.62 Recent Expansions: Distribution by Year and Type of Expansion

- Table 37.63 Recent Expansions: Distribution by Location of Expanded Facility (Region)

- Table 37.64 Recent Expansions: Distribution by Location of Expanded Facility (Country)

- Table 37.65 Recent Expansions: Distribution by Type of Expansion and Location of Headquarters (Country)

- Table 37.66 Recent Expansions: Distribution by Type of Immune Cell

- Table 37.67 Recent Expansions: Distribution by Type of Expansion and Type of Immune Cell

- Table 37.68 Recent Expansions: Distribution by Scale of Operation

- Table 37.69 Most Active Players: Distribution by Number of Expansions

- Table 37.70 Most Active Players: Distribution by Area of Expansion (in sq ft)

- Table 37.71 Big Pharma Initiatives: Distribution by Year of Initiative

- Table 37.72 Big Pharma Initiatives: Distribution by Type of Initiative

- Table 37.73 Big Pharma Initiatives: Distribution by Year and Type of Initiative

- Table 37.74 Big Pharma Initiatives: Distribution of Big Pharma Players by Number of Initiatives

- Table 37.75 Big Pharma Initiatives: Distribution by Type of Partnership

- Table 37.76 Big Pharma Initiatives: Distribution of Big Pharma Players by Number of Partnerships

- Table 37.77 Big Pharma Initiatives: Distribution by Type of Facility Expansion

- Table 37.78 Big Pharma Initiatives: Distribution of Big Pharma Players by Number of Facility Expansion

- Table 37.79 Big Pharma Initiatives: Distribution of Big Pharma Players by Region of Facility Expansion

- Table 37.80 Big Pharma Initiatives: Distribution of Big Pharma Players by Number of Mergers and Acquisitions

- Table 37.81 Big Pharma Initiatives: Distribution of Big Pharma Players by Number of Funding and Investment

- Table 37.82 Big Pharma Initiatives: Distribution by Type of Immune Cell

- Table 37.83 Big Pharma Initiatives: Distribution by Scale of Operation

- Table 37.84 Big Pharma Initiatives: Distribution of Big Pharma Players by Scale of Operation

- Table 37.85 Big Pharma Initiatives Summary

- Table 37.86 Global Installed Capacity of Industry Players for Cell Therapy Manufacturing: Distribution by Range of Installed Capacity

- Table 37.87 Global Installed Cell Therapy Manufacturing Capacity of Industry Players (Number of Cleanrooms): Distribution by Company Size

- Table 37.88 Global Installed Cell Therapy Manufacturing Capacity of Industry Players (Number of Cleanrooms): Distribution by Scale of Operation