PUBLISHER: Roots Analysis | PRODUCT CODE: 1762523

PUBLISHER: Roots Analysis | PRODUCT CODE: 1762523

Molecular Diagnostics Market: Industry Trends and Global Forecasts - Distribution by Test Type, Type of Offering, Type of Sample, Type of Technology, Therapeutic Area, End Users, and Geographical Regions

MOLECULAR DIAGNOSTICS MARKET: OVERVIEW

As per Roots Analysis, the global molecular diagnostics market is estimated to grow from USD 15.9 billion in the current year to USD 30.9 billion by 2035, at a CAGR of 6.2% during the forecast period, till 2035.

The market sizing and opportunity analysis has been segmented across the following parameters:

Test Type

- Laboratory Testing

- Point-of-Care Testing

Type of Offering

- Reagents

- Instruments

- Services

Type of Sample

- Blood, Serum and Plasma

- Urine

- Others

Type of Technology

- Polymerase Chain Reaction (PCR)

- In situ Hybridization

- Isothermal Nucleic Acid Amplification Technology

- Next Generation Sequencing

- Microarrays

- Mass Spectrometry

- Others

Therapeutic Area

- Cardiovascular Diseases

- Genetic Diseases

- Infectious Diseases

- Neurological Diseases

- Oncological Diseases

- Others

End Users

- Hospitals

- Laboratories

- Others

Key Geographical Regions

- North America (US, Canada)

- Europe (Austria, Belgium, France, Germany, Italy, Netherlands, Poland, Spain, Switzerland, UK, Rest of the Europe)

- Asia (China, India, Indonesia, Japan, Singapore, South Korea, Thailand, Rest of Asia)

- Latin America (Argentina, Brazil, Mexico, Rest of Latin America)

- Middle East and North Africa (Egypt, Israel, Saudi Arabia, Rest of Middle East and North Africa)

- Rest of the World (Australia and New Zealand)

MOLECULAR DIAGNOSTICS MARKET: GROWTH AND TRENDS

Molecular diagnostic tests are advanced techniques and tools used to analyze biological markers in the genome and proteome. These diagnostic solutions are essential for detecting and monitoring diseases, identifying genetic abnormalities, and guiding personalized treatment plans. The primary technologies used in the molecular diagnostics domain include polymerase chain reaction, next-generation sequencing and microarrays. While PCR is a highly specific technique that enables the amplification and detection of trace amounts of DNA or RNA, NGS allows for high-throughput sequencing of entire genomes. Thus, molecular diagnostic solutions are pivotal across various medical fields, including oncological disorders, infectious diseases, genetic testing, and personalized medicine. These solutions enhance the accuracy of diagnosis, enable and support tailored treatment strategies aiming to ultimately improve diagnostic outcomes and advancing public health. In addition, it is worth mentioning that more than 70% of the healthcare decisions are made based on laboratory test results, which reflects the importance of such diagnostic tools in patient care.

Further, owing to the several benefits offered by these molecular diagnostic solutions, such as providing rapid testing, reducing turnaround times and enabling quicker decision-making, the market is expected to grow at a healthy compounded annual growth rate (CAGR) during the forecast period.

MOLECULAR DIAGNOSTICS MARKET: KEY INSIGHTS

The report delves into the current state of the molecular diagnostics market and identifies potential growth opportunities within industry. Some key findings from the report include:

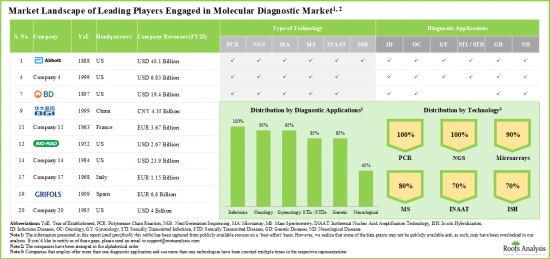

- The molecular diagnostic domain features a dynamic market landscape of players that utilize various types of advanced technologies in order to offer a variety of diagnostic applications.

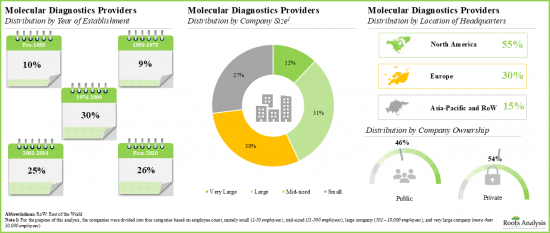

- A number of leading players considered in this analysis were established during 1951 to 2000; 60% of such players are based in North America.

- Owing to its diverse portfolio of molecular diagnostics solutions and strong financial performance in recent fiscal year, Roche emerged as the most competent company among the leading players in this domain.

- In order to study the impact of various trends in the molecular diagnostics market, we developed our proprietary research methodology to analyze different parameters under Porter's Five Forces framework.

- The molecular diagnostics market is fueled by growing awareness towards preventive healthcare; however, factors, such as navigating through regulatory complexities remain significant hurdles for industry players.

- Driven by the increasing prevalence of chronic disorders across the globe, the global molecular diagnostics market is expected to grow at a healthy growth rate of 6.2% during the forecast period.

- The anticipated future opportunity is expected to be well distributed across multiple segments, such as test type, sample type, therapeutic area, and end users.

MOLECULAR DIAGNOSTICS MARKET: KEY SEGMENTS

Laboratory Testing Segment holds the Largest Share of the Molecular Diagnostics Market

Based on the test type, the market is segmented into laboratory testing and point-of-care testing. At present, the laboratory testing segment holds the maximum share of the molecular diagnostics market. This trend is likely to remain the same in the coming future. Further, the molecular diagnostics market for point-of-care testing segment is expected to show the highest market growth potential during the forecast period.

By Type of Offering, Reagents is the Fastest Growing Segment of the Global Molecular Diagnostics Market

Based on the type of offering, the market is segmented into reagents, instruments and services. At present, the reagents segment holds the maximum share of the global molecular diagnostics market. Further, owing to the fact that reagents are required to be replenished frequently, which contributes to the recurrent revenues, the market for reagents segment is expected to grow at a higher CAGR during the forecast period.

By Type of Sample, Blood, Serum and Plasma Segment Accounts for the Largest Share of the Global Molecular Diagnostics Market

Based on the type of sample, the market is segmented into blood, serum and plasma, urine, and other samples. Currently, the blood, serum and plasma segment capture the highest proportion of the global molecular diagnostics market. However, the urine segment is expected to grow at a higher CAGR during the forecast period.

The Polymerase Chain Reaction (PCR) Segment by Type of Technology Occupy the Largest Share of the Molecular Diagnostics Market

Based on the type of technology, the market is segmented into Polymerase Chain Reaction (PCR), in situ hybridization, isothermal nucleic acid amplification technology, next generation sequencing, microarrays, mass spectrometry and others. While the polymerase chain reaction (PCR) segment is expected to be the primary driver of the overall market, it is worth highlighting that the global molecular diagnostics market for next generation sequencing segment is likely to grow at a relatively higher CAGR. This can be attributed to the several benefits offered by next generation sequencing, such as high-throughput, improved accuracy, and the capability to simultaneously sequence multiple genes.

By Therapeutic Area, Infectious Disease Segment is Likely to Dominate the Molecular Diagnostics Market

Based on the therapeutic area, the market is segmented into cardiovascular diseases, genetic diseases, infectious diseases, neurological diseases, oncological diseases and others. At present the infectious diseases segment holds the maximum share of the molecular diagnostics market. Additionally, the neurological diseases segment is expected to show the highest growth potential during the forecast period, growing at a higher CAGR, compared to the other segments.

Currently, Hospitals Segment Holds the Largest Share of the Molecular Diagnostics Market

Based on end users, the global market is segmented into hospitals, laboratories, and others. Currently, the hospitals segment holds the largest market share. However, the molecular diagnostics market for laboratories segment is expected to witness substantial growth in the coming years.

North America Accounts for the Largest Share of the Market

Based on key geographical regions, the market is segmented into North America, Europe, Asia, Latin America, Middle East and North Africa, and Rest of the World. Currently, North America dominates the global molecular diagnostics market and accounts for the largest revenue share. Further, the market in Asia-Pacific is likely to grow at a higher CAGR in the coming future.

Example Players in the Molecular Diagnostics Market

- Abbott Laboratories

- Agilent Technologies

- Becton Dickinson

- BGI Genomics

- bioMerieux

- Bio-Rad

- Danaher

- DiaSorin

- Grifols

- Hologic

- Illumina

- Qiagen

- QuidelOrtho

- Revvity

- Roche

- Sansure

- Seegene

- Siemens Healthineers

- Sysmex

- Thermo Fisher Scientific

MOLECULAR DIAGNOSTICS MARKET: RESEARCH COVERAGE

- Market Sizing and Opportunity Analysis: The report features an in-depth analysis of the global molecular diagnostics market, focusing on key market segments, including [A] test type, [B] type of offering, [C] type of sample, [D] type of technology, [E] therapeutic area, [F] end users and [D] key geographical regions.

- Market Impact Analysis: A thorough analysis of various factors, such as drivers, restraints, opportunities, and existing challenges that are likely to impact market growth.

- Market Landscape: A comprehensive evaluation of the leading molecular diagnostics companies, based on several relevant parameters, such as [A] year of establishment, [B] company size, [C] company ownership and [D] location of the headquarters. Further, the section includes a comprehensive evaluation of molecular diagnostic solutions, focusing on the parameters, such as [A] type of technology used and [B] diagnostic applications.

- Company Competitiveness Analysis: A comprehensive competitive analysis of molecular diagnostic companies, examining factors, such as [A] years of experience and [B] company competitiveness.

- Regulatory Landscape for Medical Devices: A comprehensive discussion of the various guidelines established by major regulatory bodies for medical device approval across different countries. Additionally, a multi-dimensional bubble analysis was done, focusing on the comparison of contemporary regulatory scenario in key geographies across the globe.

- Company Profiles: In-depth profiles of key players that specialize in molecular diagnostic solutions, focusing on [A] overview of the company, [B] financial information, [C] molecular diagnostic offerings and [D] recent developments and an informed future outlook.

- Porter's Five Forces Analysis: A qualitative assessment of Porter's Five Forces framework based on the five competitive forces, including [A] threats to new entrants, [B] bargaining power of product providers, [C] bargaining power of buyers, [D] threat of substitute products and [E] rivalry among existing competitors.

KEY QUESTIONS ANSWERED IN THIS REPORT

- How many companies are currently engaged in this market?

- Which are the leading companies in this market?

- What factors are likely to influence the evolution of this market?

- What is the current and future market size?

- What is the CAGR of this market?

- How is the current and future market opportunity likely to be distributed across key market segments?

REASONS TO BUY THIS REPORT

- The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. By analyzing the competitive landscape, businesses can make informed decisions to optimize their market positioning and develop effective go-to-market strategies.

- The report offers stakeholders a comprehensive overview of the market, including key drivers, barriers, opportunities, and challenges. This information empowers stakeholders to stay abreast of market trends and make data-driven decisions to capitalize on growth prospects.

ADDITIONAL BENEFITS

- Complimentary Excel Data Packs for all Analytical Modules in the Report

- 15% Free Content Customization

- Detailed Report Walkthrough Session with Research Team

- Free Updated report if the report is 6-12 months old or older

TABLE OF CONTENTS

1. BACKGROUND

- 1.1. Context

- 1.2. Project Objectives

2. RESEARCH METHODOLOGY

- 2.1. Chapter Overview

- 2.2. Research Assumptions

- 2.3. Project Methodology

- 2.4. Forecast Methodology

- 2.5. Robust Quality Control

- 2.6. Key Market Segmentations

- 2.7. Key Factors

- 2.7.1. Demographics

- 2.7.2. Economic Factors

- 2.7.3. Government Regulations

- 2.7.4. Supply Chain

- 2.7.5. COVID Impact

- 2.7.6. Market Access

- 2.7.7. Healthcare Policies

- 2.7.8. Industry Consolidation

3. ECONOMIC AND OTHER PROJECT SPECIFIC CONSIDERATIONS

- 3.1. Chapter Overview

- 3.2. Market Dynamics

- 3.2.1. Time Period

- 3.2.1.1. Historical Trends

- 3.2.1.2. Current and Future

- 3.2.2. Currency Coverage and Foreign Exchange Rate

- 3.2.2.1. Major Currencies Affecting the Market

- 3.2.2.2. Factors Affecting Currency Fluctuations and Foreign Exchange Rates

- 3.2.2.3. Impact of Foreign Exchange Rate Volatility on the Market

- 3.2.2.4. Strategies for Mitigating Foreign Exchange Risk

- 3.2.3. Trade Policies

- 3.2.3.1. Impact of Trade Barriers on the Market

- 3.2.3.2. Strategies for Mitigating the Risks Associated with Trade Barriers

- 3.2.4. Recession

- 3.2.4.1. Historical Analysis of Past Recessions and Lessons Learnt

- 3.2.4.2. Assessment of Current Economic Conditions and Potential Impact on the Market

- 3.2.5. Inflation

- 3.2.5.1. Measurement and Analysis of Inflationary Pressures in the Economy

- 3.2.5.2. Potential Impact of Inflation on the Market Evolution

- 3.2.1. Time Period

4. EXECUTIVE SUMMARY

5. INTRODUCTION

- 5.1. Overview of Molecular Diagnostics

- 5.2. Key Technologies Employed in Molecular Diagnostic Solution

- 5.3. Challenges in the Molecular Diagnostics Domain

- 5.4. Recent Developments in the Molecular Diagnostics Domain

- 5.5. Future Perspective in the Molecular Diagnostics Domain

6. MARKET IMPACT ANALYSIS: DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES

- 6.1. Market Drivers

- 6.2. Market Restraints

- 6.3. Market Opportunities

- 6.4. Market Challenges

7. GLOBAL MOLECULAR DIAGNOSTICS MARKET

- 7.1. Key Assumptions and Methodology

- 7.2. Global Molecular Diagnostics Market, Till 2035

- 7.2.1. Scenario Analysis

- 7.2.1.1. Conservative Scenario

- 7.2.1.2. Optimistic Scenario

- 7.2.1. Scenario Analysis

8. MOLECULAR DIAGNOSTICS MARKET, BY TEST TYPE

- 8.1. Market Movement Analysis

- 8.2. Molecular Diagnostics Market: Distribution by Test Type

- 8.2.1. Molecular Diagnostics Market for Laboratory Testing, Till 2035

- 8.2.2. Molecular Diagnostics Market for Point-of-Care Testing, Till 2035

9. MOLECULAR DIAGNOSTICS MARKET, BY TYPE OF OFFERING

- 9.1. Market Movement Analysis

- 9.2. Molecular Diagnostics Market: Distribution by Type of Offering

- 9.2.1. Molecular Diagnostics Market for Instruments, Till 2035

- 9.2.1.1. Molecular Diagnostics Market for In-house Instruments, Till 2035

- 9.2.1.2. Molecular Diagnostics Market for Outsourced Instruments, Till 2035

- 9.2.2. Molecular Diagnostics Marlet for Reagents, till 2035

- 9.2.3. Molecular Diagnostics Market for Services, till 2035

- 9.2.1. Molecular Diagnostics Market for Instruments, Till 2035

10. MOLECULAR DIAGNOSTICS MARKET, BY SAMPLE TYPE

- 10.1. Market Movement Analysis

- 10.2. Molecular Diagnostics Market: Distribution by Sample Type

- 10.2.1. Molecular Diagnostics Market for Blood, Serum and Plasma, till 2035

- 10.2.2. Molecular Diagnostics Market for Urine, till 2035

- 10.2.3. Molecular Diagnostics Market for Other Samples, till 2035

11. MOLECULAR DIAGNOSTICS MARKET, BY TYPE OF TECHNOLOGY

- 11.1. Market Movement Analysis

- 11.2. Molecular Diagnostics Market: Distribution by Type of Technology

- 11.2.1. Molecular Diagnostics Market for PCR, till 2035

- 11.2.2. Molecular Diagnostics Market for In Situ Hybridization, till 2035

- 11.2.3. Molecular Diagnostics Market for Isothermal Nucleic Acid Amplification Technology, till 2035

- 11.2.4. Molecular Diagnostics Market for Next Generation Sequencing, till 2035

- 11.2.5. Molecular Diagnostics Market for Microarrays, till 2035

- 11.2.6. Molecular Diagnostics Market for Mass Spectrometry, till 2035

- 11.2.7. Molecular Diagnostics Market for Other Technologies, till 2035

12. MOLECULAR DIAGNOSTICS MARKET, BY THERAPEUTIC AREA

- 12.1. Market Movement Analysis

- 12.2. Molecular Diagnostics Market: Distribution by Therapeutic Area

- 12.2.1. Molecular Diagnostics Market for Infectious Diseases, till 2035

- 12.2.1.1. Molecular Diagnostics Market for COVID-19, till 2035

- 12.2.1.2. Molecular Diagnostics Market for Respiratory Infections (Excluding COVID-19), till 2035

- 12.2.1.3. Molecular Diagnostics Market for Healthcare-associated Infections, till 2035

- 12.2.1.4. Molecular Diagnostics Market for Hepatitis, till 2035

- 12.2.1.5. Molecular Diagnostics Market for HIV, till 2035

- 12.2.1.6. Molecular Diagnostics Market for Sexually Transmitted Diseases, till 2035

- 12.2.1.7. Molecular Diagnostics Market for Other Infectious Diseases, till 2035

- 12.2.2. Molecular Diagnostics Market for Oncological Disorders, till 2035

- 12.2.2.1. Molecular Diagnostics Market for Lung Cancer, till 2035

- 12.2.2.2. Molecular Diagnostics Market for Breast Cancer, till 2035

- 12.2.2.3. Molecular Diagnostics Market for Colorectal Cancer, till 2035

- 12.2.2.4. Molecular Diagnostics Market for Prostate Cancer, till 2035

- 12.2.2.5. Molecular Diagnostics Market for Gastric Cancer, till 2035

- 12.2.2.6. Molecular Diagnostics Market for Other Oncological Disorders, till 2035

- 12.2.3. Molecular Diagnostics Market for Cardiovascular Diseases, till 2035

- 12.2.4. Molecular Diagnostics Market for Neurological Diseases, till 2035

- 12.2.5. Molecular Diagnostics Market for Genetic Diseases, till 2035

- 12.2.6. Molecular Diagnostics Market for Other Therapeutic Areas, till 2035

- 12.2.1. Molecular Diagnostics Market for Infectious Diseases, till 2035

13. MOLECULAR DIAGNOSTICS MARKET, BY END USERS

- 13.1. Market Movement Analysis

- 13.2. Molecular Diagnostics Market: Distribution by End Users

- 13.2.1. Molecular Diagnostics Market for Laboratories, till 2035

- 13.2.1.1. Molecular Diagnostics Market for Large Laboratories, till 2035

- 13.2.1.2. Molecular Diagnostics Market for Small and Medium-sized Laboratories, till 2035

- 13.2.2. Molecular Diagnostics Market for Hospitals, till 2035

- 13.2.3. Molecular Diagnostics Market for Other End Users, till 2035

- 13.2.1. Molecular Diagnostics Market for Laboratories, till 2035

14. MOLECULAR DIAGNOSTICS MARKET, BY GEOGRAPHICAL REGIONS

- 14.1. Market Movement Analysis

- 14.2. Molecular Diagnostics Market: Distribution by Geographical Regions

- 14.2.1. Molecular Diagnostics Market in North America, till 2035

- 14.2.1.1. Molecular Diagnostics Market in the US, till 2035

- 14.2.1.2. Molecular Diagnostics Market in Canada, till 2035

- 14.2.2. Molecular Diagnostics Market in Europe, till 2035

- 14.2.2.1. Molecular Diagnostics Market in Austria, till 2035

- 14.2.2.2. Molecular Diagnostics Market in Belgium, till 2035

- 14.2.2.3. Molecular Diagnostics Market in France, till 2035

- 14.2.2.4. Molecular Diagnostics Market in Germany, till 2035

- 14.2.2.5. Molecular Diagnostics Market in Italy, till 2035

- 14.2.2.6. Molecular Diagnostics Market in the Netherlands, till 2035

- 14.2.2.7. Molecular Diagnostics Market in Poland, till 2035

- 14.2.2.8. Molecular Diagnostics Market in Spain, till 2035

- 14.2.2.9. Molecular Diagnostics Market in Switzerland, till 2035

- 14.2.2.10. Molecular Diagnostics Market in the UK, till 2035

- 14.2.2.11. Molecular Diagnostics Market in the Rest of Europe, till 2035

- 14.2.3. Molecular Diagnostics Market in Asia, till 2035

- 14.2.3.1. Molecular Diagnostics Market in China, till 2035

- 14.2.3.2. Molecular Diagnostics Market in India, till 2035

- 14.2.3.3. Molecular Diagnostics Market in Indonesia, till 2035

- 14.2.3.4. Molecular Diagnostics Market in Japan, till 2035

- 14.2.3.5. Molecular Diagnostics Market in Singapore, till 2035

- 14.2.3.6. Molecular Diagnostics Market in South Korea, till 2035

- 14.2.3.7. Molecular Diagnostics Market in Thailand, till 2035

- 14.2.3.8. Molecular Diagnostics Market in Rest of Asia, till 2035

- 14.2.4. Molecular Diagnostics Market in Latin America, till 2035

- 14.2.4.1. Molecular Diagnostics Market in Brazil, till 2035

- 14.2.4.2. Molecular Diagnostics Market in Argentina, till 2035

- 14.2.4.3. Molecular Diagnostics Market in Mexico, till 2035

- 14.2.4.4. Molecular Diagnostics Market in Rest of Latin America, till 2035

- 14.2.5. Molecular Diagnostics Market in Middle East and North Africa, till 2035

- 14.2.5.1. Molecular Diagnostics Market in Egypt, till 2035

- 14.2.5.2. Molecular Diagnostics Market in Israel, till 2035

- 14.2.5.3. Molecular Diagnostics Market in Saudi Arabia, till 2035

- 14.2.5.4. Molecular Diagnostics Market in the Rest of Middle East and North Africa, till 2035

- 14.2.6. Molecular Diagnostics Market in Rest of the World, till 2035

- 14.2.6.1. Molecular Diagnostics Market in Australia, till 2035

- 14.2.6.2. Molecular Diagnostics Market in New Zealand, till 2035

- 14.2.1. Molecular Diagnostics Market in North America, till 2035

15. MOLECULAR DIAGNOSTICS MARKET, BY LEADING PLAYERS

- 15.1. Molecular Diagnostics Market: Distribution of Leading Players by Annual Revenues

16. MARKET OVERVIEW: LEADING MOLECULAR DIAGNOSTIC SOLUTION PROVIDERS

- 16.1. Molecular Diagnostic Solution: Overall Market Landscape

- 16.1.1. Analysis by Type of Technology

- 16.1.2. Analysis by Diagnostic Applications

- 16.1.3. Analysis by Type of Technology and Diagnostic Applications

- 16.2. Molecular Diagnostics: Solution Providers Landscape

- 16.2.1. Analysis by Year of Establishment

- 16.2.2. Analysis by Company Size

- 16.2.3. Analysis by Location of Headquarters

- 16.2.4. Analysis by Company Ownership

17. COMPANY COMPETITIVENESS ANALYSIS: MOLECULAR DIAGNOSTIC SOLUTION PROVIDERS

- 17.1. Methodology and Key Parameters Assessed

- 17.2. Molecular Diagnostic Solution Providers: Competitiveness Analysis of Very Large Players

- 17.3. Molecular Diagnostic Solution Providers: Competitiveness Analysis of Large Players

- 17.4. Benchmarking Analysis: Leading Molecular Diagnostics Solution Providers

- 17.4.1. Benchmarking of Companies

- 17.4.1.1. Roche: Benchmarking Analysis

- 17.4.1.2. Abbott: Benchmarking Analysis

- 17.4.1.3. Thermo Fisher Scientific: Benchmarking Analysis

- 17.4.1.4. Qiagen: Benchmarking Analysis

- 17.4.1.5. bioMerieux: Benchmarking Analysis

- 17.4.1.6. DiaSorin: Benchmarking Analysis

- 17.4.1.7. Illumina: Benchmarking Analysis

- 17.4.1.8. Sysmex: Benchmarking Analysis

- 17.4.1.9. Perkin Elmer: Benchmarking Analysis

- 17.4.1.10. Bio-Rad: Benchmarking Analysis

- 17.4.2. Benchmarking of Parameters

- 17.4.2.1. Leading Molecular Diagnostics Solution Providers: Benchmarking by Competitiveness

- 17.4.2.2. Leading Molecular Diagnostic Solution Providers: Benchmarking by Type of Technology Score

- 17.4.2.3. Leading Molecular Diagnostic Solution Providers: Benchmarking by Diagnostic Applications Score

- 17.4.1. Benchmarking of Companies

18. COMPANY PROFILES: MOLECULAR DIAGNOSTICS SOLUTION PROVIDERS BASED IN NORTH AMERICA

- 18.1. Detailed Company Profiles

- 18.1.1. Abbott

- 18.1.1.1. Company Overview

- 18.1.1.2. Product Portfolio

- 18.1.1.3. Financial Information

- 18.1.1.4. Recent Developments and Future Outlook

- 18.1.2. Agilent Technologies

- 18.1.3. BD

- 18.1.4. Danaher

- 18.1.5. Thermo Fisher Scientific

- 18.1.1. Abbott

- 18.2. Short Company Profiles

- 18.2.1. Bio-Rad

- 18.2.1.1. Company Overview

- 18.2.1.2. Product Portfolio

- 18.2.2. Illumina

- 18.2.3. Hologic

- 18.2.4. PerkinElmer

- 18.2.5. QuidelOrtho

- 18.2.1. Bio-Rad

19. COMPANY PROFILES: MOLECULAR DIAGNOSTICS SOLUTION PROVIDERS BASED IN EUROPE

- 19.1. Detailed Company Profiles

- 19.1.1. bioMerieux

- 19.1.1.1. Company Overview

- 19.1.1.2. Product Portfolio

- 19.1.1.3. Financial Information

- 19.1.1.4. Recent Developments and Future Outlook

- 19.1.2. Grifols

- 19.1.3. Roche

- 19.1.4. Siemens Healthineers

- 19.1.1. bioMerieux

- 19.2. Brief Company Profiles

- 19.2.1. DiaSorin

- 19.2.1.1. Company Overview

- 19.2.1.2. Product Portfolio

- 19.2.2. Qiagen

- 19.2.1. DiaSorin

20. COMPANY PROFILES: MOLECULAR DIAGNOSTICS SOLUTION PROVIDERS BASED IN ASIA

- 20.1. Detailed Company Profiles

- 20.1.1. Sysmex

- 20.1.1.1. Company Overview

- 20.1.1.2. Product Portfolio

- 20.1.1.3. Financial Information

- 20.1.1.4. Recent Developments and Future Outlook

- 20.1.1. Sysmex

- 20.2. Brief Company Profiles

- 20.2.1. BGI Genomics

- 20.2.1.1. Company Overview

- 20.2.1.2. Product Portfolio

- 20.2.2. Sansure

- 20.2.3. Seegene

- 20.2.1. BGI Genomics

21. PORTER'S FIVE FORCES ANALYSIS

- 21.1. Methodology and Assumptions

- 21.2. Key Parameters

- 21.2.1. Threats of New Entrants

- 21.2.2. Bargaining Power of Buyers

- 21.2.3. Bargaining Power of Suppliers

- 21.2.4. Threats of Substitute Products

- 21.2.5. Rivalry among Existing Competitors

- 21.3. Porter's Five Force Analysis: Harvey Ball Analysis

- 21.4. Concluding Remarks

22. APPENDIX I: TABULATED DATA

23. APPENDIX II: LIST OF COMPANIES AND ORGANIZATIONS

List of Tables

- Table 16.1 Leading Molecular Diagnostics Solution Providers: Information on Year of Establishment, Headquarters, Company Ownership, Type of Technology and Diagnostic Applications

- Table 16.2 Other Leading Molecular Diagnostics Solution Providers: Information on Year of Establishment, Headquarters and Company Ownership

- Table 18.1 Abbott: Company Overview

- Table 18.2 Abbott: Product Portfolio

- Table 18.3 Abbott: Recent Developments and Future Outlook

- Table 18.4 Agilent Technologies: Company Overview

- Table 18.5 Agilent Technologies: Product Portfolio

- Table 18.6 Agilent Technologies: Recent Developments and Future Outlook

- Table 18.7 BD: Company Overview

- Table 18.8 BD: Product Portfolio

- Table 18.9 BD: Recent Developments and Future Outlook

- Table 18.10 Danaher: Company Overview

- Table 18.11 Danaher: Product Portfolio

- Table 18.12 Danaher: Recent Developments and Future Outlook

- Table 18.13 Roche: Company Overview

- Table 18.14 Roche: Product Portfolio

- Table 18.15 Roche: Recent Developments and Future Outlook

- Table 18.16 Thermo Fisher Scientific: Company Overview

- Table 18.17 Thermo Fisher Scientific: Product Portfolio

- Table 18.18 Thermo Fisher Scientific: Recent Developments and Future Outlook

- Table 18.19 Bio-Rad: Company Overview

- Table 18.20 Bio-Rad: Product Portfolio

- Table 18.21 Illumina: Company Overview

- Table 18.22 Illumina: Product Portfolio

- Table 18.23 Hologic: Company Overview

- Table 18.24 Hologic: Product Portfolio

- Table 18.25 PerkinElmer: Company Overview

- Table 18.26 PerkinElmer: Product Portfolio

- Table 18.27 QuidelOrtho: Company Overview

- Table 18.28 QuidelOrtho: Product Portfolio

- Table 19.1 bioMerieux: Company Overview

- Table 19.2 bioMerieux: Product Portfolio

- Table 19.3 bioMerieux: Recent Developments and Future Outlook

- Table 19.4 Grifols: Company Overview

- Table 19.5 Grifols: Product Portfolio

- Table 19.6 Grifols: Recent Developments and Future Outlook

- Table 19.7 Siemens Healthineers: Company Overview

- Table 19.8 Siemens Healthineers: Product Portfolio

- Table 19.9 Siemens Healthineers: Recent Developments and Future Outlook

- Table 19.10 DiaSorin: Company Overview

- Table 19.11 DiaSorin: Product Portfolio

- Table 19.12 Qiagen: Company Overview

- Table 19.13 Qiagen: Product Portfolio

- Table 20.1 Sysmex: Company Overview

- Table 20.2 Sysmex: Product Portfolio

- Table 20.3 Sysmex: Recent Developments and Future Outlook

- Table 20.4 BGI Genomics: Company Overview

- Table 20.5 BGI Genomics: Product Portfolio

- Table 20.6 Sansure: Company Overview

- Table 20.7 Sansure: Product Portfolio

- Table 20.8 Seegene: Company Overview

- Table 20.9 Seegene: Product Portfolio

- Table 22.1 Global Molecular Diagnostics Market, Till 2035 (USD Billion)

- Table 22.2 Global Molecular Diagnostics Market, Conservative Scenario, till 2035 (USD Billion)

- Table 22.3 Global Molecular Diagnostics Market, Optimistic Scenario, till 2035 (USD Billion)

- Table 22.4 Molecular Diagnostics Market: Distribution by Test Type

- Table 22.5 Molecular Diagnostics Market for Laboratory Testing, Till 2035 (USD Billion)

- Table 22.6 Molecular Diagnostics Market for Point-of-Care Testing, Till 2035 (USD Billion)

- Table 22.7 Molecular Diagnostics Market: Distribution by Type of Offering

- Table 22.8 Molecular Diagnostics Market for Instruments, Till 2035 (USD Billion)

- Table 22.9 Molecular Diagnostics Market for In-house Instruments, Till 2035 (USD Billion)

- Table 22.10 Molecular Diagnostics Market for Outsourced Instruments, Till 2035 (USD Billion)

- Table 22.11 Molecular Diagnostics Market for Reagents, Till 2035 (USD Billion)

- Table 22.12 Molecular Diagnostics Market for Services, Till 2035 (USD Billion)

- Table 22.13 Molecular Diagnostics Market: Distribution by Sample Type

- Table 22.14 Molecular Diagnostics Market for Blood, Serum and Plasma, Till 2035 (USD Billion)

- Table 22.15 Molecular Diagnostics Market for Urine, Till 2035 (USD Billion)

- Table 22.16 Molecular Diagnostics Market for Others, Till 2035 (USD Billion)

- Table 22.17 Molecular Diagnostics Market: Distribution by Type of Technology

- Table 22.18 Molecular Diagnostics Market for PCR, Till 2035 (USD Billion)

- Table 22.19 Molecular Diagnostics Market for In situ Hybridization, Till 2035 (USD Billion)

- Table 22.20 Molecular Diagnostics Market for Isothermal Nucleic Acid Amplification Technology, Till 2035 (USD Billion)

- Table 22.21 Molecular Diagnostics Market for Next Generation Sequencing, Till 2035 (USD Billion)

- Table 22.22 Molecular Diagnostics Market for Microarrays, Till 2035 (USD Billion)

- Table 22.23 Molecular Diagnostics Market for Mass Spectrometry, Till 2035 (USD Billion)

- Table 22.24 Molecular Diagnostics Market for Other Technologies, Till 2035 (USD Billion)

- Table 22.25 Molecular Diagnostics Market: Distribution by Therapeutic Area

- Table 22.26 Molecular Diagnostics Market for Infectious Diseases, Till 2035 (USD Billion)

- Table 22.27 Molecular Diagnostics Market for COVID-19, Till 2035 (USD Billion)

- Table 22.28 Molecular Diagnostics Market for Respiratory Infections (Excluding COVID-19), Till 2035 (USD Billion)

- Table 22.29 Molecular Diagnostics Market for Healthcare-associated Infections, Till 2035 (USD Billion)

- Table 22.30 Molecular Diagnostics Market for Hepatitis, Till 2035 (USD Billion)

- Table 22.31 Molecular Diagnostics Market for HIV, Till 2035 (USD Billion)

- Table 22.32 Molecular Diagnostics Market for Sexually Transmitted Diseases, Till 2035 (USD Billion)

- Table 22.33 Molecular Diagnostics Market for Other Infectious Diseases, Till 2035 (USD Billion)

- Table 22.34 Molecular Diagnostics Market for Oncological Disorders, Till 2035 (USD Billion)

- Table 22.35 Molecular Diagnostics Market for Lung Cancer, Till 2035 (USD Billion)

- Table 22.36 Molecular Diagnostics Market for Breast Cancer, Till 2035 (USD Billion)

- Table 22.37 Molecular Diagnostics Market for Colorectal Cancer, Till 2035 (USD Billion)

- Table 22.38 Molecular Diagnostics Market for Prostate Cancer, Till 2035 (USD Billion)

- Table 22.39 Molecular Diagnostics Market for Gastric Cancer, Till 2035 (USD Billion)

- Table 22.40 Molecular Diagnostics Market for Other Oncological Disorders, Till 2035 (USD Billion)

- Table 22.41 Molecular Diagnostics Market for Cardiovascular Diseases, Till 2035 (USD Billion)

- Table 22.42 Molecular Diagnostics Market for Neurological Diseases, Till 2035 (USD Billion)

- Table 22.43 Molecular Diagnostics Market for Genetic Diseases, Till 2035 (USD Billion)

- Table 22.44 Molecular Diagnostics Market for Other Therapeutic Areas, Till 2035 (USD Billion)

- Table 22.45 Molecular Diagnostics Market: Distribution by End Users

- Table 22.46 Molecular Diagnostics Market for Laboratories, Till 2035 (USD Billion)

- Table 22.47 Molecular Diagnostics Market for Large Laboratories, Till 2035 (USD Billion)

- Table 22.48 Molecular Diagnostics Market for Small and Medium-sized Laboratories, Till 2035 (USD Billion)

- Table 22.49 Molecular Diagnostics Market for Hospitals, Till 2035 (USD Billion)

- Table 22.50 Molecular Diagnostics Market for Other End Users, Till 2035 (USD Billion)

- Table 22.51 Molecular Diagnostics Market: Distribution by Geographical Regions

- Table 22.52 Molecular Diagnostics Market in North America, Till 2035 (USD Billion)

- Table 22.53 Molecular Diagnostics Market in the US, Till 2035 (USD Billion)

- Table 22.54 Molecular Diagnostics Market in Canada, Till 2035 (USD Billion)

- Table 22.55 Molecular Diagnostics Market in Europe, Till 2035 (USD Billion)

- Table 22.56 Molecular Diagnostics Market in Austria, Till 2035 (USD Billion)

- Table 22.57 Molecular Diagnostics Market in Belgium, Till 2035 (USD Billion)

- Table 22.58 Molecular Diagnostics Market in France, Till 2035 (USD Billion)

- Table 22.59 Molecular Diagnostics Market in Germany, Till 2035 (USD Billion)

- Table 22.60 Molecular Diagnostics Market in Italy, Till 2035 (USD Billion)

- Table 22.61 Molecular Diagnostics Market in the Netherlands, Till 2035 (USD Billion)

- Table 22.62 Molecular Diagnostics Market in Poland, Till 2035 (USD Billion)

- Table 22.63 Molecular Diagnostics Market in Spain, Till 2035 (USD Billion)

- Table 22.64 Molecular Diagnostics Market in Switzerland, Till 2035 (USD Billion)

- Table 22.65 Molecular Diagnostics Market in the UK, Till 2035 (USD Billion)

- Table 22.66 Molecular Diagnostics Market in Rest of the Europe, Till 2035 (USD Billion)

- Table 22.67 Molecular Diagnostics Market in Asia, Till 2035 (USD Billion)

- Table 22.68 Molecular Diagnostics Market in China, Till 2035 (USD Billion)

- Table 22.69 Molecular Diagnostics Market in India, Till 2035 (USD Billion)

- Table 22.70 Molecular Diagnostics Market in Indonesia, Till 2035 (USD Billion)

- Table 22.71 Molecular Diagnostics Market in Japan, Till 2035 (USD Billion)

- Table 22.72 Molecular Diagnostics Market in Singapore, Till 2035 (USD Billion)

- Table 22.73 Molecular Diagnostics Market in South Korea, Till 2035 (USD Billion)

- Table 22.74 Molecular Diagnostics Market in Thailand, Till 2035 (USD Billion)

- Table 22.75 Molecular Diagnostics Market in Rest of Asia, Till 2035 (USD Billion)

- Table 22.76 Molecular Diagnostics Market in Latin America, Till 2035 (USD Billion)

- Table 22.77 Molecular Diagnostics Market in Brazil, Till 2035 (USD Billion)

- Table 22.78 Molecular Diagnostics Market in Argentina, Till 2035 (USD Billion)

- Table 22.79 Molecular Diagnostics Market in Mexico, Till 2035 (USD Billion)

- Table 22.80 Molecular Diagnostics Market in Rest of Latin America, Till 2035 (USD Billion)

- Table 22.81 Molecular Diagnostics Market in Middle East and North Africa, Till 2035 (USD Billion)

- Table 22.82 Molecular Diagnostics Market in Egypt, Till 2035 (USD Billion)

- Table 22.83 Molecular Diagnostics Market in Israel, Till 2035 (USD Billion)

- Table 22.84 Molecular Diagnostics Market in Saudi Arabia, Till 2035 (USD Billion)

- Table 22.85 Molecular Diagnostics Market in Rest of Middle East and North Africa, Till 2035 (USD Billion)

- Table 22.86 Molecular Diagnostics Market in Rest of the World, Till 2035 (USD Billion)

- Table 22.87 Molecular Diagnostics Market in Australia, Till 2035 (USD Billion)

- Table 22.88 Molecular Diagnostics Market in New Zealand, Till 2035 (USD Billion)

- Table 22.89 Molecular Diagnostics Market: Distribution of Leading Players by Annual Revenues (FY23, USD Billion

- Table 22.90 Molecular Diagnostic Solution: Distribution by Type of Technology

- Table 22.91 Molecular Diagnostic Solution: Distribution by Diagnostic Applications

- Table 22.92 Molecular Diagnostic Solution: Distribution by Type of Technology and Diagnostic Applications

- Table 22.93 Molecular Diagnostics Solution Providers: Distribution by Year of Establishment

- Table 22.94 Molecular Diagnostics Solution Providers: Distribution by Company Size

- Table 22.95 Molecular Diagnostics Solution Providers: Distribution by Location of Headquarters

- Table 22.96 Molecular Diagnostics Solution Providers: Distribution by Company Ownership

- Table 22.97 Abbott: Financial Information (USD Billion)

- Table 22.98 Agilent Technologies: Financial Information (USD Billion)

- Table 22.99 BD: Financial Information (USD Billion)

- Table 22.100 Danaher: Financial Information (USD Billion)

- Table 22.101 Thermo Fisher Scientific: Financial Information (CHF Billion)

- Table 22.102 bioMerieux: Financial Information (EUR Billion)

- Table 22.103 Grifols: Financial Information (EUR Billion)

- Table 22.104 Roche: Financial Information (CHF Billion)

- Table 22.105 Siemens Healthineers: Financial Information (EUR Billion)

- Table 22.106 Sysmex: Financial Information (JPY Billion)

List of Figures

- Figure 2.1 Research Methodology: Research Assumptions

- Figure 2.2 Research Methodology: Project Methodology

- Figure 2.3 Research Methodology: Forecast Methodology

- Figure 2.4 Research Methodology: Robust Quality Control

- Figure 2.5 Research Methodology: Key Market Segmentations

- Figure 5.1 Key Technologies Employed in Molecular Diagnostic Solution

- Figure 5.2 Challenges in the Molecular Diagnostics Domain

- Figure 6.1 Market Drivers

- Figure 6.2 Market Restraints

- Figure 6.3 Market Opportunities

- Figure 6.4 Market Challenges

- Figure 7.1 Global Molecular Diagnostics Market, Till 2035 (USD Billion)

- Figure 7.2 Global Molecular Diagnostics Market, Conservative Scenario, Till 2035 (USD Billion)

- Figure 7.3 Global Molecular Diagnostics Market, Optimistic Scenario, Till 2035 (USD Billion)

- Figure 8.1 Molecular Diagnostics Market: Distribution by Test Type

- Figure 8.2 Molecular Diagnostics Market for Laboratory Testing, Till 2035 (USD Billion)

- Figure 8.3 Molecular Diagnostics Market for Point-of-Care Testing, Till 2035 (USD Billion)

- Figure 9.1 Molecular Diagnostics Market: Distribution by Type of Offering

- Figure 9.2 Molecular Diagnostics Market for Instruments, Till 2035 (USD Billion)

- Figure 9.3 Molecular Diagnostics Market for In-house Instruments, Till 2035 (USD Billion)

- Figure 9.4 Molecular Diagnostics Market for Outsourced Instruments, Till 2035 (USD Billion)

- Figure 9.5 Molecular Diagnostics Market for Reagents, Till 2035 (USD Billion)

- Figure 9.6 Molecular Diagnostics Market for Services, Till 2035 (USD Billion)

- Figure 10.1 Molecular Diagnostics Market: Distribution by Sample Type

- Figure 10.2 Molecular Diagnostics Market for Blood, Serum and Plasma, Till 2035 (USD Billion)

- Figure 10.3 Molecular Diagnostics Market for Urine, Till 2035 (USD Billion)

- Figure 10.4 Molecular Diagnostics Market for Others, Till 2035 (USD Billion)

- Figure 11.1 Molecular Diagnostics Market: Distribution by Type of Technology

- Figure 11.2 Molecular Diagnostics Market for PCR, Till 2035 (USD Billion)

- Figure 11.3 Molecular Diagnostics Market for In Situ Hybridization, Till 2035 (USD Billion)

- Figure 11.4 Molecular Diagnostics Market for Isothermal Nucleic Acid Amplification Technology, Till 2035 (USD Billion)

- Figure 11.5 Molecular Diagnostics Market for Next Generation Sequencing, Till 2035 (USD Billion)

- Figure 11.6 Molecular Diagnostics Market for Microarrays, Till 2035 (USD Billion)

- Figure 11.7 Molecular Diagnostics Market for Mass Spectrometry, Till 2035 (USD Billion)

- Figure 11.8 Molecular Diagnostics Market for Other Technologies, Till 2035 (USD Billion)

- Figure 12.1 Molecular Diagnostics Market: Distribution by Therapeutic Area

- Figure 12.2 Molecular Diagnostics Market for Infectious Diseases, Till 2035 (USD Billion)

- Figure 12.3 Molecular Diagnostics Market for COVID-19, Till 2035 (USD Billion)

- Figure 12.4 Molecular Diagnostics Market for Respiratory Infections (Excluding COVID-19), Till 2035 (USD Billion)

- Figure 12.5 Molecular Diagnostics Market for Healthcare-associated Infections, Till 2035 (USD Billion)

- Figure 12.6 Molecular Diagnostics Market for Hepatitis, Till 2035 (USD Billion)

- Figure 12.7 Molecular Diagnostics Market for HIV, Till 2035 (USD Billion)

- Figure 12.8 Molecular Diagnostics Market for Sexually Transmitted Diseases, Till 2035 (USD Billion)

- Figure 12.9 Molecular Diagnostics Market for Other Infectious Diseases, Till 2035 (USD Billion)

- Figure 12.10 Molecular Diagnostics Market for Oncological Disorders, Till 2035 (USD Billion)

- Figure 12.11 Molecular Diagnostics Market for Lung Cancer, Till 2035 (USD Billion)

- Figure 12.12 Molecular Diagnostics Market for Breast Cancer, Till 2035 (USD Billion)

- Figure 12.13 Molecular Diagnostics Market for Colorectal Cancer, Till 2035 (USD Billion)

- Figure 12.14 Molecular Diagnostics Market for Prostate Cancer, Till 2035 (USD Billion)

- Figure 12.15 Molecular Diagnostics Market for Gastric Cancer, Till 2035 (USD Billion)

- Figure 12.16 Molecular Diagnostics Market for Other Oncological Disorders, Till 2035 (USD Billion)

- Figure 12.17 Molecular Diagnostics Market for Cardiovascular Diseases, Till 2035 (USD Billion)

- Figure 12.18 Molecular Diagnostics Market for Neurological Diseases, Till 2035 (USD Billion)

- Figure 12.19 Molecular Diagnostics Market for Genetic Diseases, Till 2035 (USD Billion)

- Figure 12.20 Molecular Diagnostics Market for Other Therapeutic Areas, Till 2035 (USD Billion)

- Figure 13.1 Molecular Diagnostics Market: Distribution by End Users

- Figure 13.2 Molecular Diagnostics Market for Laboratories, Till 2035 (USD Billion)

- Figure 13.3 Molecular Diagnostics Market for Large Laboratories, Till 2035 (USD Billion)

- Figure 13.4 Molecular Diagnostics Market for Small and Medium-sized Laboratories, Till 2035 (USD Billion)

- Figure 13.5 Molecular Diagnostics Market for Hospitals, Till 2035 (USD Billion)

- Figure 13.6 Molecular Diagnostics Market for Other End Users, Till 2035 (USD Billion)

- Figure 14.1 Molecular Diagnostics Market: Distribution by Geographical Regions

- Figure 14.2 Molecular Diagnostics Market in North America, Till 2035 (USD Billion)

- Figure 14.3 Molecular Diagnostics Market in the US, Till 2035 (USD Billion)

- Figure 14.4 Molecular Diagnostics Market in Canada, Till 2035 (USD Billion)

- Figure 14.5 Molecular Diagnostics Market in Europe, Till 2035 (USD Billion)

- Figure 14.6 Molecular Diagnostics Market in Austria, Till 2035 (USD Billion)

- Figure 14.7 Molecular Diagnostics Market in Belgium, Till 2035 (USD Billion)

- Figure 14.8 Molecular Diagnostics Market in France, Till 2035 (USD Billion)

- Figure 14.9 Molecular Diagnostics Market in Germany, Till 2035 (USD Billion)

- Figure 14.10 Molecular Diagnostics Market in Italy, Till 2035 (USD Billion)

- Figure 14.11 Molecular Diagnostics Market in the Netherlands, Till 2035 (USD Billion)

- Figure 14.12 Molecular Diagnostics Market in Poland, Till 2035 (USD Billion)

- Figure 14.13 Molecular Diagnostics Market in Spain, Till 2035 (USD Billion)

- Figure 14.14 Molecular Diagnostics Market in Switzerland, Till 2035 (USD Billion)

- Figure 14.15 Molecular Diagnostics Market in the UK, Till 2035 (USD Billion)

- Figure 14.16 Molecular Diagnostics Market in Rest of Europe, Till 2035 (USD Billion)

- Figure 14.17 Molecular Diagnostics Market in Asia, Till 2035 (USD Billion)

- Figure 14.18 Molecular Diagnostics Market in China, Till 2035 (USD Billion)

- Figure 14.19 Molecular Diagnostics Market in India, Till 2035 (USD Billion)

- Figure 14.20 Molecular Diagnostics Market in Indonesia, Till 2035 (USD Billion)

- Figure 14.21 Molecular Diagnostics Market in Japan, Till 2035 (USD Billion)

- Figure 14.22 Molecular Diagnostics Market in Singapore, Till 2035 (USD Billion)

- Figure 14.23 Molecular Diagnostics Market in South Korea, Till 2035 (USD Billion)

- Figure 14.24 Molecular Diagnostics Market in Thailand, Till 2035 (USD Billion)

- Figure 14.25 Molecular Diagnostics Market in Rest of the Asia, Till 2035 (USD Billion)

- Figure 14.26 Molecular Diagnostics Market in Latin America, Till 2035 (USD Billion)

- Figure 14.27 Molecular Diagnostics Market in Brazil, Till 2035 (USD Billion)

- Figure 14.28 Molecular Diagnostics Market in Argentina, Till 2035 (USD Billion)

- Figure 14.29 Molecular Diagnostics Market in Mexico, Till 2035 (USD Billion)

- Figure 14.30 Molecular Diagnostics Market in Rest of Latin America, Till 2035 (USD Billion)

- Figure 14.31 Molecular Diagnostics Market in Middle East and North Africa, Till 2035 (USD Billion)

- Figure 14.32 Molecular Diagnostics Market in Egypt, Till 2035 (USD Billion)

- Figure 14.33 Molecular Diagnostics Market in Israel, Till 2035 (USD Billion)

- Figure 14.34 Molecular Diagnostics Market in Saudi Arabia, Till 2035 (USD Billion)

- Figure 14.35 Molecular Diagnostics Market in Rest of Middle East and North Africa, Till 2035 (USD Billion)

- Figure 14.36 Molecular Diagnostics Market in Rest of the World, Till 2035 (USD Billion)

- Figure 14.37 Molecular Diagnostics Market in Australia, Till 2035 (USD Billion)

- Figure 14.38 Molecular Diagnostics Market in New Zealand, Till 2035 (USD Billion)

- Figure 15.1 Molecular Diagnostics Market: Distribution of Leading Players by Annual Revenue (FY23, USD Billion)

- Figure 16.1 Molecular Diagnostic Solution: Distribution by Type of Technology

- Figure 16.2 Molecular Diagnostic Solution: Distribution by Diagnostic Applications

- Figure 16.3 Molecular Diagnostic Solution: Distribution by Type of Technology and Diagnostic Applications

- Figure 16.4 Molecular Diagnostics Solution Providers: Distribution by Year of Establishment

- Figure 16.5 Molecular Diagnostics Solution Providers: Distribution by Company Size

- Figure 16.6 Molecular Diagnostics Solution Providers: Distribution by Location of Headquarters

- Figure 16.7 Molecular Diagnostics Solution Providers: Distribution by Company Ownership

- Figure 17.1 Molecular Diagnostic Solution Providers: Competitiveness Analysis of Very Large Players

- Figure 17.2 Molecular Diagnostic Solution Providers: Competitiveness Analysis of Large Players

- Figure 17.3 Roche: Benchmarking Analysis

- Figure 17.4 Abbott: Benchmarking Analysis

- Figure 17.5 Thermo Fisher Scientific: Benchmarking Analysis

- Figure 17.6 Qiagen: Benchmarking Analysis

- Figure 17.7 bioMerieux: Benchmarking Analysis

- Figure 17.8 DiaSorin: Benchmarking Analysis

- Figure 17.9 Illumina: Benchmarking Analysis

- Figure 17.10 Sysmex: Benchmarking Analysis

- Figure 17.11 Perkin Elmer: Benchmarking Analysis

- Figure 17.12 Bio-Rad: Benchmarking Analysis

- Figure 17.13 Leading Molecular Diagnostic Solution Providers: Benchmarking by Competitiveness

- Figure 17.14 Leading Molecular Diagnostic Solution Providers: Benchmarking by Type of Technology Score

- Figure 17.15 Leading Molecular Diagnostic Solution Providers: Benchmarking by Diagnostic Applications Score

- Figure 18.1 Abbott: Financial Information (USD Billion)

- Figure 18.2 Agilent Technologies: Financial Information (USD Billion)

- Figure 18.3 BD: Financial Information (USD Billion)

- Figure 18.4 Danaher: Financial Information (USD Billion)

- Figure 18.5 Thermo Fisher Scientific: Financial Information (CHF Billion)

- Figure 19.1 bioMerieux: Financial Information (EUR Billion)

- Figure 19.2 Grifols: Financial Information (EUR Billion)

- Figure 19.3 Roche: Financial Information (CHF Billion)

- Figure 19.4 Siemens Healthineers: Financial Information (EUR Billion)

- Figure 20.1 Sysmex: Financial Information (JPY Billion)

- Figure 21.1 Threats of New Entrants

- Figure 21.2 Bargaining Power of Buyers

- Figure 21.3 Bargaining Power of Suppliers

- Figure 21.4 Threats of Substitute Products

- Figure 21.5 Rivalry among Existing Competitors

- Figure 21.6 Porter's Five Force Analysis: Harvey Ball Analysis