PUBLISHER: Roots Analysis | PRODUCT CODE: 1919787

PUBLISHER: Roots Analysis | PRODUCT CODE: 1919787

AI in Clinical Trials Market, till 2040: Distribution by Trial Phase, Target Therapeutic Area, End User and Key Geographical Regions: Industry Trends and Global Forecasts

AI In Clinical Trials Market Outlook

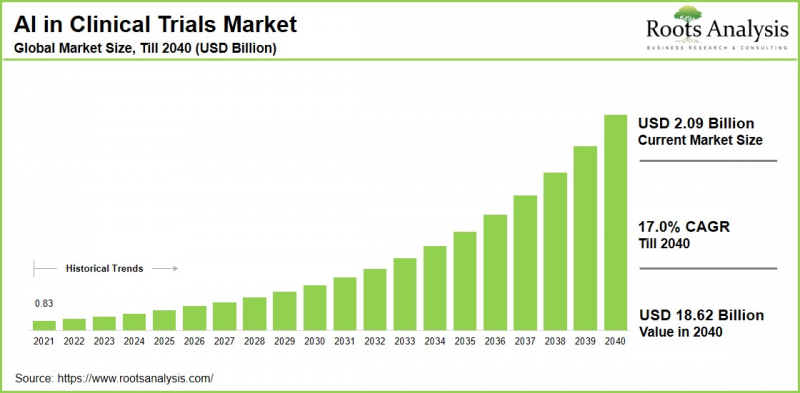

As per Roots Analysis, the global artificial intelligence in clinical trials market size is estimated to grow from USD 2.09 billion in the current year to USD 18.62 billion by 2040, at a CAGR of 17.0% during the forecast period, till 2040.

Developing novel therapeutic interventions demands substantial time and financial resources, typically spanning about 10-15 years. Clinical trials, essential for evaluating efficacy and safety in humans, consume roughly 50-70% of this timeline and budget, yet many fail due to design flaws, recruitment issues, stratification errors, and high dropout rates. Therefore, pharma stakeholders are increasingly adopting AI to mitigate these hurdles, leveraging its capacity to process vast datasets for smarter trial optimization.

It is worth mentioning that artificial intelligence transforms clinical trials by accelerating patient recruitment through precise matching, refining trial designs via digital twins, and extracting safety and efficacy signals from multifaceted data sources like EHRs and imaging. Further, it automates the routine tasks such as reporting and monitoring. Overall, considering the above mentioned factors, the global AI in clinical trials market is expected to grow significantly during the forecast period.

Strategic Insights for Senior Leaders

Key Roles and Applications of AI in Clinical Trials

AI plays pivotal roles across clinical trials, from patient recruitment and site selection to trial design, data management, and outcome prediction. Key applications include using machine learning to analyze electronic health records and real-world data for precise patient matching. Further, it is used for reducing screen failures and accelerating enrollment. AI also automates data cleaning, detects anomalies, forecasts adverse events, and enhances monitoring through continuous analysis of diverse datasets. This enables improvement in efficiency, cutting costs, and boosting trial success rates while supporting personalized medicine approaches.

Prominent Drivers Propelling Growth of AI in Clinical Trials Market

The AI in clinical trials market is expanding rapidly due to several critical drivers, including enhanced patient recruitment through analysis of electronic health records and genetic data. This approach accelerates identification of suitable candidates and reduces trial timelines and costs. Predictive analytics and machine learning enable optimized trial designs by forecasting outcomes, while integration of real-world data provides deeper insights into patient behaviors. Further, rising demand for personalized medicine, growth in precision therapies, and the need to manage vast clinical datasets fuel adoption of such technologies.

AI in Clinical Trials Market: Competitive Landscape of Companies in this Industry

The competitive landscape of AI in clinical trials market is characterized by intense competition, featuring a combination of large and smaller firms. Key players such as IQVIA, Medidata (Dassault Systemes), IBM Watson Health, Oracle Health Sciences, and Phesi dominate through comprehensive platforms for data analytics, patient matching, and trial optimization, often collaborating with pharmaceutical firms like Pfizer and Novartis.

Emerging companies including AiCure, Deep 6 AI, Mendel.ai, Saama Technologies, Unlearn.ai, ConcertAI, and Tempus AI are gaining traction with niche solutions like real-time monitoring, and predictive modeling, intensifying competition amid rising demand for efficiency in drug development.

AI in Clinical Trials Evolution: Emerging Trends in the Industry

Emerging trends in this domain include automating processes, enhancing patient matching, and enabling predictive analytics to cut costs and timelines significantly. Agentic AI autonomously manages trial workflows, from patient recruitment to real-time risk monitoring and protocol adjustments in adaptive trials. Unlike generative AI, it executes decisions independently, reducing manual tasks and accelerating enrollment. Generative AI draft protocols, creates synthetic datasets for training models, and automates patient-facing content like eConsent. It optimizes trial design by simulating scenarios from historical data, potentially cutting development time by 50% and costs by 25%. Additionally, digital twins simulate individual patient responses using AI and historical data, enabling smaller trials with higher statistical power.

Key Market Challenges

The market for AI in clinical trials faces significant challenges, including stringent data privacy regulations like GDPR and HIPAA that complicate handling sensitive patient information, integration hurdles with legacy systems requiring substantial customization and interoperability standards. Additional barriers encompass data quality issues such as incompleteness and bias in real-world datasets, high upfront costs for infrastructure amid a shortage of AI-savvy clinicians. These factors necessitate collaborative efforts between pharma firms, tech providers, and regulators to unlock AI's potential in streamlining recruitment, monitoring, and adaptive designs.

AI In Clinical Trials Market: Key Market Segmentation

Trial Phase

- Phase I

- Phase II

- Phase III

Target Therapeutic Area

- Cardiovascular Disorders

- CNS Disorders

- Infectious Diseases

- Metabolic Disorders

- Oncological Disorders

- Other Disorders

End-user

- Pharmaceutical and Biotechnology Companies

- Other End-users

Geographical Regions

- North America

- US

- Canada

- Mexico

- Other North American countries

- Europe

- Austria

- Belgium

- Denmark

- France

- Germany

- Ireland

- Italy

- Netherlands

- Norway

- Russia

- Spain

- Sweden

- Switzerland

- UK

- Other European countries

- Asia

- China

- India

- Japan

- Singapore

- South Korea

- Other Asian countries

- Latin America

- Brazil

- Chile

- Colombia

- Venezuela

- Other Latin American countries

- Middle East and North Africa

- Egypt

- Iran

- Iraq

- Israel

- Kuwait

- Saudi Arabia

- UAE

- Other MENA countries

- Rest of the World

- Australia

- New Zealand

- Other countries

AI in clinical trials Market: Key Market Share Insights

Market Share by Therapeutic Area

Based on the therapeutic area, the global market is segmented into cardiovascular disorders, CNS disorders, infectious diseases, metabolic disorders, oncological disorders and other disorders. According to our estimates, currently, oncological disorders capture majority share of the market. This is due to the high volume and complexity of cancer trials; these trials generate vast, heterogeneous datasets from genomics, imaging, and electronic health records, which AI efficiently analyzes for precise patient recruitment.

Market Share by Geography

According to our estimates Asia-Pacific currently captures a significant share of the AI in clinical trials market. This is due to the massive, diverse patient population, offering rapid recruitment for trials amid rising chronic disease burdens like cancer and diabetes. Further, the region has cost-effective operations along with improving regulatory frameworks, government incentives, and expanding biotech infrastructure which fuels the growth.

Example Players in AI in Clinical Trials Market

- AiCure

- Antidote Technologies

- Deep 6 AI

- Innoplexus

- IQVIA

- Median Technologies

- Medidata

- Mendel.ai

- Phesi

- Saama Technologies

- Signant Health

- Trials.ai

AI in Clinical Trials Market: Report Coverage

The report on the AI in clinical trials market features insights on various sections, including:

- Market Sizing and Opportunity Analysis: An in-depth analysis of the AI in clinical trials market, focusing on key market segments, including [A] trial phase, [B] target therapeutic area, [C] end user, and [D] key geographical regions.

- Competitive Landscape: A comprehensive analysis of the companies engaged in the AI in clinical trials market, based on several relevant parameters, such as [A] year of establishment, [B] company size, [C] location of headquarters and [D] ownership structure.

- Company Profiles: Elaborate profiles of prominent players engaged in the AI in clinical trials market, providing details on [A] location of headquarters, [B] company size, [C] company mission, [D] company footprint, [E] management team, [F] contact details, [G] financial information, [H] operating business segments, [I] portfolio, [J] recent developments, and an informed future outlook.

- Megatrends: An evaluation of ongoing megatrends in the AI in clinical trials industry.

- Patent Analysis: An insightful analysis of patents filed / granted in the AI in clinical trials domain, based on relevant parameters, including [A] type of patent, [B] patent publication year, [C] patent age and [D] leading players.

- Recent Developments: An overview of the recent developments made in the AI in clinical trials market, along with analysis based on relevant parameters, including [A] year of initiative, [B] type of initiative, [C] geographical distribution and [D] most active players.

- Porter's Five Forces Analysis: An analysis of five competitive forces prevailing in the AI in clinical trials market, including threats of new entrants, bargaining power of buyers, bargaining power of suppliers, threats of substitute products and rivalry among existing competitors.

- SWOT Analysis: An insightful SWOT framework, highlighting the strengths, weaknesses, opportunities and threats in the domain. Additionally, it provides Harvey ball analysis, highlighting the relative impact of each SWOT parameter.

- Value Chain Analysis: A comprehensive analysis of the value chain, providing information on the different phases and stakeholders involved in the AI in clinical trials market.

Key Questions Answered in this Report

- What is the current and future market size?

- Who are the leading companies in this market?

- What are the growth drivers that are likely to influence the evolution of this market?

- What are the key partnership and funding trends shaping this industry?

- Which region is likely to grow at higher CAGR till 2040?

- How is the current and future market opportunity likely to be distributed across key market segments?

Reasons to Buy this Report

- Detailed Market Analysis: The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- In-depth Analysis of Trends: Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. Each report maps ecosystem activity across partnerships, funding, and patent landscapes to reveal growth hotspots and white spaces in the industry.

- Opinion of Industry Experts: The report features extensive interviews and surveys with key opinion leaders and industry experts to validate market trends mentioned in the report.

- Decision-ready Deliverables: The report offers stakeholders with strategic frameworks (Porter's Five Forces, value chain, SWOT), and complimentary Excel / slide packs with customization support.

Additional Benefits

- Complimentary Dynamic Excel Dashboards for Analytical Modules

- Exclusive 15% Free Content Customization

- Personalized Interactive Report Walkthrough with Our Expert Research Team

- Free Report Updates for Versions Older than 6-12 Months

TABLE OF CONTENTS

1. PREFACE

- 1.1. Scope of the Report

- 1.2. Research Methodology

- 1.3. Key Questions Answered

- 1.4. Chapter Outlines

2. EXECUTIVE SUMMARY

3. INTRODUCTION

- 3.1. Chapter Overview

- 3.2. Evolution of AI

- 3.3. Subfields of AI

- 3.4. Applications of AI in Healthcare

- 3.4.1. Drug Discovery

- 3.4.2. Drug Manufacturing

- 3.4.3. Marketing

- 3.4.4. Diagnosis and Treatment

- 3.4.5. Clinical Trials

- 3.5. Applications of AI in Clinical Trials

- 3.6. Challenges Associated with the Adoption of AI

- 3.7. Future Perspective

4. COMPETITIVE LANDSCAPE

- 4.1. Chapter Overview

- 4.2. AI in Clinical Trials: AI Software and Service Providers Landscape

- 4.2.1. Analysis by Year of Establishment

- 4.2.2. Analysis by Company Size

- 4.2.3. Analysis by Location of Headquarters

- 4.2.4. Analysis by Company Size and Location of Headquarters (Region-wise)

- 4.2.5. Analysis by Key Offering

- 4.2.6. Analysis by Business Model

- 4.2.7. Analysis by Deployment Option

- 4.2.8. Analysis by Type of AI Technology

- 4.2.9. Analysis by Application Area

- 4.2.10. Analysis by Potential End-user

5. COMPANY PROFILES

- 5.1. Chapter Overview

- 5.2. AiCure

- 5.2.1. Company Overview

- 5.2.2. AI-based Clinical Trial Offerings

- 5.2.3. Recent Developments and Future Outlook

- 5.3. Antidote Technologies

- 5.3.1. Company Overview

- 5.3.2. AI-based Clinical Trial Offerings

- 5.3.3. Recent Developments and Future Outlook

- 5.4. Deep 6 AI

- 5.4.1. Company Overview

- 5.4.2. AI-based Clinical Trial Offerings

- 5.4.3. Recent Developments and Future Outlook

- 5.5. Innoplexus

- 5.5.1. Company Overview

- 5.5.2. AI-based Clinical Trial Offerings

- 5.5.3. Recent Developments and Future Outlook

- 5.6. IQVIA

- 5.6.1. Company Overview

- 5.6.2. Financial Information

- 5.6.3. AI-based Clinical Trial Offerings

- 5.6.4. Recent Developments and Future Outlook

- 5.7. Median Technologies

- 5.7.1. Company Overview

- 5.7.2. Financial Information

- 5.7.3. AI-based Clinical Trial Offerings

- 5.7.4. Recent Developments and Future Outlook

- 5.8. Medidata

- 5.8.1. Company Overview

- 5.8.2. Financial Information

- 5.8.3. AI-based Clinical Trial Offerings

- 5.8.4. Recent Developments and Future Outlook

- 5.9. Mendel.ai

- 5.9.1. Company Overview

- 5.9.2. AI-based Clinical Trial Offerings

- 5.9.3. Recent Developments and Future Outlook

- 5.10. Phesi

- 5.10.1. Company Overview

- 5.10.2. AI-based Clinical Trial Offerings

- 5.10.3. Recent Developments and Future Outlook

- 5.11. Saama Technologies

- 5.11.1. Company Overview

- 5.11.2. AI-based Clinical Trial Offerings

- 5.11.3. Recent Developments and Future Outlook

- 5.12. Signant Health

- 5.12.1. Company Overview

- 5.12.2. AI-based Clinical Trial Offerings

- 5.12.3. Recent Developments and Future Outlook

- 5.13. Trials.ai

- 5.13.1. Company Overview

- 5.13.2. AI-based Clinical Trial Offerings

- 5.13.3. Recent Developments and Future Outlook

6. CLINICAL TRIAL ANALYSIS

- 6.1. Chapter Overview

- 6.2. Scope and Methodology

- 6.3. AI in Clinical Trials

- 6.3.1. Analysis by Trial Registration Year

- 6.3.2. Analysis by Number of Patients Enrolled

- 6.3.3. Analysis by Trial Phase

- 6.3.4. Analysis by Trial Status

- 6.3.5. Analysis by Trial Registration Year and Status

- 6.3.6. Analysis by Type of Sponsor

- 6.3.7. Analysis by Patient Gender

- 6.3.8. Analysis by Patient Age

- 6.3.9. Word Cloud Analysis: Emerging Focus Areas

- 6.3.10. Analysis by Target Therapeutic Area

- 6.3.11. Analysis by Study Design

- 6.3.11.1. Analysis by Type of Patient Allocation Model Used

- 6.3.11.2. Analysis by Type of Trial Masking Adopted

- 6.3.11.3. Analysis by Type of Intervention

- 6.3.11.4. Analysis by Trial Purpose

- 6.3.12. Most Active Players: Analysis by Number of Clinical Trials

- 6.3.13. Analysis of Clinical Trials by Geography

- 6.3.14. Analysis of Clinical Trials by Geography and Trial Status

- 6.3.15. Analysis of Patients Enrolled by Geography and Trial Registration Year

- 6.3.16. Analysis of Patients Enrolled by Geography and Trial Status

7. PARTNERSHIPS AND COLLABORATIONS

- 7.1. Chapter Overview

- 7.2. Partnership Models

- 7.3. AI in Clinical Trials: Partnerships and Collaborations

- 7.3.1. Analysis by Year of Partnership

- 7.3.2. Analysis by Type of Partnership

- 7.3.3. Analysis by Year and Type of Partnership

- 7.3.4. Analysis by Application Area

- 7.3.5. Analysis by Target Therapeutic Area

- 7.3.6. Analysis by Type of Partner

- 7.3.7. Most Active Players: Analysis by Number of Partnerships

- 7.3.8. Analysis by Geography

- 7.3.8.1. Local and International Agreements

- 7.3.8.2. Intercontinental and Intracontinental Agreements

8. FUNDING AND INVESTMENTS

- 8.1. Chapter Overview

- 8.2. Types of Funding

- 8.3. AI in Clinical Trials: Funding and Investments

- 8.3.1. Analysis by Year of Funding

- 8.3.2. Analysis by Amount Invested

- 8.3.3. Analysis by Type of Funding

- 8.3.4. Analysis by Year and Type of Funding

- 8.3.5. Analysis by Type of Funding and Amount Invested

- 8.3.6. Analysis by Application Area

- 8.3.7. Analysis by Geography

- 8.3.8. Most Active Players: Analysis by Number of Funding Instances and Amount Raised

- 8.3.9. Leading Investors: Analysis by Number of Funding Instances

- 8.4. Concluding Remarks

9. BIG PHARMA INITIATIVES

- 9.1. Chapter Overview

- 9.2. Scope and Methodology

- 9.3. Analysis by Year of Initiative

- 9.4. Analysis by Type of Initiative

- 9.5. Analysis by Application Area of AI

- 9.6. Analysis by Target Therapeutic Area

- 9.7. Benchmarking Analysis: Big Pharma Players

10. AI IN CLINICAL TRIALS: USE CASES

- 10.1. Chapter Overview

- 10.2. Use Case 1: Collaboration between Roche and AiCure

- 10.2.1. Roche

- 10.2.2. AiCure

- 10.2.3. Business Needs

- 10.2.4. Objectives Achieved and Solutions Provided

- 10.3. Use Case 2: Collaboration between Takeda and AiCure

- 10.3.1. Takeda

- 10.3.2. AiCure

- 10.3.3. Business Needs

- 10.3.4. Objectives Achieved and Solutions Provided

- 10.4. Use Case 3: Collaboration between Teva Pharmaceuticals and Intel

- 10.4.1. Teva Pharmaceuticals

- 10.4.2. Intel

- 10.4.3. Business Needs

- 10.4.4. Objectives Achieved and Solutions Provided

- 10.5. Use Case 4: Collaboration between Undisclosed Pharmaceutical Company and Antidote

- 10.5.1. Antidote

- 10.5.2. Business Needs

- 10.5.3. Objectives Achieved and Solutions Provided

- 10.6. Use Case 5: Collaboration between Undisclosed Pharmaceutical Company and Cognizant

- 10.6.1. Cognizant

- 10.6.2. Business Needs

- 10.6.3. Objectives Achieved and Solutions Offered

- 10.7. Use Case 6: Collaboration between Cedars-Sinai Medical Center and Deep 6 AI

- 10.7.1. Cedars-Sinai Medical Center

- 10.7.2. Deep 6 AI

- 10.7.3. Business Needs

- 10.7.4. Objectives Achieved and Solutions Offered

- 10.8. Use Case 7: Collaboration between GlaxoSmithKline (GSK) and PathAI

- 10.8.1. PathAI

- 10.8.2. GlaxoSmithKline (GSK)

- 10.8.3. Business Needs

- 10.8.4. Objectives Achieved and Solutions Provided

- 10.9. Use Case 8: Collaboration between Bristol Myers Squibb (BMS) and Concert AI

- 10.9.1. Concert AI

- 10.9.2. Bristol Myers Squibb (BMS)

- 10.9.3. Business Needs

- 10.9.4. Objectives Achieved and Solutions Provided

11. VALUE CREATION FRAMEWORK: A STRATEGIC GUIDE TO ADDRESS UNMET NEEDS IN CLINICAL TRIALS

12. COST SAVING ANALYSIS

13. MARKET FORECAST AND OPPORTUNITY ANALYSIS

- 13.1. Chapter Overview

- 13.2. Key Assumptions and Forecast Methodology

- 13.3. Global AI in Clinical Trials Market

- 13.3.1. AI in Clinical Trials Market: Distribution by Trial Phase

- 13.3.1.1. AI in Clinical Trials Market for Phase I

- 13.3.1.2. AI in Clinical Trials Market for Phase II

- 13.3.1.3. AI in Clinical Trials Market for Phase III

- 13.3.2. AI in Clinical Trials Market: Distribution by Target Therapeutic Area

- 13.3.2.1. AI in Clinical Trials Market for Cardiovascular Disorders

- 13.3.2.2. AI in Clinical Trials Market for CNS Disorders

- 13.3.2.3. AI in Clinical Trials Market for Infectious Diseases

- 13.3.2.4. AI in Clinical Trials Market for Metabolic Disorders

- 13.3.2.5. AI in Clinical Trials Market for Oncological Disorders

- 13.3.2.6. AI in Clinical Trials Market for Other Disorders

- 13.3.3. AI in Clinical Trials Market: Distribution by End-user

- 13.3.3.1. AI in Clinical Trials Market for Pharmaceutical and Biotechnology Companies

- 13.3.3.2. AI in Clinical Trials Market for Other End-users

- 13.3.4. AI in Clinical Trials Market: Distribution by Key Geographical Regions

- 13.3.4.1. AI in Clinical Trials Market in North America

- 13.3.4.2. AI in Clinical Trials Market in Europe

- 13.3.4.3. AI in Clinical Trials Market in Asia-Pacific

- 13.3.4.4. AI in Clinical Trials Market in Middle East and North Africa

- 13.3.4.5. AI in Clinical Trials Market in Latin America

- 13.3.1. AI in Clinical Trials Market: Distribution by Trial Phase

14. CONCLUSION

15.. EXECUTIVE INSIGHTS

- 15.1. Chapter Overview

- 15.2. Company A

- 15.2.1. Company Snapshot

- 15.2.2. Interview Transcript: Danielle Ralic, Co-Founder, Chief Executive Officer and Chief Technology Officer

- 15.3. Company B

- 15.3.1. Company Snapshot

- 15.3.2. Interview Transcript: Wout Brusselaers, Founder and Chief Executive Officer

- 15.4. Company C

- 15.4.1. Company Snapshot

- 15.4.2. Interview Transcript: Dimitrios Skaltsas, Co-Founder and Executive Director

- 15.5. Company D

- 15.5.1. Company Snapshot

- 15.5.2. Interview Transcript: R. A. Bavasso, Founder and Chief Executive Officer

- 15.6. Company E

- 15.6.1. Company Snapshot

- 15.6.2. Interview Transcript: Troy Bryenton (Chief Technology Officer), Michael Shipton (Chief Commercial Officer), Darcy Forman (Chief Delivery Officer), Grazia Mohren (Head of Marketing)

16. APPENDIX I: TABULATED DATA

17. APPENDIX II: LIST OF COMPANIES AND ORGANIZATIONS